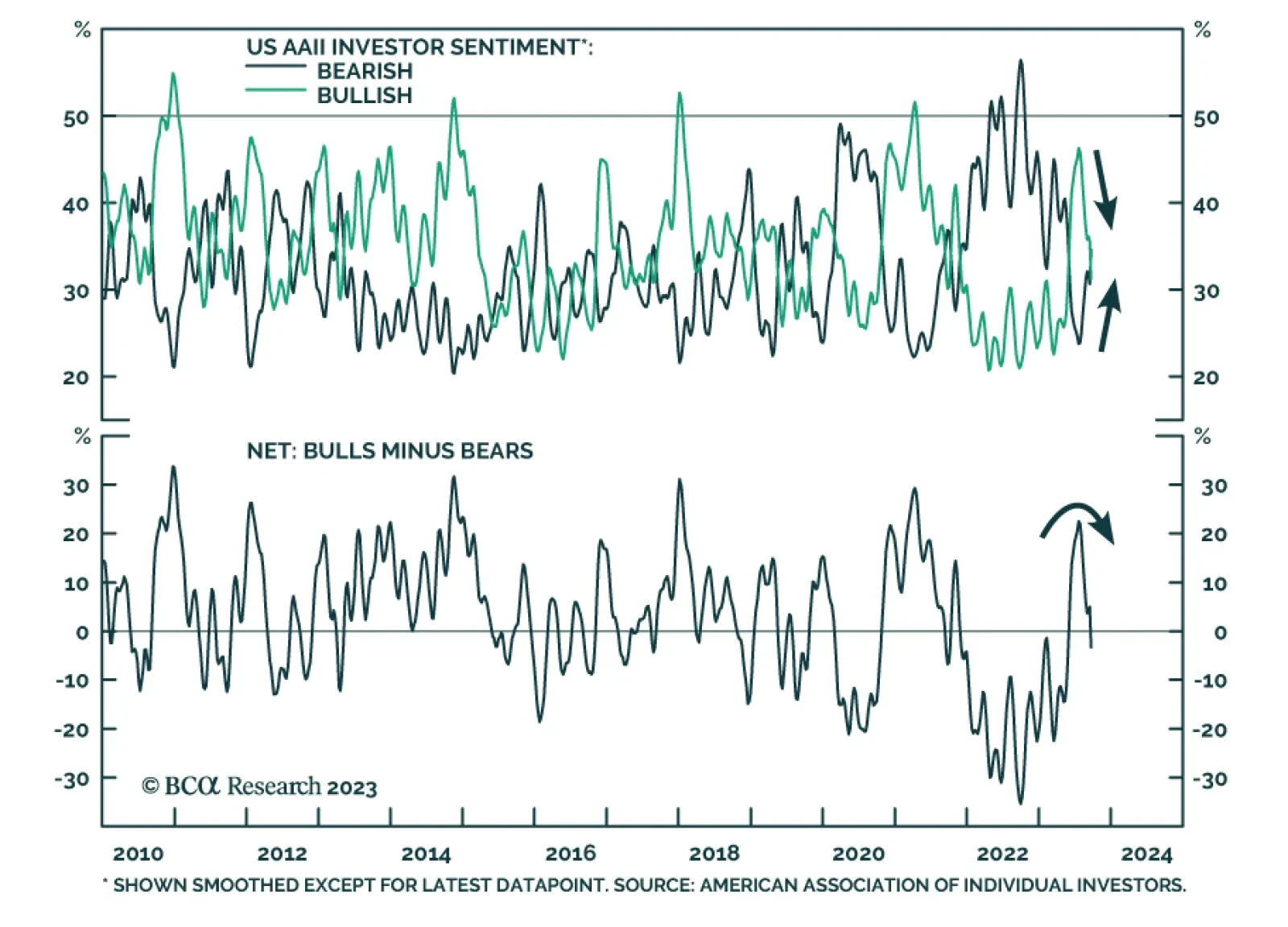

Investor sentiment has turned less optimistic. According to the latest AAII survey, the share of respondents with a bullish outlook has collapsed to 31.3% from its peak of 51.4% two months ago. It is now back down below its…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

Emergency pandemic fiscal and monetary policy measures buffered households and nonfinancial corporate businesses in ways that have acted to lengthen the lags between monetary policy changes and their effect on the economy. We believe…

