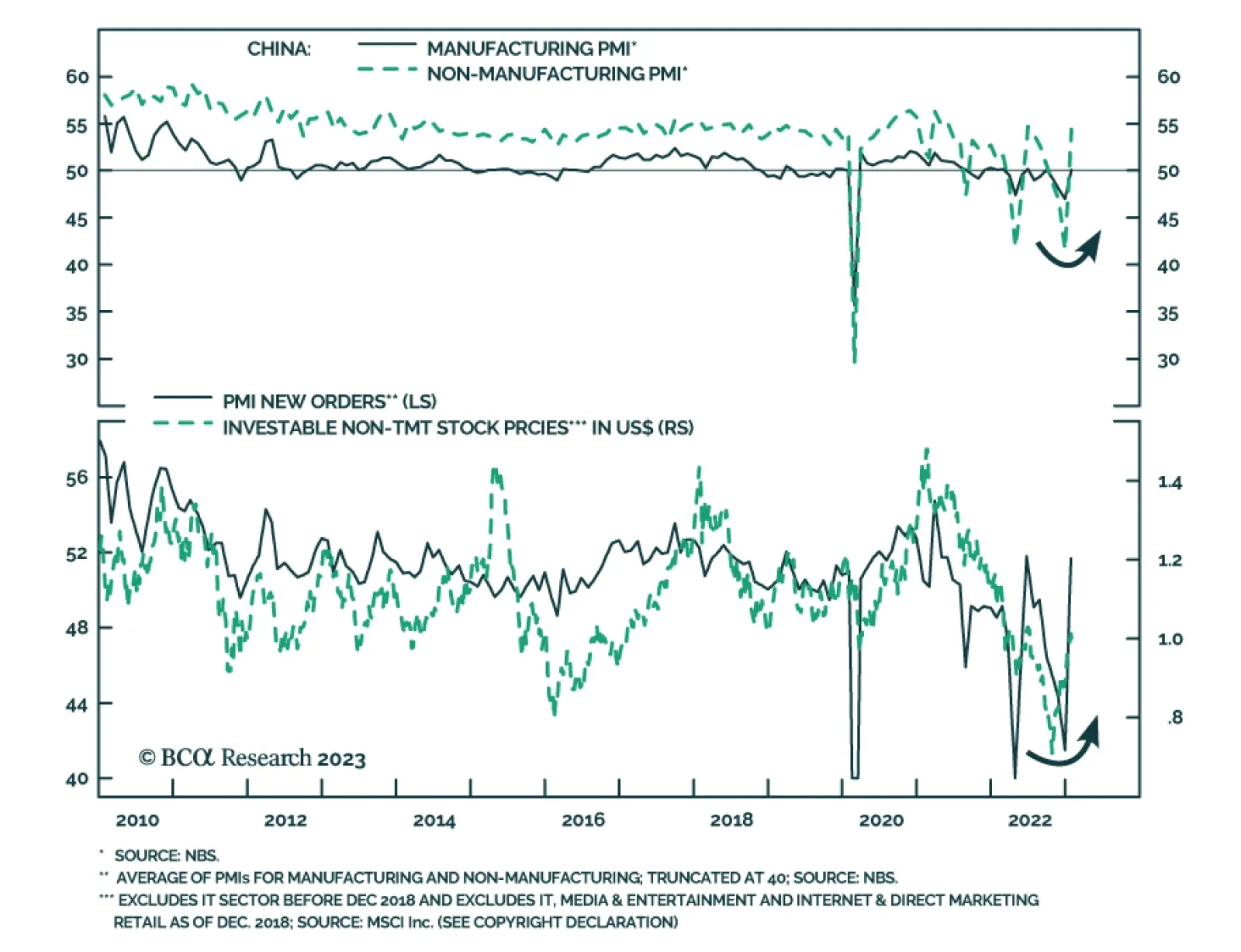

China’s NBS PMI release delivered a positive surprise for January. Both the manufacturing and the non-manufacturing indices returned to expansion, suggesting that economic activity is gaining momentum following Beijing…

Remain cautious and defensive overall. Stay long DM Europe over EM Europe. Look for EM opportunities in Southeast Asia and Latin America over Greater China.

