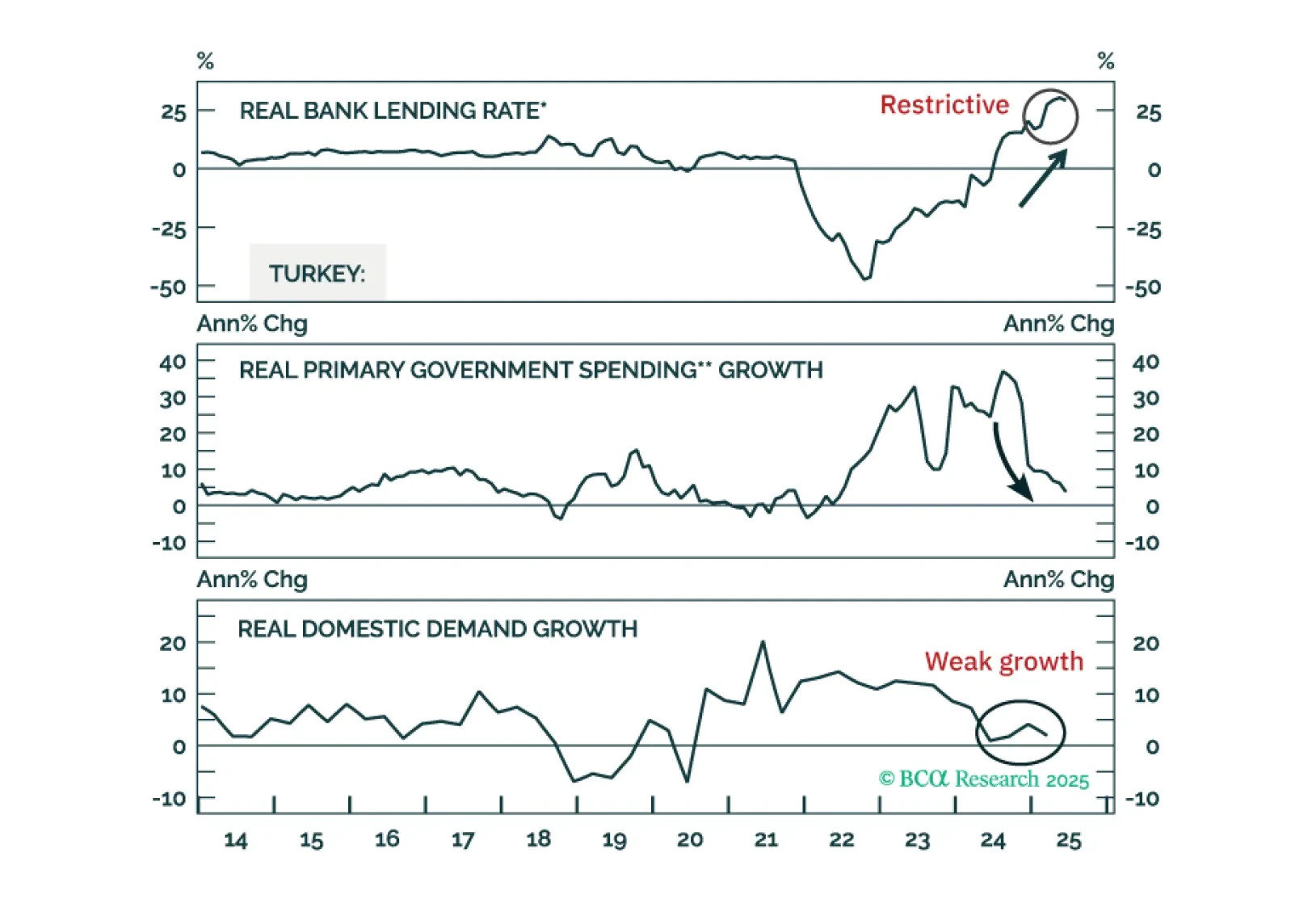

Thanks to the tight monetary and fiscal policies so far, inflation and growth are heading lower in Turkey. Buy 2-year local currency bonds, currency unhedged. Also, upgrade Turkey's domestic bonds from neutral to overweight and…

