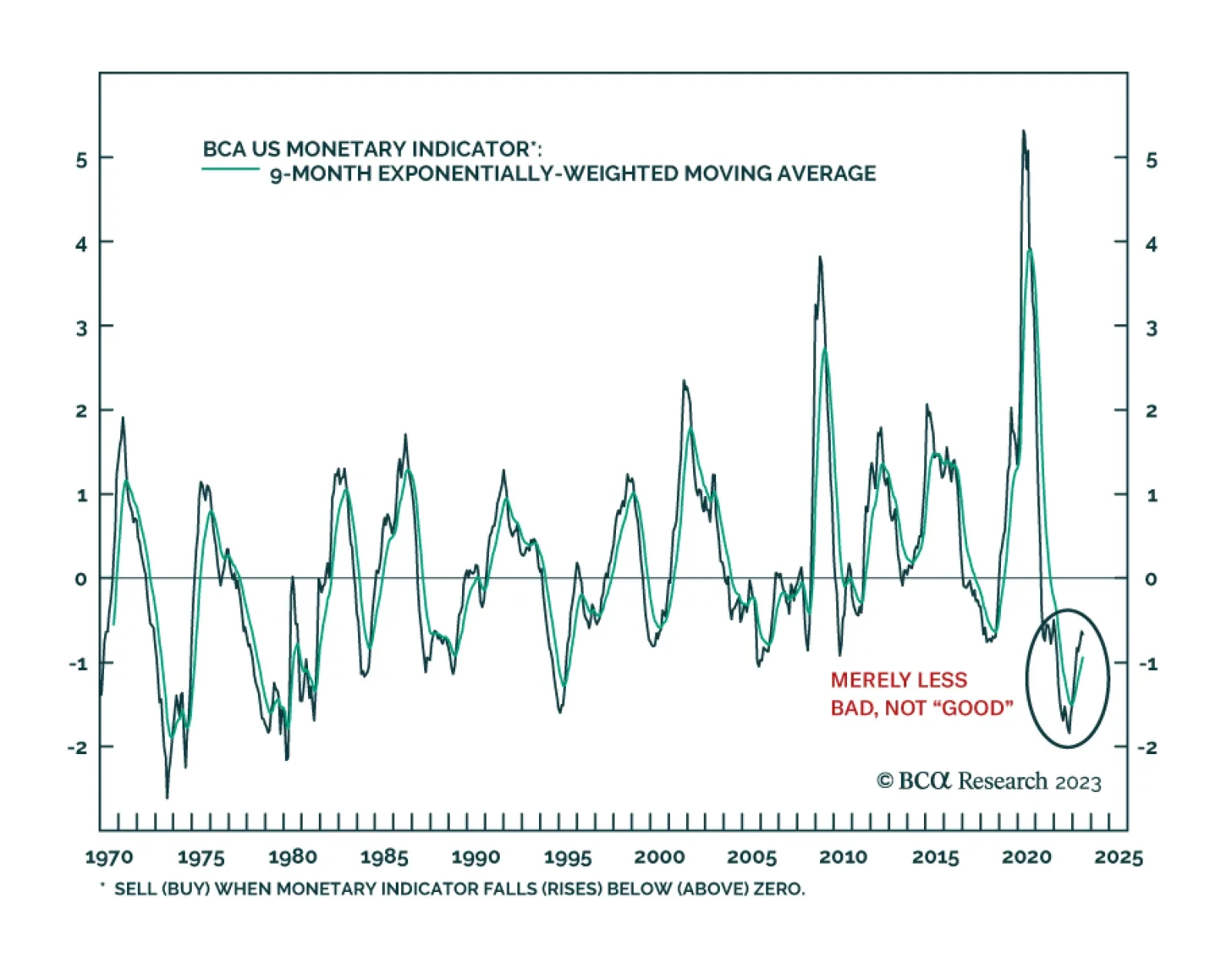

In a recently published report, BCA’s Bank Credit Analyst service reviewed the BCA Valuation Index, alongside three other US equity indicators which are published in Section III of each month’s report. The other…

