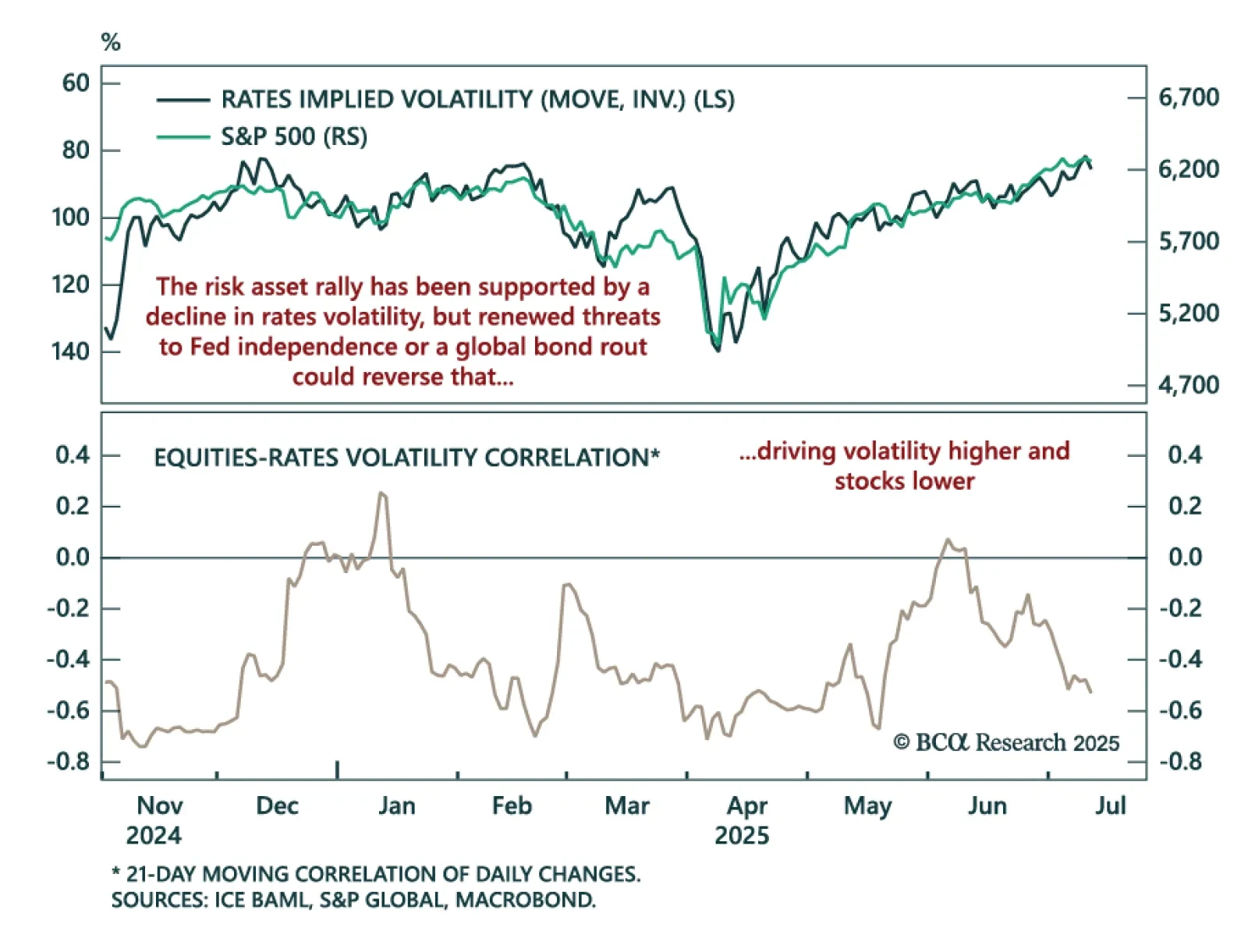

Equities have retraced sharply from Liberation Day lows, but renewed policy risk and mispriced volatility keep us tactically cautious. The Trump administration softened its trade stance as equities neared bear market territory in…

We still believe a recession looms, but it has yet to rear its ugly head. We continue to recommend investors position defensively, but we will change tack if clear signs of a recession don’t emerge soon.

