Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

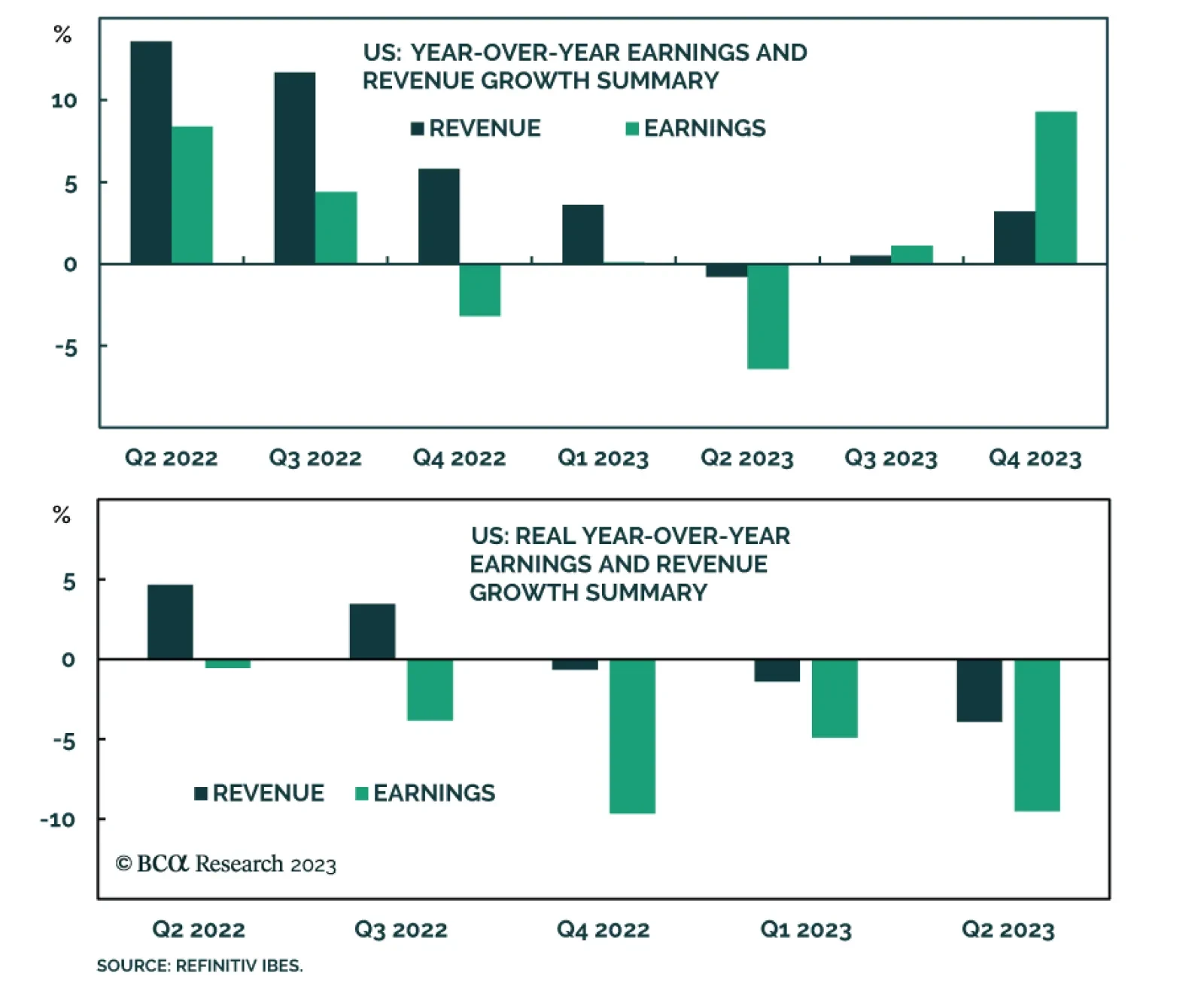

The Q2-2023 earnings season will kick off this Friday. The following are the investors’ “Cliff notes” to this earnings season. Market Expectations Earnings growth: According to Refinitiv IBES, earnings…

The stratospheric valuation of this year’s AI mania is likely to deflate, just as it did after the Web 1.0 mania of the late 90s. We go through some long-term and short-term investment implications.