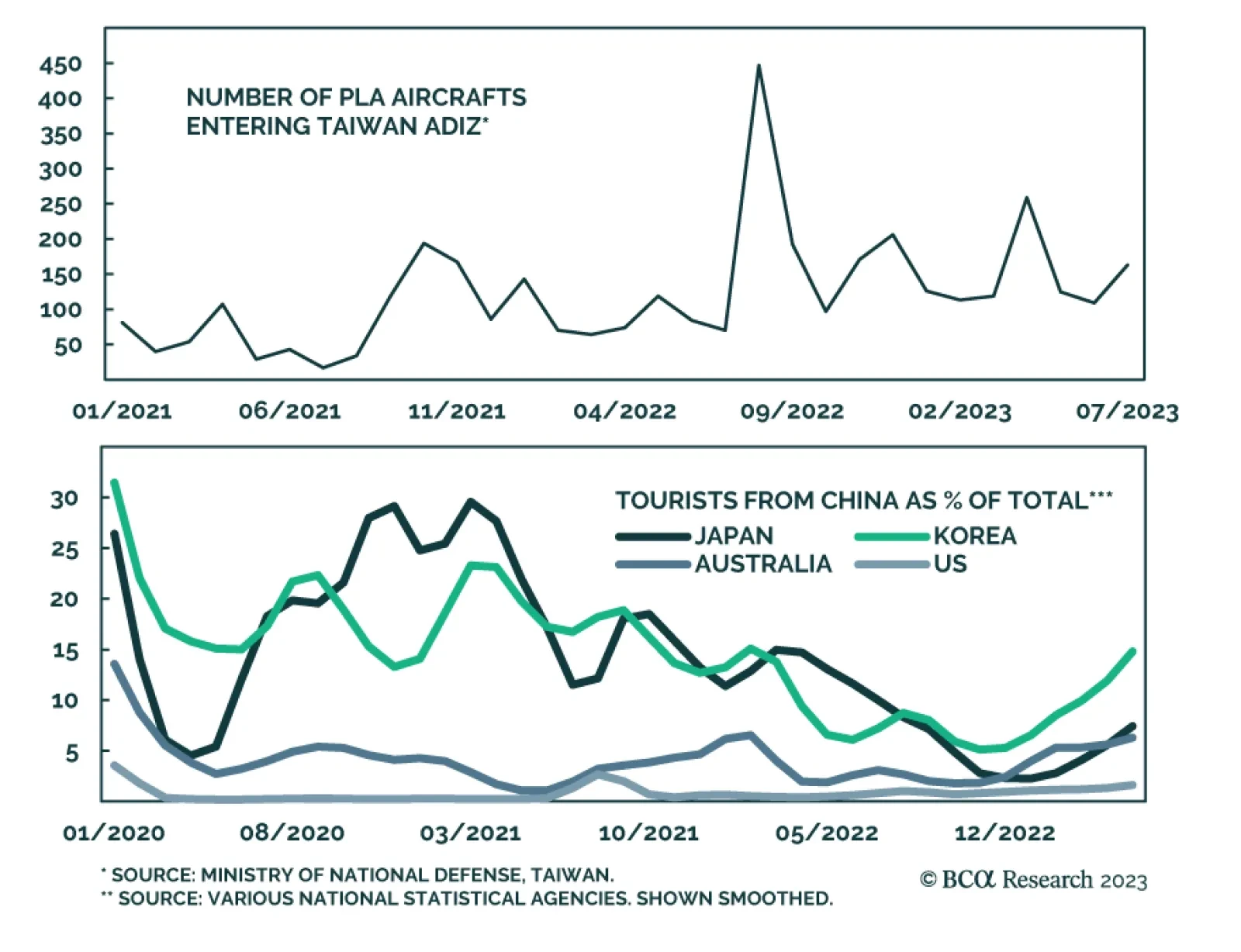

On Monday, Asia Pacific equity markets closed in the red due to the news that China’s largest real estate developer, Country Garden, is suspending the trading of some of its bonds. This recent episode is a continuation of…

Outperformance of Growth sectors most likely has run its course. It is time to shift Growth vs. Value allocation to neutral, downgrade Semis, and upgrade Energy to overweight.

European real GDP growth is stabilizing, so why would European equities continue to trade sideways for the remainder of the year? The answer lies with nominal growth and its impact on earnings.

Inspired by a client’s questions, we examine the rationale behind the implementation of the trailing stop governing our near-term asset allocation recommendations.

