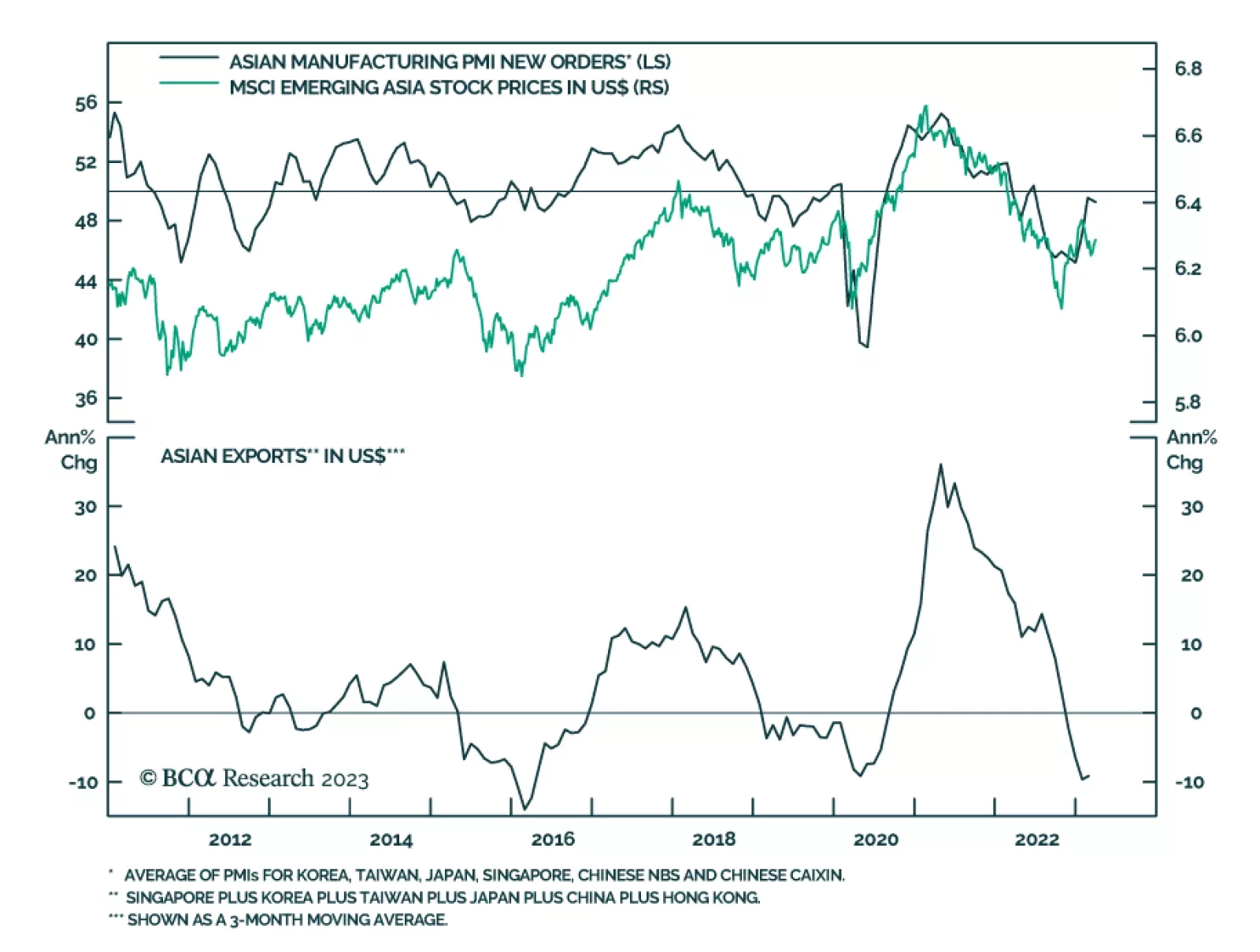

According to our Emerging Markets Strategy service, Asian exports will continue contracting at a double-digit rate warranting a cautious stance on emerging Asian equity markets. The New Orders component of Asian Manufacturing…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

In Section I, we discuss the implications of the banking crisis that emerged in March. We do not expect what happened in the US or Europe to morph into a full-blown meltdown of the financial system, but this month’s events will…

