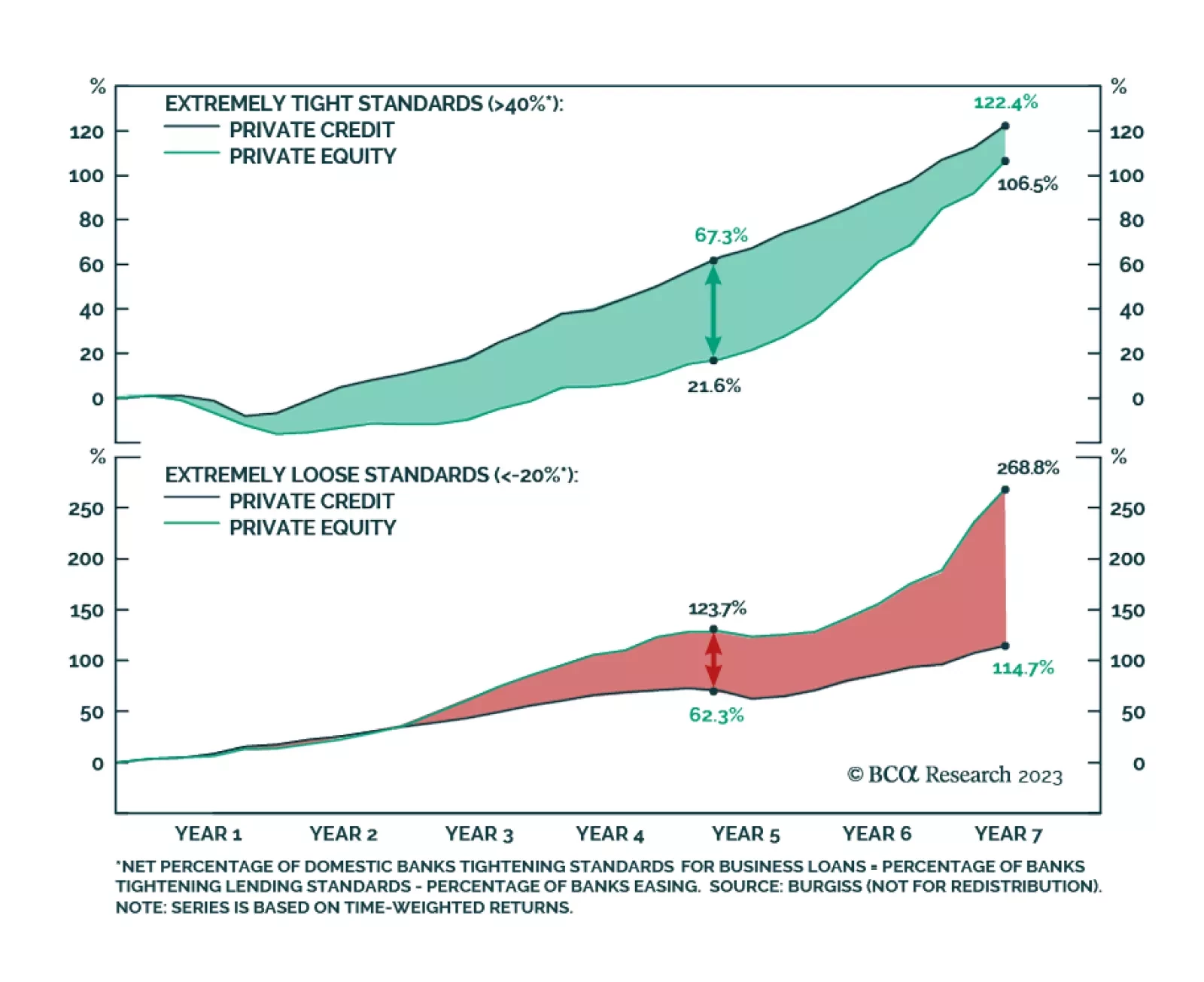

According to BCA Research’s newly launched Private Markets & Alternatives service, the present moment in the business cycle appears to be favorable for Private Credit relative to Private Equity. The current…