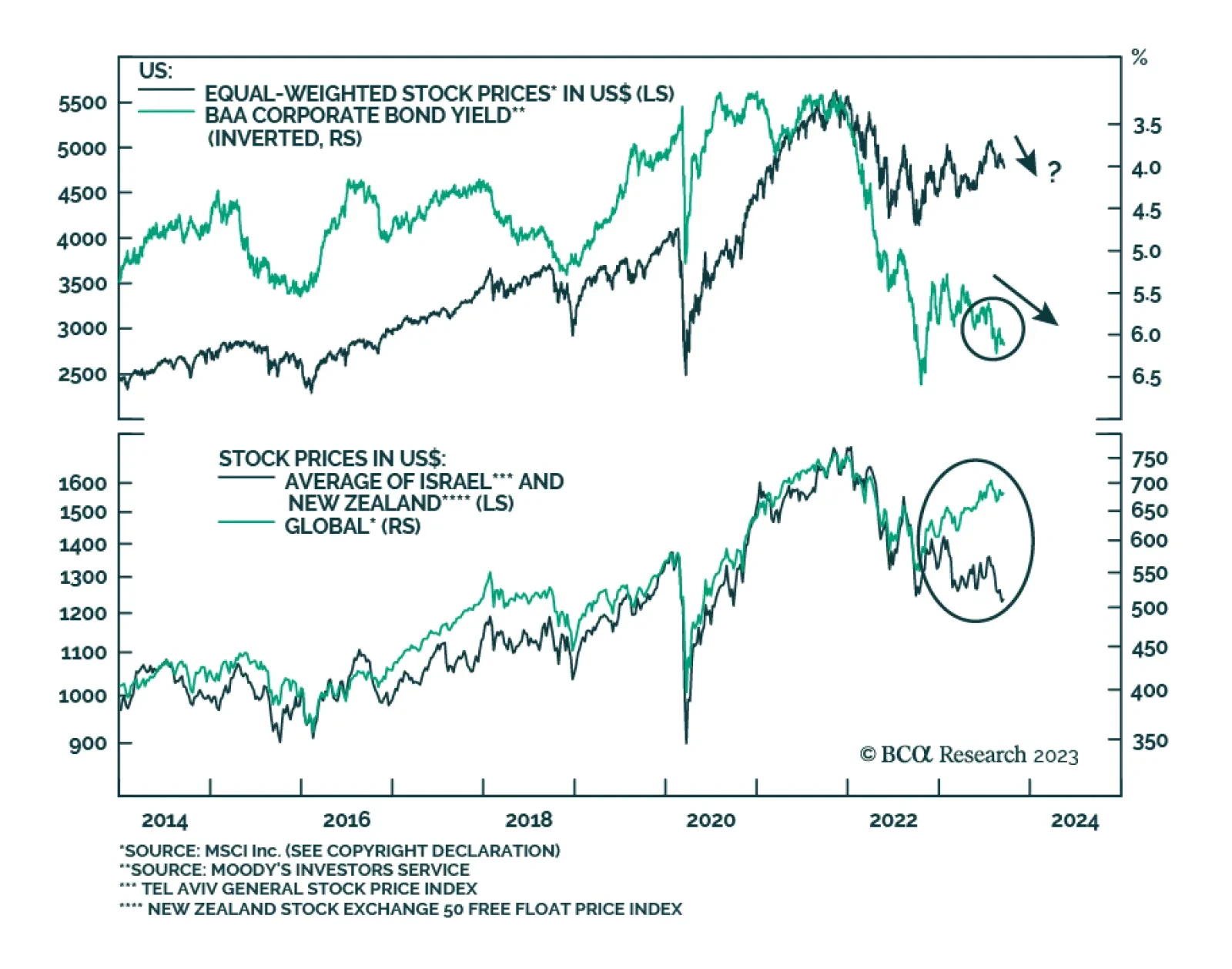

According to BCA Research’s Emerging Markets Strategy service, the combination of rising oil prices, an appreciating US dollar, and mounting US bond yields constitutes a triple whammy for US share prices. One risk that…

The global downturn will be shallower than it was in 2008 and in 2020 but will last for longer. The primary reason for a more prolonged downturn is that policymakers in the US, Europe, and China will be reluctant to proactively and…

The biggest misunderstanding in the markets right now is that to keep expected inflation well-anchored at 2 percent, inflation must undershoot 2 percent for some time. This implies that interest rate futures curves are mispriced, and…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The Chinese economy will not recover without significant “irrigation-style” stimulus. The latter is still unlikely for the time being. Dim economic fundamentals justify lower valuations of Chinese equities. Lingering deflationary…

