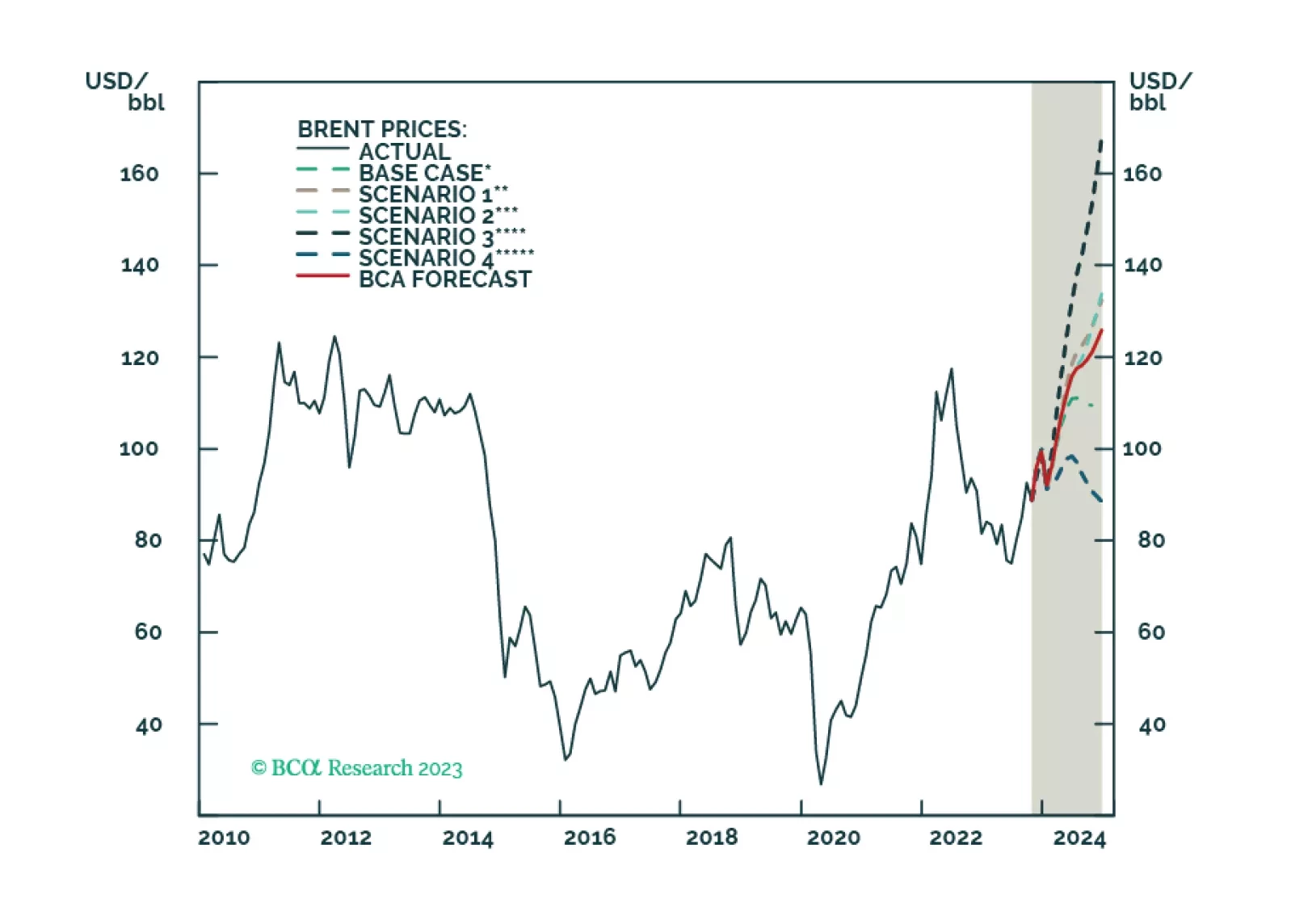

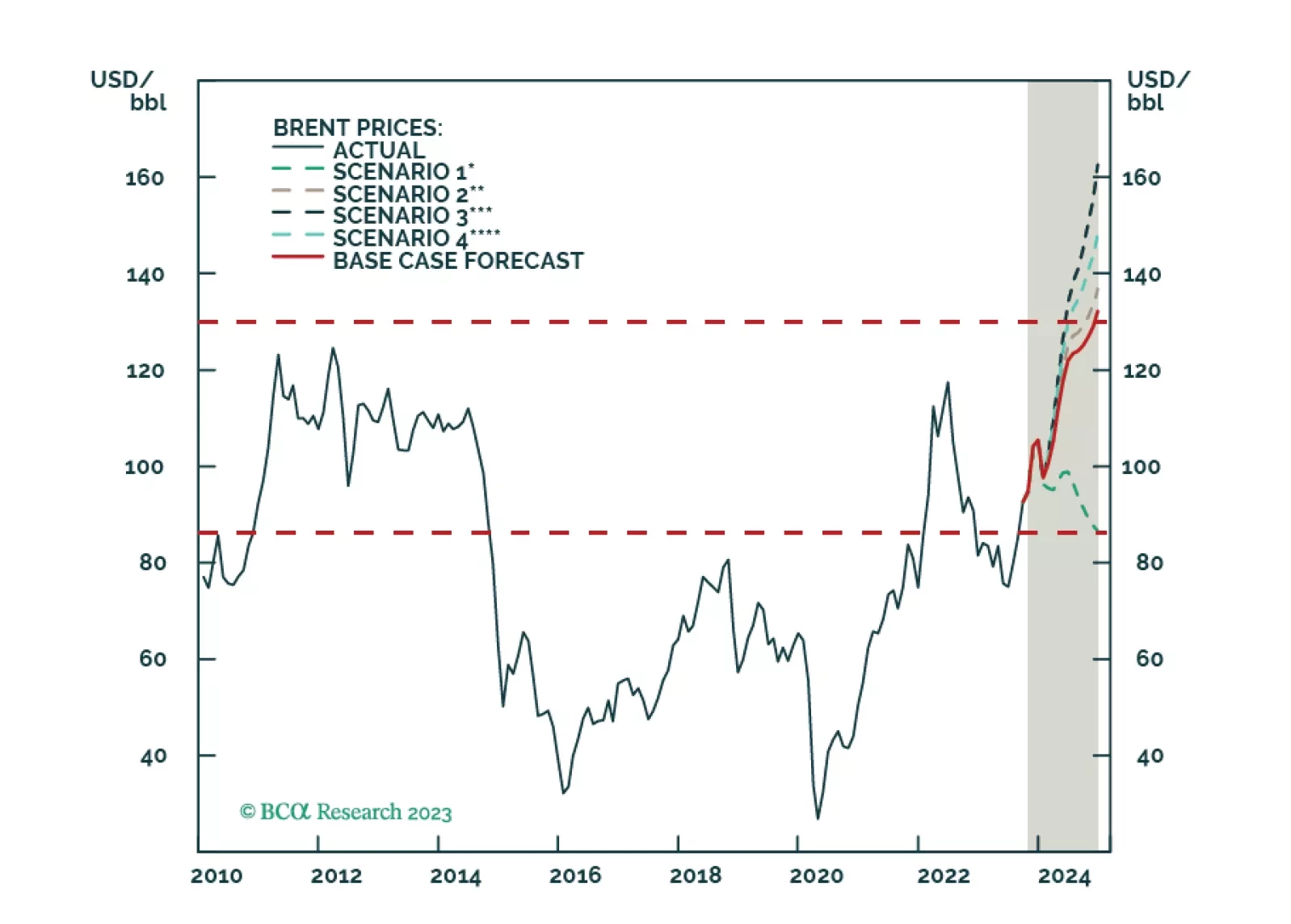

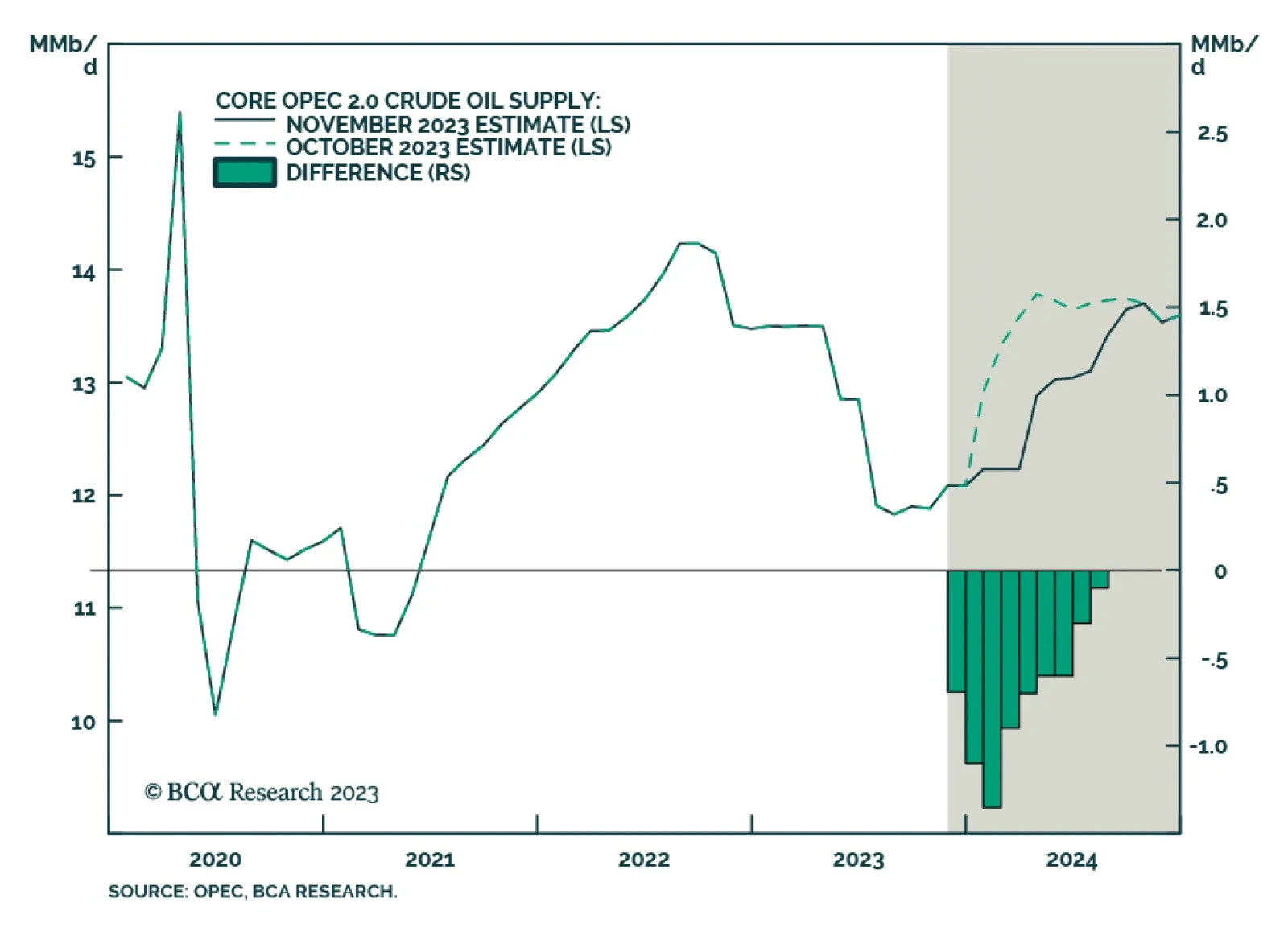

BCA Research's Commodity & Energy Strategy service continues to expect Russia to reduce oil exports next year by up to 2mm b/d (25% probability), in an effort to reduce US President Biden’s chances of being re-…

