The ECB is done lifting interest rate for the cycle and its next move will be a cut next year. Yet, European rates will climb even higher in the second half of the decade.

While we are sympathetic to the view that the Fed could temporarily achieve a soft landing, we are skeptical that it could stick that landing for very long. Stocks could strengthen into year-end, with small caps potentially leading…

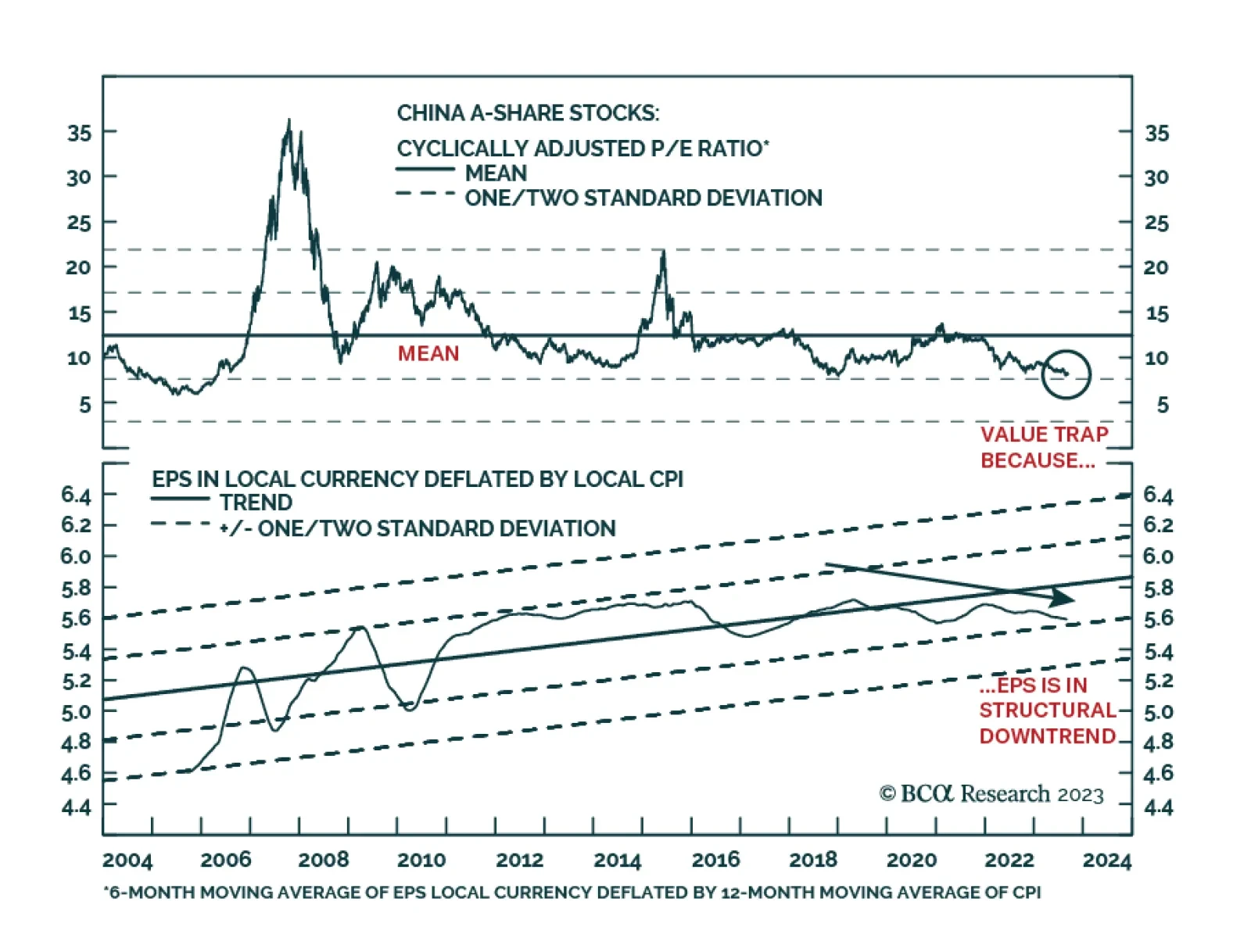

According to BCA Research’s China Investment Strategy service, lower valuation readings in Chinese equities are justified by fundamentals. In absolute terms, valuations of both A-shares and investable stocks are…

While Chinese stocks have low valuations and are oversold, their attractiveness is dampened by uncertainties in the magnitude of stimulus and the dismal outlook for corporate profits in the next six to nine months.

