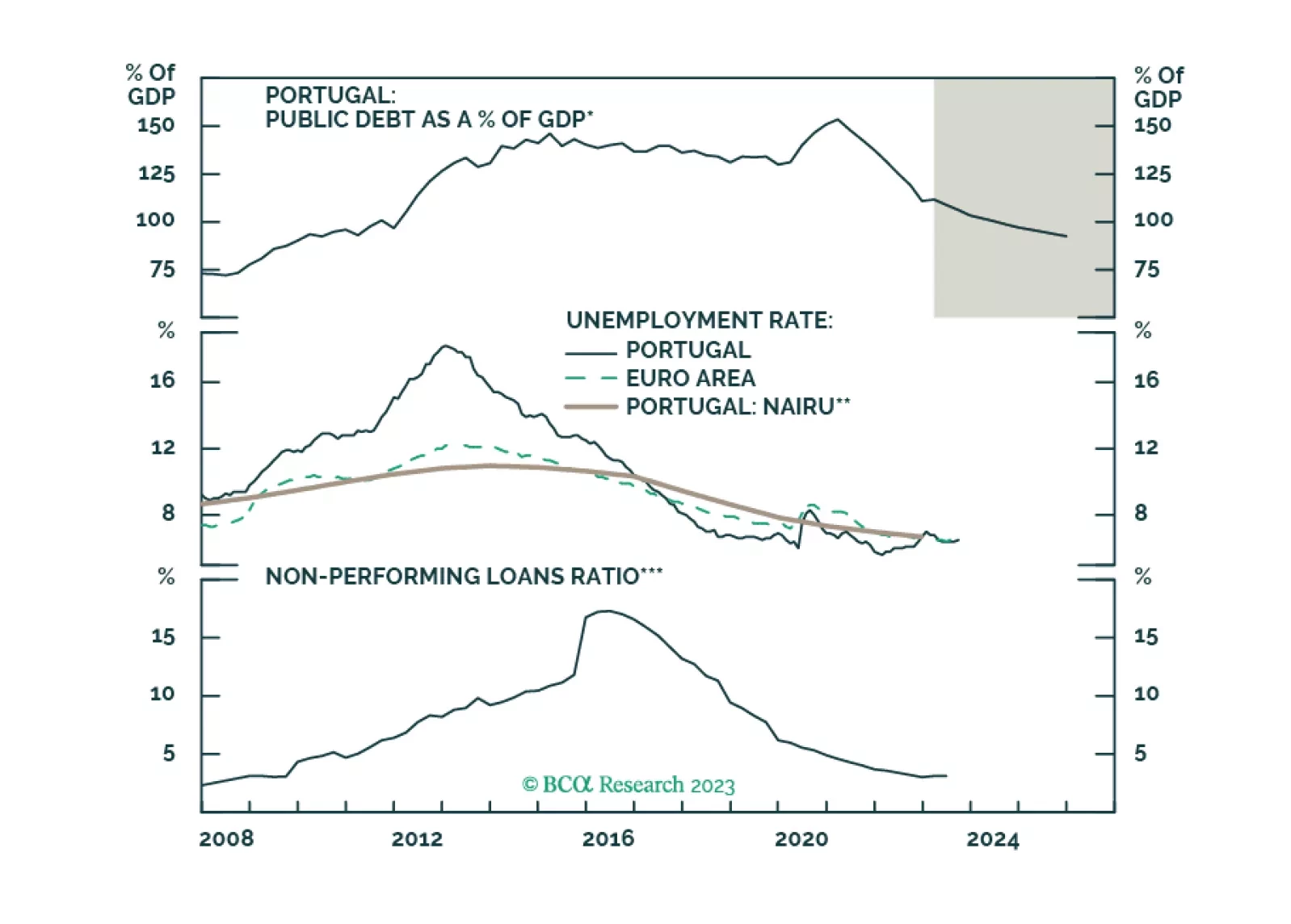

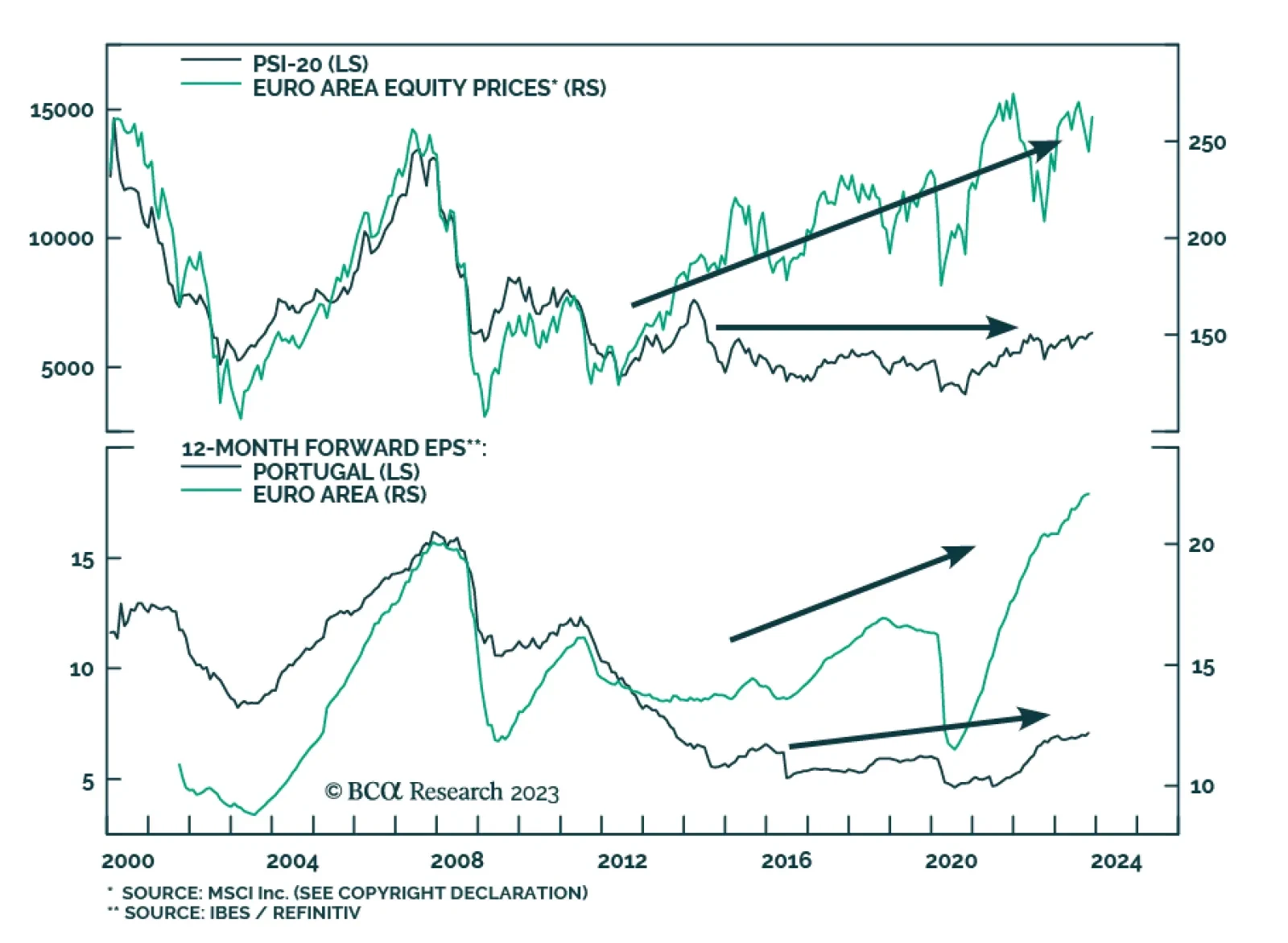

According to BCA Research's European Investment Strategy service, given the defensive nature of Portuguese equities and the team's recession view, investors should favor the Portuguese bourse relative to Euro Area…

