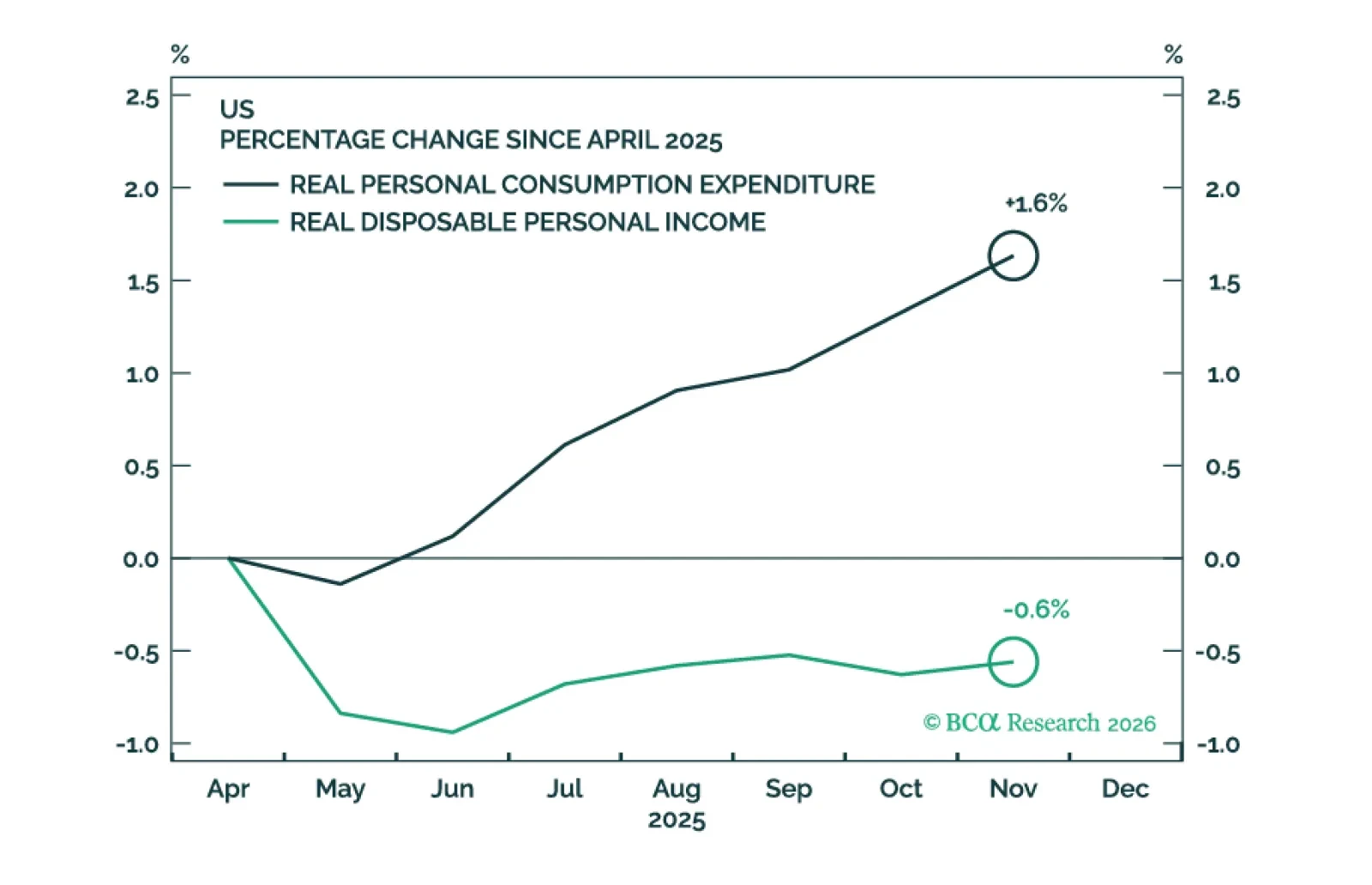

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

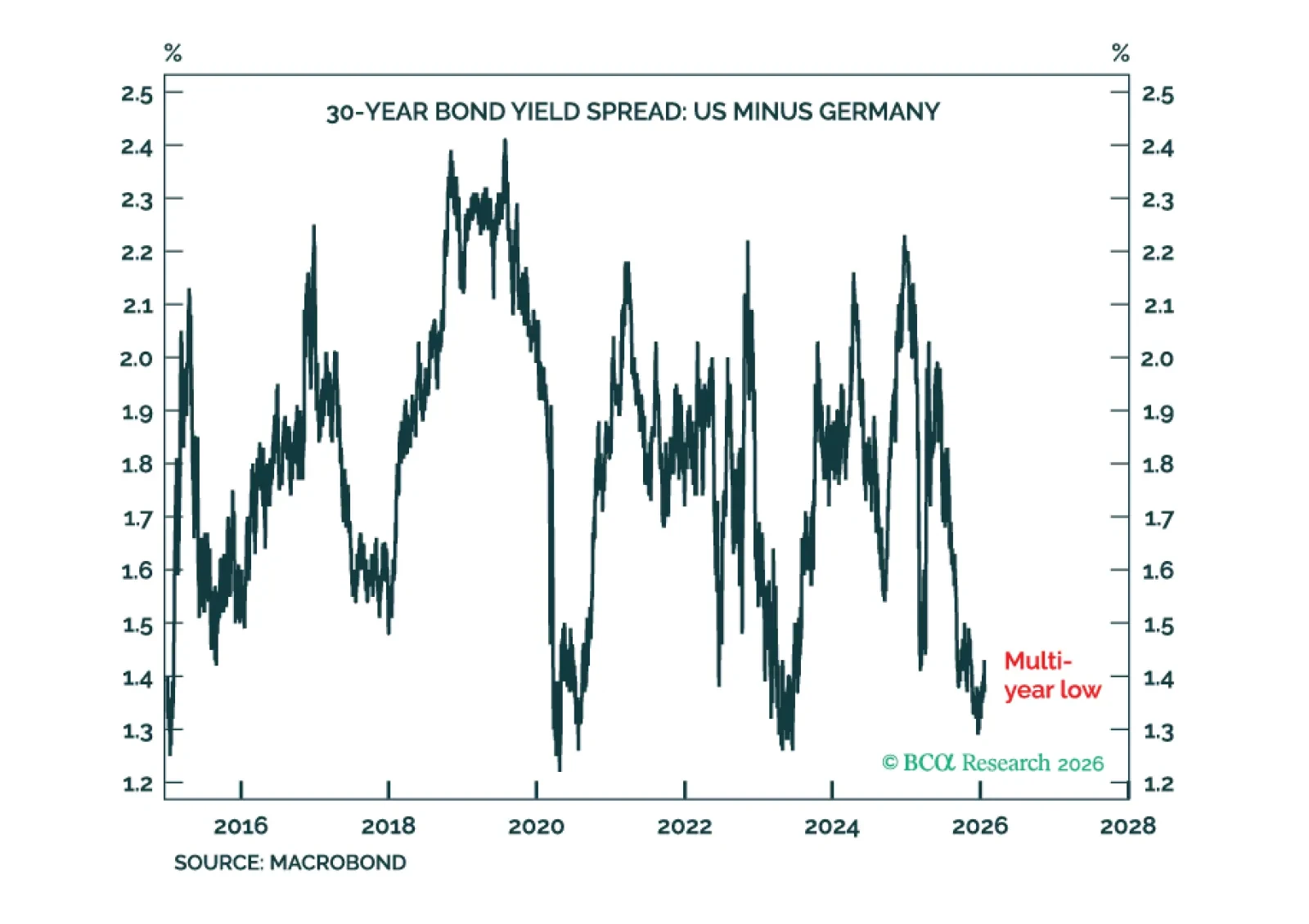

US Treasury yields require a higher premium for both geopolitical risk and inflation risk, but higher bond yields are not necessarily bad for stocks.

