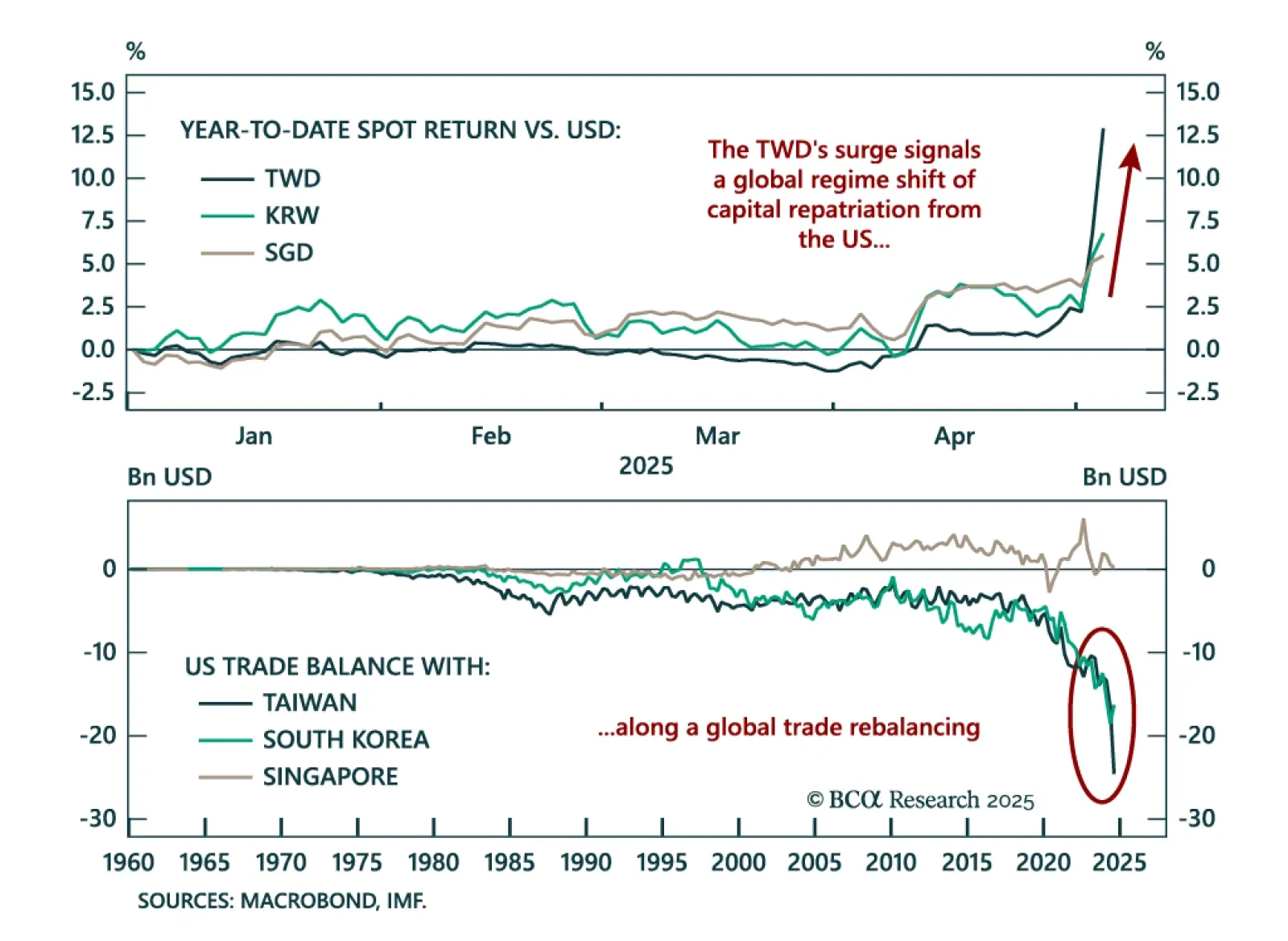

Our EM strategists see rising odds of a structural regime shift in Emerging Asian currencies. However, they expect a USD rebound and are looking to close short positions in IDR, PHP, and TWD. Severe deflationary shocks will drive…

Our Portfolio Allocation Summary for May 2025.

