Even if Iran tries to revive talks, the US has an irresistible opportunity to dismantle its nuclear program. Tactically, investors should favor Treasuries over the S&P, defensive sectors over cyclicals, energy stocks over…

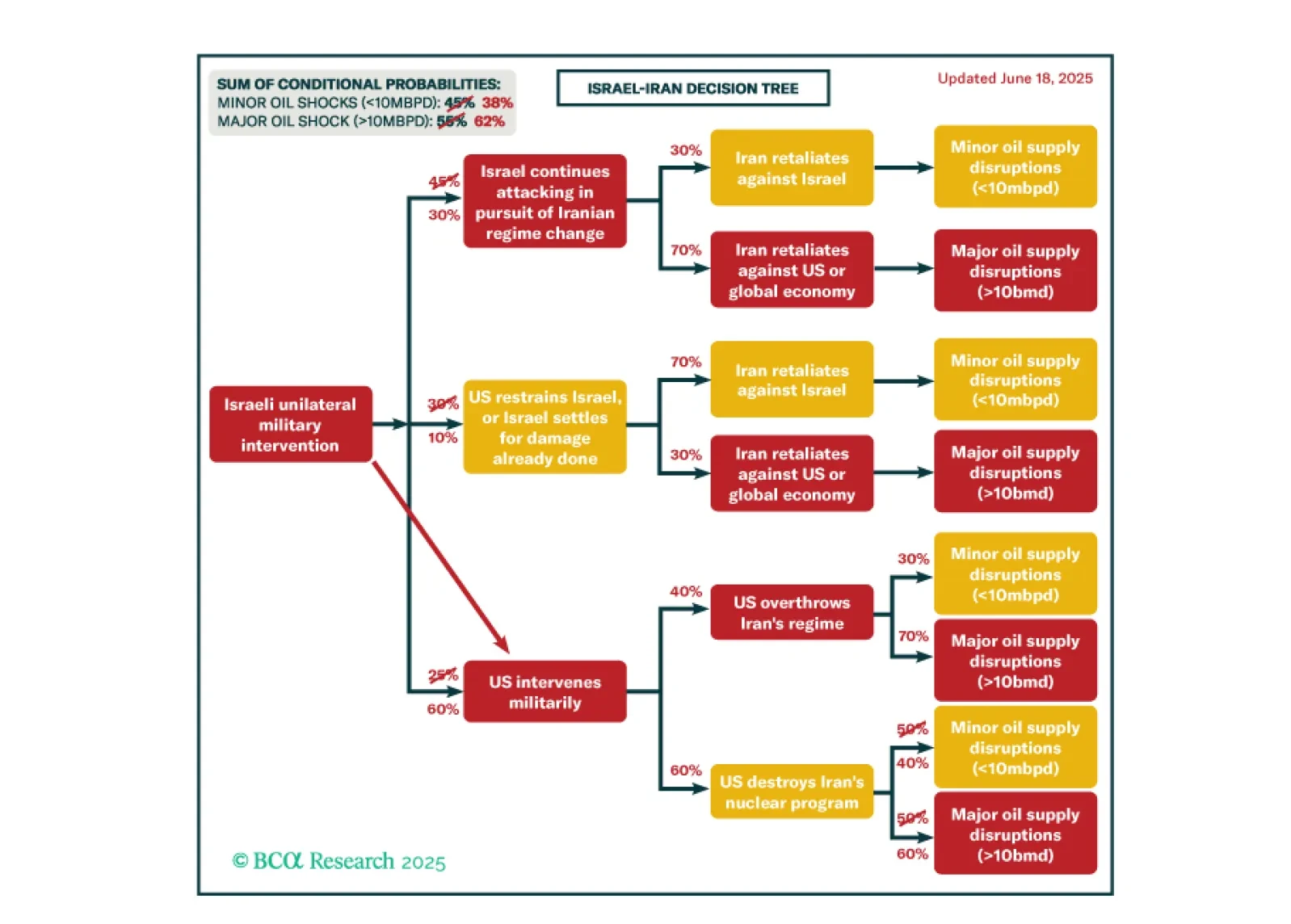

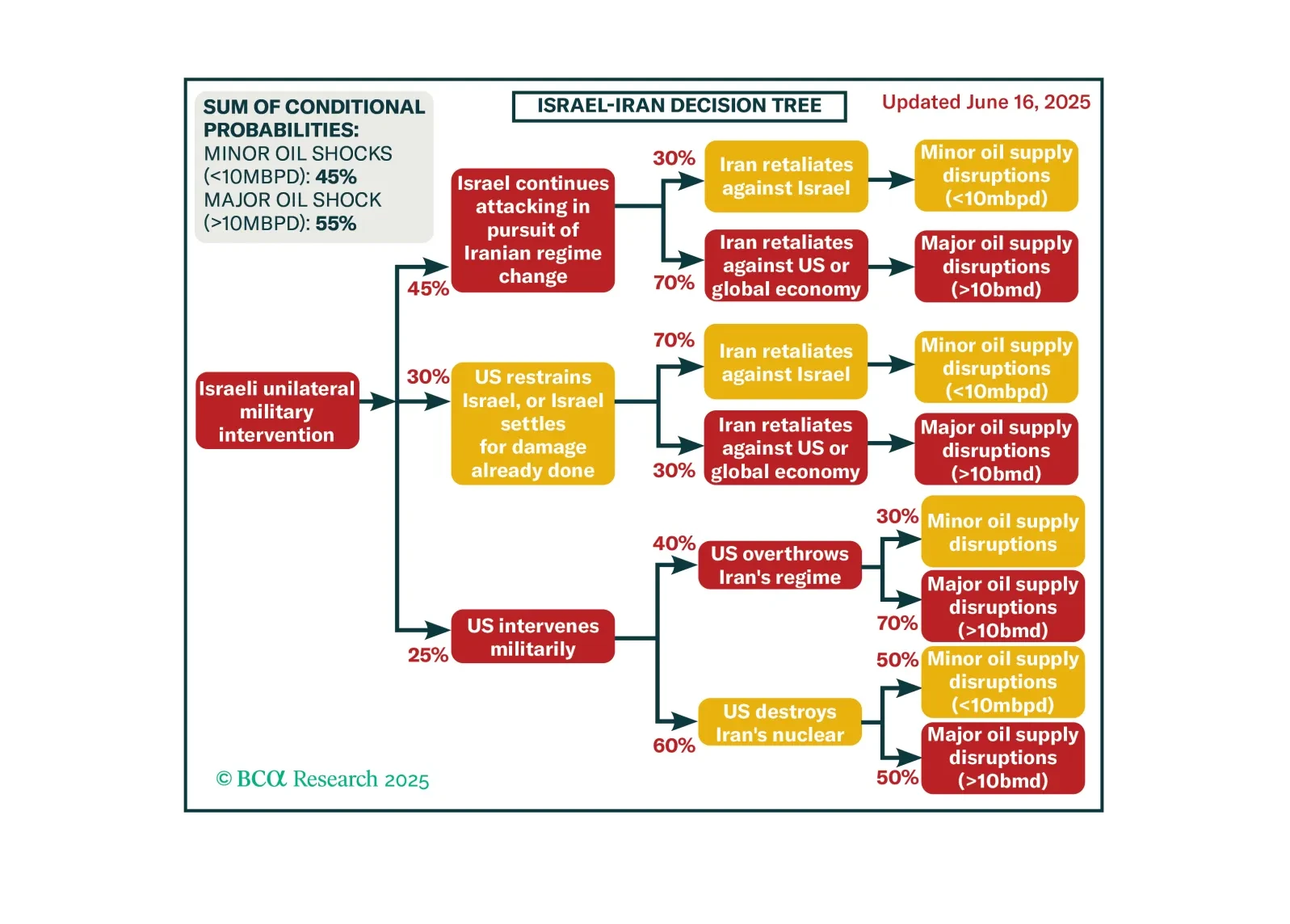

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.

