In the first five months of the year, optimism about GAI (generative AI) drove a narrow rally in US equities. The three sectors that contain companies that are most exposed to this dynamic were the only ones that experienced…

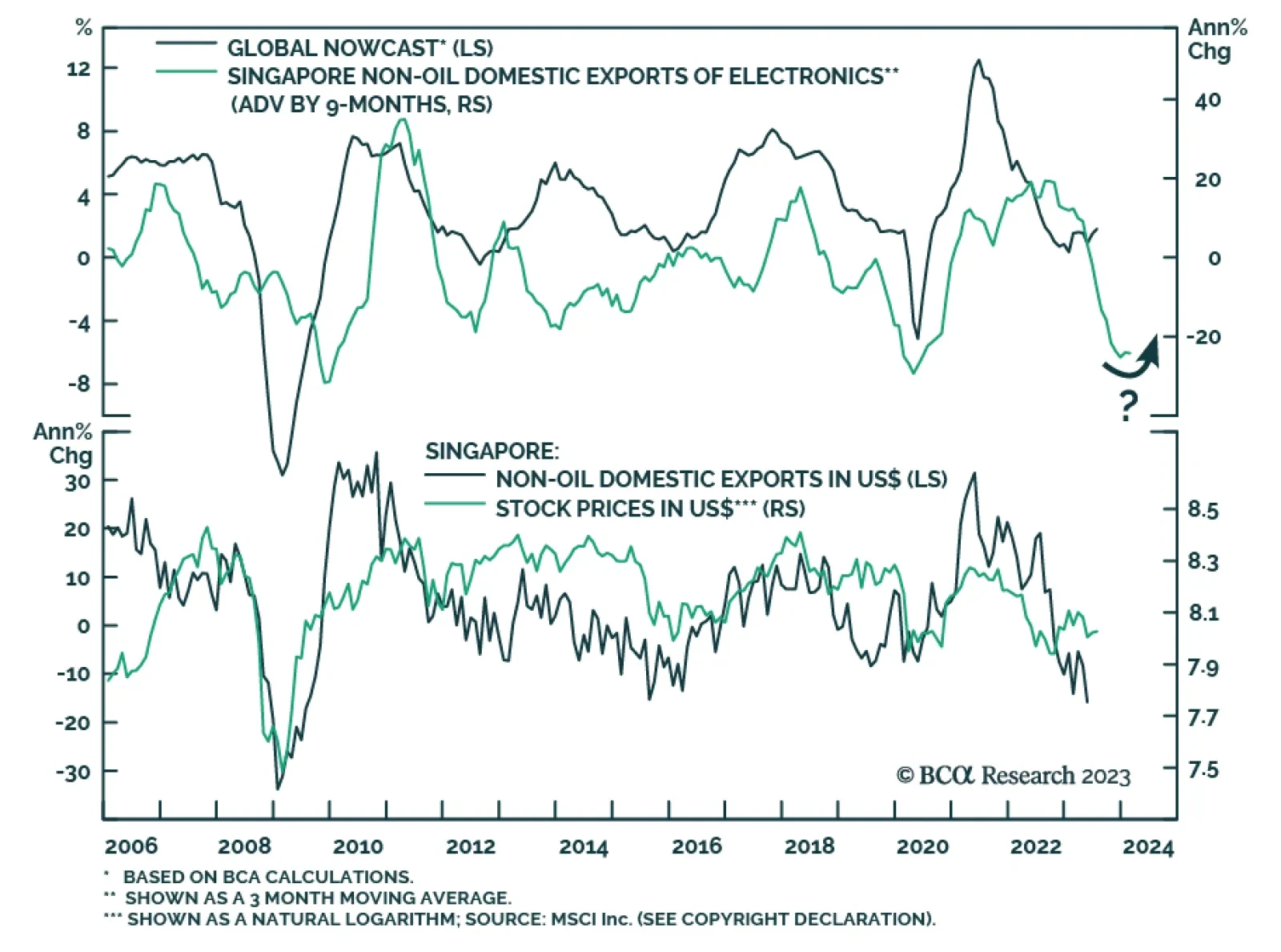

Singapore’s trade data continue to send a pessimistic signal about global manufacturing conditions. The year-over-year contraction in non-oil domestic exports (NODX) deepened to -15.5% y/y in June from -14.8% y/y –…

