In Section I, we reiterate why a soft economic landing remains improbable in the US. Some reasonable estimates of the level of excess savings point to their depletion in a year’s time, but other estimates indicate a much earlier end…

The combination of a global manufacturing recession and tight/tightening policy is raising a red flag for global non-TMT stocks. In China, households are entering a liquidity trap, and deflationary pressures are heightening.…

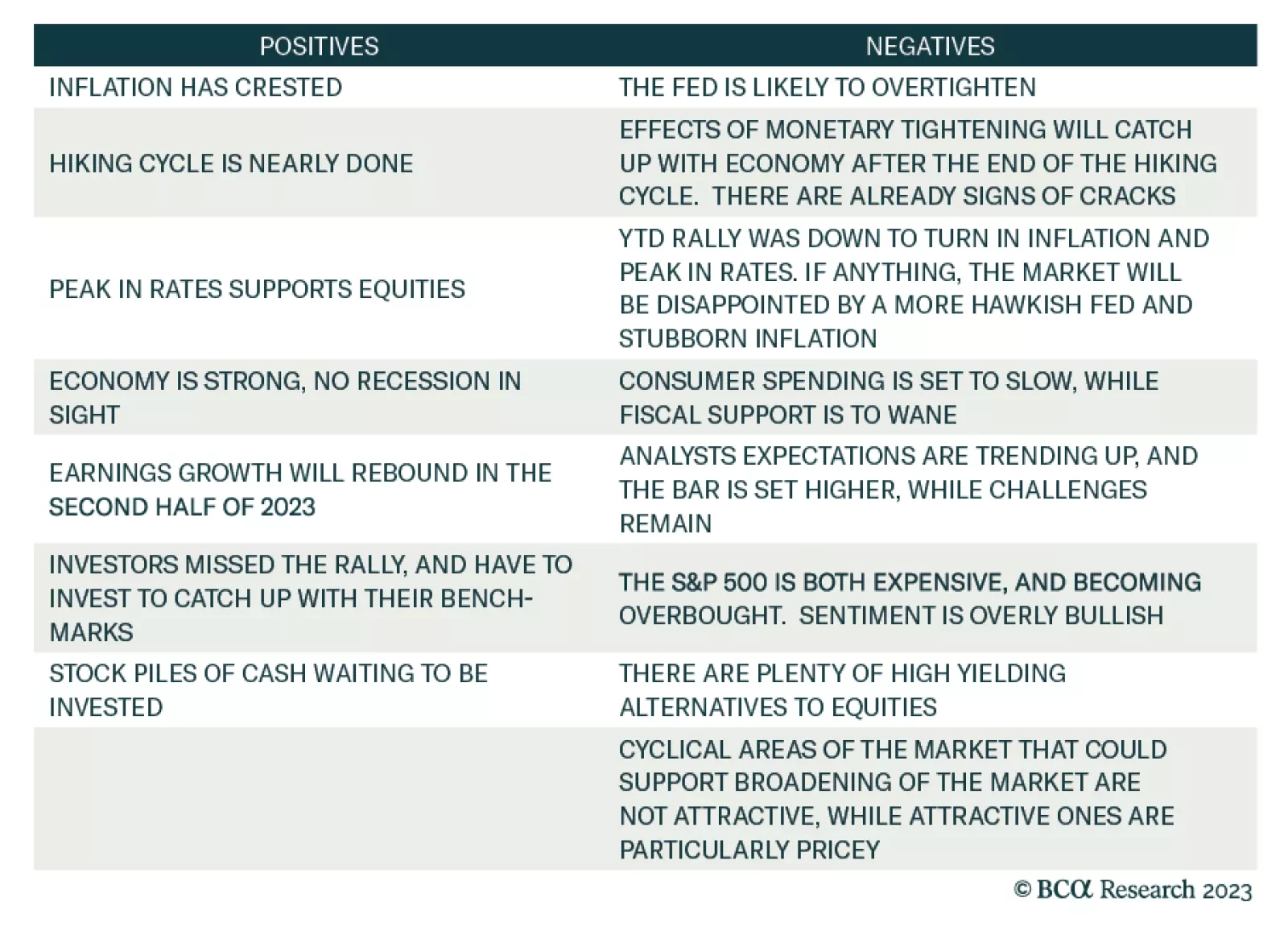

Our US Equity Strategy service looks back at their performance for the first half of the year and assesses what they hit or missed so far and comments on the ongoing rally in the stock market. The team hit on the economic…

