The tempo of China’s and the US’s military operations is picking up sharply. The risk of a sudden, perhaps unintended, escalation of military conflict, therefore, is rising in the South China Sea. So is the risk of another shooting…

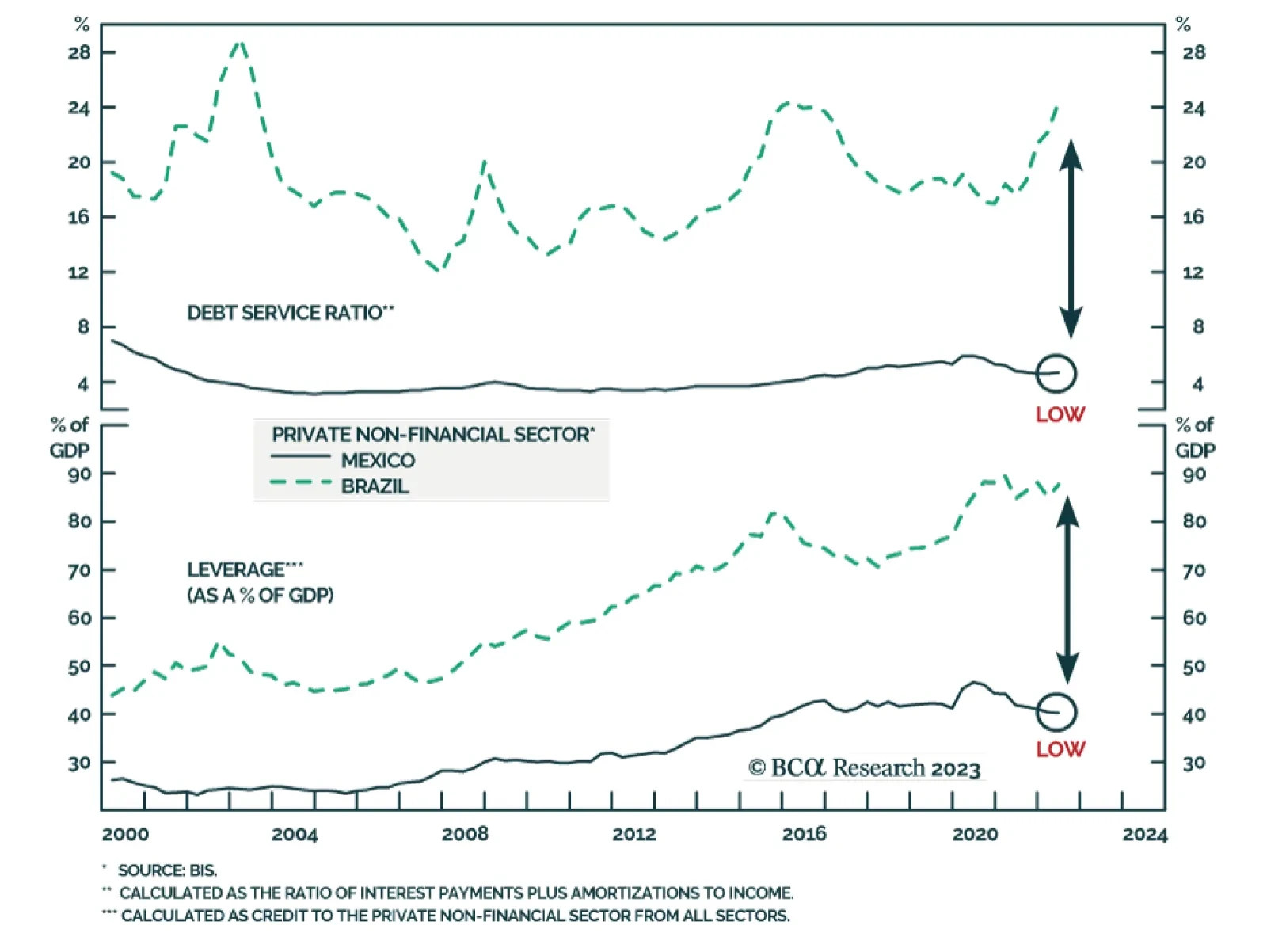

BCA Research’s Emerging Markets Strategy service recommends investors go long Mexican bank stocks / short Brazilian banks, currency unhedged. Bank stocks have been the strongest performers in the Mexican bourse over the…

This week we present our Portfolio Allocation Summary for February 2023.

