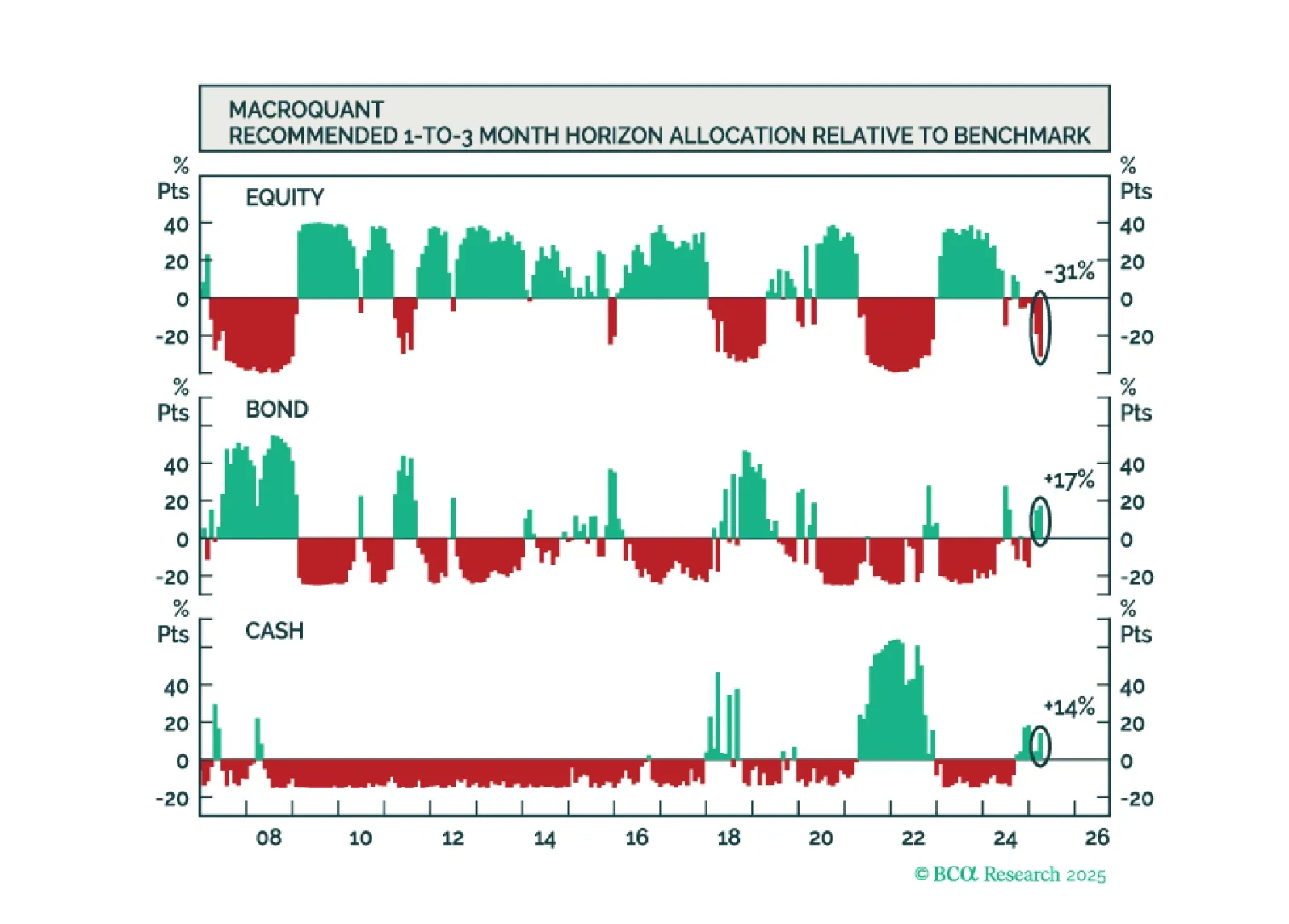

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

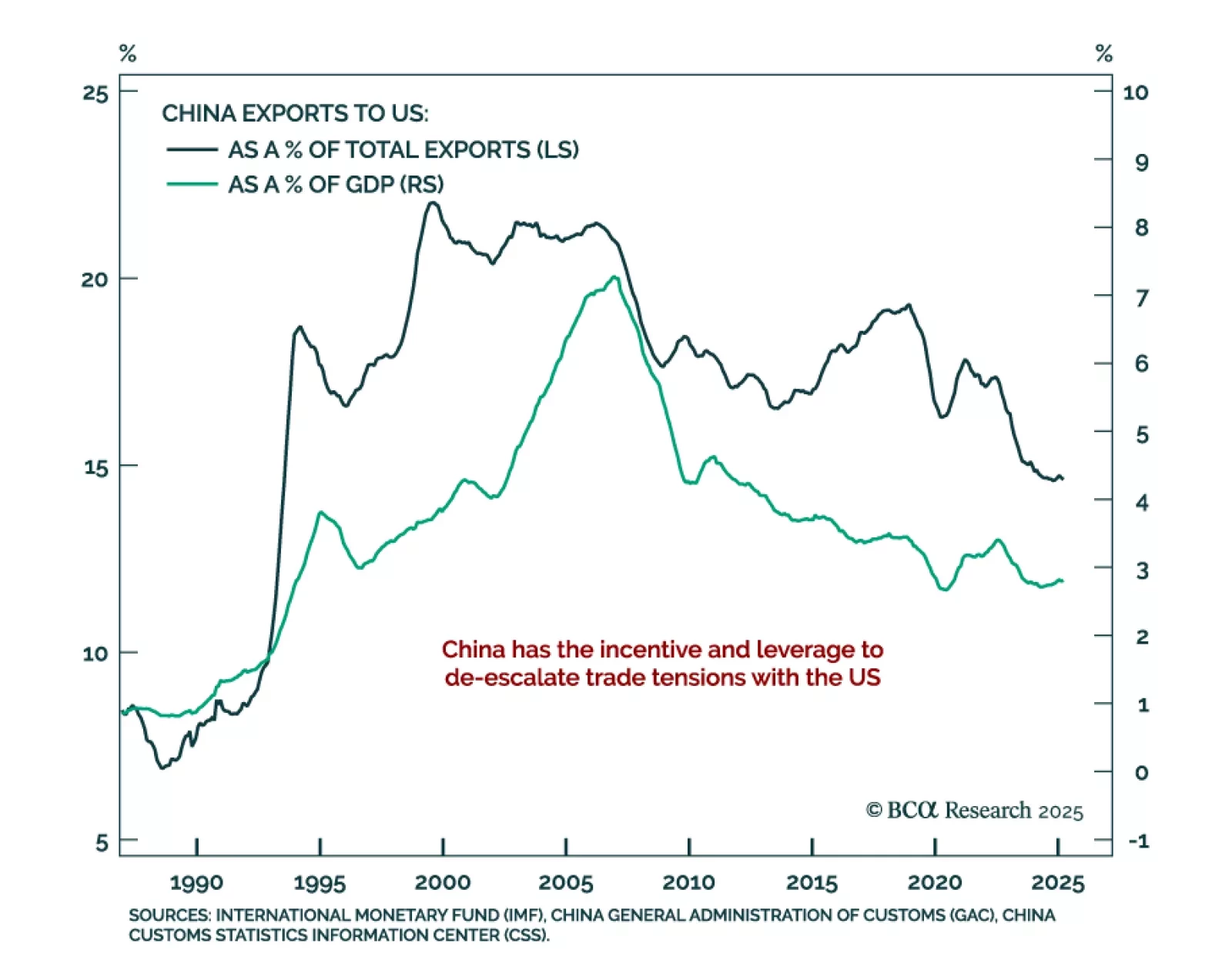

Trade headlines shift too fast to interpret reliably, but cutting through the noise reveals the US is pivoting from escalation to de-escalation. As the equity and bond selloff intensified, the tone from Washington softened,…

