The bear market in US bonds will likely end with a bang rather than a whimper. Even during the secular US bond bull market of 1982-2021, cyclical bond bear markets ended only after an eruption of financial turmoil. It would be…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

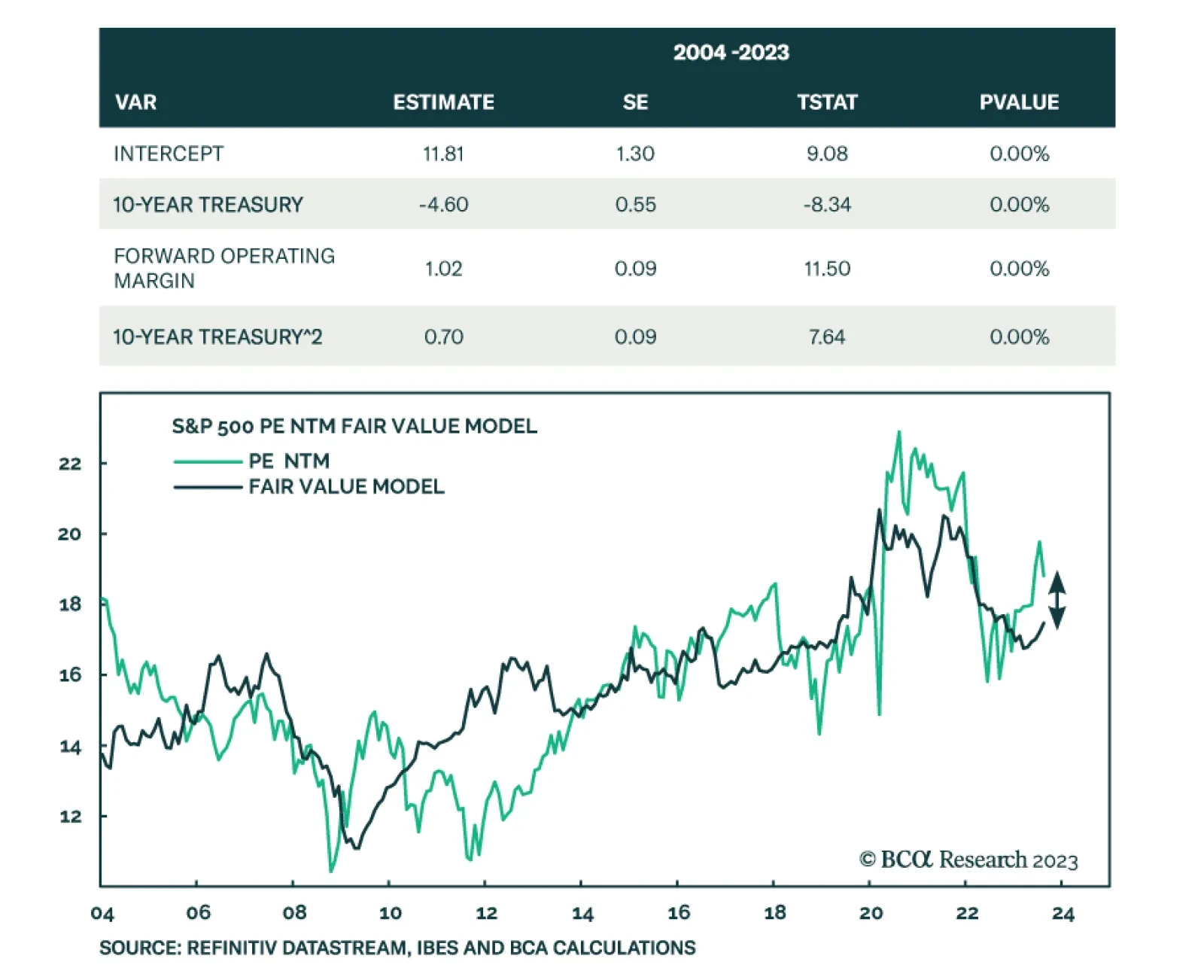

One of the few things US equity investors agree upon these days is that the S&P 500 is expensive whether it is relative to history, other asset classes, or the level of interest rates. But how overvalued is the market? To…

