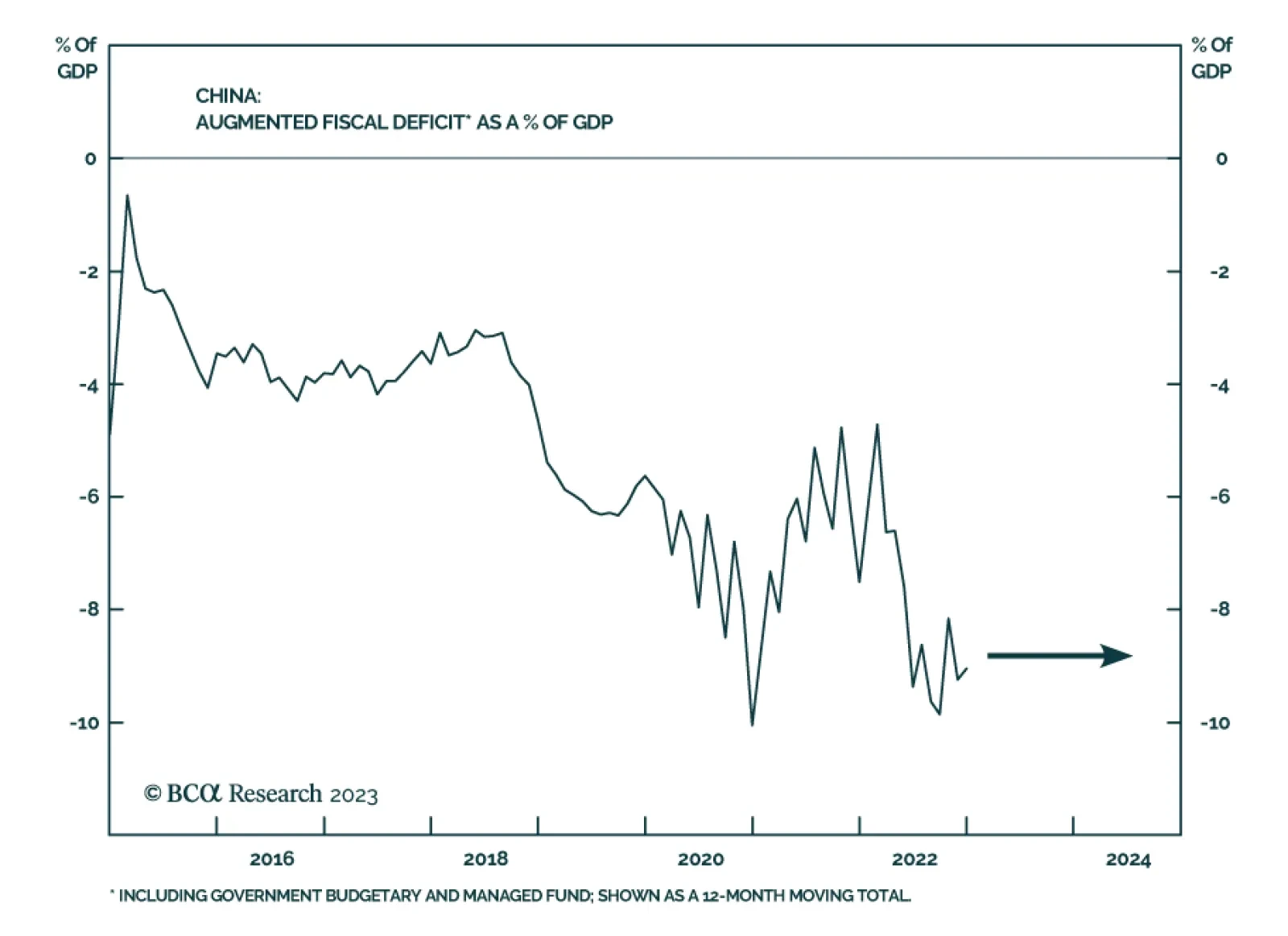

China’s legislative session, which formally opened on March 5, should be seen as a tentative disappointment for global risk assets and cyclical markets and sectors. While China is reopening from strict Covid-19 restrictions…

This week we present our Portfolio Allocation Summary for March 2023.