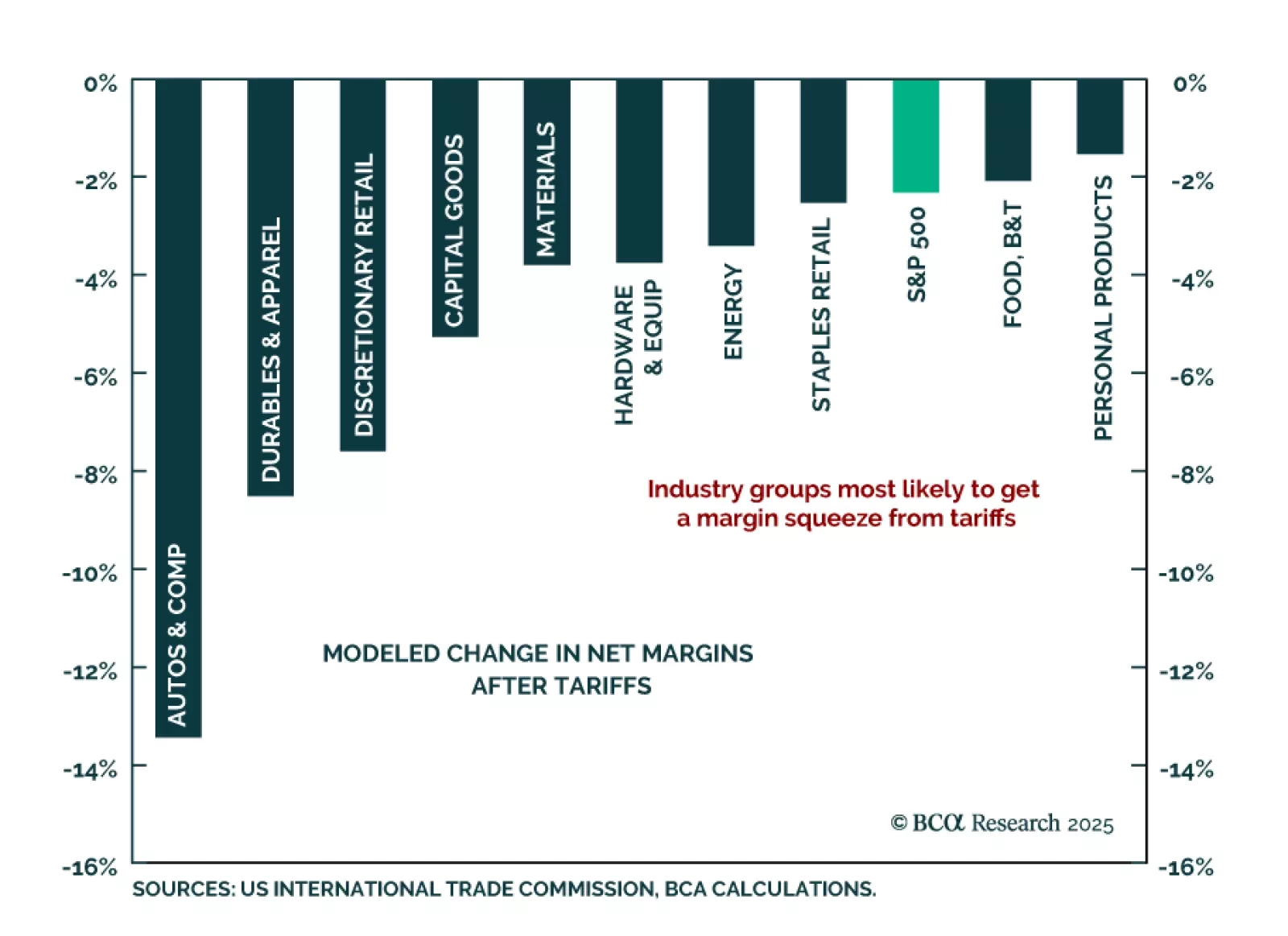

Our US Equity strategists warn that tariffs will meaningfully compress S&P 500 margins, with little pricing power to offset rising input costs. A two-point hit to net margins and falling multiples will drive earnings downgrades…