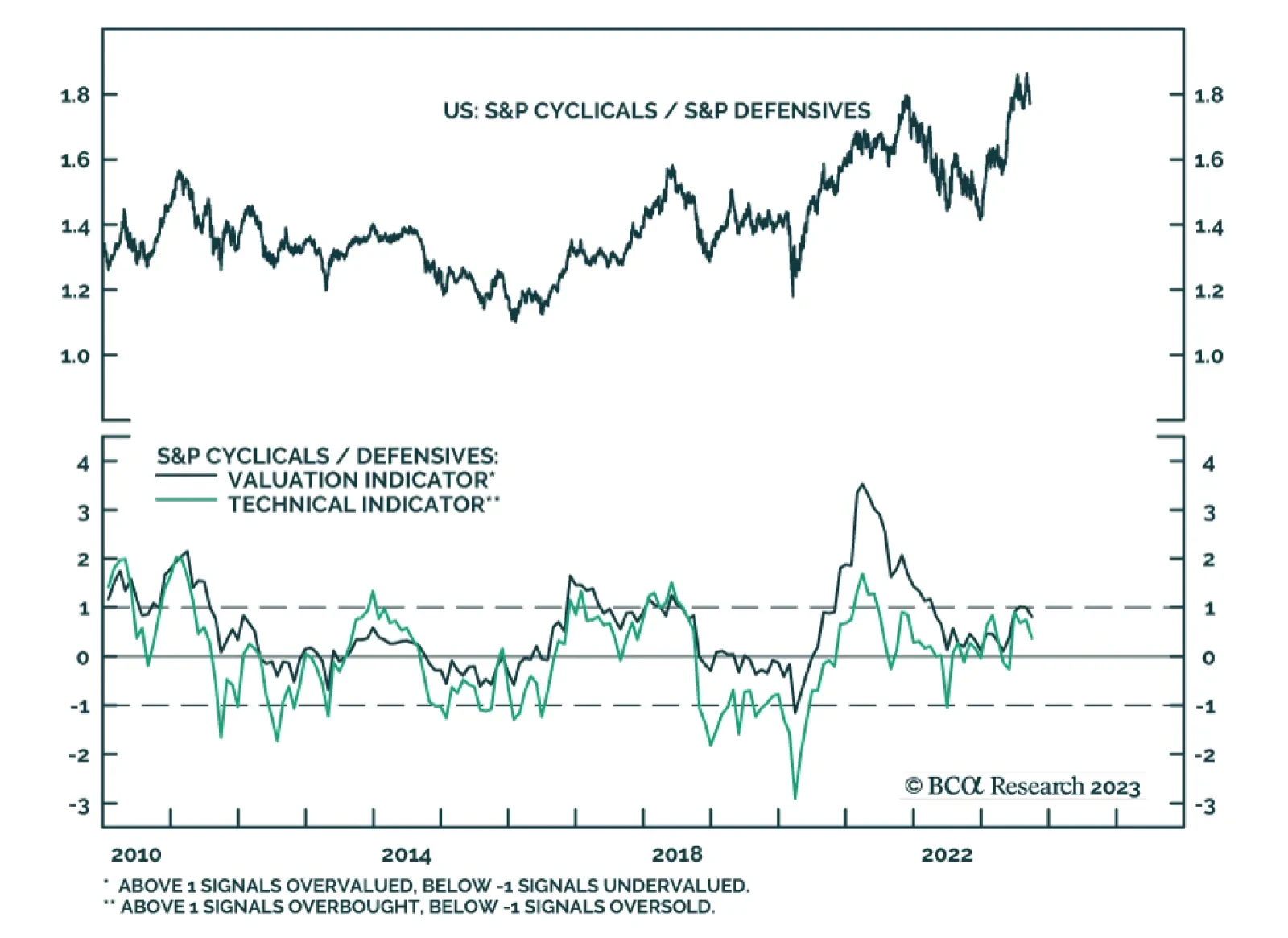

The year-to-date rally in US cyclical stocks has fizzled. After climbing 29% in the first seven months of the year, cyclical equities are down 6.0% since the beginning of August. This drop is happening in the context of a general…

