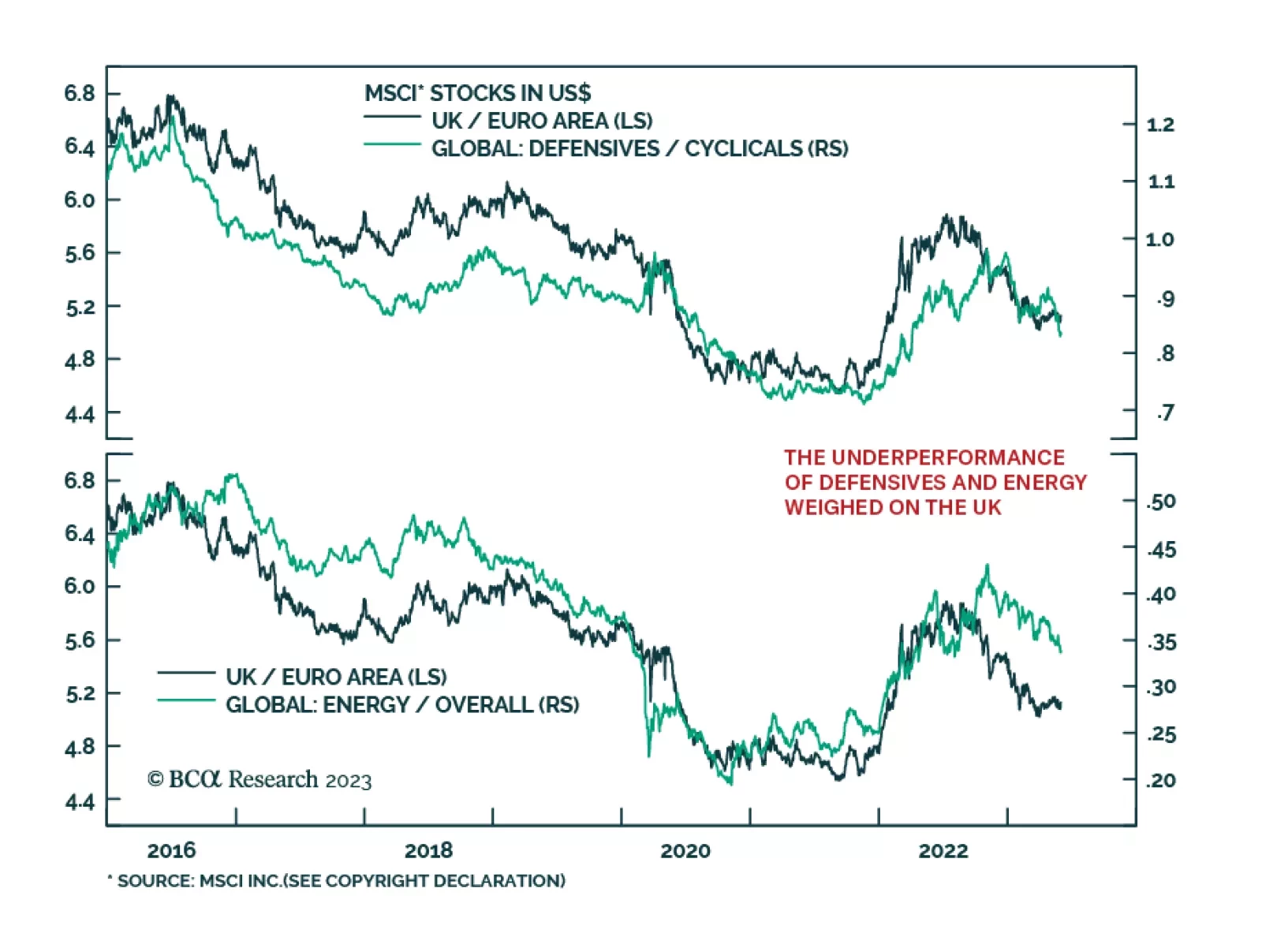

In our May In Review Insight, we showed that last month, UK stocks posted the lowest z-score among all major global equity markets, underperforming their Eurozone peers. What explains this relative weakness? The chart above…

The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

Risk assets would perform well over 12 months only if inflation falls to 2% without triggering a recession. That would be unprecedented. We recommend investors stay defensive.

Expectations for oil demand growth through 2023-24 are way too optimistic. Until these expectations fall to -0.5-1 percent, the oil price has further downside. Plus: collapsed complexity confirms that AI is in a mania, while basic…

We expect the CCP to pivot toward more fiscal stimulus – and less credit stimulus – this year, which will put a bid under energy and metals prices. On the back of this view, at tonight’s close we are getting long 4Q23 Brent futures…

EM oil demand remains resilient and will continue to be propelled by global growth this year. Supply management by OPEC 2.0 and production discipline outside the coalition will be maintained, forcing inventories lower. Recent price…

The crisis hitting regional and local banks in the US is adding to oil-price volatility and gold demand. The crisis arguably is fallout from the Fed’s aggressive monetary policy tightening, and contributes to the upending economic…

Pent-up demand for services is keeping the global economy going, but we still expect recession over the next 12 months. Investors should keep a cautious portfolio stance.

EUR/USD is trying to breach above 1.10. What is the balance of positive versus negative factors that would allow the euro to breakout?

Fertilizer prices will continue to move lower as the natgas price shock touched off by the Russian invasion of Ukraine dissipates. As a result, we expect grain prices to soften another 10% this year. Food-price inflation will move…