The US High Quality (USHQ) portfolio underperformed its benchmark through July, returning -1.5%, whilst its SPY benchmark returned 0.2%. On a trailing three-month basis, performance was notably weak vs. benchmark, with USHQ…

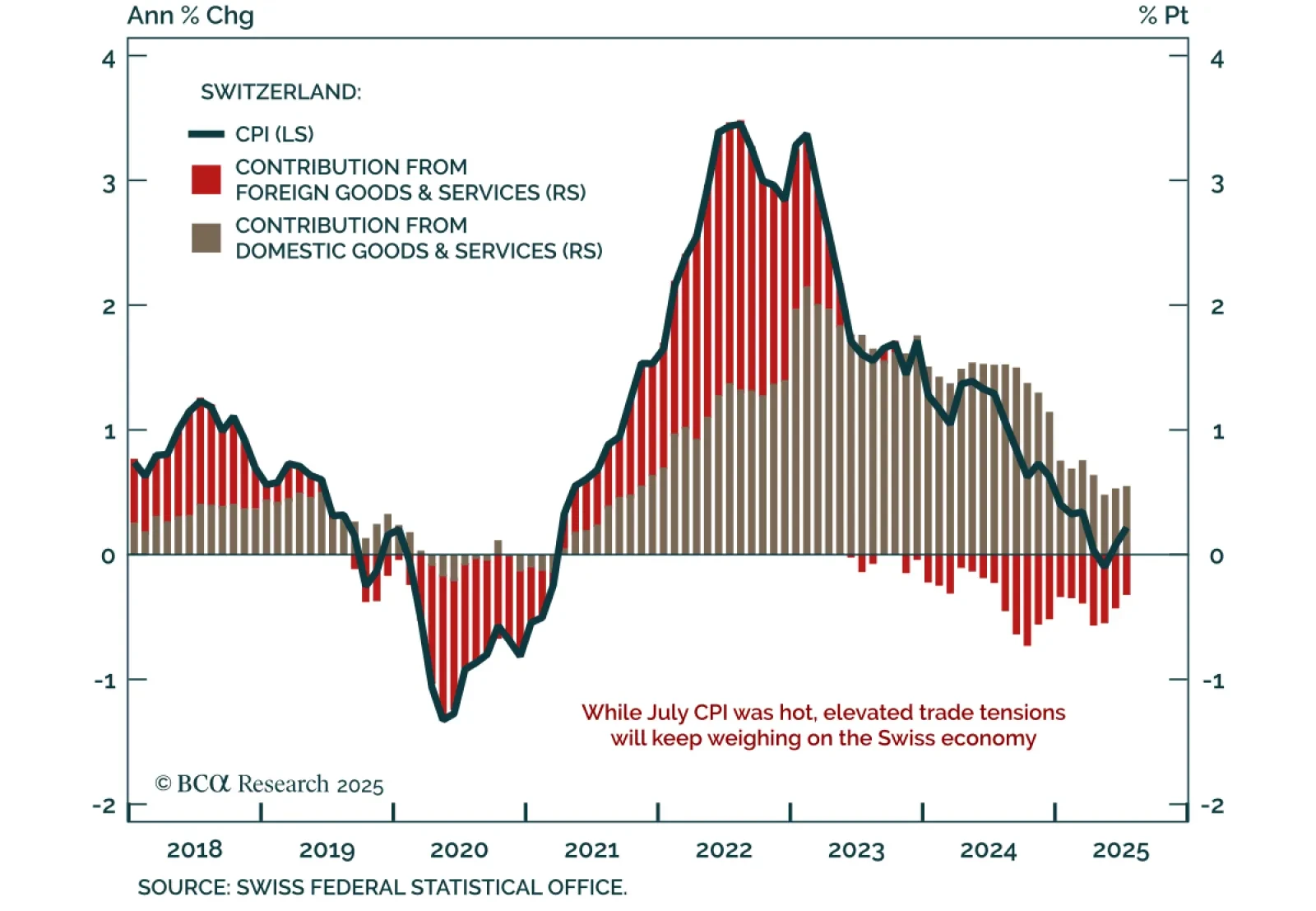

Hot July inflation does little to alter Switzerland’s near-term deflationary outlook, as soft data and trade risks support a defensive stance and preference for bonds over equities. CPI ticked up to 0.2% y/y from 0.1%, with core…

