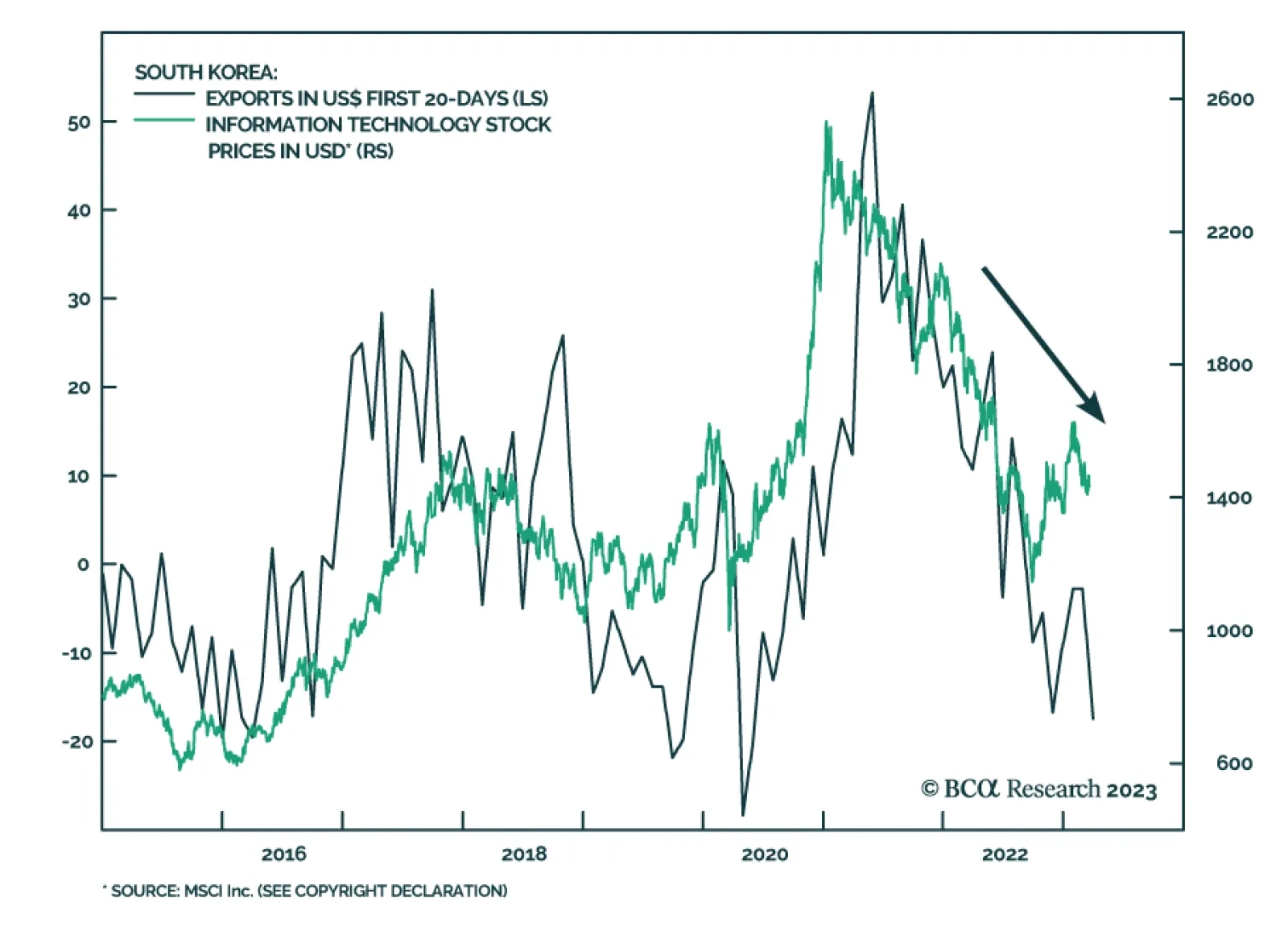

The deep contraction in South Korean exports corroborates the signal from other Asian trade data that global demand for manufactured goods remains weak. Exports dropped by 17.4% y/y in the first 20 days of March, marking the…