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

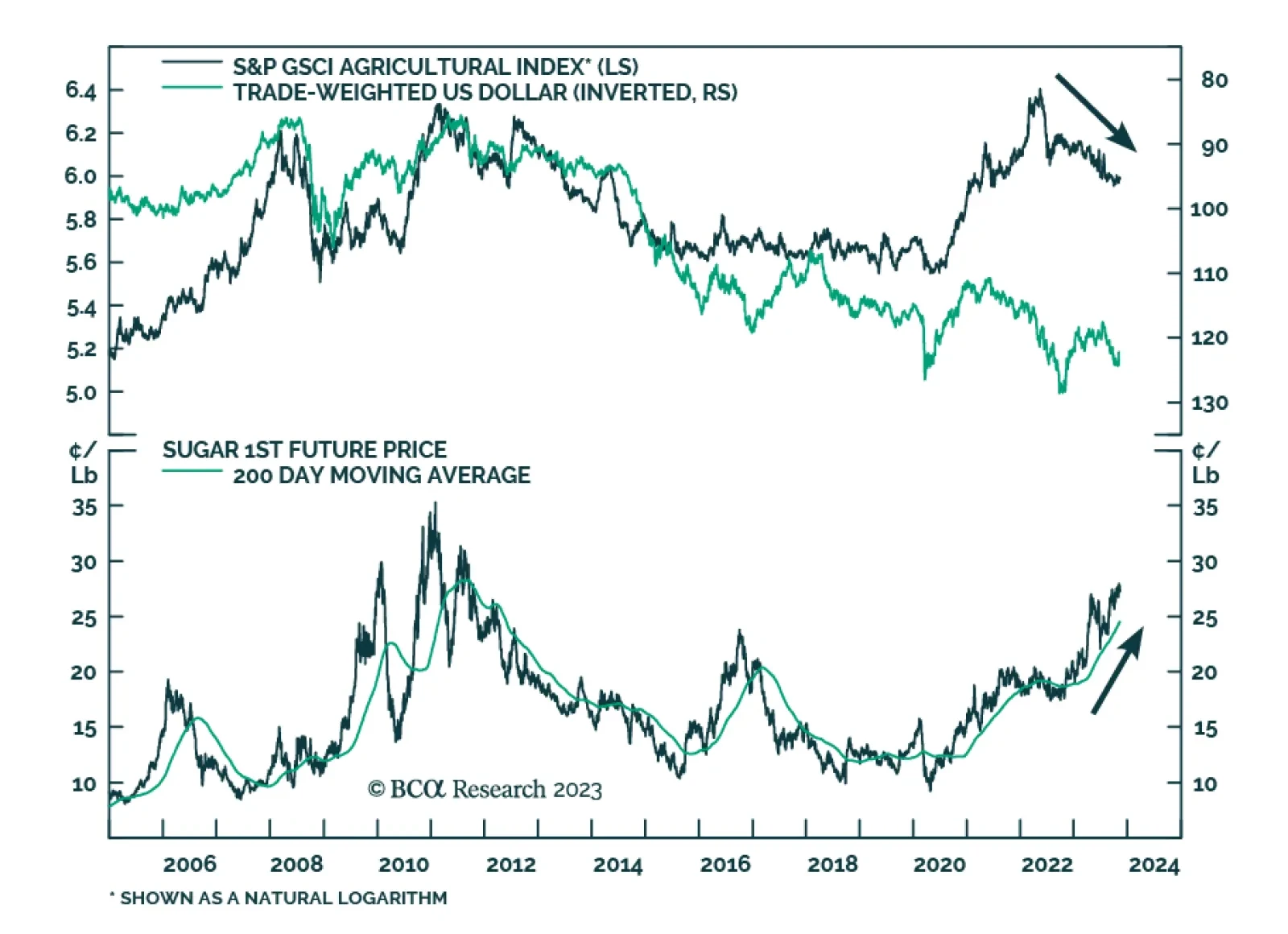

Agriculture commodity prices have been on a steady decline for over a year. Since peaking in mid-May 2022, the GSCI Agriculture index has dropped by 34% -- nearly half of which occurred in 2023. The weakness is generally broad-…