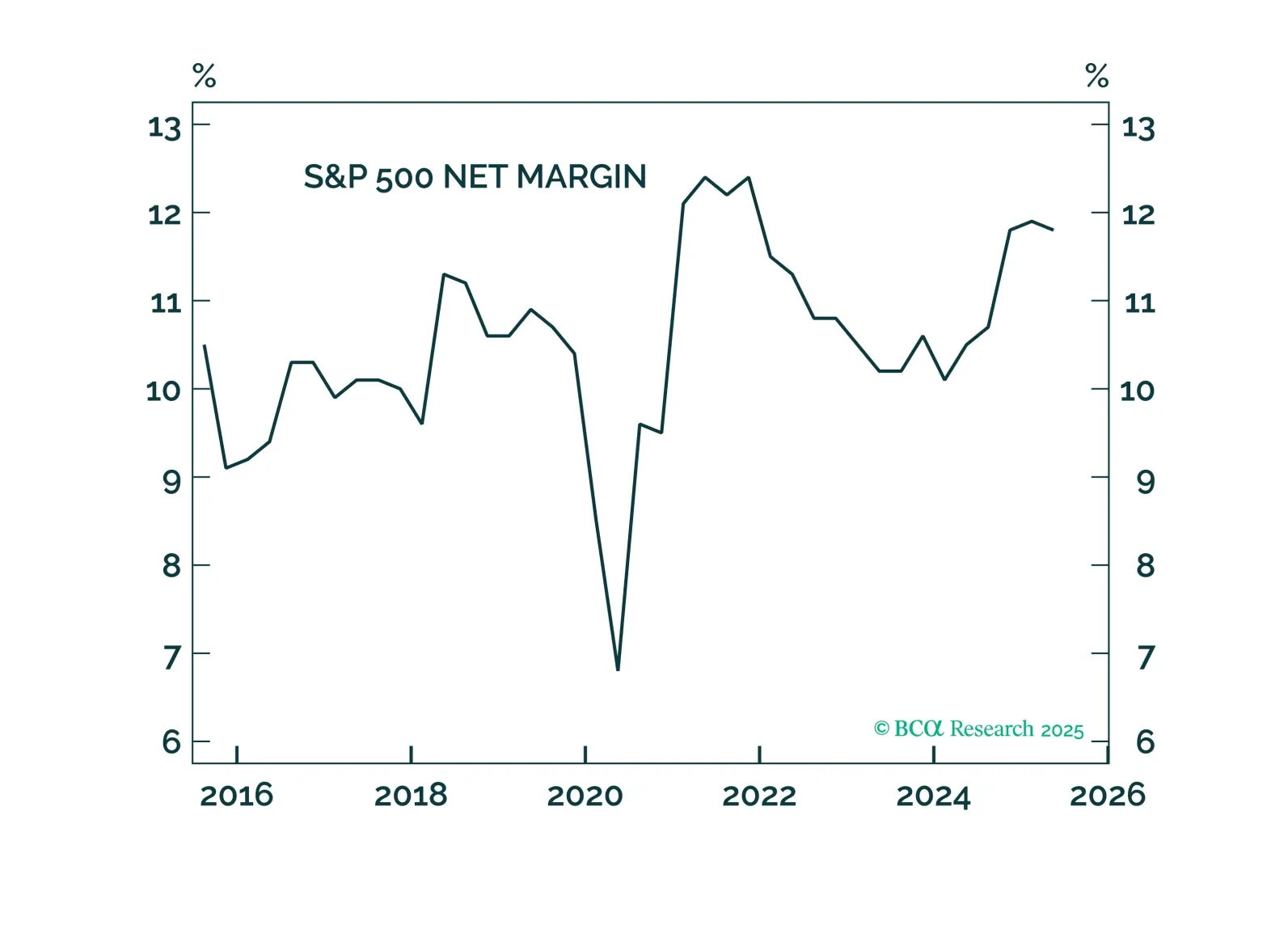

The S&P 500 recently breached new highs, but narrow leadership and a slowing labor market reinforce caution on risk assets. Equities rebounded from their post-Liberation Day lows, but the rally has been led mostly by the tech…

