Despite our bearish predisposition towards stocks, we are open-minded to anything that could challenge our thesis. As such, in this report, we review five upside scenarios for equities.

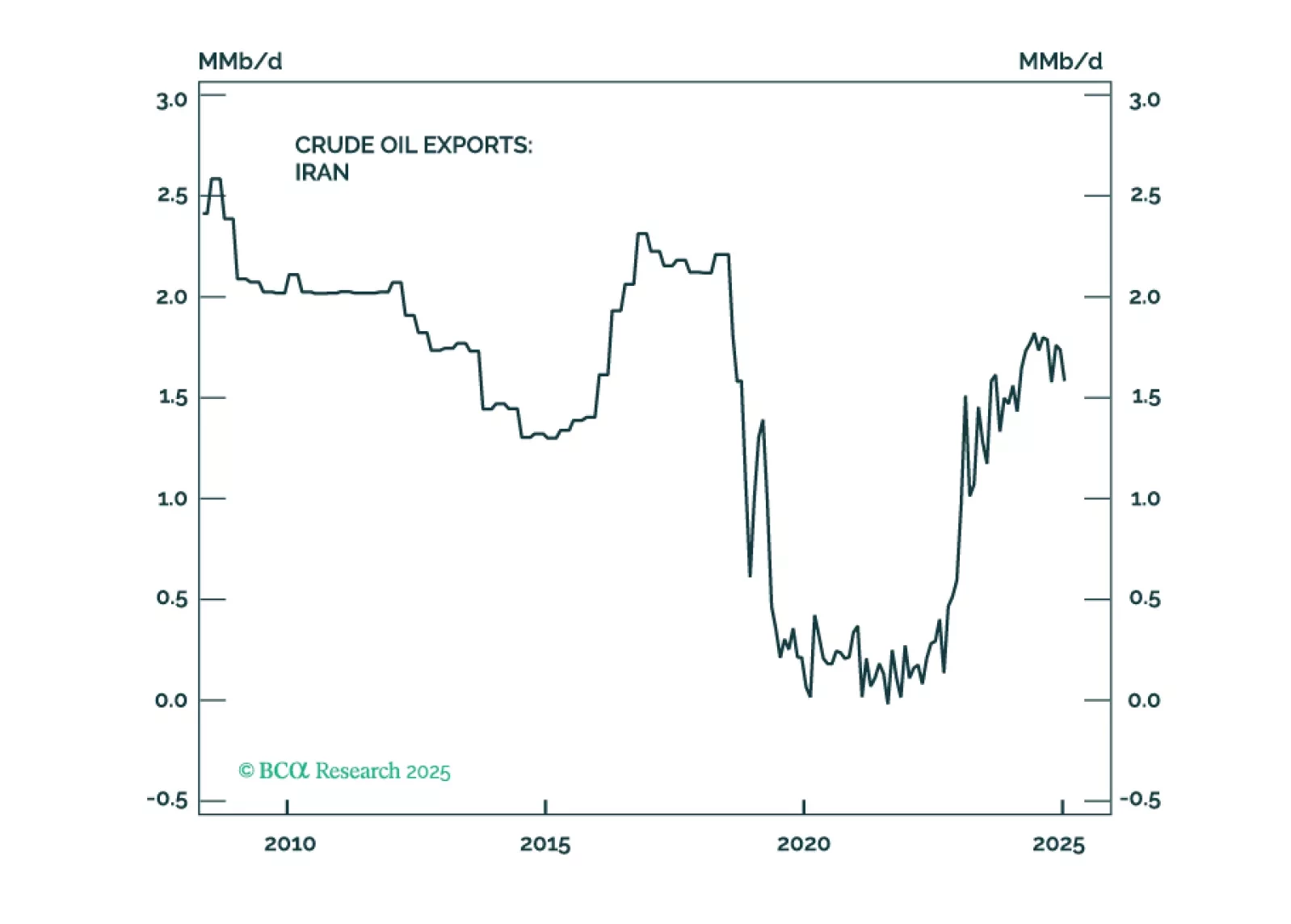

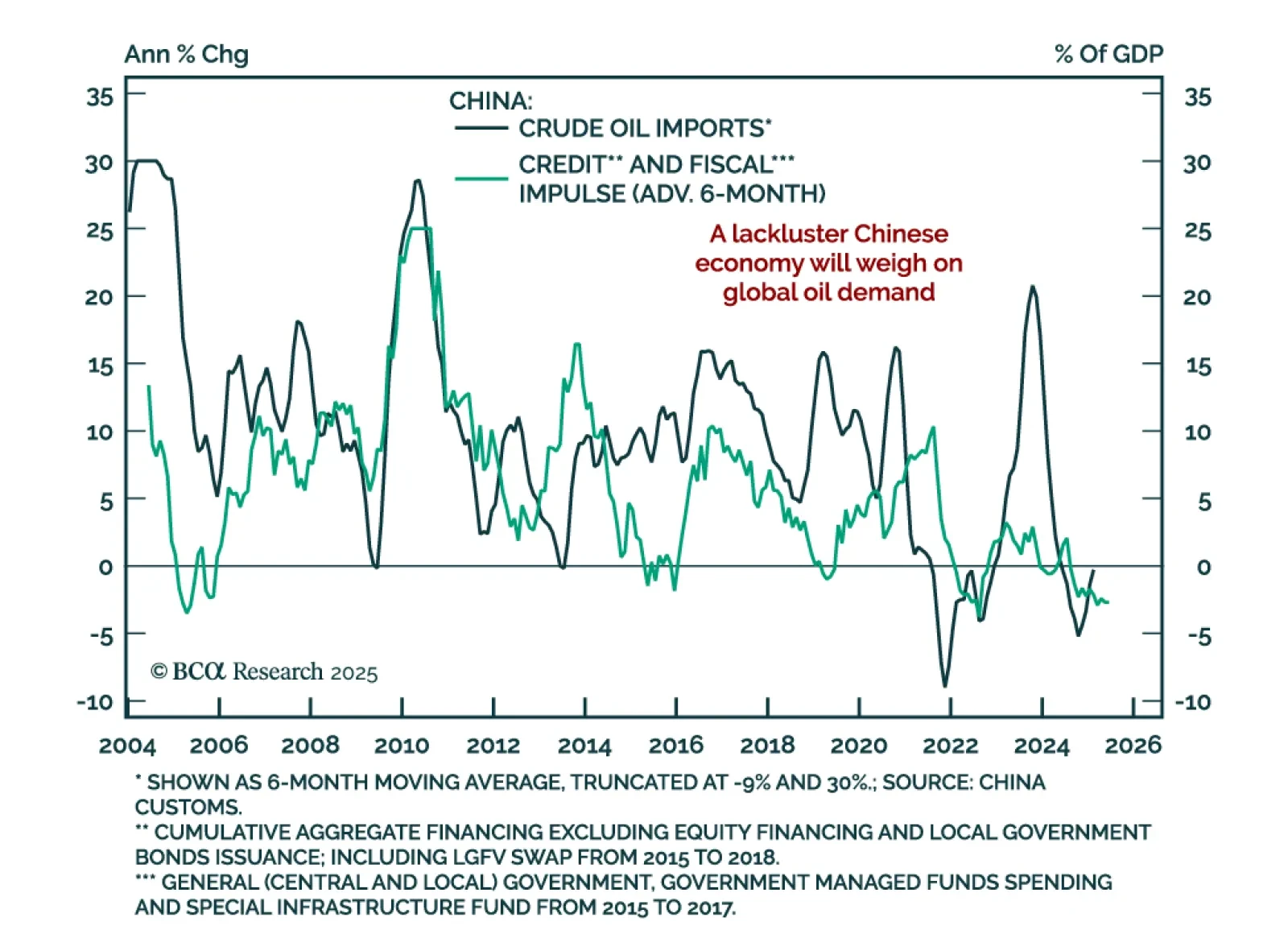

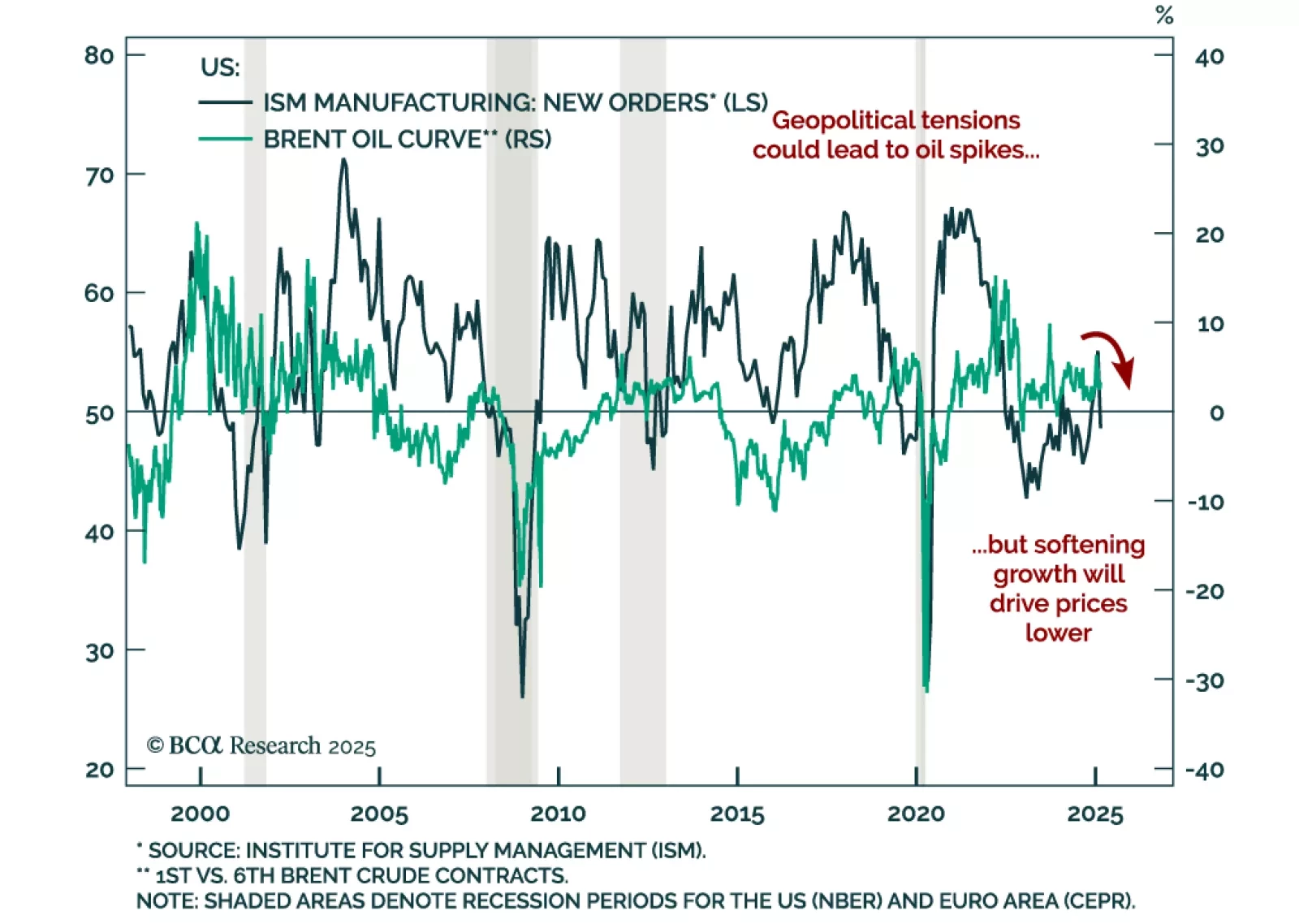

Our Commodities strategists assessed the outlook for oil as crude remains pulled between geopolitical and fundamentals forces. OPEC+’s decision to raise oil supply is driven more by geopolitics than economics. A sustained…