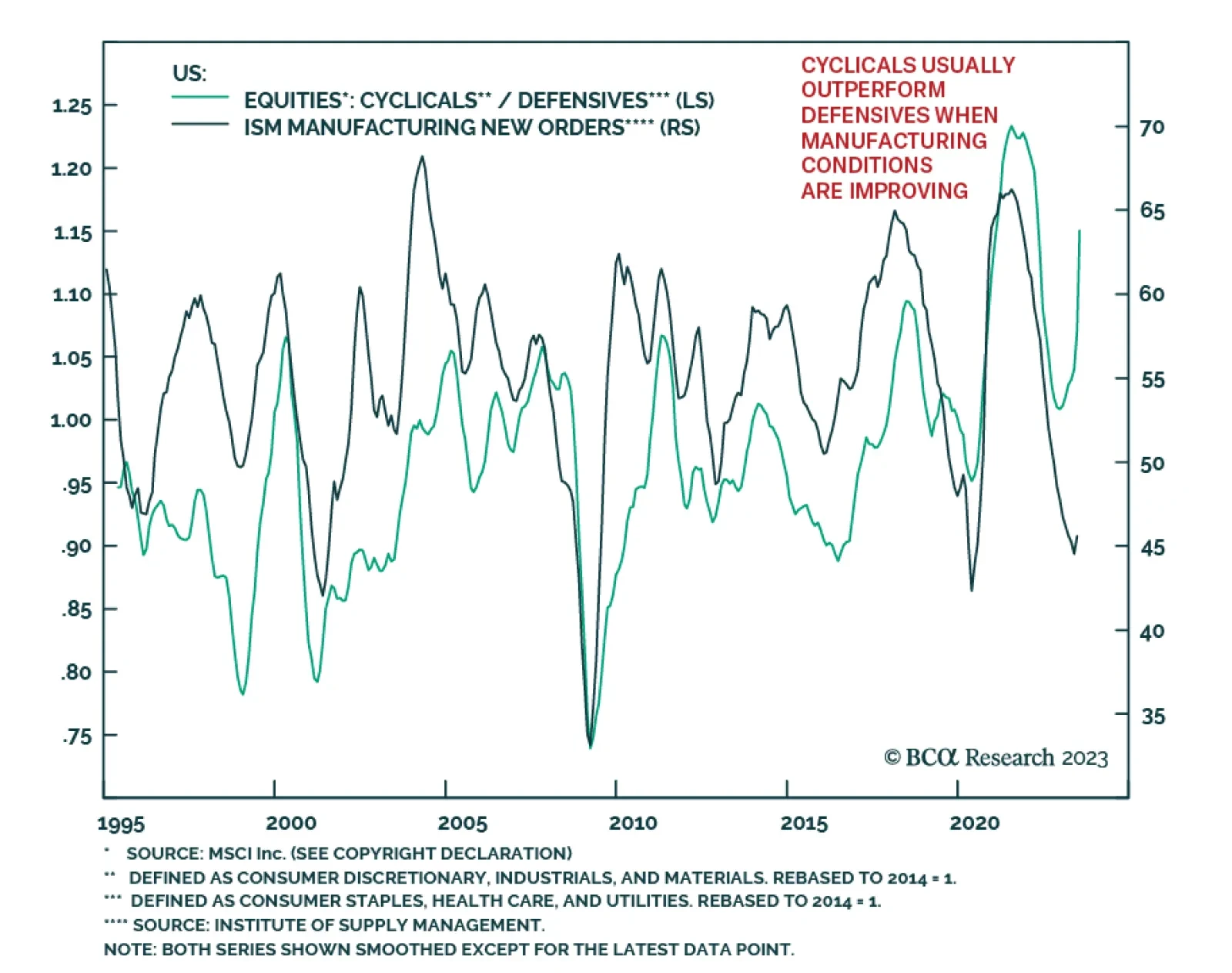

A range of indicators suggest that the US manufacturing sector is currently under duress. But should this weakness be extrapolated into the rest of the year? The US manufacturing cycle tends to follow a very predictable wave-…