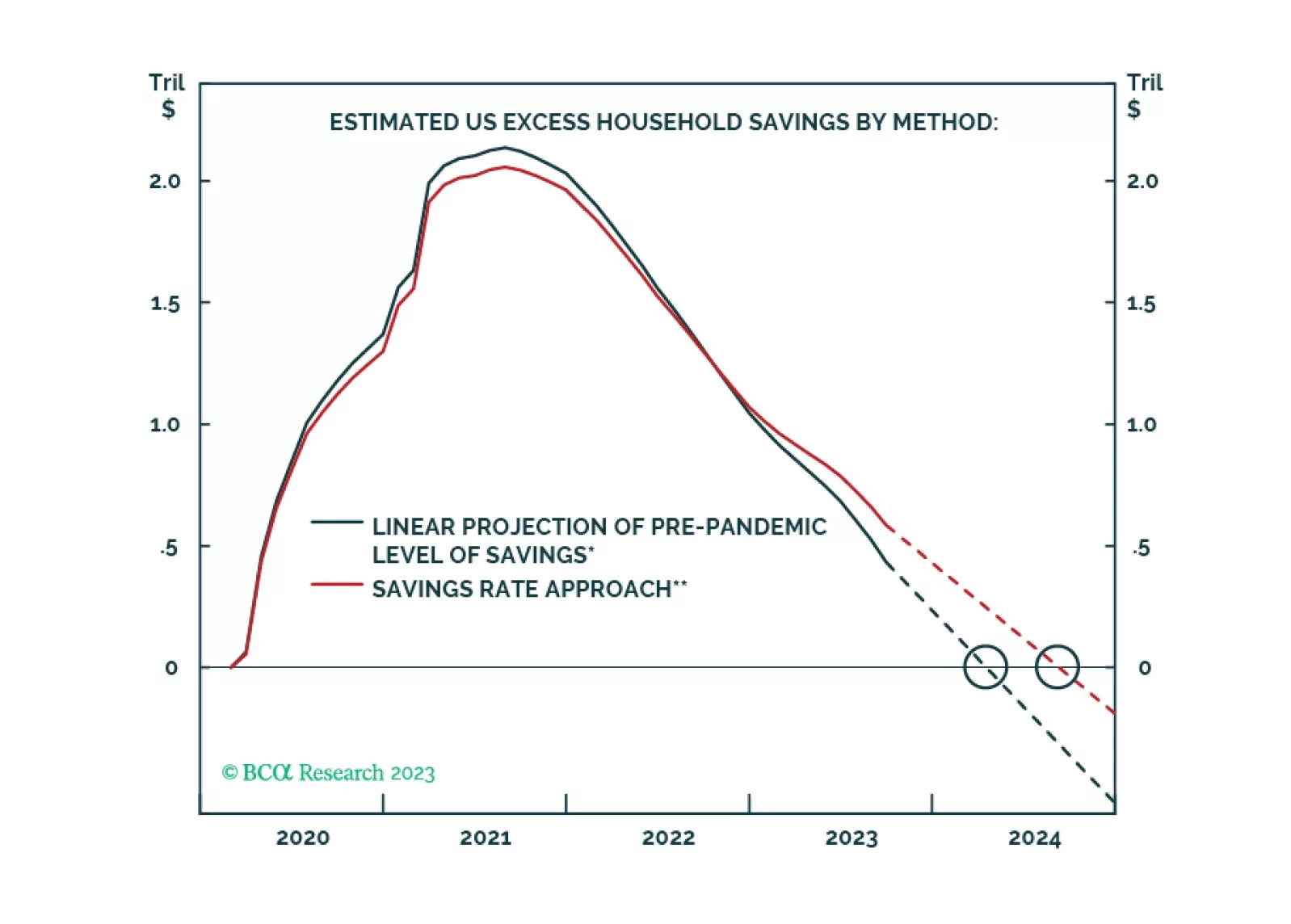

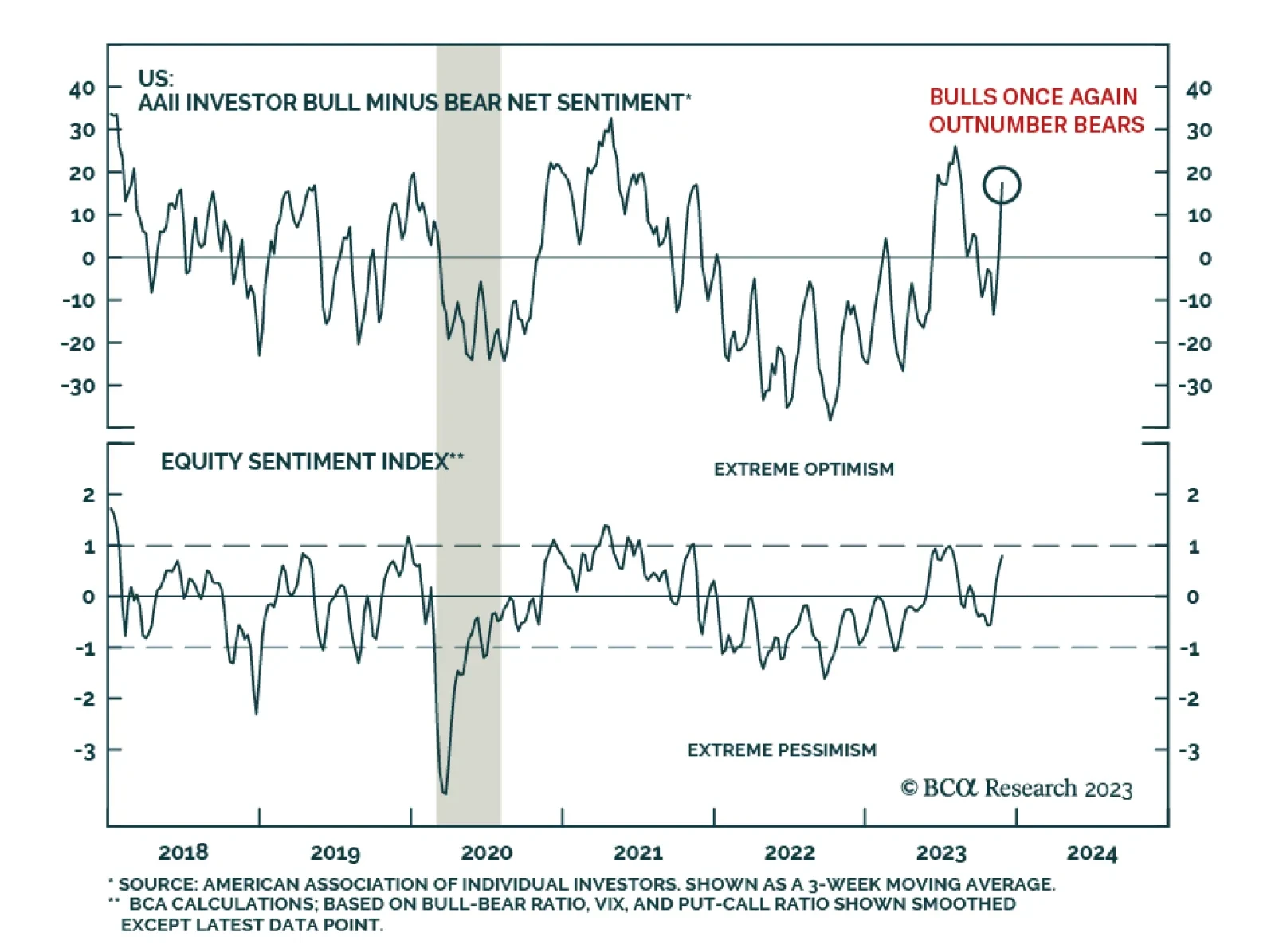

After a sharp rally since late-October, the S&P 500 is now on the verge of breaking above its late July year-to-date high and completely erasing the losses incurred over the prior three months. Investor sentiment has also…