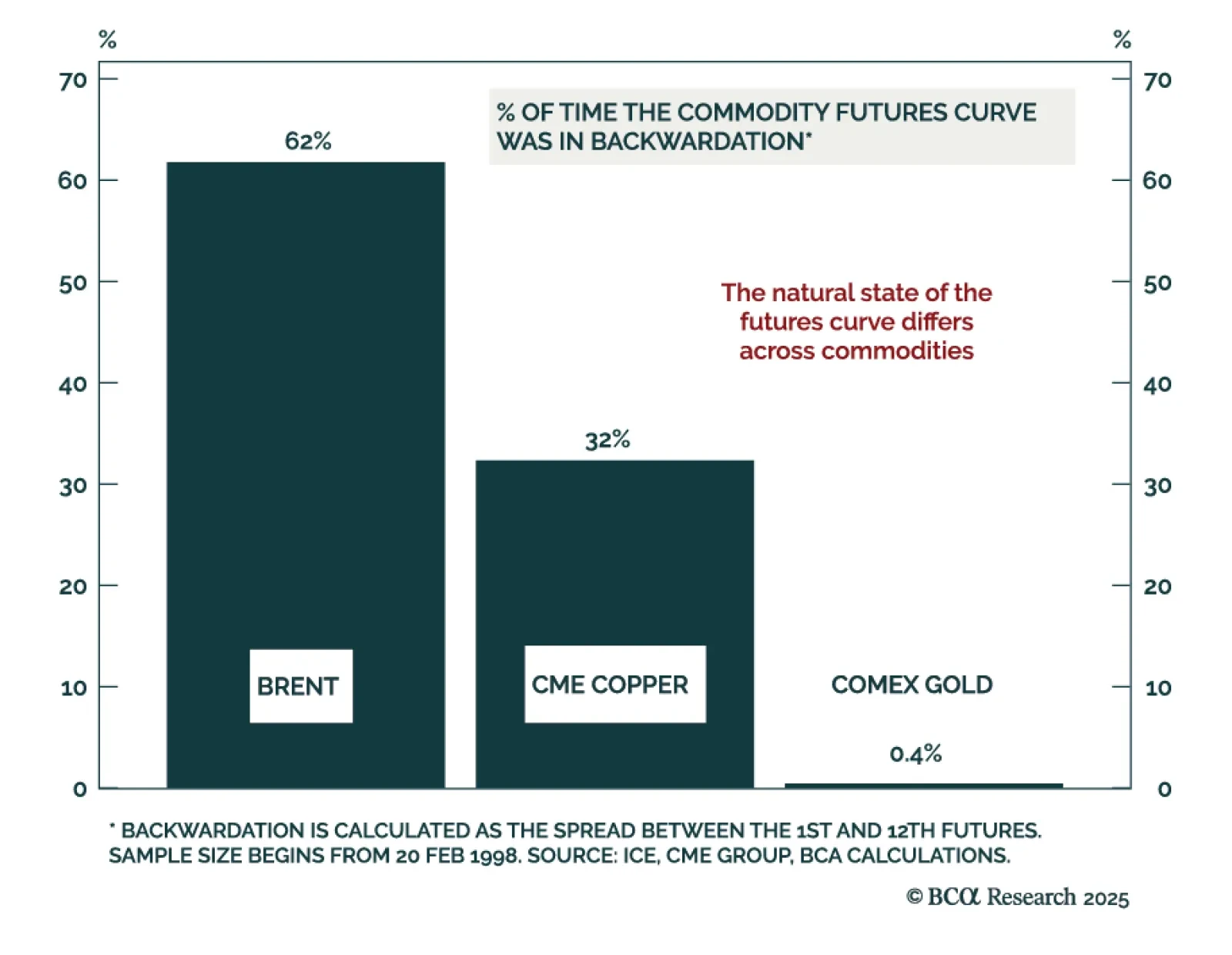

Oil, copper, and gold futures curves have experienced abnormal changes in the past few months, but a bearish global outlook will steepen contango structures across all three. Oil’s curve structure has flipped from backwardation…