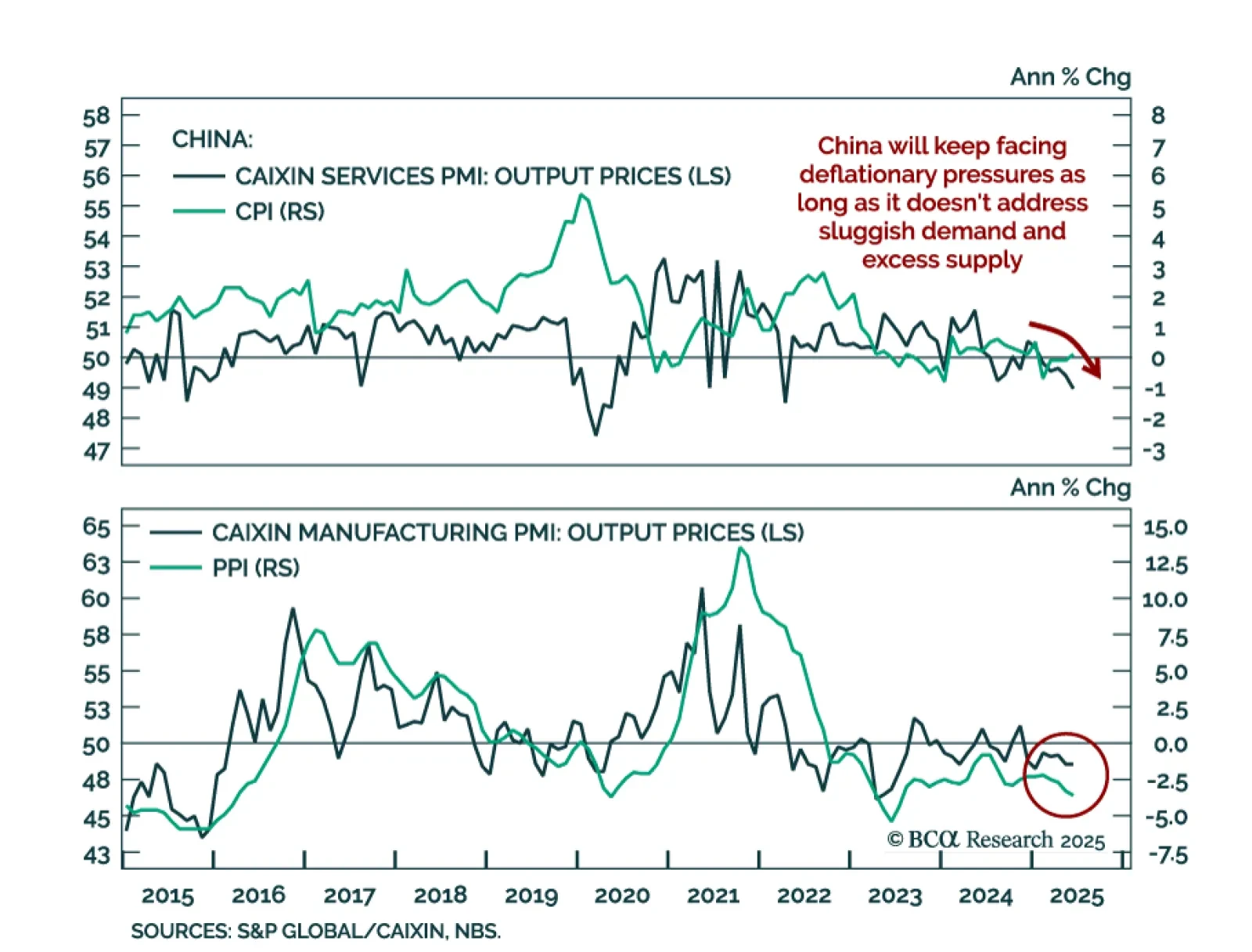

Persistent deflation and constrained policy options support a defensive stance on China, favoring bonds and high-dividend equities. Consumer prices were roughly flat in June, rising just 0.1% y/y after a 0.1% decline in May. Producer…

