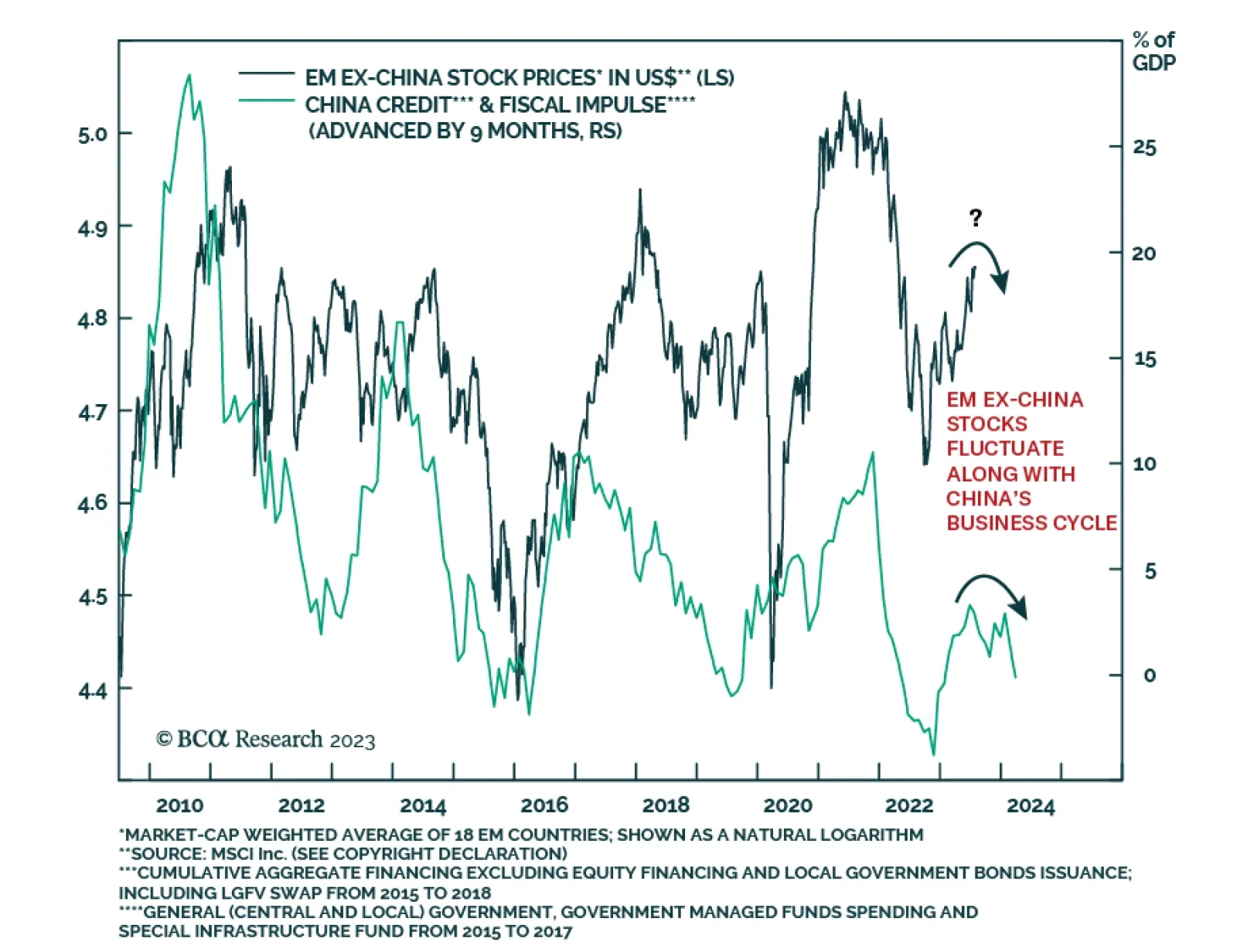

According to BCA Research’s Emerging Markets Strategy service, while EM ex-China markets are set to continue outperforming Chinese investable/offshore equities, they are unlikely to deliver superior absolute returns.…