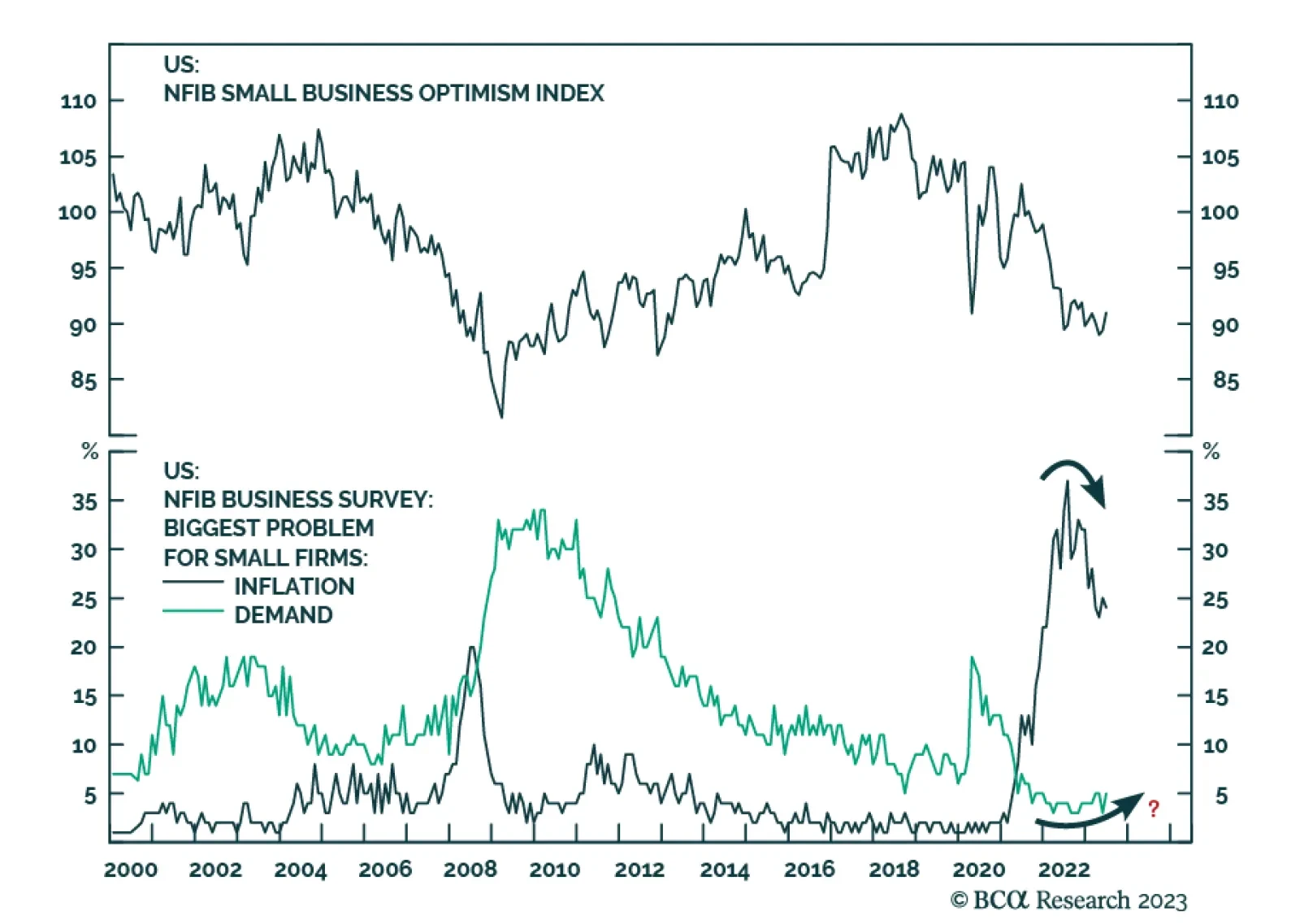

The NFIB survey provided a slightly positive signal about the US economy in June. Small business optimism improved from 89.4 to a 7-month high of 91.0 – beating expectations of a more muted increase to 89.9. Details of…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

