Volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. The risk of a major oil supply shock has gone up, but meanwhile supply constraints will remain at…

Oil prices are having a tough start to Q4. The price of brent has collapsed by 13% over the past week, with the bulk of the selloff occurring on Wednesday and continuing into Thursday. Brent now stands below $85/bbl. There are…

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for oil prices, Fed policy, and the global economy. On the outlook for crude oil, a larger share of respondents…

The “September Effect” was in full force again this year as the broad-based selloff continued. Nearly all major financial assets generated outsized returns last month. In particular, the “higher for longer…

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

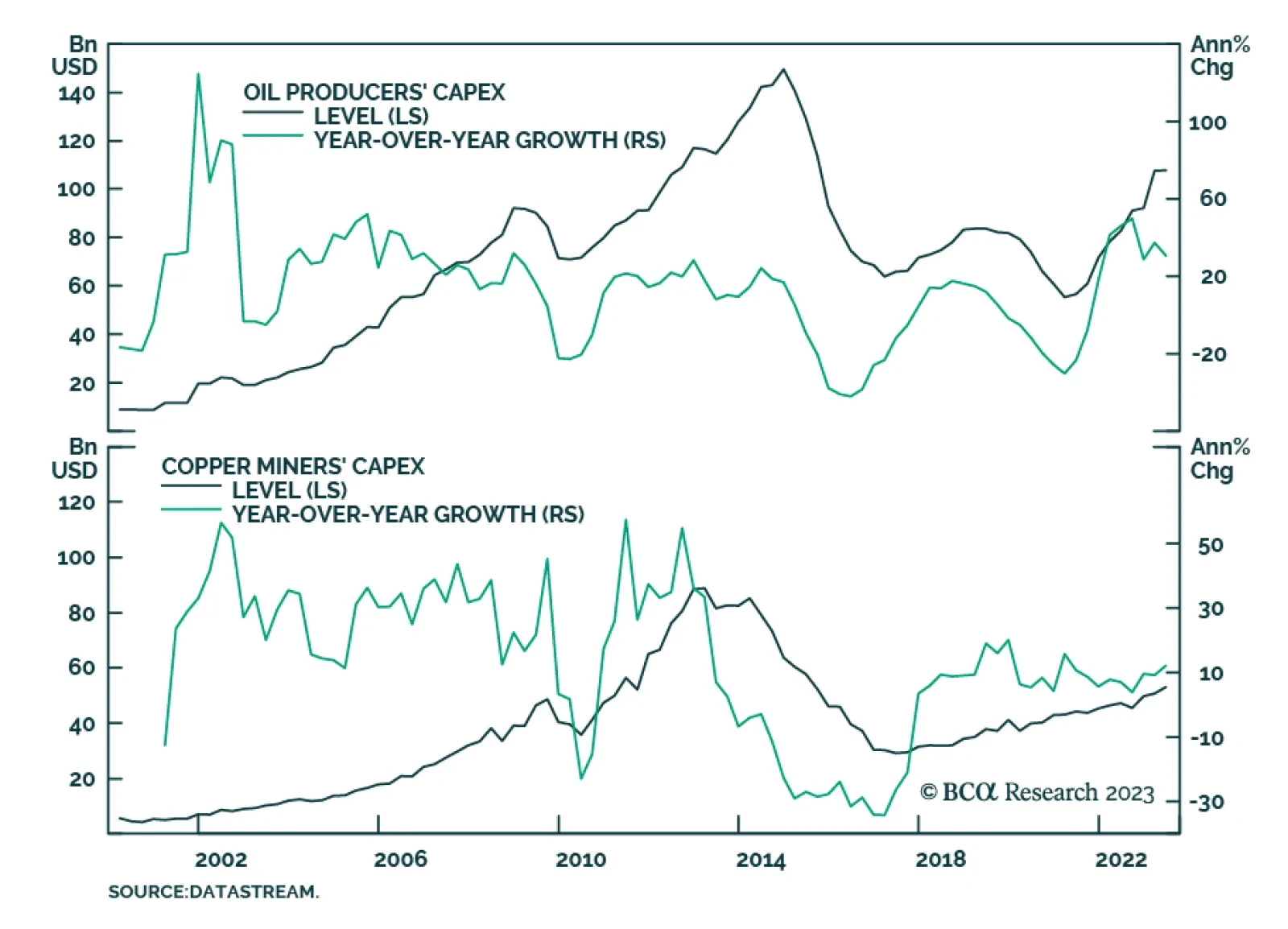

According to BCA Research’s Commodity & Energy Strategy service, the global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. The…