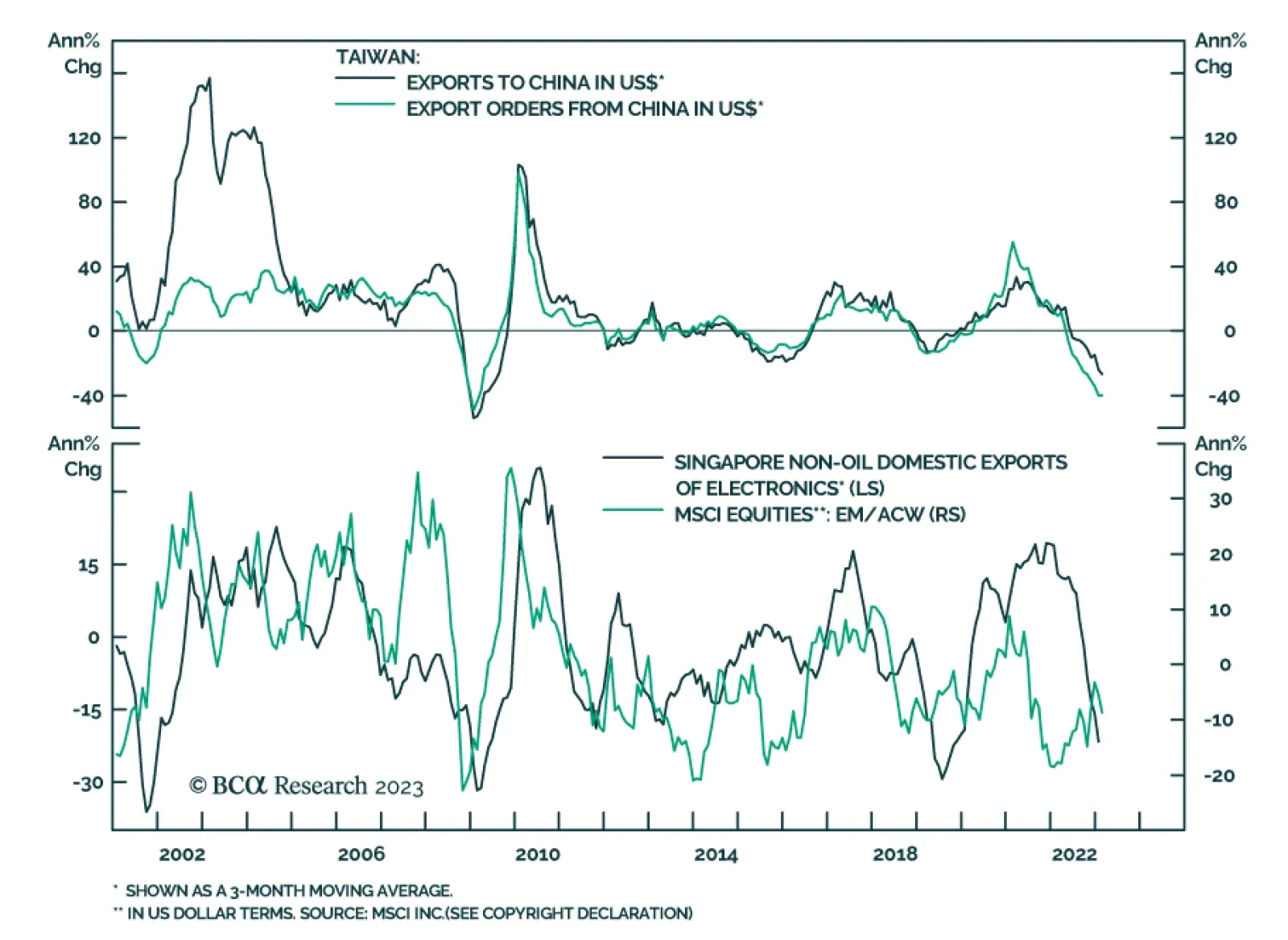

Asian trade data continue to send a negative signal for the global manufacturing cycle. Taiwanese export orders contracted for the sixth consecutive month in February, declining by 18.3% y/y. The weakness remains broad-based…