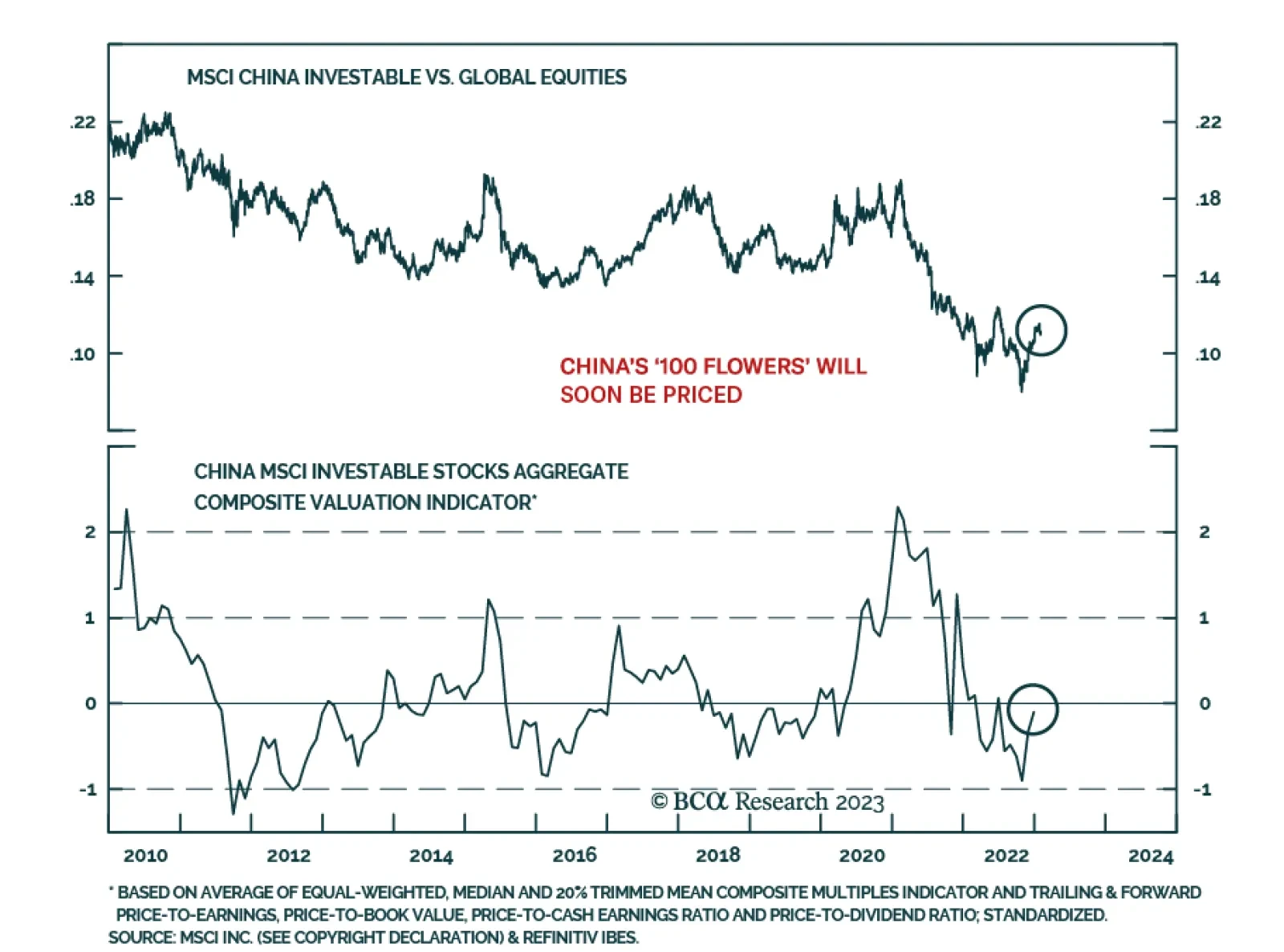

According to BCA Research’s Geopolitical Strategy service, the demographic and property bust combined with US-China geopolitical competition have permanently damaged China’s growth potential. The year has started…

