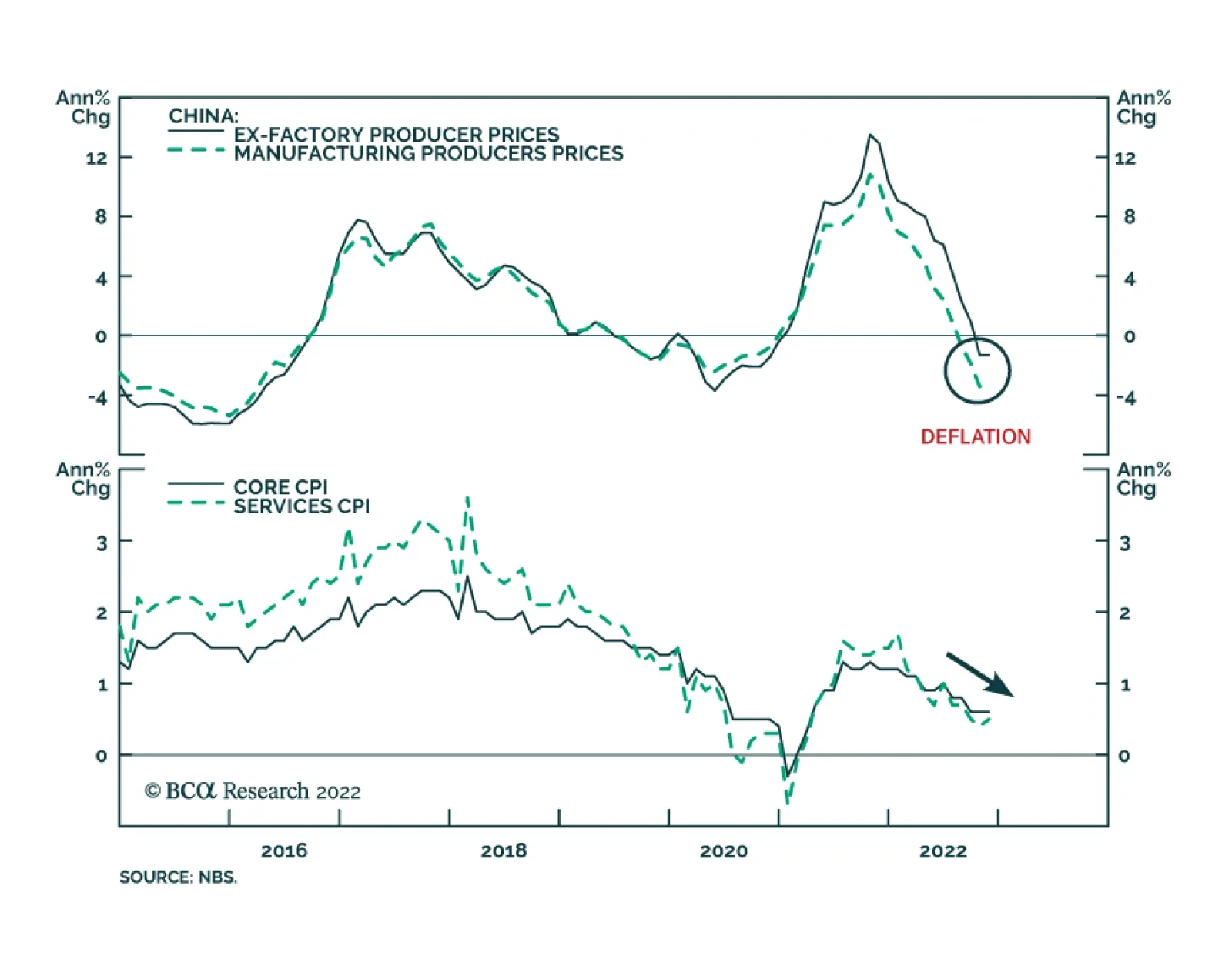

Two main opposing forces will dominate China’s near-term macro outlook. On the one hand, deflationary forces are engulfing the economy. PPI inflation contracted again by 1.3% y/y in November, marking the second…

Prefer government bonds over stocks, defensive sectors over cyclicals, and large caps over small caps. Favor North America over other markets. Favor emerging markets like Southeast Asia and Latin America over Greater China, Turkey,…

In this Strategy Outlook, we present the major investment themes and views we see playing out next year and beyond.