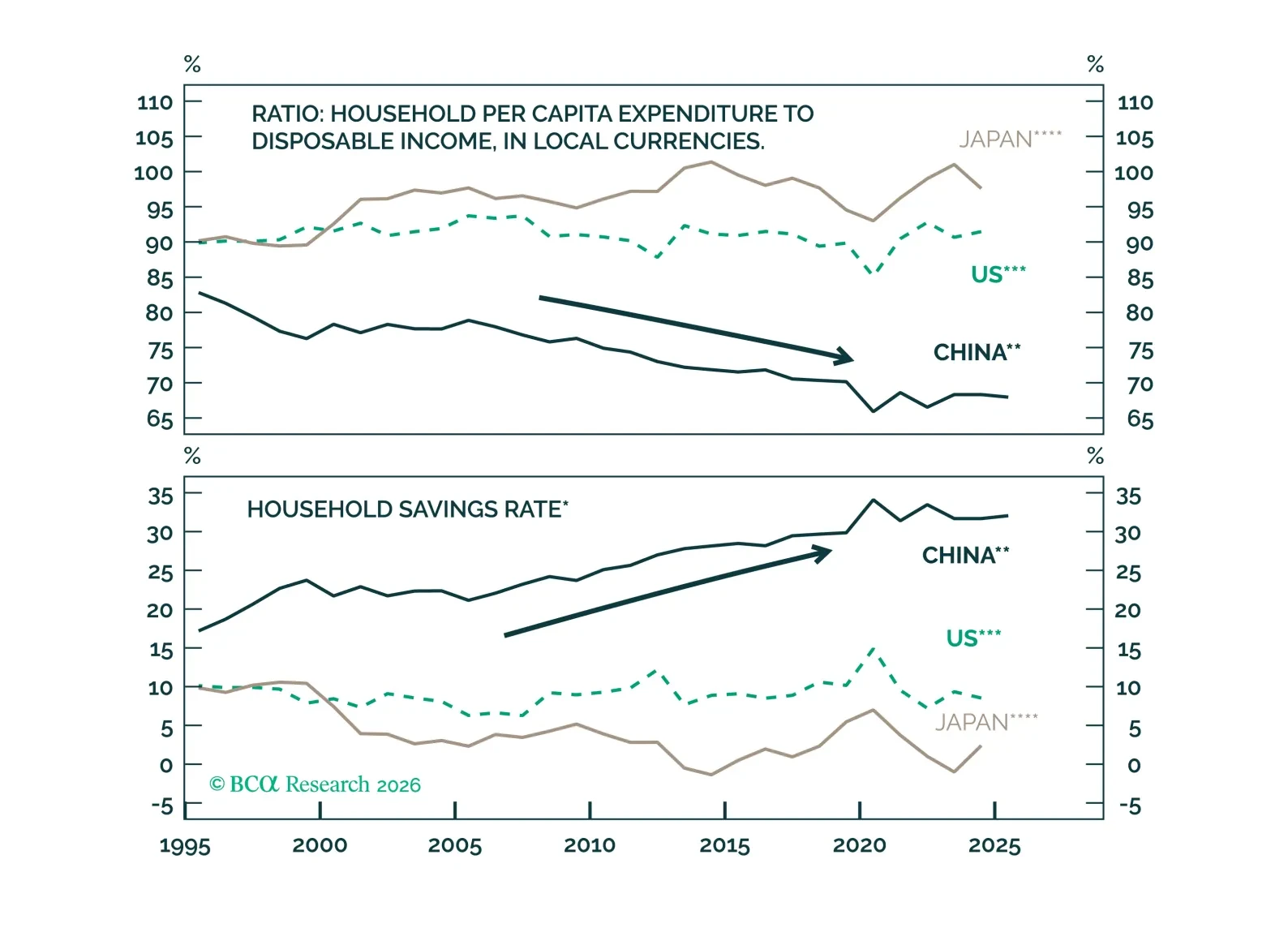

Europe is in a geopolitical sweet spot. Exaggerated fears of Russian military aggression and abandonment by the United States, as well as increased competition from China, create a geopolitical imperative to stimulate, reflate, and…