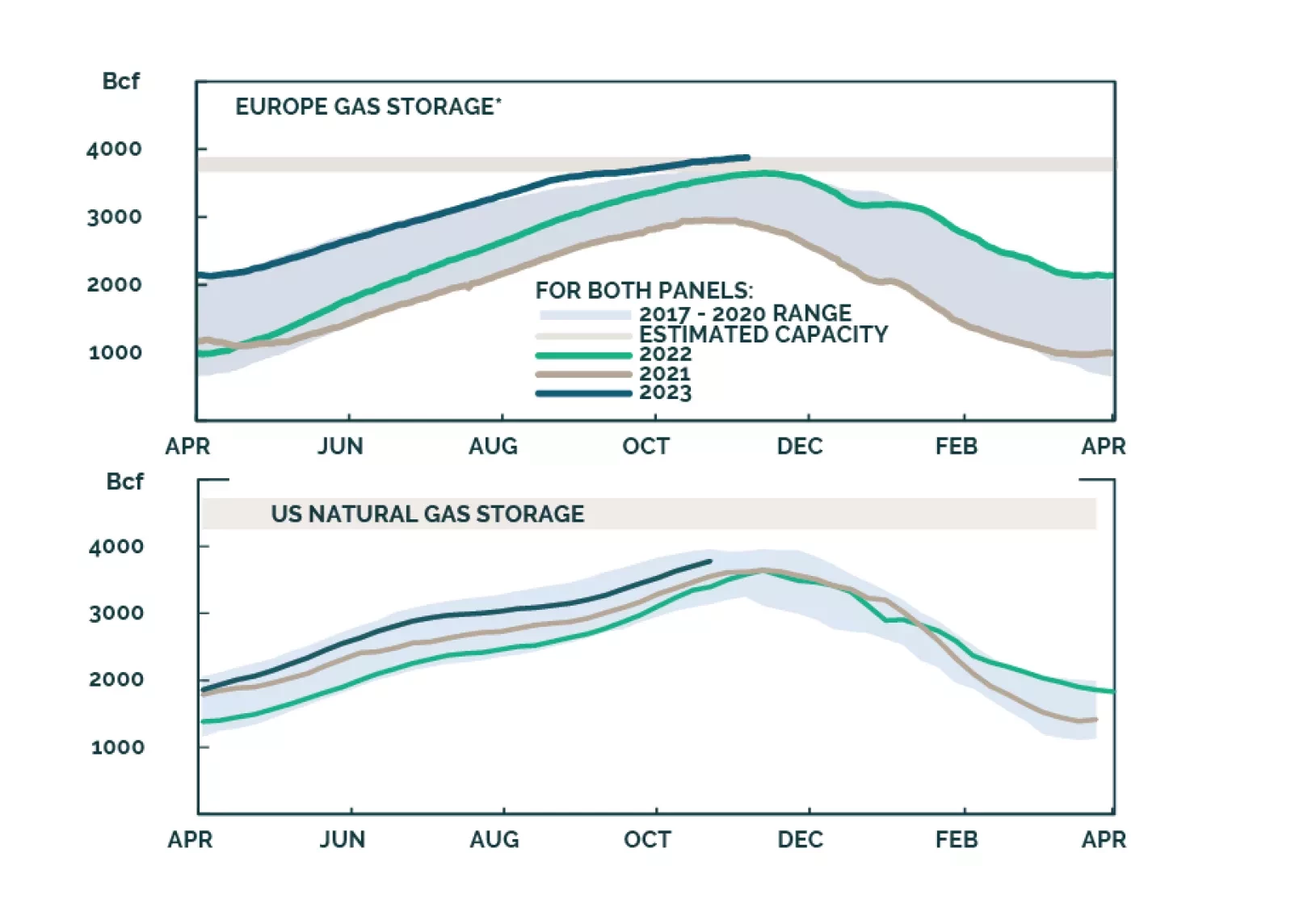

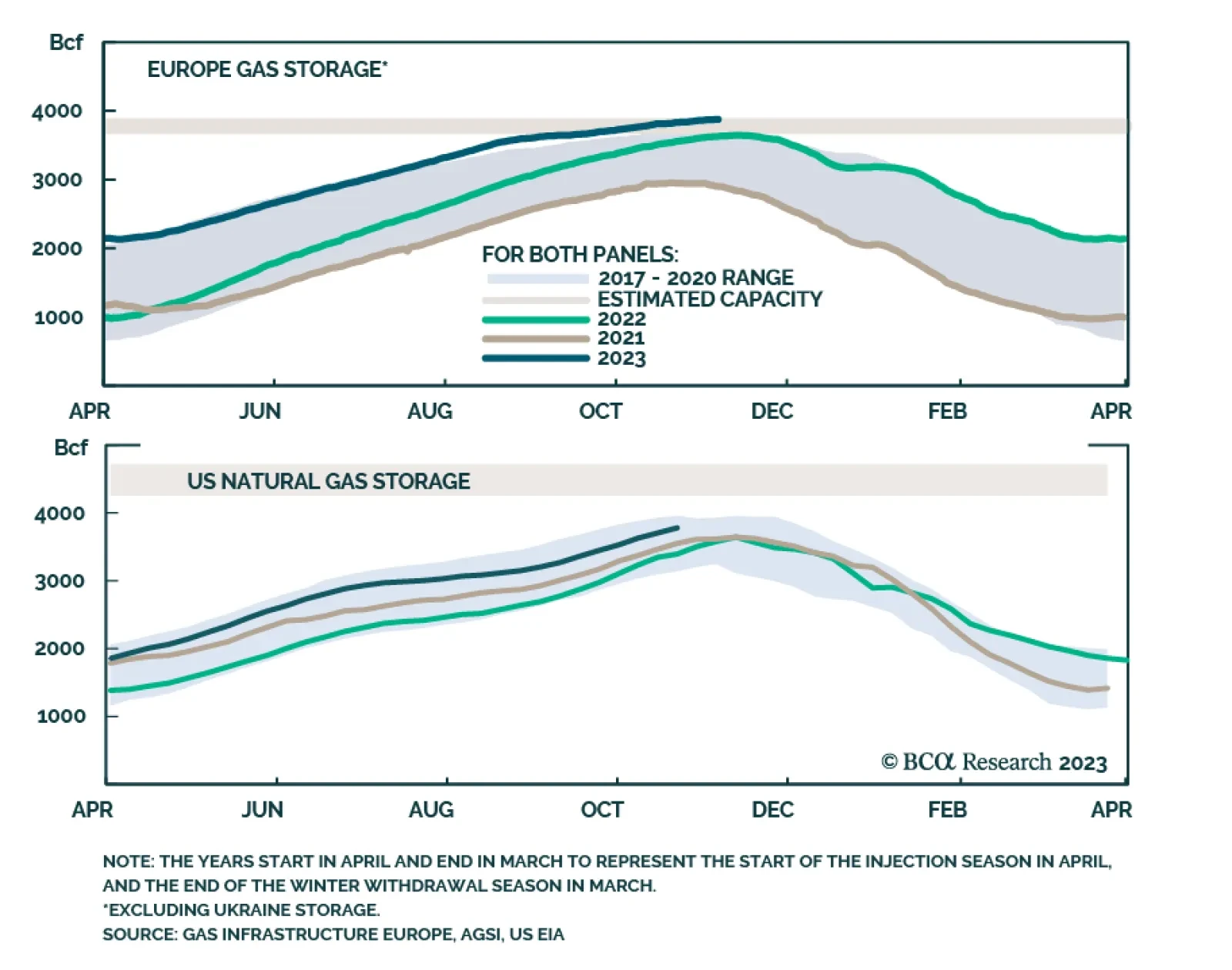

In the short run – i.e., over the current Northern Hemisphere winter – natural gas storage levels will be sufficient to balance heating and industrial demand with flowing supplies, assuming a normal winter in the EU…

Natural gas storage levels in the US and EU are sufficient to balance flowing supply and demand this winter, assuming normal weather. China continues to invest in domestic production, and to diversify supply sources to compensate…