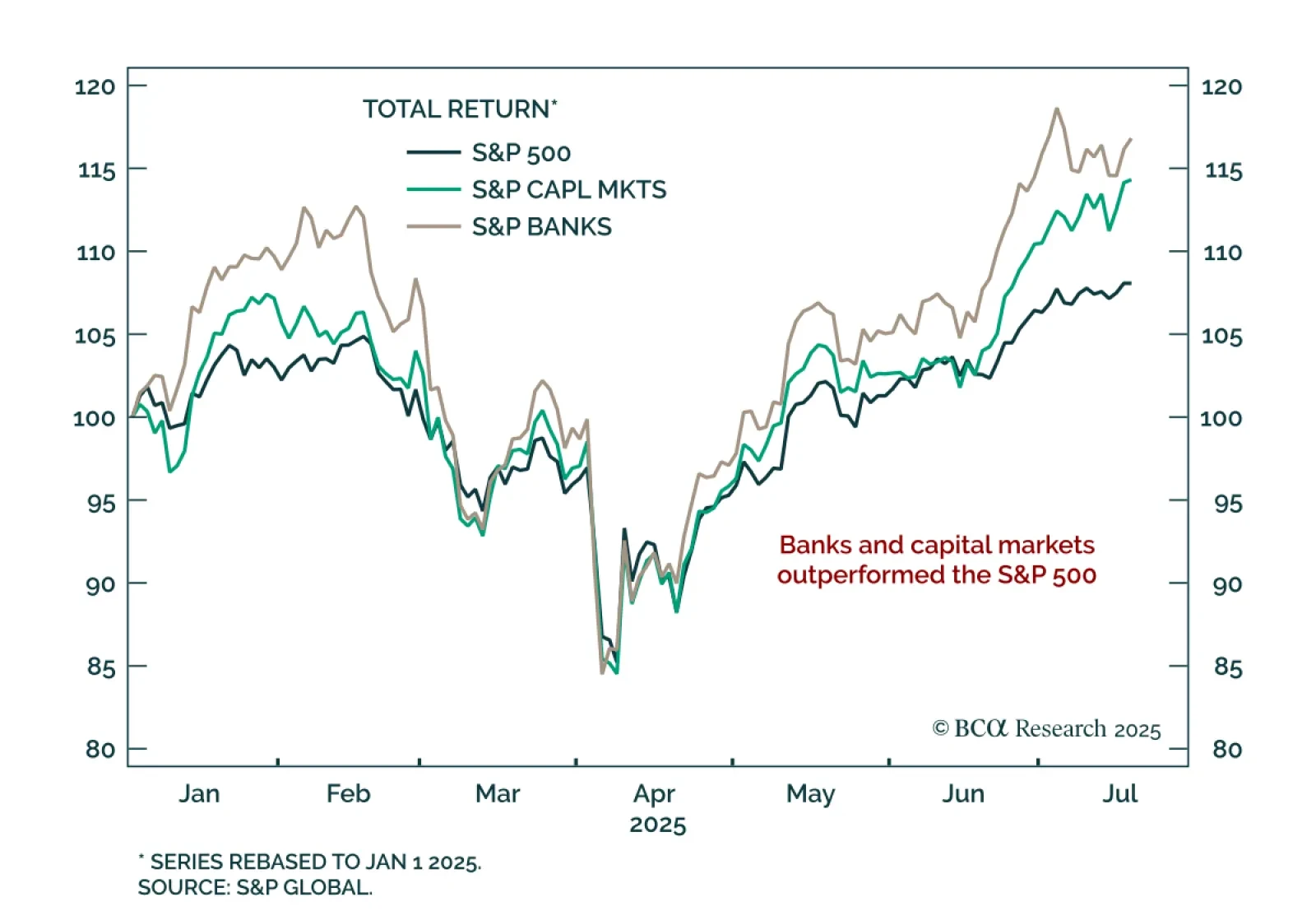

BCA’s US Equity strategists reiterate their overweight stance on Banks and Diversified Financials. Q2 results were solid, with resilient consumer strength and a rebound in capital markets activity. Net interest margins are…

This insight gives life to four high-conviction views on European small caps, aero¬space & defense, banks, and telecoms by harnessing the power of BCA’s Equity Analyzer (EA).