The Chilean economy is entering a recession. Inflation will drop rapidly and the central bank will cut rates meaningfully in H2 2023. We continue to recommend a structural overweight across Chilean risk assets on the basis of falling…

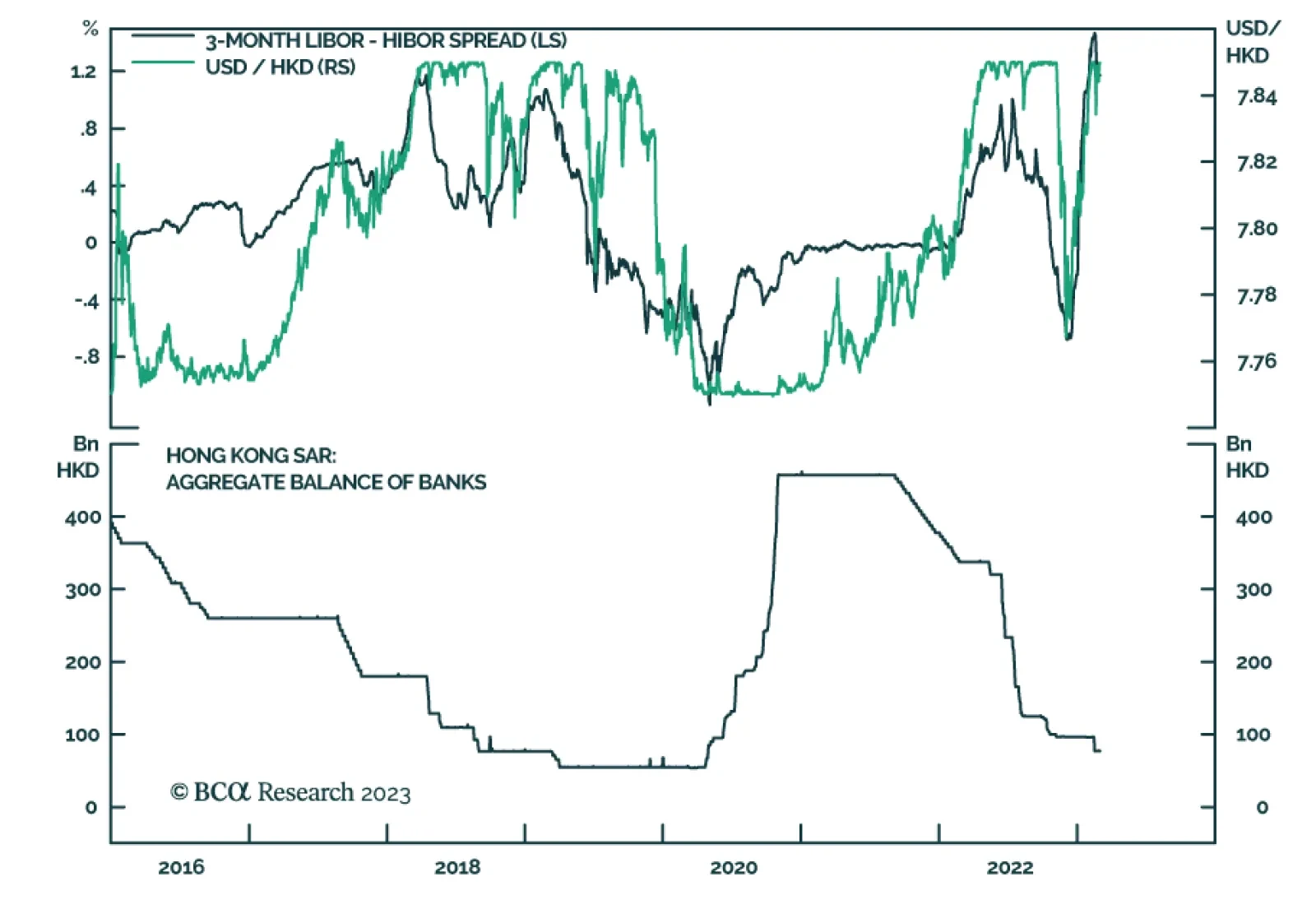

Since December of last year, USD/HKD has been trading on the weaker side of its convertibility band, around 7.85. In fact, up until November of 2022, HKD weakness prompted the monetary authorities to heavily intervene in foreign…