Global non-TMT stocks are at risk of a relapse given worsening conditions in global manufacturing and still hawkish policies from the Fed and ECB. According to the preliminary release, manufacturing PMI new orders for advanced…

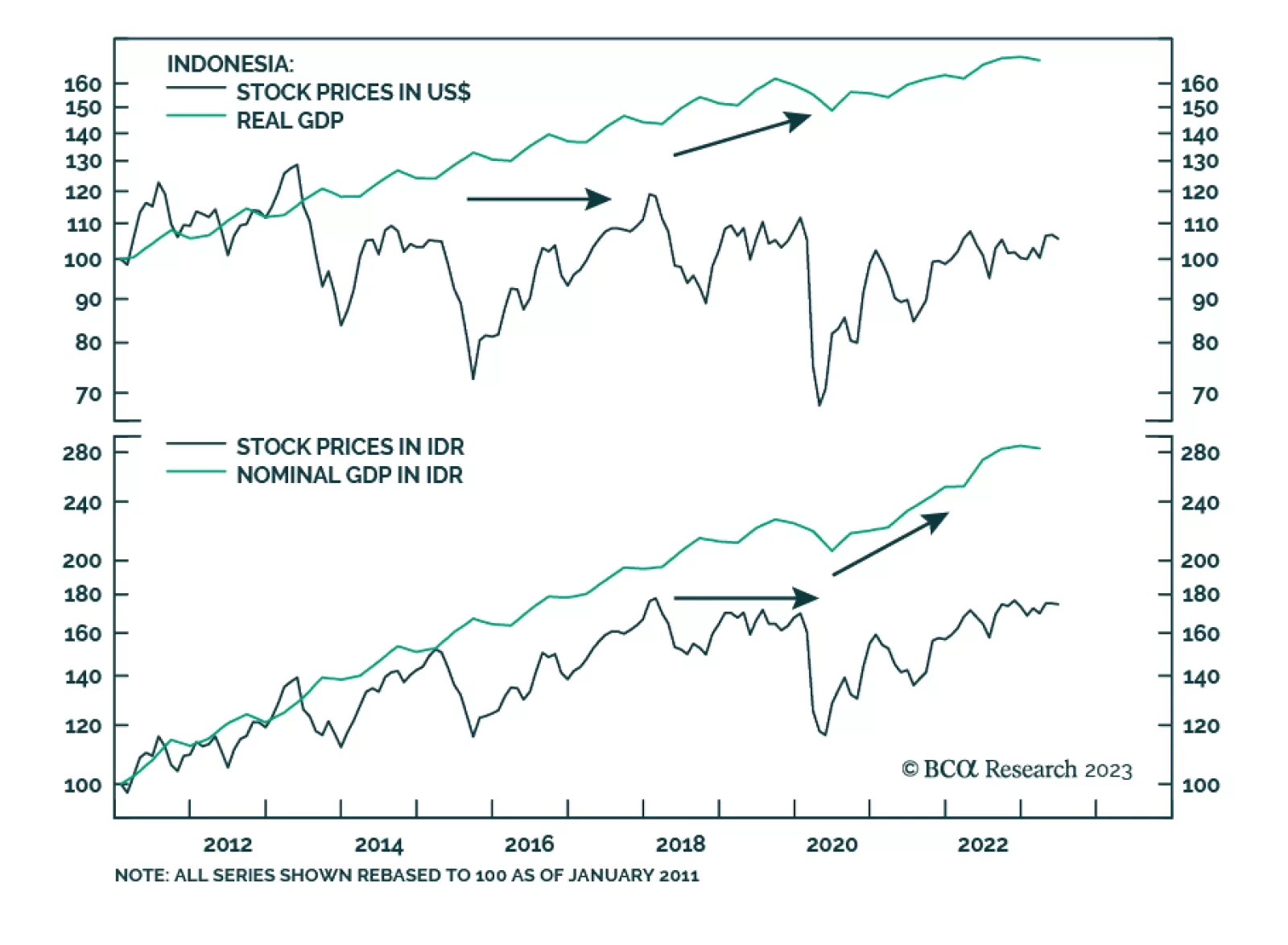

In a recent report, our Emerging Markets Strategy team recommended an underweight stance for Indonesian equities in EM portfolios. The team is also bearish on the rupiah. An unprecedented trade surplus recently gave Indonesia…