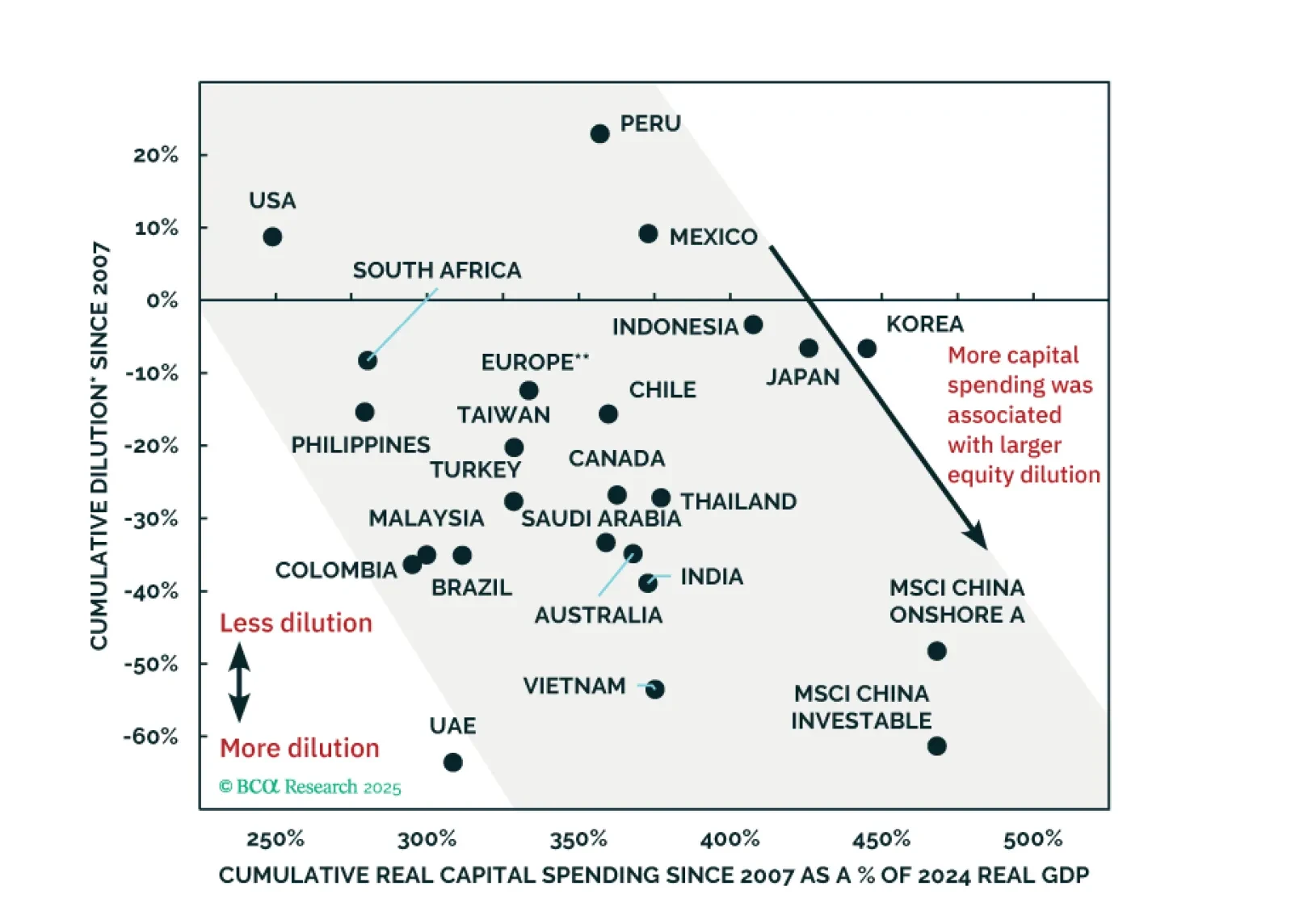

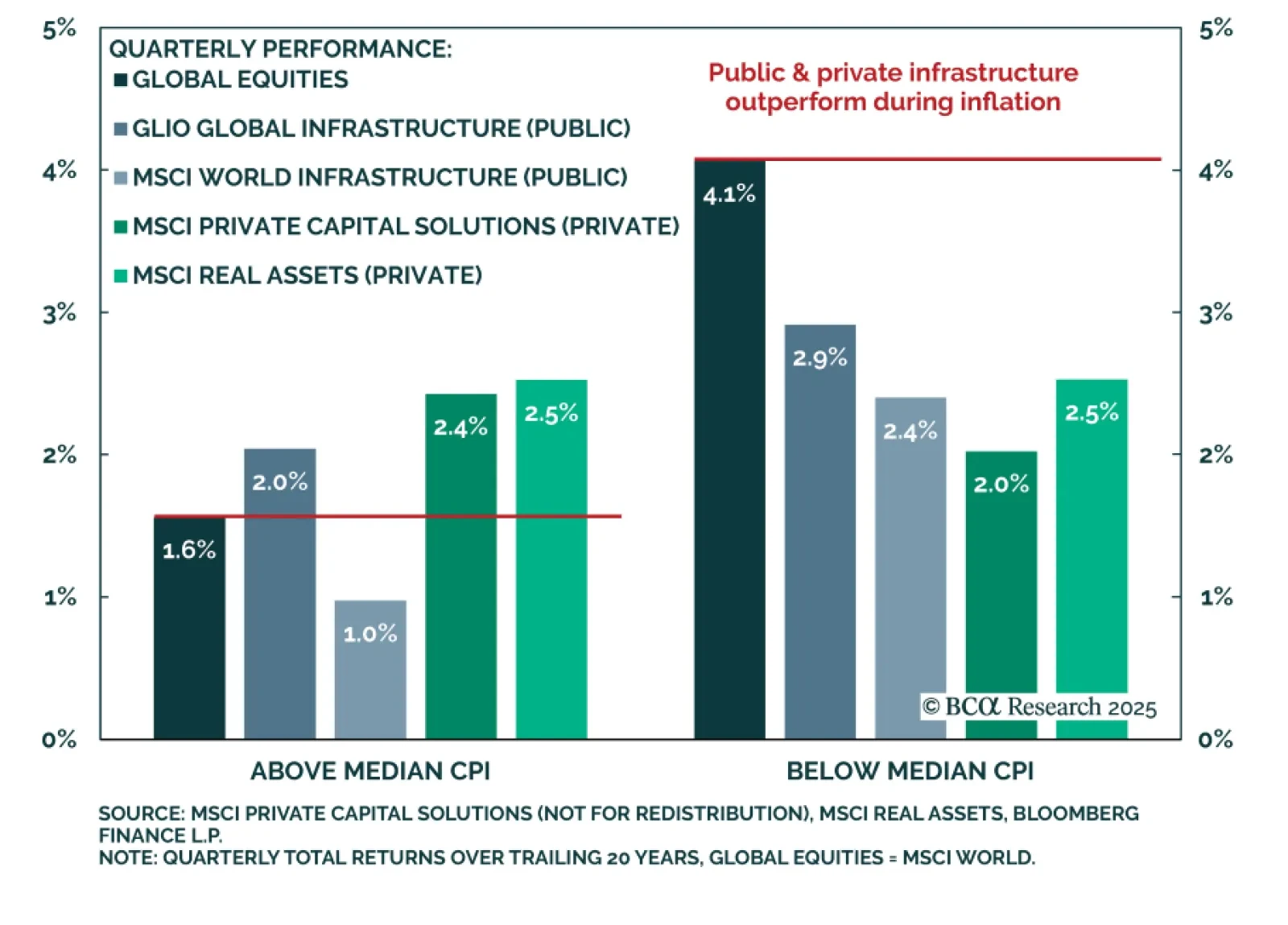

BCA’s Private Markets & Alternatives strategists recommend a balanced allocation across Public and Private Infrastructure, with near-term valuation favoring Public. Structural differences in index construction, sector mix, and…