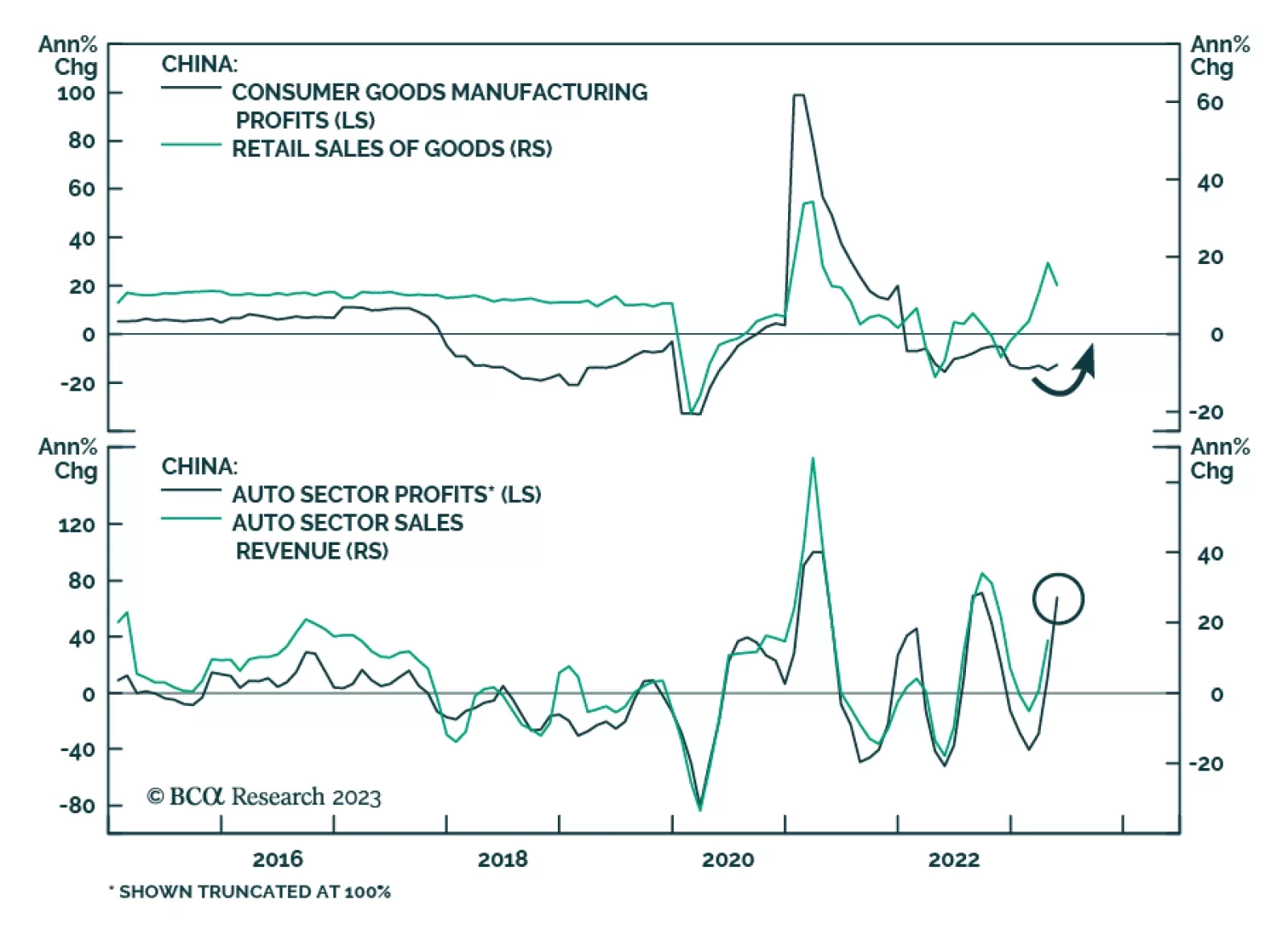

According to BCA Research’s China Investment Strategy service, although the recovery in overall Chinese industrial profits will be subdued, there will be a silver lining among China’s consumer goods producers, autos…