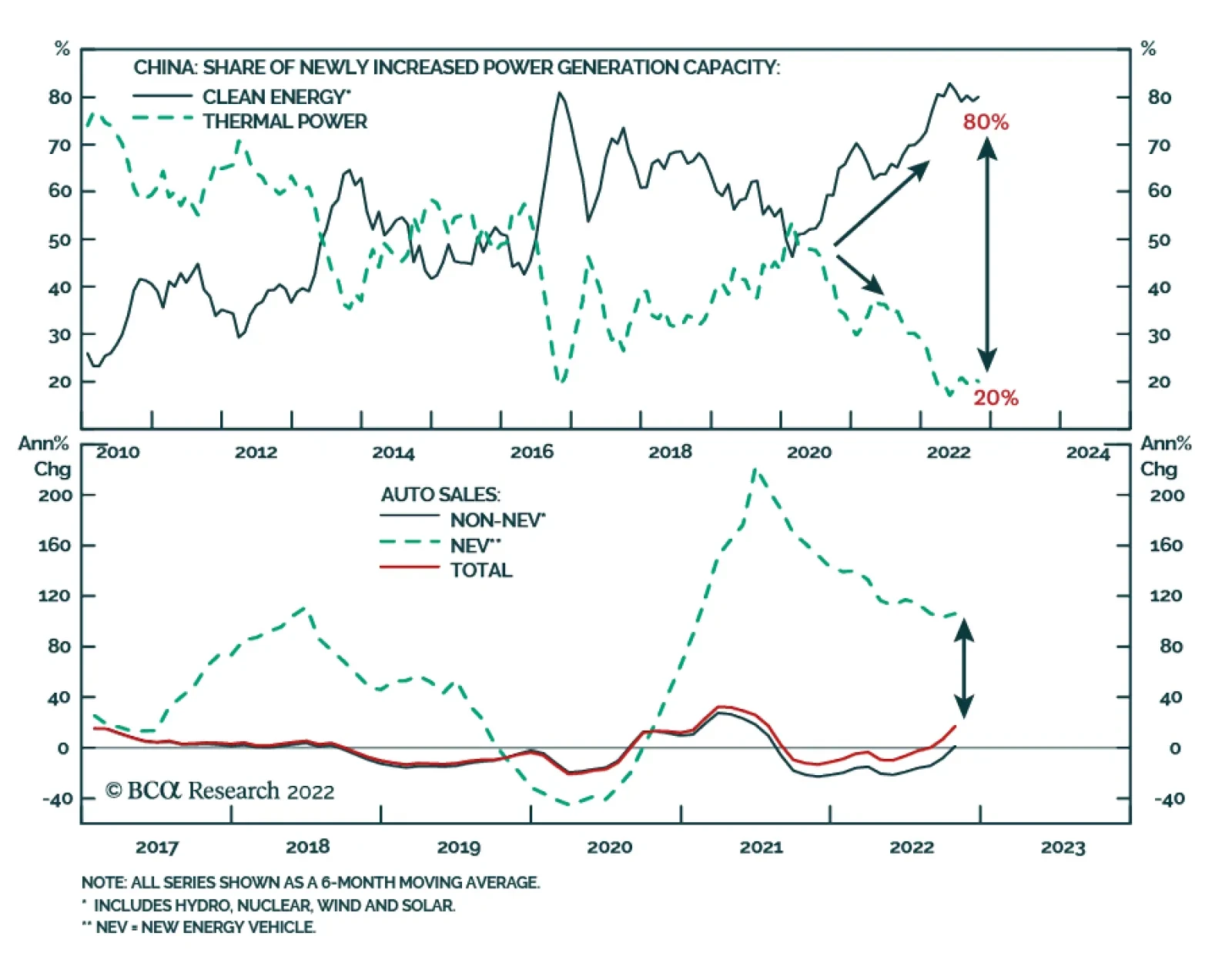

BCA Research’s China Investment Strategy service expects the country’s green and tech infrastructure investment to continue to boom in 2023 and beyond. China’s tech infrastructure investment skyrocketed by…