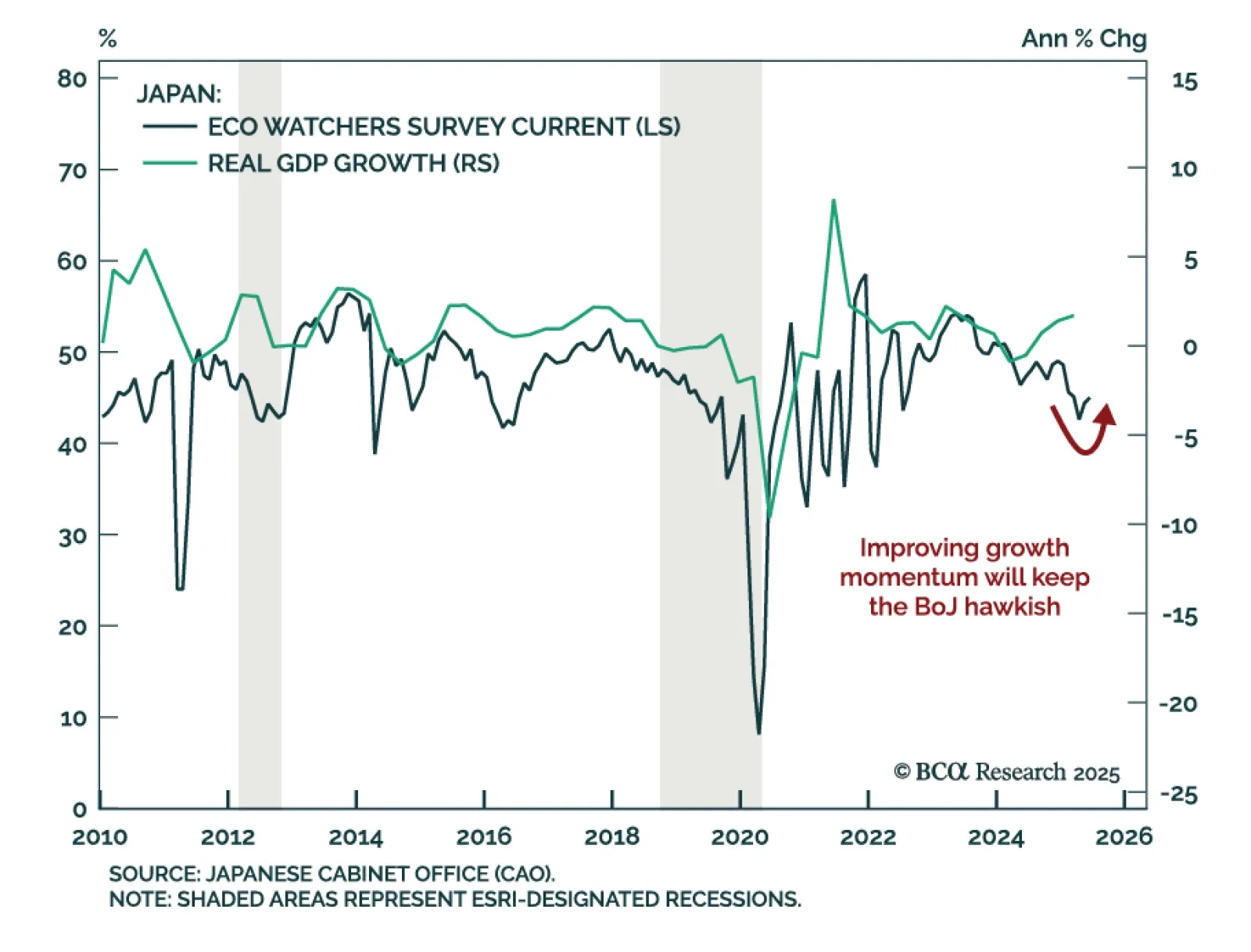

Japan’s improving growth momentum and structural inflation shift support an underweight in JGBs and long JPY positioning. The June Eco Watchers Survey was broadly in line with expectations, with current conditions ticking up to 45.0…

