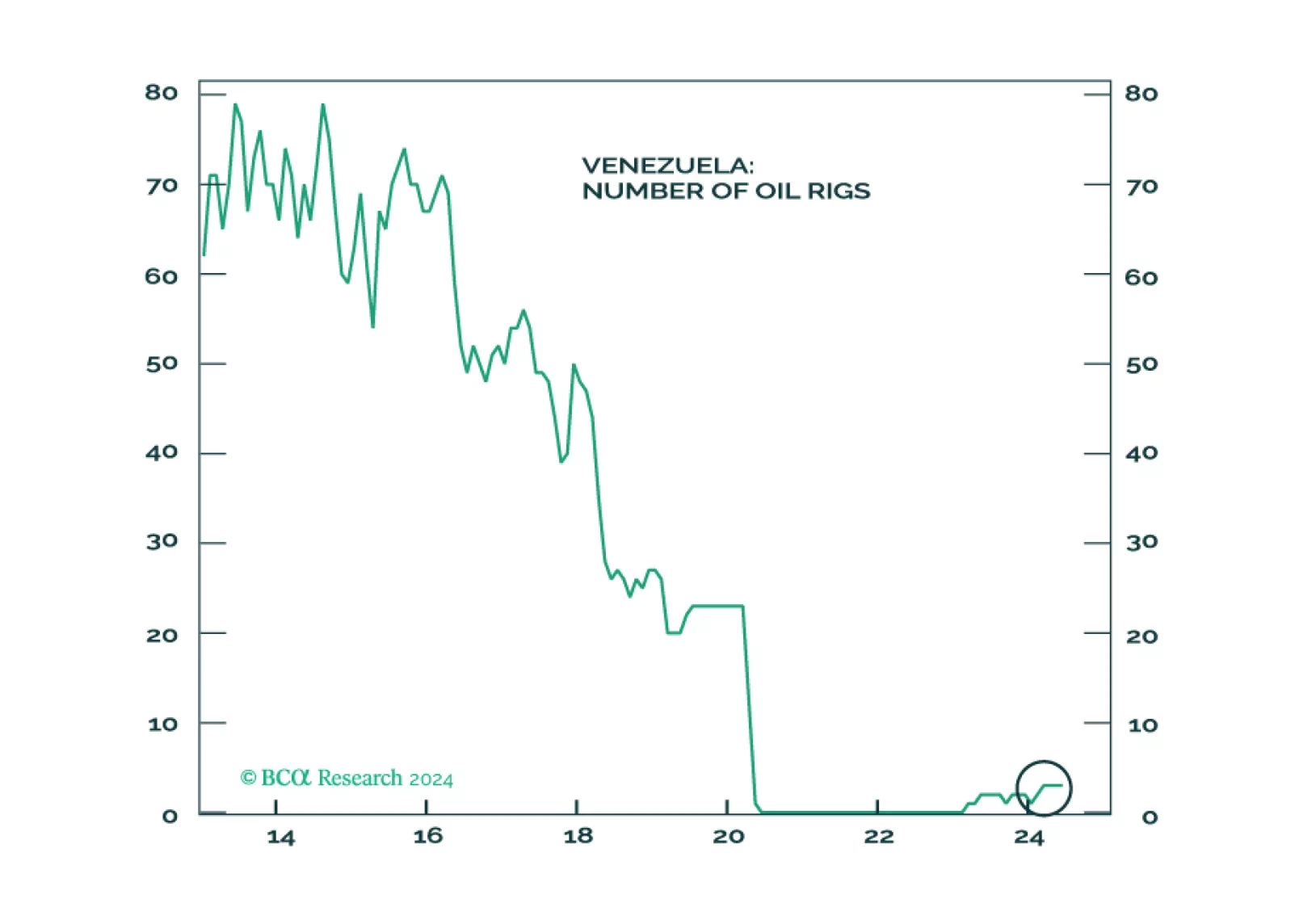

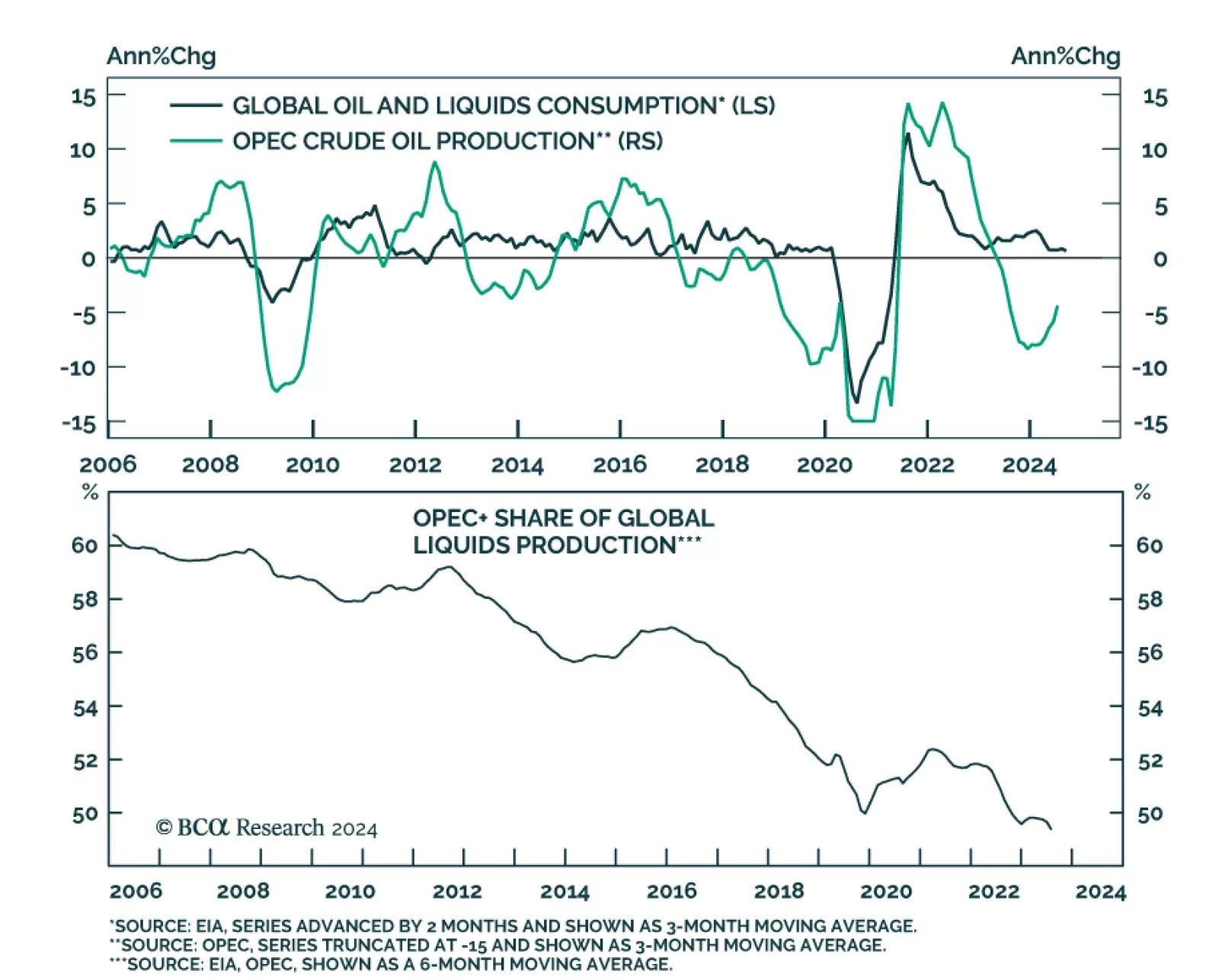

According to BCA Research’s Commodity and Energy Strategy service, soft oil demand growth raises the likelihood that OPEC+ will back down from its plan to begin unwinding some of its production cuts later this year. However…