Real wages are set to rise in CE3 economies with implications for their asset markets and currencies. Of the three, Polish assets and the zloty are the most vulnerable.

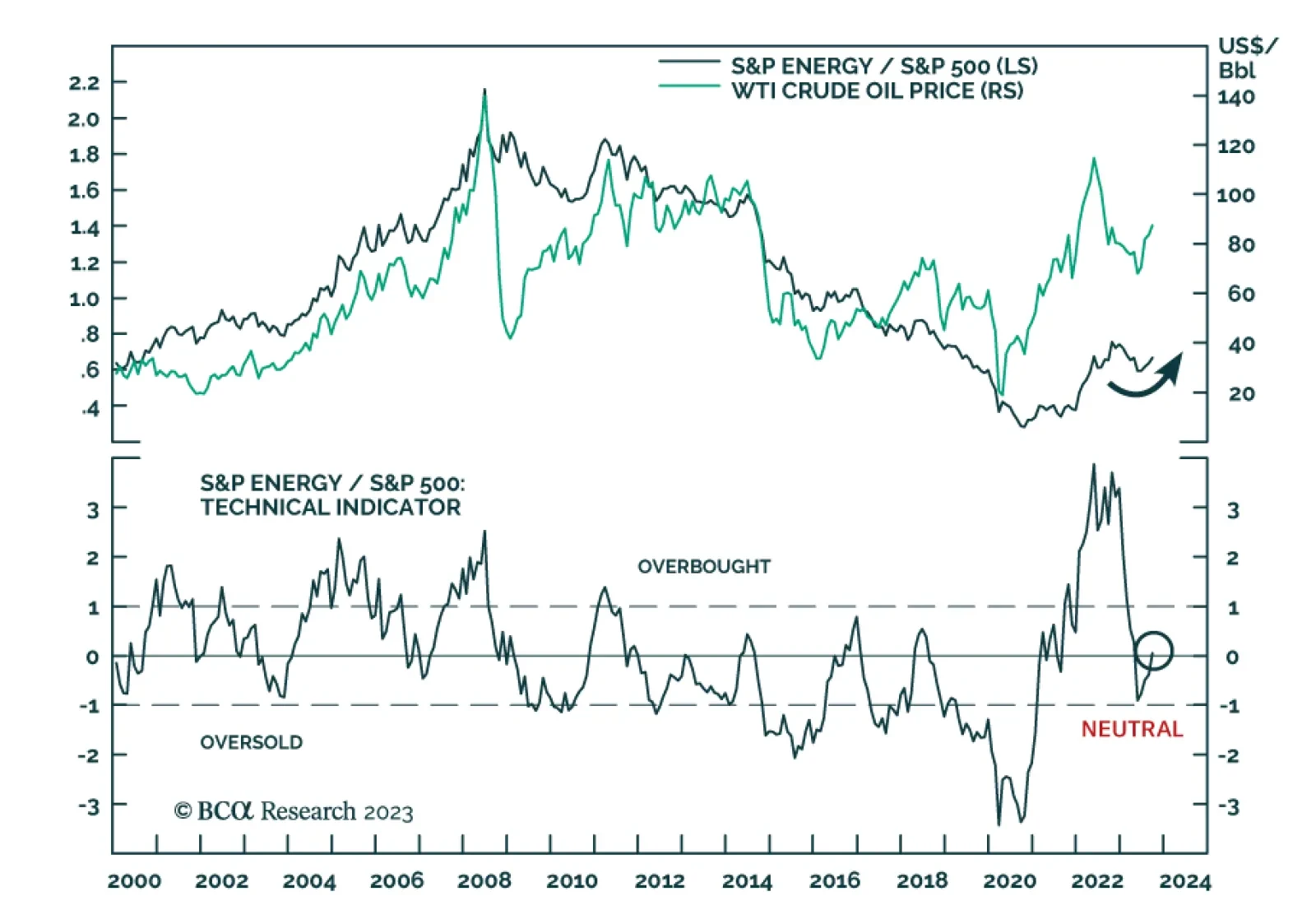

The S&P 500 Energy sector’s fortunes have recently reversed. After having been the worst performing sector in the first half of the year — losing 7.3% versus the S&P 500’s 15.9% gain — Energy is…