Both EV and Green Energy themes still hold strategic promise for investors, posing large upside, despite prevailing macro headwinds. While both themes have yet to claw back their pandemic peaks, a broadening of the rally supports a…

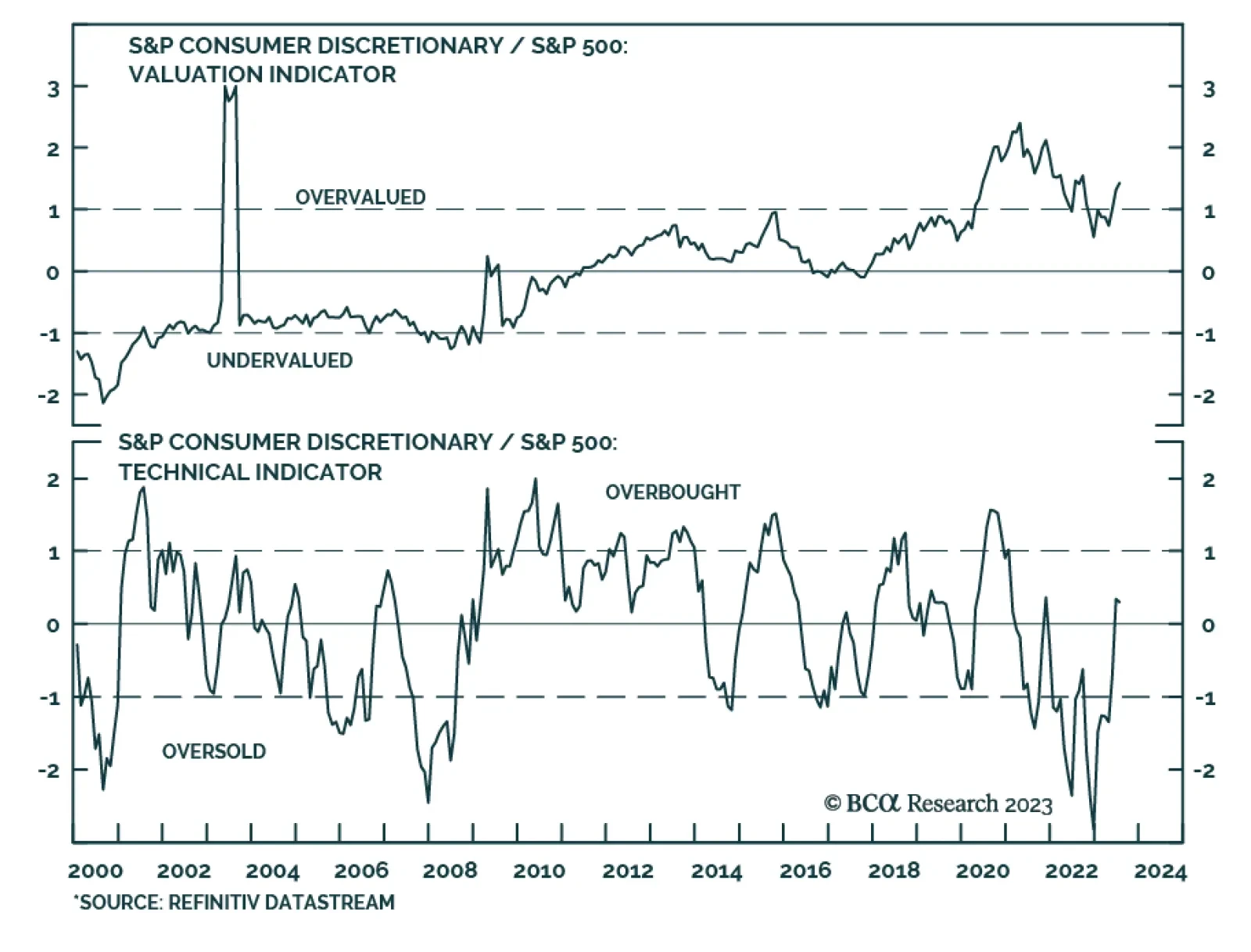

The S&P 500 reached our 4,500 mid-year target last week, but the bears have yet to capitulate and stocks could melt up so we are placing a trailing stop on our tactical overweight instead of downgrading equities outright.