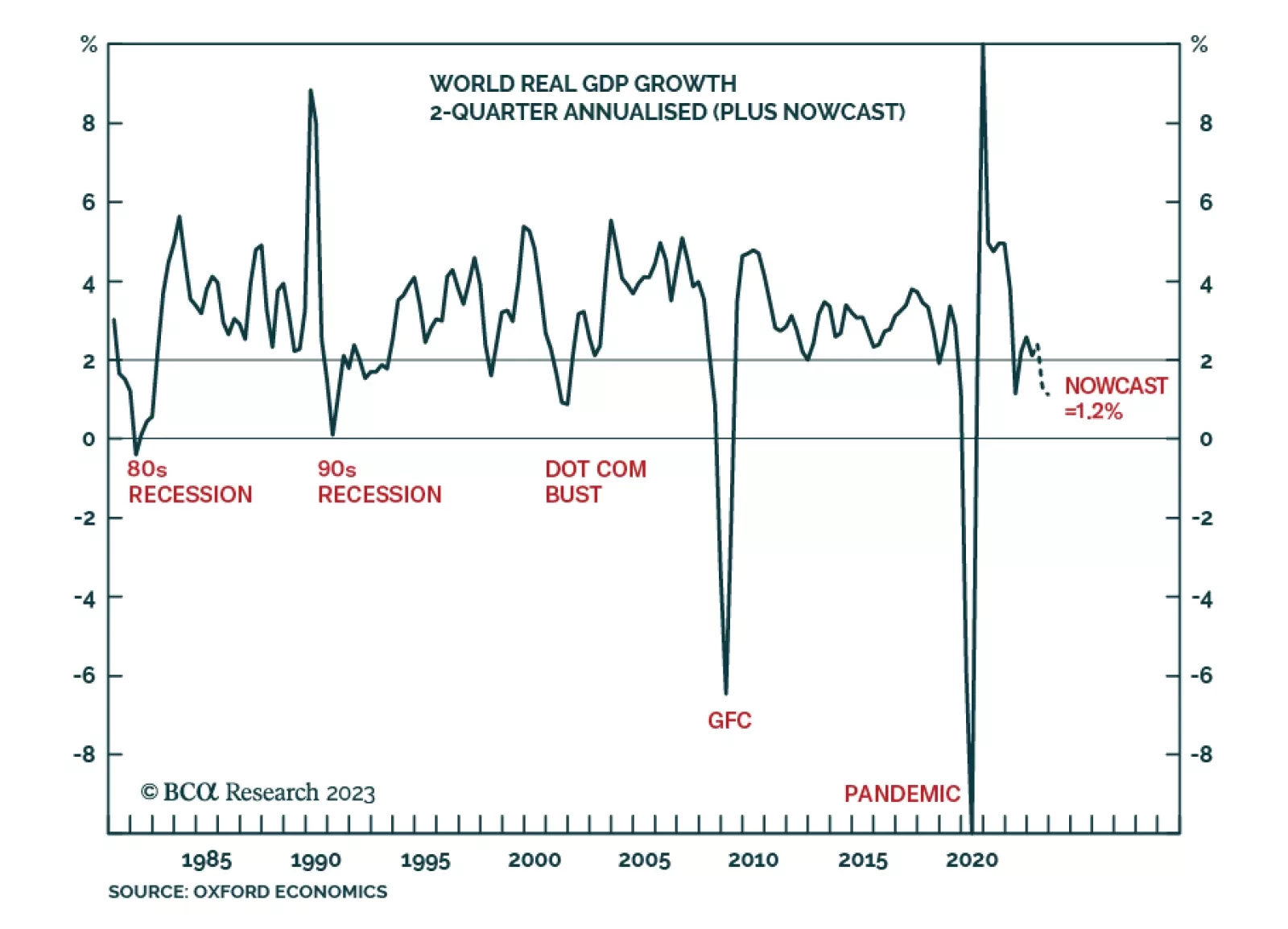

According to our Counterpoint strategy service, latest nowcasts indicate that world growth has likely slowed to sub-2 percent, thereby passing the threshold of a typical world recession as experienced in the early 1970s, early…

On one hand, China will be exporting deflation to the rest of the world. On the other hand, core inflation is sticky in the US, making the Fed err on the hawkish side. Altogether, these crosscurrents are creating a toxic mix for risk…

