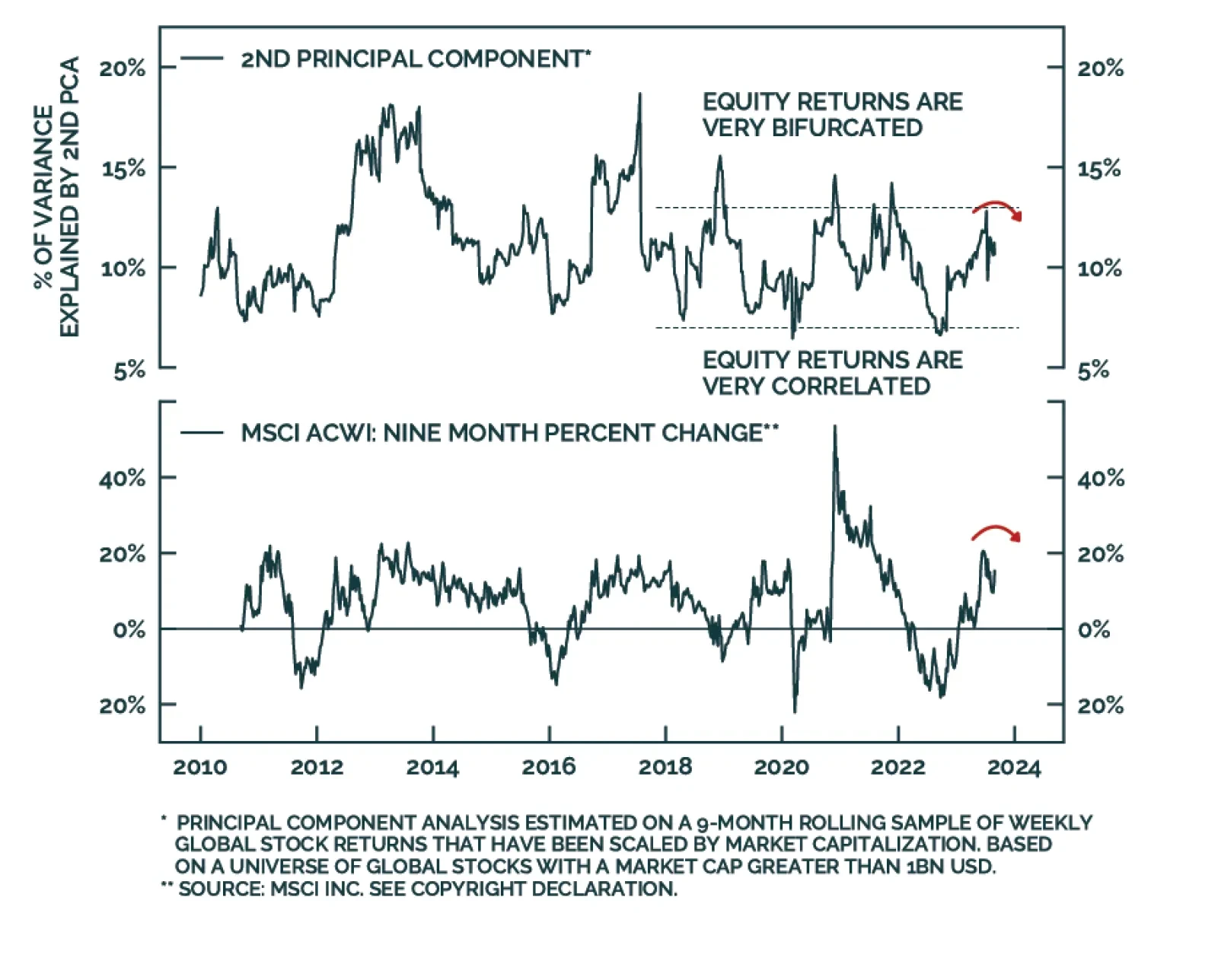

Unsupervised methods, like Principal Component Analysis (PCA), can create powerful indicators that are based purely on the structure of the data and void of researcher bias. Therefore, they can provide agnostic evidence to…