In Section I, we explain why we do not see the deceleration in US inflation, the likely near-term pickup in European growth, and the end of China’s dynamic zero-COVID policy as signs of a sustainable rebound in global economic…

It is not unusual for a period of rebounding share prices to occur between an inflation-driven selloff and a growth scare. Initially, stocks rally on falling inflation and prospects of lower interest rates. Then, worries about…

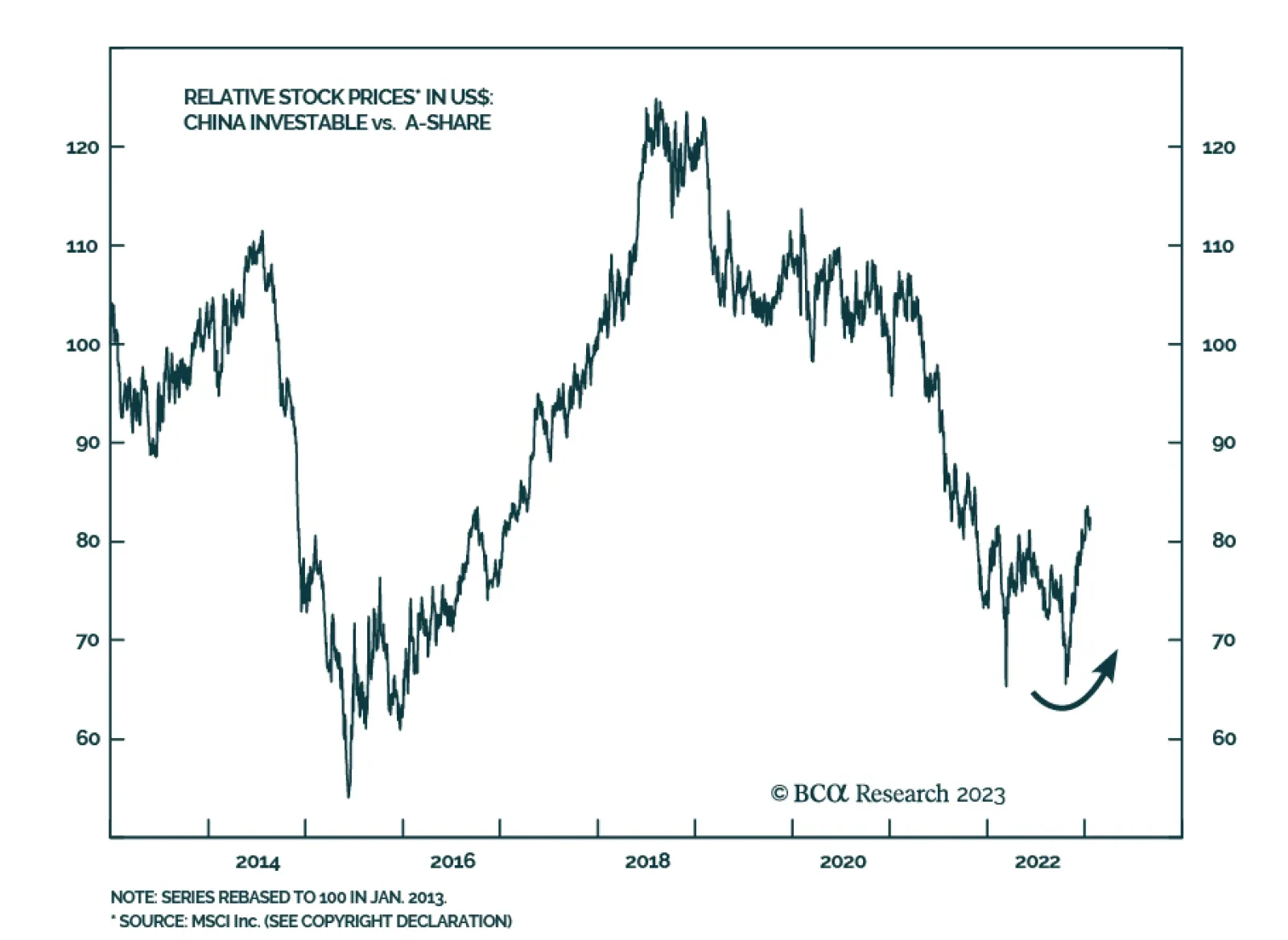

Chinese investable stocks have benefited more from Beijing’s reopening plans and pro-growth policy pivot than their onshore peers. The former’s 55% gain in USD terms since its October 31 bottom is more than double the…

In EM ex-China, growth will continue decelerating. Some economies will experience an outright recession, while most will have a growth recession. Nearly every single economy will experience a cyclical drop in inflation (with the…

China’s re-opening – powered by the fiscal and monetary stimulus required to achieve at least 5% real GDP growth after flattish 2022 growth – and a weaker USD will catalyze demand growth this year and next, lifting global oil…

This insight presents an outlook on USD-Denominated Emerging Market Bonds.