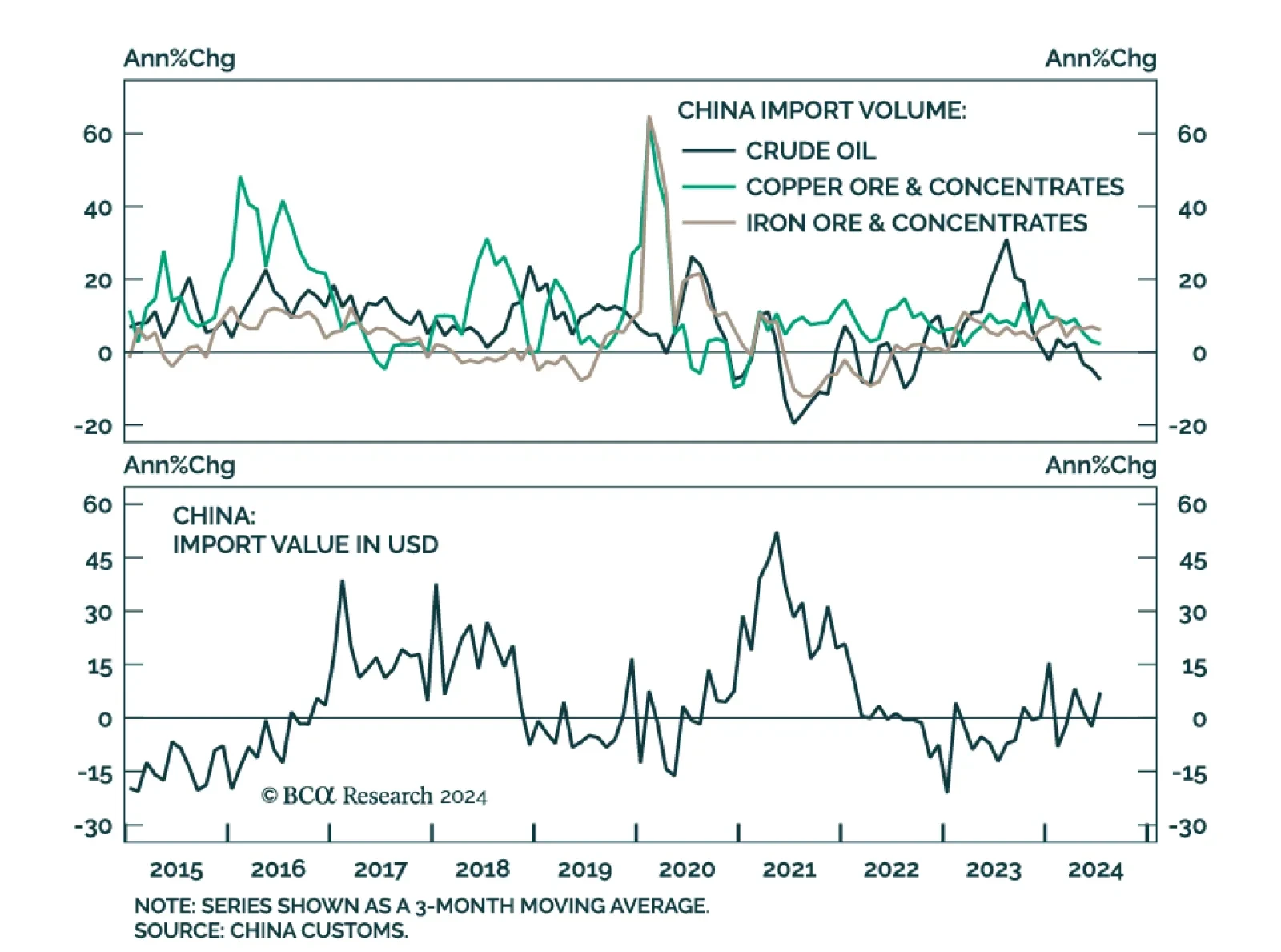

Chinese exports in USD terms missed expectations in July, growing by 7.0% y/y, down from 8.6% in June. Conversely, imports rebounded smartly from a 2.3% contraction, rising by 7.2% in July and upending expectations of 3.2%.…