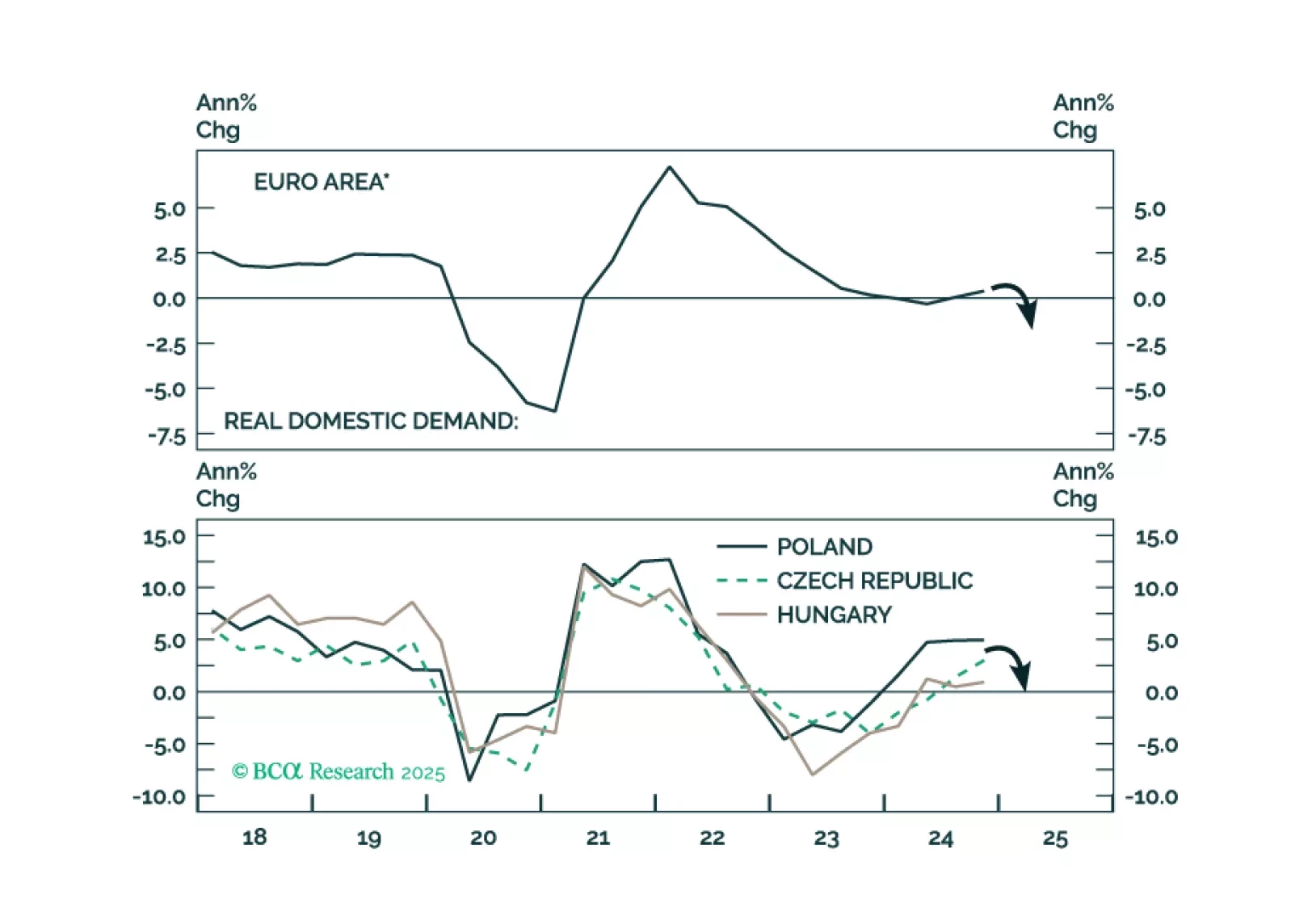

The European economies are facing a major deflationary shock. We recommend that investors stay long a basket of Central European (CE3) domestic bonds. They should also upgrade CE3 bonds and stocks in their respective EM portfolios.

