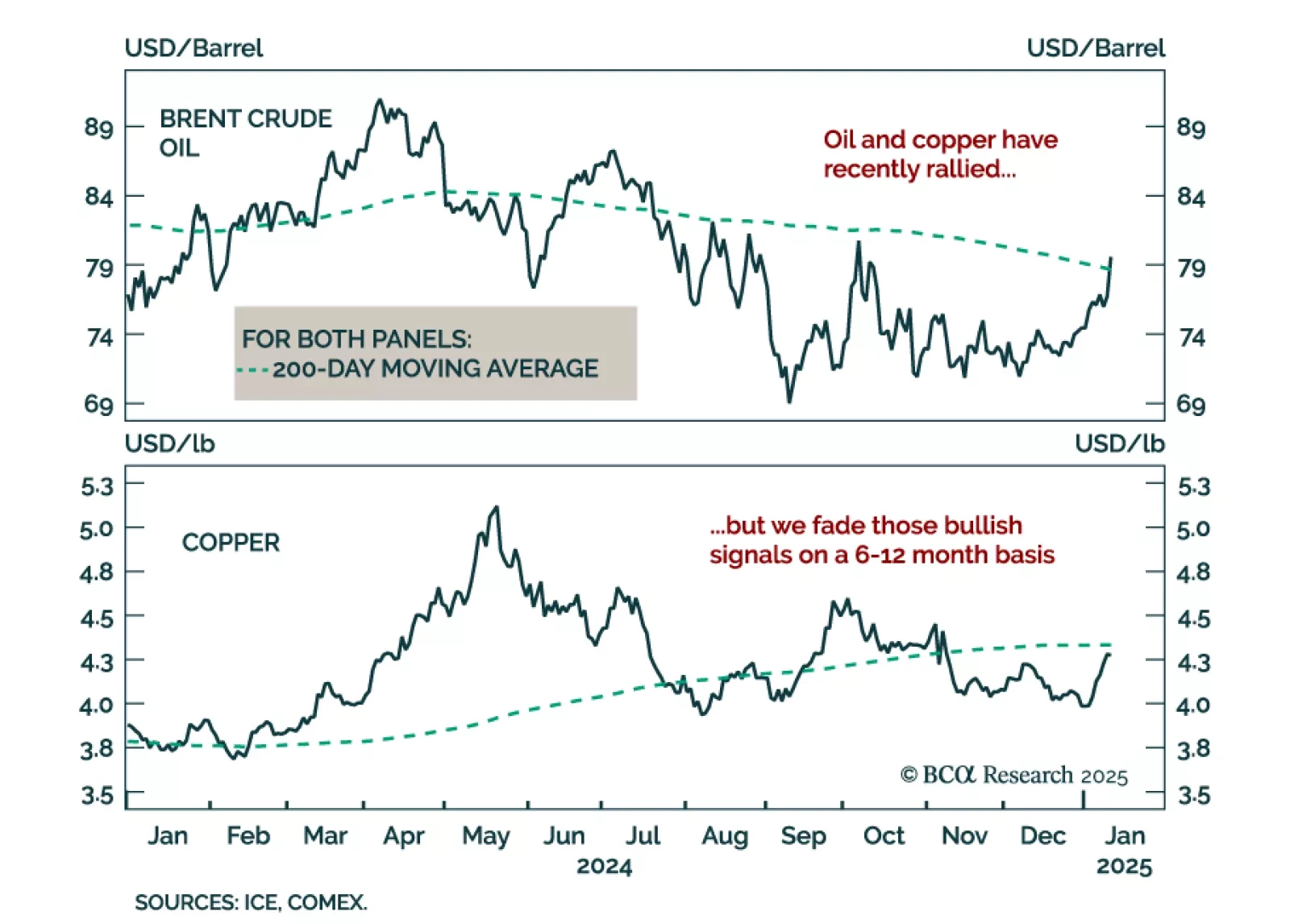

Despite a strong dollar, rising yields, and falling equities, oil and copper prices have recently risen. Oil has broken out above its 200-day moving average, while copper is currently testing its own. Oil’s bullish price…