CCP officials are discussing policy options for breaking out of a deepening liquidity trap. Anything policymakers come up with will be additive to existing spending and to the multi-trillion-dollar fiscal-stimulus packages being…

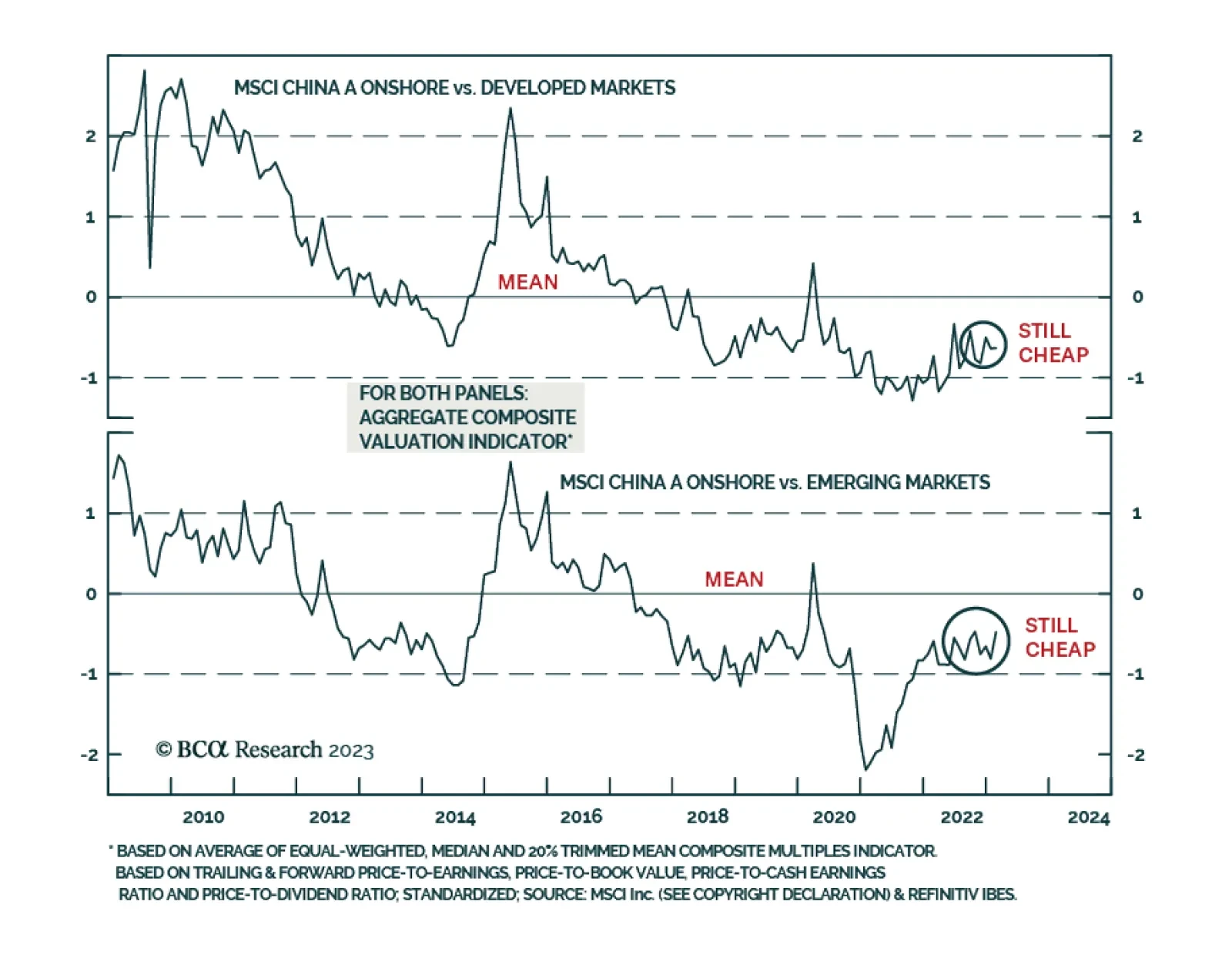

According to BCA Research’s China Investment Strategy service, a diverging corporate profit cycle and cheaper valuations should support a cyclical outperformance in Chinese onshore stocks versus global equities. In the…