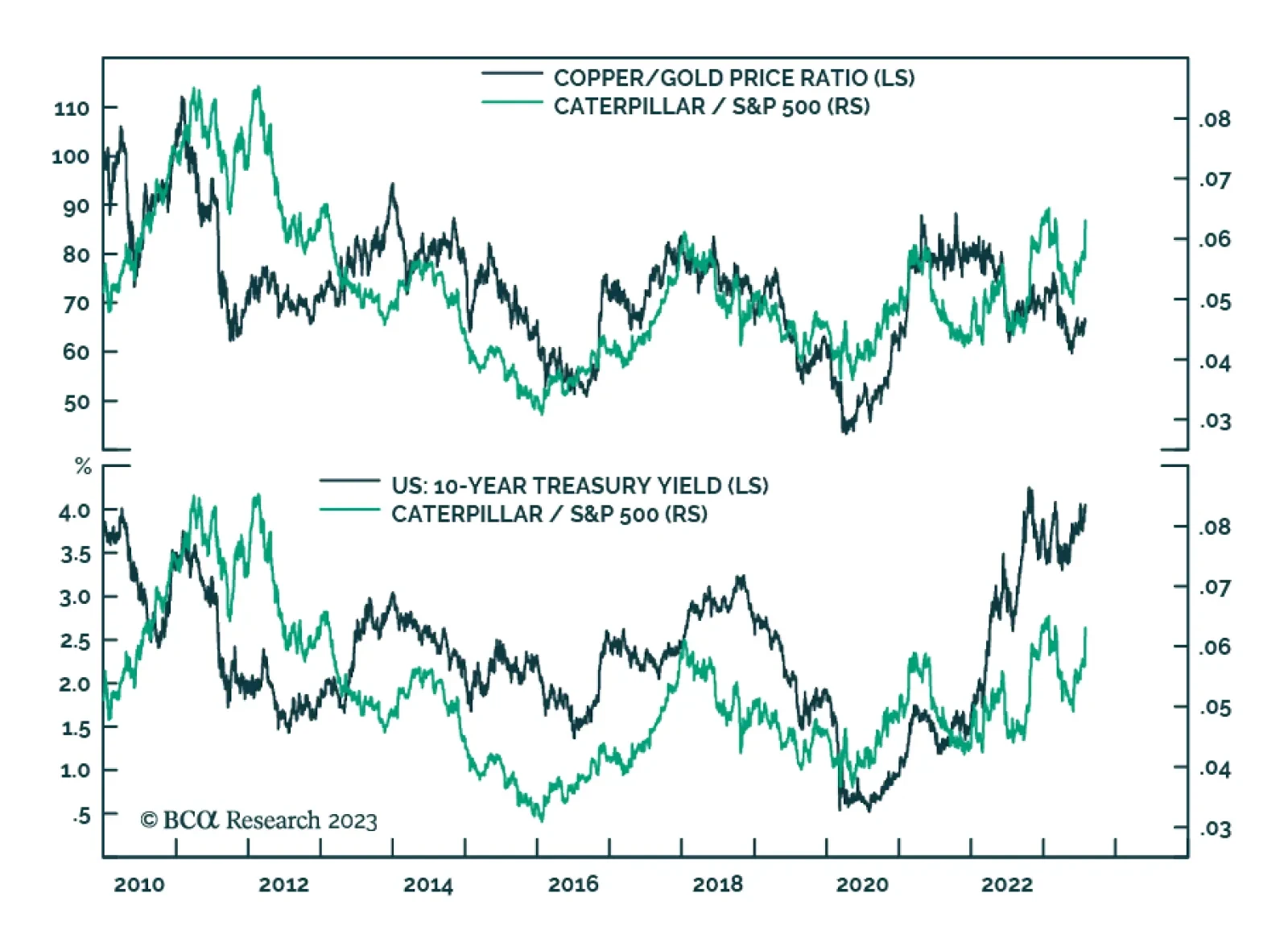

Caterpillar’s Q2 earnings results released on Tuesday beat consensus estimates by a wide margin. Second quarter profit of $2.92 billion ($5.67 per share) came in well above expectations of $2.38 billion ($4.46 per share).…

Collapsed complexity, plus the unwinding of favourable base effects and favourable seasonal adjustments to the inflation and jobs numbers, all pose a danger to the Goldilocks market.