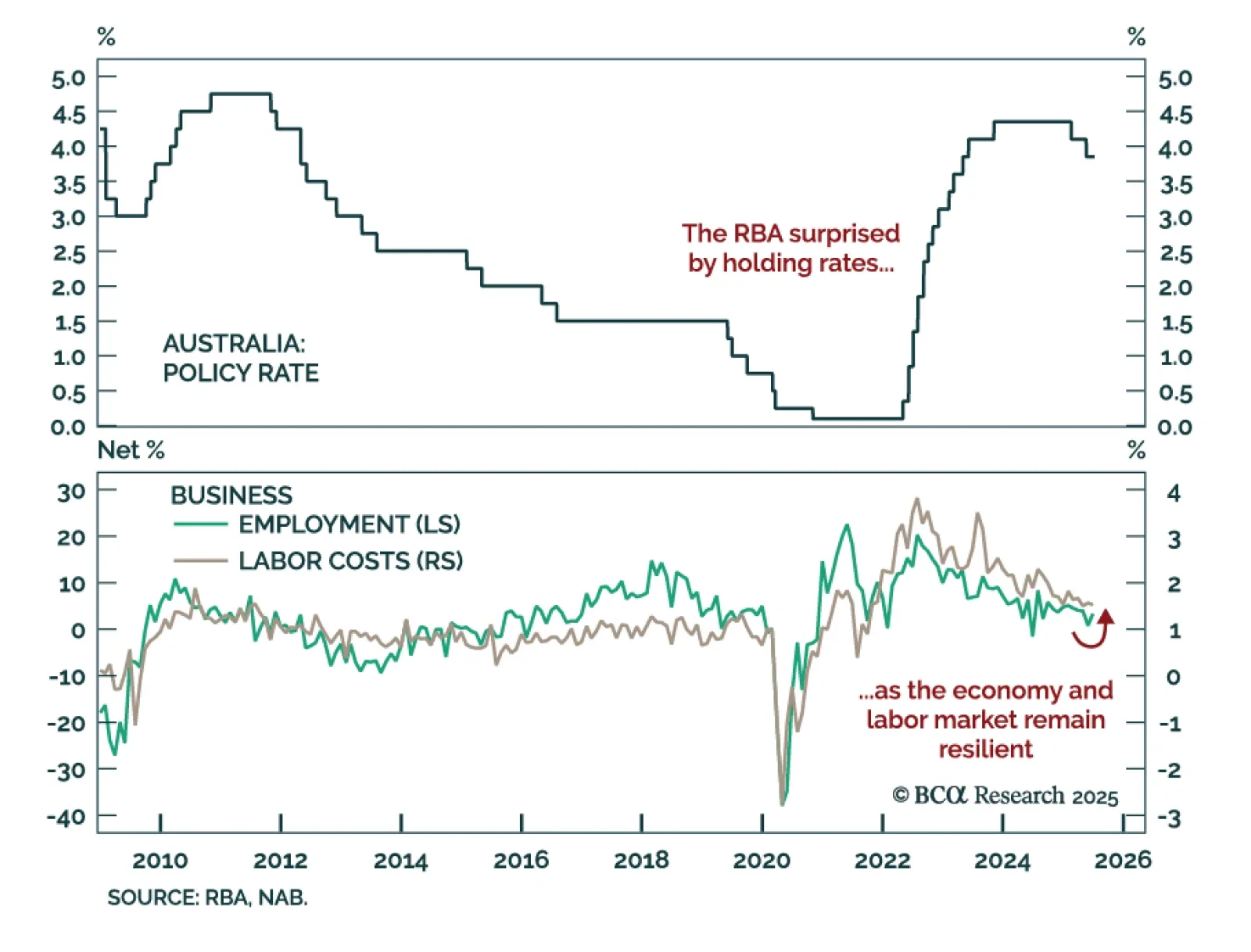

The RBA’s surprise hold reinforces a slower easing path, warranting an underweight on Australian bonds. Markets had priced in a 25 bps cut, but the central bank opted to keep rates at 3.85%. Governor Bullock characterized the…

