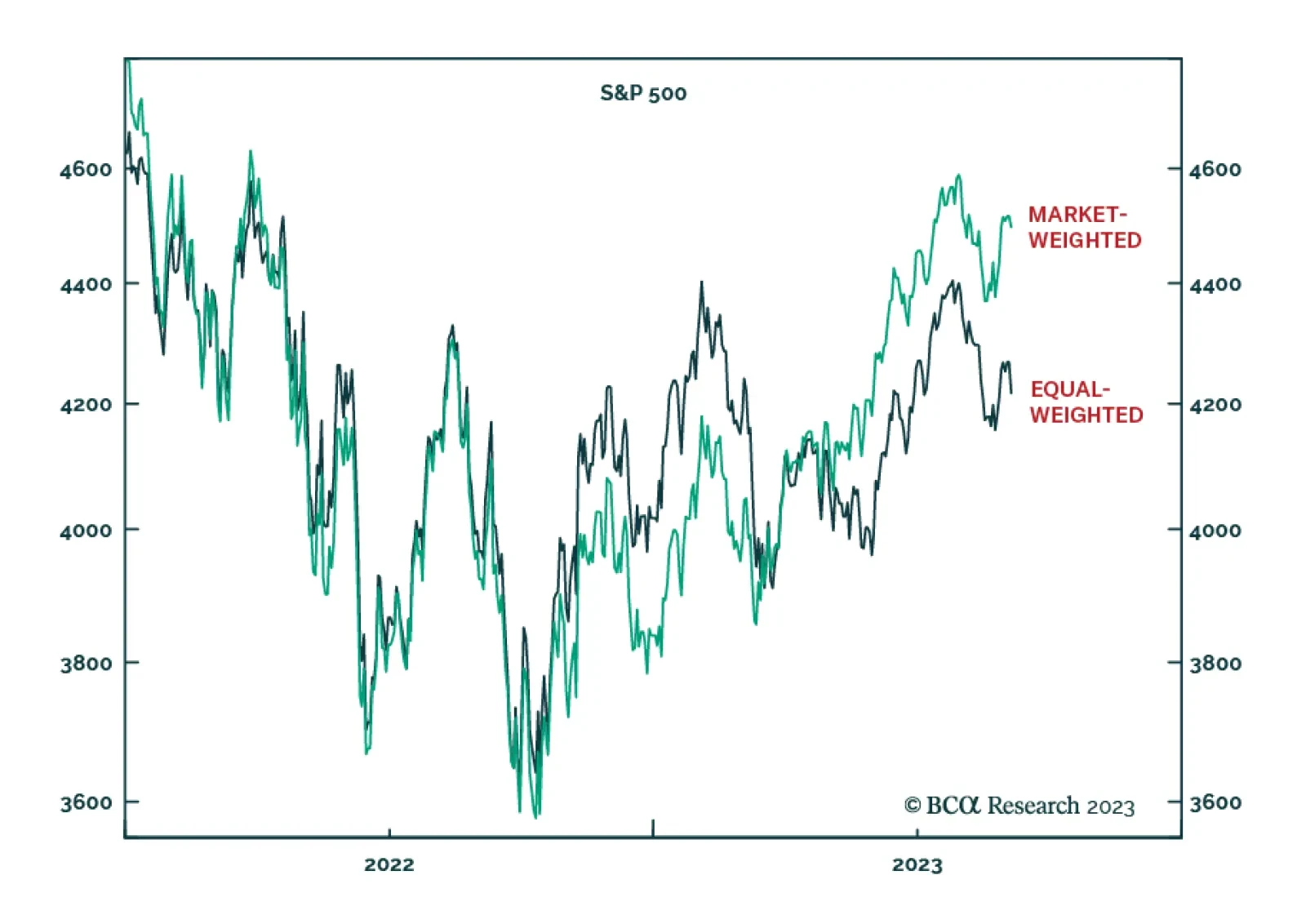

Strategists arguing for an end of the outperformance of US equities over international stocks have pointed to the lofty valuations of American stocks vis-à-vis their global counterparts. Moreover, they have highlighted…