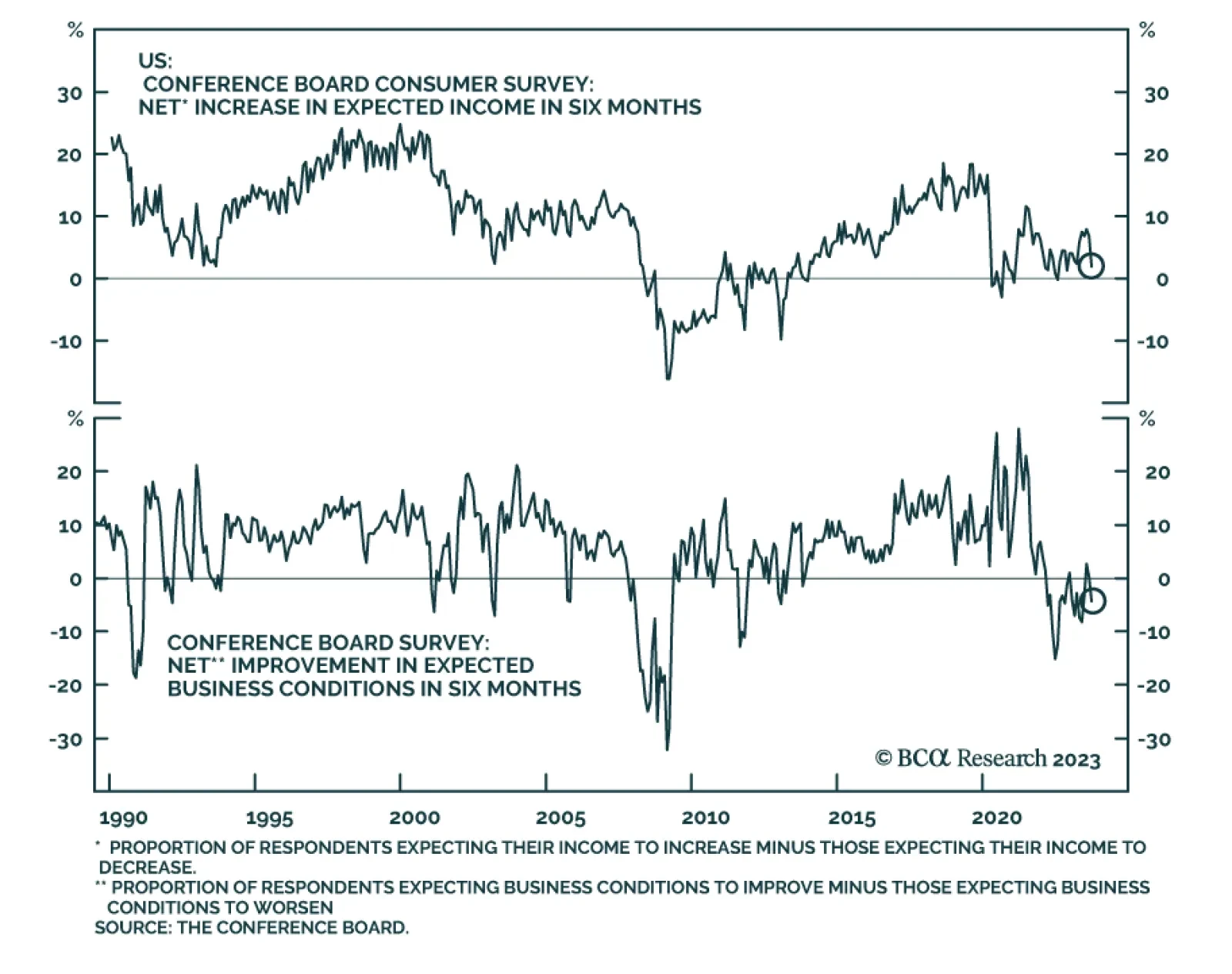

The Conference Board’s Consumer Survey results delivered a negative signal about the US consumption outlook on Tuesday. Although the present situation component inched up marginally in September, a 9.6-point drop in the…