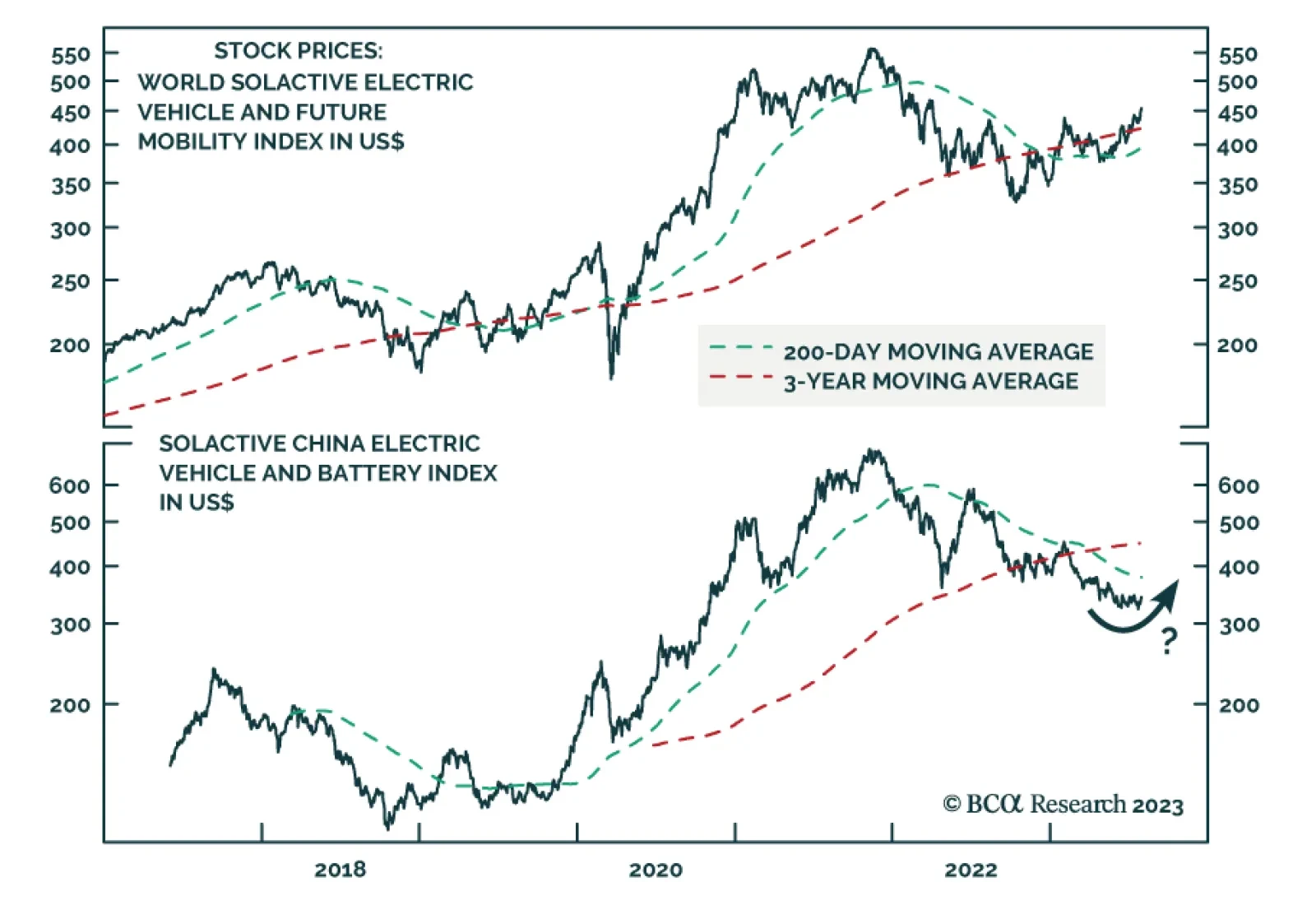

According to BCA Research’s China Investment Strategy service, Beijing’s investment focus is shifting from traditional infrastructure to new economy infrastructure, which includes clean energy and high-tech sectors…