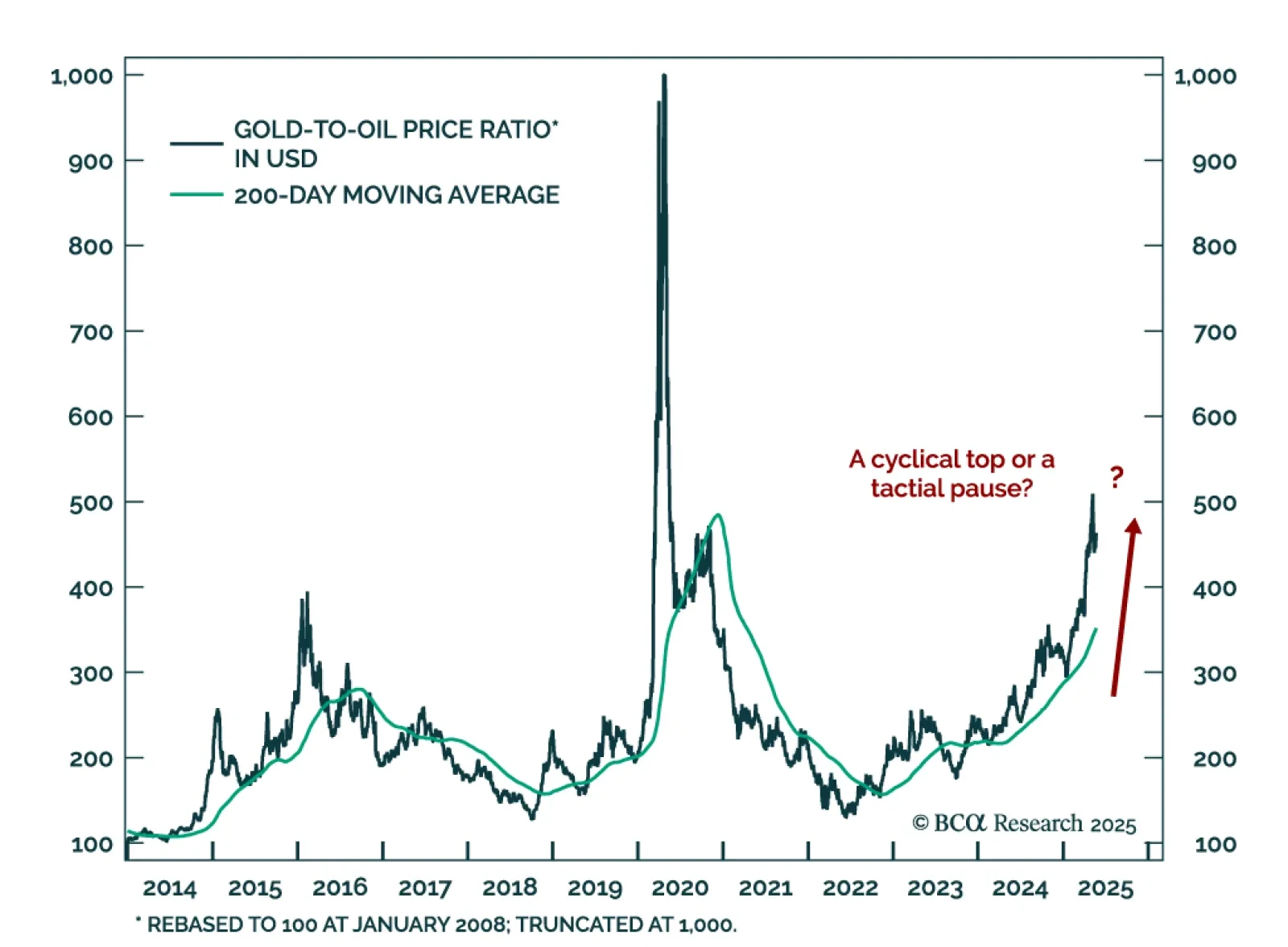

The gold-to-oil price ratio seems tactically overextended, but global macro drivers suggest it will rise further. The gold bull run is still relatively young and not yet stretched compared to rallies from the past 50…