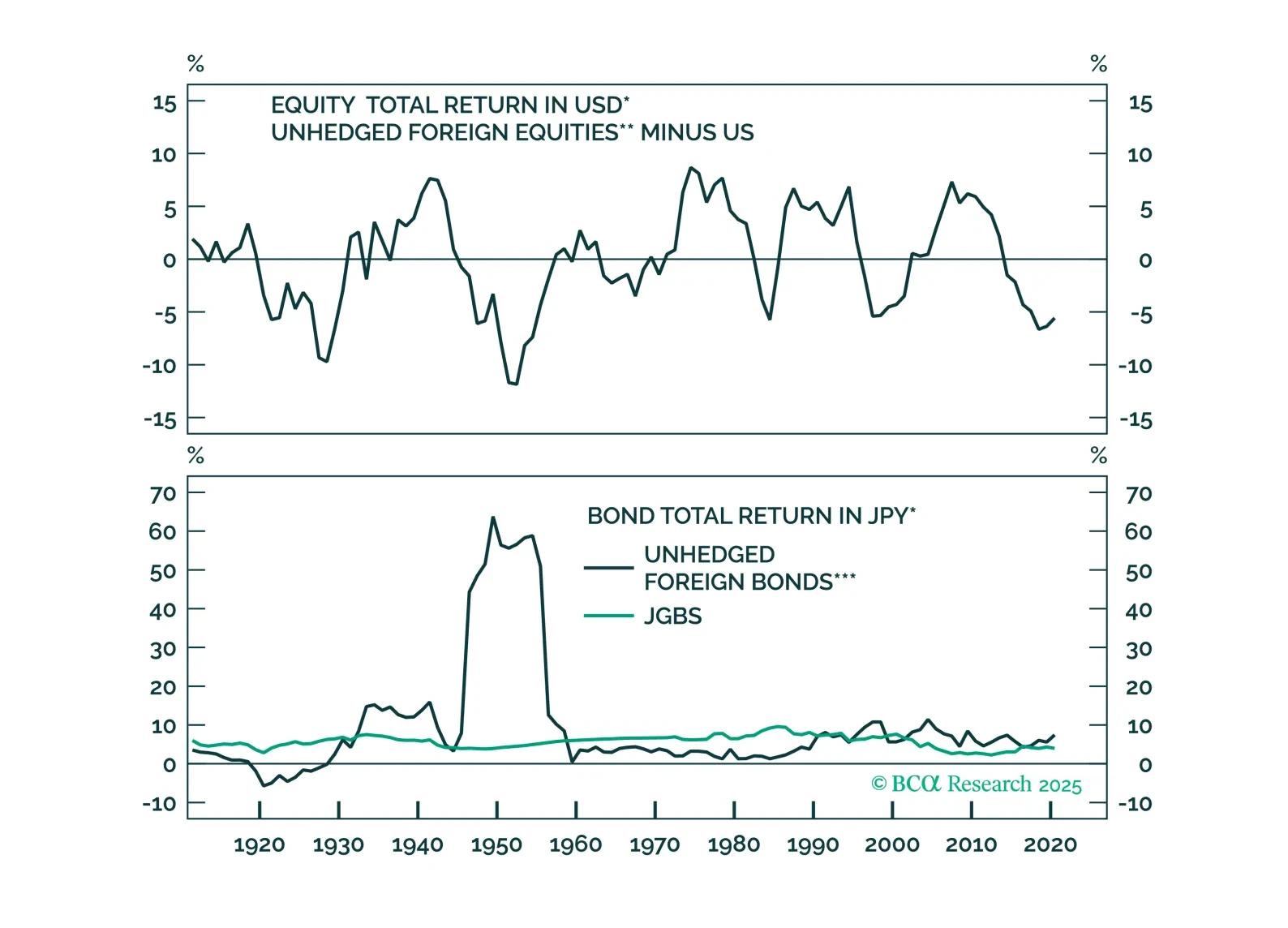

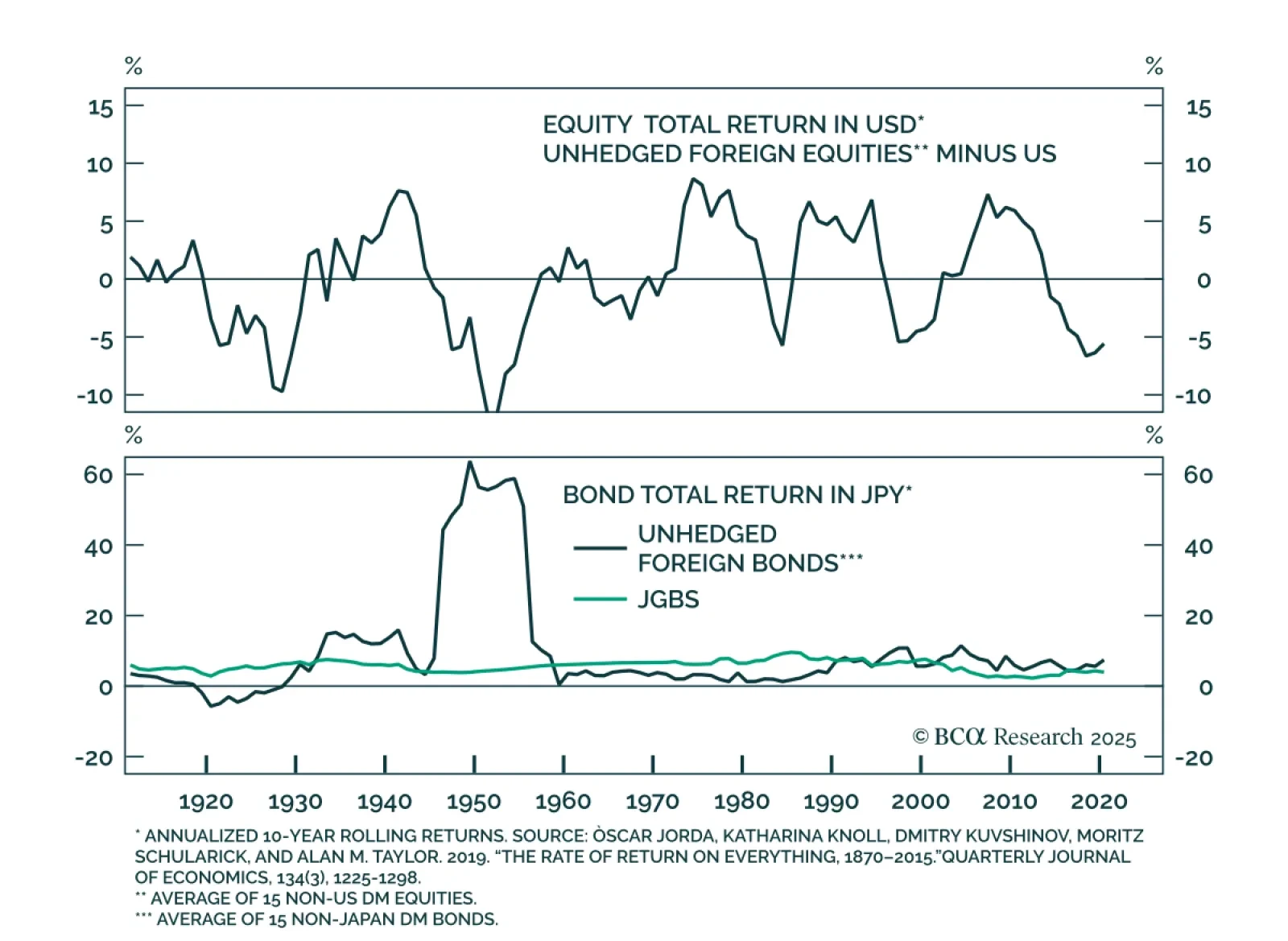

BCA’s Global Asset Allocation strategists find that international diversification outperforms home bias in both bonds and equities, especially when FX risk is hedged. Unhedged foreign bonds have consistently underperformed domestic…