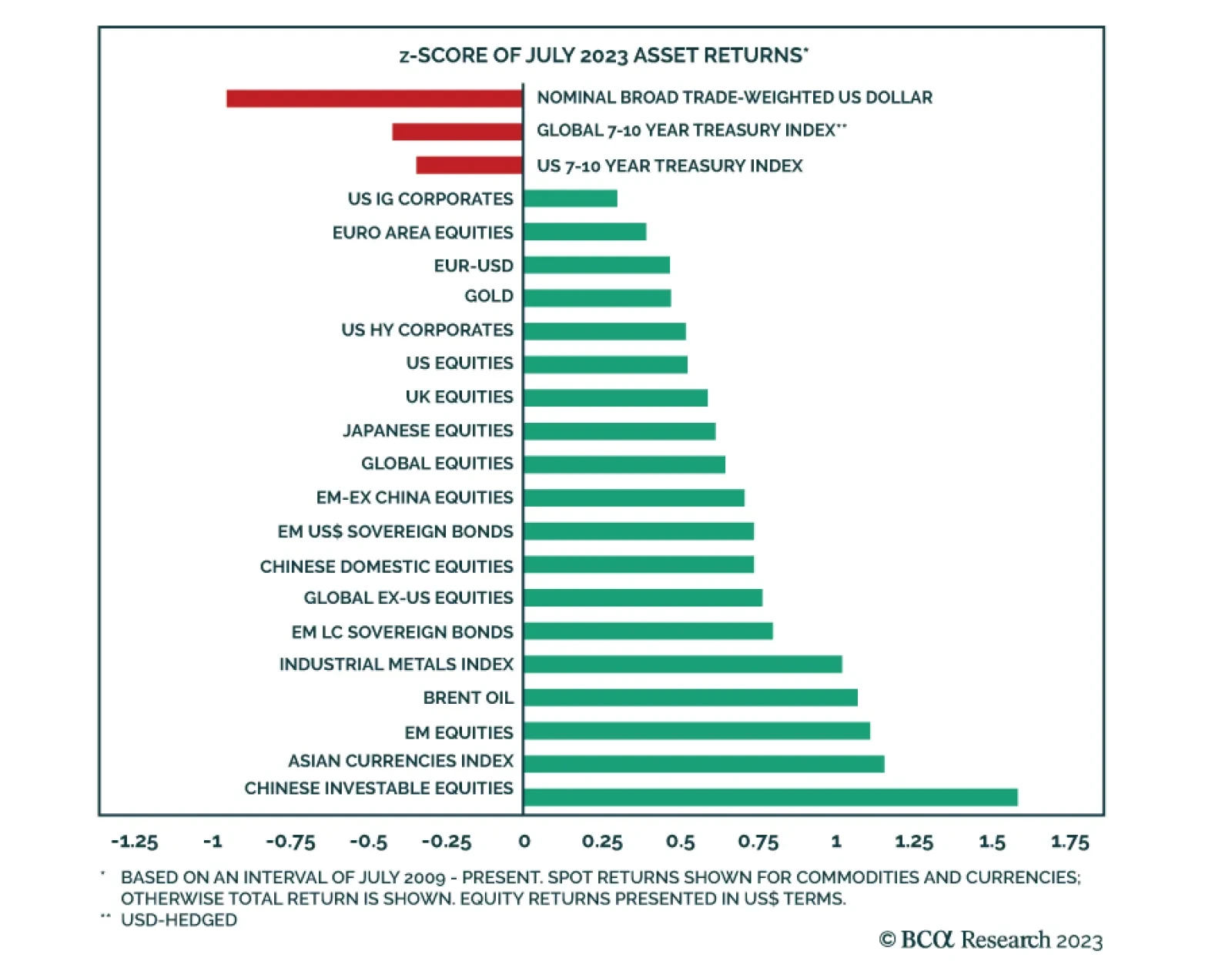

The performance of global financial markets continued to improve in July, with most of the major financial assets we track generating positive abnormal returns for the second consecutive month. Asian markets led this dynamic…