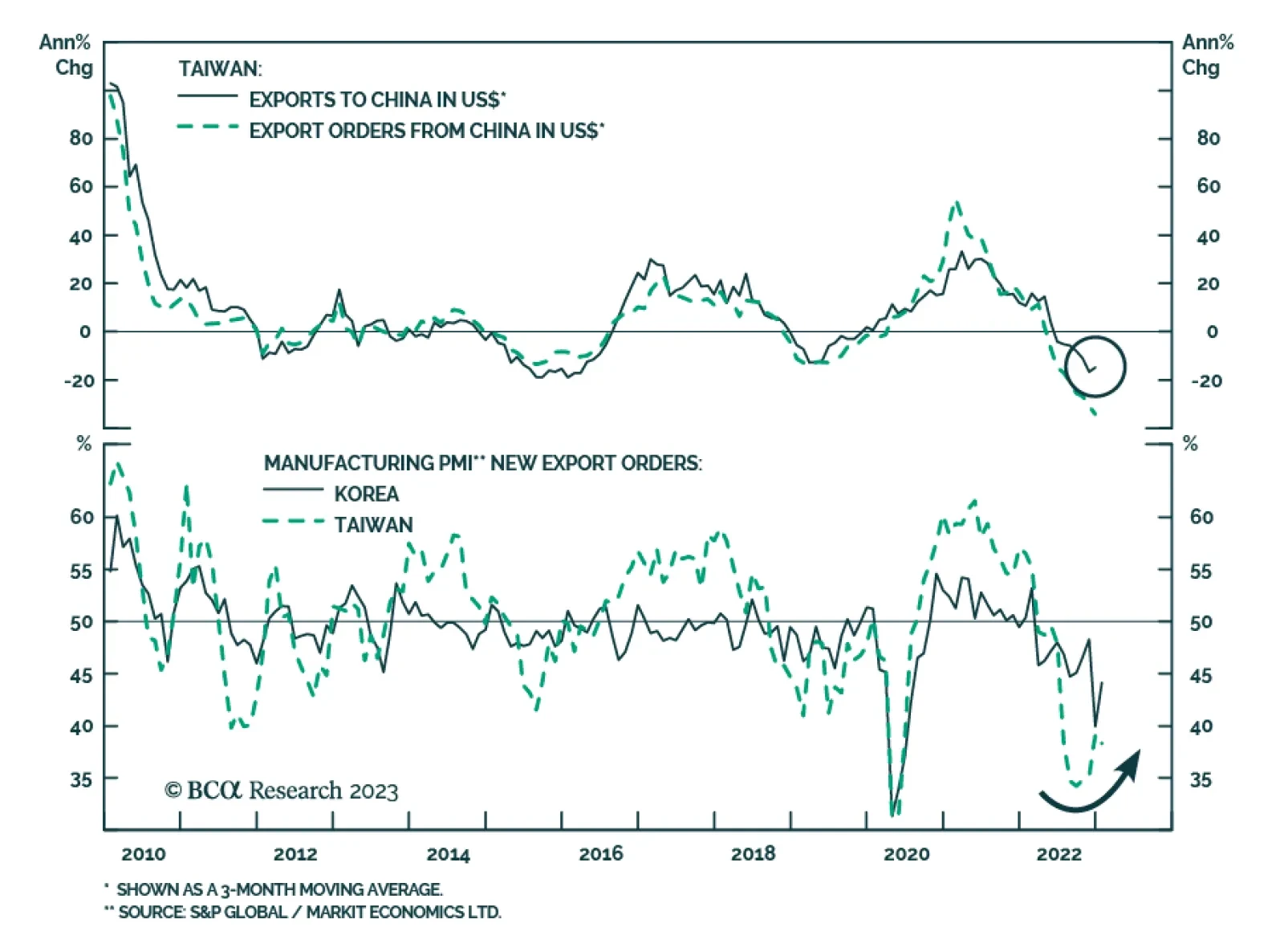

Some of the recent data have been less bleak about manufacturing conditions in Asia. In particular, at 38.3 in January, the New Export Orders index from the Taiwanese Manufacturing PMI is off its September 2022 low of 34.2.…

The risk-on rally is challenging our annual forecast so we are cutting some losses. But we still think central banks and geopolitics will combine to reverse the rally later this year.