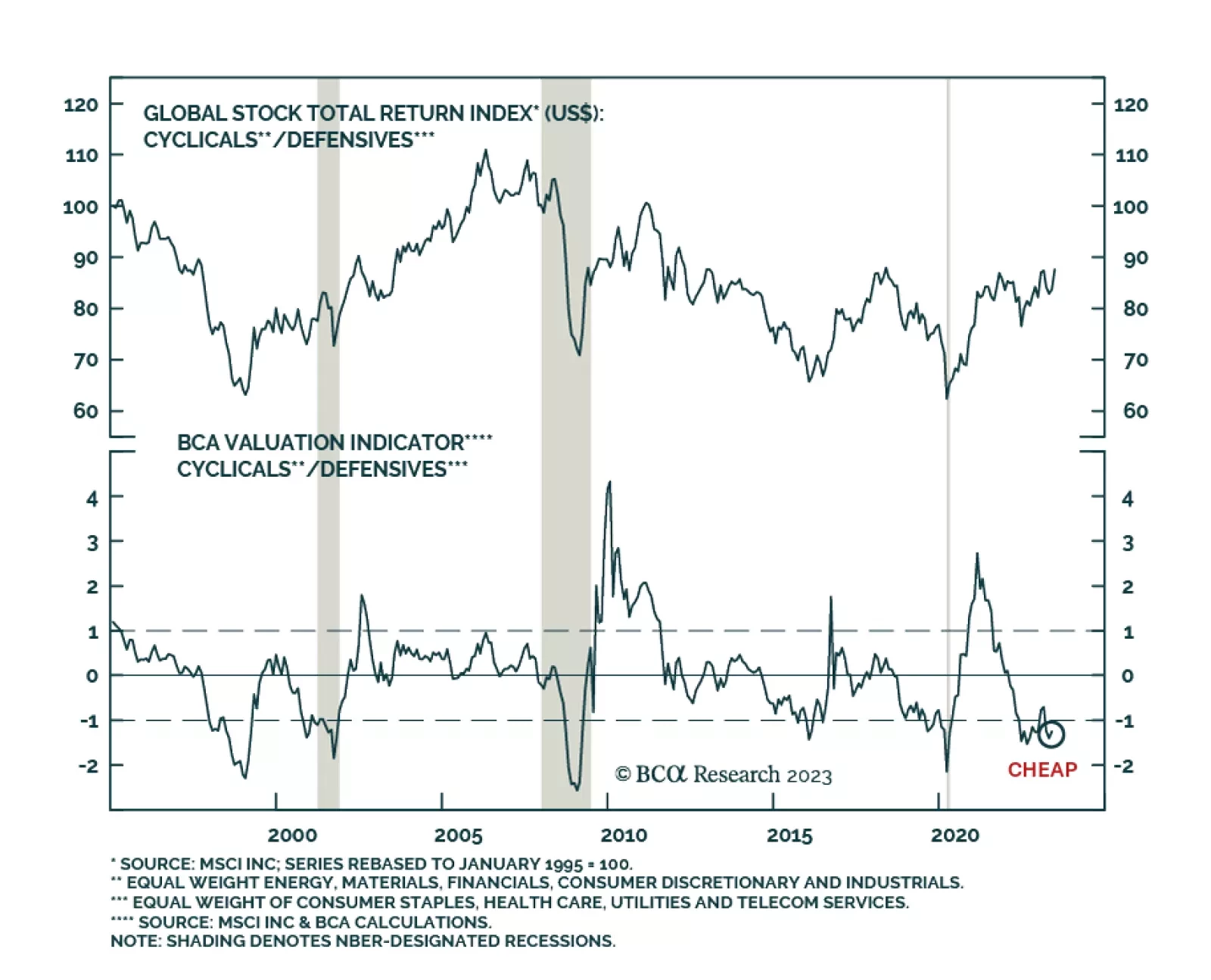

Once again, global cyclical stocks have recently been outperforming defensive sectors. This comes after the late-2022/early-2023 relative rally in cyclical stocks was cut short by the emergence of bank turmoil in early March.…