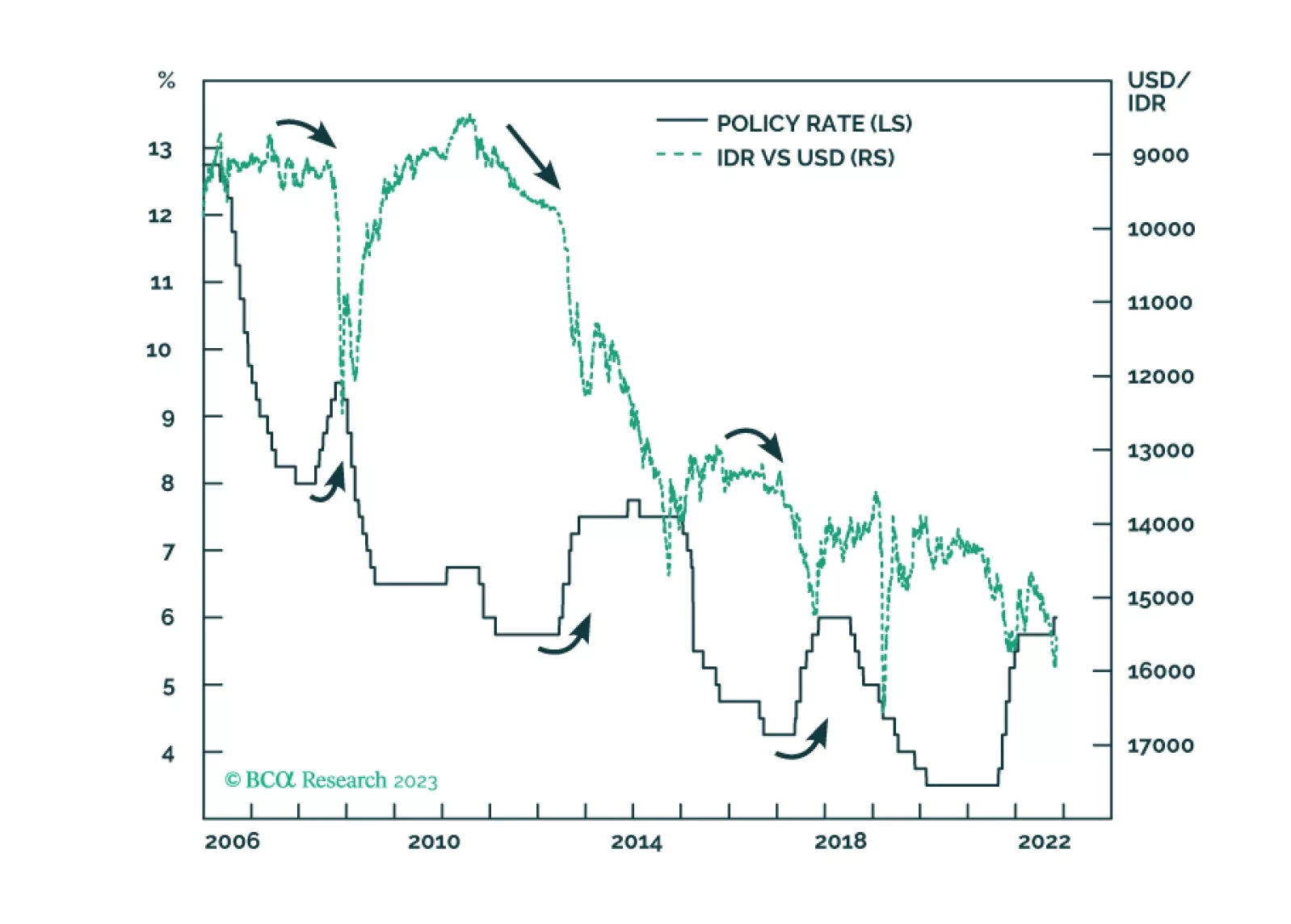

Despite very low inflation, Bank Indonesia raised its policy rates last month to support the currency. The strategy did not work before and will not work now. Stay short the rupiah.