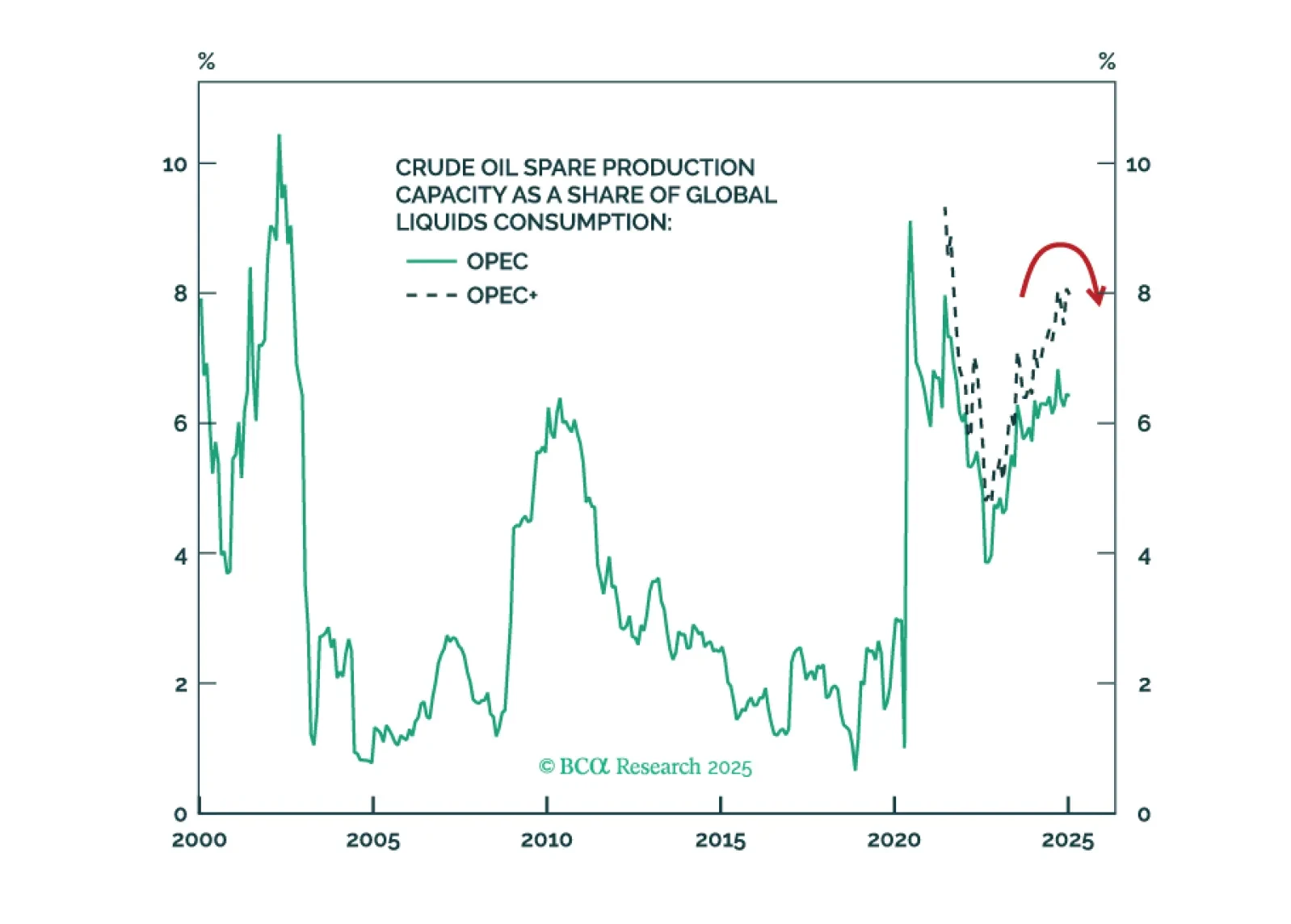

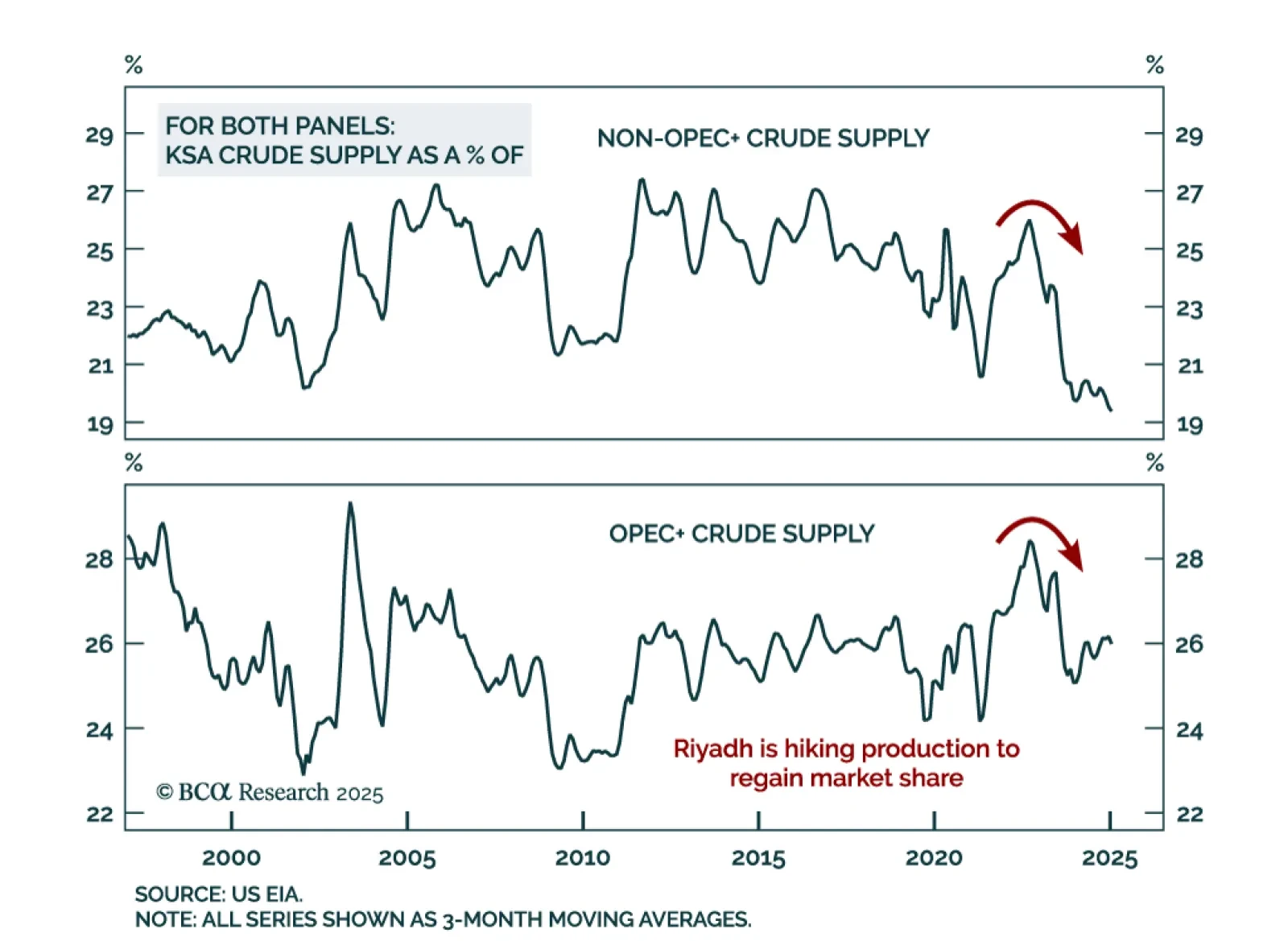

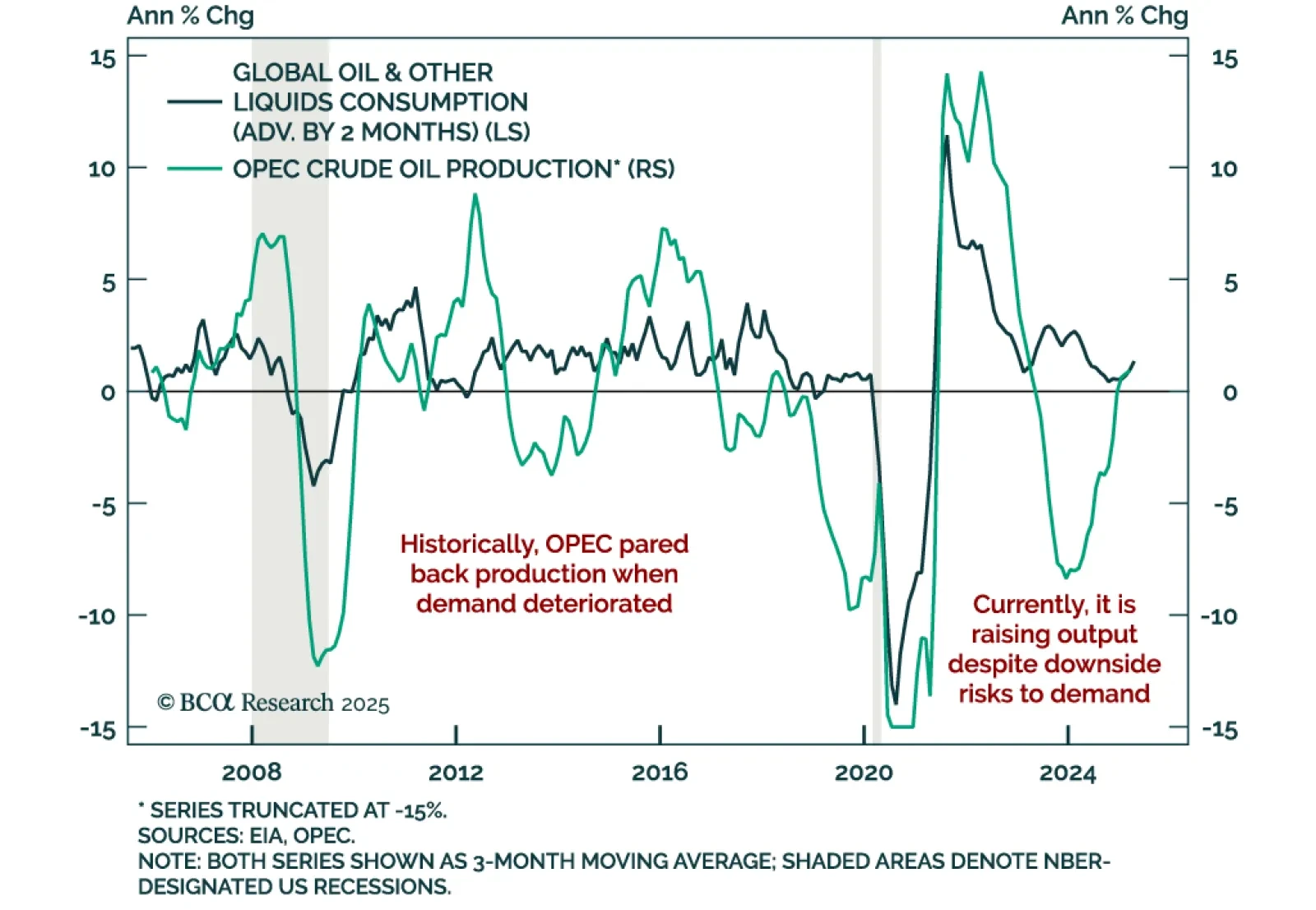

Our Commodities strategists believe Saudi Arabia is pursuing a controlled price war. Riyadh is intentionally pushing oil prices lower to regain market share and reset relations with the US. With OPEC+ production rising despite…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

Our Commodity strategists stay short oil and long gold as global demand weakens and OPEC+ offers no support. Brent’s floor has likely fallen to $50, and bearish supply and demand forces continue to dominate the price outlook. …