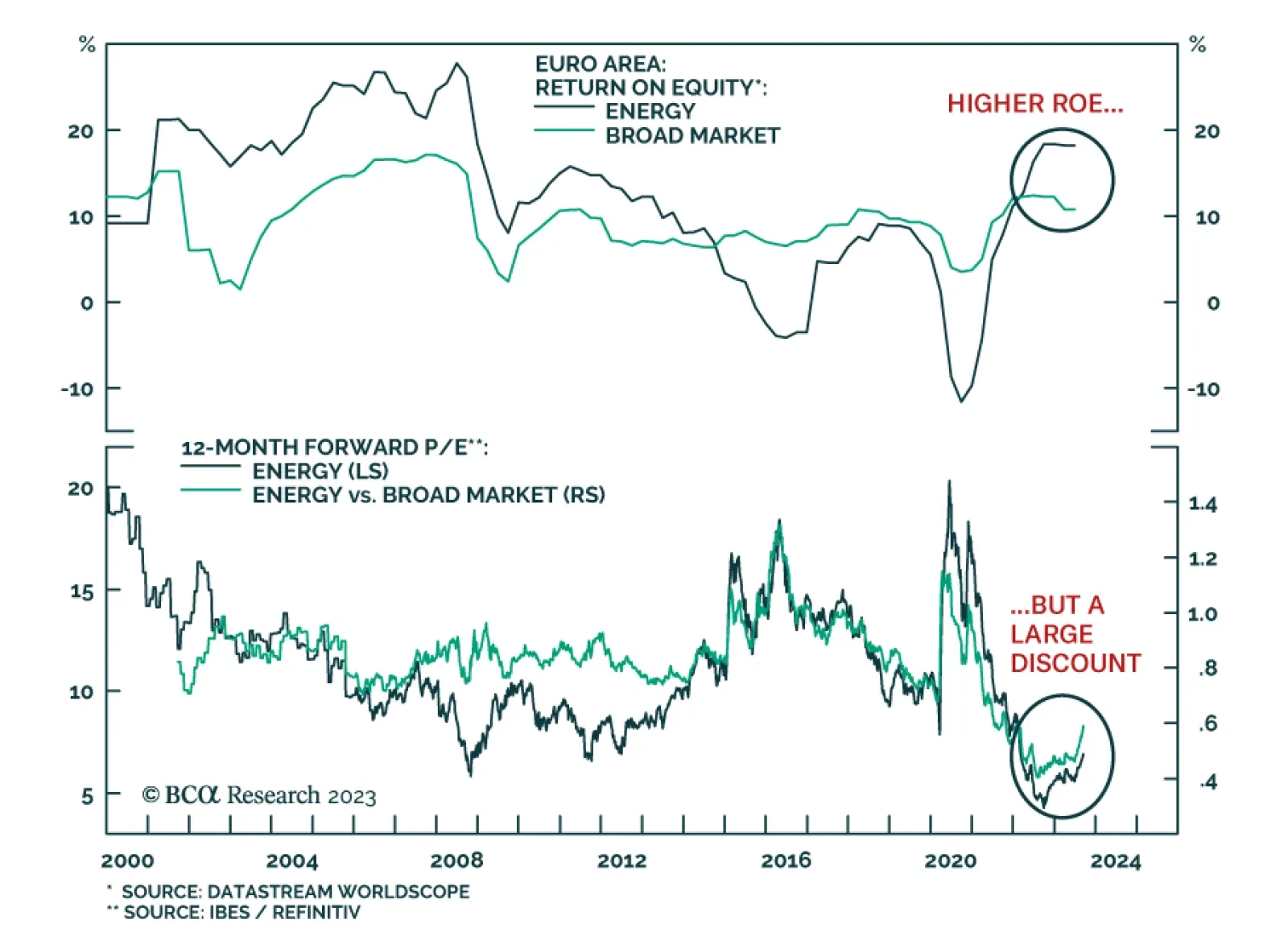

According to BCA Research’s European Investment Strategy service, energy stocks are an appealing overweight as a hedge against oil supply cuts. For now, the earnings of the energy sector continue to lag that of the broad…