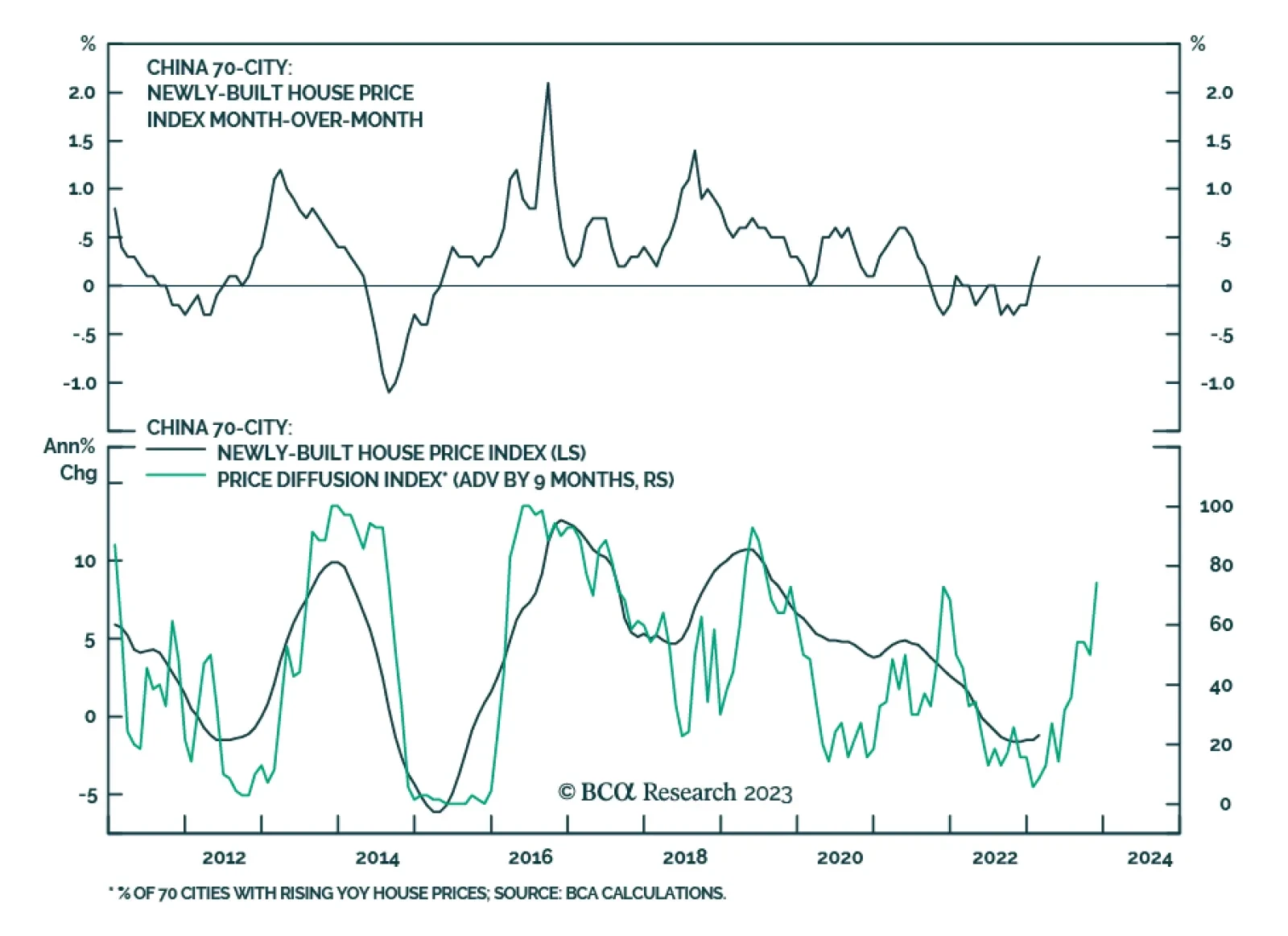

The 70-city average price of a new house in China ticked up by 0.3% m/m in February, registering the first monthly increase since August 2021. Notably, this trend is broad-based across Chinese cities with new house prices rising…

China’s victory in getting KSA and Iran to restore diplomatic relations is of far greater consequence to commodity markets than the past weeks’ bank failures in the US. For China, further success in sorting long-standing security…