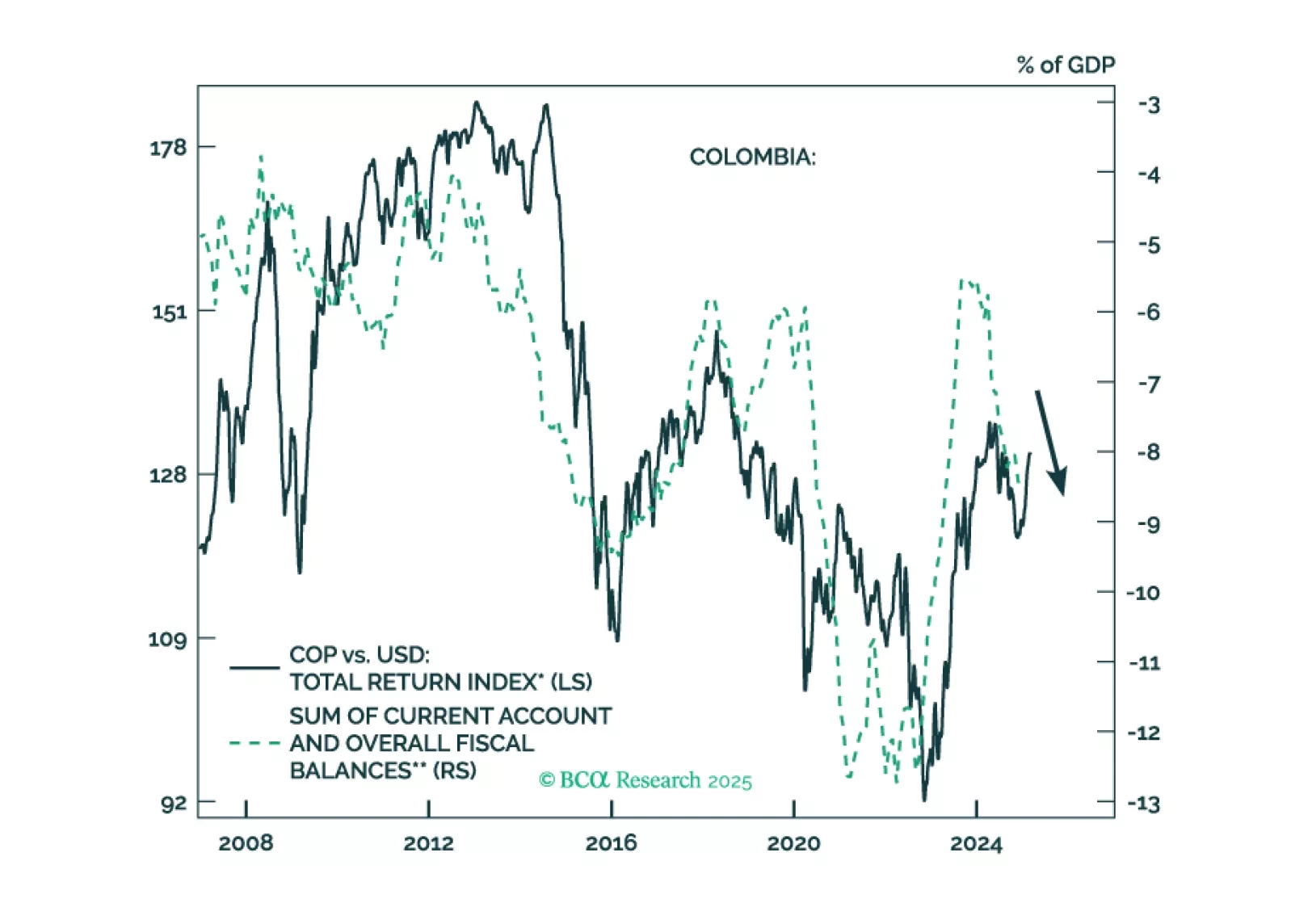

Colombian financial markets have rallied on the expectation that a right-wing government will be elected in 2026. We take a contrarian bearish stance on the nation's financial markets. Colombia is suffering from two…

After range-bound trading late last year, oil prices began the year rising to resistance levels, before falling and testing support on the downside. Oil remains caught between conflicting supply and demand risks. Increased…

Interest rates will decline if the disinflationary trend continues, deficits are reduced, or economic growth falters. Oil prices are likely to spike over the short term, but the long-term outlook is unfavorable. Not all GenAI…