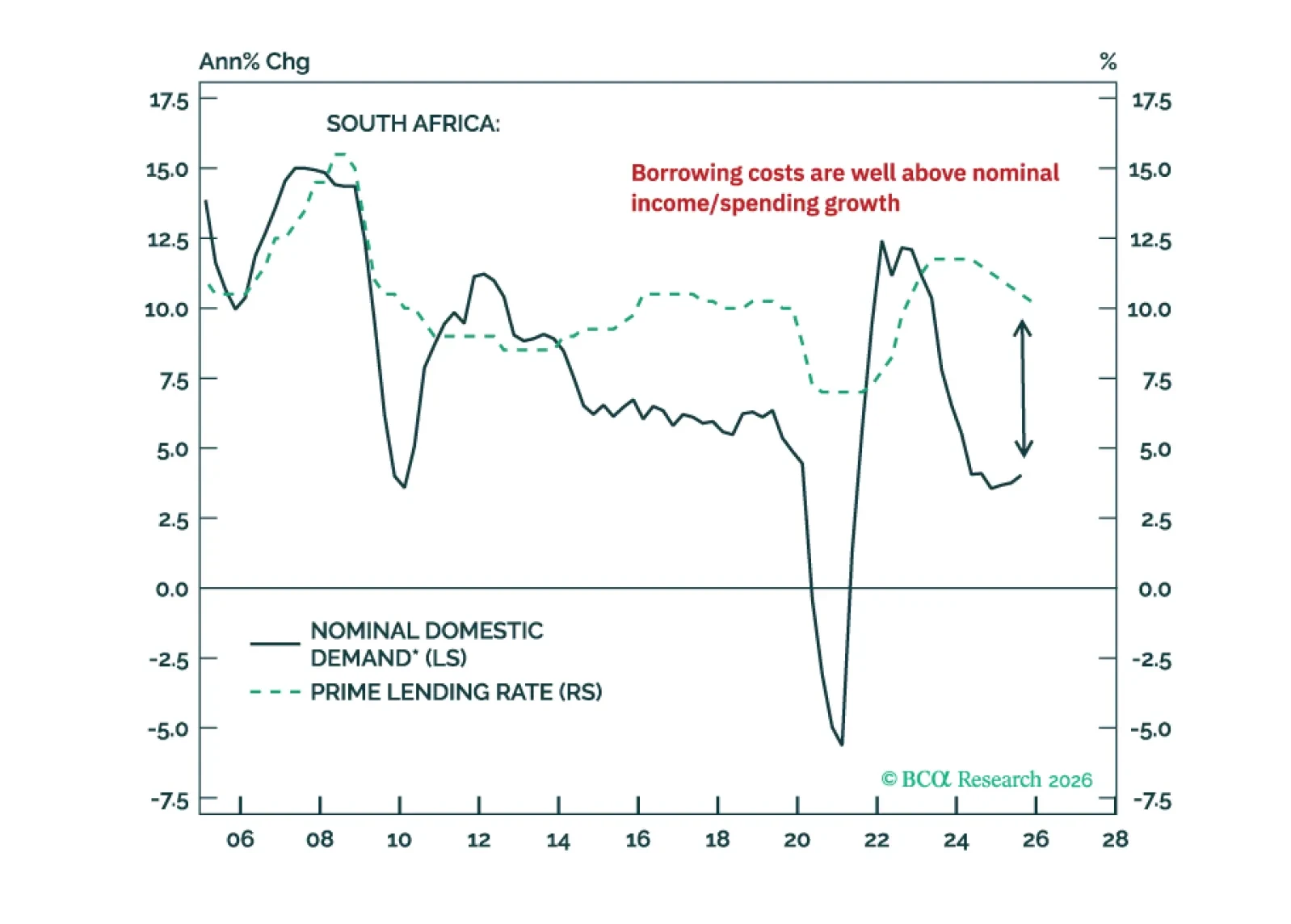

The precious metal bonanza has not resolved the South African economy’s plight. Nor did it improve its public debt sustainability issues. Investors should brace for a reversal in South African stocks, bonds, and the currency.