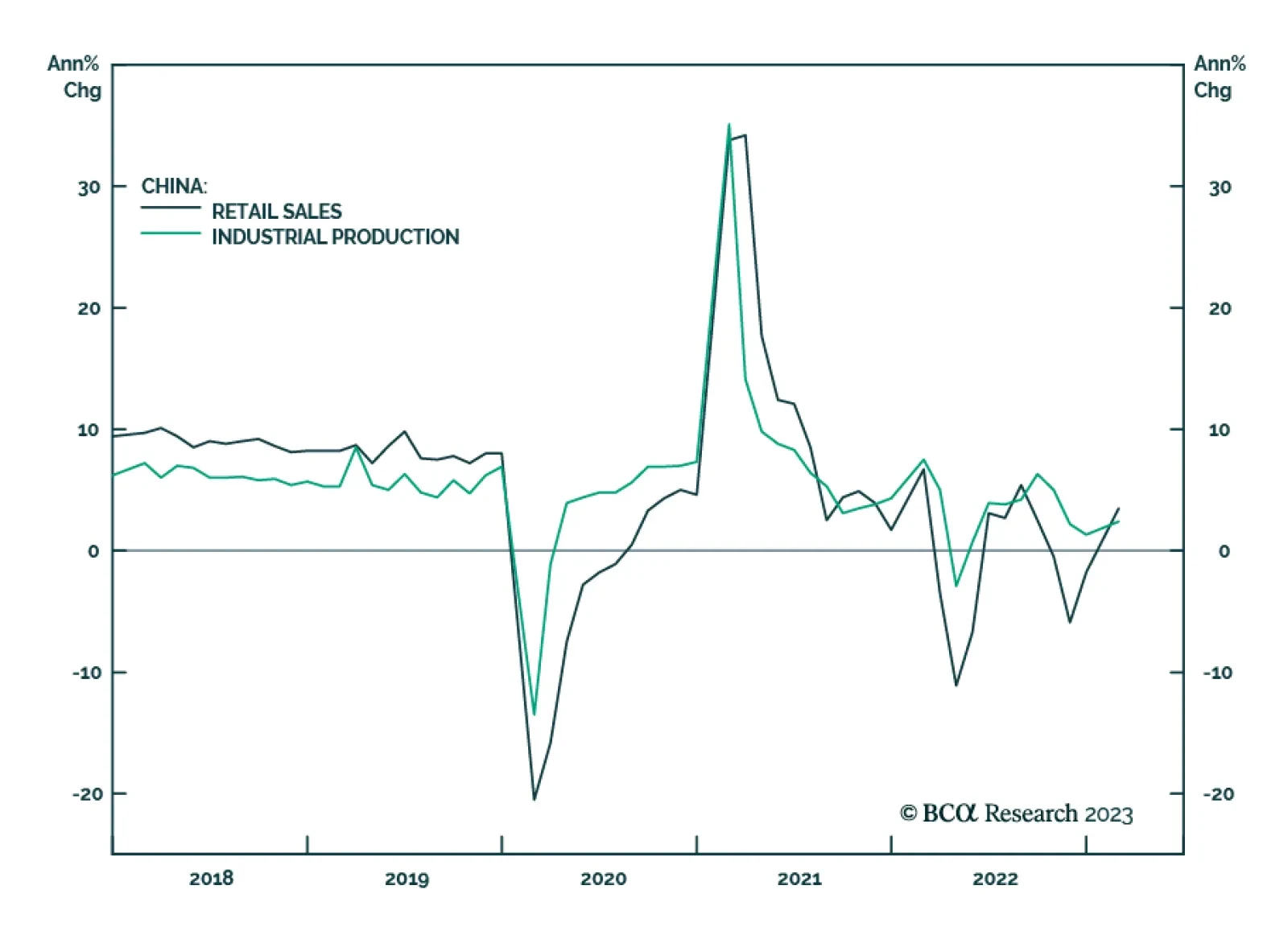

Chinese data confirms that household spending rebounded in the first two months of 2023. The 3.5% y/y increase in retail sales in January and February follows two consecutive months of declines at the end of last year and…

The odds of achieving a goldilocks scenario in the US where inflation drops amidst robust growth are low. If US bank woes do not escalate, the Fed will continue hiking amid a contraction in US corporate profits and global trade. The…