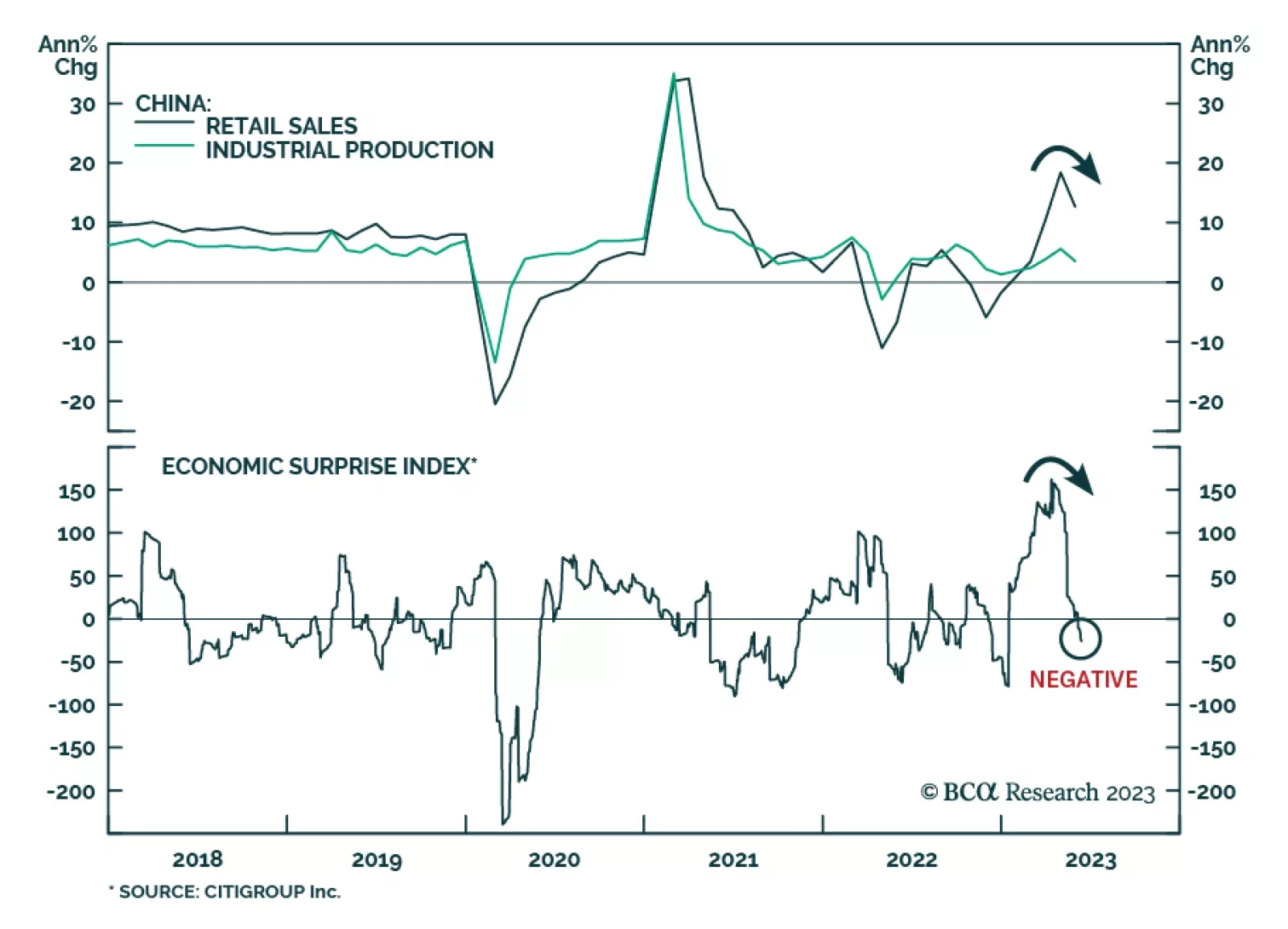

China’s economic data releases for May fell below consensus estimates. The 7.2% y/y contraction in property investment in the first five months of the year was worse than the expected 6.7% decline. The deceleration in…