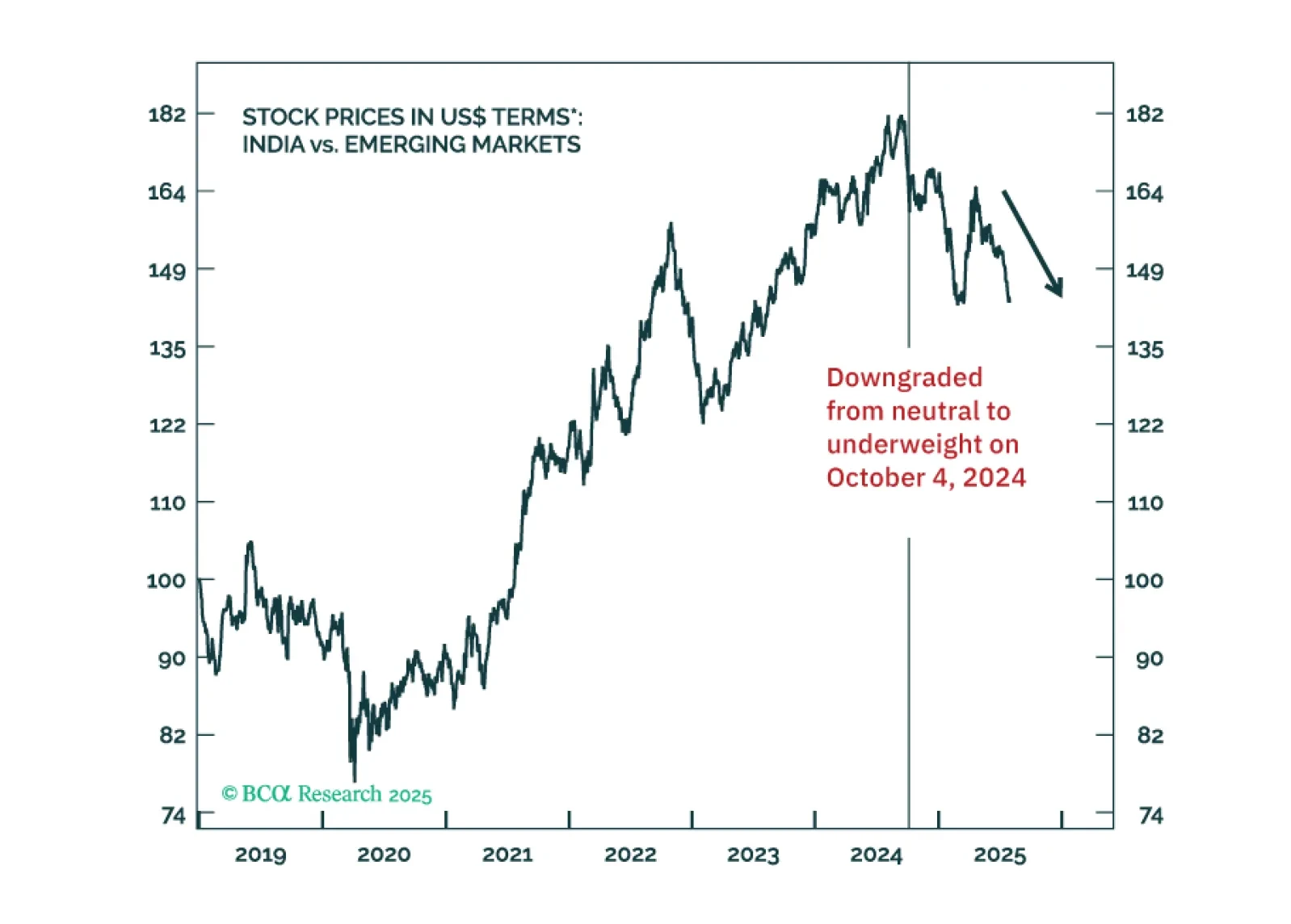

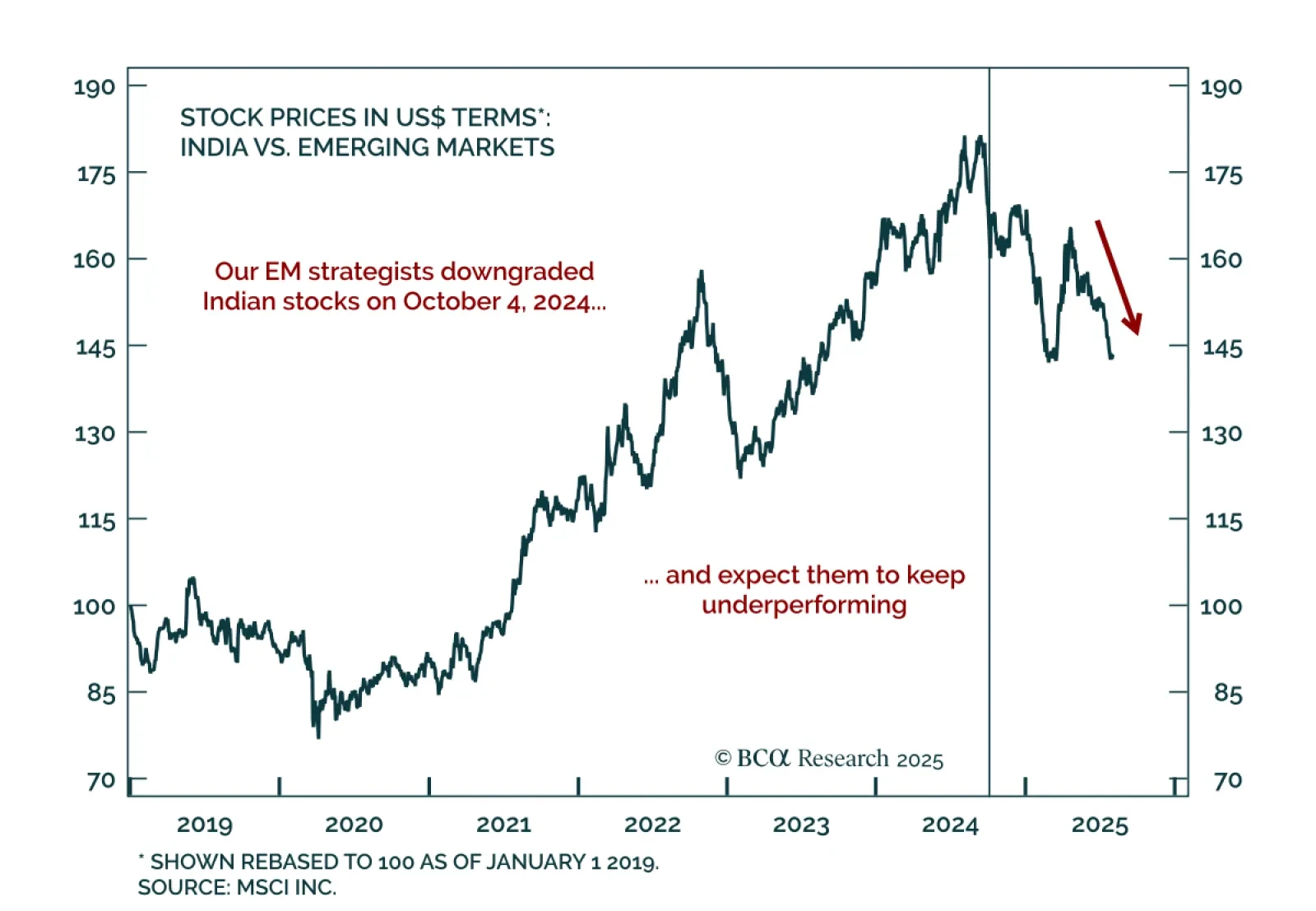

Our Emerging Markets strategists recommend staying underweight India in EM equity and Asia portfolios, while maintaining an overweight in India within EM domestic bond allocations. A relatively higher US tariff rate and ongoing trade…