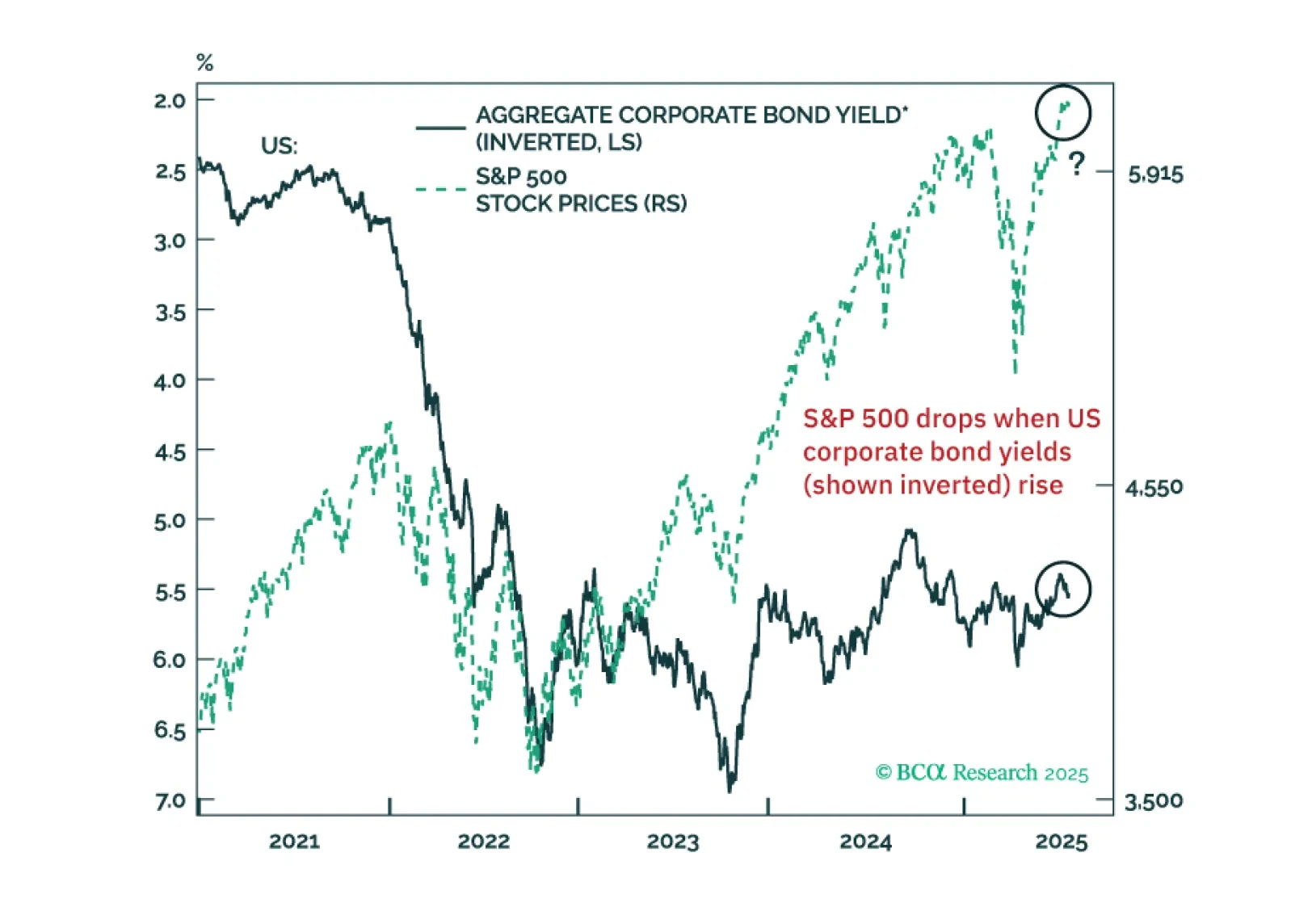

US equity investors should heed warning signals from US corporate bond yields. There are early red flags for EM share prices. Global trade will shrink in H2 2025. China’s economic tailwinds from H1 2025 – fiscal and export…