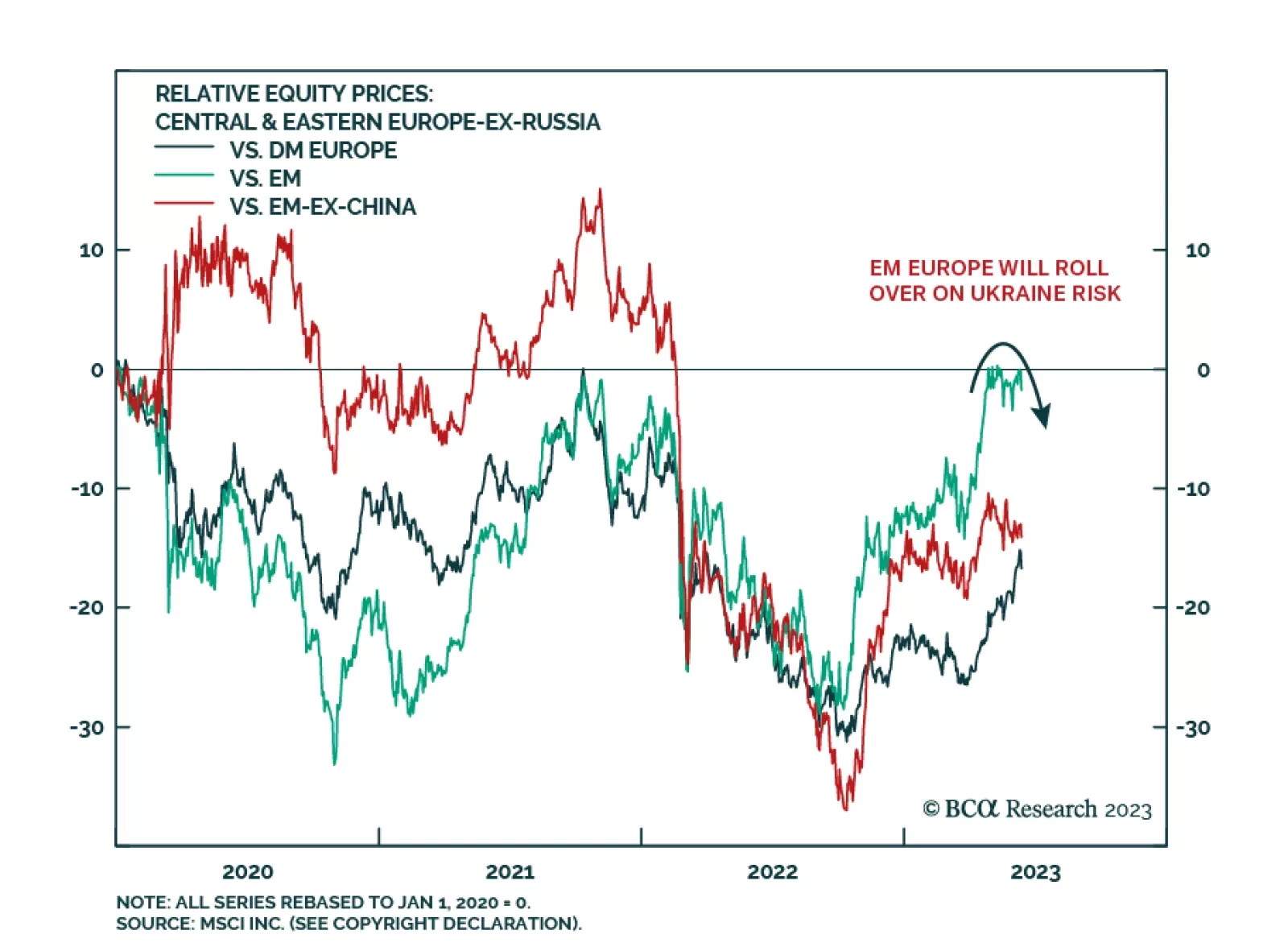

According to BCA Research’s Geopolitical Strategy service, geopolitical risk will rise before the Ukraine war is resolved, punishing eastern European emerging market assets on a relative basis. Ukraine’s…

As the major central banks once again mull their policy options, they face a daunting task. They must phase-transition inflation back to imperceptible, without phase-transitioning unemployment to perceptible. This report explains why…

Policymakers will likely continue to stimulate domestic demand via targeted measures and piecemeal stimulus. Yet, the economy will disappoint unless Beijing provides “irrigation-style” stimulus. The latter is not our base case…

