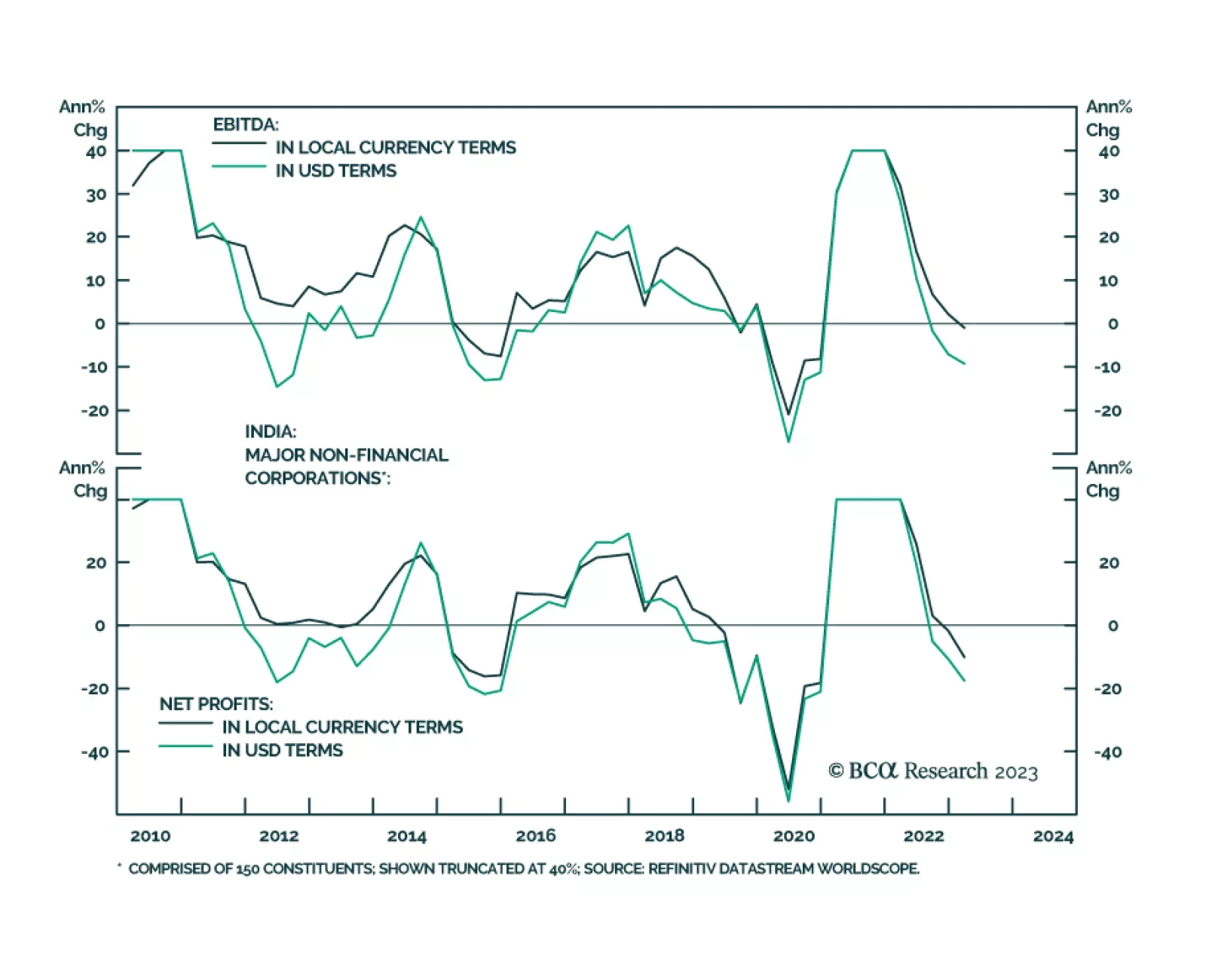

The Indian equity market has fallen by about 15% from its peak last year. Nevertheless, our Emerging Markets Strategists expect a further decline as both drivers of stock prices – EPS growth and multiples – remain…