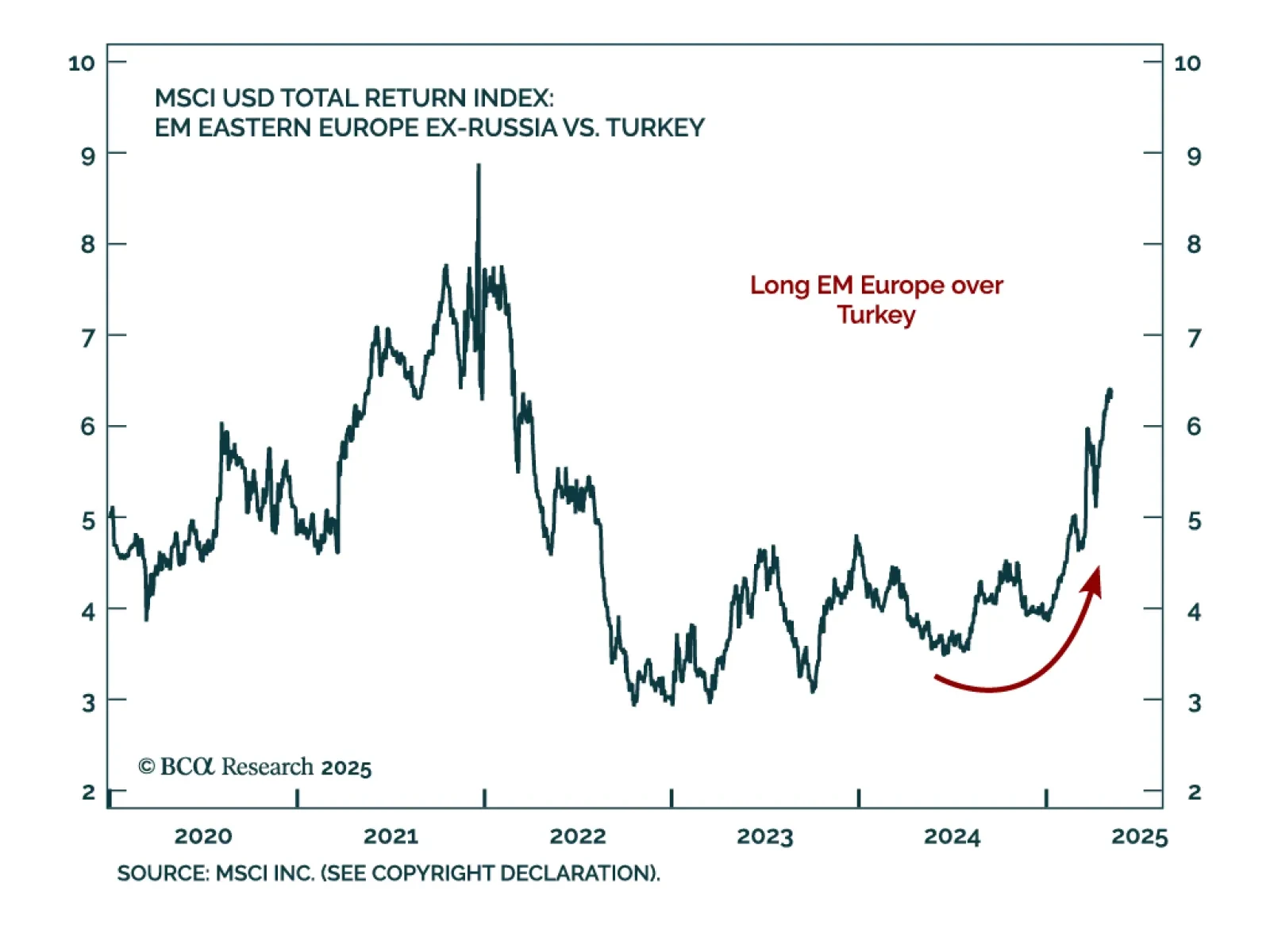

Our Geopolitical strategists recommend underweighting Turkish assets. Erdogan’s weakening rule, rising social unrest, and eroding governance are deepening Turkey’s macro deterioration. Inflation will stay sticky as odds of new…

