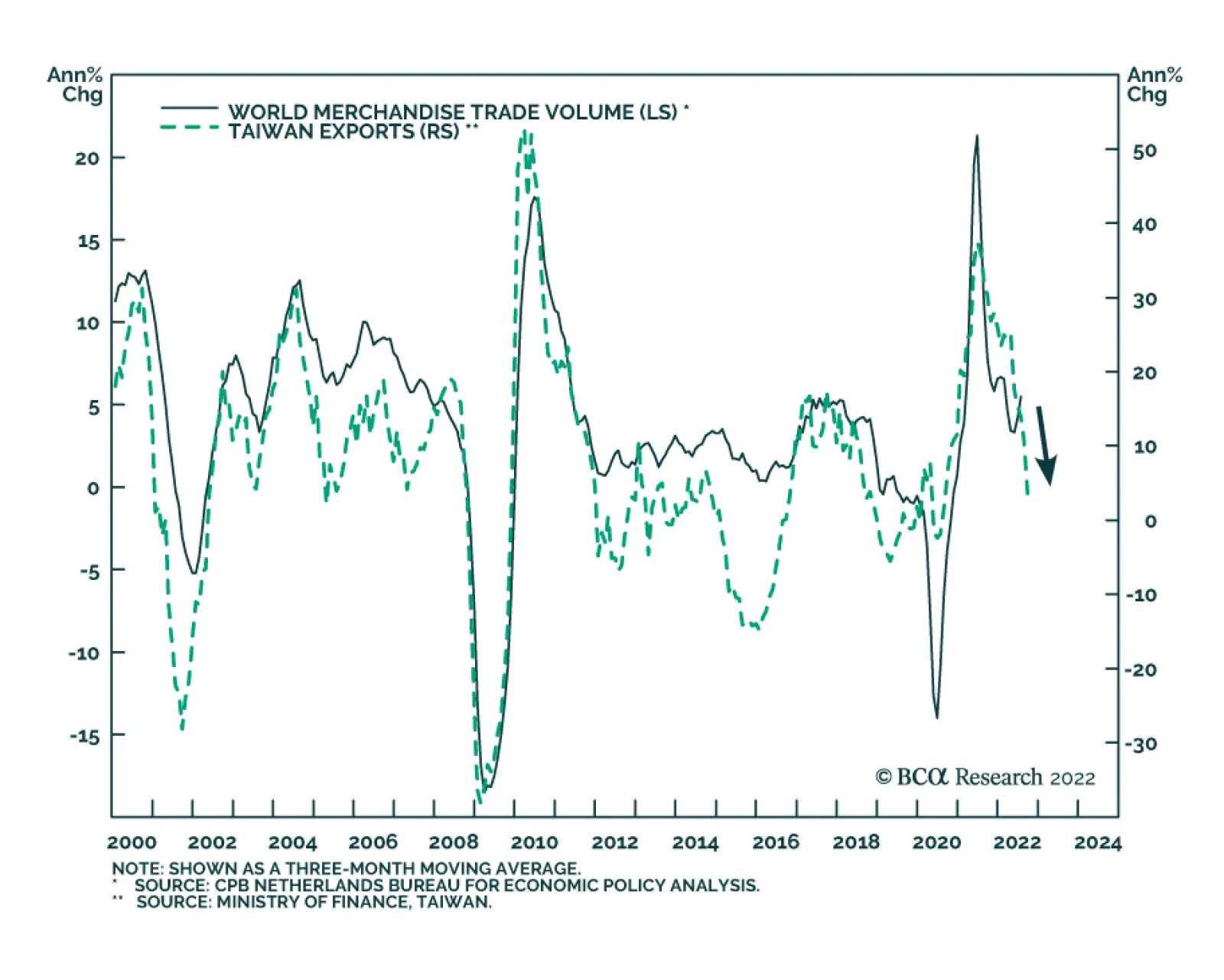

The most recent update from the CPB Netherlands Bureau of Economic Policy Analysis’ World Trade Monitor shows world trade volumes grew 0.7% m/m in July following June’s 0.6% m/m contraction. Although the…

The Hang Seng tech index recently dipped below its mid-March lows before abruptly bouncing back. Although it subsequently gave up some of these gains, it nevertheless ended the week higher. These moves raise the…