According to BCA Research’s Emerging Markets Strategy service, the gap that has formed between the S&P 500 price and its operating profit margins, as well as the divergence between the S&P 500 Forward P/E ratio and…

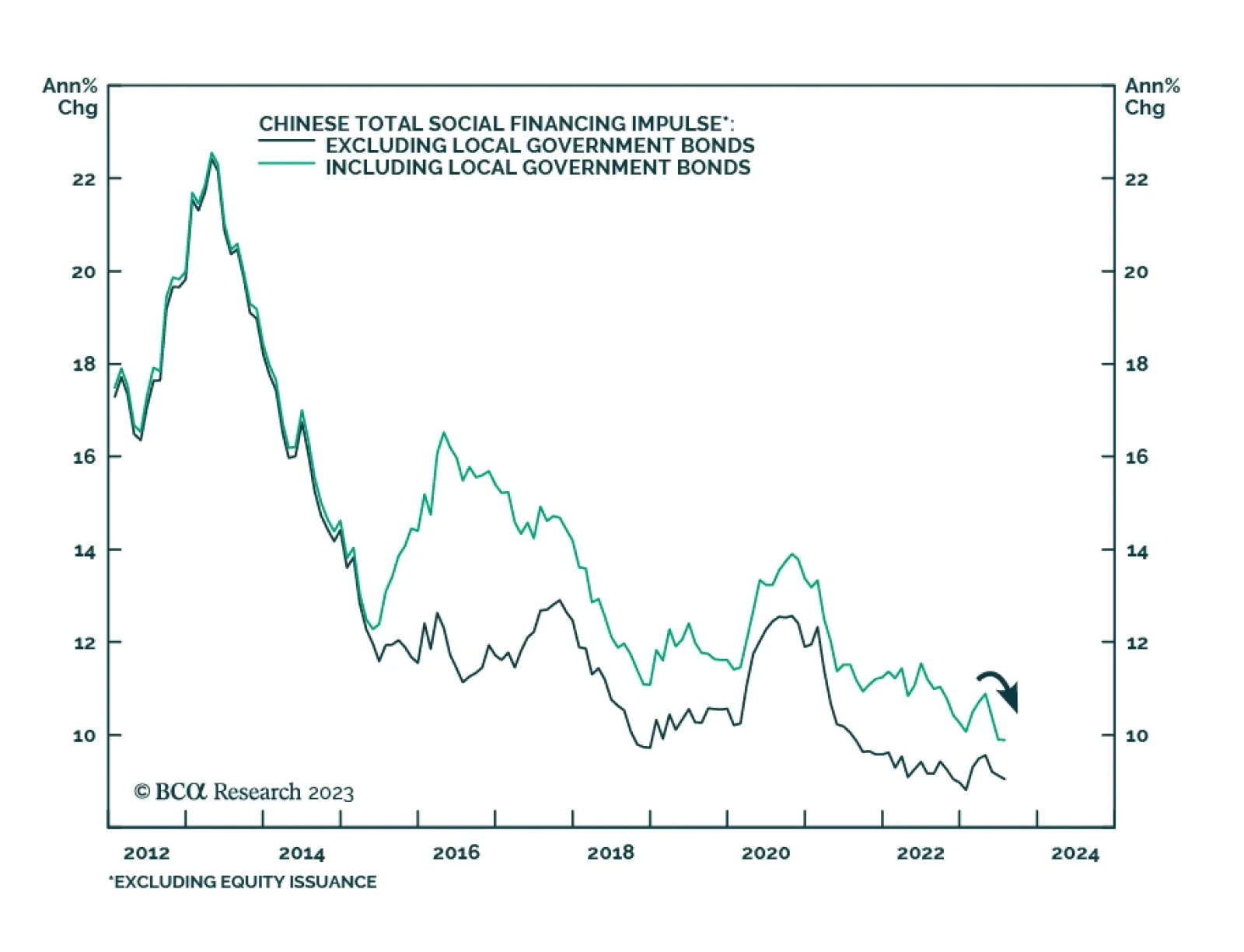

Chinese credit and money data fell significantly below expectations in July. The CNY 0.53 trillion increase in aggregate social financing marks a significant slowdown from CNY 4.22 trillion in June and came in significantly below…

Numerous divergences have opened up between global risk assets and global business cycle variables. These gaps are unsustainable, and odds are that the recoupling will occur to the downside with risk assets selling off.