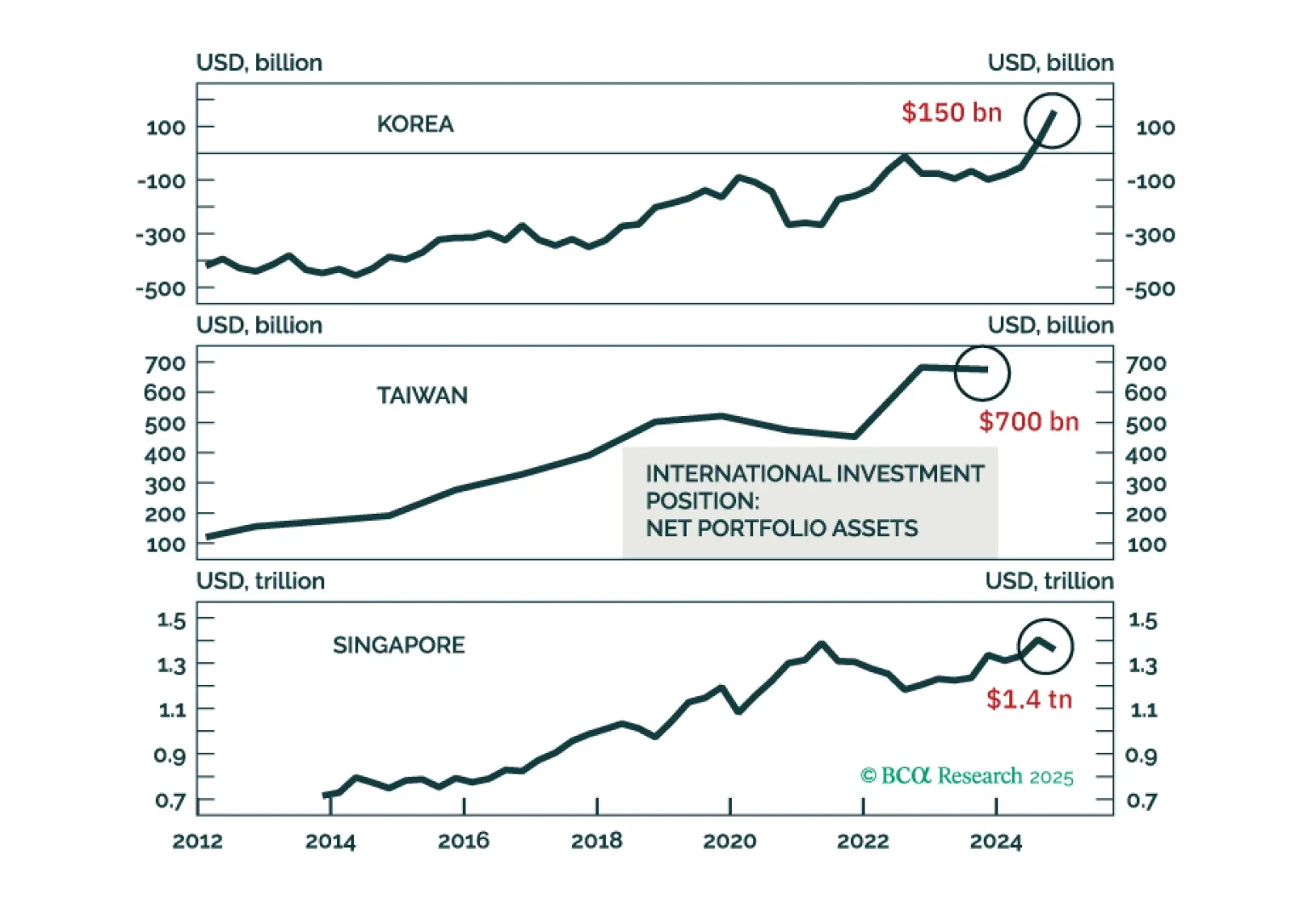

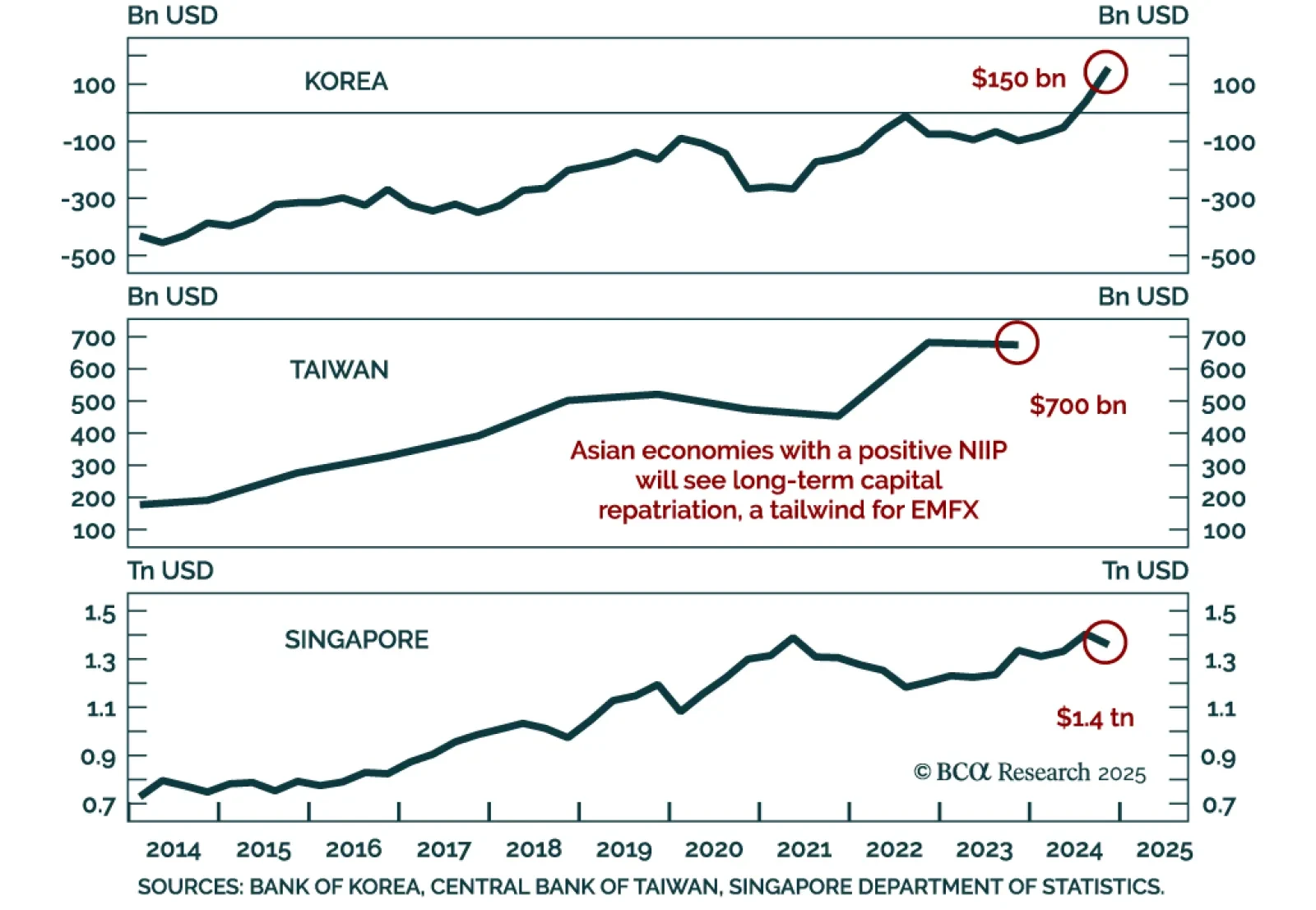

Taiwan, Singapore, and Korea's currencies might appreciate versus the USD, driven by capital repatriation from domestic private investors away from the US. This thesis is less pertinent to India, Indonesia, and the Philippines…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