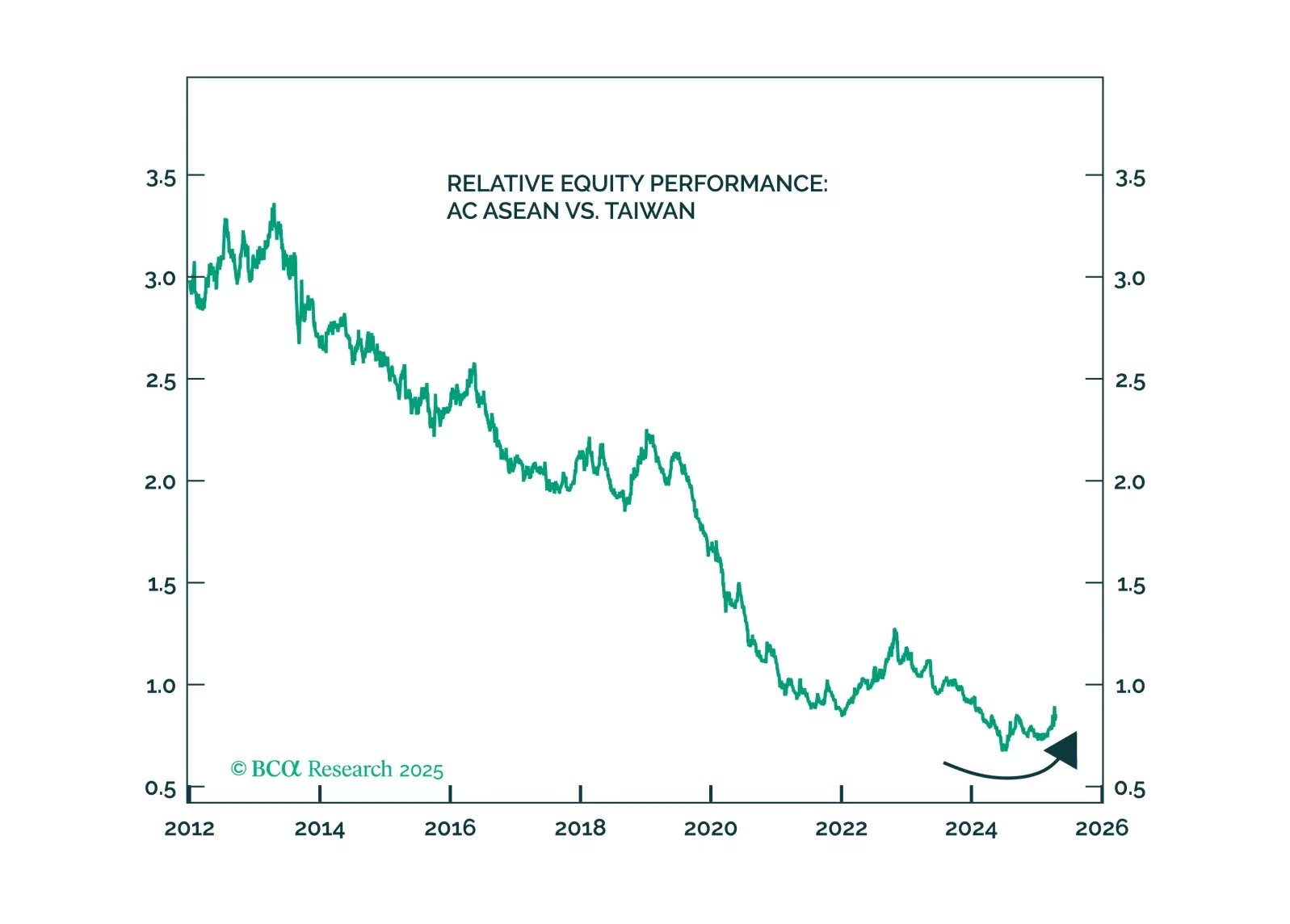

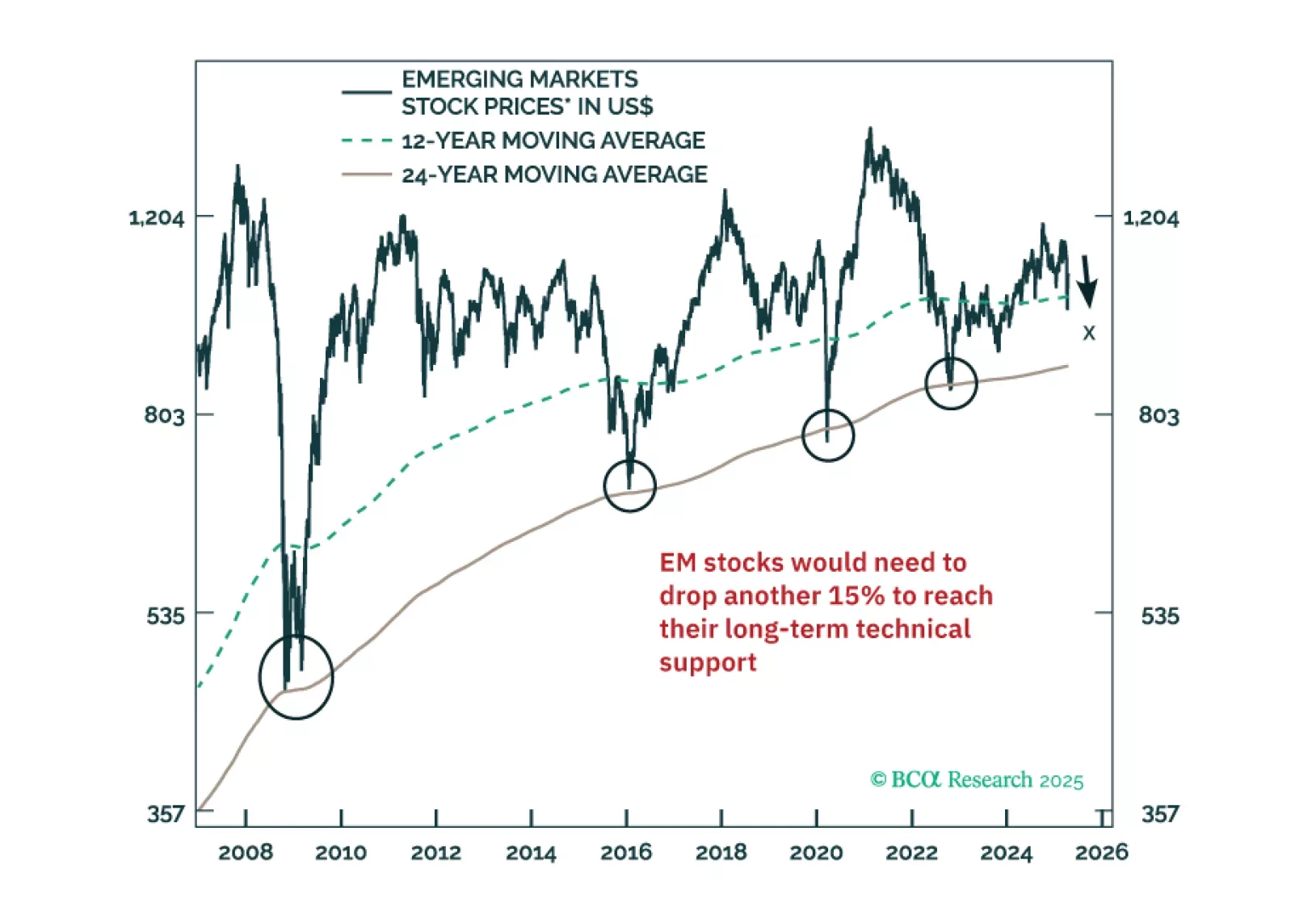

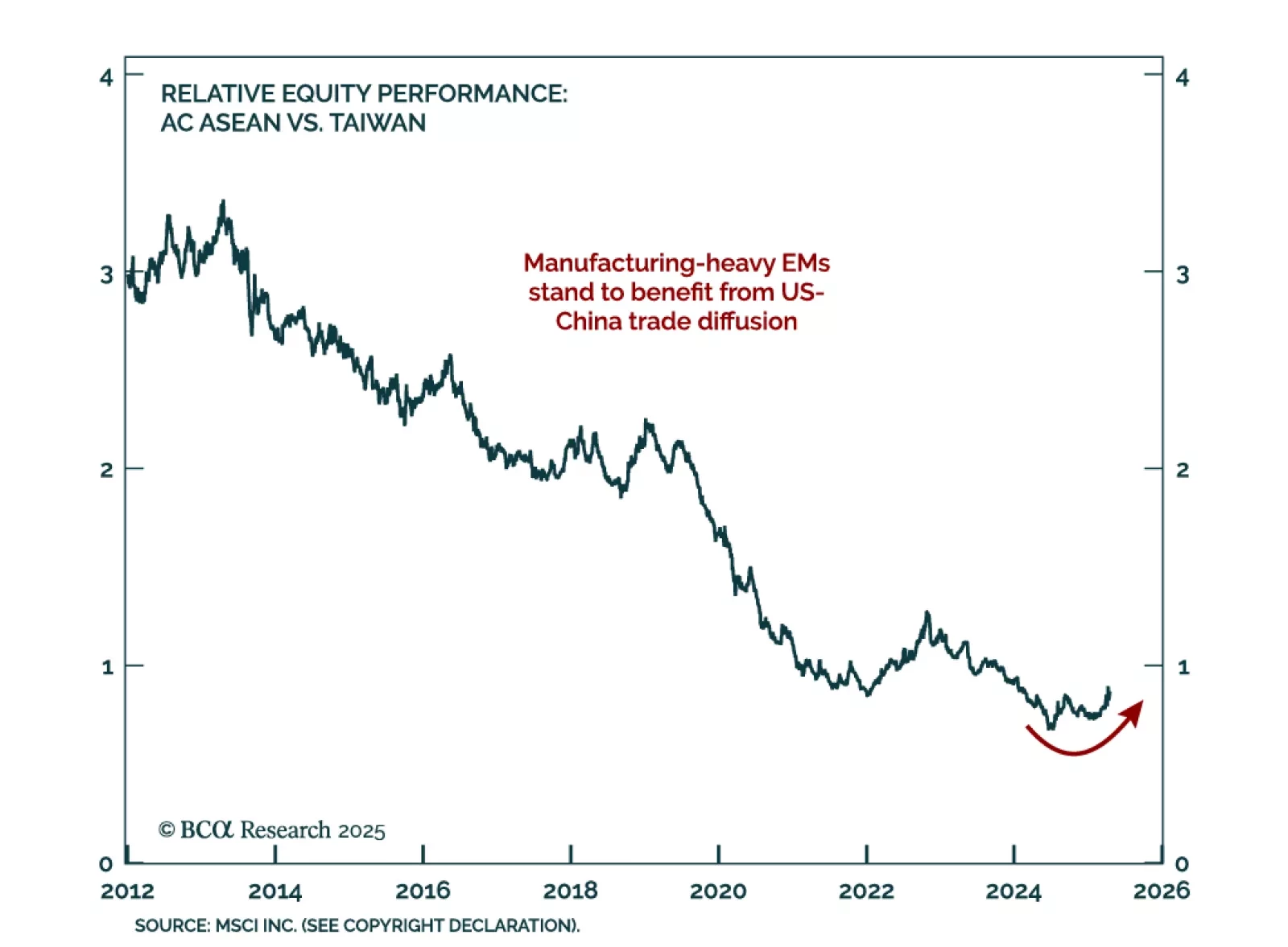

Our Geopolitical and GeoMacro strategists recommend buying tail-risk protection and adding exposure to manufacturing-oriented EMs as the risk of US-China military escalation rises. They now see a 10% chance of full-scale war over…

