BCA Research’s China Investment Strategy service recommends investors overweight Chinese onshore stocks within a global equity portfolio. Authorities are determined to boost the onshore equity market, in general,…

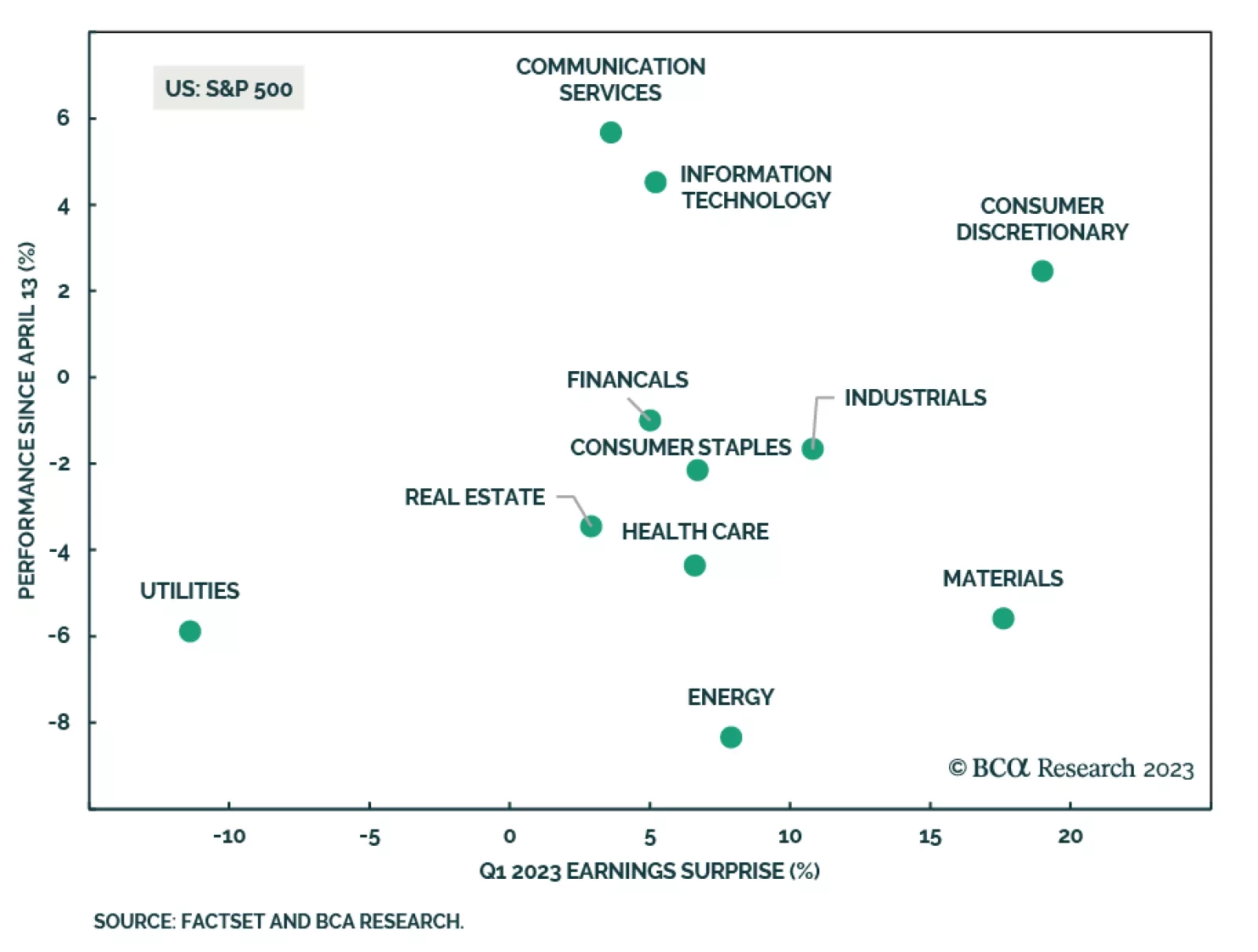

One of the features of the Q1 earnings season is that the market response to positive earnings surprises has been relatively muted. According to the latest Earnings Insight from FactSet, the average price increase of 0.5% (during…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…