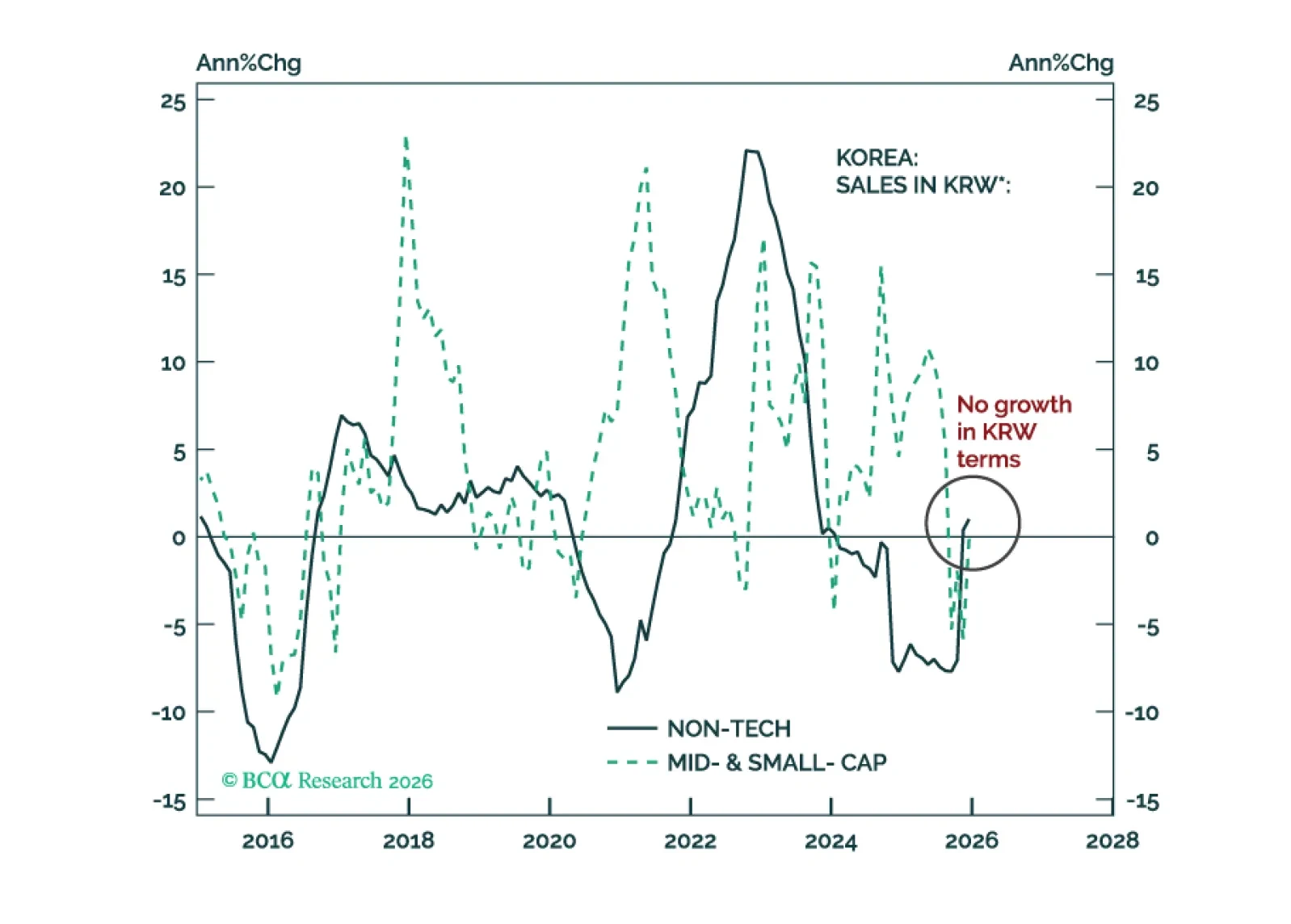

Go long KRW versus USD. Within an EM equity portfolio, overweight Korean tech and stay neutral on Korean non-tech. However, we are not bullish on the Korean bourse's absolute performance.