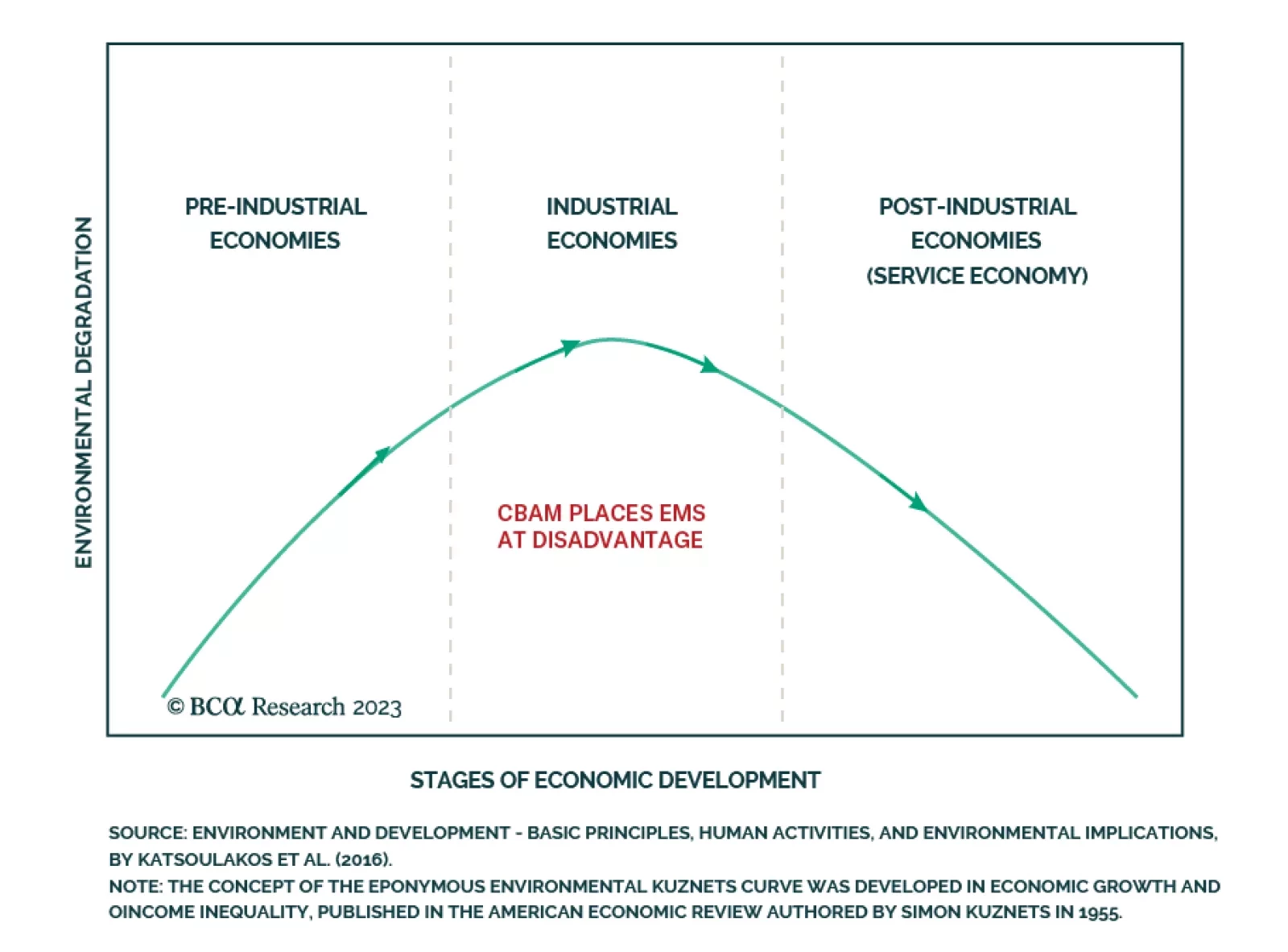

According to BCA Research’s Commodity & Energy Strategy service, the EU’s Carbon Border Adjustment Mechanism (CBAM) will impart an upward bias to prices in the EU and its trading partners’ economies.…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