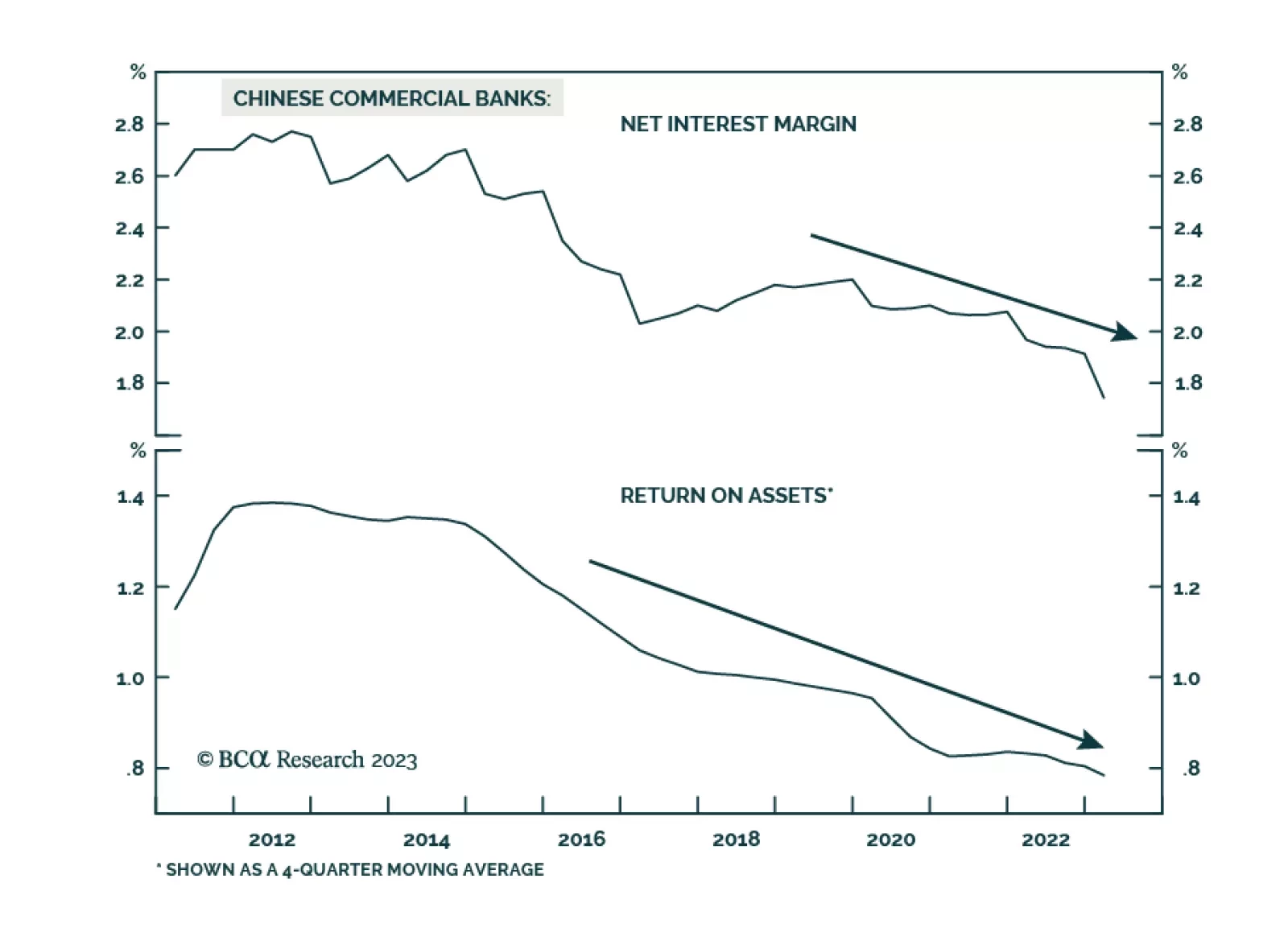

China’s recovery is losing steam. Its industrial segments will disappoint, while the pace of consumer spending will be moderate. Overall, the Chinese economic recovery will underwhelm in the months ahead. Odds are that interest rate…

