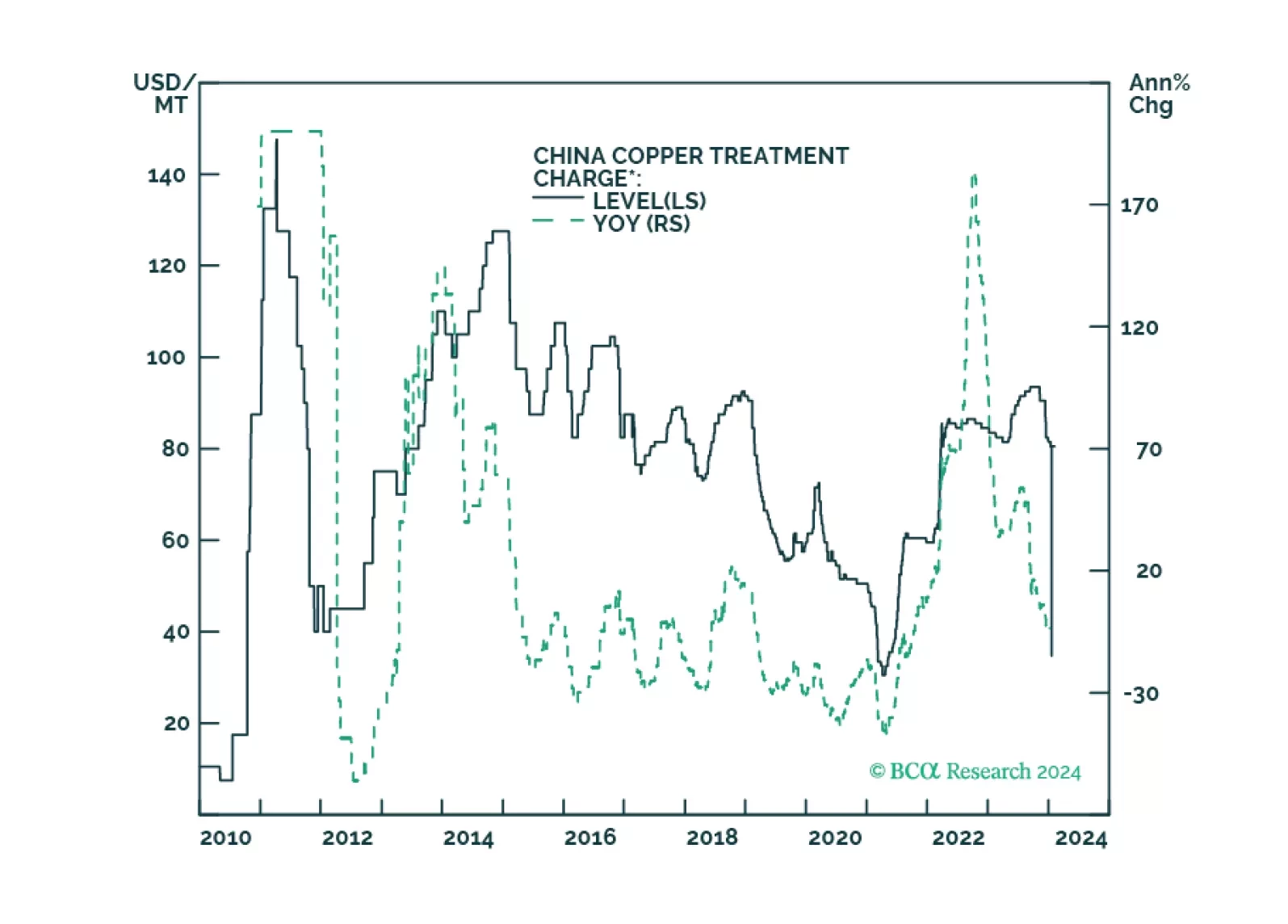

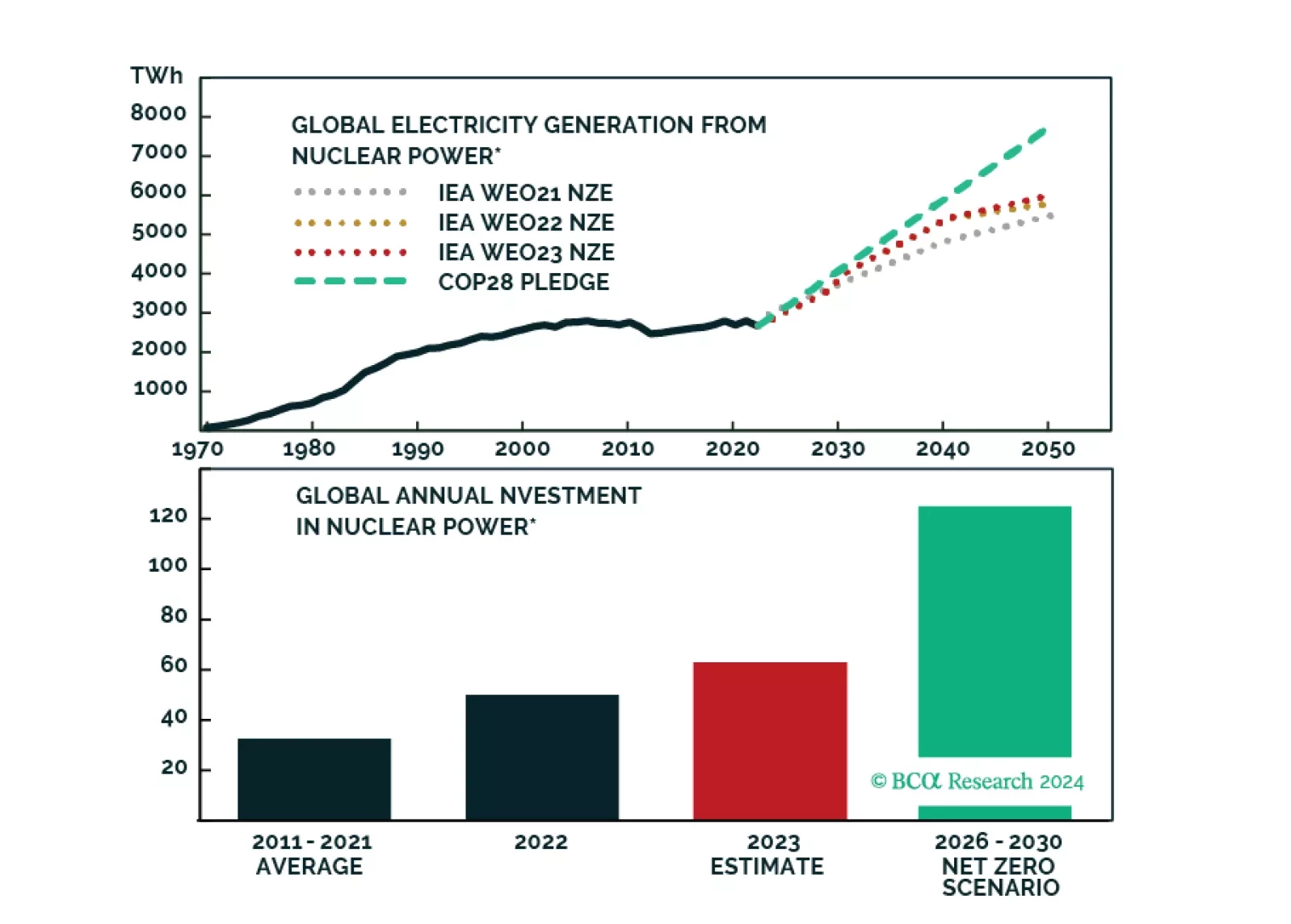

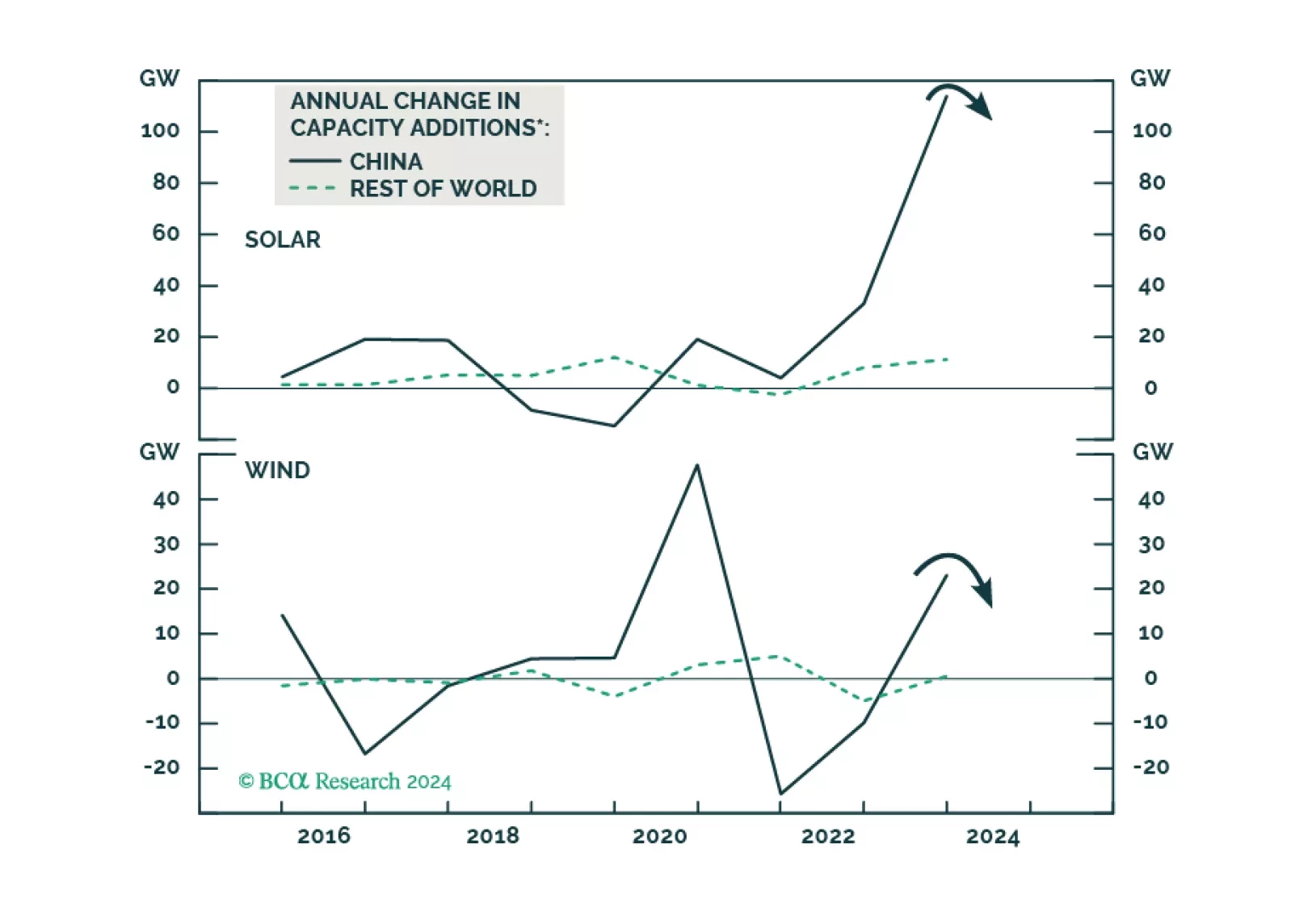

Supply and demand shocks in markets critical to the renewable-energy