Chinese onshore stocks are attractive on a risk-reward basis relative to their global counterparts. If the global equity bear market continues, our bias is that Chinese onshore stock prices will also drop, but they will likely fall…

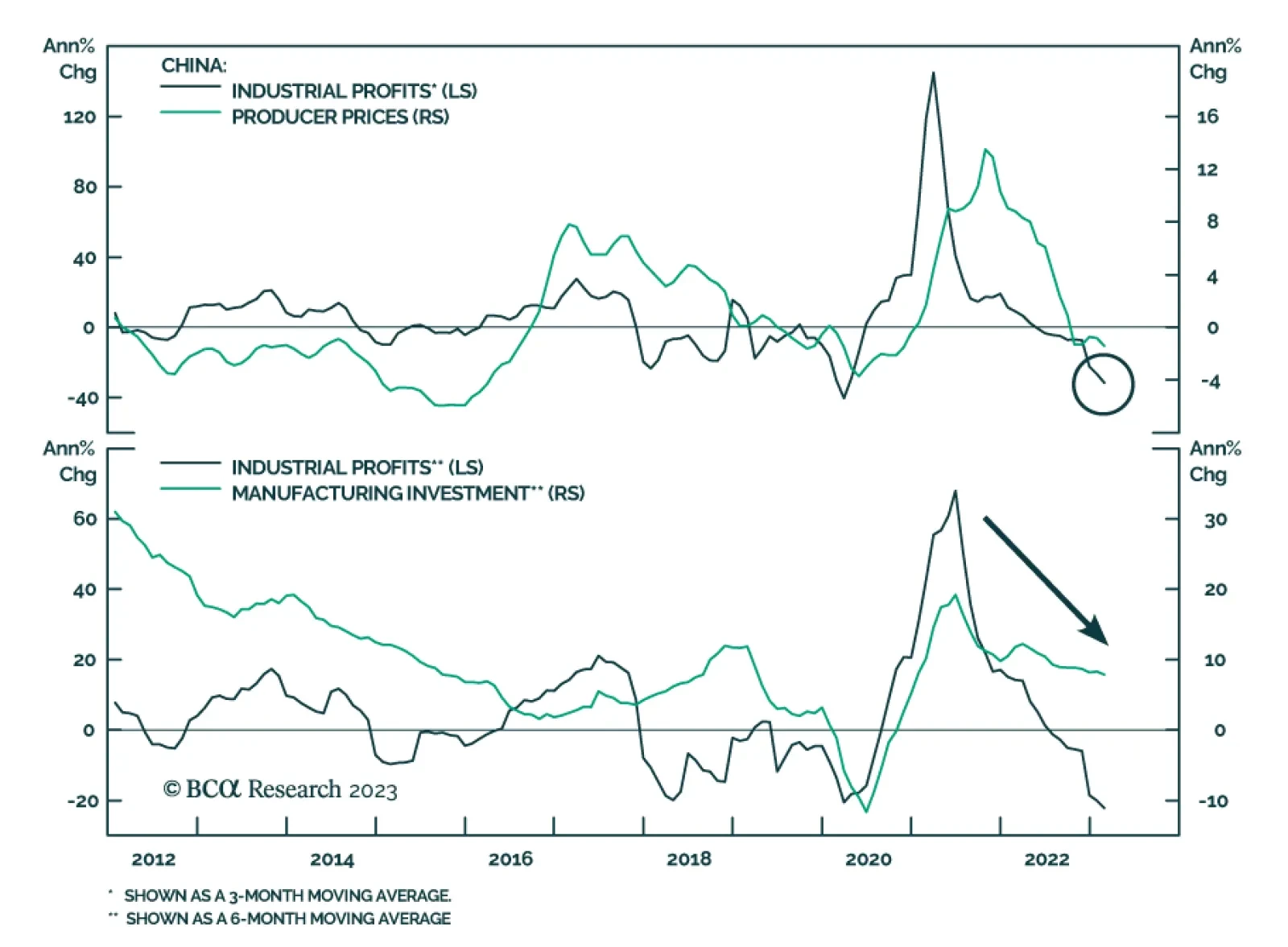

Profits of Chinese industrial firms dropped by 22.9% y/y in the first two months of 2023, extending and deepening the contraction that began in July. Notably, the weakness has been particularly pronounced across the manufacturing…