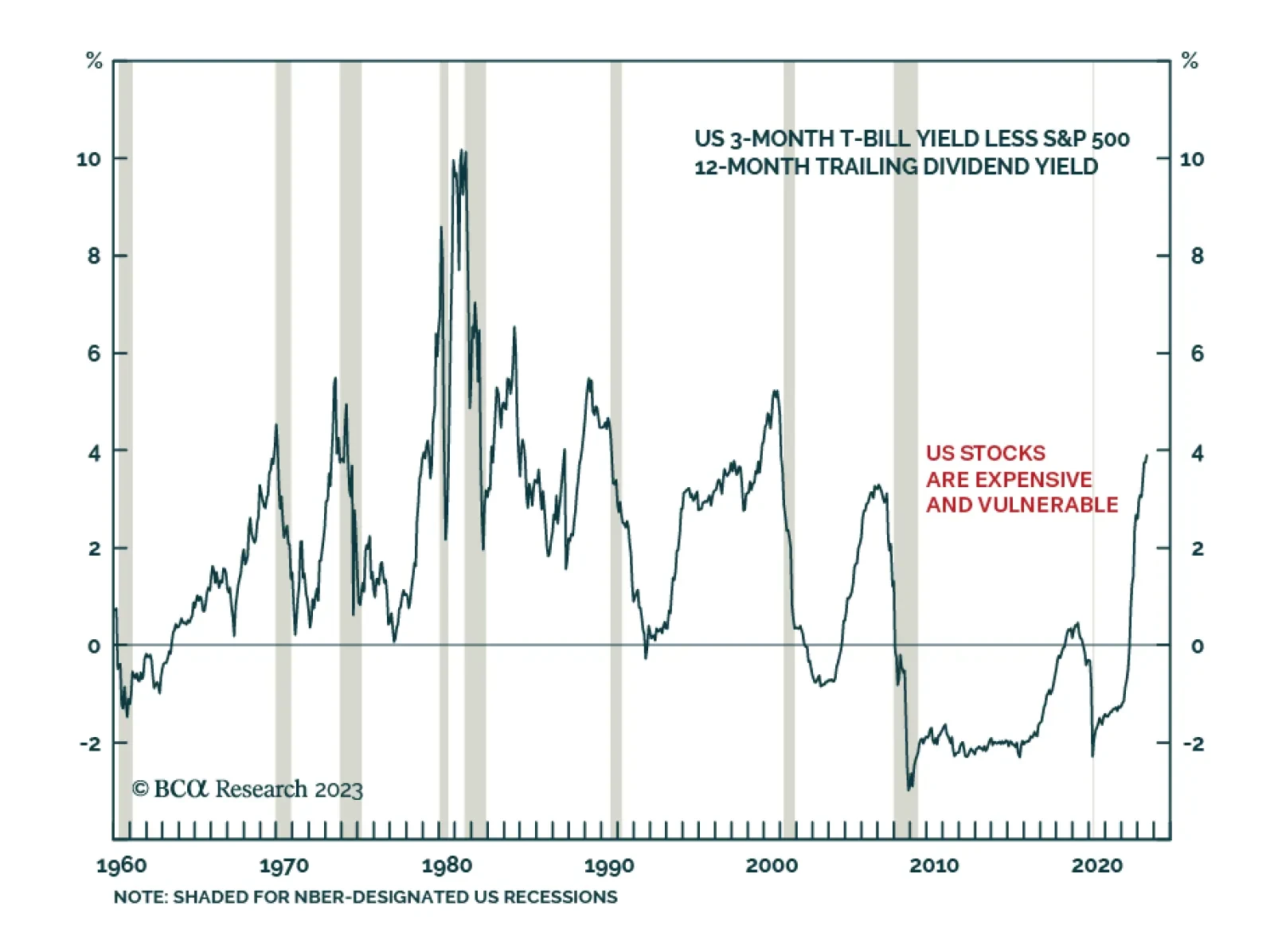

During the last economic expansion, a structurally overweight allocation to stocks was at least partially warranted by the idea that “There Is No Alternative” – or “T.I.N.A.” During the last…