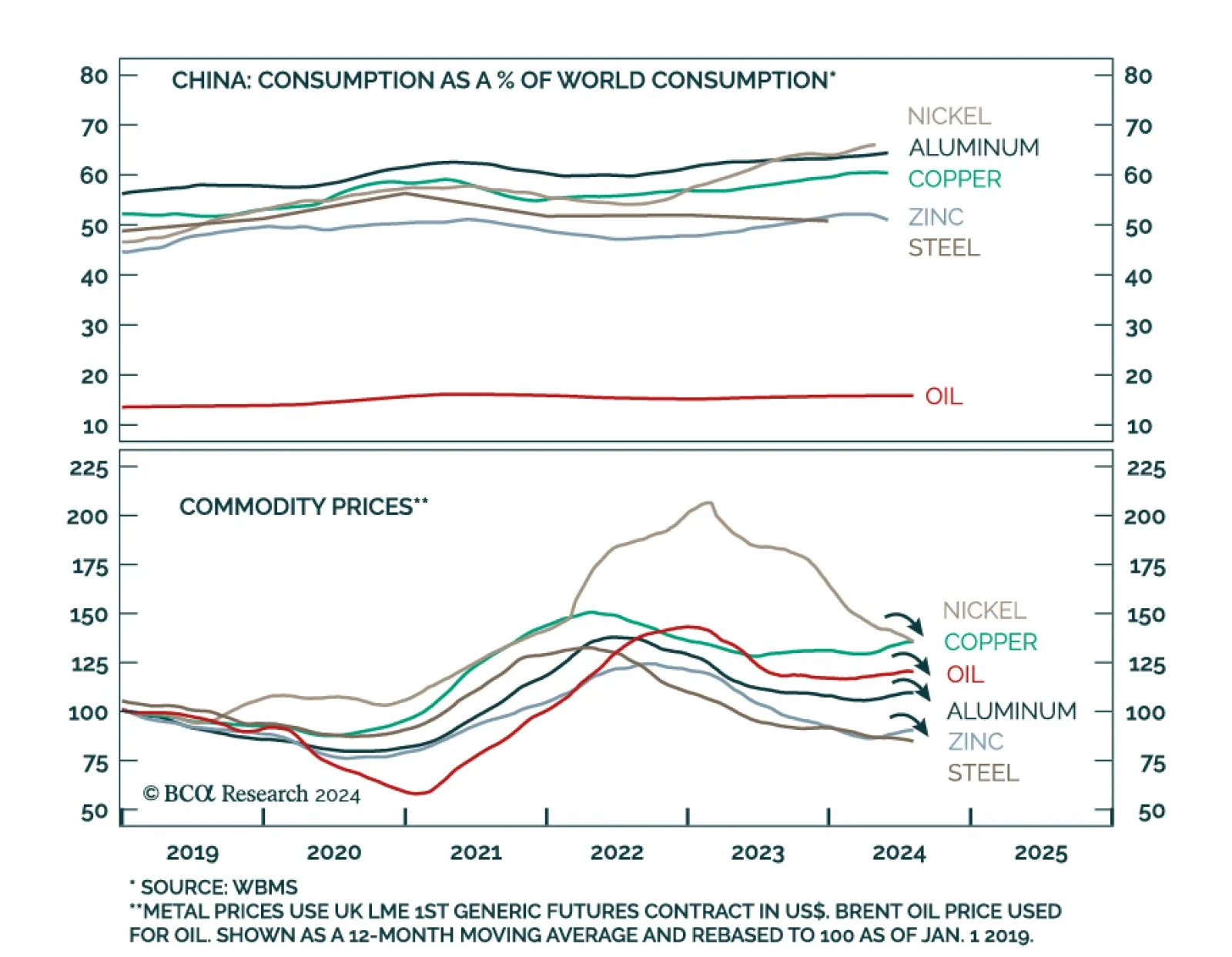

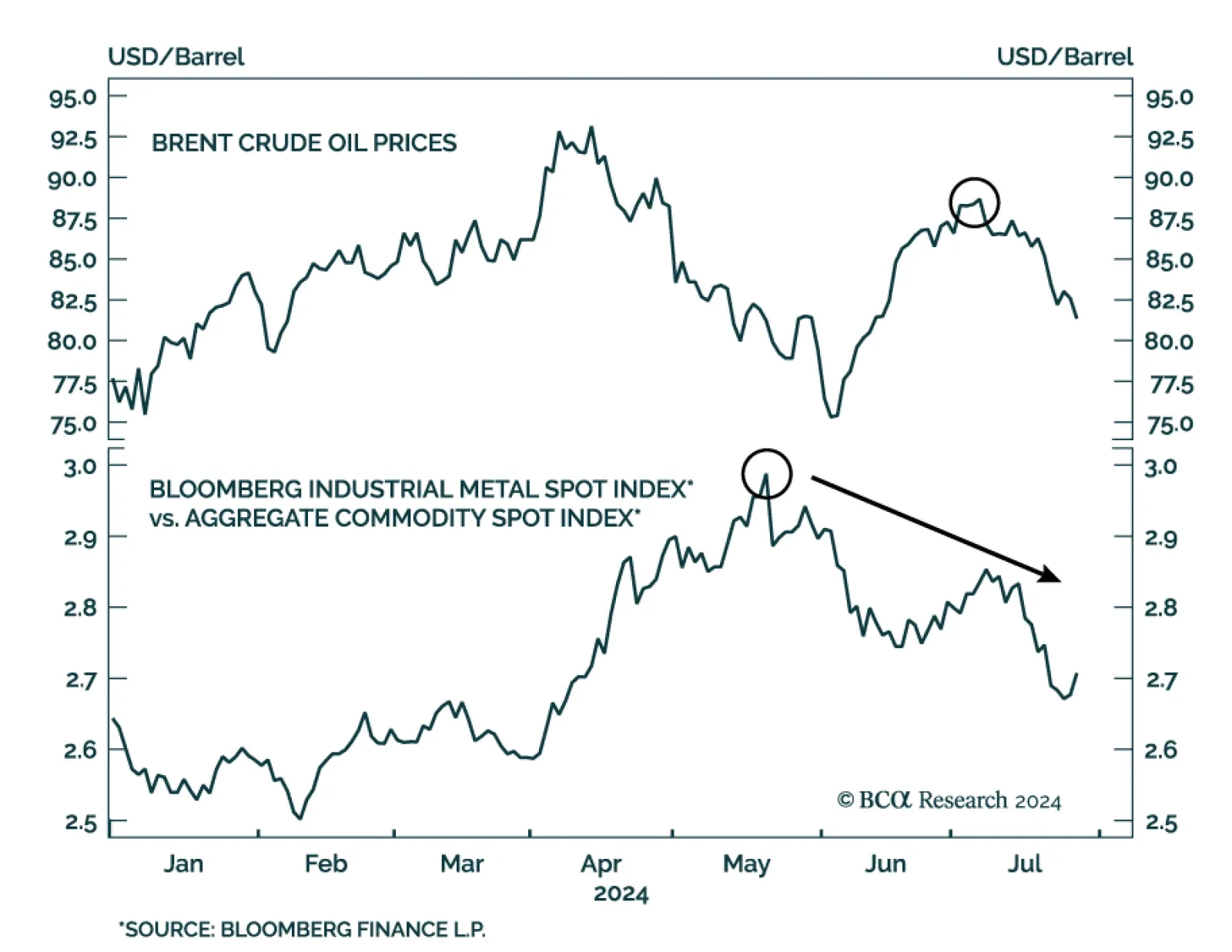

Industrial metals were one of the worst performing asset classes last month. Have prices declined enough to make them an attractive investment? The outlook for industrial commodity prices is bearish over a 12-month horizon…