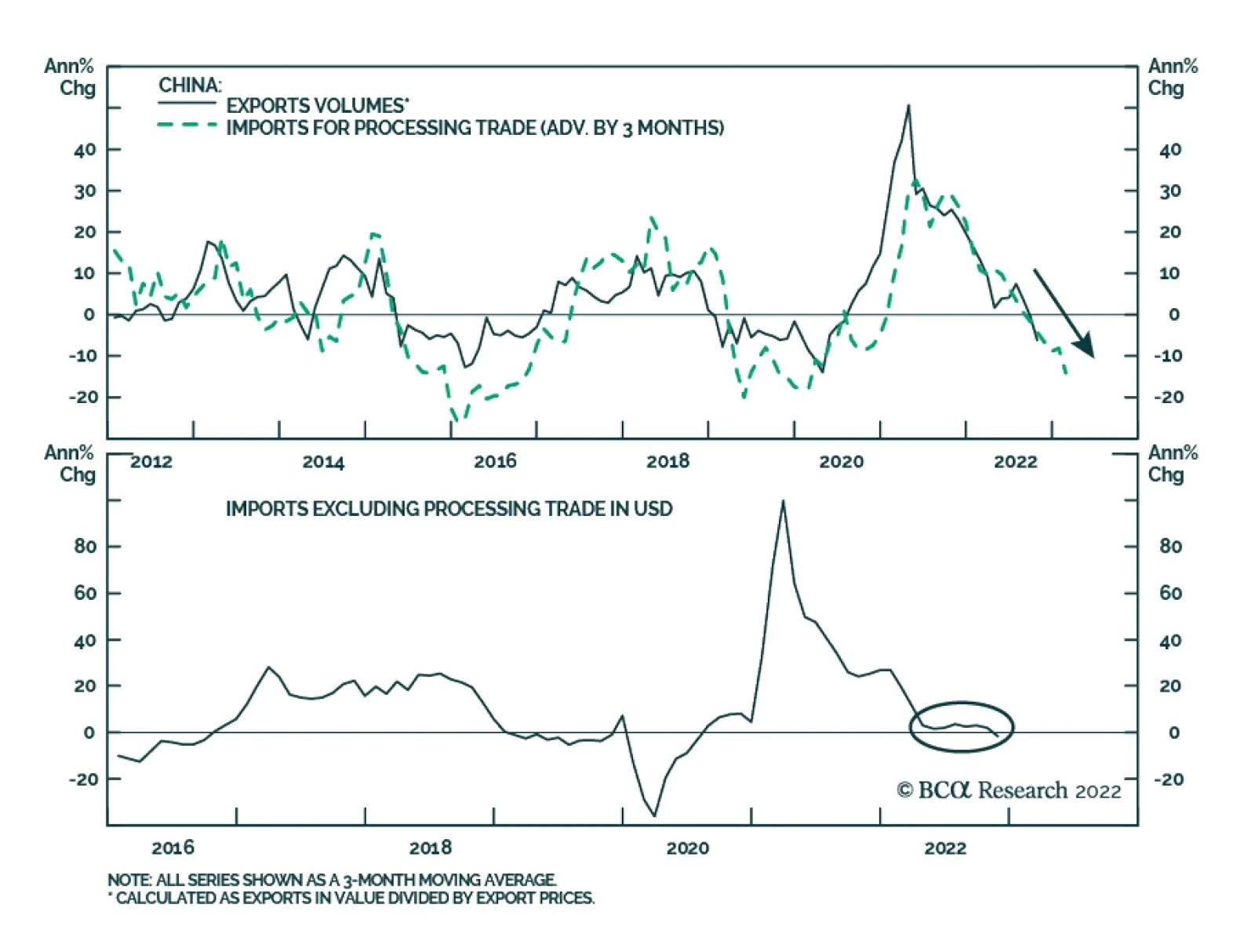

Chinese import and export growth both disappointed and signal that the Chinese economy continues to face acute global and domestic headwinds. Imports collapsed by 10.6% y/y in USD terms following October’s 0.7% y/y decline…