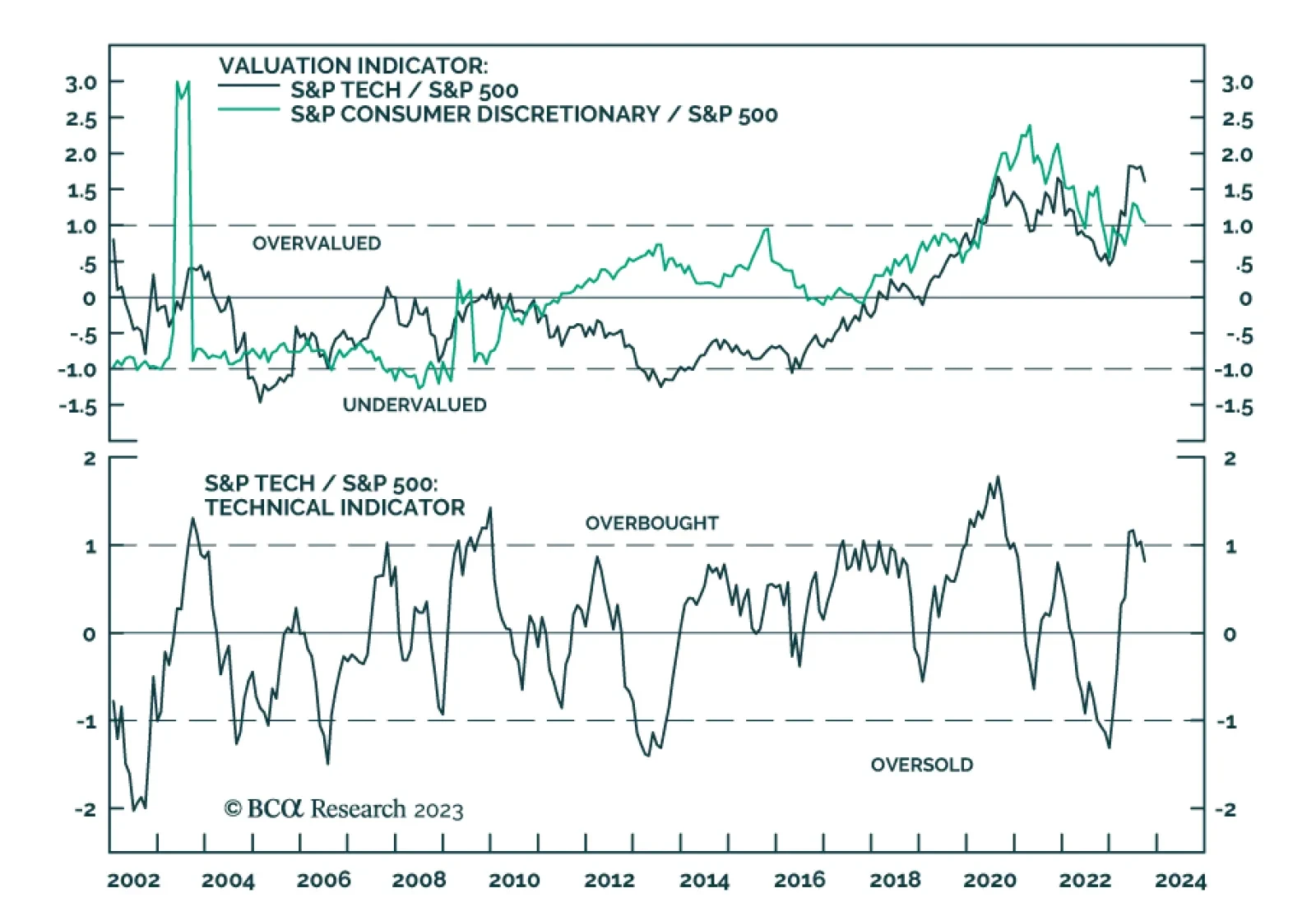

Tech stocks have recently been bearing the brunt of the US equity selloff. The Information Technology and Consumer Discretionary sectors – home to major H1 outperformers including Nvidia, Microsoft, Apple, Amazon, and Tesla…