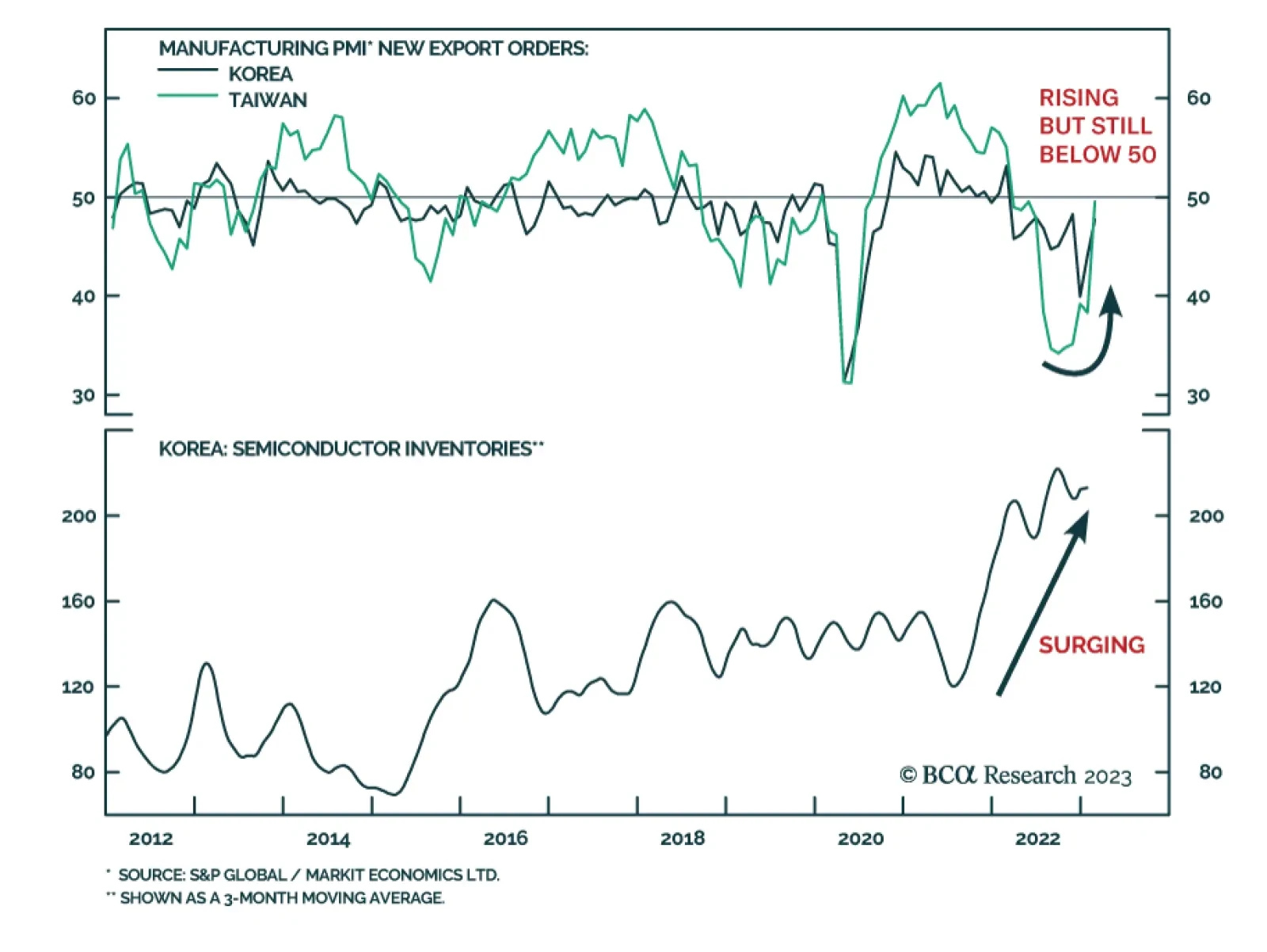

The sharp rebound in China’s NBS and Caixin PMIs indicate that manufacturing activity accelerated in February – not too surprising given that it comes on the back of the post-lockdown economic reopening. What is…

China’s housing market adjustment will be protracted, causing several years of sub-par growth in the world’s second largest economy. We go through the major investment implications.