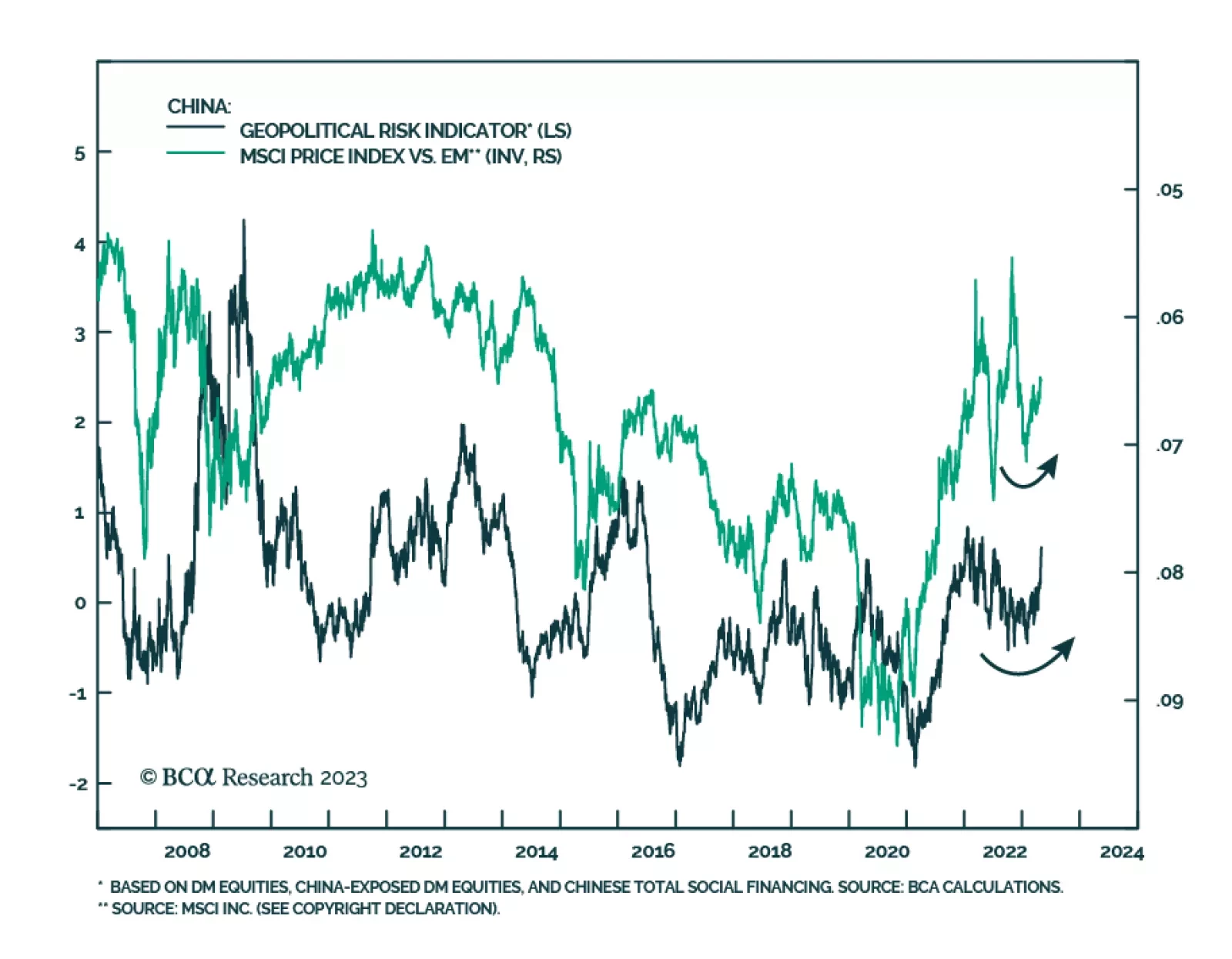

According to BCA Research’s Geopolitical Strategy service, the late April meeting of China’s Politburo suggests that the Chinese government will maintain the accommodative macroeconomic policies outlined in March.…

China’s reopening, combined with a slew of pro-consumption policy stimuli, will likely boost household consumption by 10% in nominal terms in 2023 from a year ago. Some of the hardest hit service sectors during the pandemic will…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