If we look at global growth as an aircraft, the plane is experiencing failing engines and will lose more altitude in the coming months. Yet, neither Chinese authorities, nor the Fed or the ECB will be quick to come to the rescue as…

According to BCA Research’s Counterpoint service, Goldilocks is just a fairy tale. In the near-term, this will be negative for stocks, neutral for bonds, and positive for the dollar. The Fed can win the war against…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

The broader rally that started in June is premised on a Goldilocks narrative that will prove to be a fairy tale. Either by stubborn inflation. Or, by higher unemployment that shows that the war on inflation is far from costless. Or,…

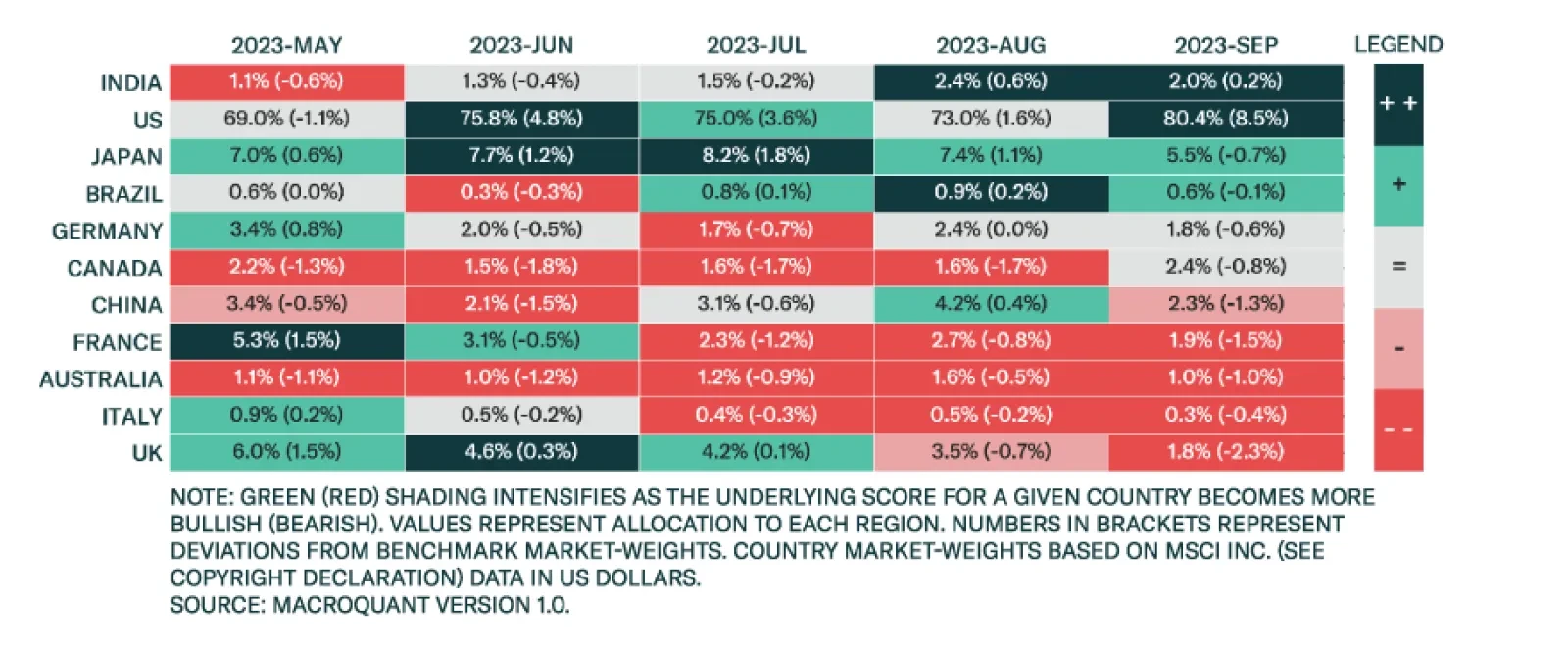

Our Global Investment Strategy Service’s MacroQuant 1.0 model favors the US and India within the equity universe. The 1.0 version of the MacroQuant model is calibrated to produce recommendations over a 30-day investment…