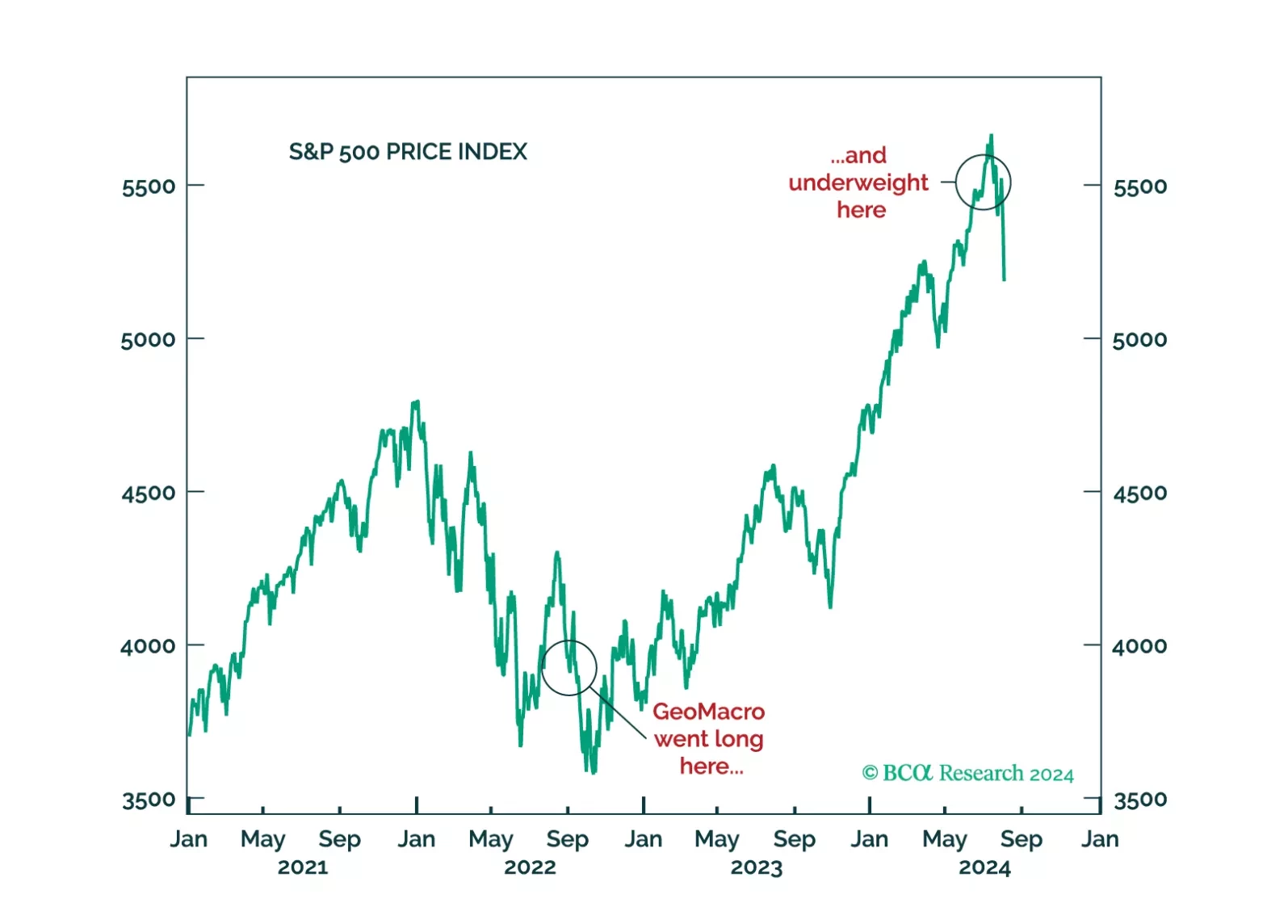

The decision by GeoMacro team on July 2 to short USDJPY and underweight equities has proven to be prescient. We still do not like the market setup from here on out. A recession would, obviously, be negative for risk assets. But even…

The market is pricing in a soft landing, but we see growing signs that the global economy is faltering. Investors should be defensively positioned.