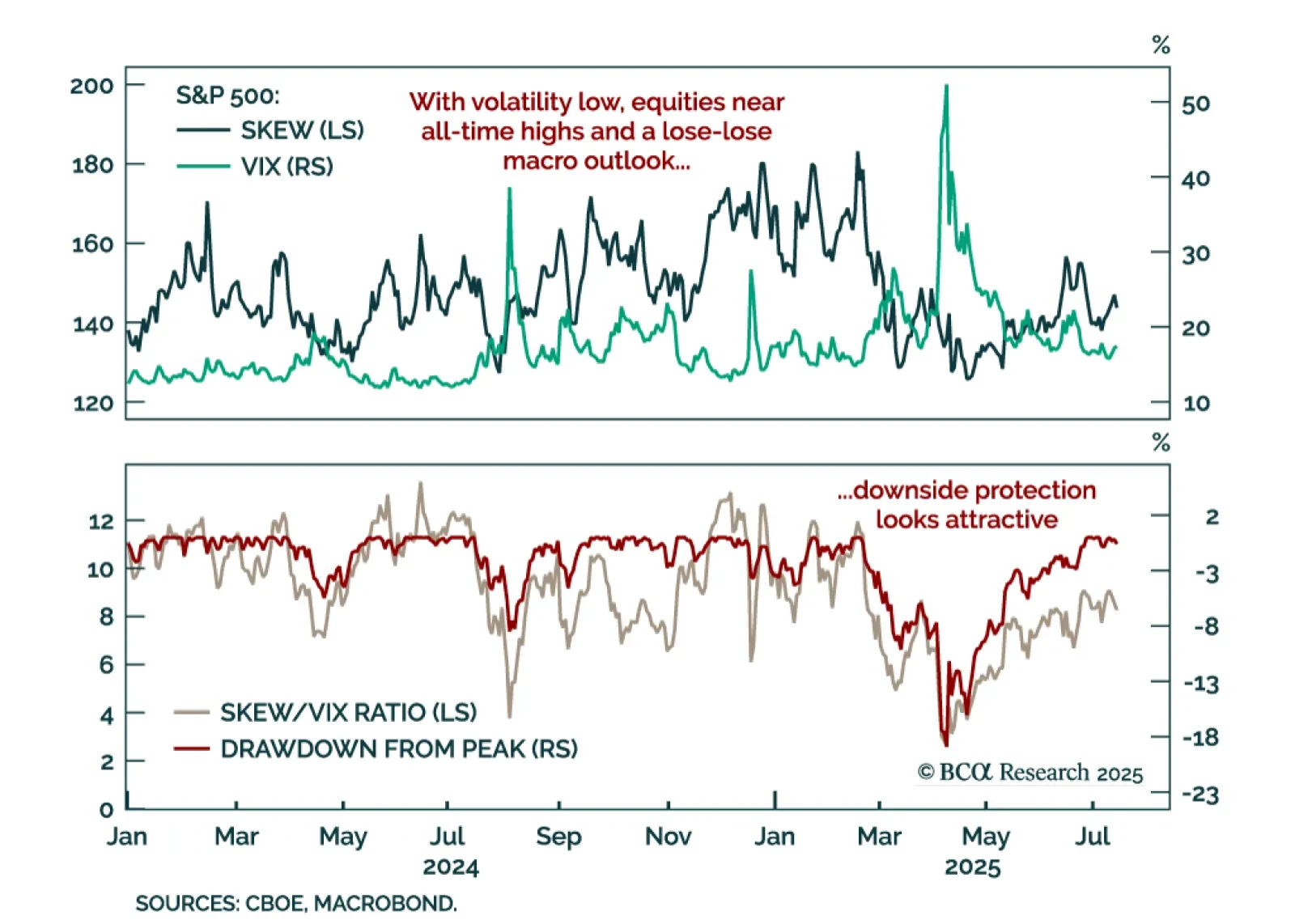

The S&P 500 sits near all-time highs, but sentiment and positioning suggest euphoria has not driven this rally. Prices are elevated, yet the SKEW/VIX ratio sits at 8.3, or its 67th percentile. While not at extreme levels…