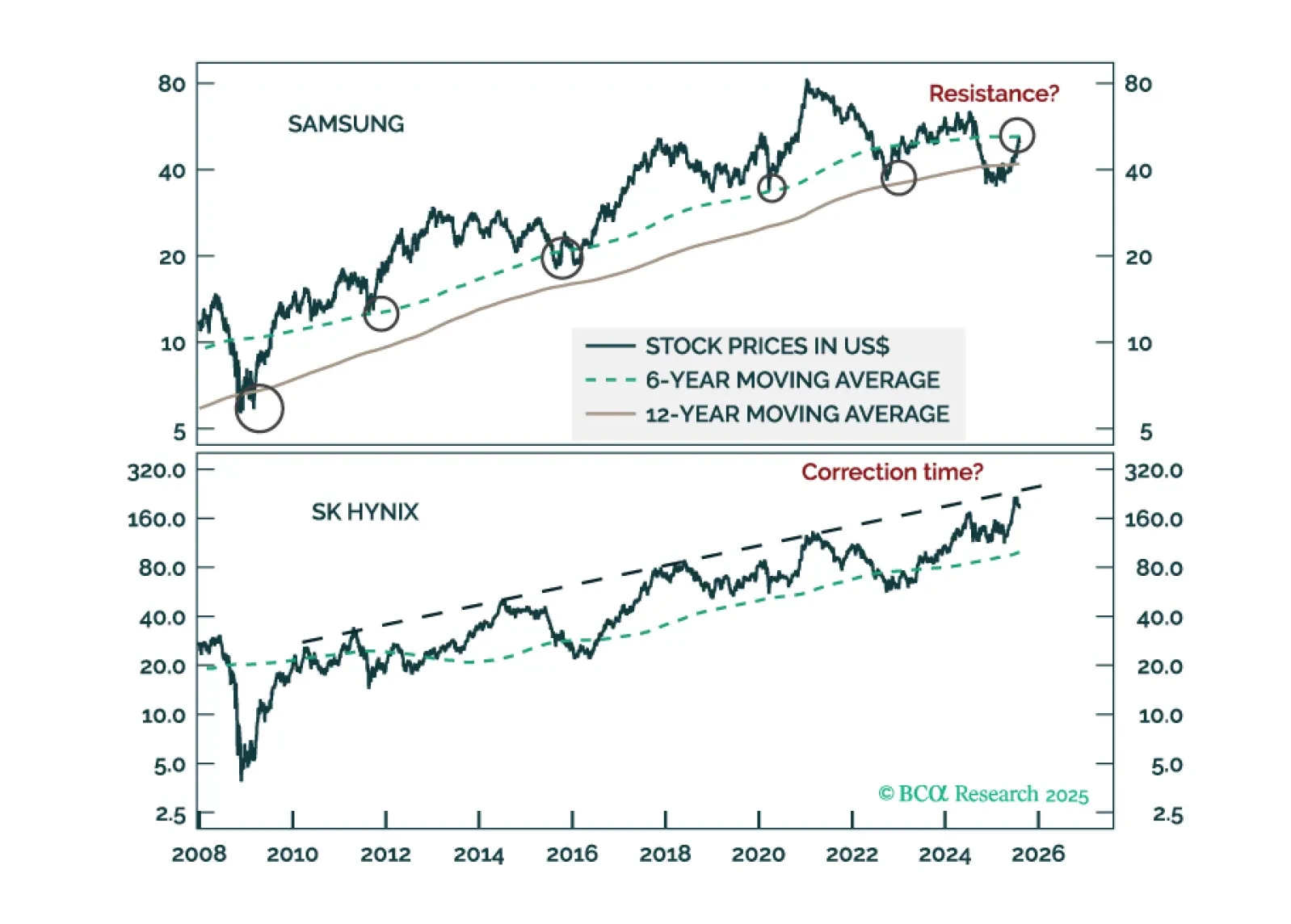

A deflationary shock from shrinking exports will ripple throughout the Korean economy. We are downgrading the KOSPI from overweight to neutral and reiterating a long position in 10-year domestic bonds, currency unhedged.