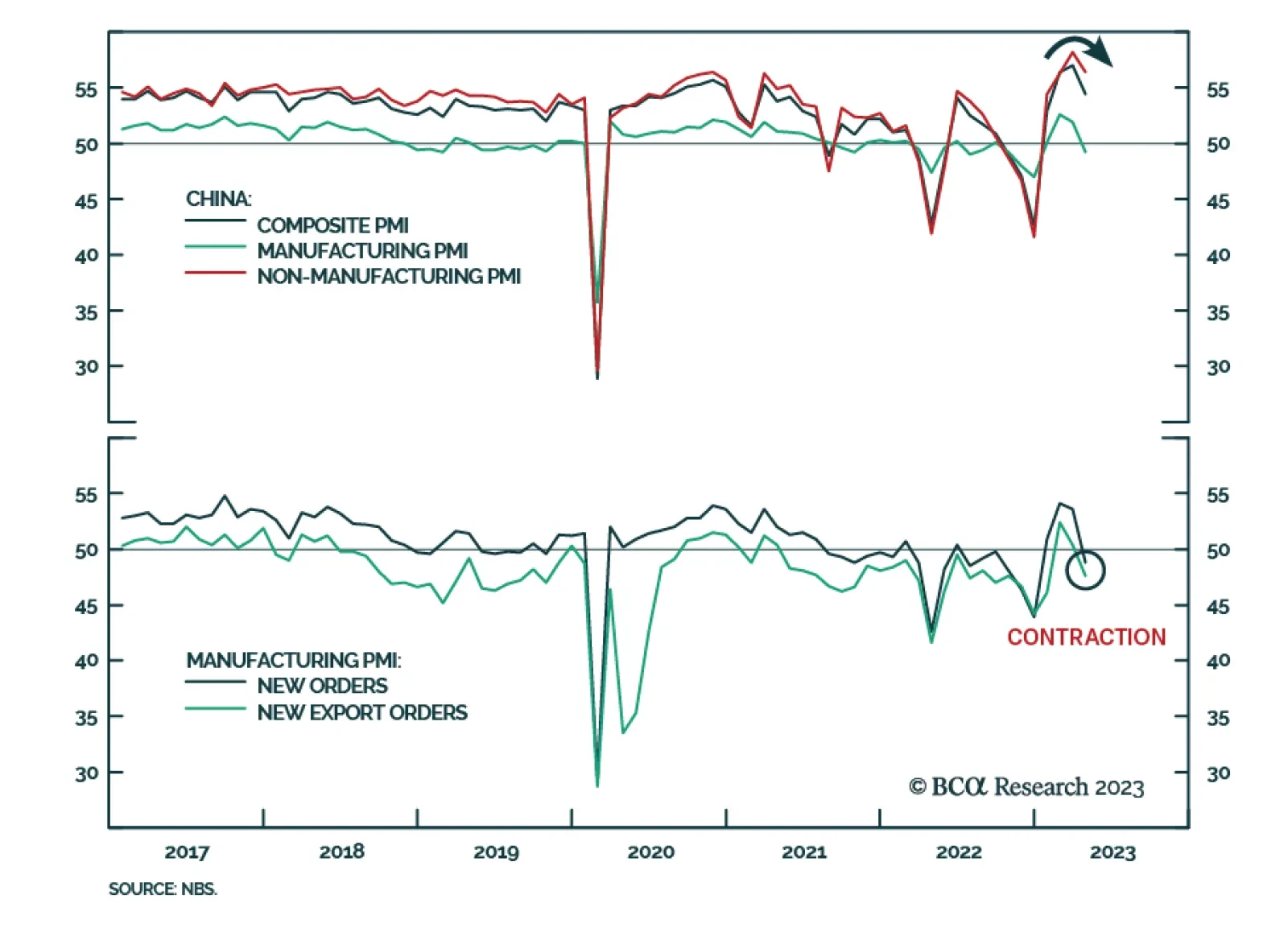

China’s NBS Composite PMI relapsed to 54.4 in April from 57 – the first monthly decline since the index bottomed at 42.6 in December. Importantly, both the manufacturing and non-manufacturing indices fell. In…

The risk-reward of the US dollar is currently positive. If a US recession is not imminent, then US bond yields will move higher, thus supporting the greenback. If the US enters a recession soon, the US dollar will benefit because it…

This week we present our Portfolio Allocation Summary for May 2023.