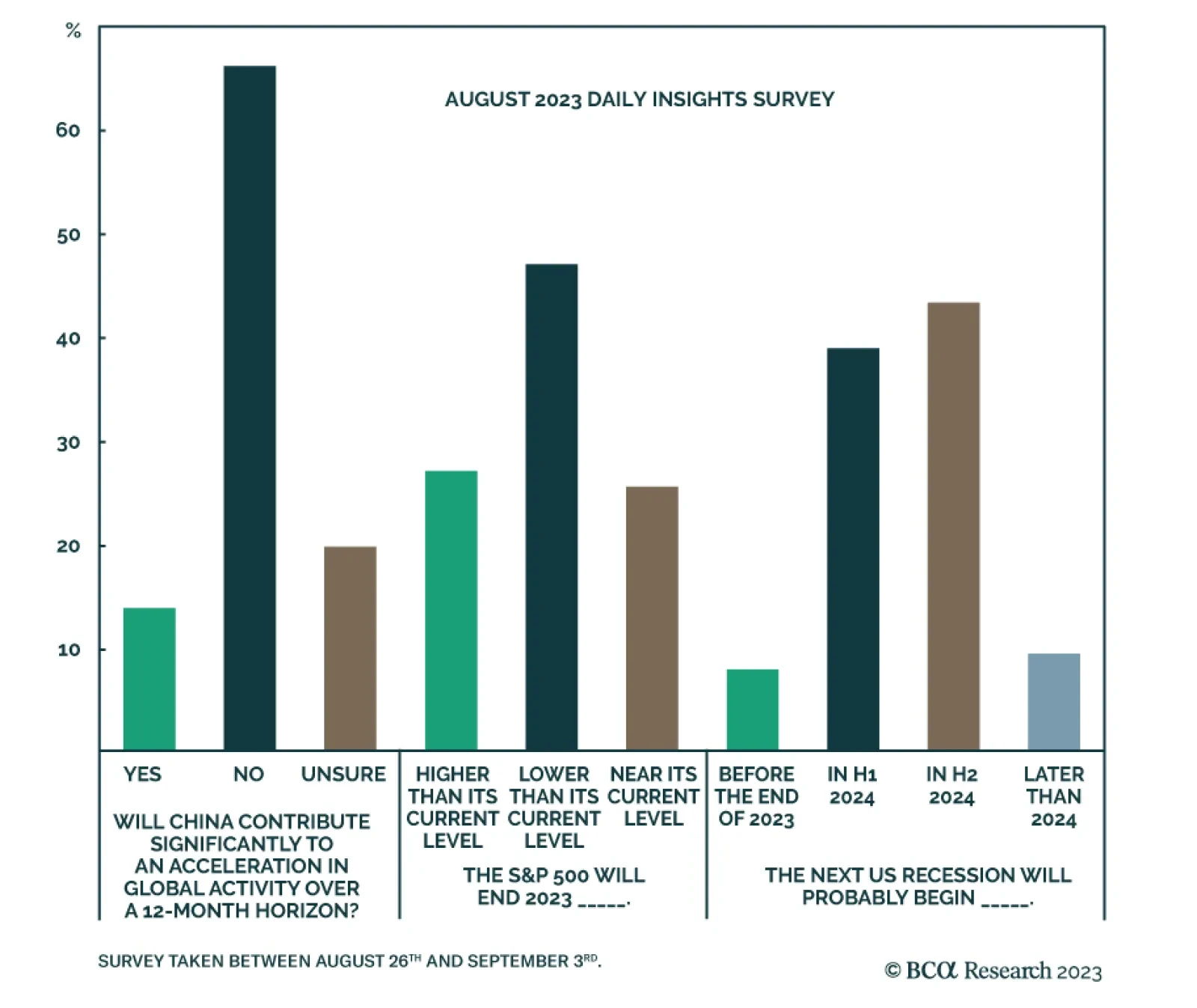

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for the US economy, US stocks, and China’s contribution to global growth. On the outlook for the US economy…