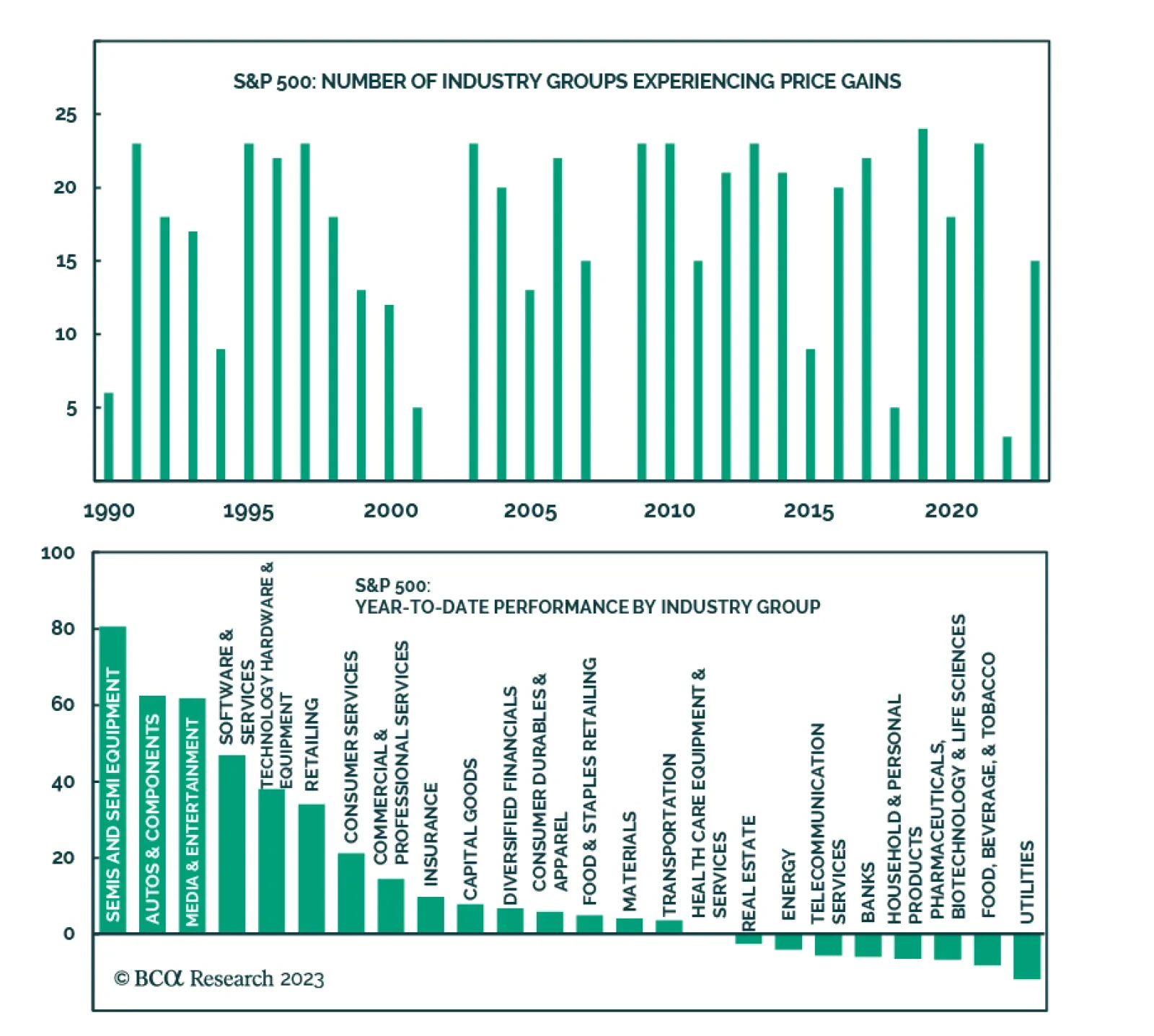

While the S&P 500 has rallied by 18.8% so far this year, not all sectors and industries have gained on a year-to-date basis. Nearly half of the 11 sectors are in the red. This list, which is made up of Utilities (-11.7%),…

Chinese industrial profits for October delivered a pessimistic signal on Monday as the annual growth rate eased to 2.7% y/y. While the latest update marks the third consecutive month of profit growth, it is a sharp slowdown from…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