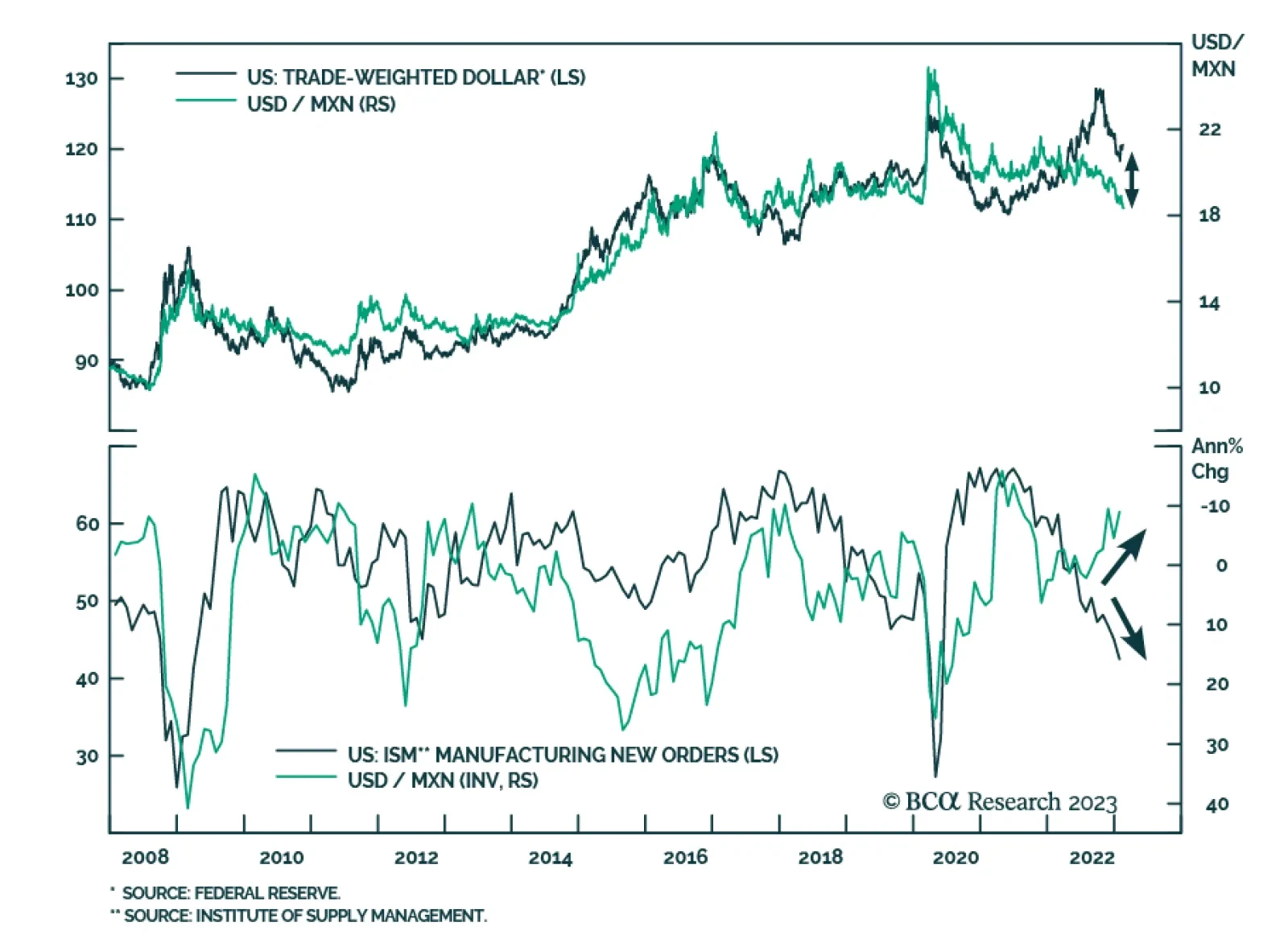

The Mexican peso is the only major currency that has appreciated against the US dollar since the greenback’s February 2 bottom. Notably, USD/MXN has lost 1% over this period, despite the broad trade weighted dollar’s…

Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…