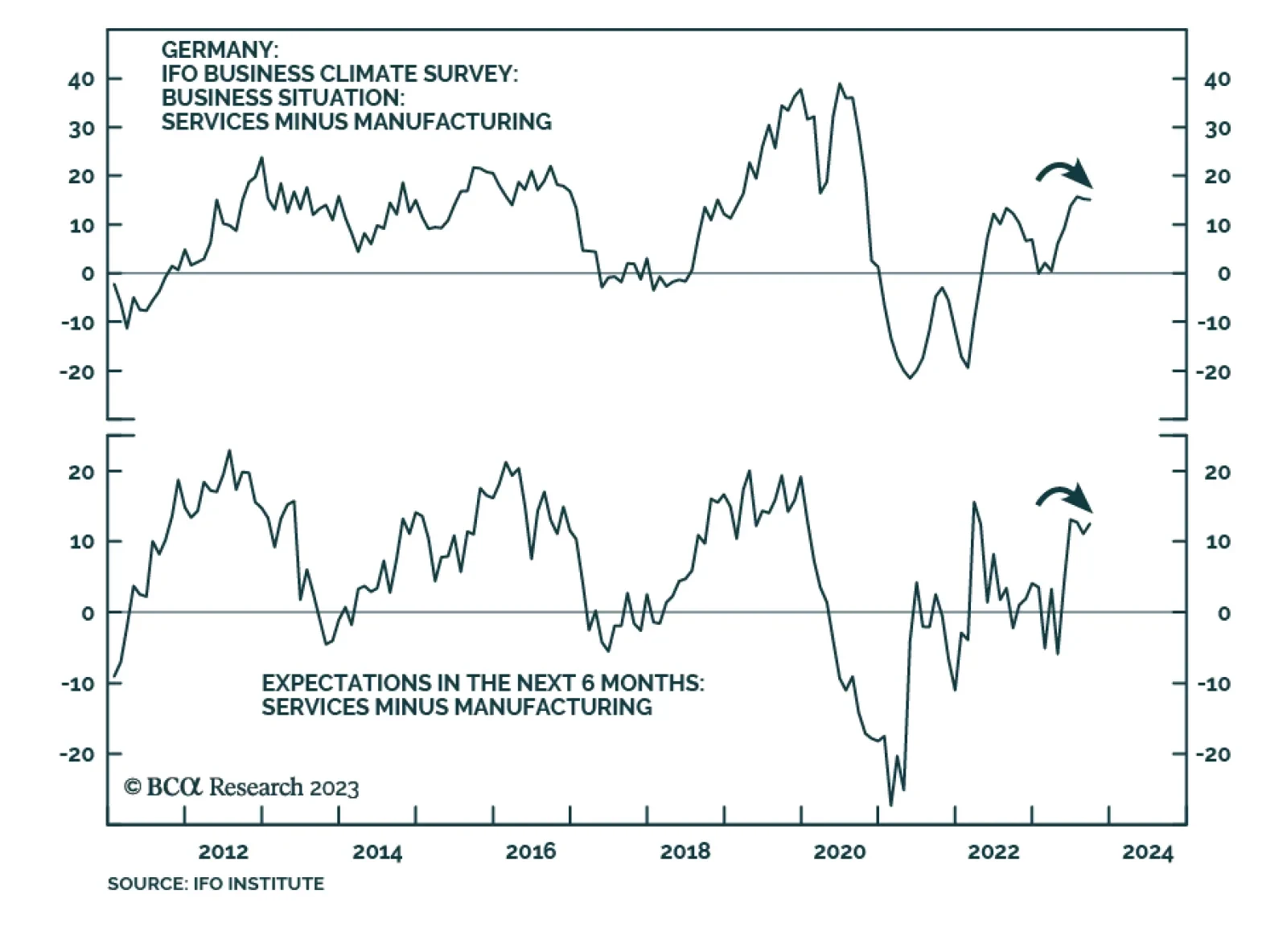

The message from the German Ifo is that although business sentiment continues to weaken, the pace of deterioration slowed in September and appears to be in the process of bottoming. The Business Climate Index’s marginal…

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

European stocks and the euro continue to weaken; soon, they will test the bottom of their recent trading range. Which sectors can protect investors against this downdraft?