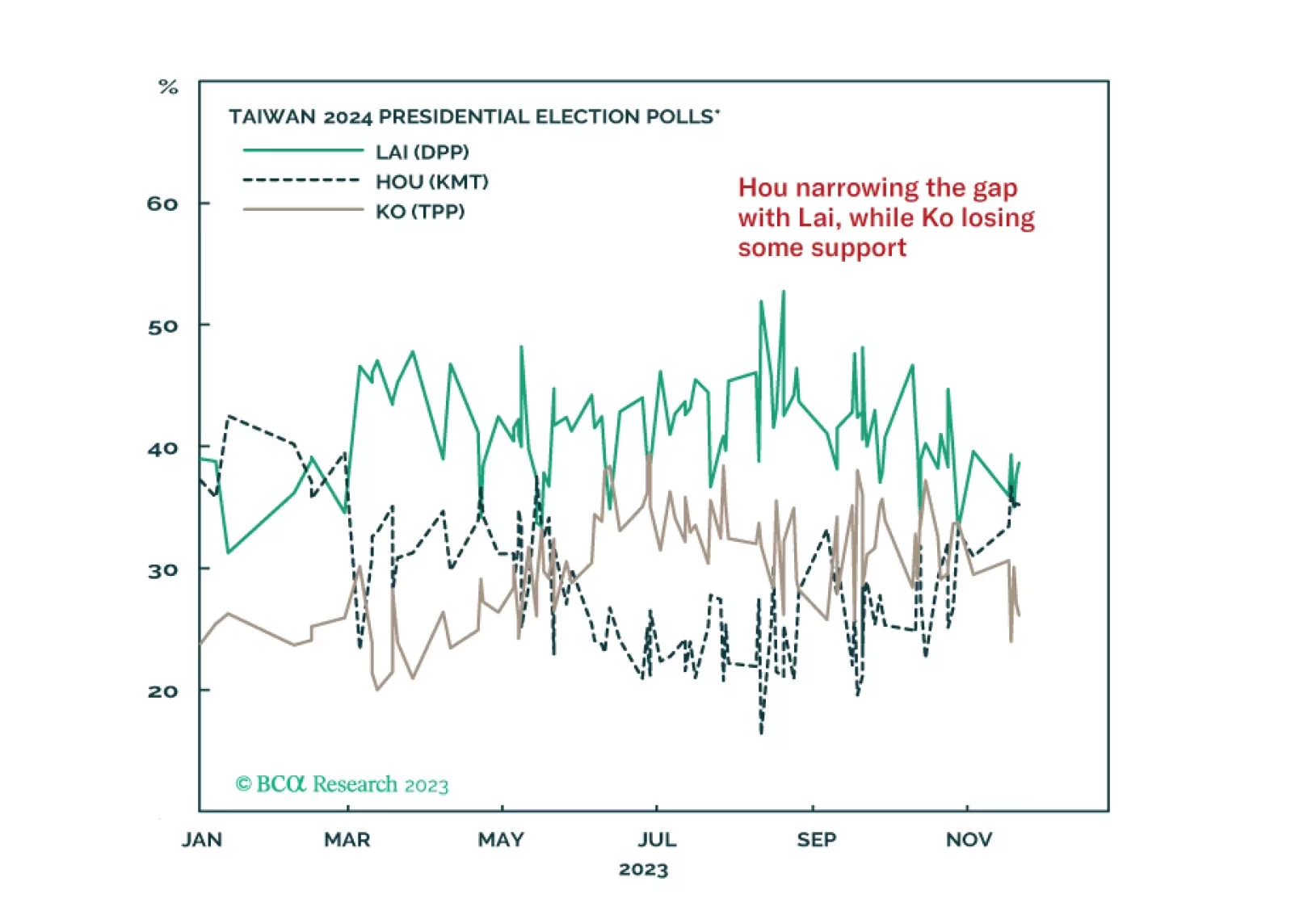

A series of notable events took place over the Thanksgiving holiday but none of them force us to change our fundamental assessments. The conflict in the Middle East is likely to escalate rather than de-escalate, while the Taiwan…