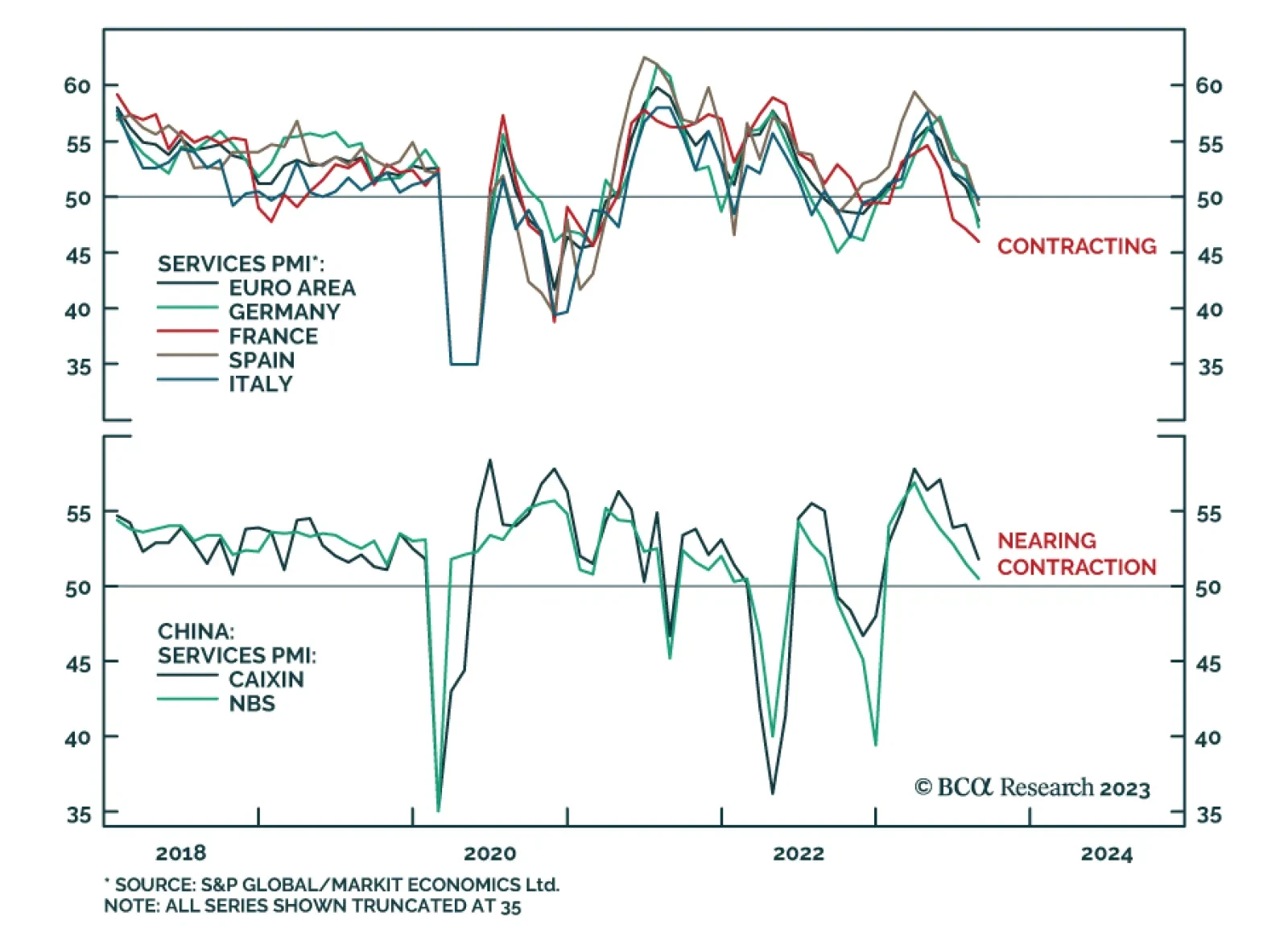

The final PMIs for August delivered a pessimistic update on service sector conditions in the Euro Area and China. The Eurozone services index was unexpectedly revised down from 48.3 to 47.9 – indicating a more pronounced…