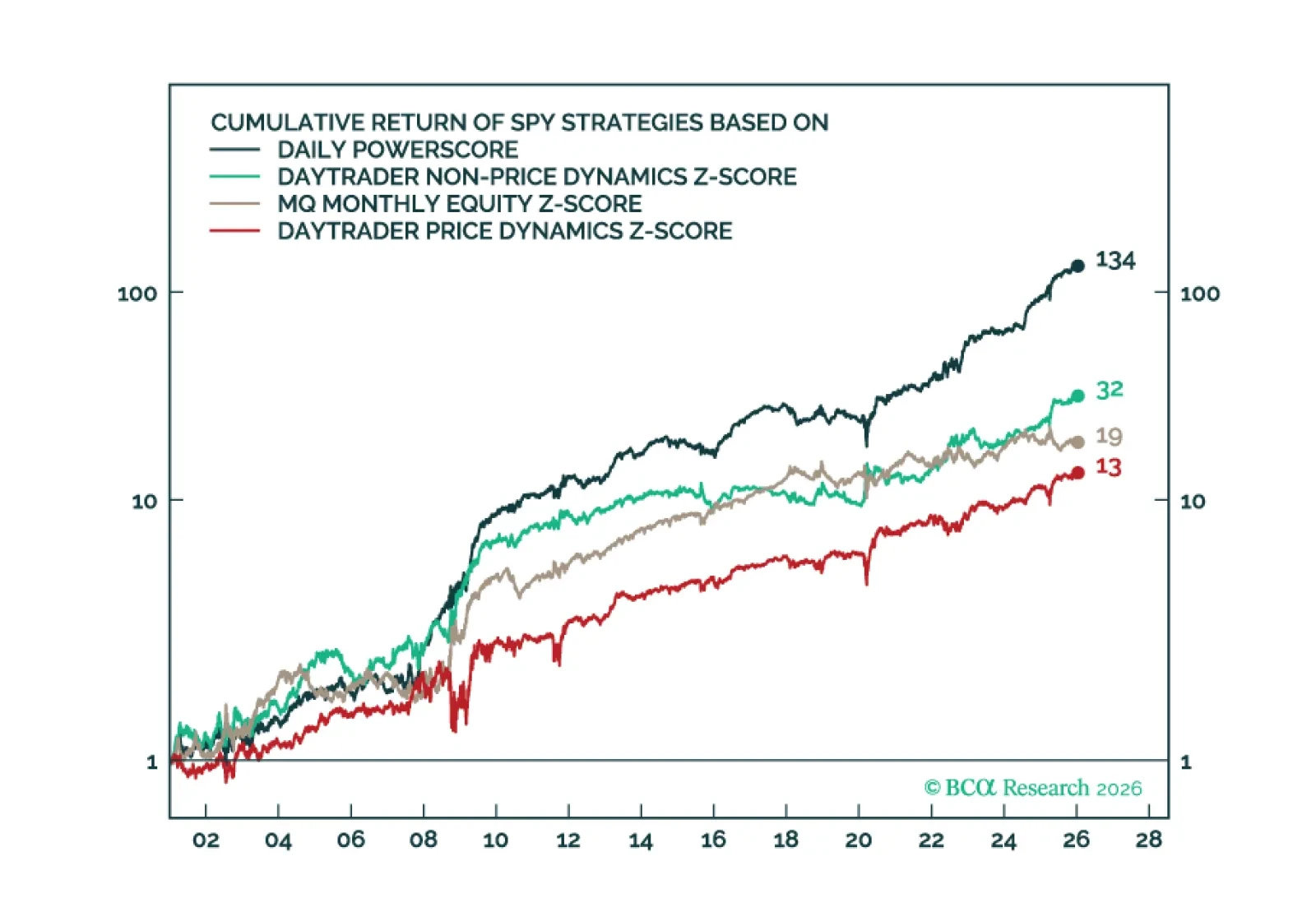

Over the past few months, we have been deploying new market-timing tools aimed at improving the accuracy of our calls. Today’s report highlights our ultra high-frequency Daily Oscillators, which provide daily signals on the near-term…