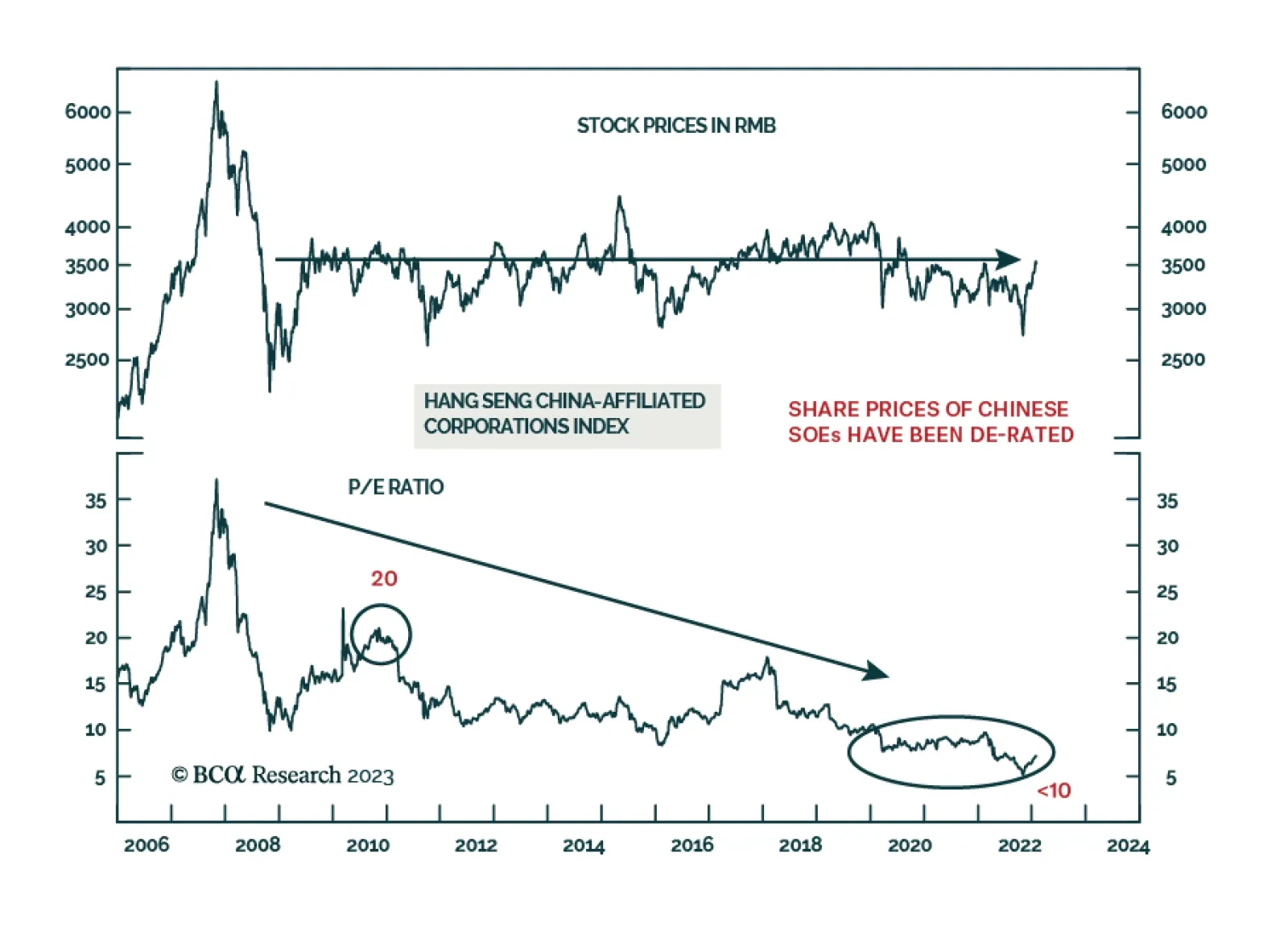

According to BCA Research’s China Investment Strategy service, the stocks of China’s largest platform companies are unlikely to experience a structural uptrend. Over time, Chinese platform companies will likely…

When does rising unemployment become a bigger problem than inflation? The Fed won't cut rates until that happens, probably thwarting market hopes of big cuts in 2H.