The resiliency of consumers through 2023 has surprised investors. However, consumer strength will fade into yearend as factors supporting growth in income and spending are waning. i.e., job gains are slowing, wage growth is…

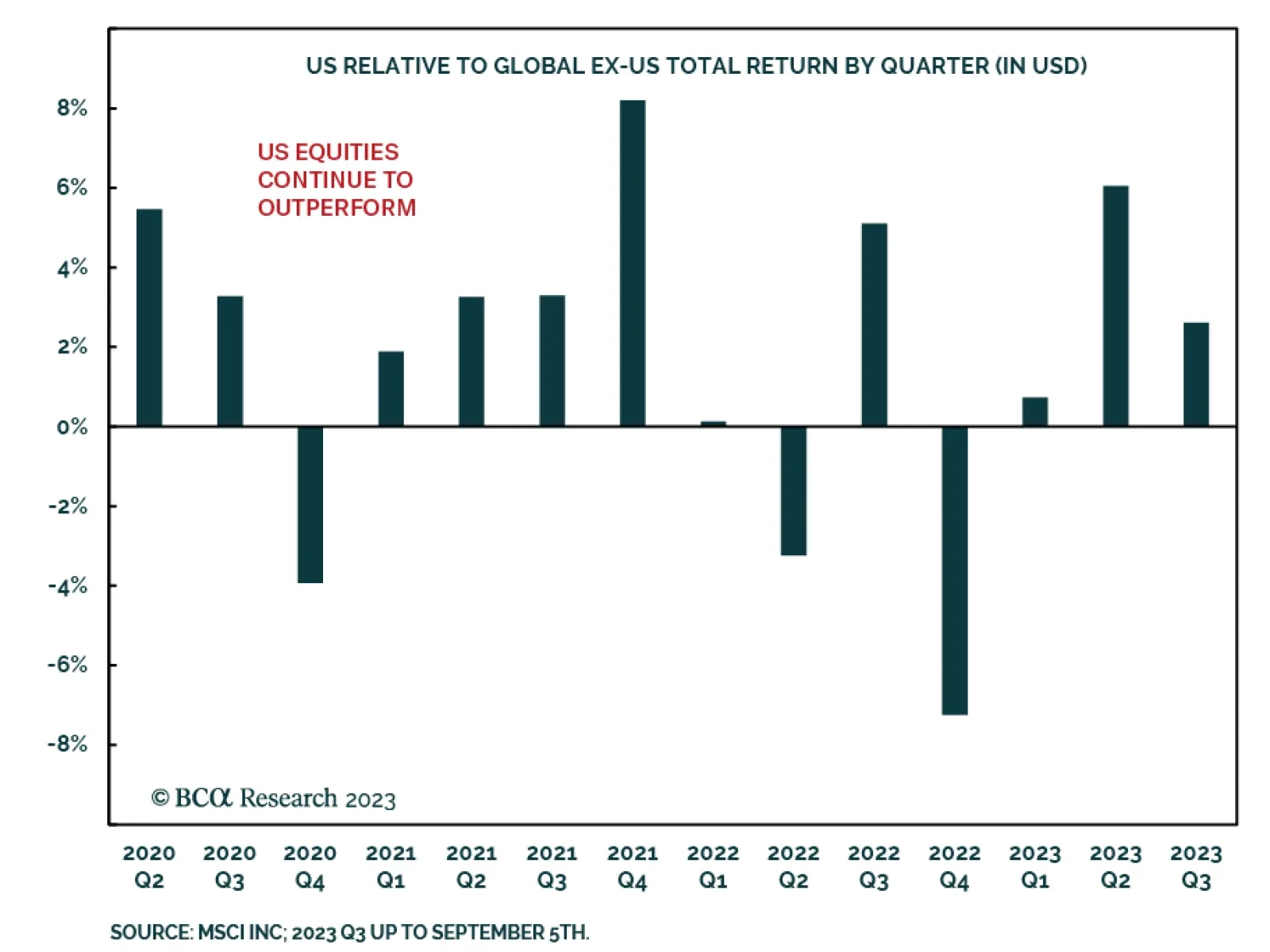