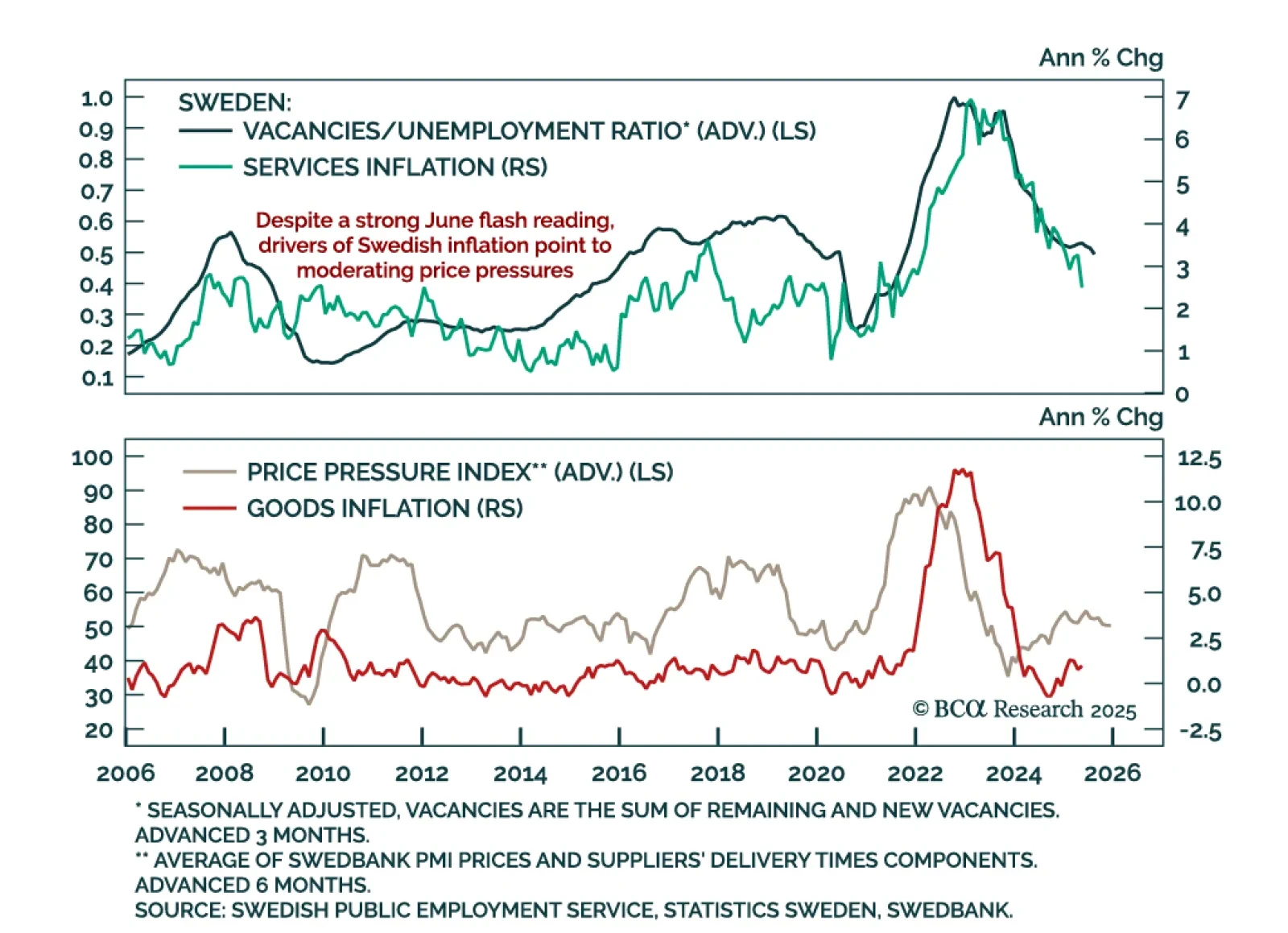

Stronger-than-expected June inflation will likely keep the Riksbank on hold in August, despite soft underlying trends. Headline inflation accelerated more than expected to 0.5% m/m (0.8% y/y), while CPI ex-housing rose to 2.9% y/y…