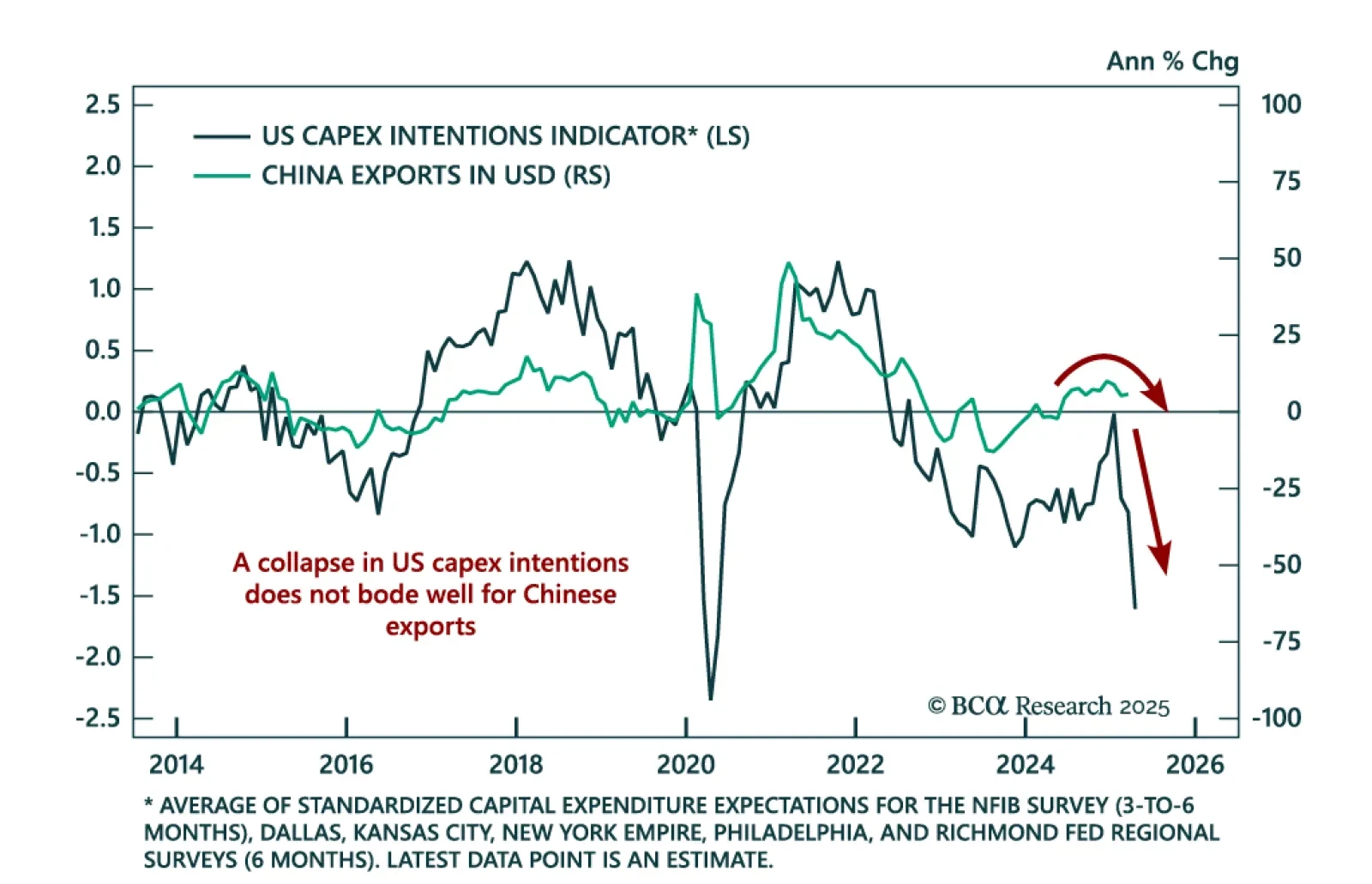

BCA’s China Investment Strategists remain defensive as China’s growth outlook is still weak. Even if some US tariff rates are rolled back, export headwinds and lagging stimulus will continue to weigh on Chinese equities. The…

The TWD’s surge reflects a regime shift in global capital flows that supports EM Asia government bonds. Alongside other Asian currencies, the TWD has rallied sharply against the USD since late last week. While the first wave of…