The Q2 reporting season underscores the resilience of corporate earnings, supporting our bullish outlook for equities, an outlook further bolstered by expectations of fiscal and monetary easing. However, for now, we are booking…

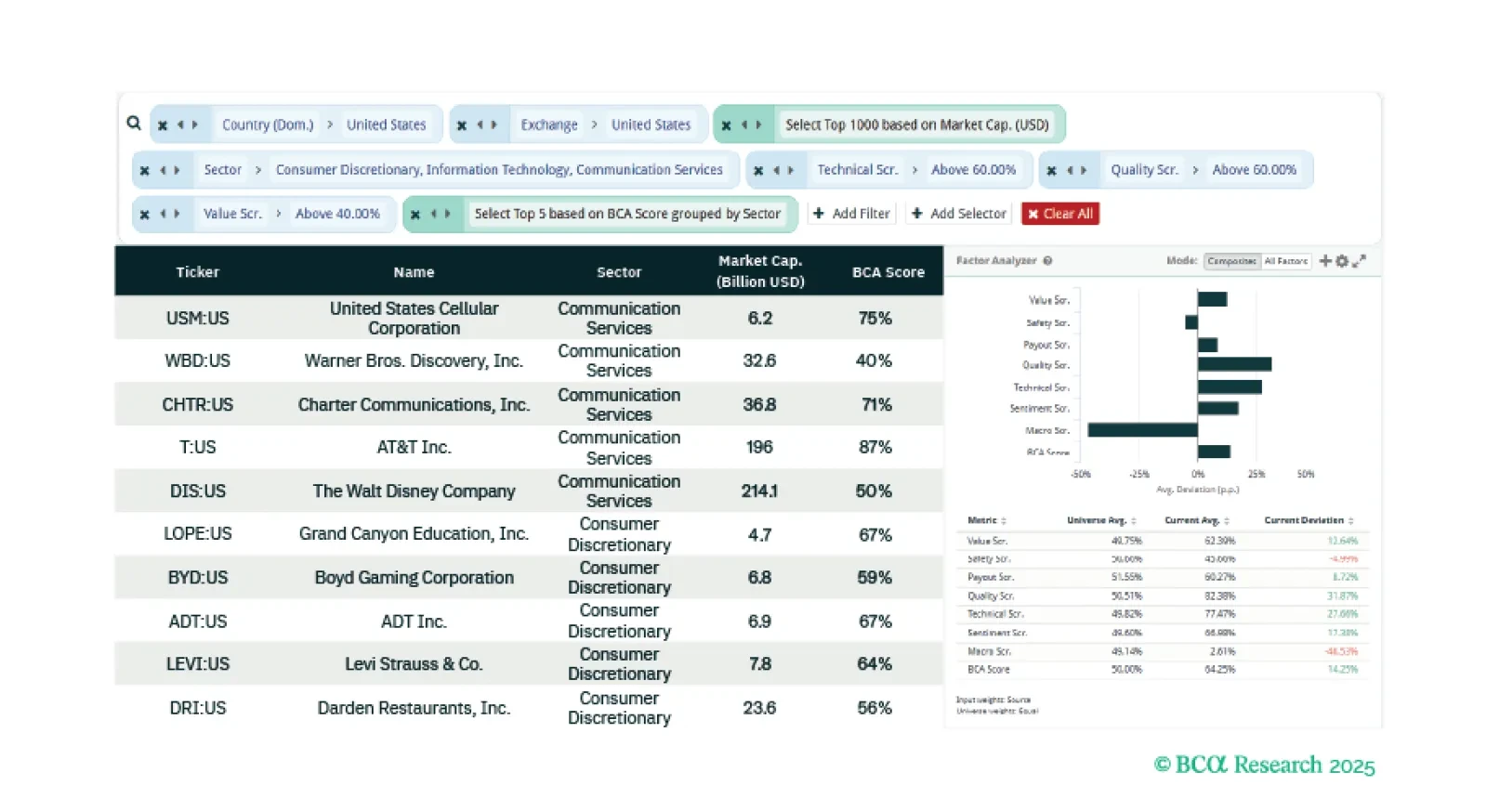

This week our three screeners identify: Broader and more accessible tech-driven equities, US equities exposed to cryptocurrencies, and doubling-down on top-decile stocks.