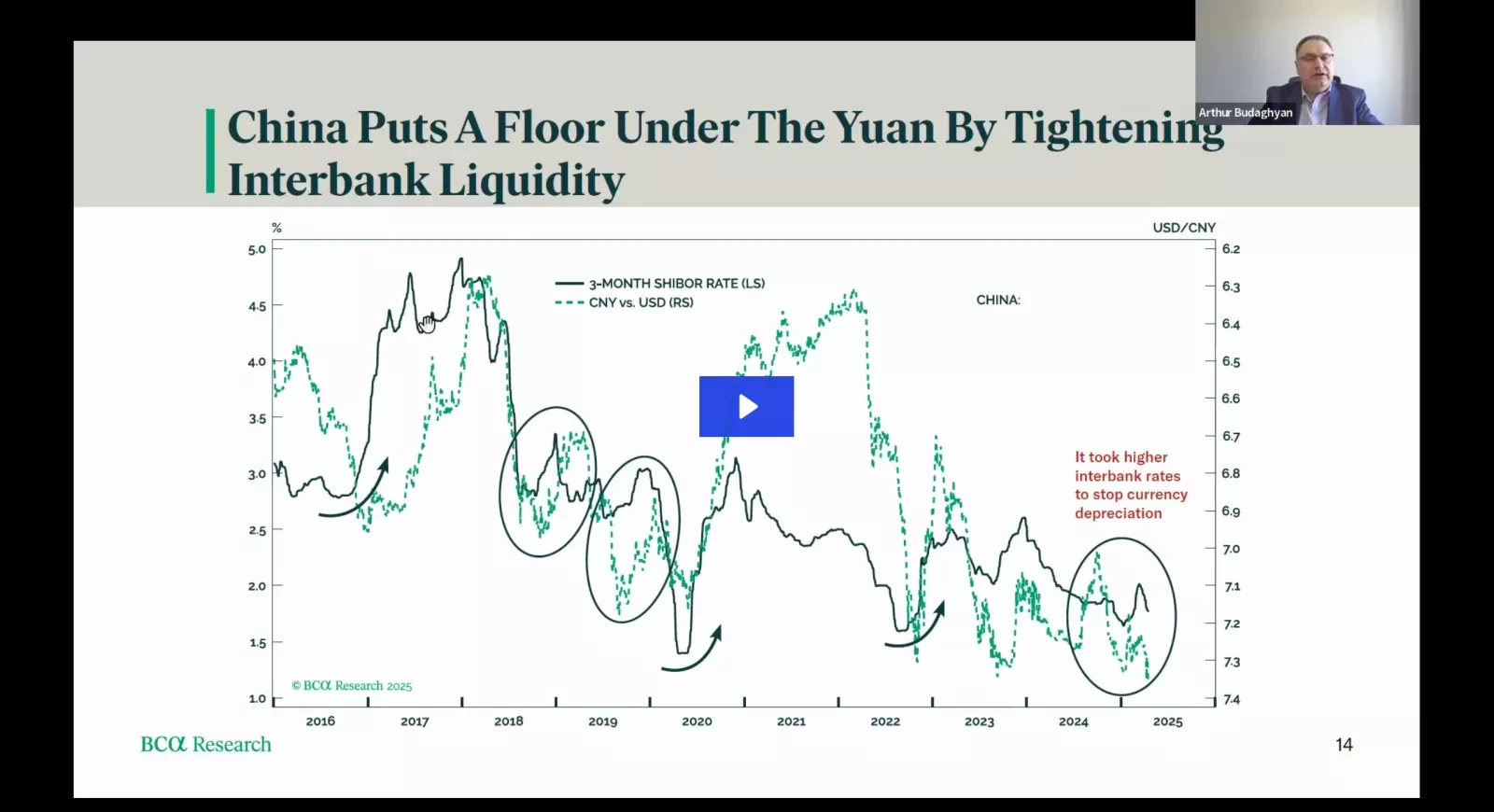

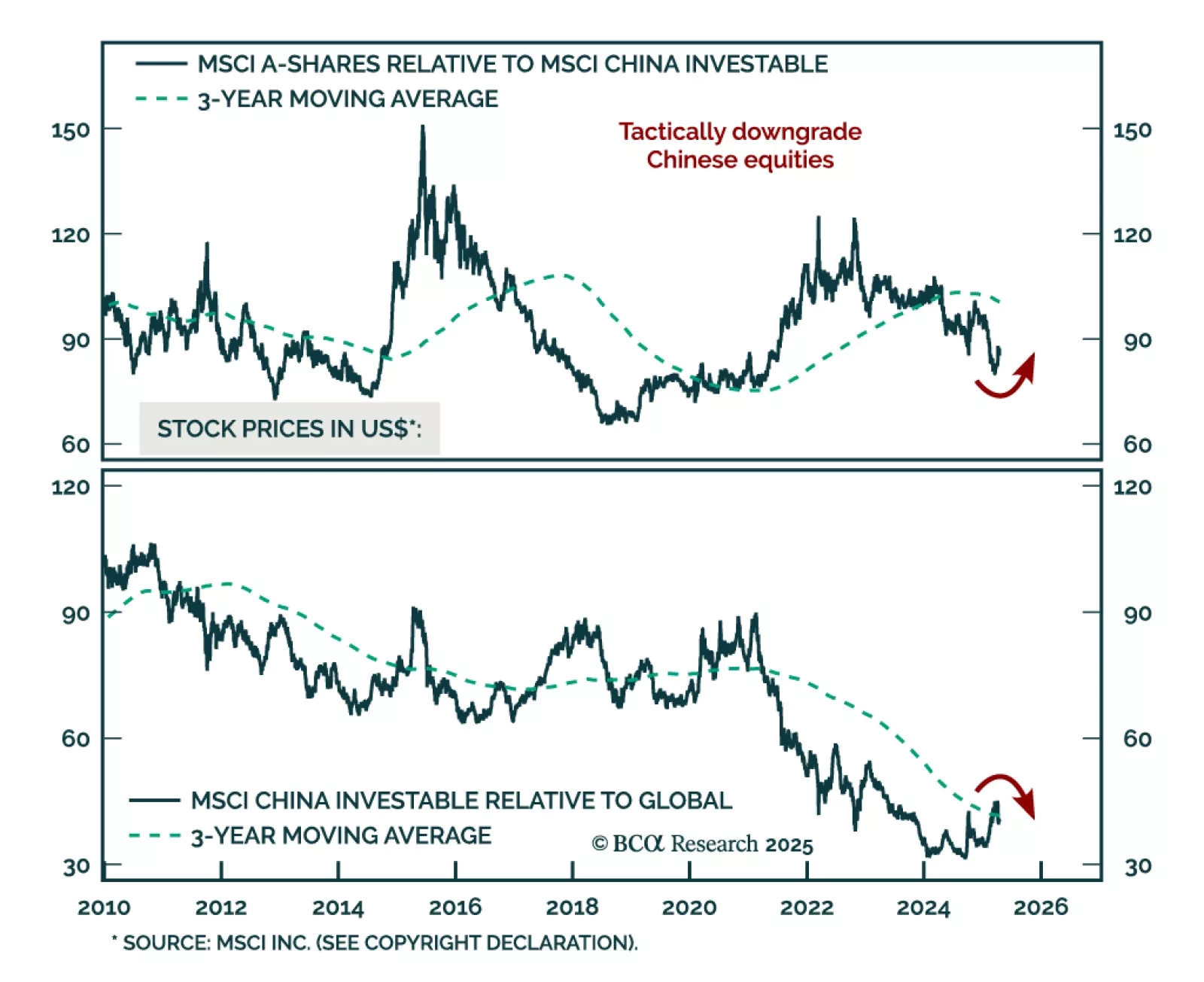

Our China strategists remain defensive and tactically downgrade MSCI China to underweight, citing escalating US China tariff tensions and subdued domestic demand. Favor government bonds over equities, defensive sectors, and A-Shares…

We are pleased to share the replay of Emerging Markets Webcast "Regime Shifts In Global Macro And The Implications", hosted by Chief EM & China Strategist Arthur Budaghyan.

Even after policymakers retract their prejudicial actions, financial markets might continue selling off. We compare the current tariff shock with two past episodes when policy reversals did not produce market turnarounds: (1) the RMB…