OPEC 2.0’s decision to cut 2mm b/d of output beginning in December telescopes the loss of Russian volumes we expect over the course of the coming year. OPEC 2.0 clearly is not playing by the G7’s or the US’s rules. This will keep…

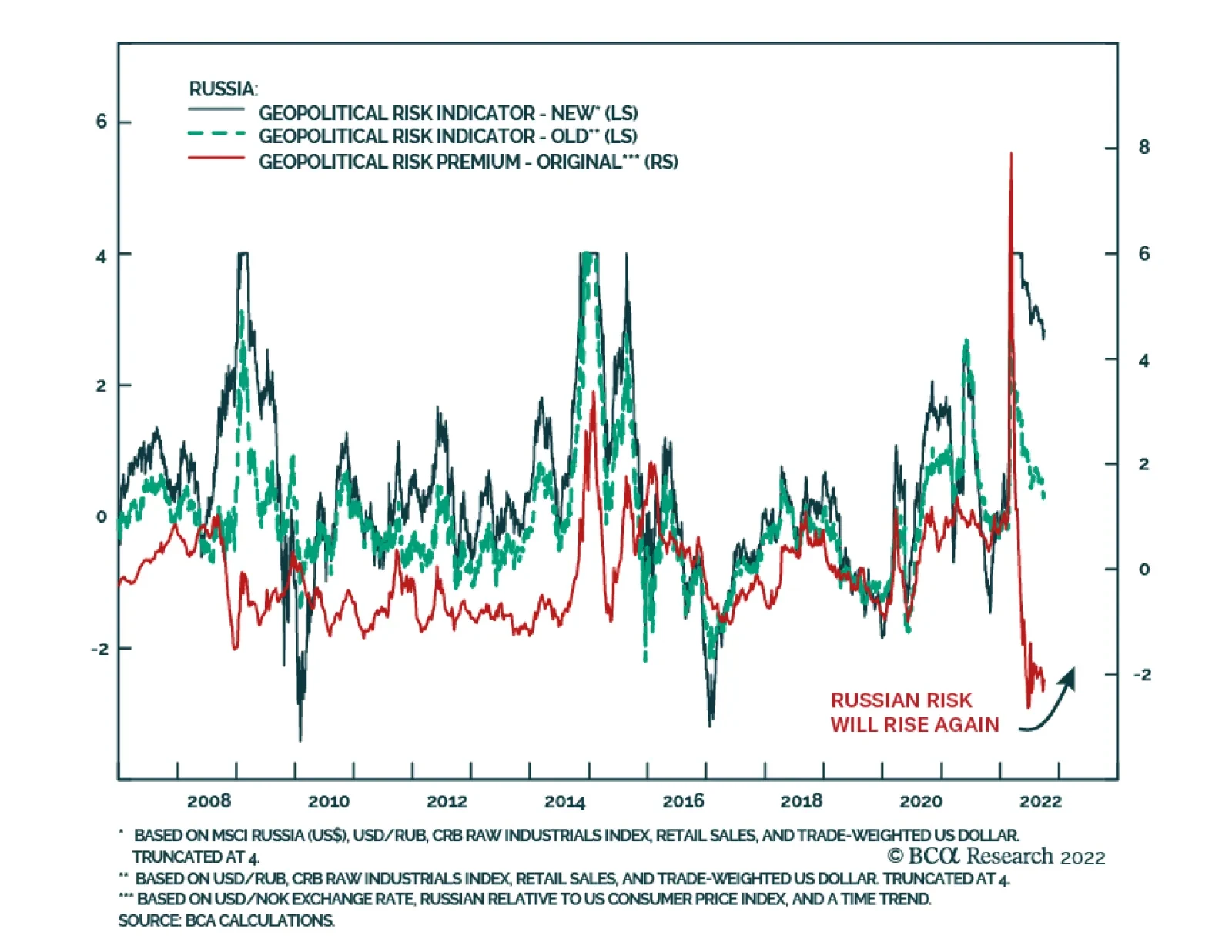

BCA Research’s Geopolitical Strategy service expects Russia’s conflict with the West to escalate and trigger more bad news for risky assets this fall. The “balance of terror” is a variation on…