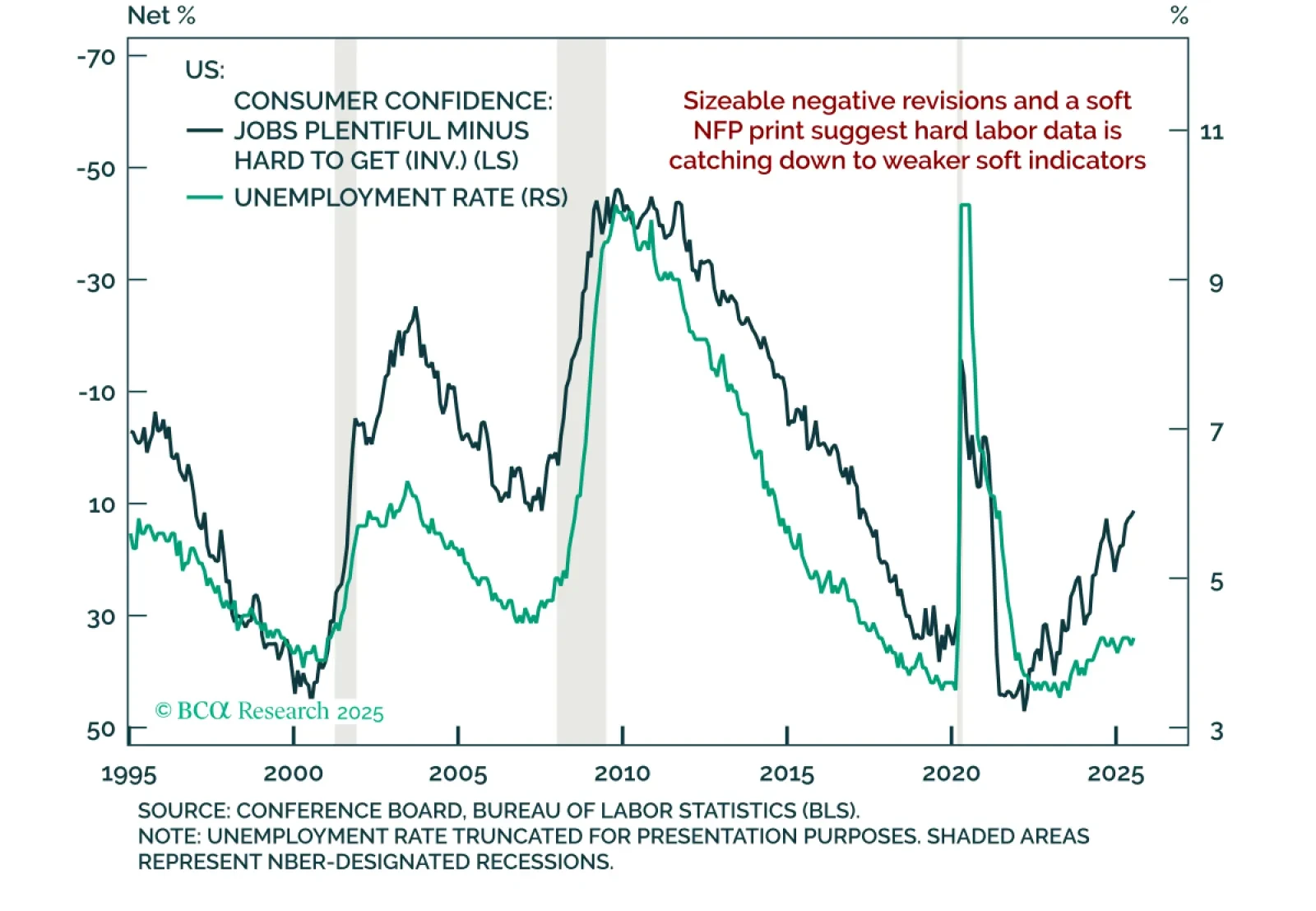

The July employment report revealed large downward revisions and slowing payroll growth, reinforcing our defensive stance. Nonfarm payrolls rose just 73k, and prior months were revised down by 258k, bringing the 3-month average to…