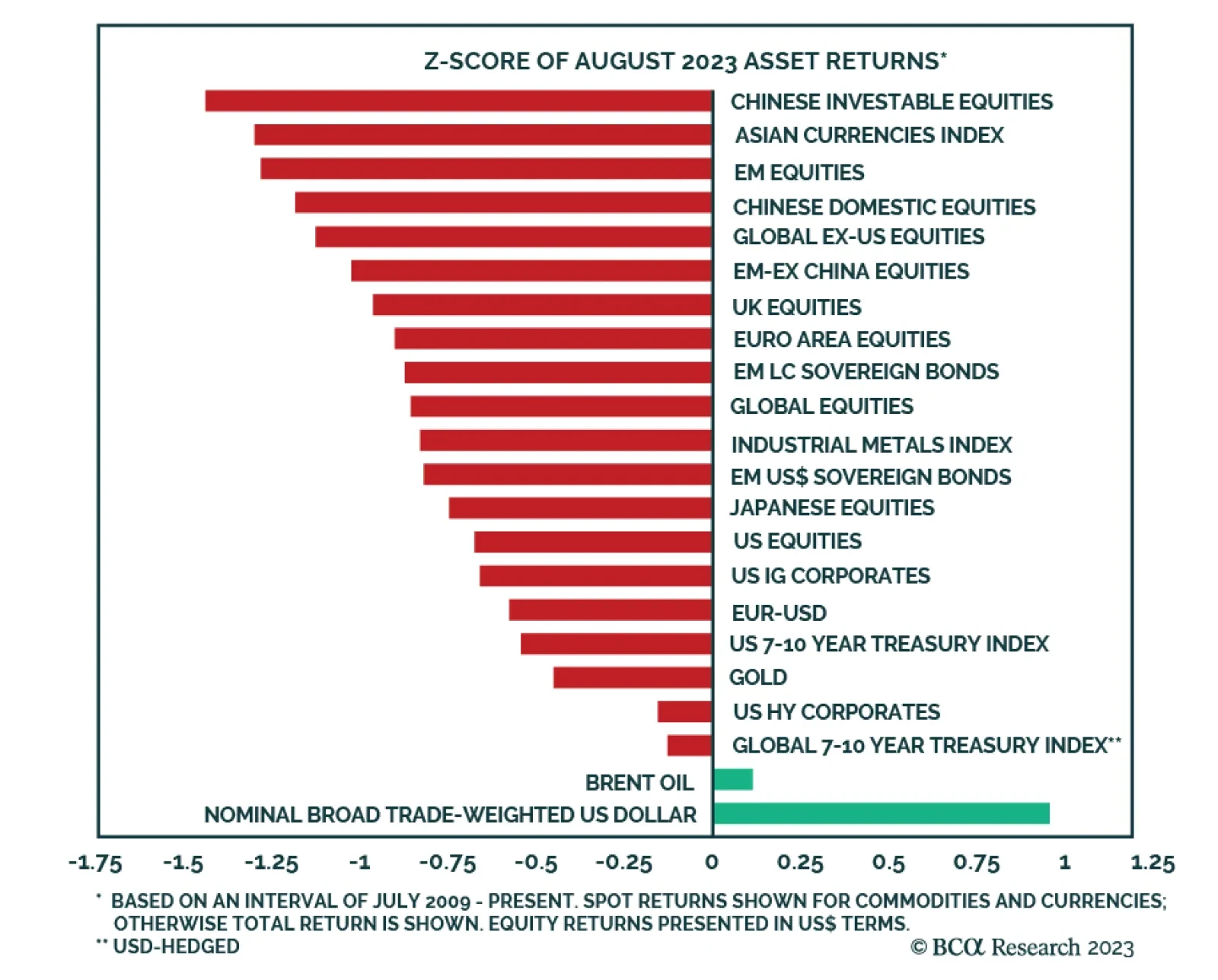

Global financial markets relapsed in August. After a relatively strong performance in June and July, most of the major financial assets we track generated below average returns last month as investors shifted their focus to the…