and defense industries will continue to play havoc with prices, which will negatively impact capex. In the short run, this benefits China given its already-dominant…

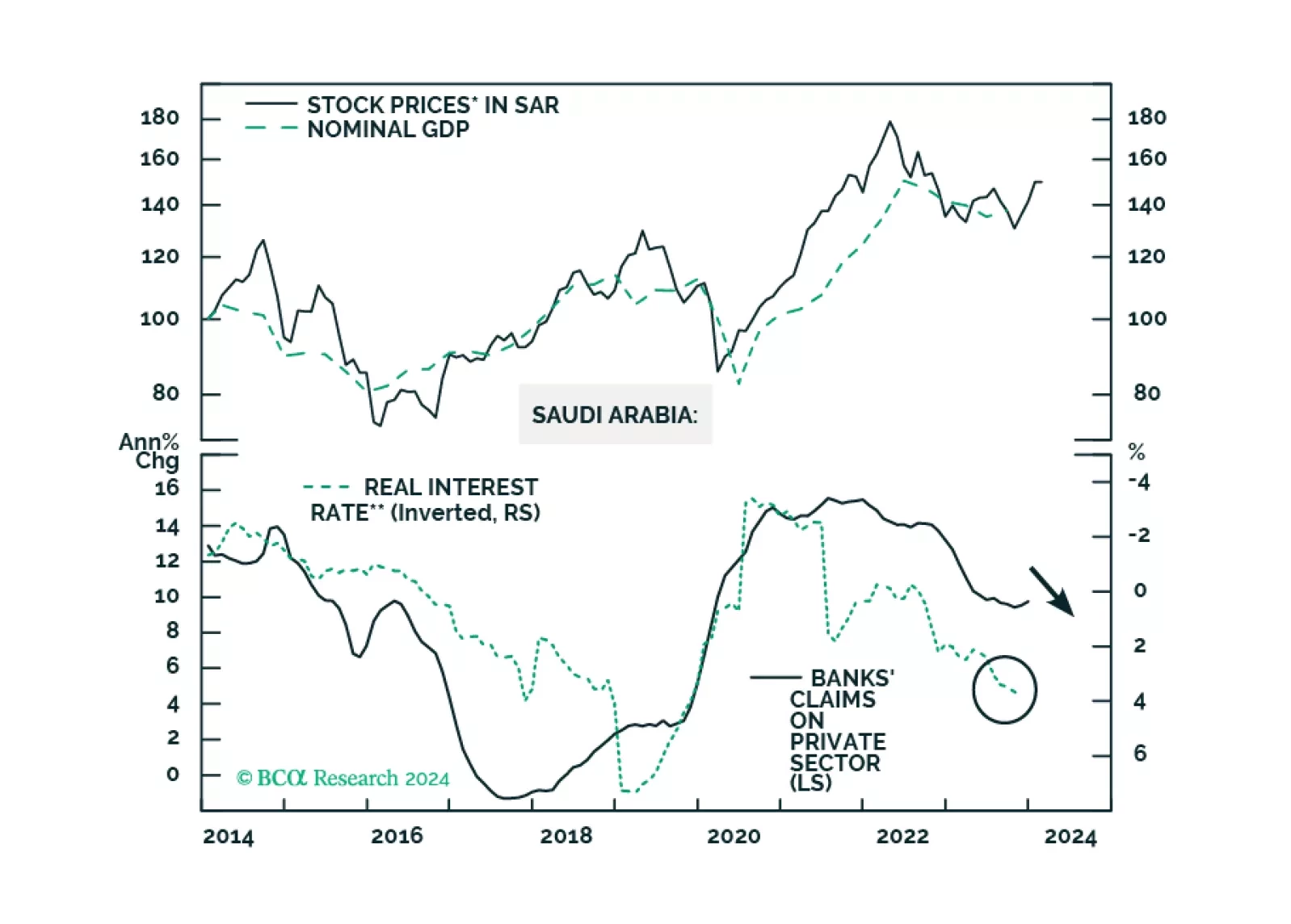

The Saudi economy is facing internal and external headwinds. The geopolitical conflict is also escalating in the Middle East. EM equity portfolios should stay neutral