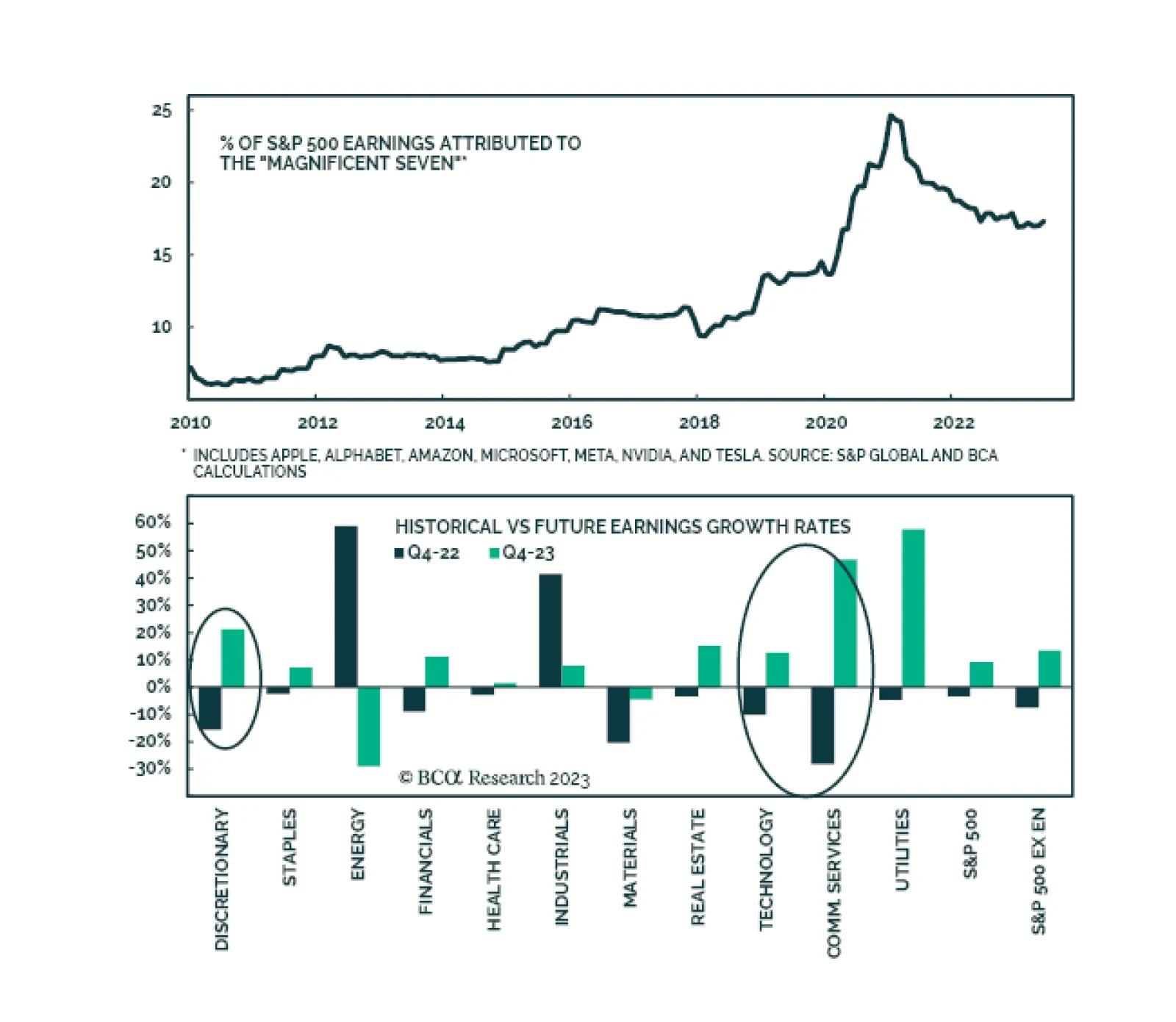

It is widely expected by consensus that earnings growth will rebound into the year-end and into 2024. Multiple factors will drive the reacceleration in earnings growth. Sales growth will pick up: In the remainder of the year,…

History suggests that a “soft landing” is highly unlikely after such an aggressive Fed tightening cycle. The rally could continue for a little longer but, on the 12-month horizon, market risks are very skewed to the downside.