The market does not grasp the implied depths of recessions that will be needed to prevent inflation expectations from un-anchoring. Among the major economies, the most vulnerable to a deep recession is the UK. We explain why, and…

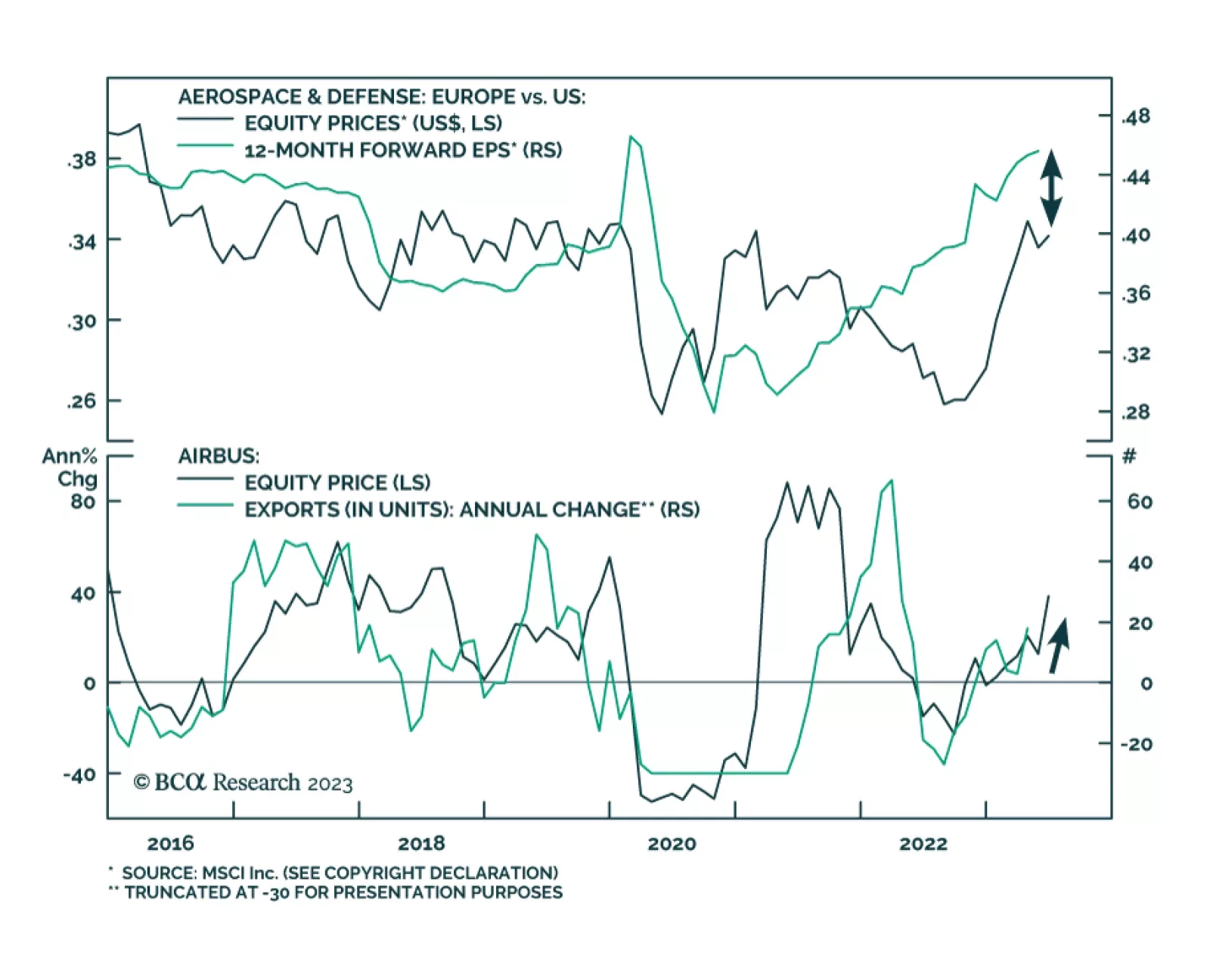

European aerospace and defense stocks are on the offense. Year-to-date, they are up 20% in absolute terms and 24% relative to their US counterparts, both in US dollar terms. The relative 12-month forward earnings suggest that…