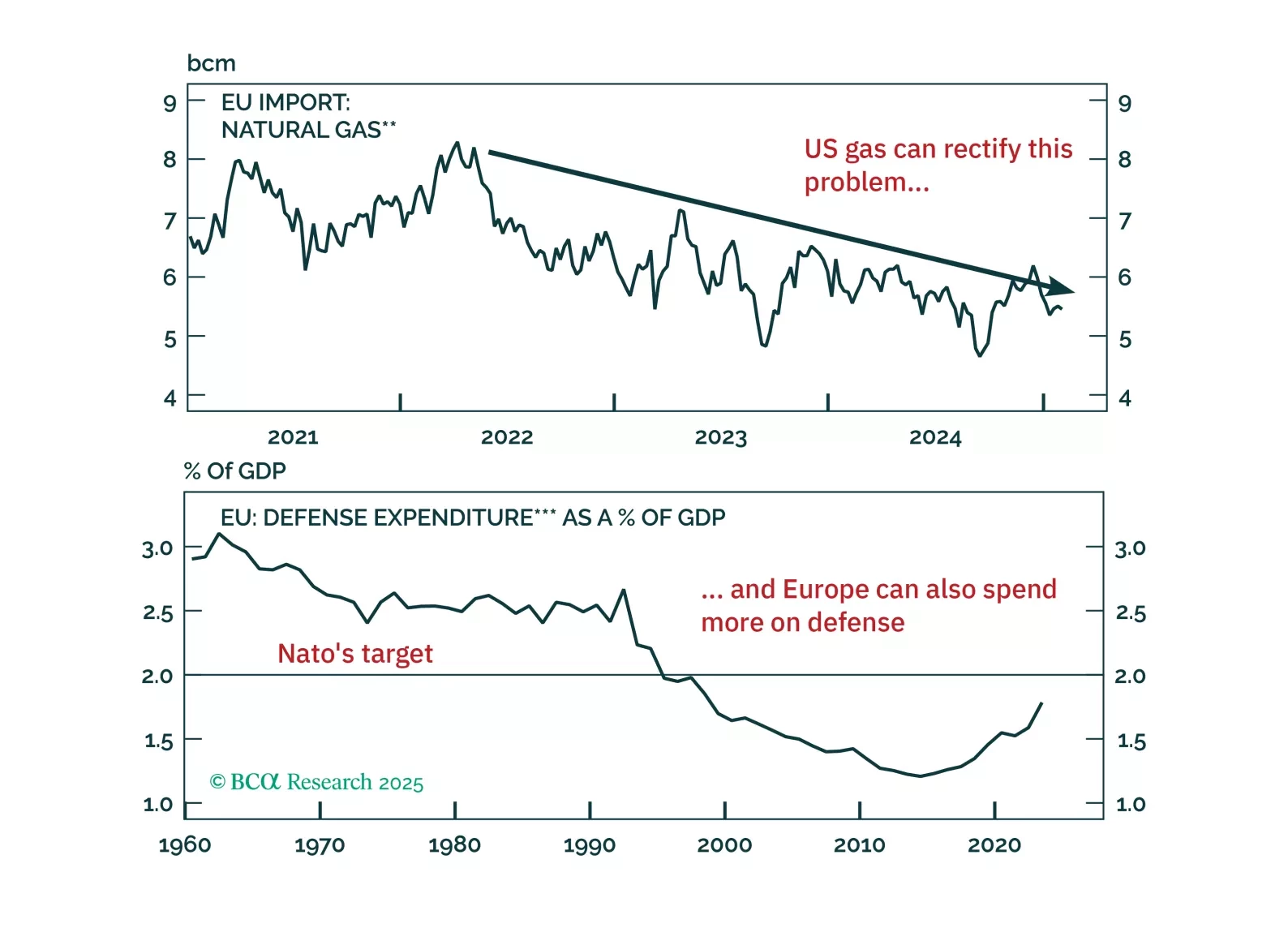

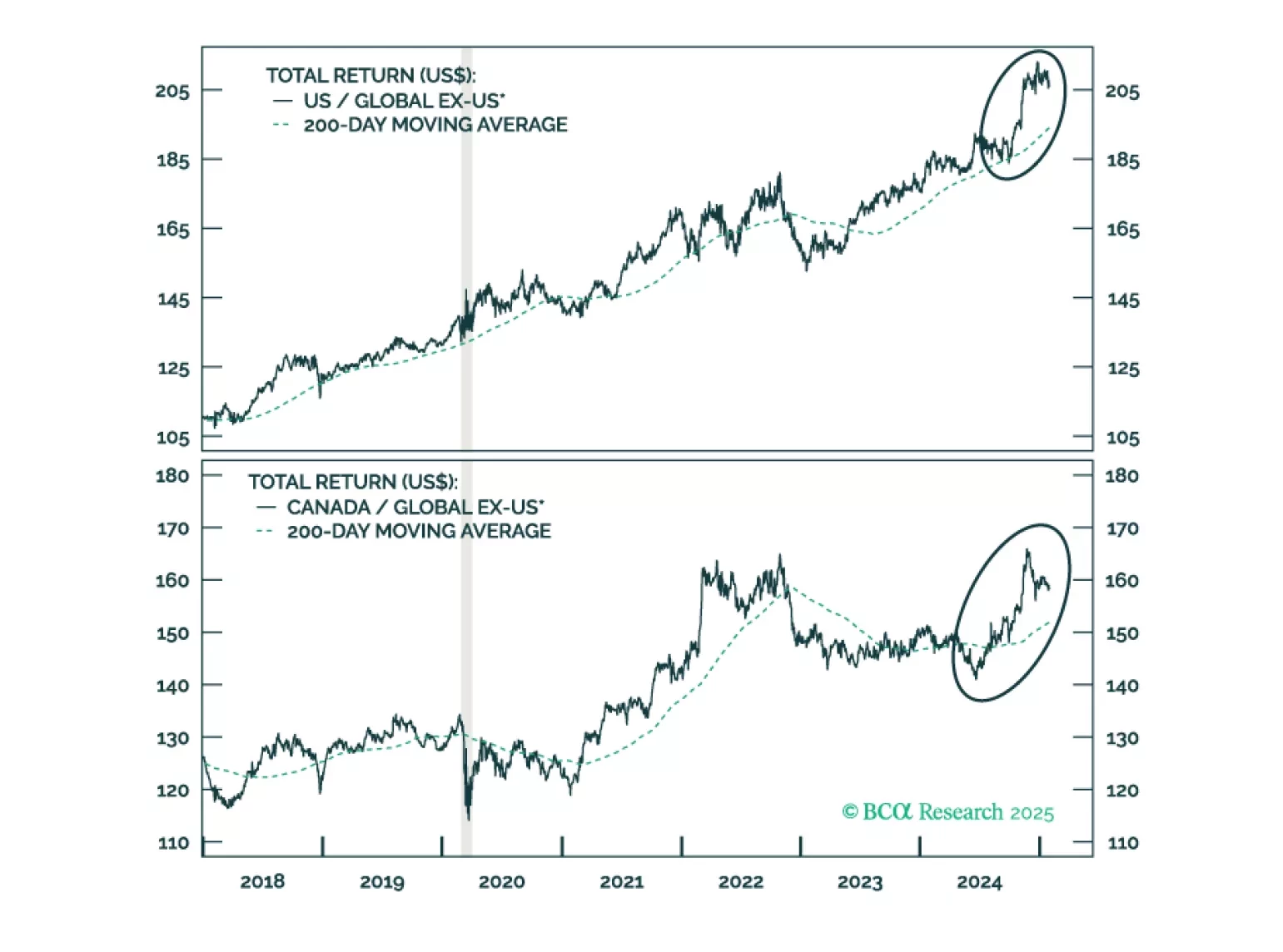

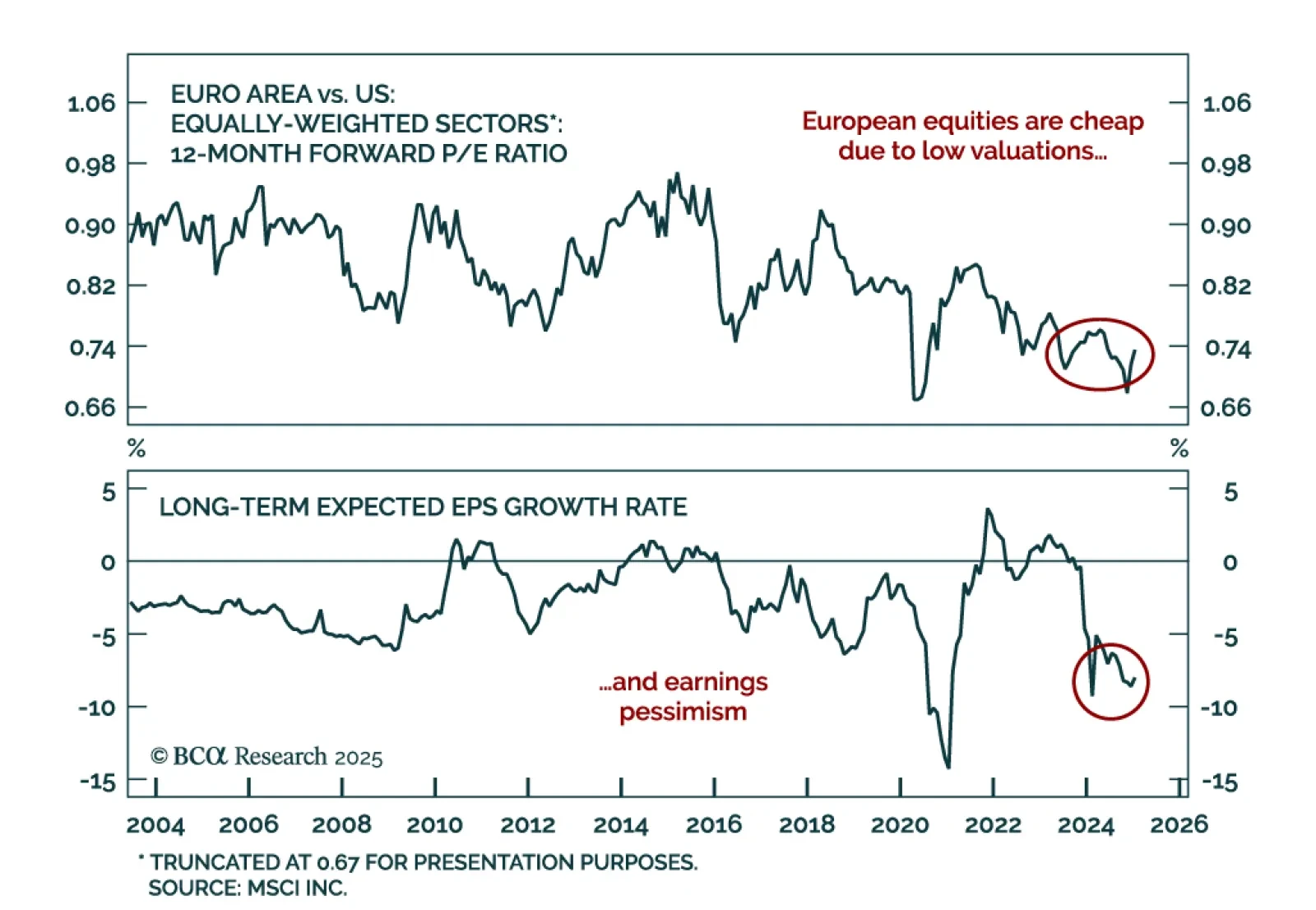

Our European strategists look at European equities after they garnered attention due to their low valuations. European equities are attracting interest primarily due to low valuations rather than strong growth expectations. Key…