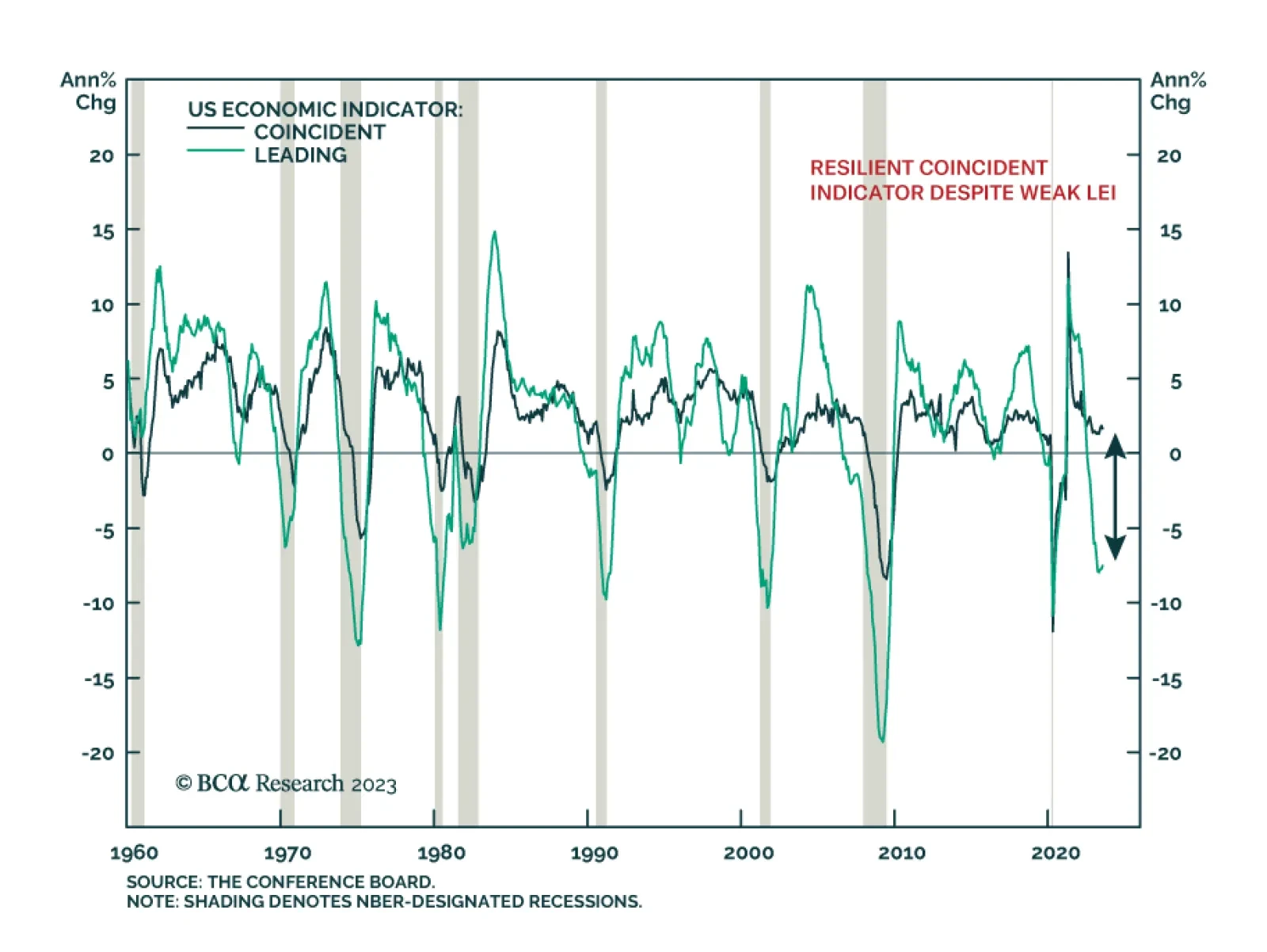

A global recession continues to be likely over the next 12 months. The impact of tighter monetary policy is slowly being felt. Government bonds look increasingly attractive as a safe haven.