Policymakers will likely continue to stimulate domestic demand via targeted measures and piecemeal stimulus. Yet, the economy will disappoint unless Beijing provides “irrigation-style” stimulus. The latter is not our base case…

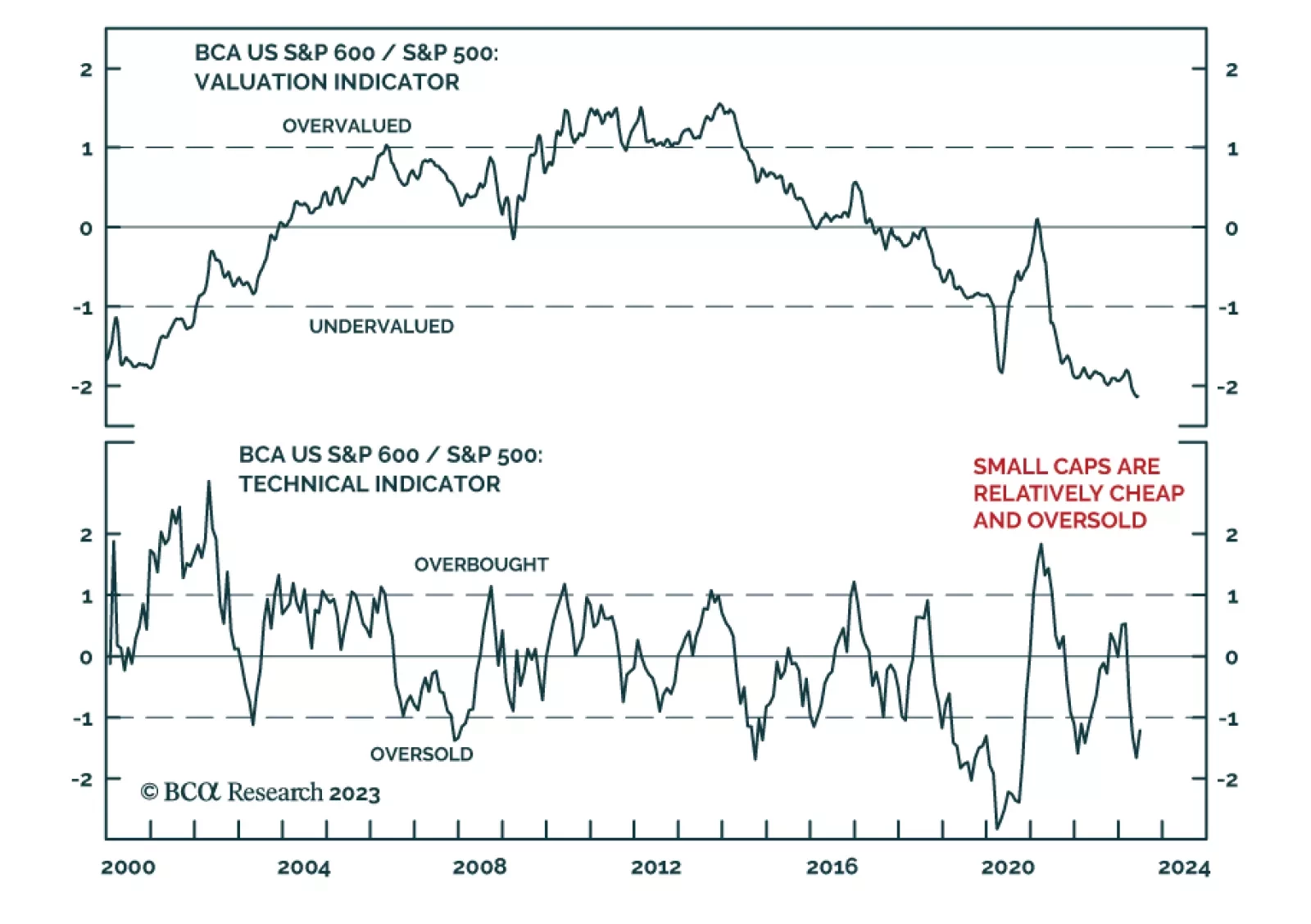

US equity market moves have recently shifted in favor of small caps. After underperforming the S&P 500 by 16% between the start of March and beginning of June, the S&P 600’s recent 6% gain is greater than its large-…