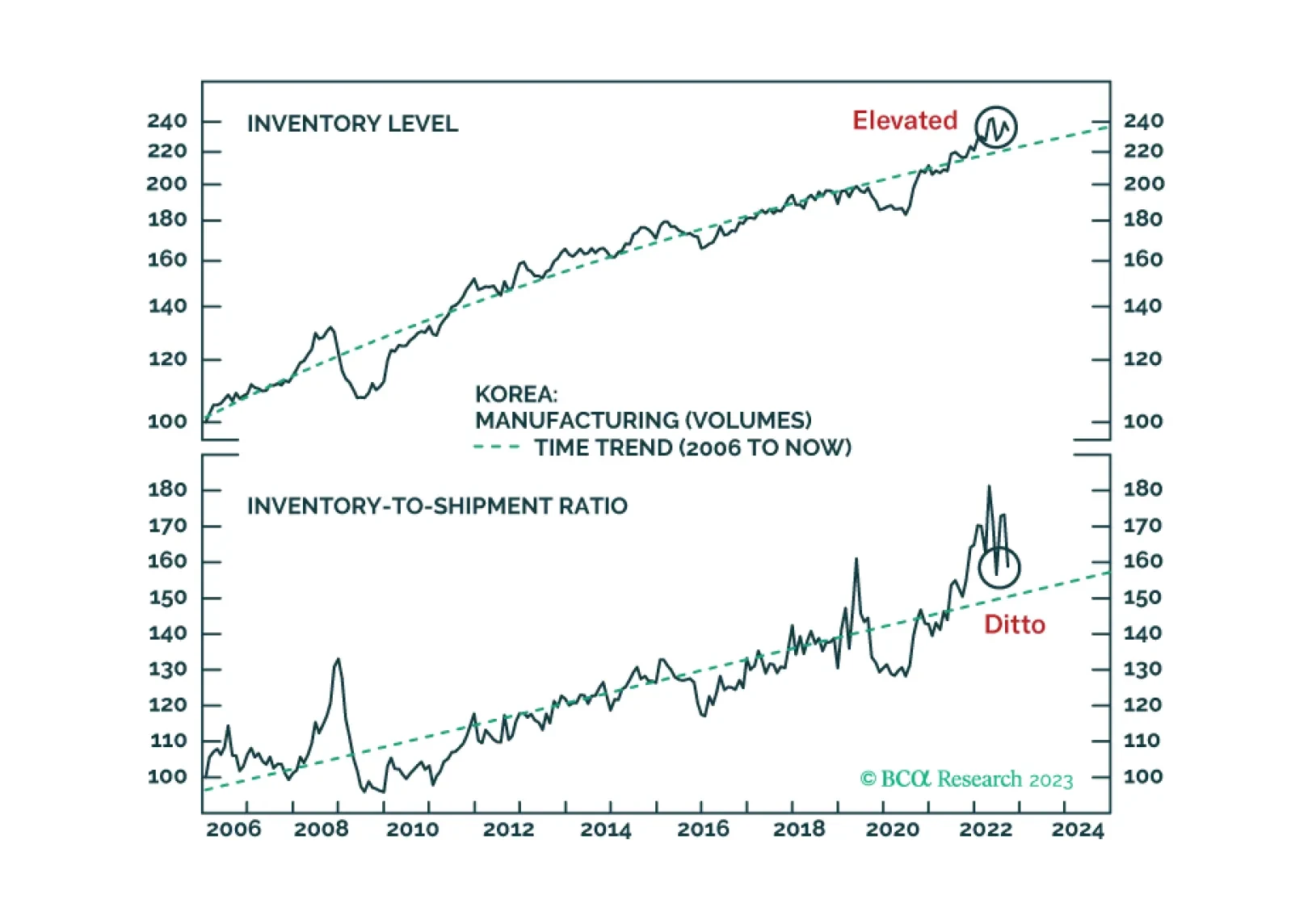

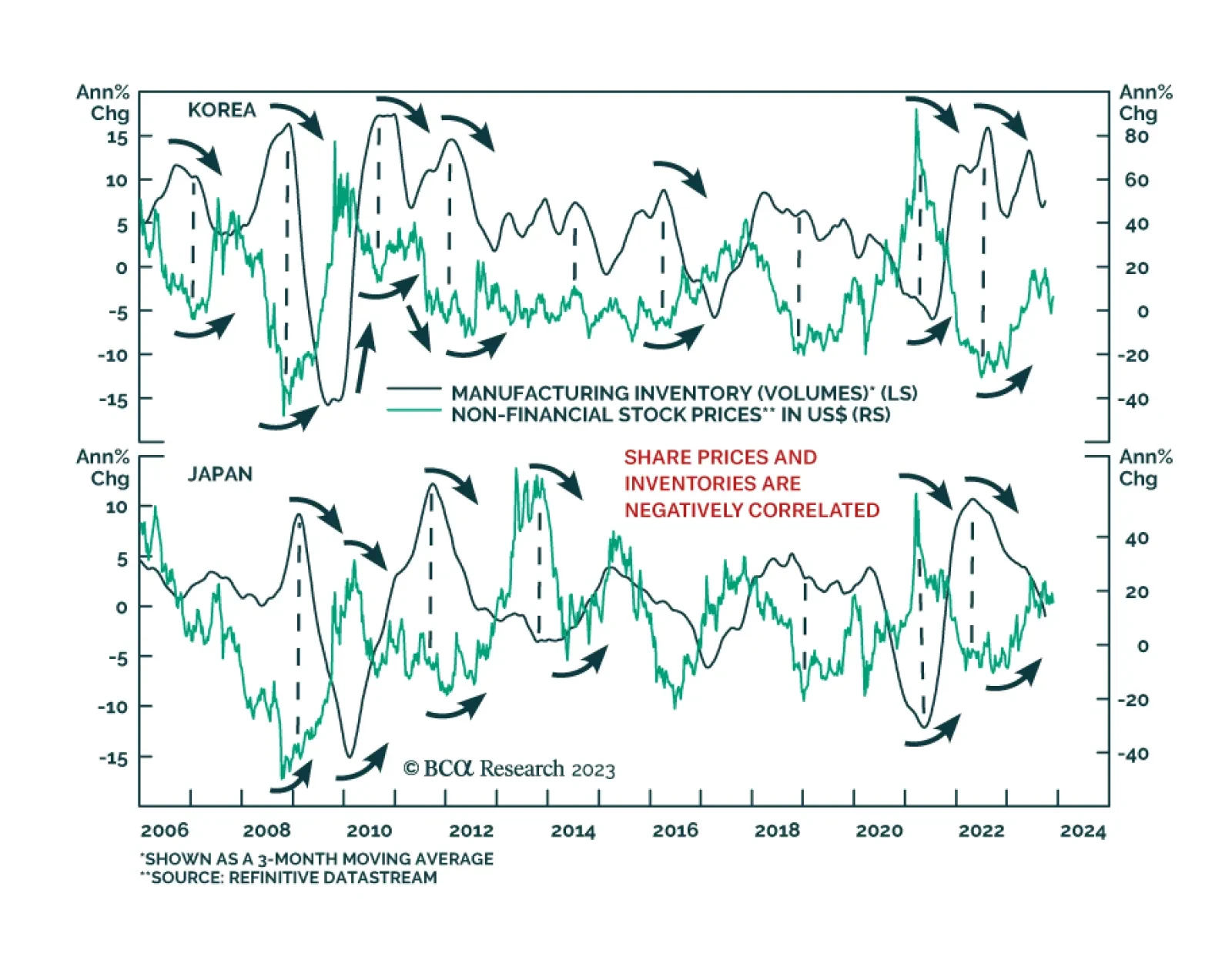

According to BCA Research's Emerging Markets Strategy service, investors should focus on fluctuations in final demand rather than inventories. A common narrative endorsed by many market participants is that inventory…

The Q3 earnings season is coming to an end. By Friday, 481 companies in the S&P 500 index had reported earnings. In aggregate, the results are generally favorable. The share of companies whose earnings exceeded analyst…

Contrary to the prevalent belief in the global investment community, goods/merchandise inventories in the US and East Asia are rather elevated. Financial markets respond to final demand fluctuations, not inventory restocking. Global…