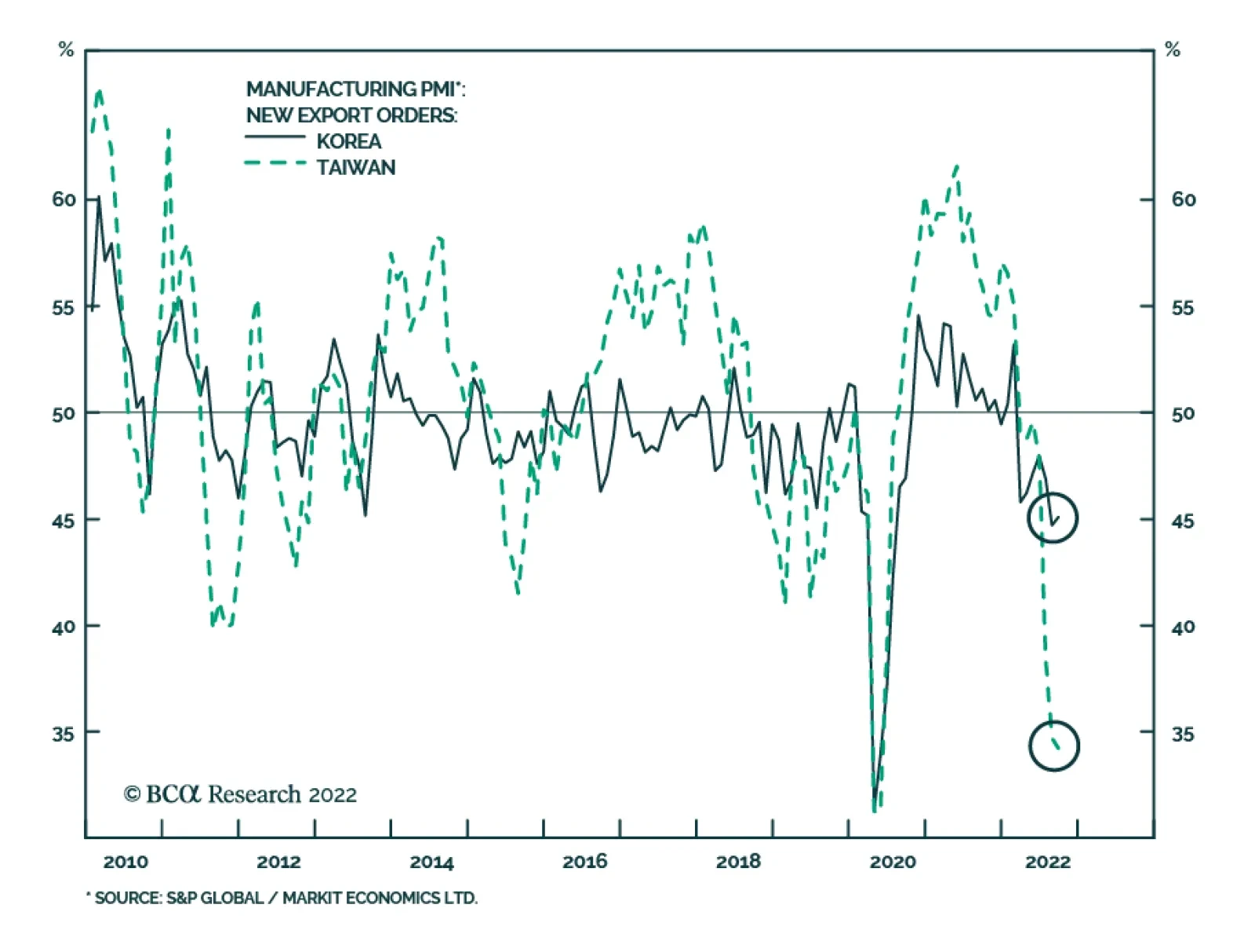

Earlier this week, we highlighted that September’s Manufacturing PMIs provided a bleak signal for global factory activity. Some of the key indicators we track from the PMI releases corroborate this assessment.…

Russia’s conflict with the West will escalate and trigger more bad news for risky assets this fall. Beyond that, stalemate looms. Latin American equities present a potential opportunity once the macro and geopolitical backdrop…

This week we present our Portfolio Allocation Summary for October 2022.