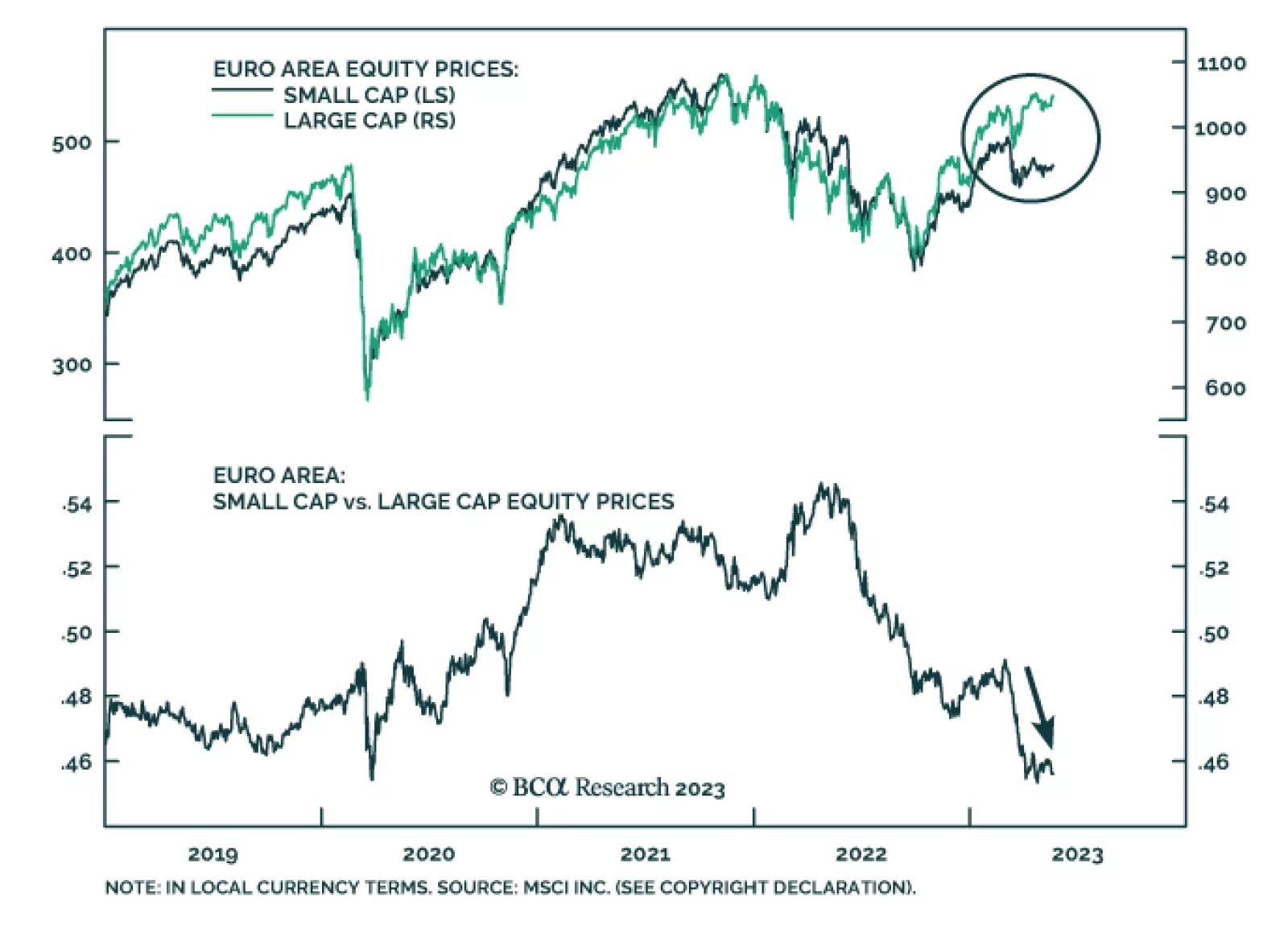

In recent insights we have noted a recent deterioration in European sentiment indicators such as the ZEW and Sentix. Similarly, measures of manufacturing activity are deteriorating. The flash estimate of the HCOB Eurozone…