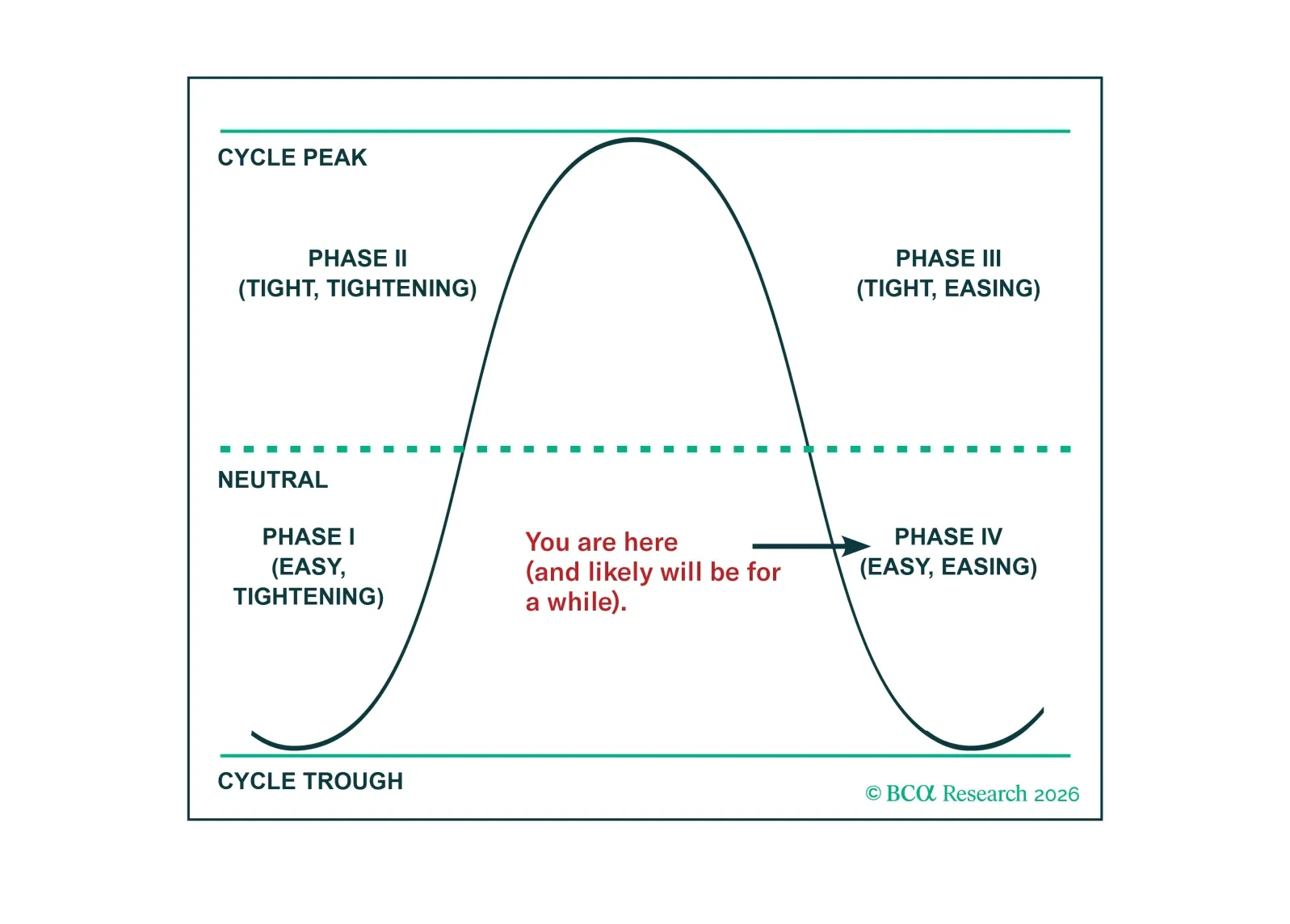

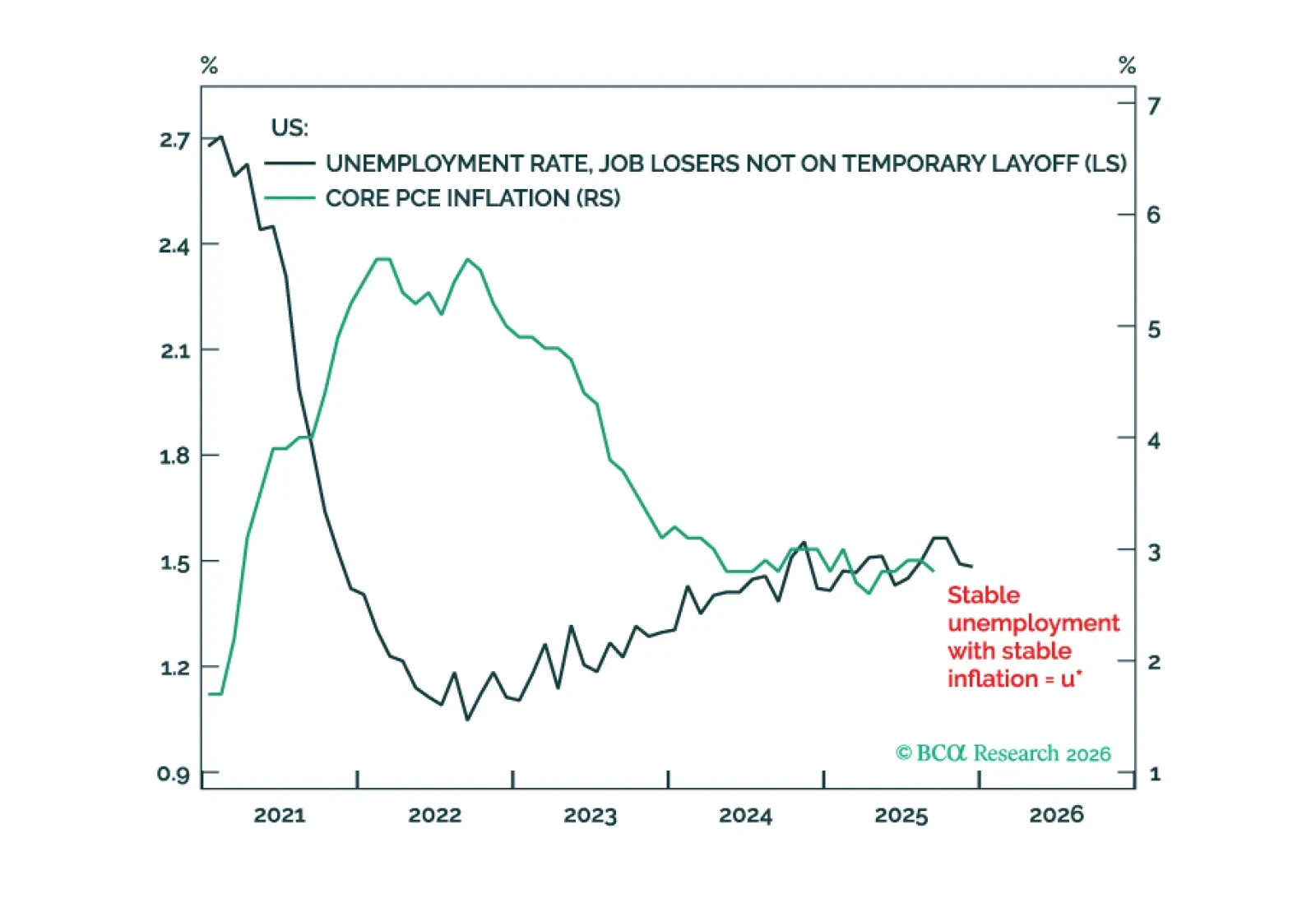

With the US unemployment rate and interest rate close to the ‘neutral’ u-star and r-star respectively, further Fed rate cuts risk pushing up inflation and long-term inflation expectations. This is bad for bonds but good for stocks.…