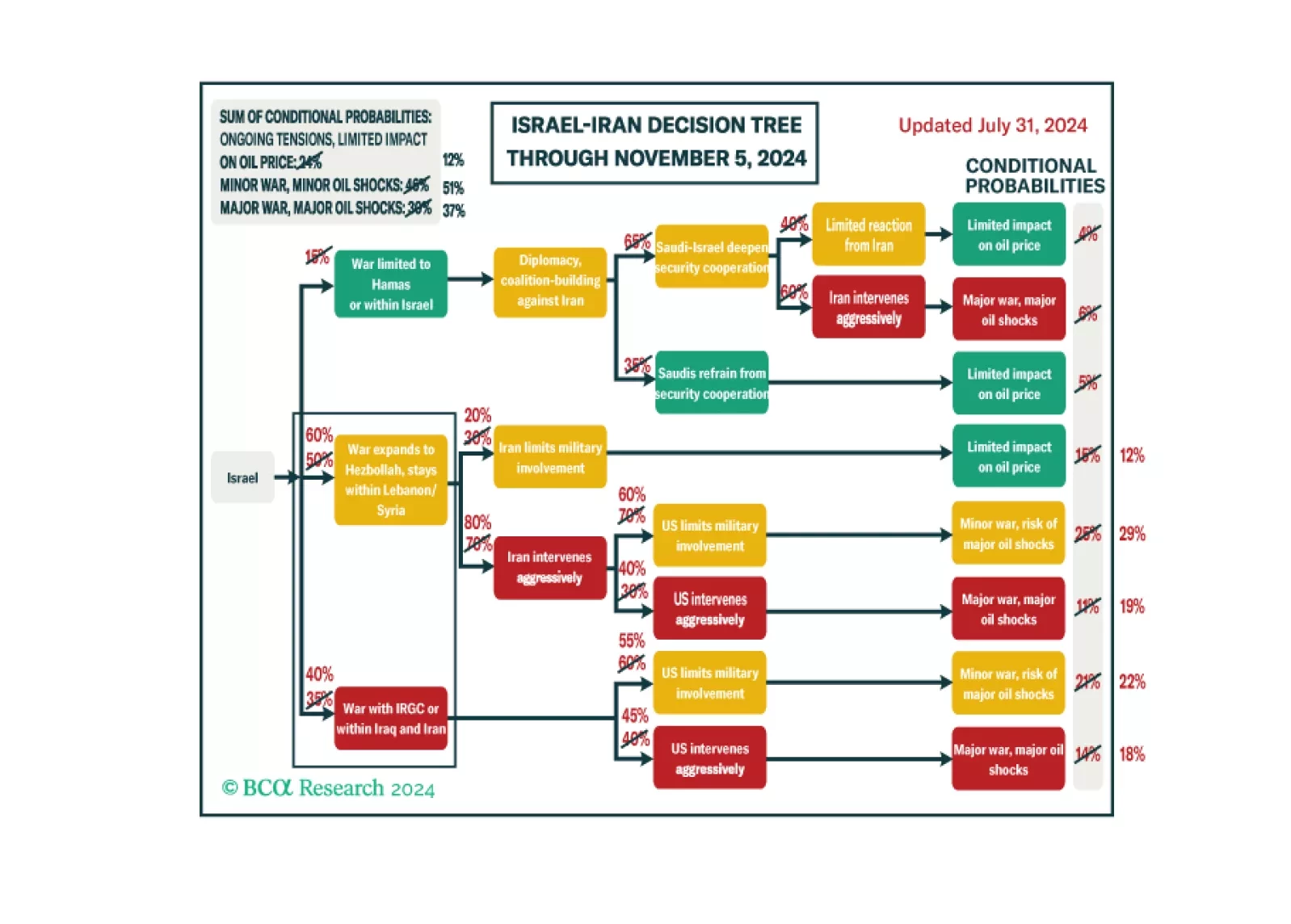

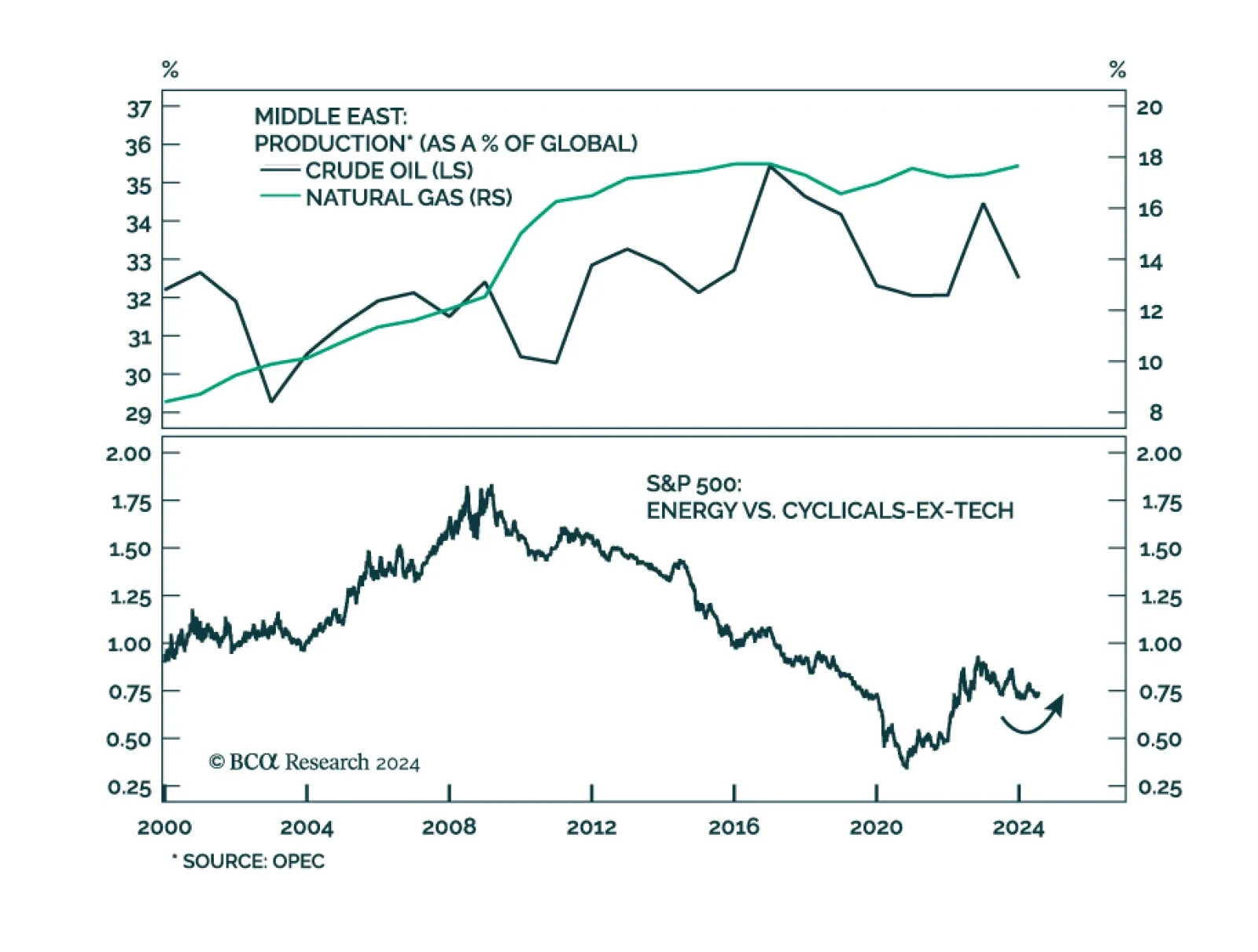

Following the recent escalation in the Middle East conflict, BCA Research’s Geopolitical Strategy service upgrades its subjective odds of a major oil supply shock to 37%. Volatility should spike again as investors…