The growth and inflation profiles of the three central European countries are set to diverge. The outlook for Polish and Hungarian Bonds are not attractive anymore. Book profits on them. Instead, initiate a new trade: pay Polish /…

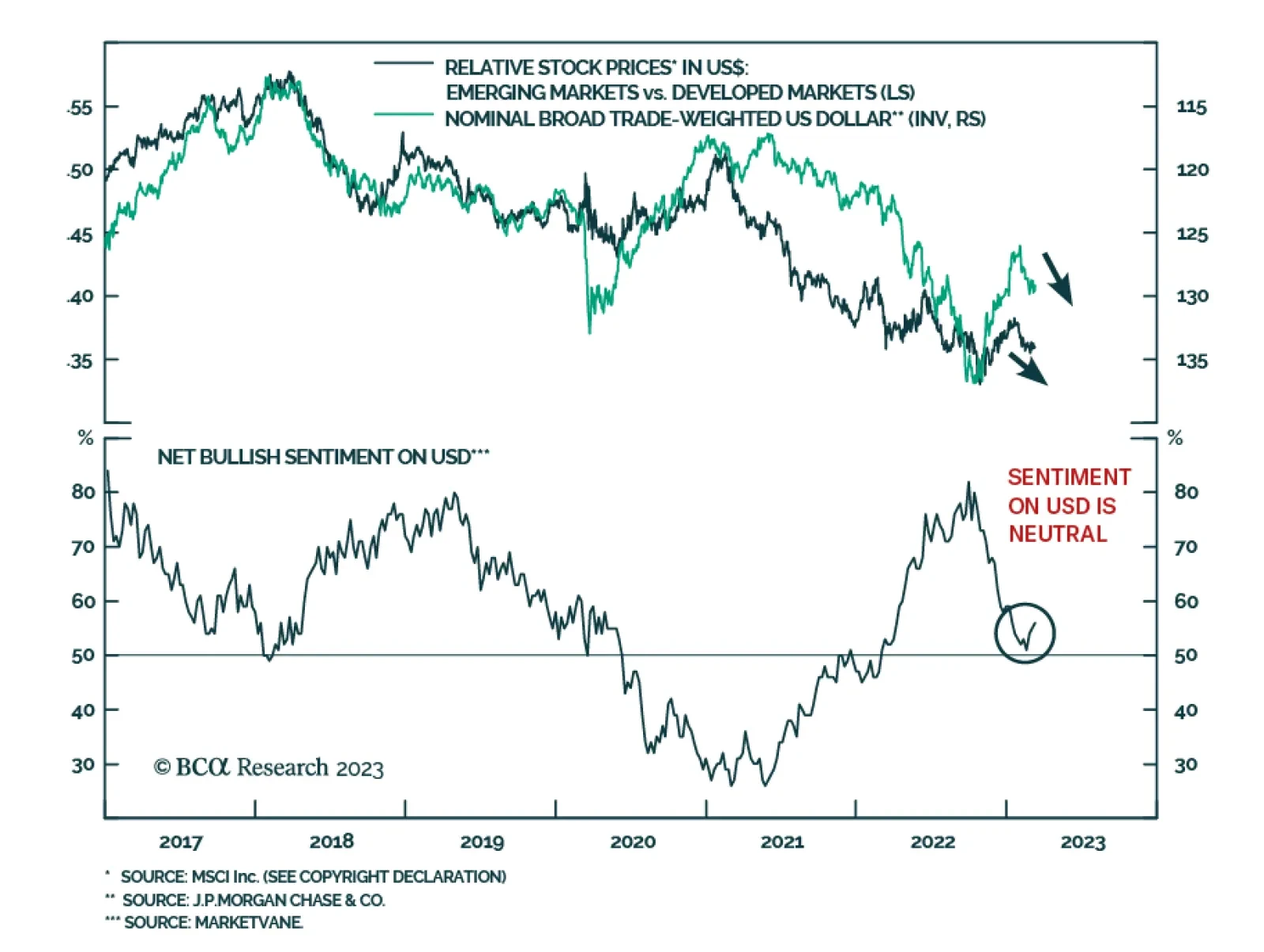

Emerging market stocks have recently outperformed their developed market peers as the US banking woes have heightened. Is it the beginning of a new trend or a short-term aberration? To a large extent, the answer depends on…