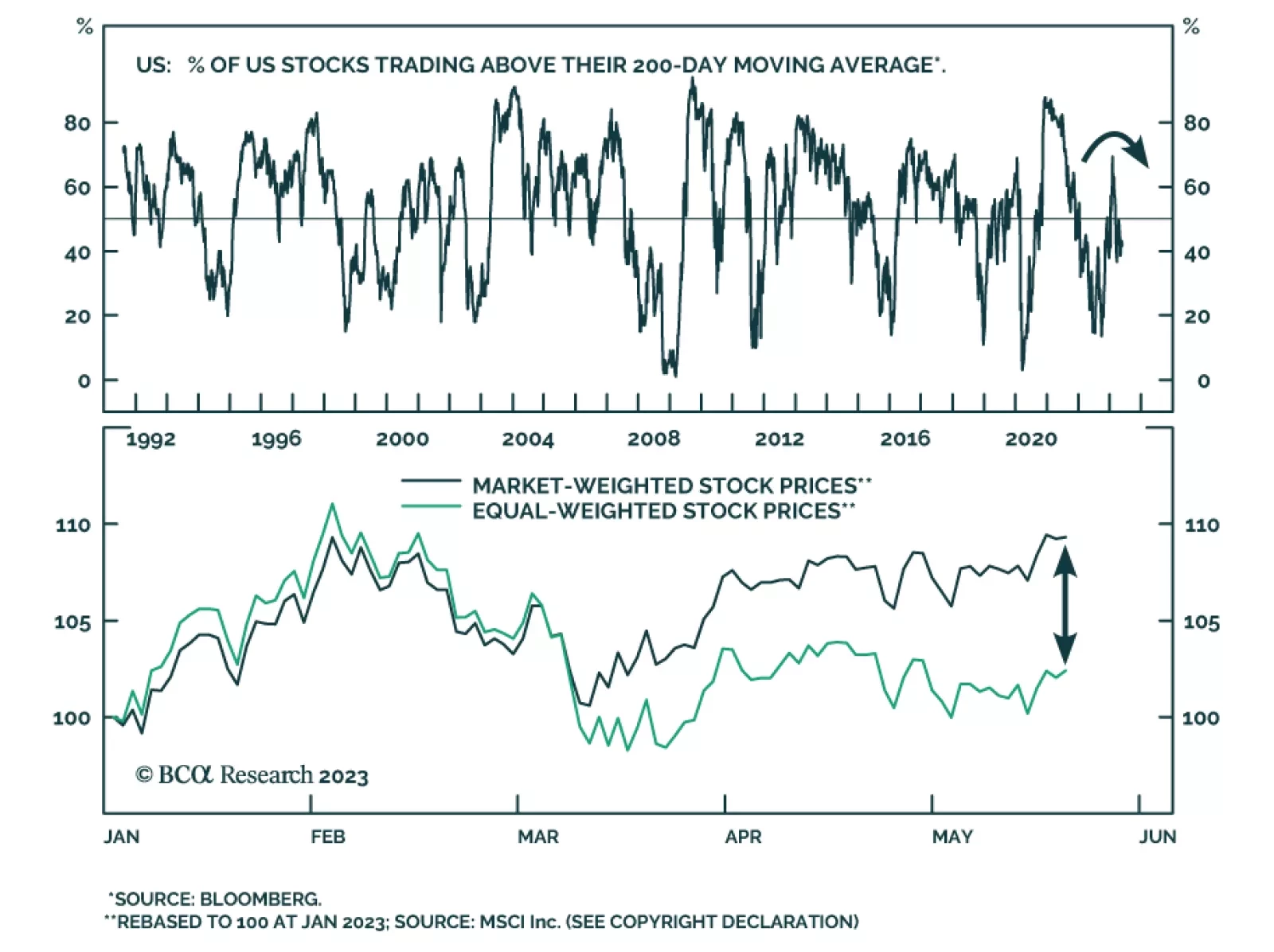

Measures of US equity breadth have been deteriorating over the past few months following an improvement in the fourth quarter of 2022. The share of US stocks trading above their 200-day moving average have been trending lower…