The global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. We remain long exposure to the equities of oil and gas producers via the XOP ETF; the COMT ETF to…

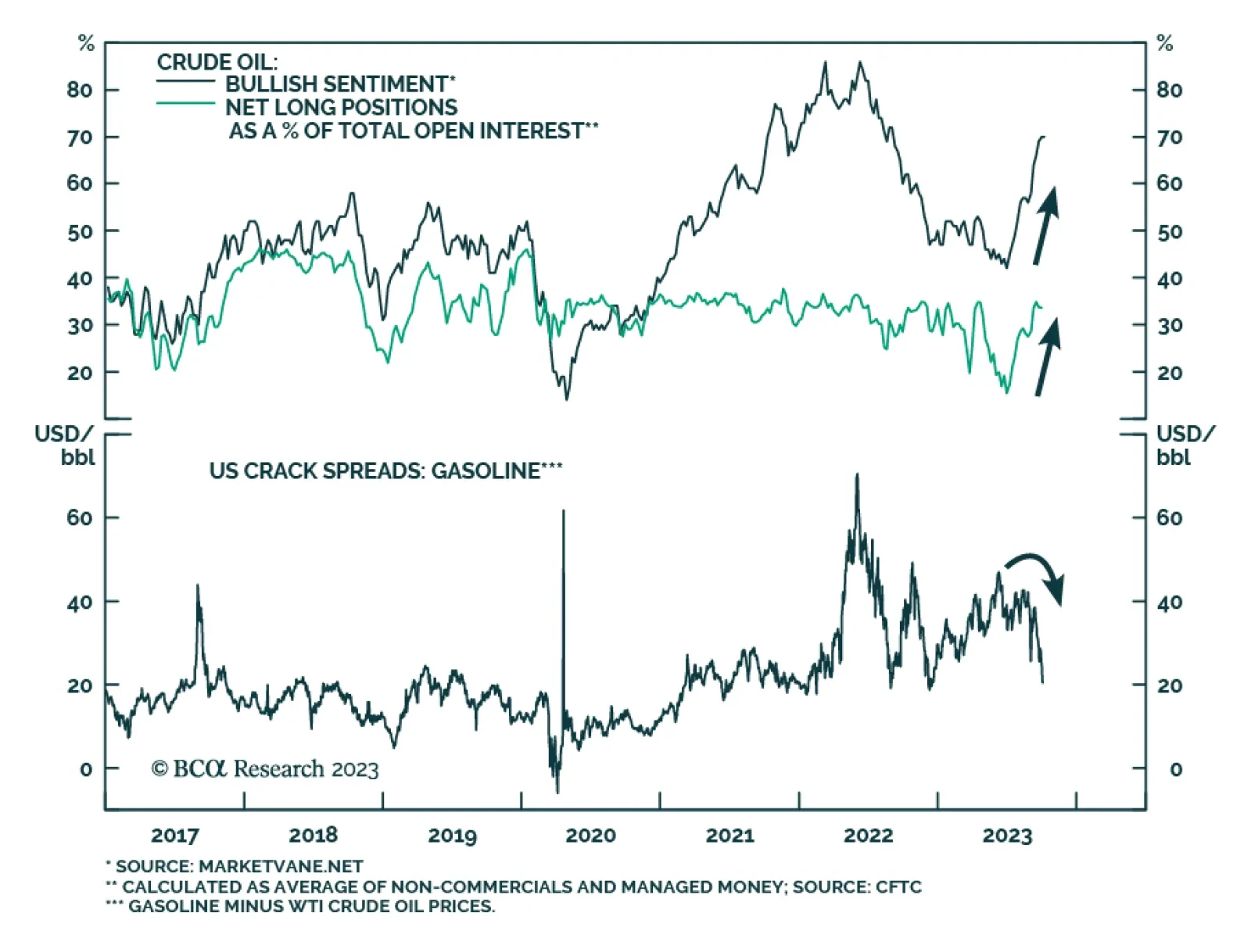

Brent crude oil price surged by 2.96% to an 11-month high of 96.75 on Wednesday on the back of ongoing supply concerns and data from the US EIA showing an ongoing decline in domestic inventories. The weekly inventory draw…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

BCA Research’s China Investment Strategy service estimates that China’s oil demand growth will decline from 12% year-on-year in the past eight months to a still robust 4%-6% in the next six-to-nine months. China…