Monetary policy is difficult to calibrate: it is hard to get it just right. The Global Investment Strategy (GIS) service has been iterating that while the Fed could temporarily achieve a soft landing, there is much uncertainty…

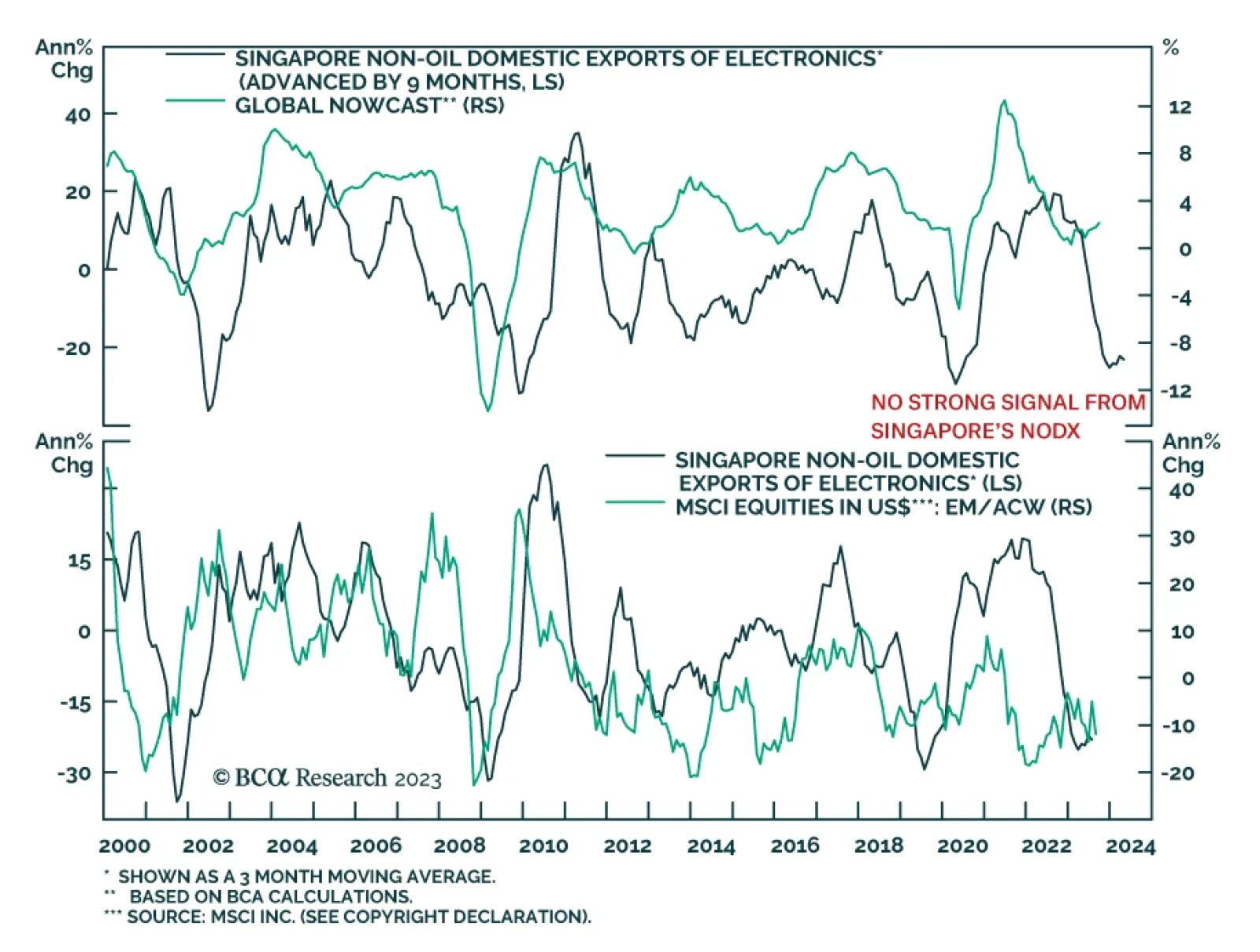

Singapore’s non-oil domestic exports (NODX) sent a pessimistic signal about the global manufacturing cycle on Monday. The 20.1% y/y contraction in August is broadly in line with July’s 20.3% y/y drop and came in…