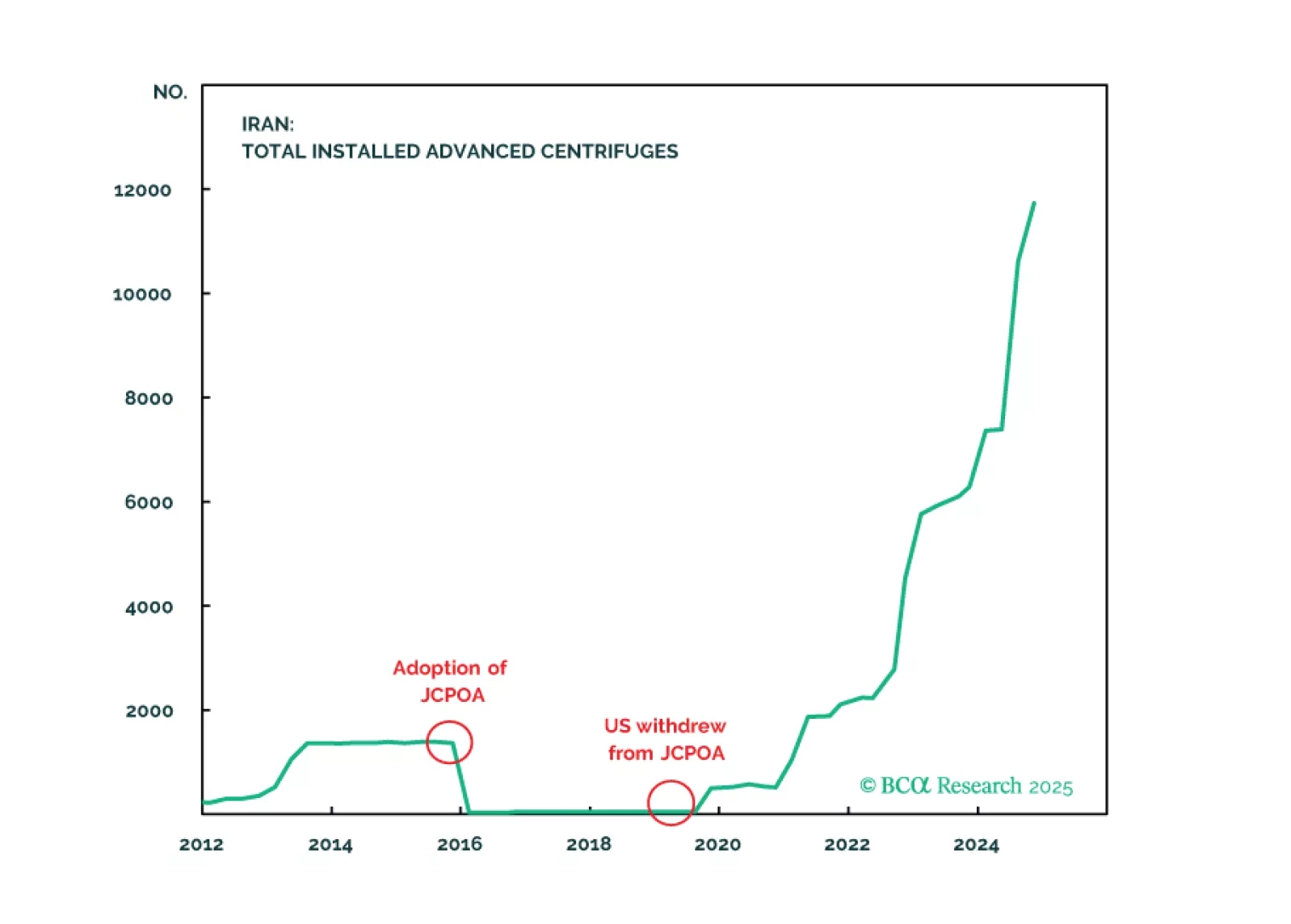

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

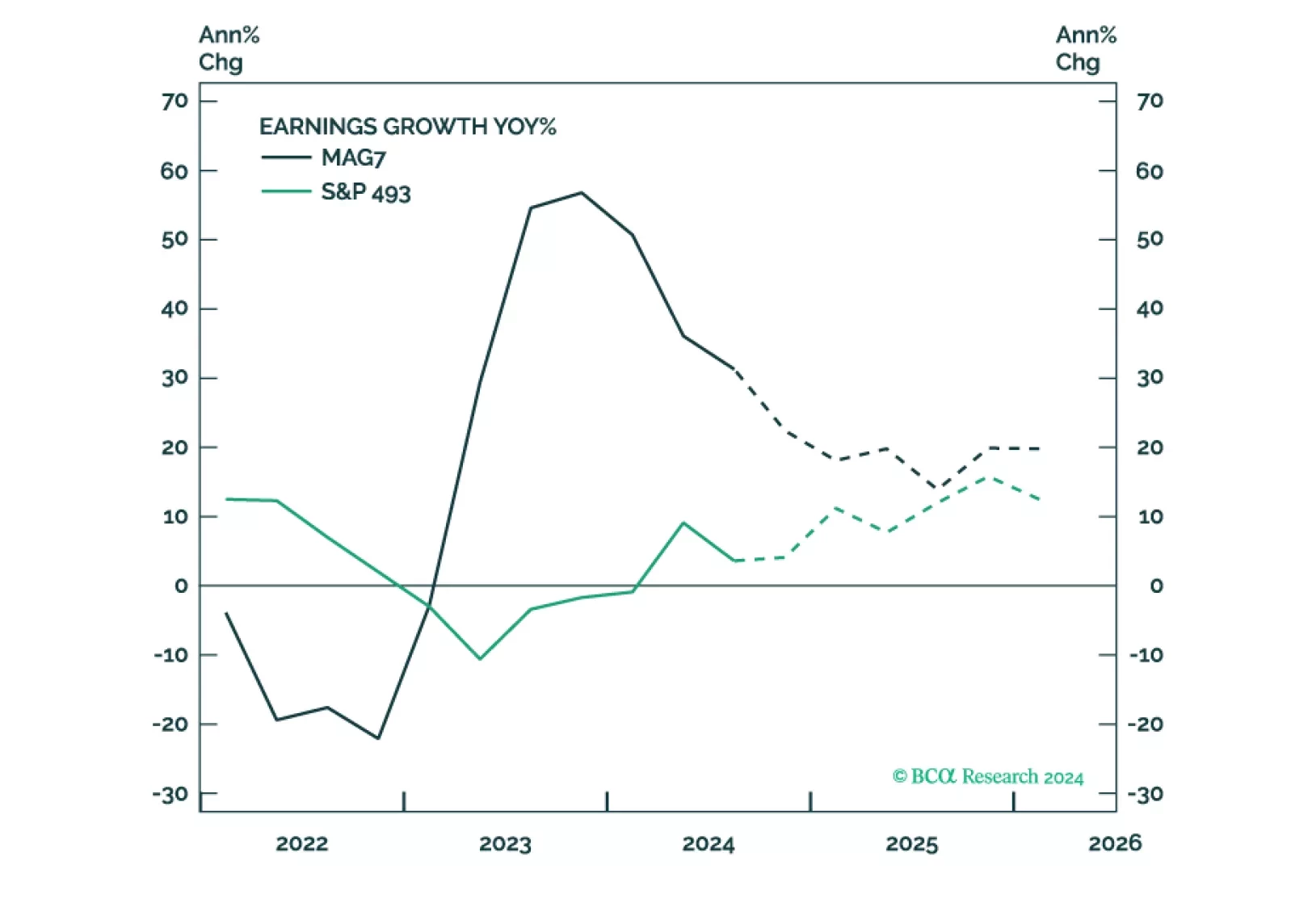