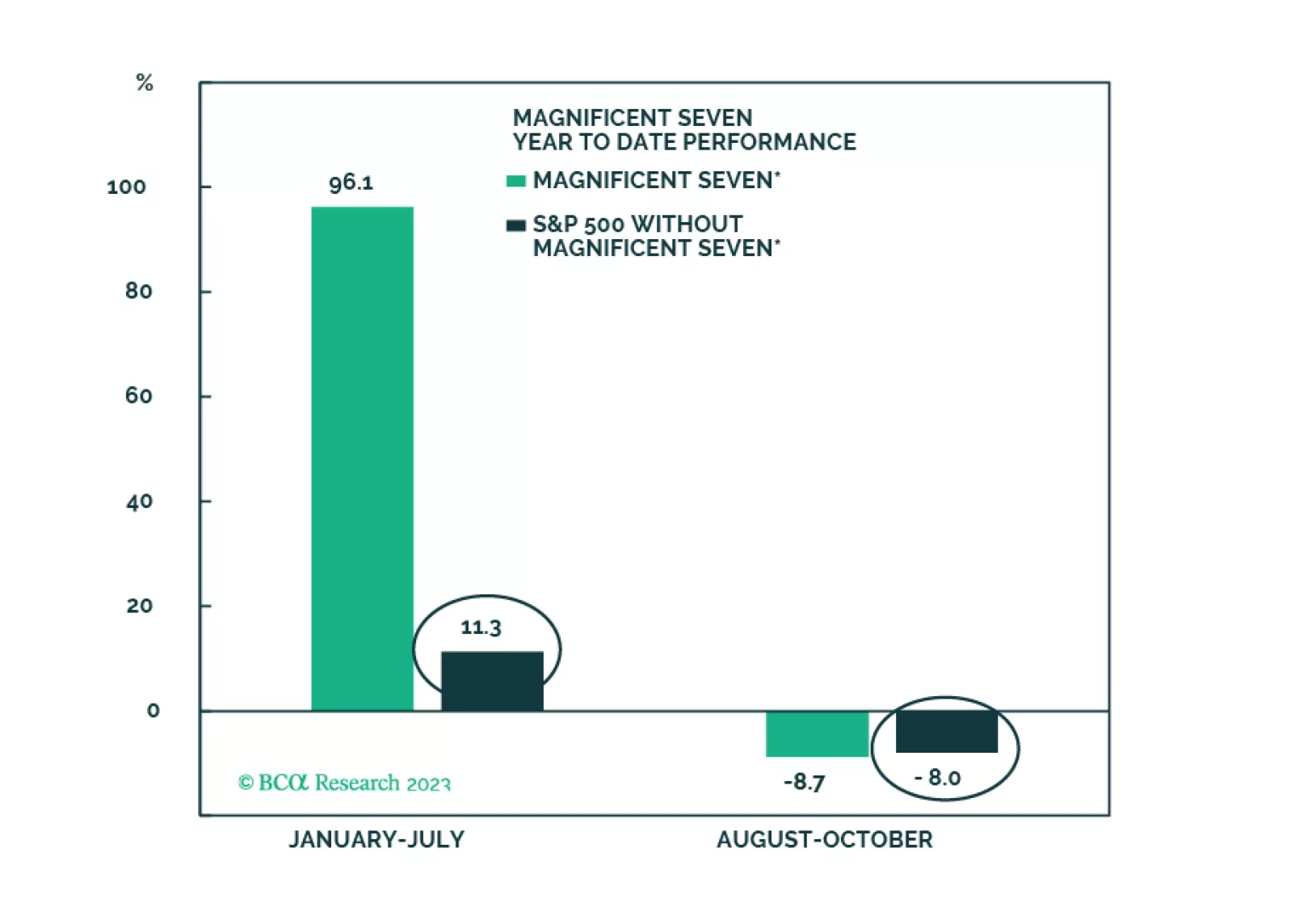

The Vicious Troika remains a long-term threat, but over the short term, rates will likely have another leg down on growth concerns, offering support to equities, which are now fairly valued and are no longer overbought. Longer-term…