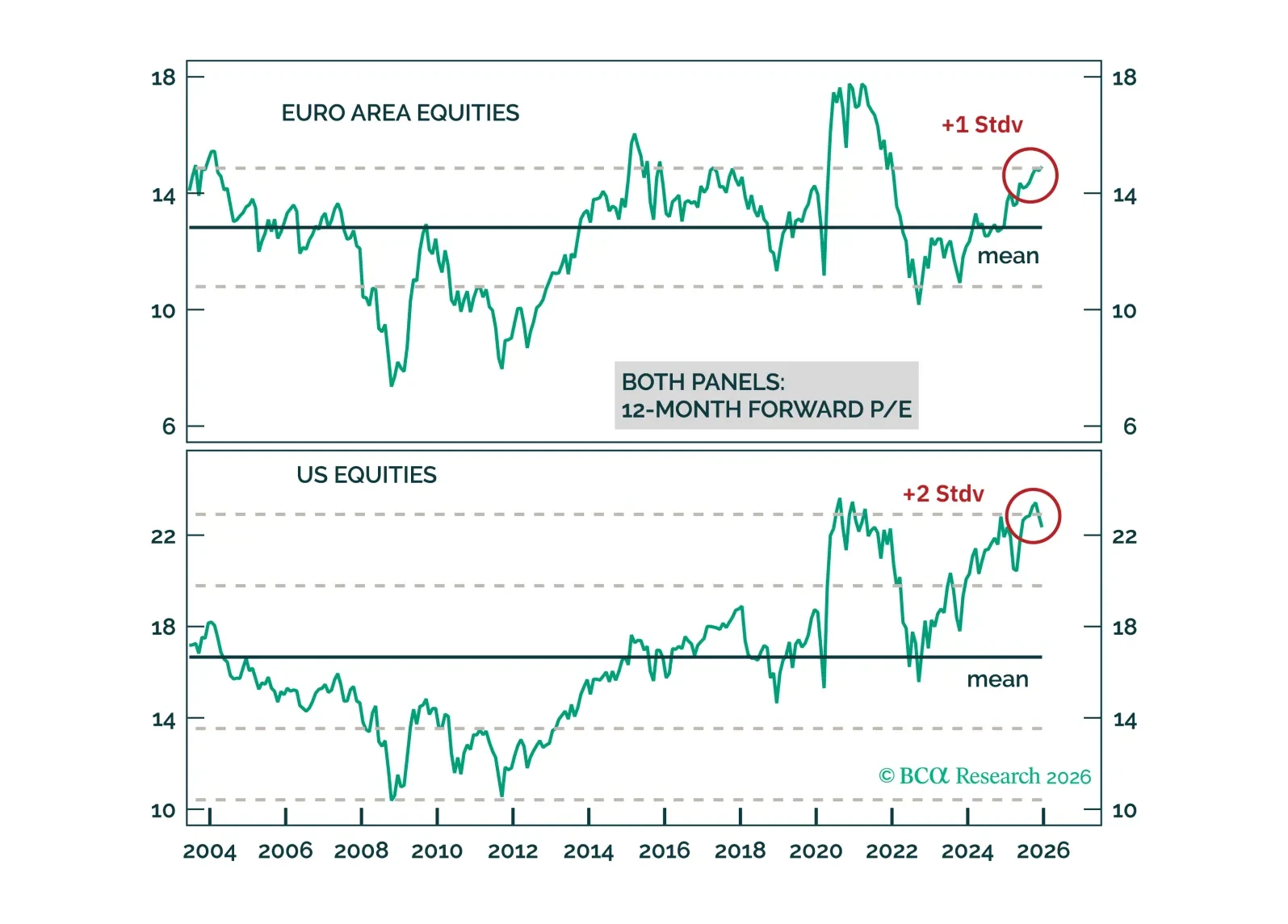

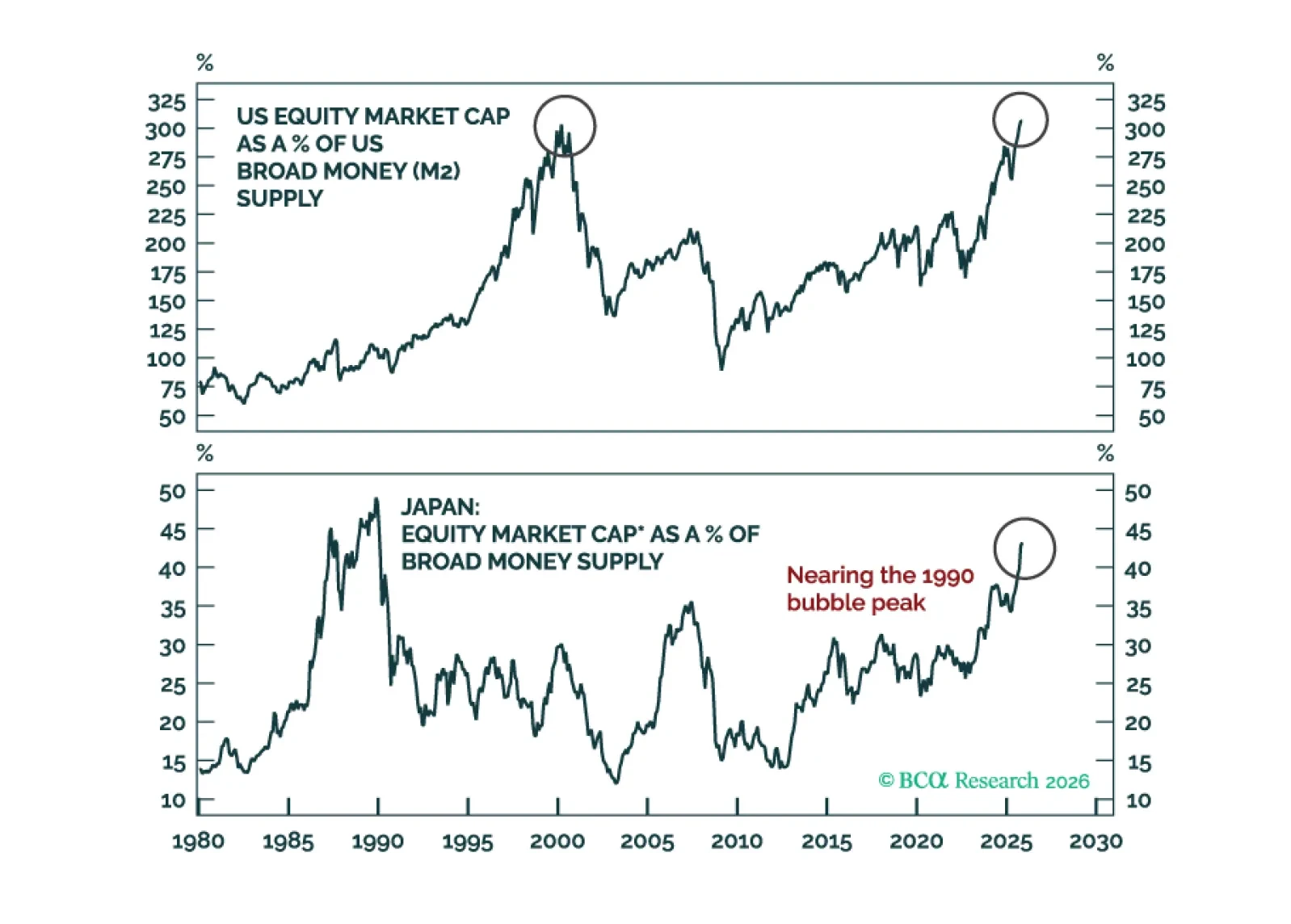

At major technical crossroads, markets eitherpull back before staging a sustainable breakout, or attempt to break out only to drop considerably (i.e., a fakeout). We believe the latter dynamics are more likely to play out.