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

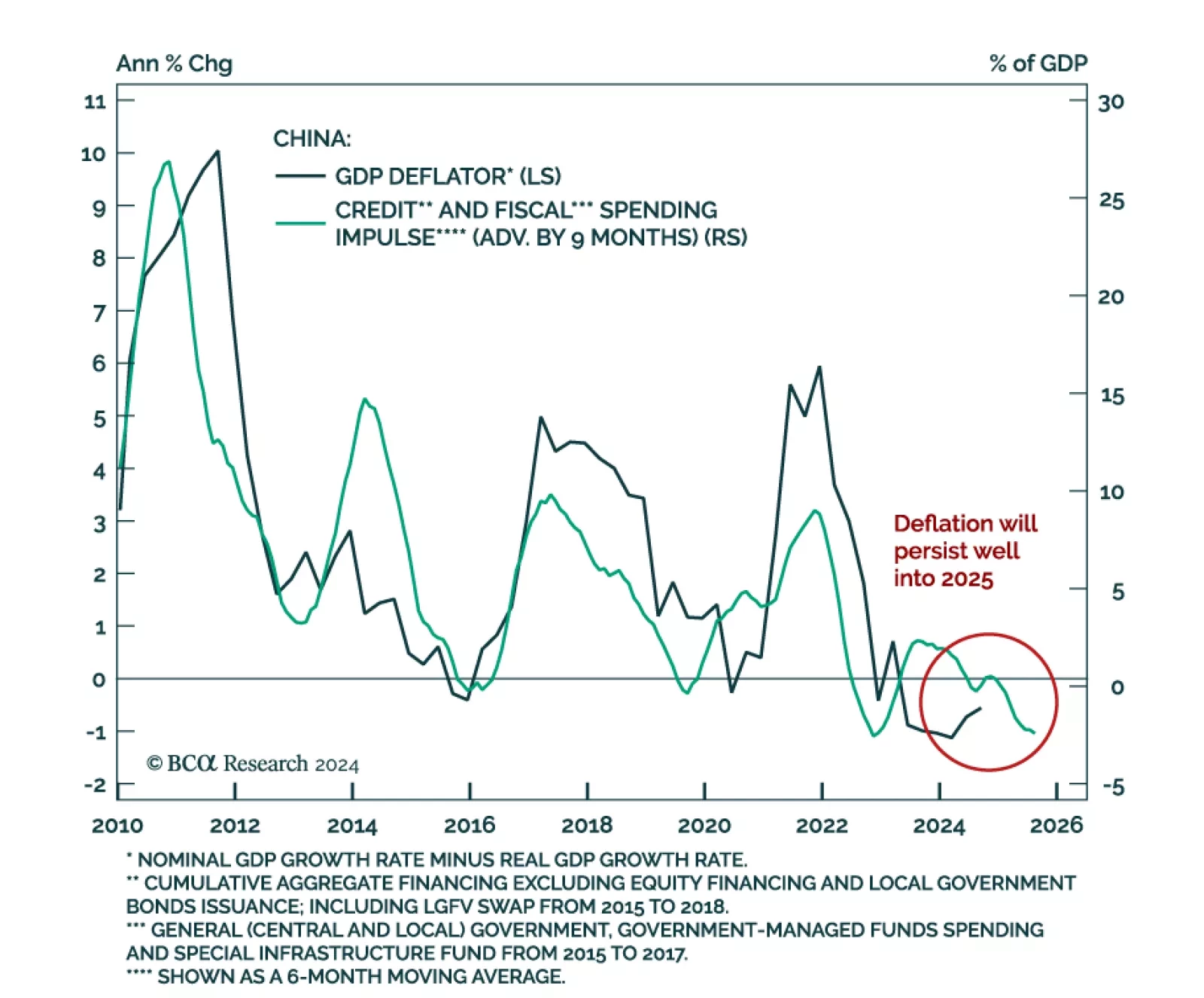

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