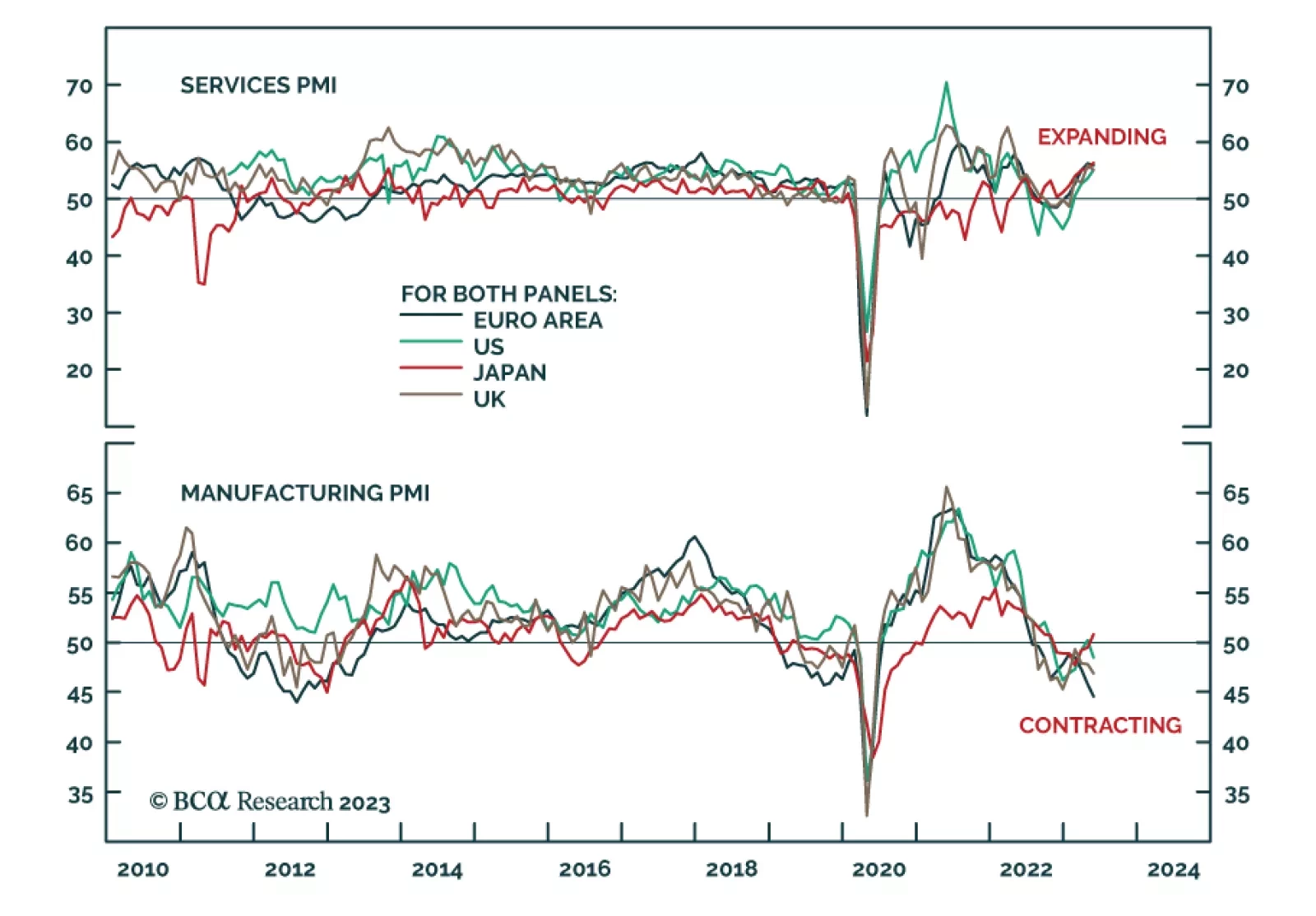

Preliminary PMI releases for May continue to show a divergence in activity across DM economies. On the one hand, the pace of expansion of service sector activity accelerated. The US Services PMI rose from 53.6 to 55.1 –…

The Q1-2023 earnings season has surprised as companies’ results point to the end of the earnings recession. However, the good news is already priced in – the market has barely budged over the past six weeks. Earnings rebound may…

Global growth will weaken in the coming months, yet monetary authorities worldwide will be reluctant to ease policy. This state of affairs foreshadows a clash between markets and policymakers in the months ahead. China’s recovery is…