on Saudi stocks. EM sovereign credit portfolios should upgrade…

A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

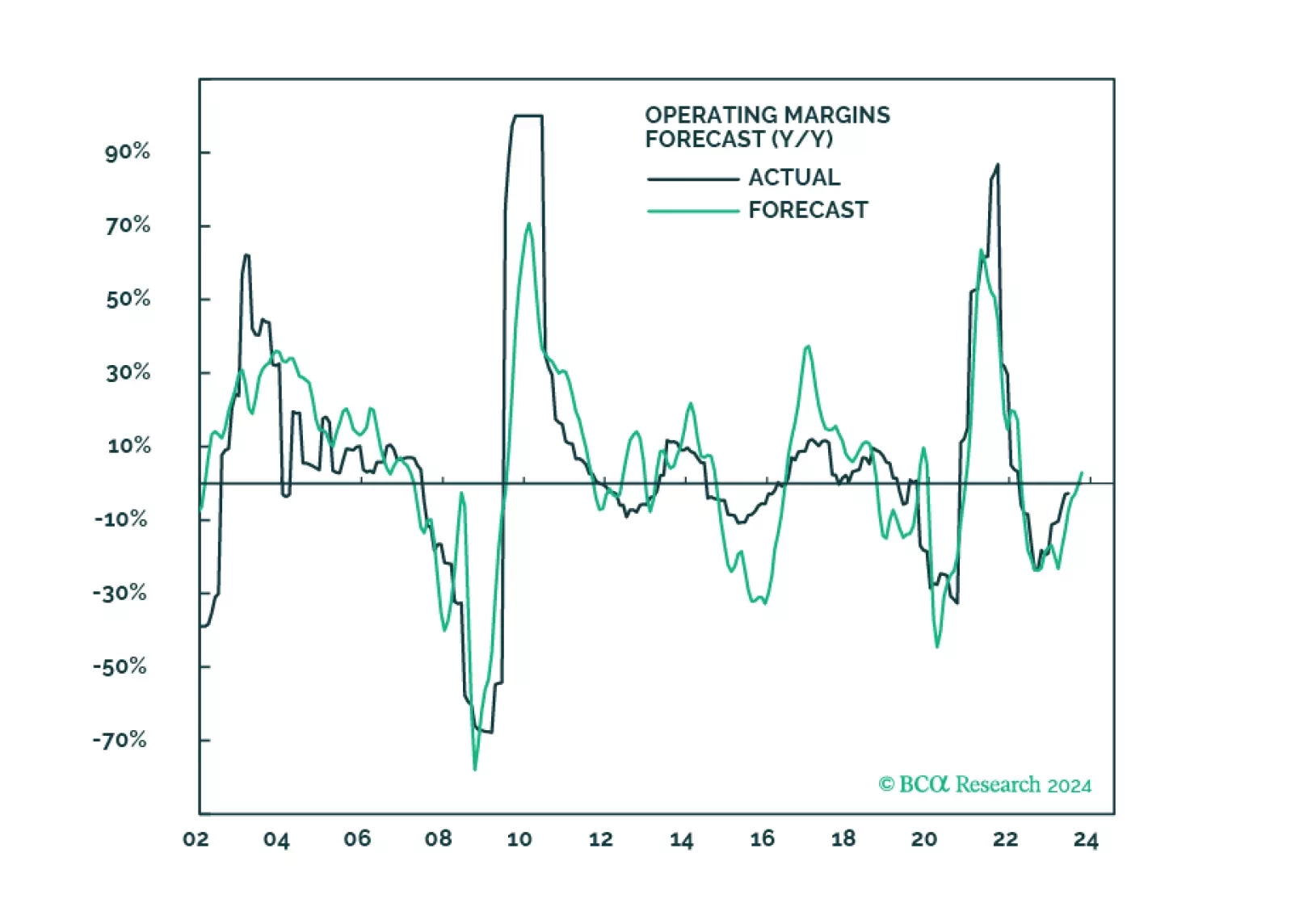