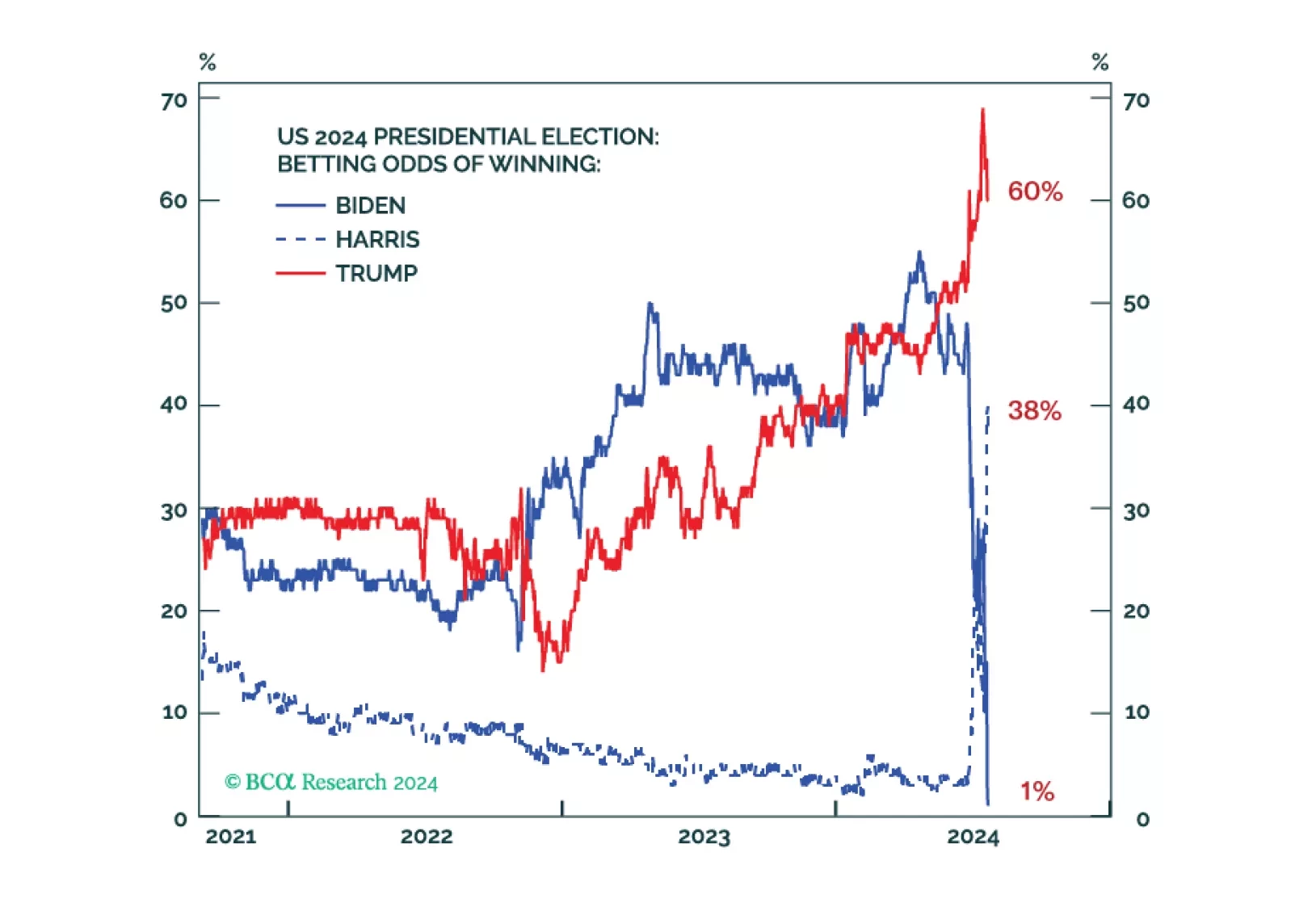

The war in the Middle East is expanding, upgrading our subjective odds of a major oil supply shock to 37% and underscoring our 60% odds of Republican victory in November. Volatility should spike again as investors contemplate the…

Brent prices have fallen 6% so far in July, reversing their June gains. Interestingly, these losses are occurring despite escalating Middle East tensions and quickening Chinese industrial profit growth in June (see The Numbers…

Investors should focus on growth concerns rather than the “Trump trade.” Bond yields will fall in the short run due to cyclically disinflationary economic slowdown, rather than rise in anticipation of a Republican full sweep and…