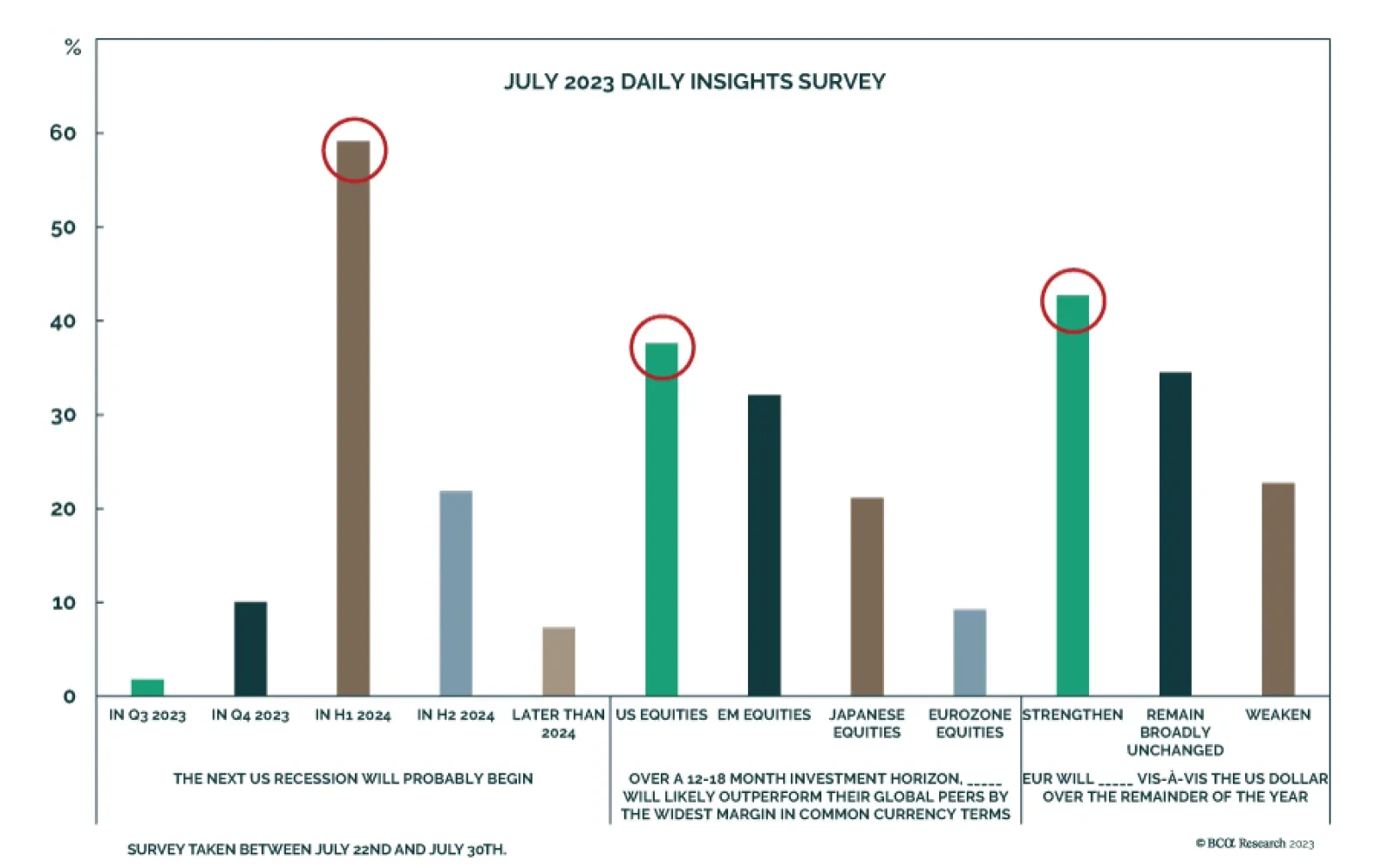

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for the US economy, regional equity allocation, and EUR/USD. On the outlook for the US economy, the majority of…