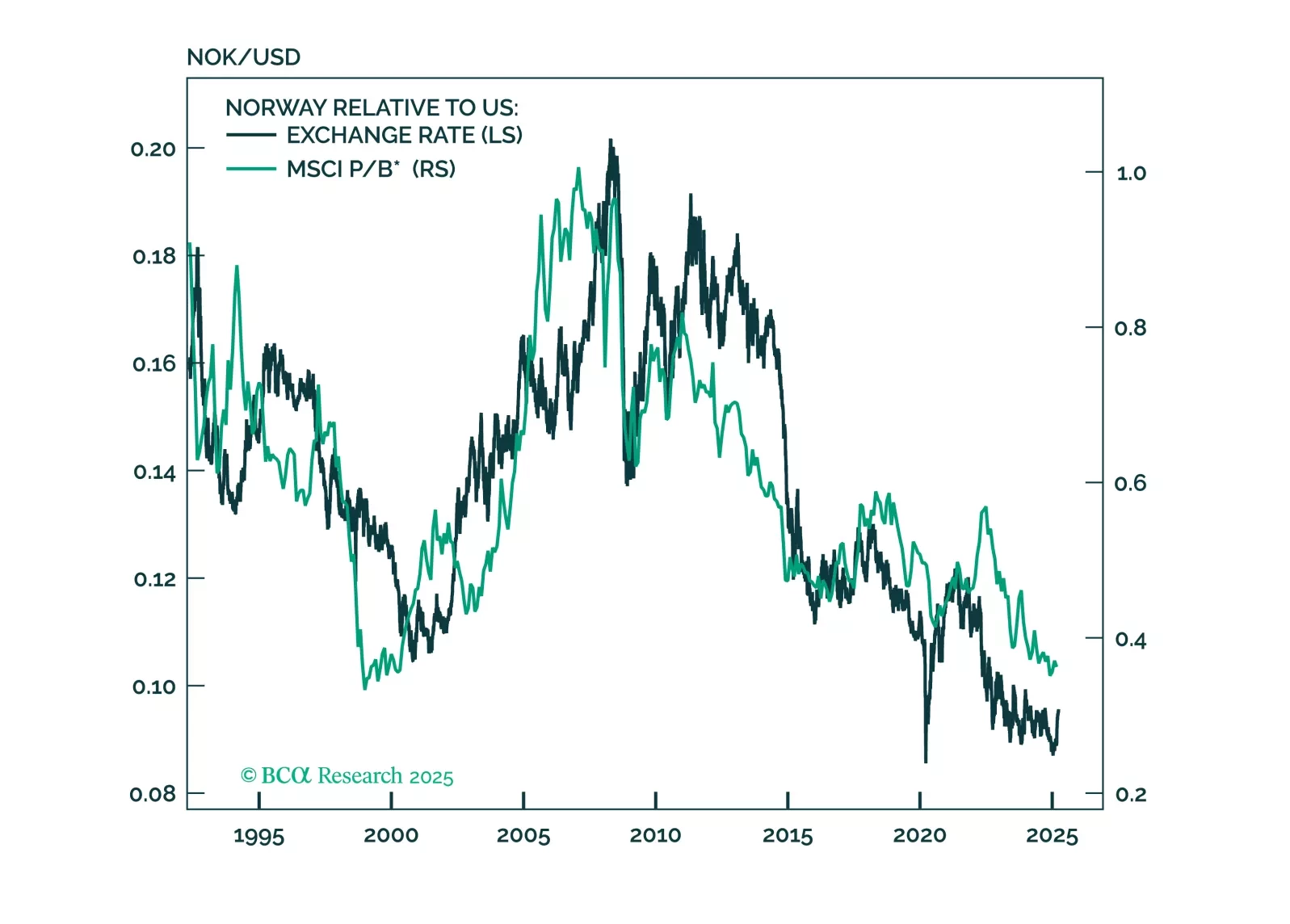

This report looks at investment implications, for Norwegian assets, given the recent meeting, from the Norges Bank.

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…