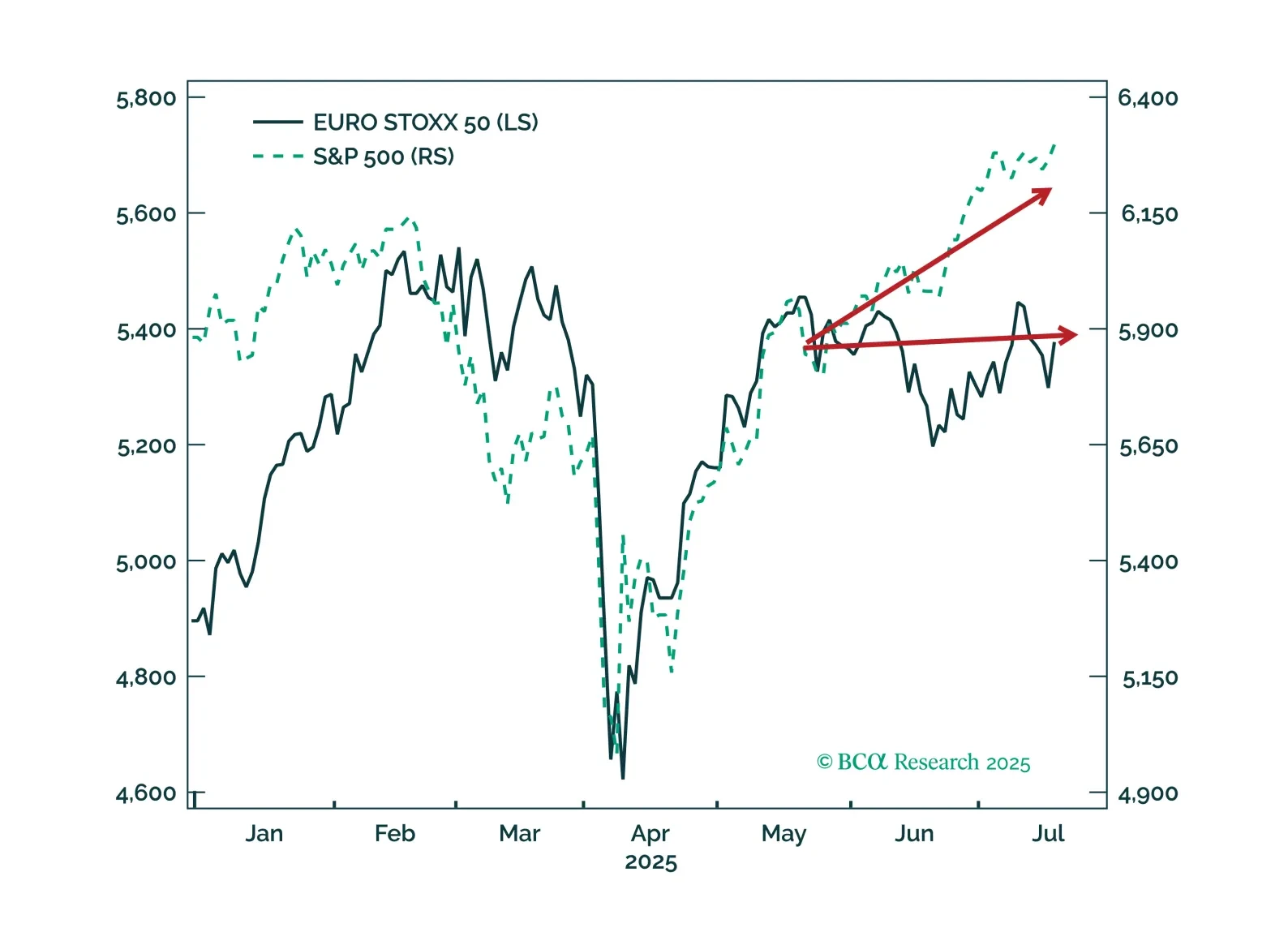

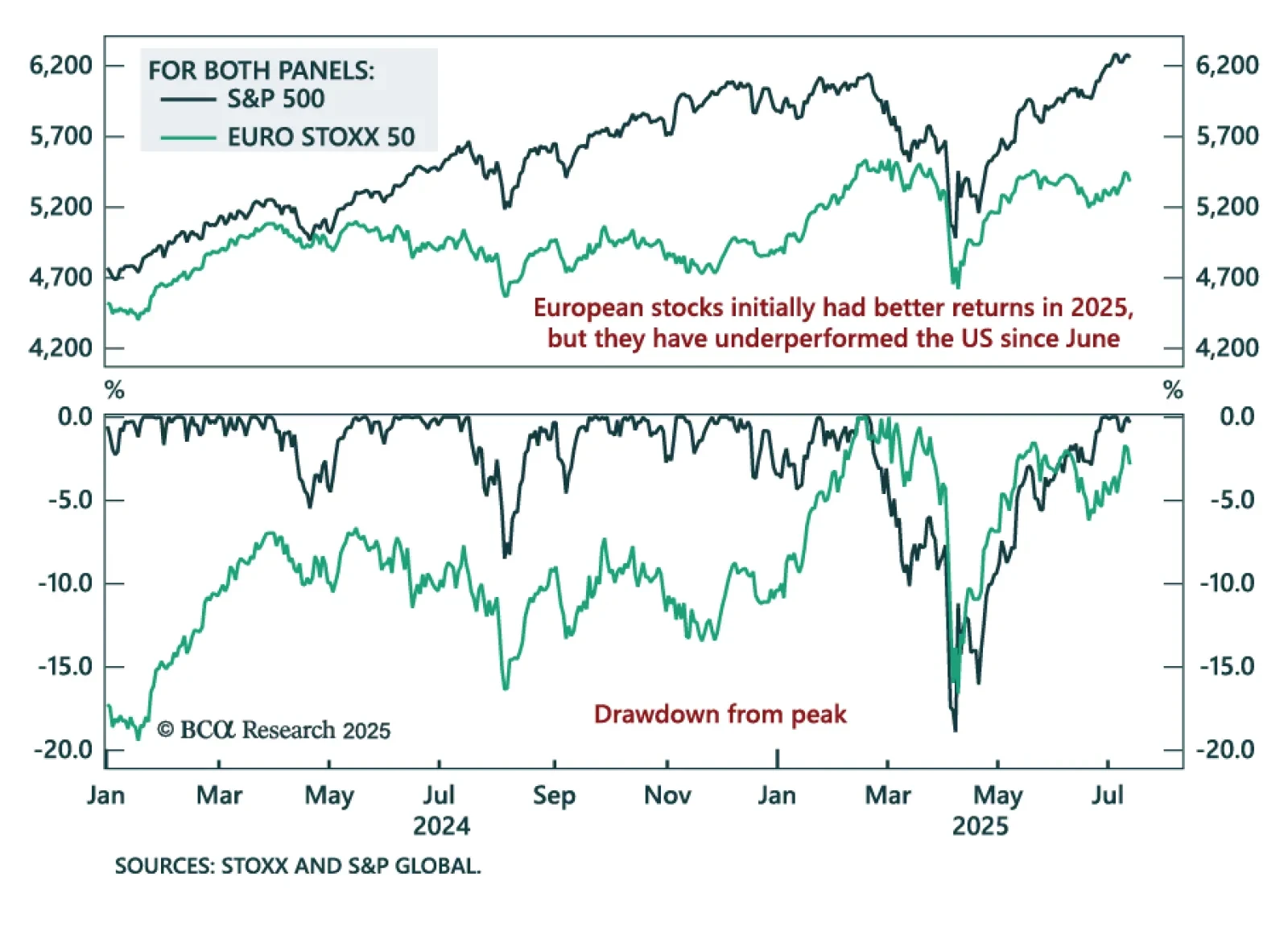

European equities have recently lagged the S&P 500, with short-term risks building despite a constructive long-term outlook. After reaching all-time highs in February, the EURO STOXX 50 began to stall as US markets sold off on…