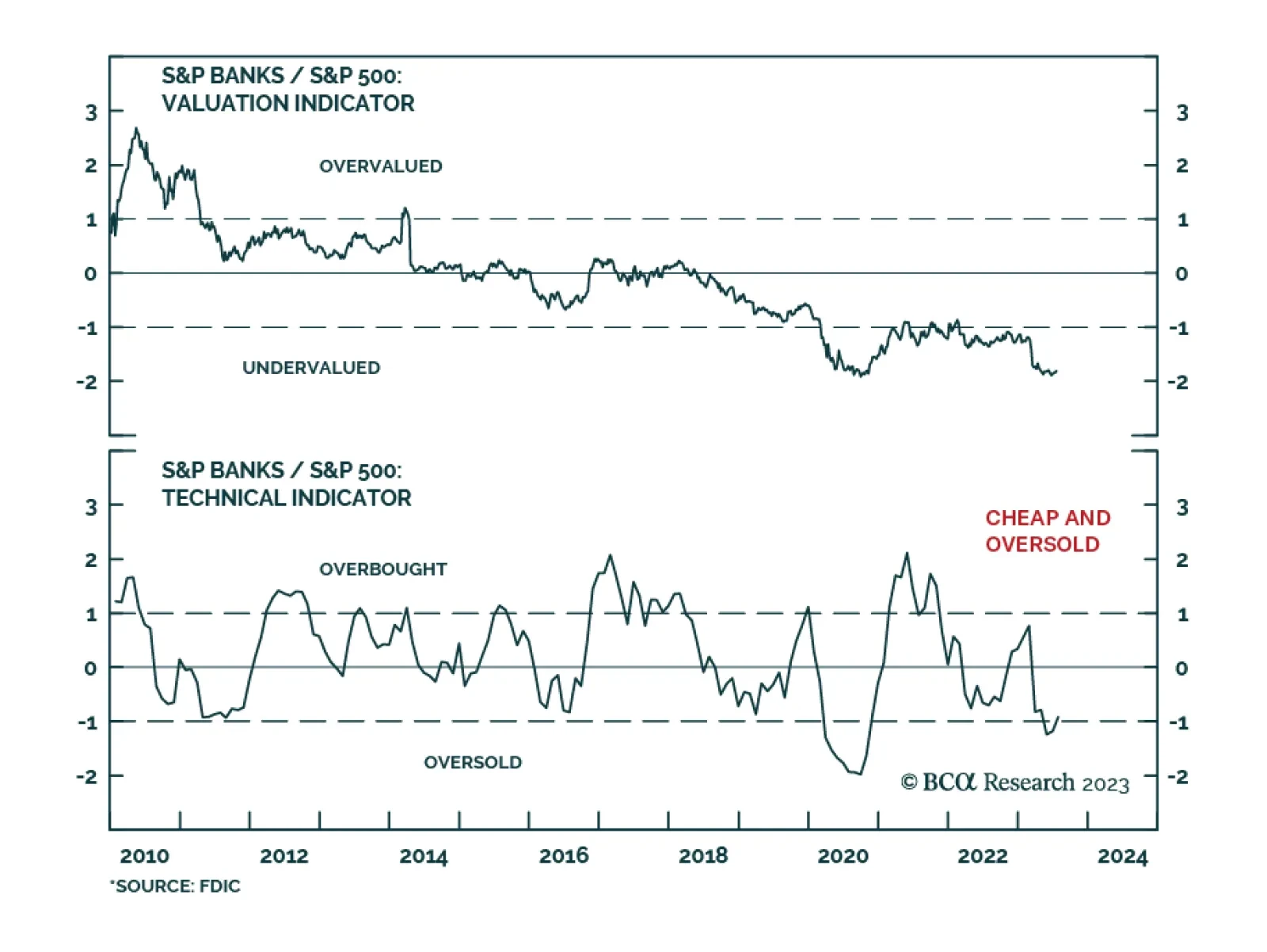

On Monday, Moody’s downgraded the credit ratings of 10 small to mid-sized US banks and placed some of the biggest US banks on downgrade watch. The latter include Bank of New York Mellon, US Bancorp, State Street, and Truist…