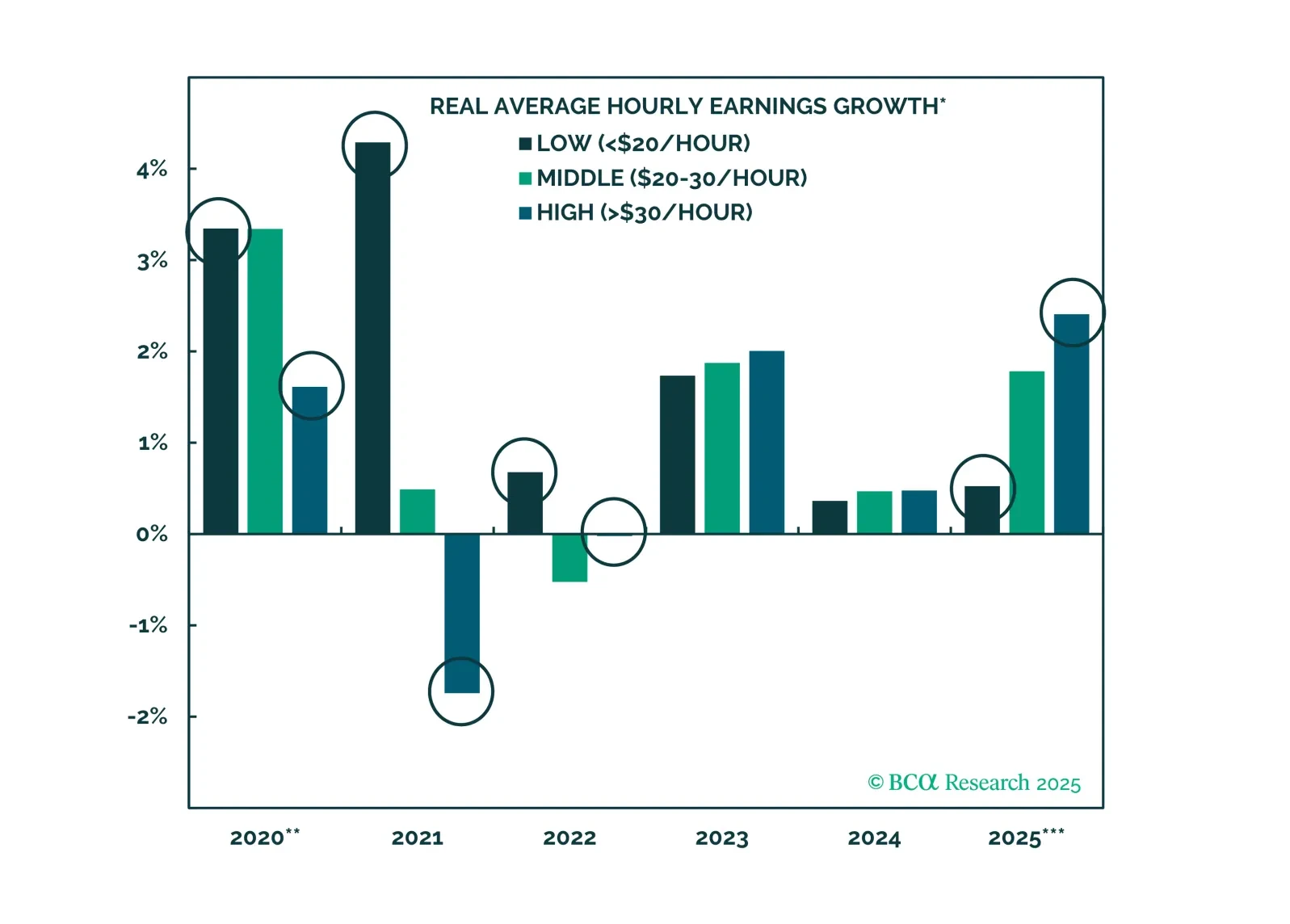

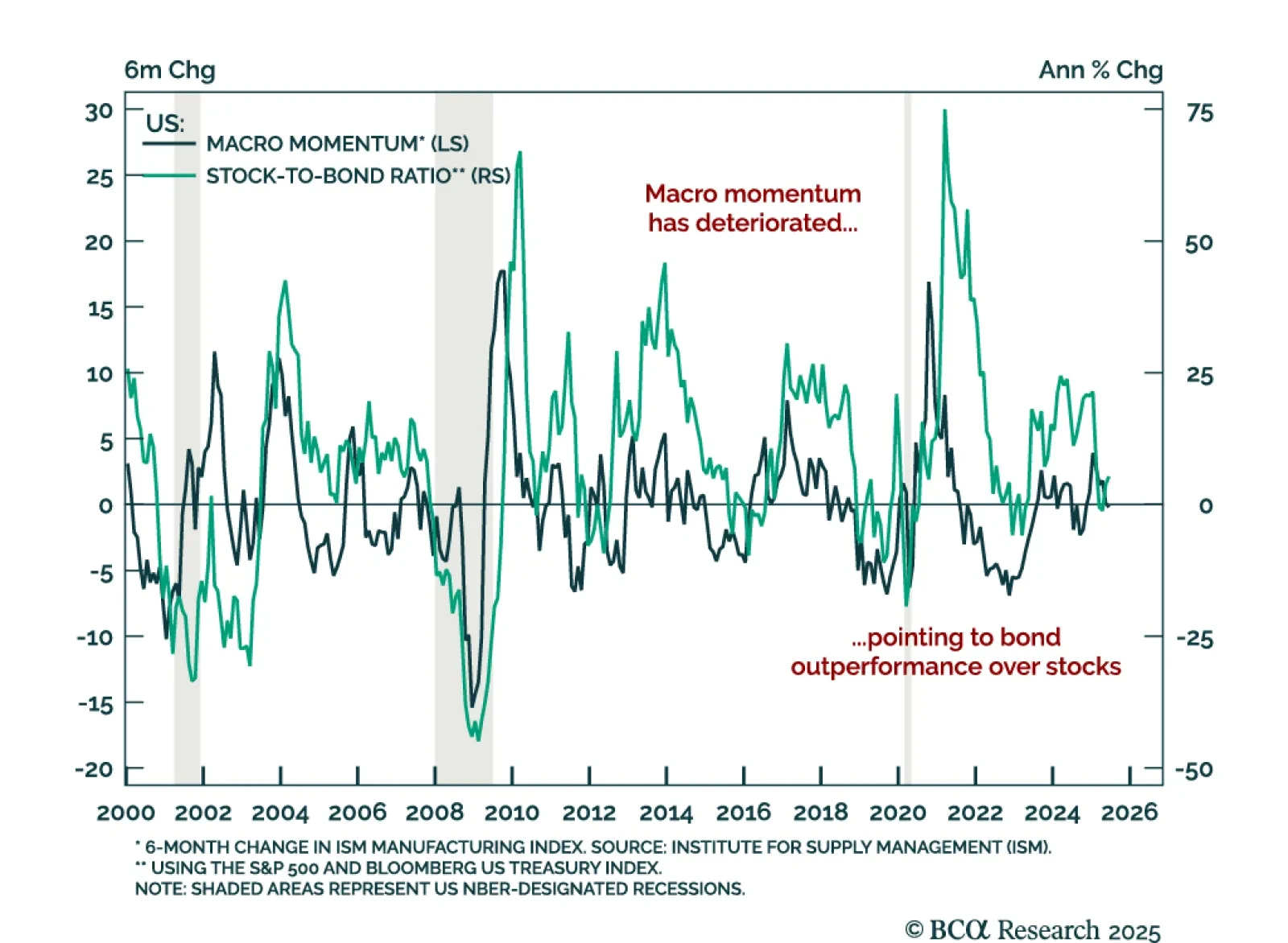

Deteriorating macro momentum supports a defensive asset allocation stance as hard data deteriorates. Last week’s ISM Manufacturing and Services PMIs confirmed that growth is slowing and price pressures are easing from a high level.…