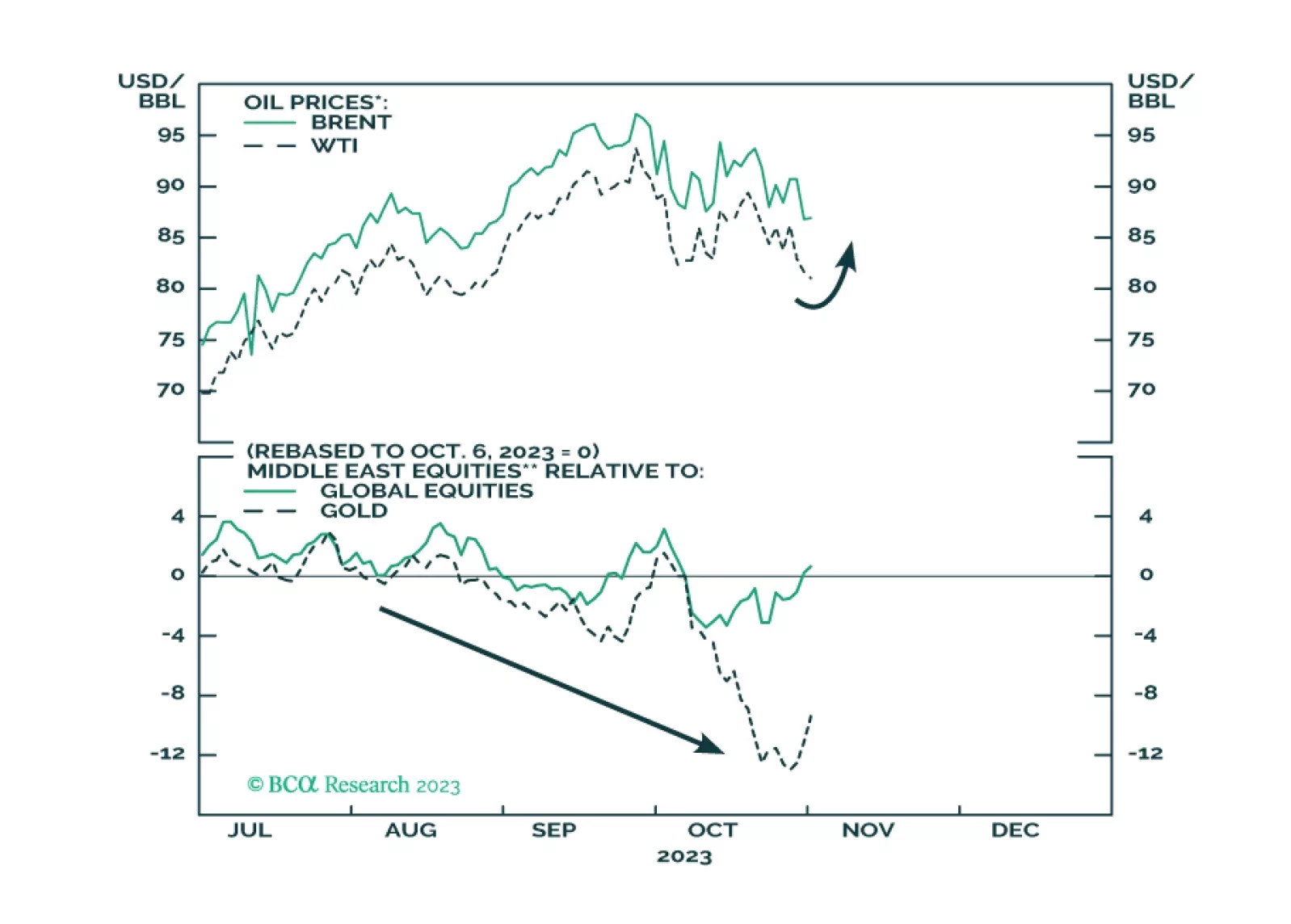

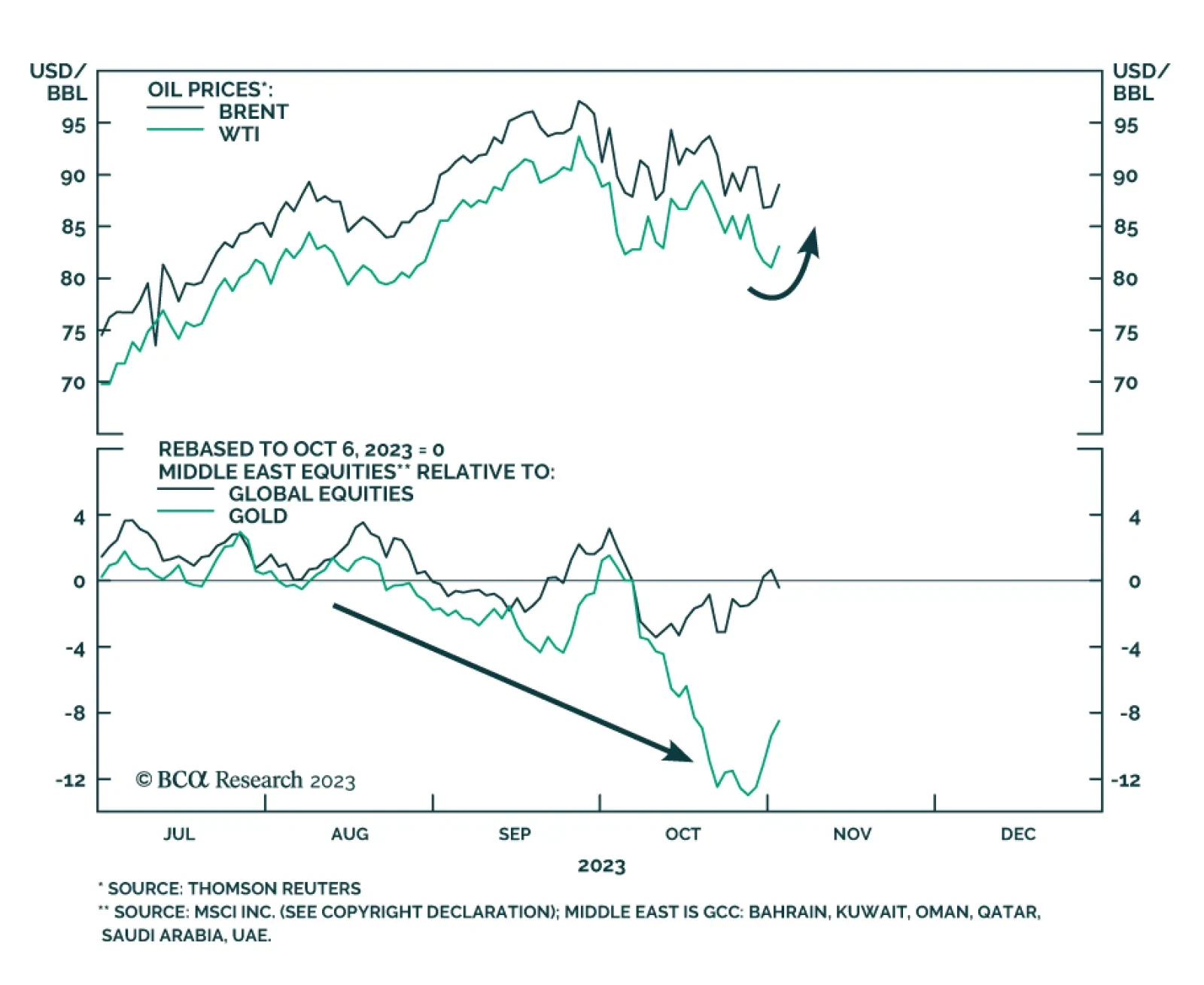

According to BCA Research's Geopolitical Strategy service, investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the…

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.