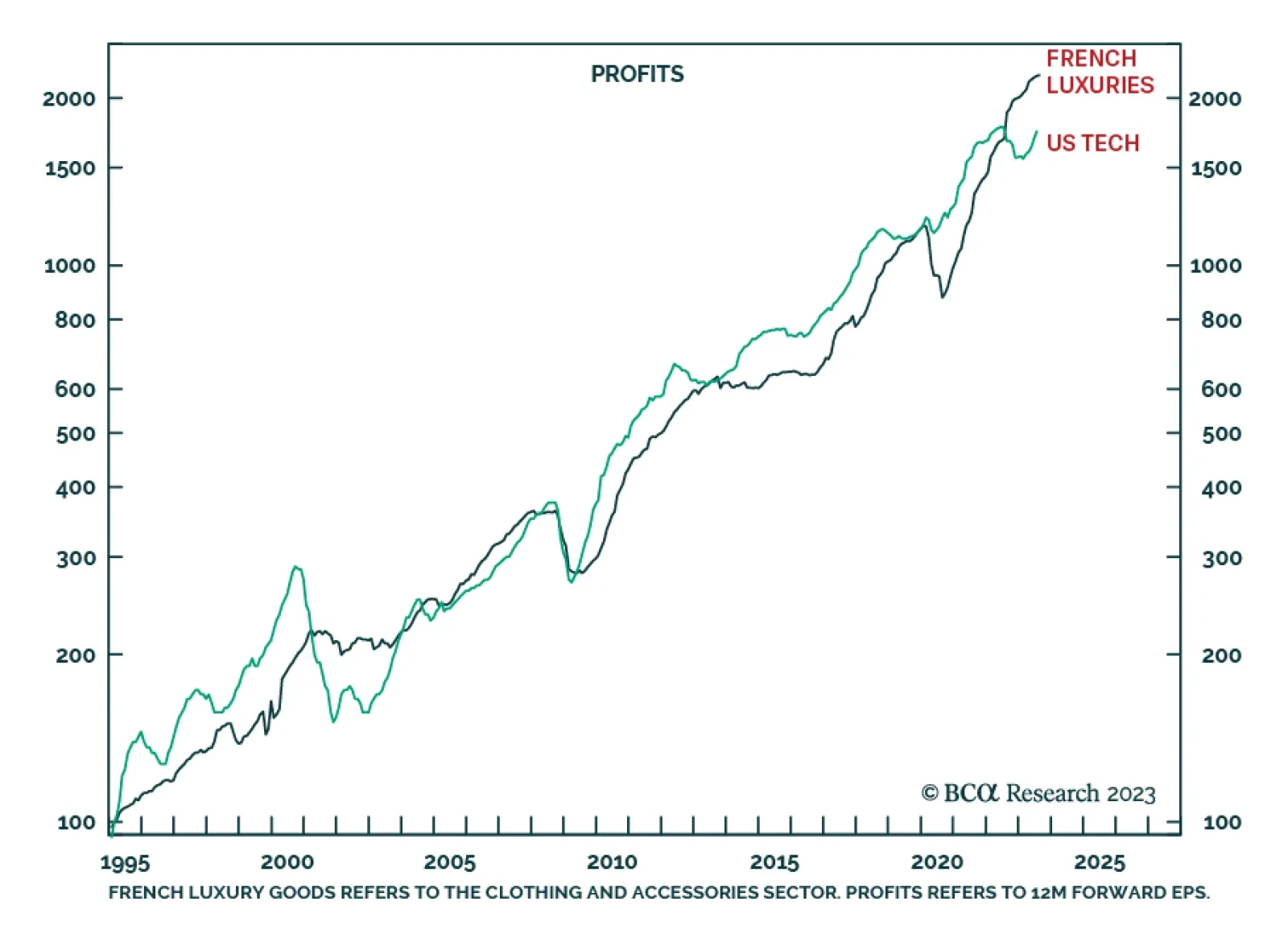

The stock market’s pre-eminent growth sector is not US technology, it is French luxury goods. On most time horizons over the past decades, French luxuries have trumped US technology on profit growth, price performance and…

In Section I, we respond to the ongoing challenge to our view that the US economy is on a recessionary path. The available evidence overwhelmingly supports the notion that US monetary policy is tight, which argues against the “no…

Stocks should continue to rally in the near term, but investors should prepare to turn more defensive towards the end of the year in advance of a recession in 2024.