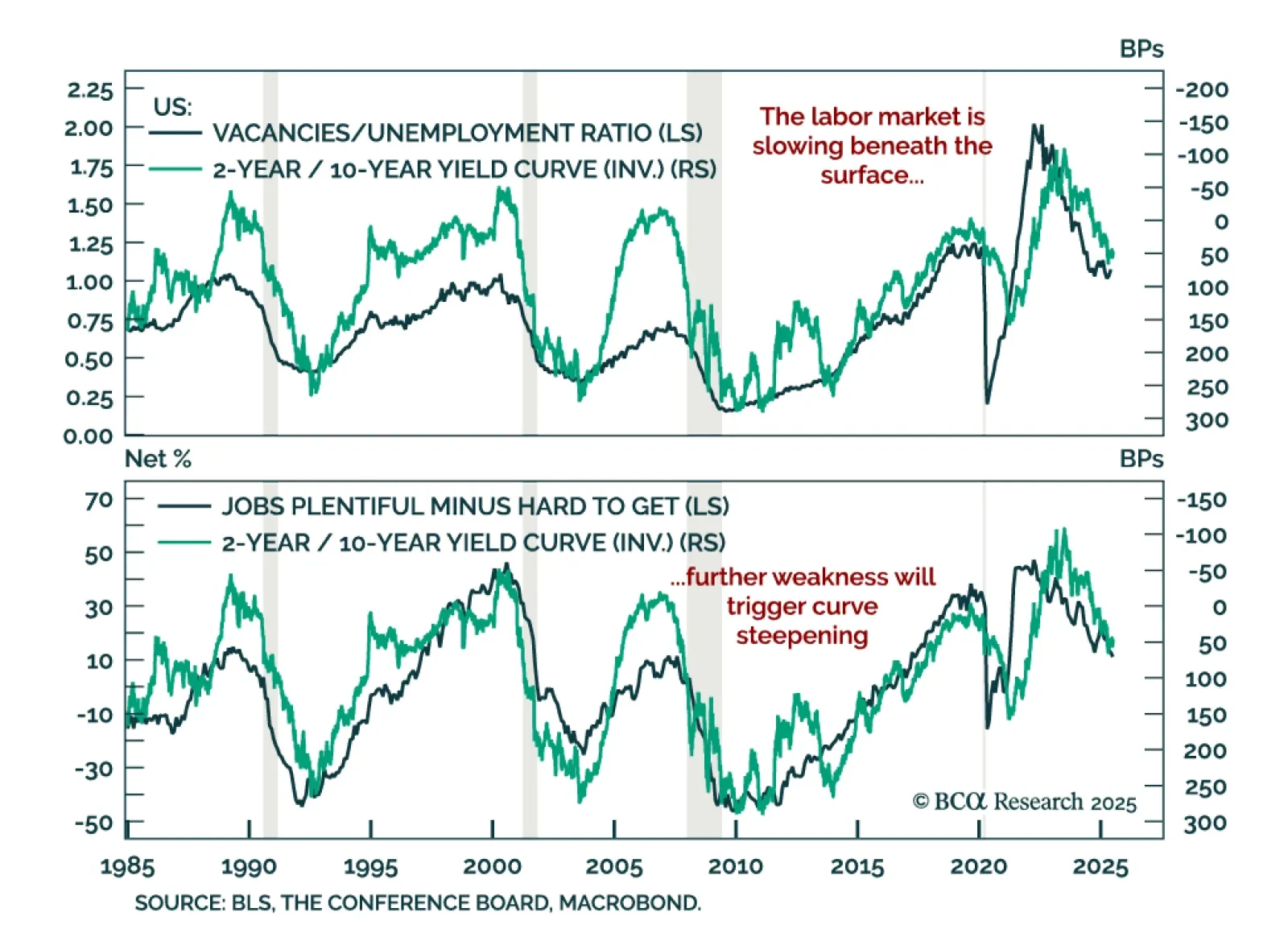

Labor market cracks reinforce long duration and steepener positioning as growth risks mount. Job market data has looked strong on the surface, but the details of the June employment and JOLTS reports confirm a slowing trend within…