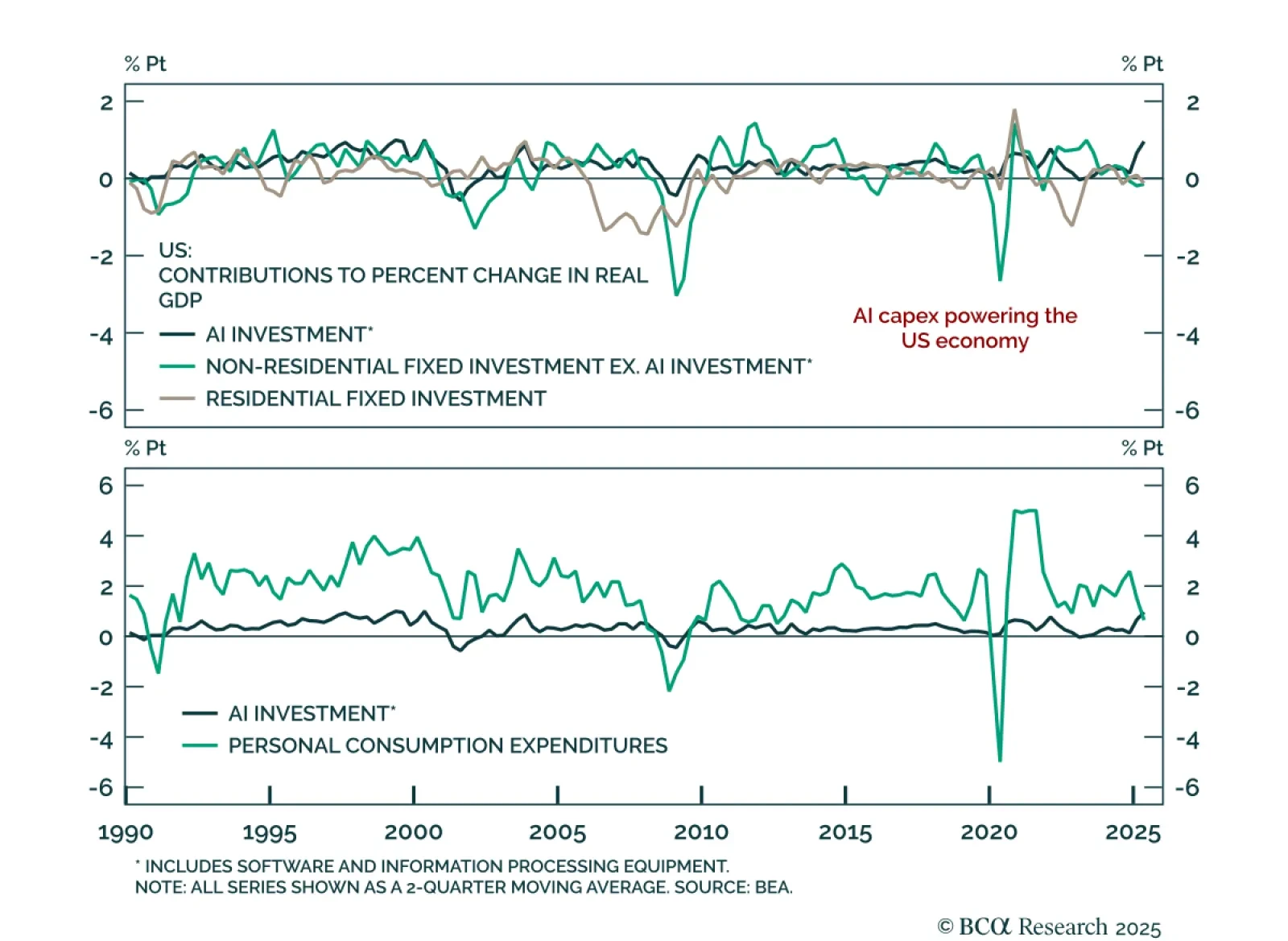

AI capex has emerged as the dominant driver of US growth in 2025, reshaping both macro dynamics and equity strategy. Our Chart Of The Week comes from Juan Correa, Chief Strategist for Global Asset Allocation.Over the first half of…

A high US tariff and the lingering uncertainties on the US-India trade deal will hurt investors sentiment. This and contracting corporate profits will push share prices lower. Stay underweight Indian stocks.