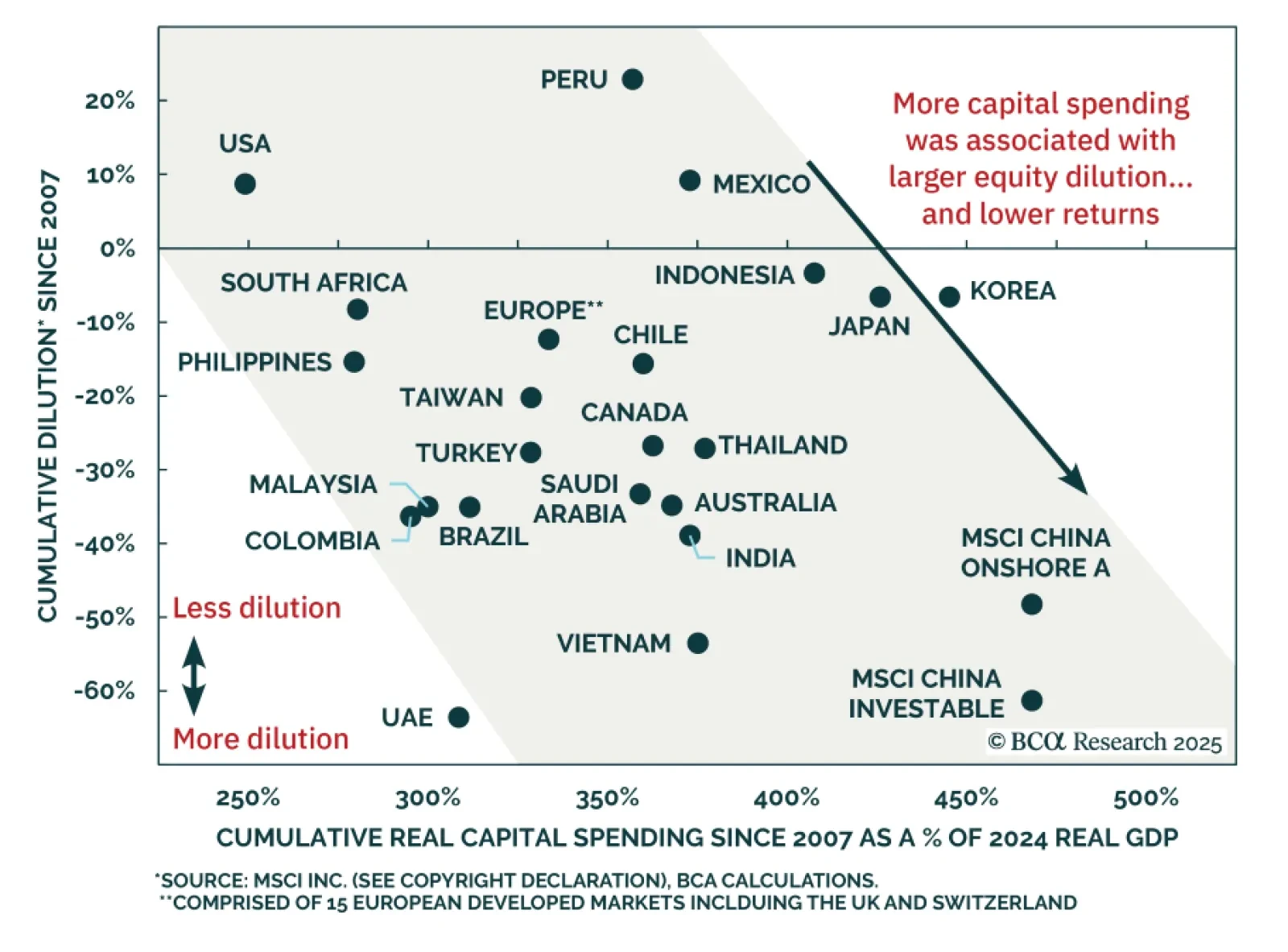

BCA’s Emerging Markets strategists remain negative on EM stocks in absolute terms but recommend a neutral weighting within global equity portfolios. Economic growth does not reliably translate into earnings per share or shareholder…