Have global equity markets reached a riot point? Is the Fed going on hold a sufficient condition for stocks to stage a cyclical rally? If not, what would be needed to produce such a rally? Does the Fed’s recent balance sheet…

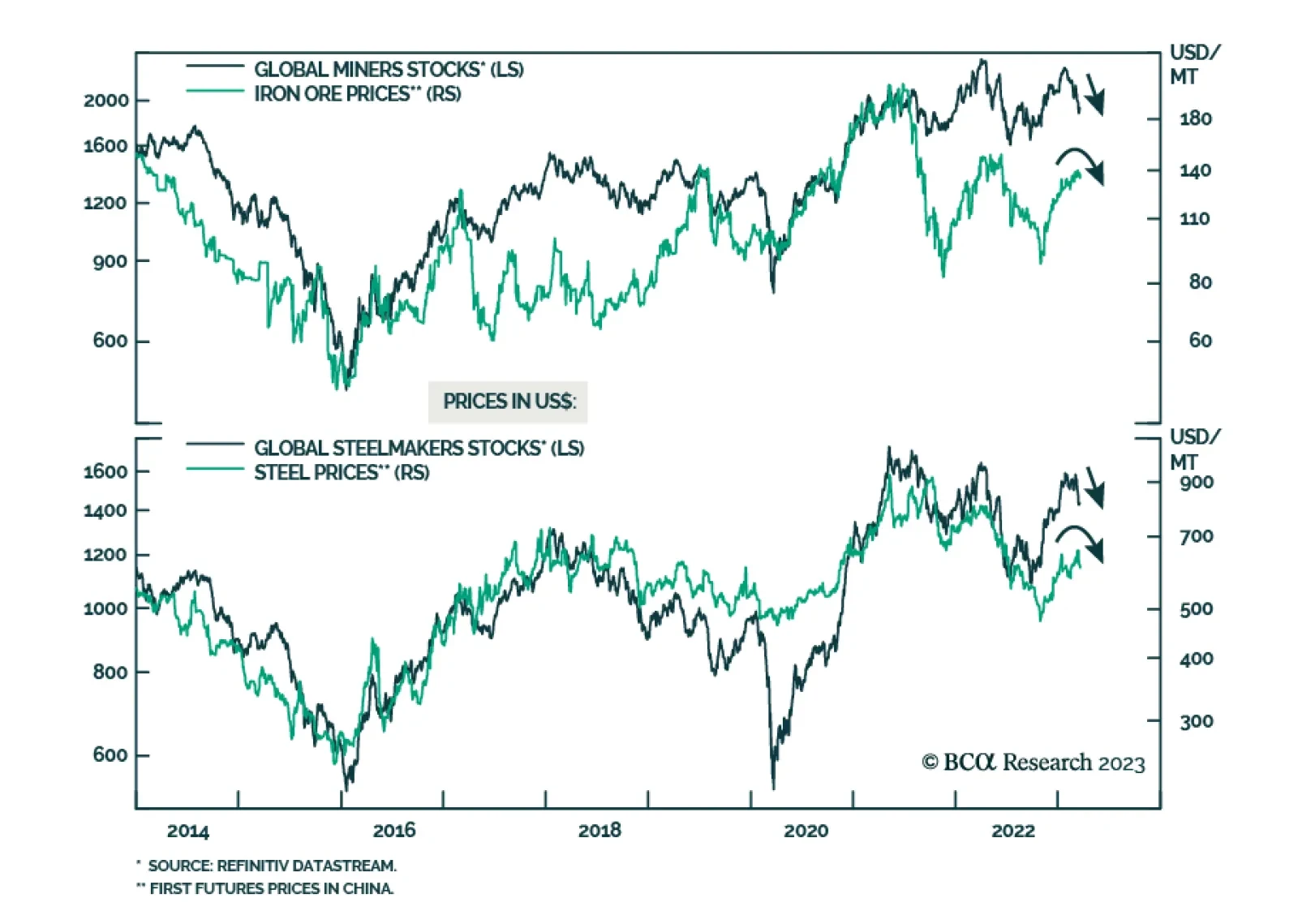

BCA Research’s China Investment Strategy service expects both iron ore and steel prices to drop by 15%-20% from their current levels and they recommend that investors short stocks for global steelmakers and global mining…