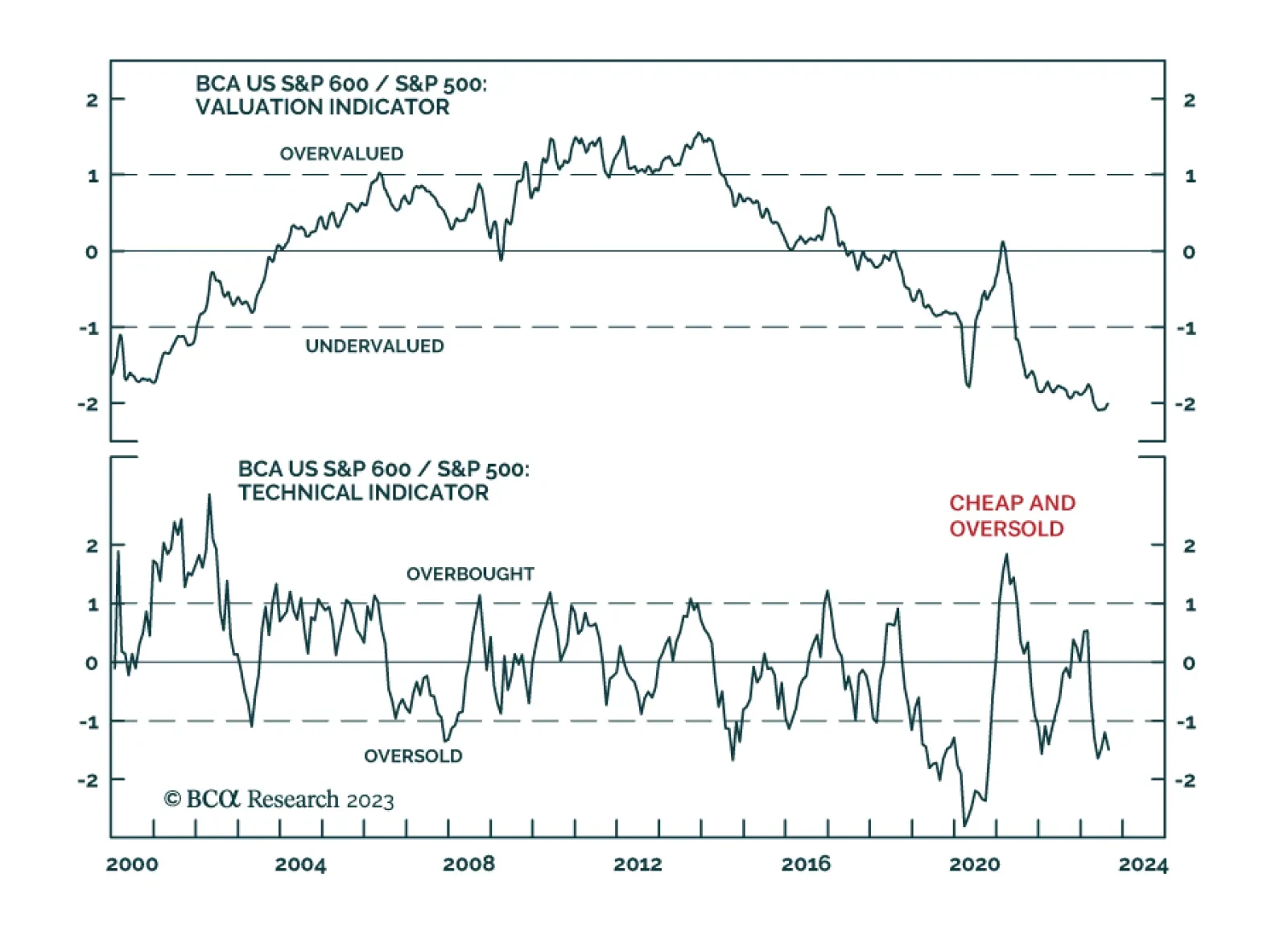

After having sold off in the first five months of the year, the performance of small-cap stocks improved in June and July with the S&P 600 index gaining 13.9% in those two months. A broadening of the US equity rally –…

Consensus expectations for the US economy were bleak at the start of the year. In hindsight, this pessimism was excessive: real GDP expanded in the first two quarters of the year (see Country Focus). Similarly, the US Conference…