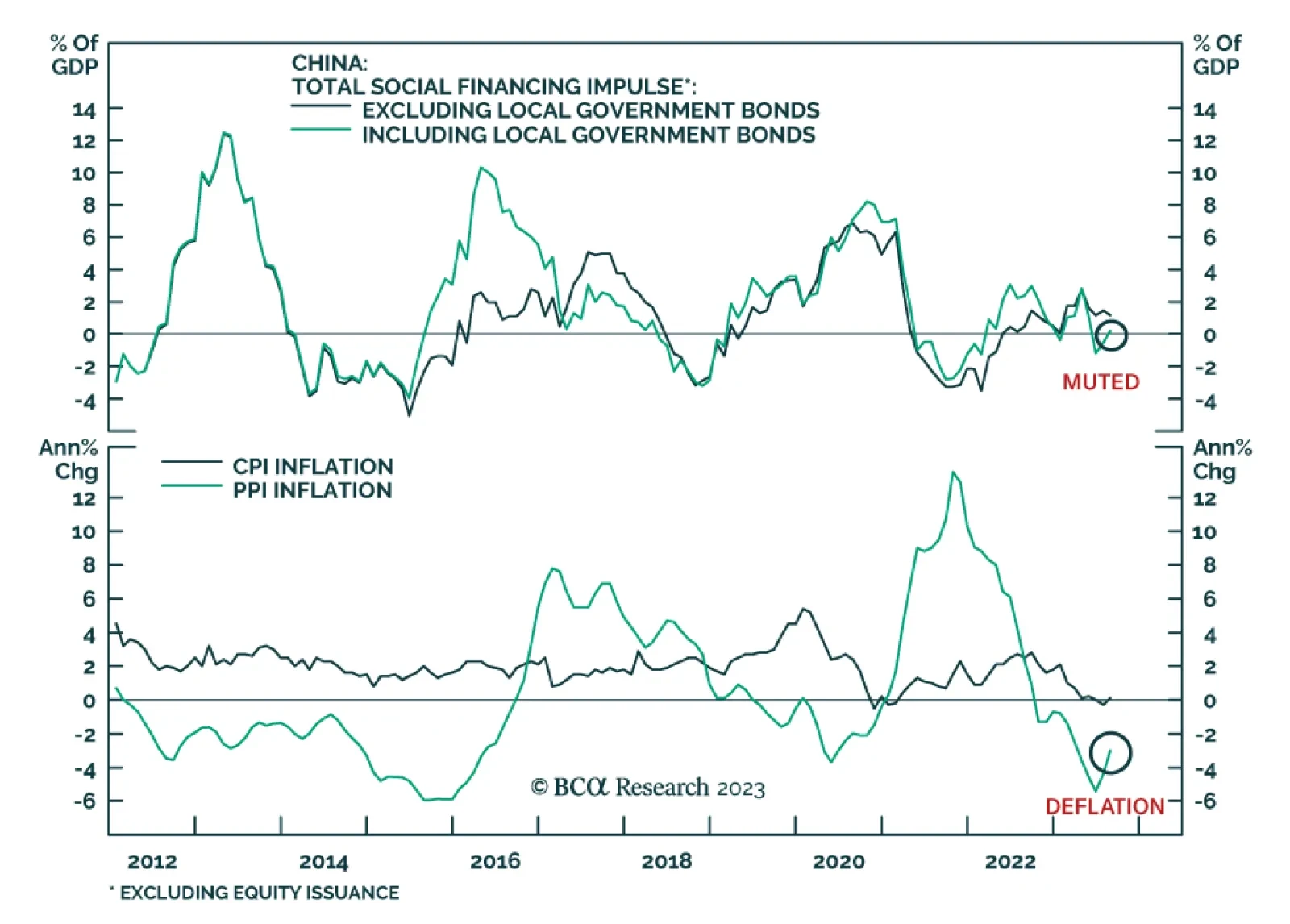

Recent Chinese economic data show some signs of stabilization. China’s credit expansion surprised to the upside in August. Aggregate social financing totaled CNY3.12 trillion – above expectations of CNY2.69…