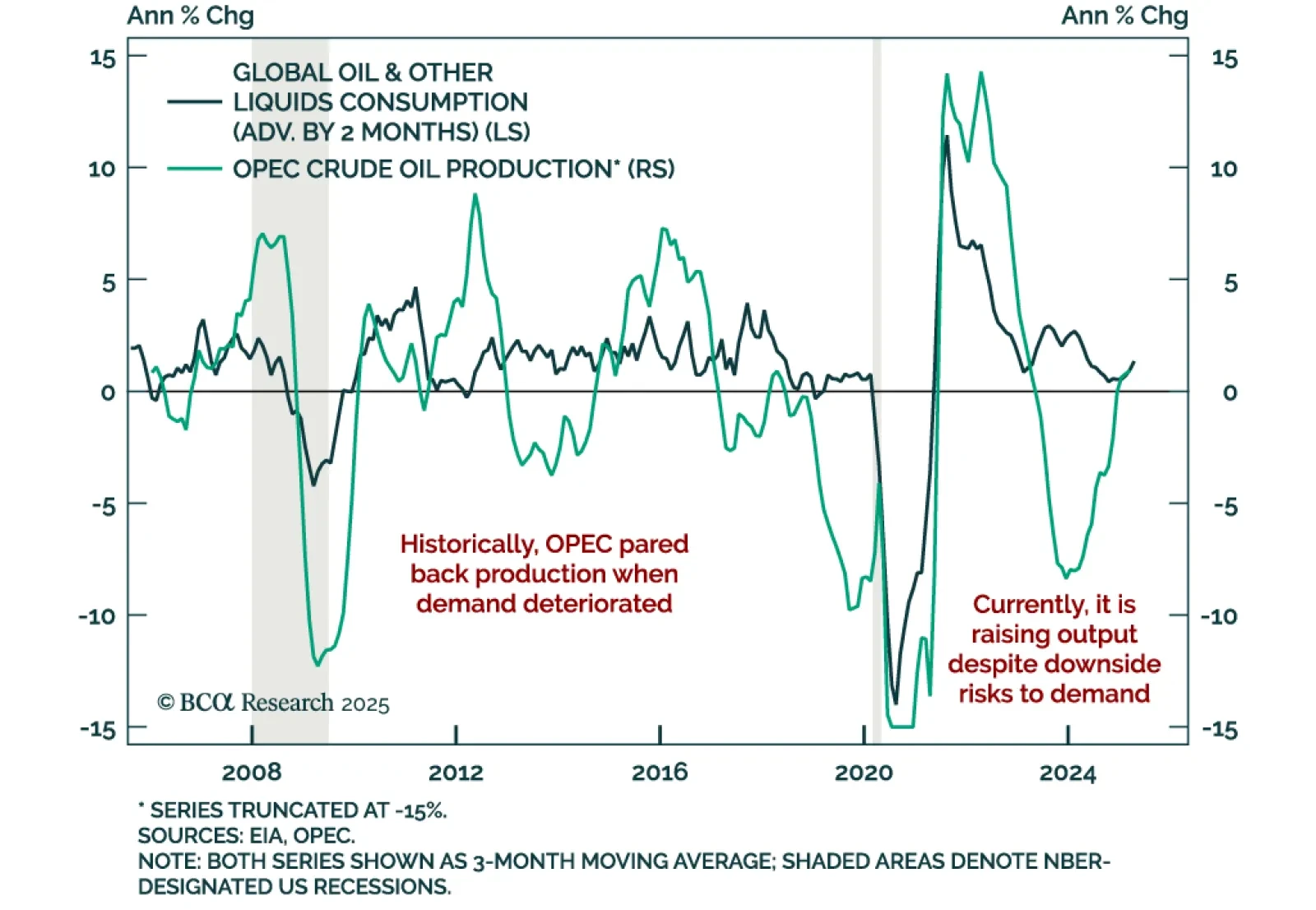

Our Commodity strategists stay short oil and long gold as global demand weakens and OPEC+ offers no support. Brent’s floor has likely fallen to $50, and bearish supply and demand forces continue to dominate the price outlook. …