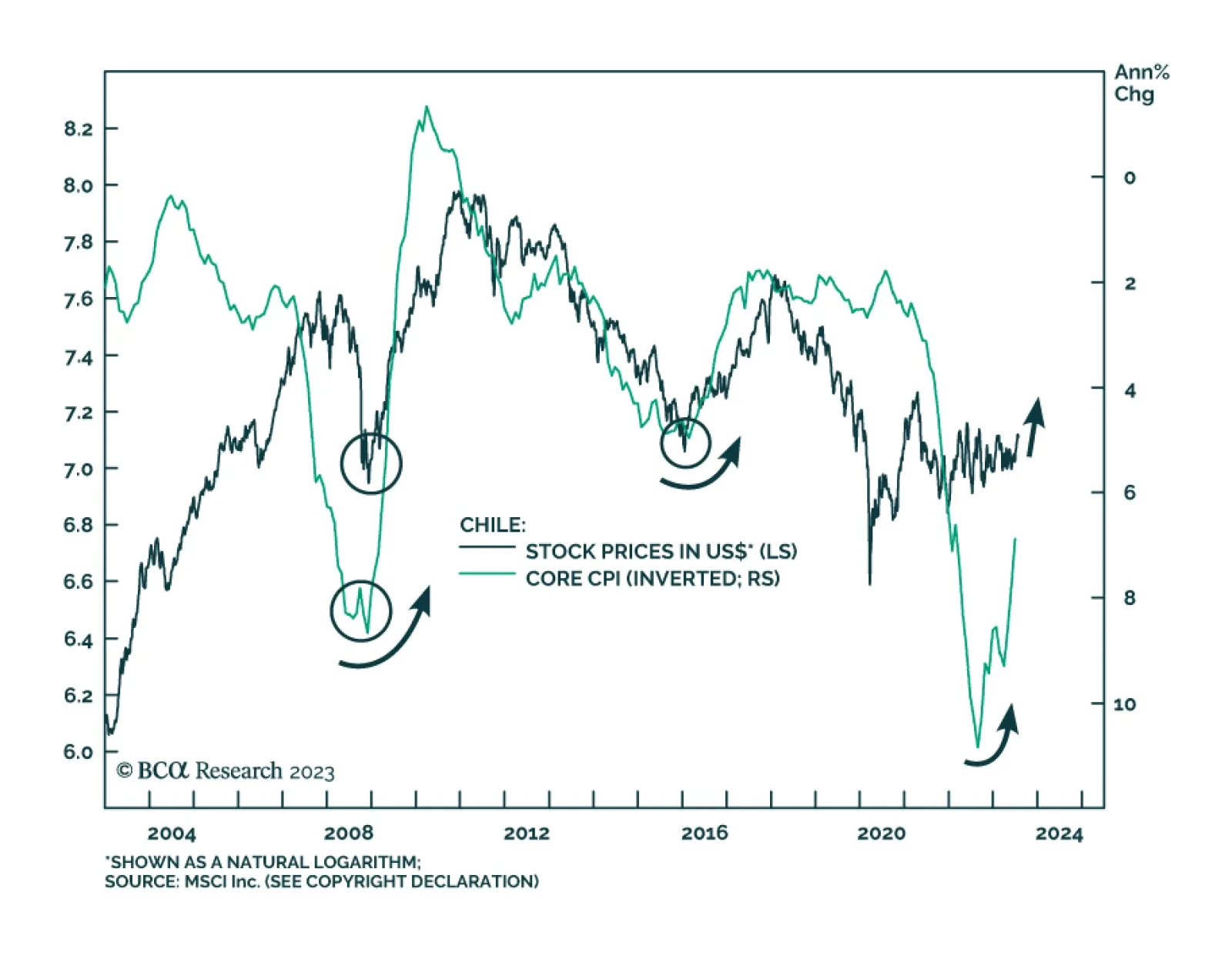

Last Friday, the Central Bank of Chile became the first major Latin American monetary authority to cut rates, thereby beginning the EM monetary easing cycle. In its latest meeting, board members decided to reduce the policy…