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

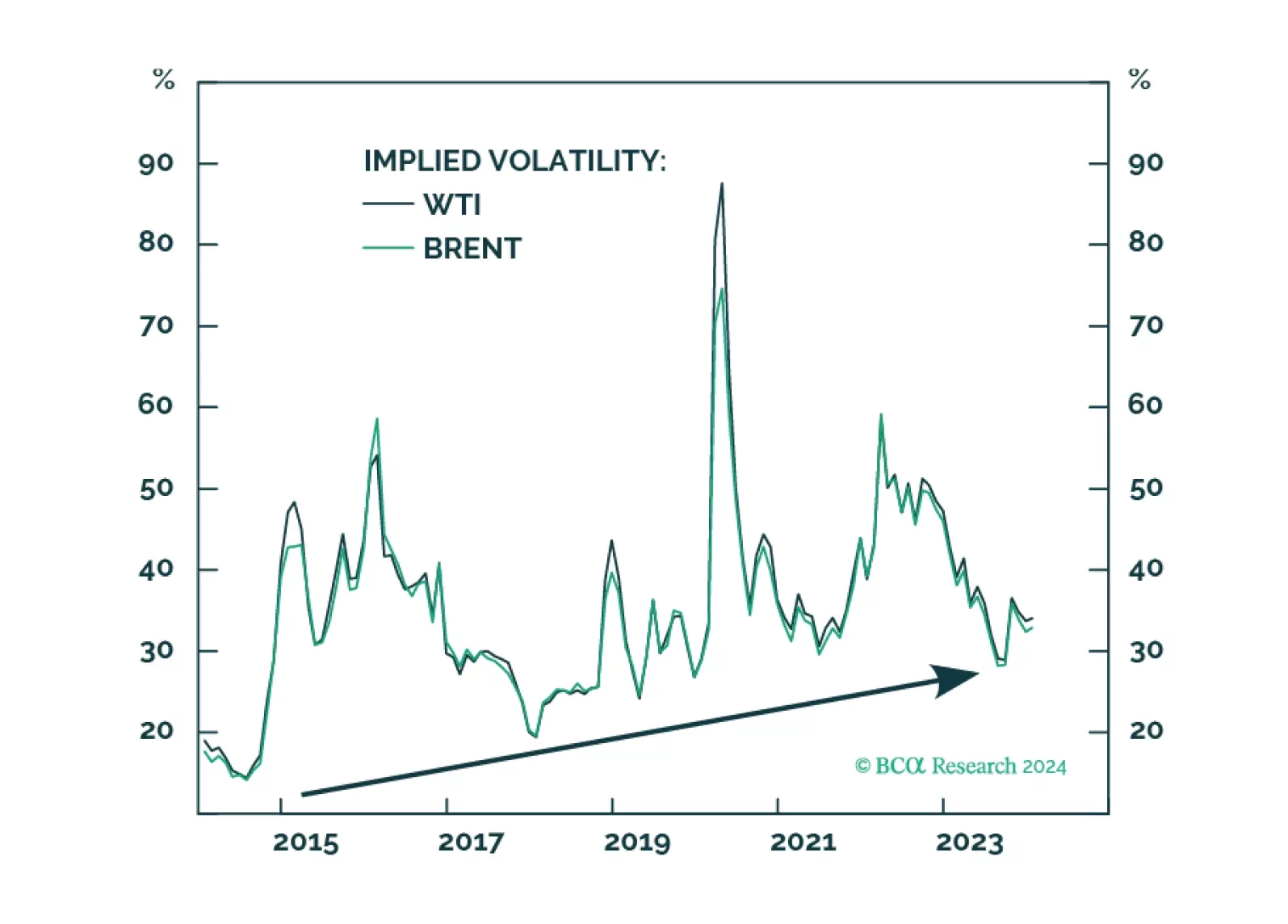

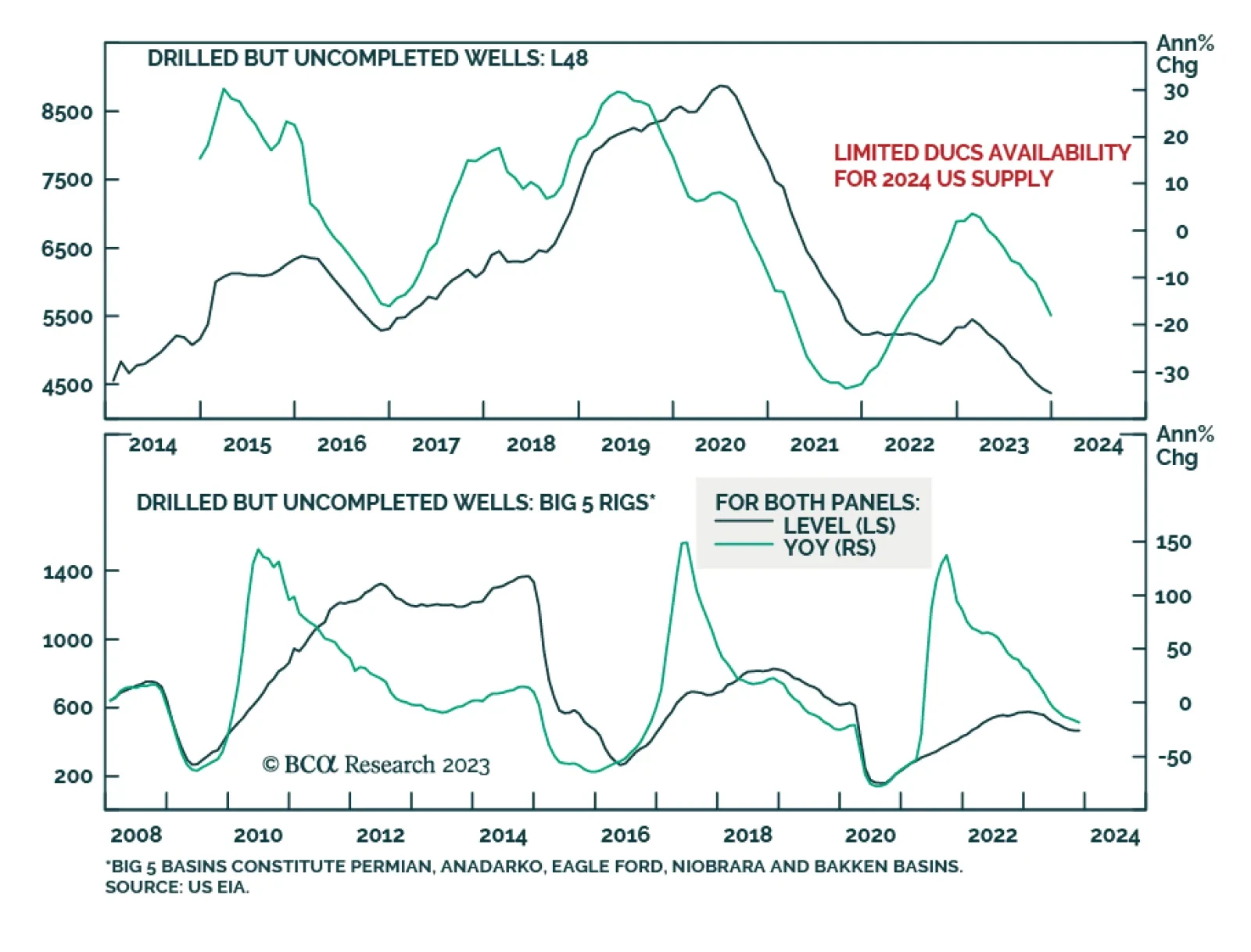

The 1mm b/d surge in US crude oil production last year was the result of a flood of low-cost drilled-but-uncompleted (DUCs) shale-oil wells coming online, mostly in 2H23 in the Permian Basin, which our colleagues in BCA's…

The risk markets will be surprised by another 1mm b/d increase in crude oil supplies this year or next from the US is low, given the depletion of the unfinished-well inventory that drove shale output higher. Demand remains strong,…