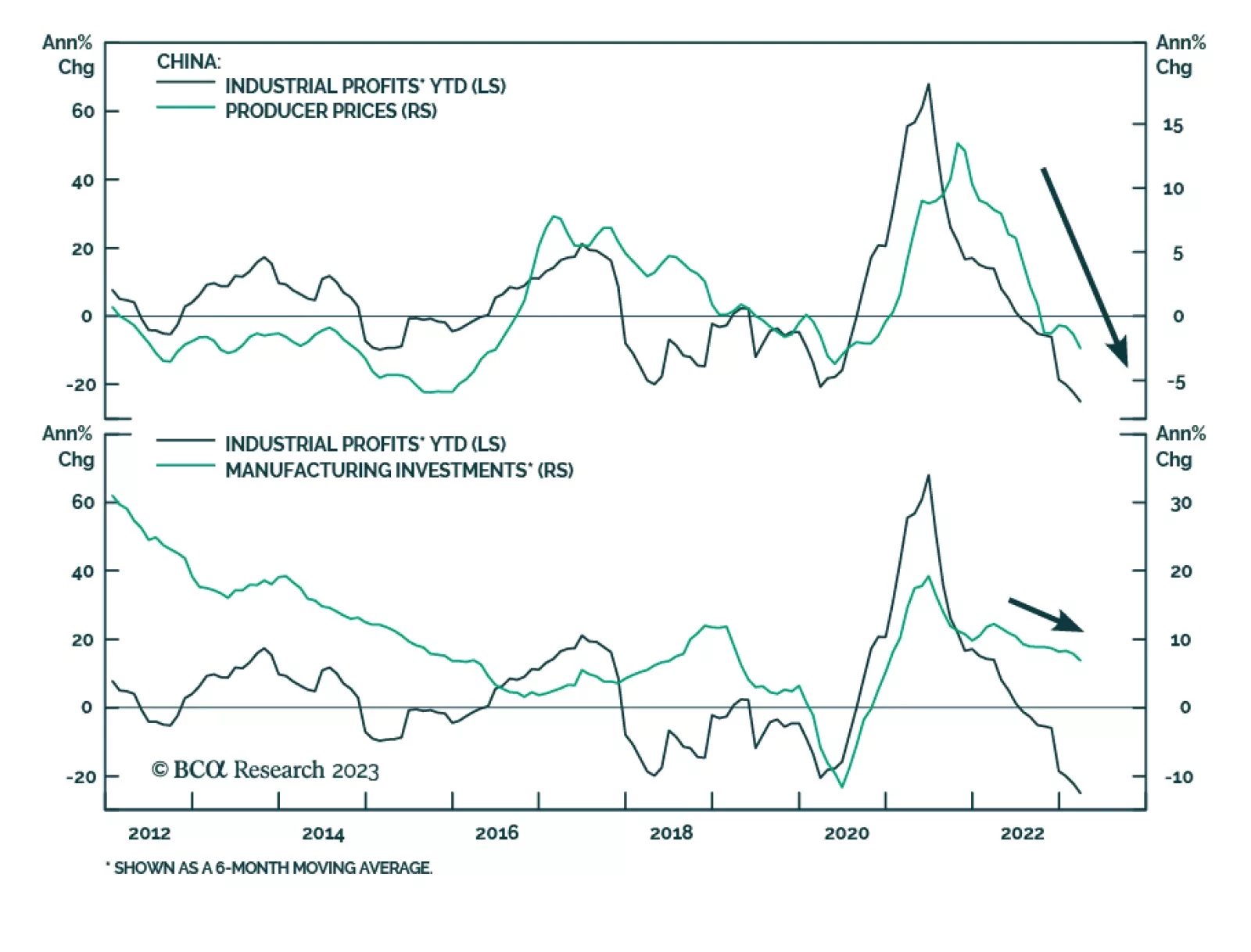

Incoming economic data confirm that China’s post-lockdown recovery remains bifurcated. On the one hand, the end of the zero-Covid policy is boosting consumer spending – particularly on services. On the other hand,…