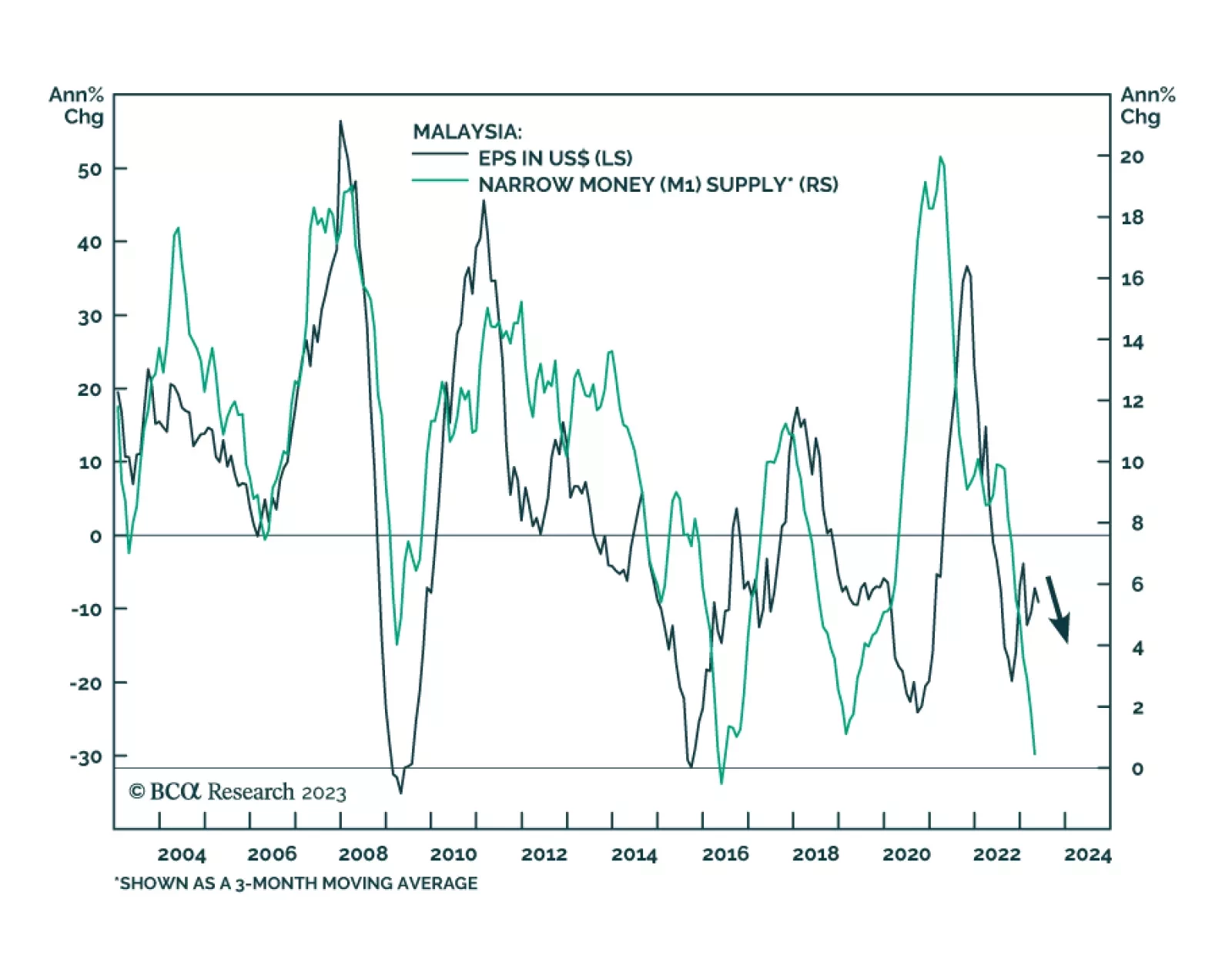

In a recent report, our Emerging Markets Strategy team posited that the bear market in Malaysian stocks will be prolonged. Disinflationary forces have taken hold of the Malaysian economy: money supply has plunged, bond yields…

Momentum, high cash balances, FOMO, and expectations of soft landing drive the market higher. This rally may continue for a while, but macroeconomic headwinds are intensifying and will eventually derail the rally. It is too early to…