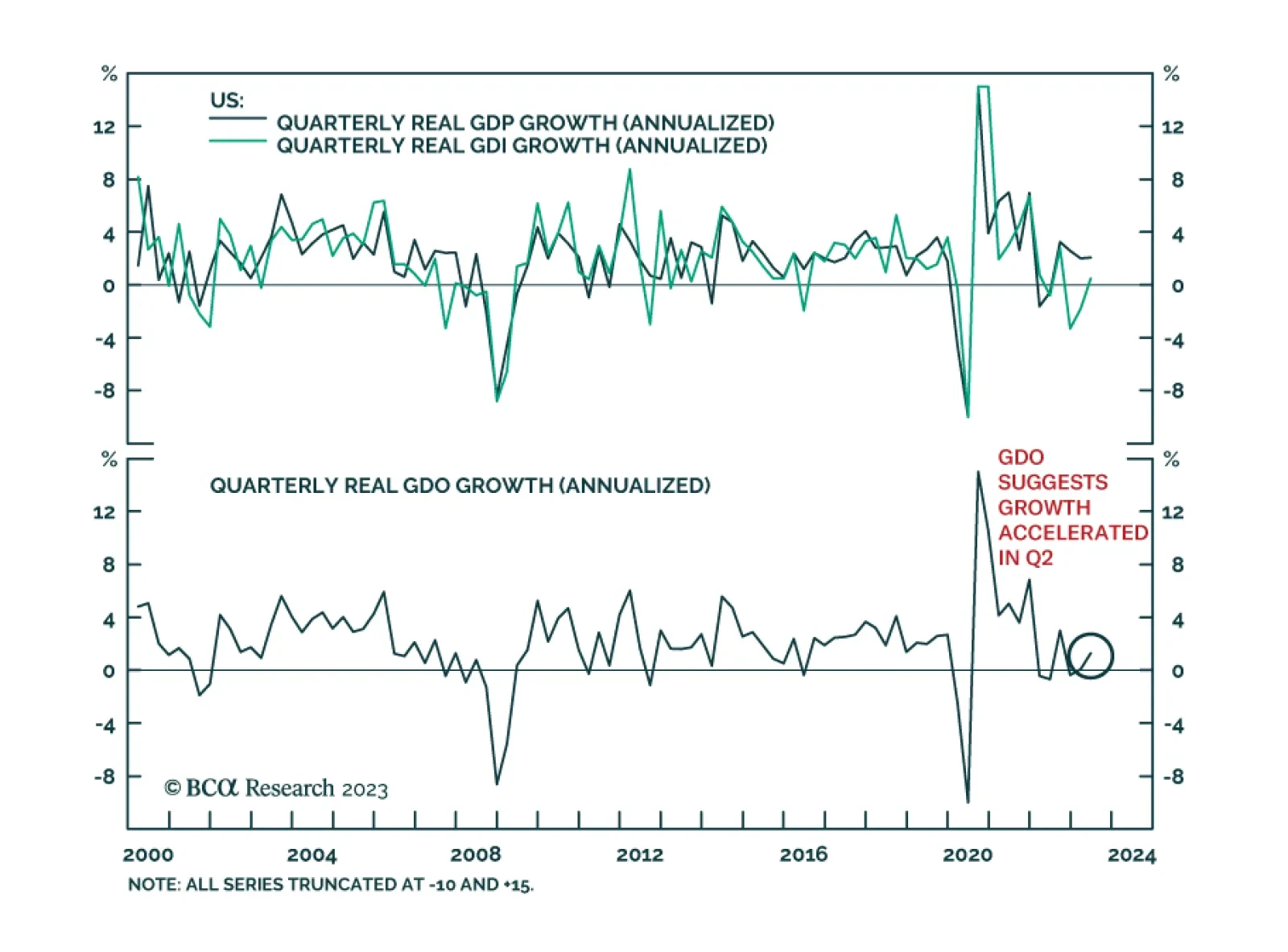

US Q2 GDP growth was revised down from 2.4% to 2.1% on a quarterly annualized basis, only slightly above Q1 growth of 2.0%. Although consumption was revised up by 0.1 percentage points to 1.7%, business spending grew at a slower…