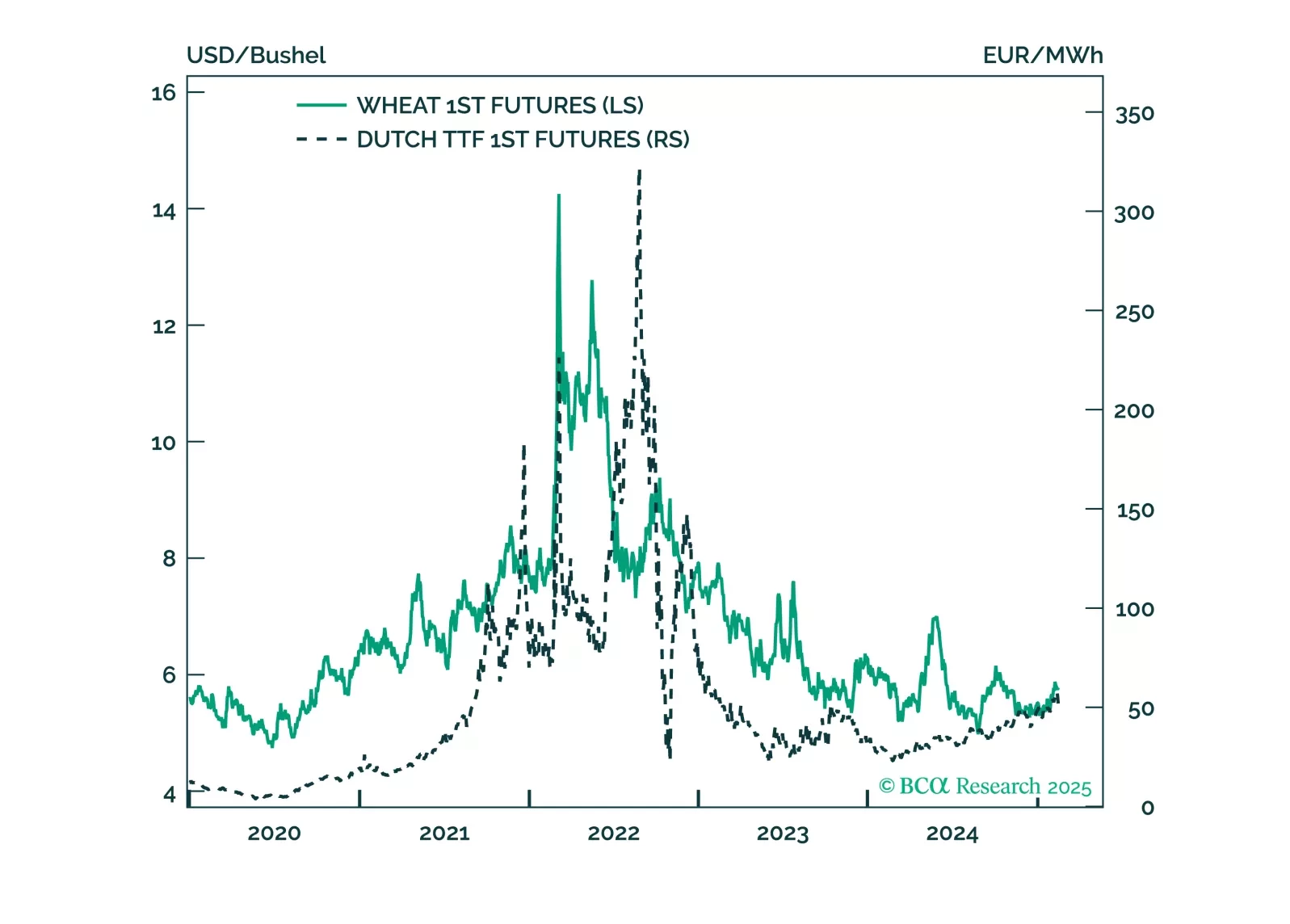

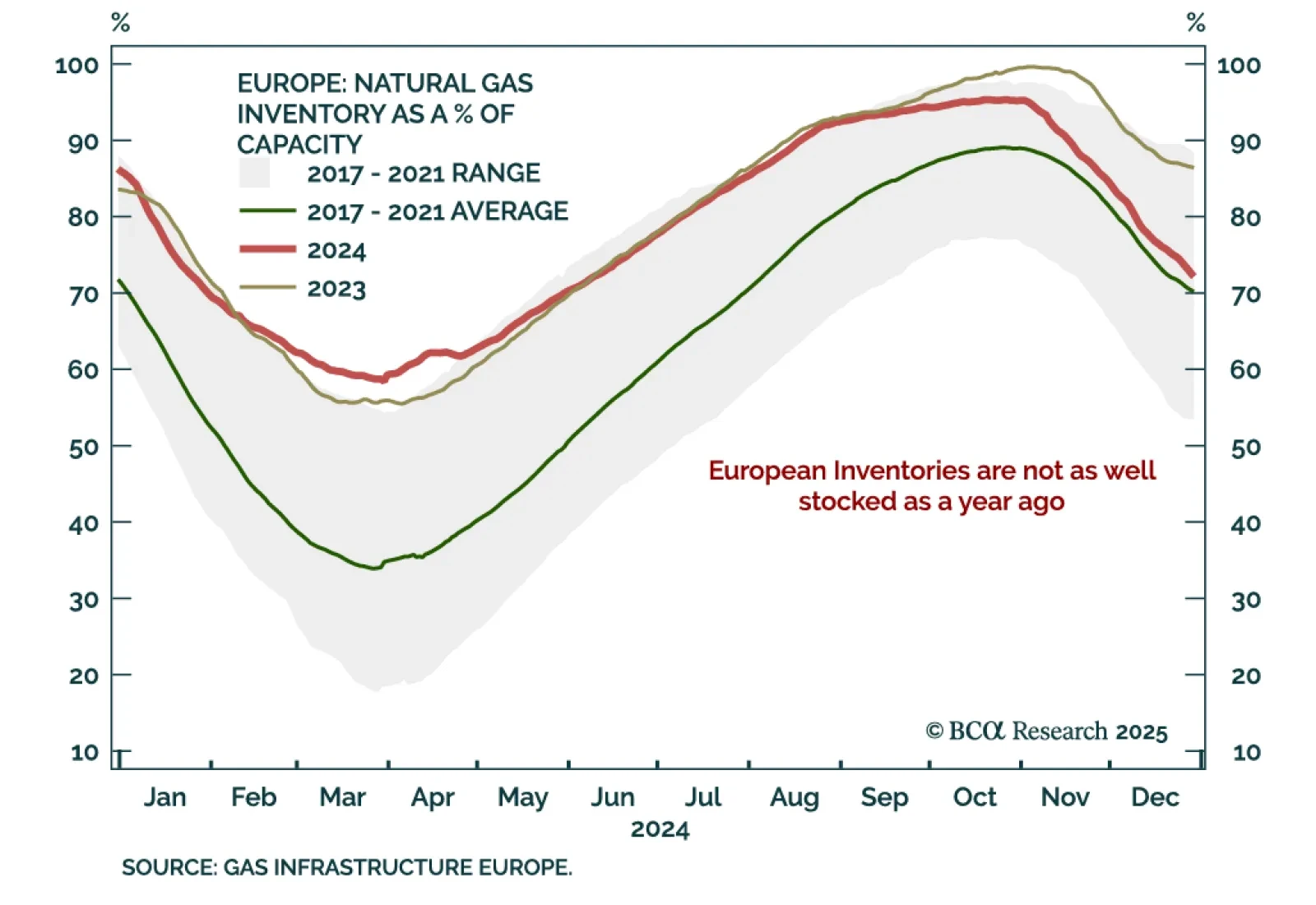

President Trump is negotiating a ceasefire in Ukraine. This will be a marginal headwind to some commodities which benefitted from the conflict like natural gas and wheat, and will be a marginal tailwind for European assets,…

As a push for Russia-Ukraine peace talks emerges, energy prices are easing. Reduced geopolitical risk and the potential lifting of sanctions on Russia would be a headwind for oil and European natural gas prices. Should investors bet…

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…