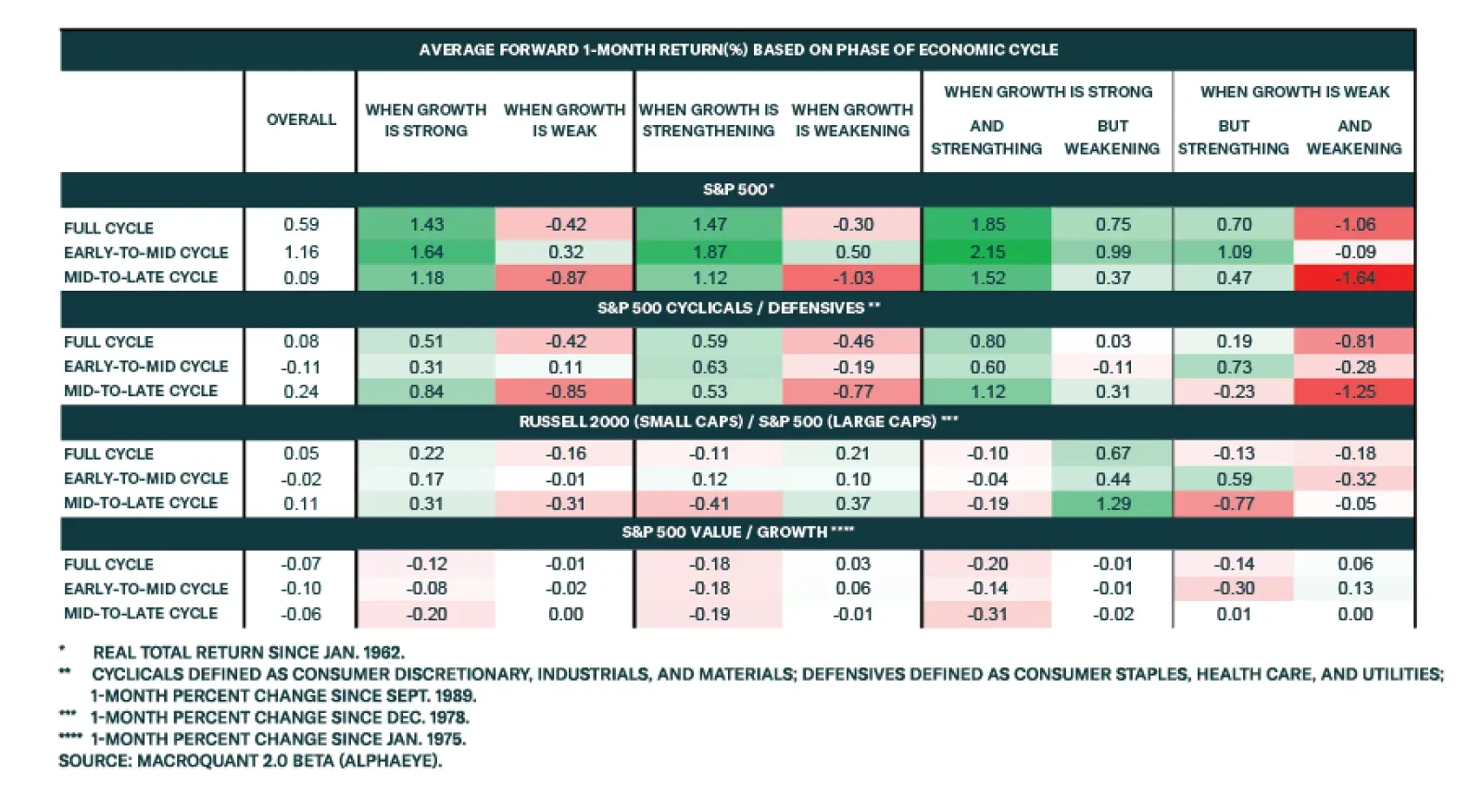

According to BCA Research’s Global Investment Strategy service, stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. In classical physics, the trajectory of an object…