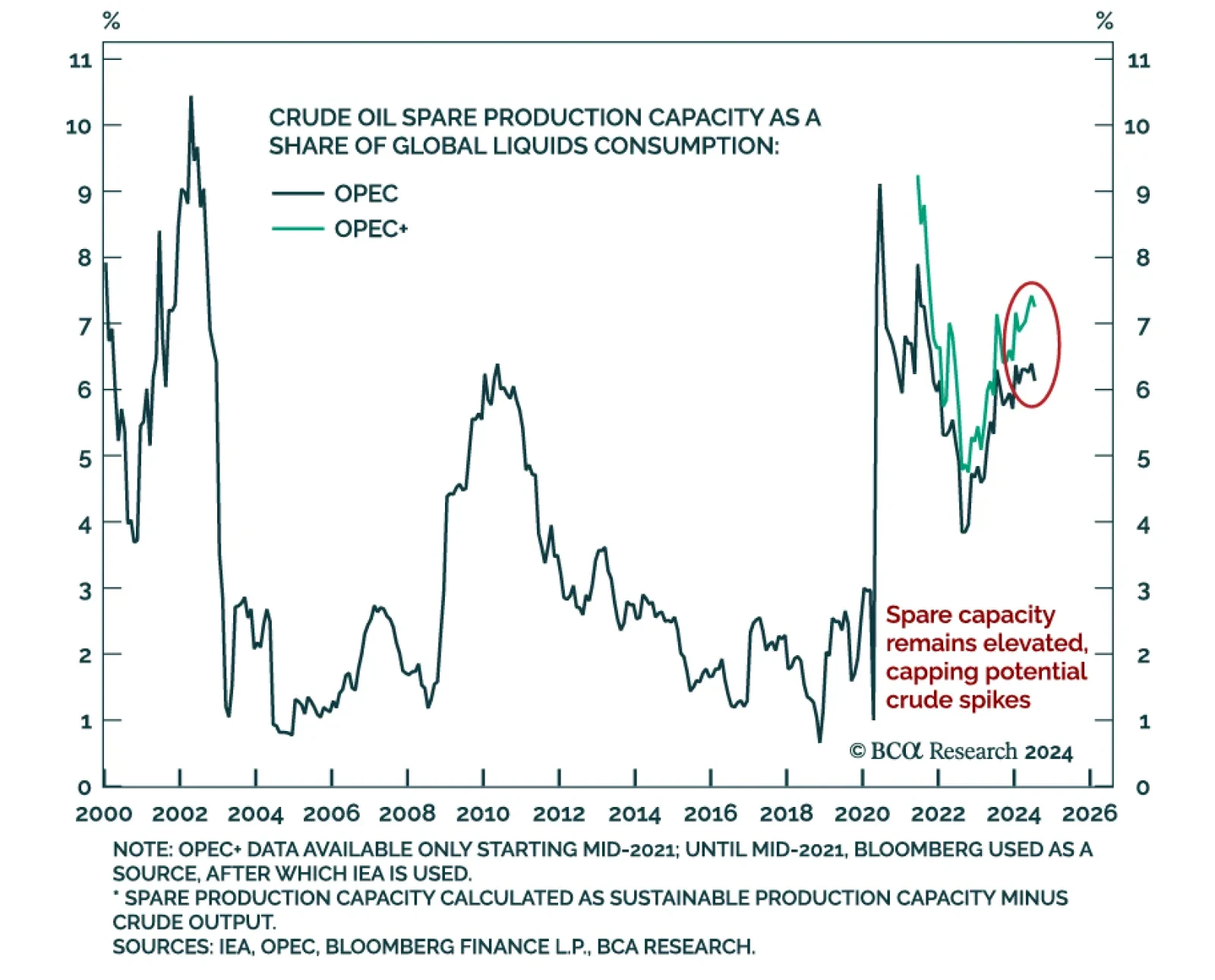

OPEC+ extended its production cuts for the third time, and lengthened the period over which it plans to bring spare capacity back online. Oil prices continue to trade near the bottom of their trading range despite the…