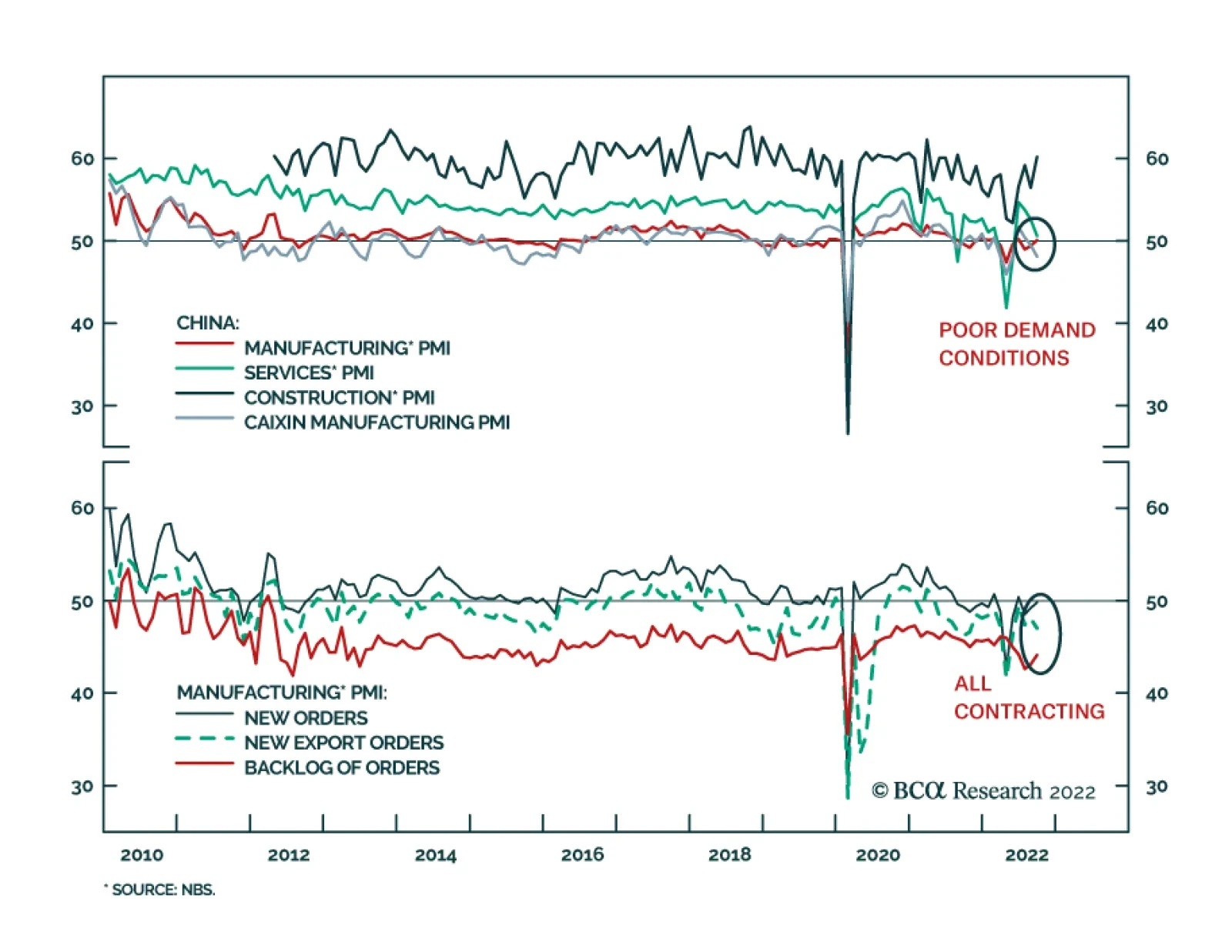

China’s Official PMI data continues to paint a bleak picture of domestic demand conditions. Although the manufacturing index increased by 0.5 points, at 50.1 it is barely above the boom-bust line, and instead suggests…

Investors should go long US treasuries and stay overweight defensive versus cyclical sectors, large caps versus small caps, and aerospace/defense stocks. Regionally we favor the US, India, Southeast Asia, and Latin America, while…