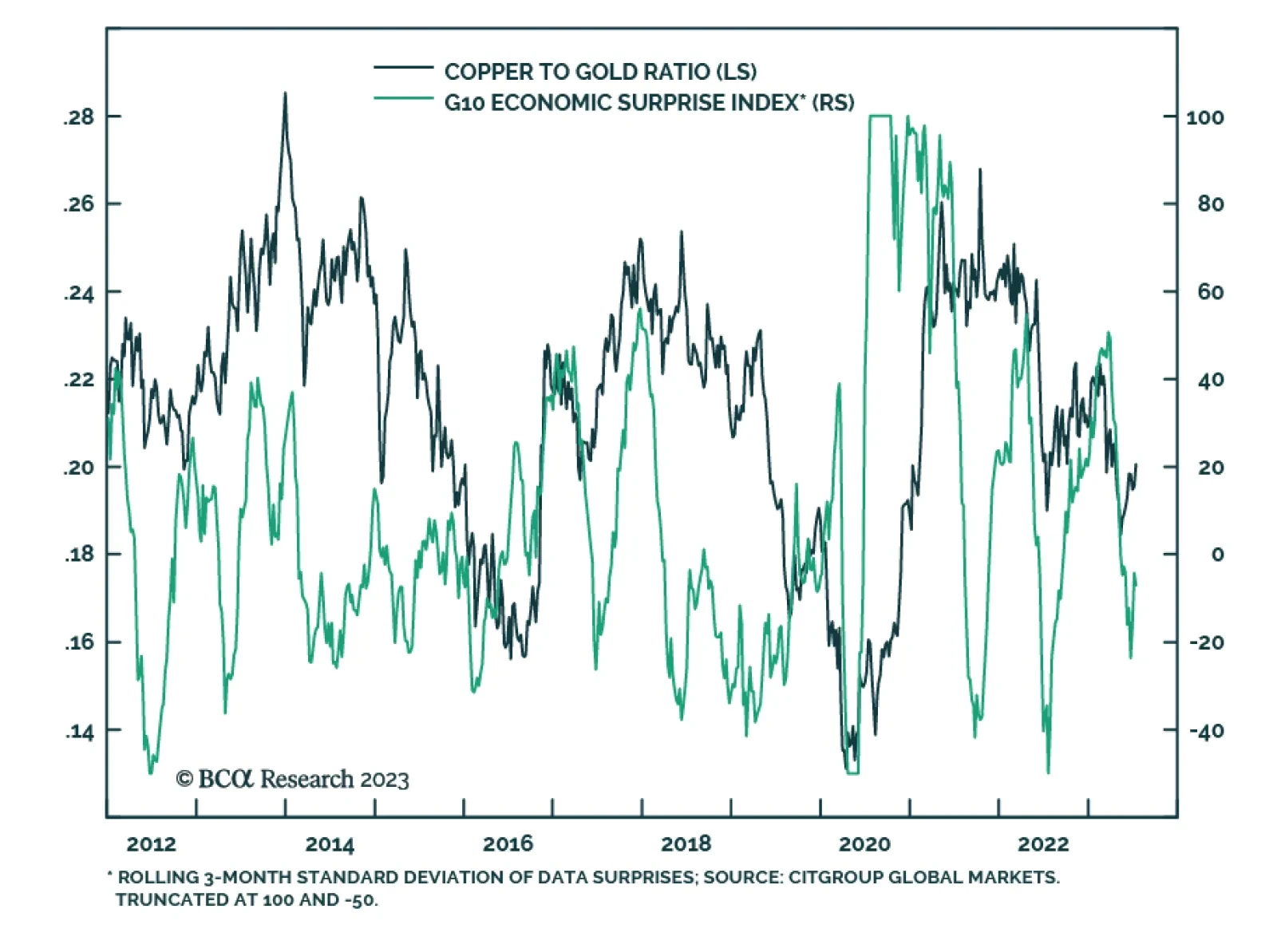

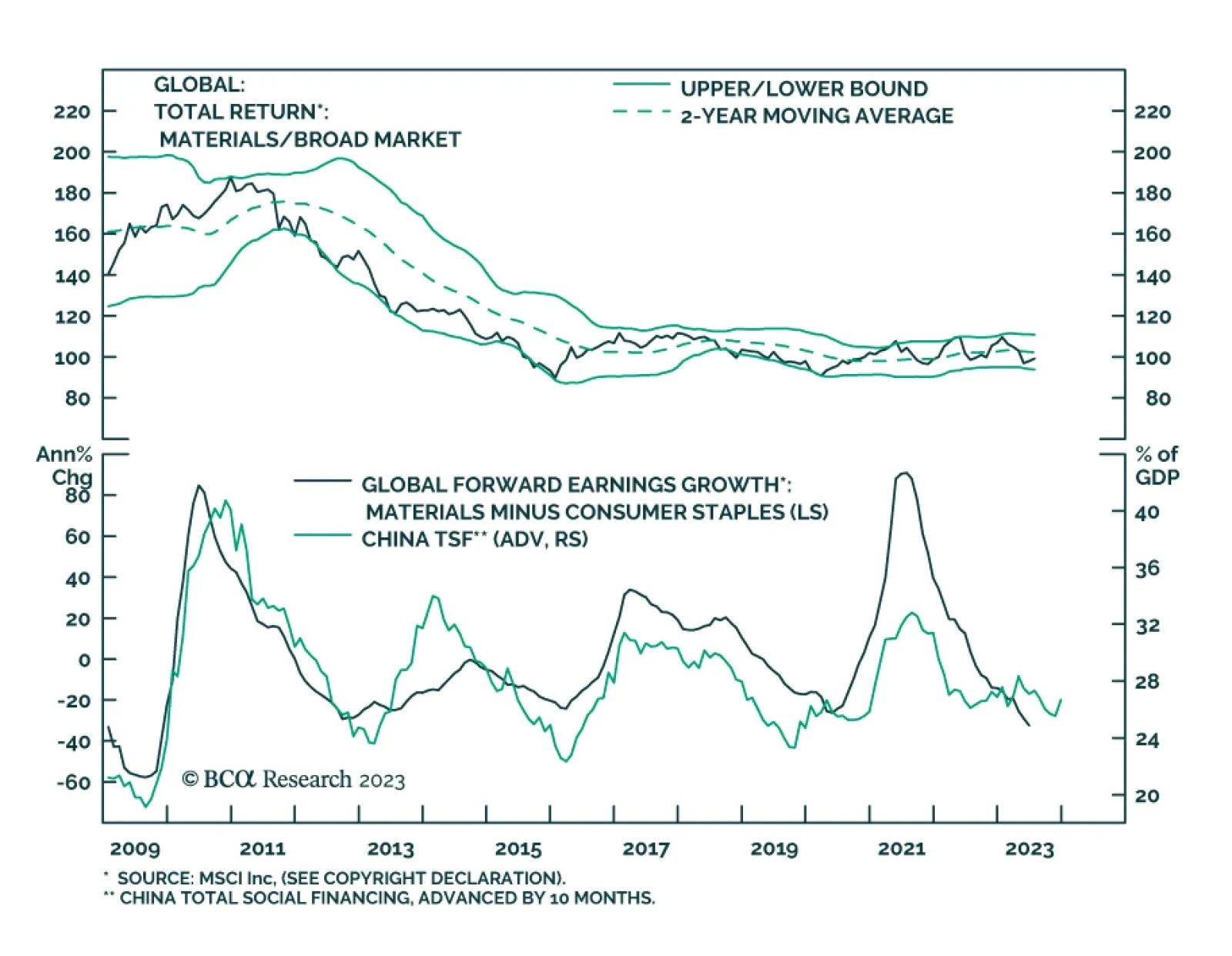

Copper rallied to a two-month high by the end of last week. Importantly, this move did not occur in isolation. It coincides with greater optimism about the prospects of a soft landing. Indeed, the US economic surprise index is…

Stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. The good news is that the economic growth score for the US in our MacroQuant model is above its historic average. The bad news…

BCA’s Global Asset Allocation service (GAA) recommends a defensive multi-asset portfolio allocation due to a high probability of recession. However, our colleagues also add a hedge to manage upside risk because they do not…

In this report, we explore Brazil’s inflation and monetary policy outlook, the Lula administration’s back-and-forth between pragmatism and populism, and how these factors will affect Brazilian financial markets going forward. All in…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…