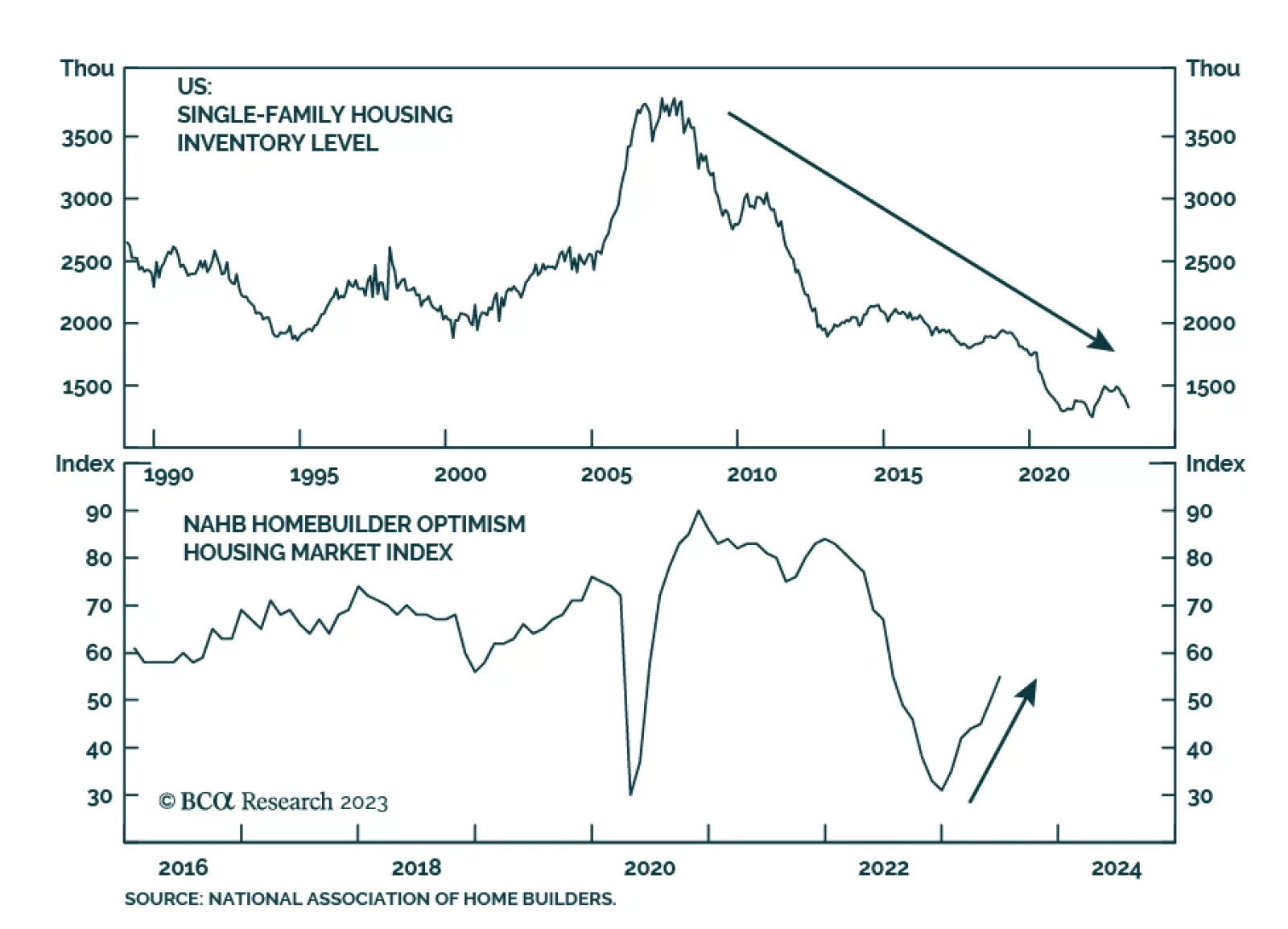

According to BCA Research’s US Equity Strategy service, residential REITs, homebuilders, and durable goods manufacturers are the beneficiaries of the negative supply shock in residential housing. Shortage of inventories…