Magnificent Seven leadership is neither a new nor an unnatural phenomenon. There is no shortage of reasons why equities might have already made a top, but investors should not be tricked into thinking that the rally was somehow…

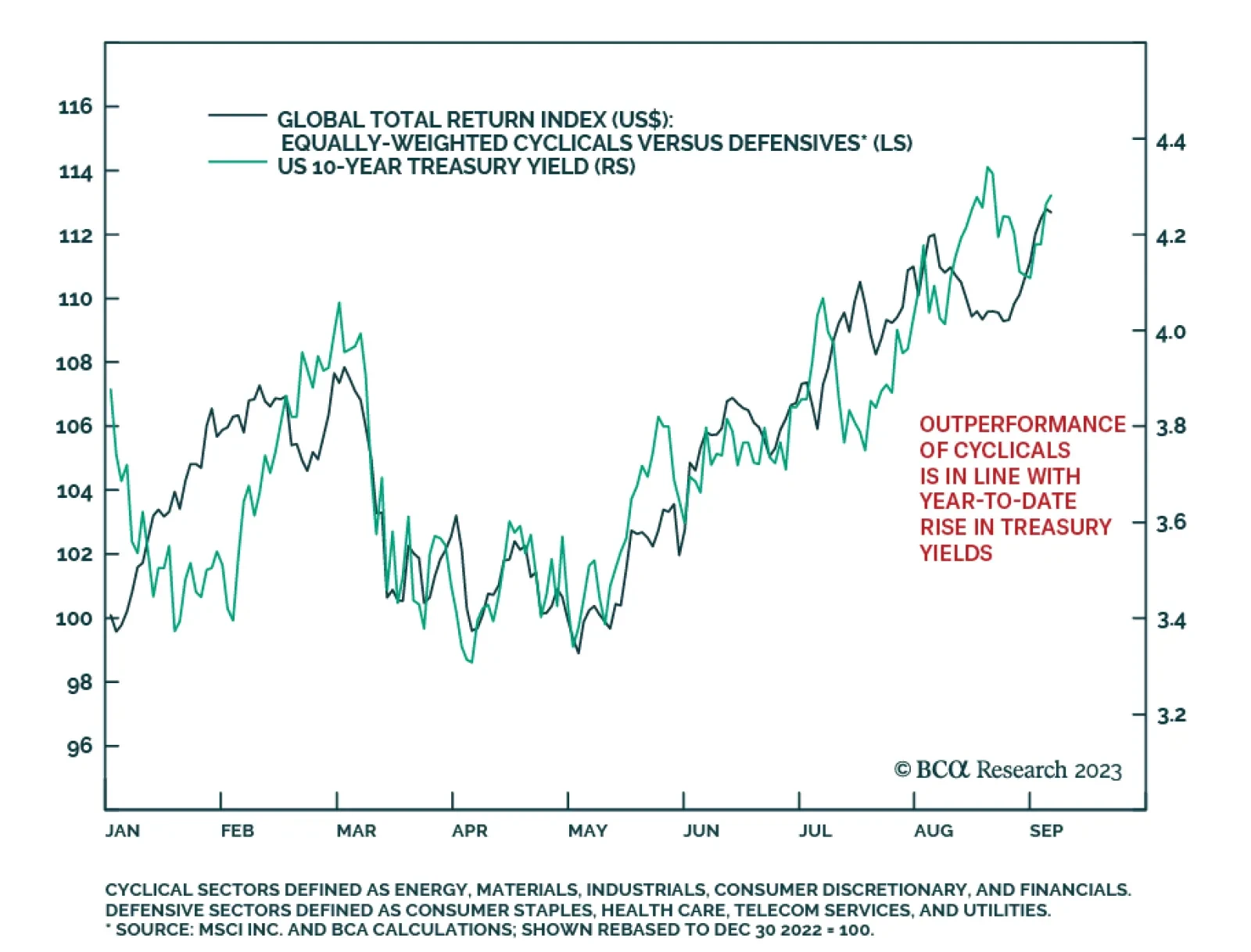

Since the beginning of the year, our equally-weighted global cyclicals index has outperformed equally-weighted defensives by about 13%. As the chart above shows, this relative performance trend has been extremely positively…