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

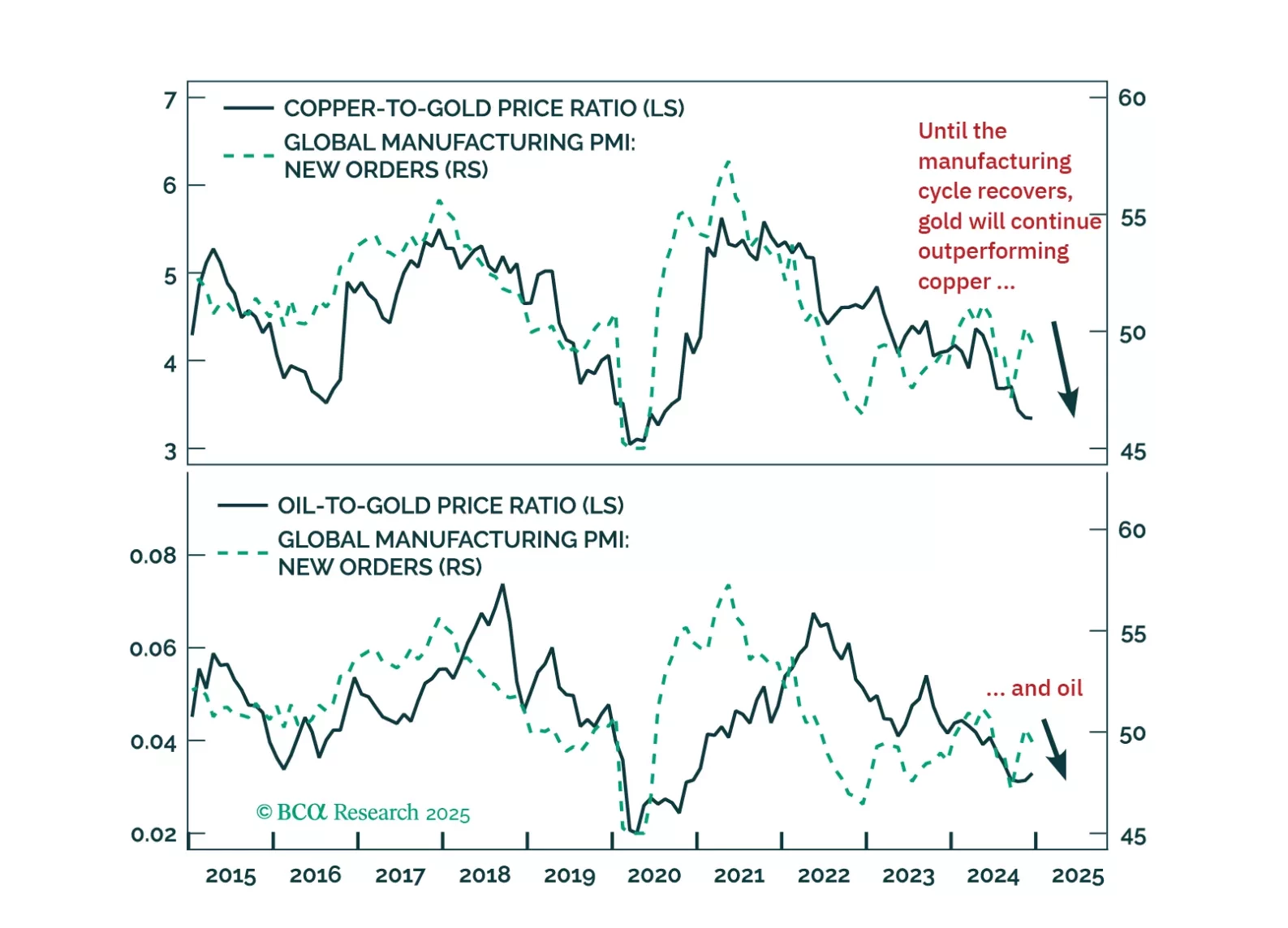

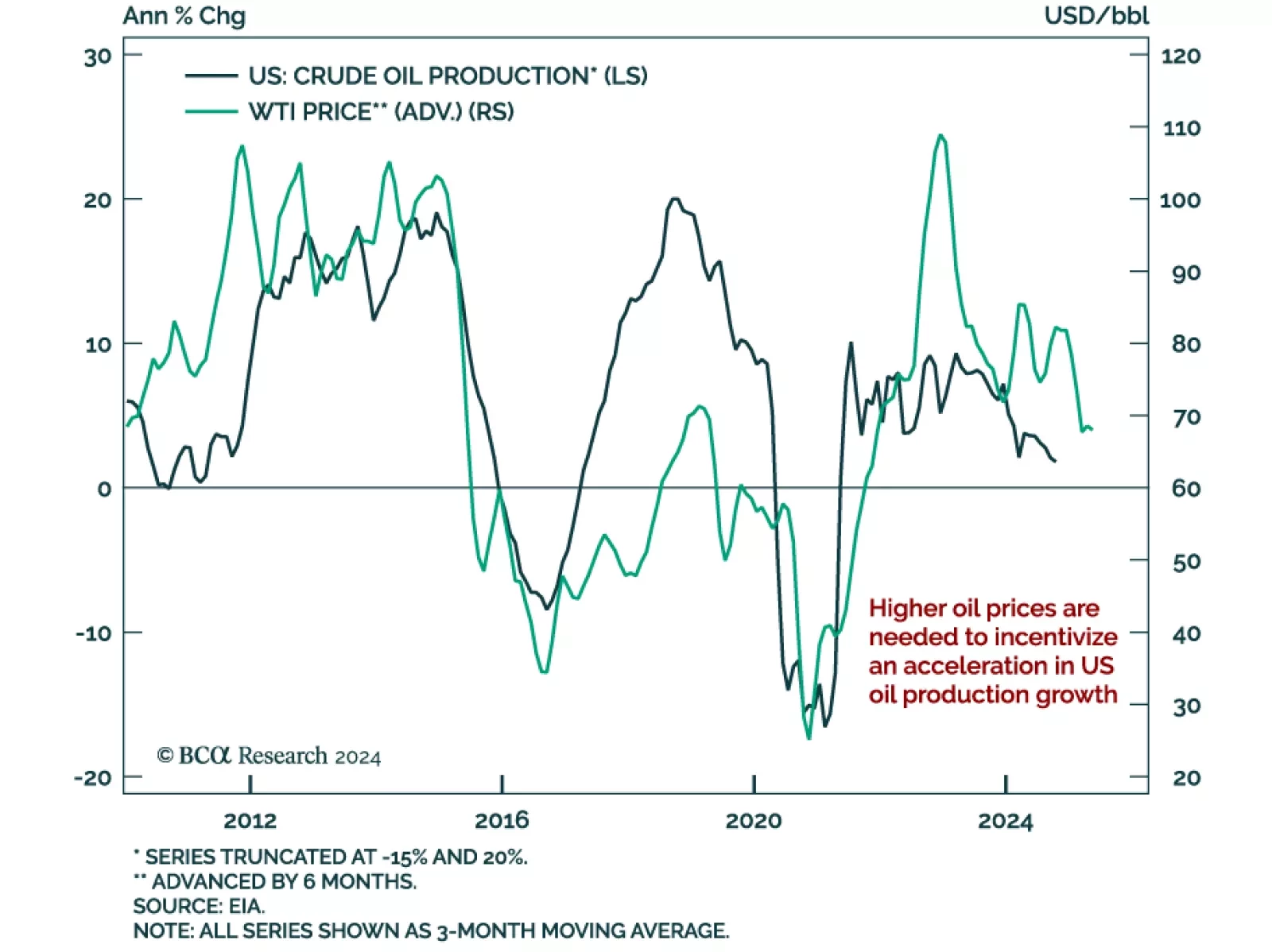

Our Commodity & Energy Strategy team evaluated the impact of president-elect Trump’s policies on commodity markets. Trump’s energy policies, while promoting increased domestic oil production, are unlikely to…