In Section I, we review the three possible economic scenarios over the coming year, and underscore that the “soft landing” scenario remains improbable. A “no landing” scenario could occur, but it would ultimately lead back to the…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…

China’s recovery is losing steam. Its industrial segments will disappoint, while the pace of consumer spending will be moderate. Overall, the Chinese economic recovery will underwhelm in the months ahead. Odds are that interest rate…

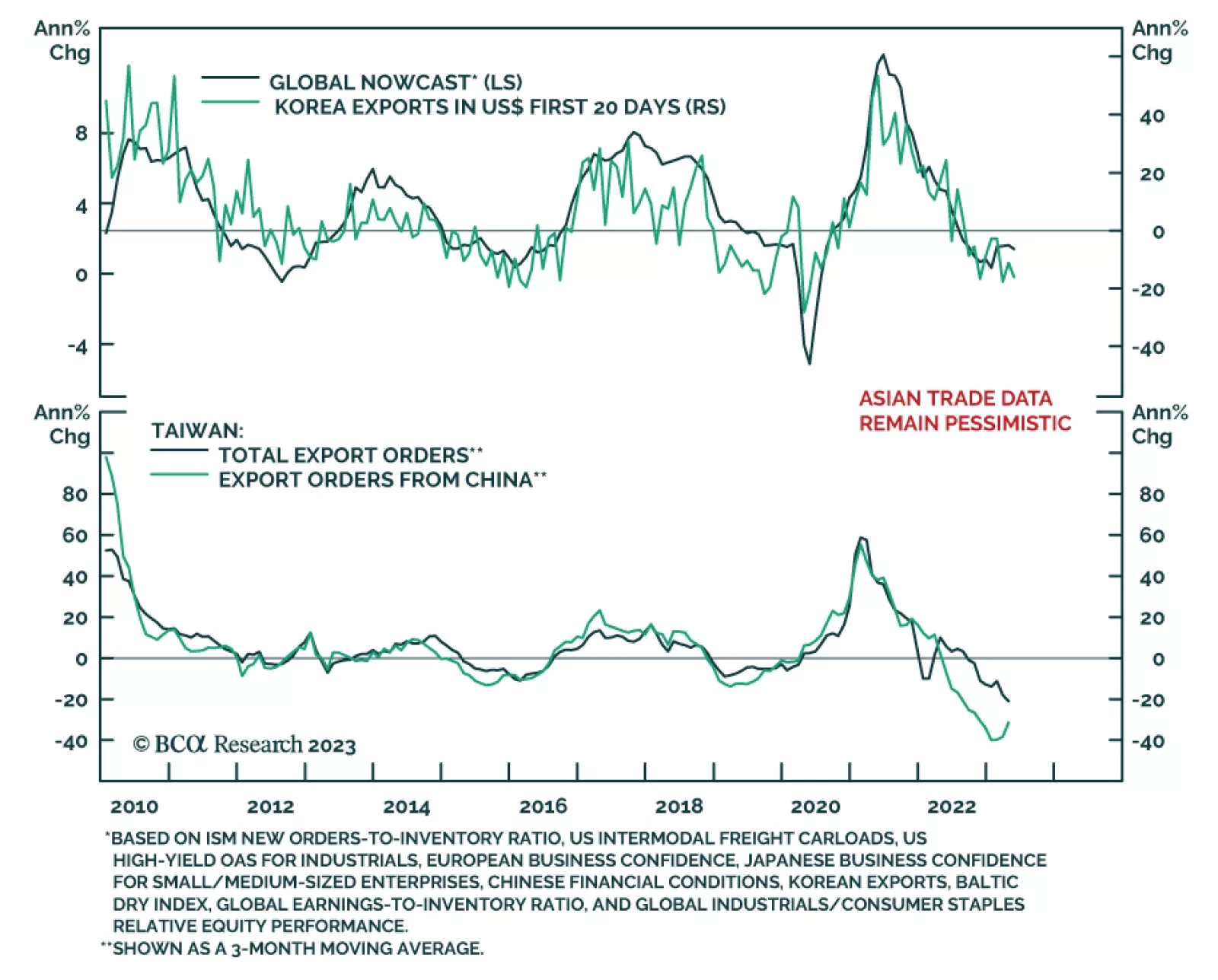

Recent Asian trade data do not provide any optimism that the global manufacturing slump is nearing its end. South Korean exports collapsed by 16.1% y/y in the first 20 days of May. While the decline was broad-based, sales to…

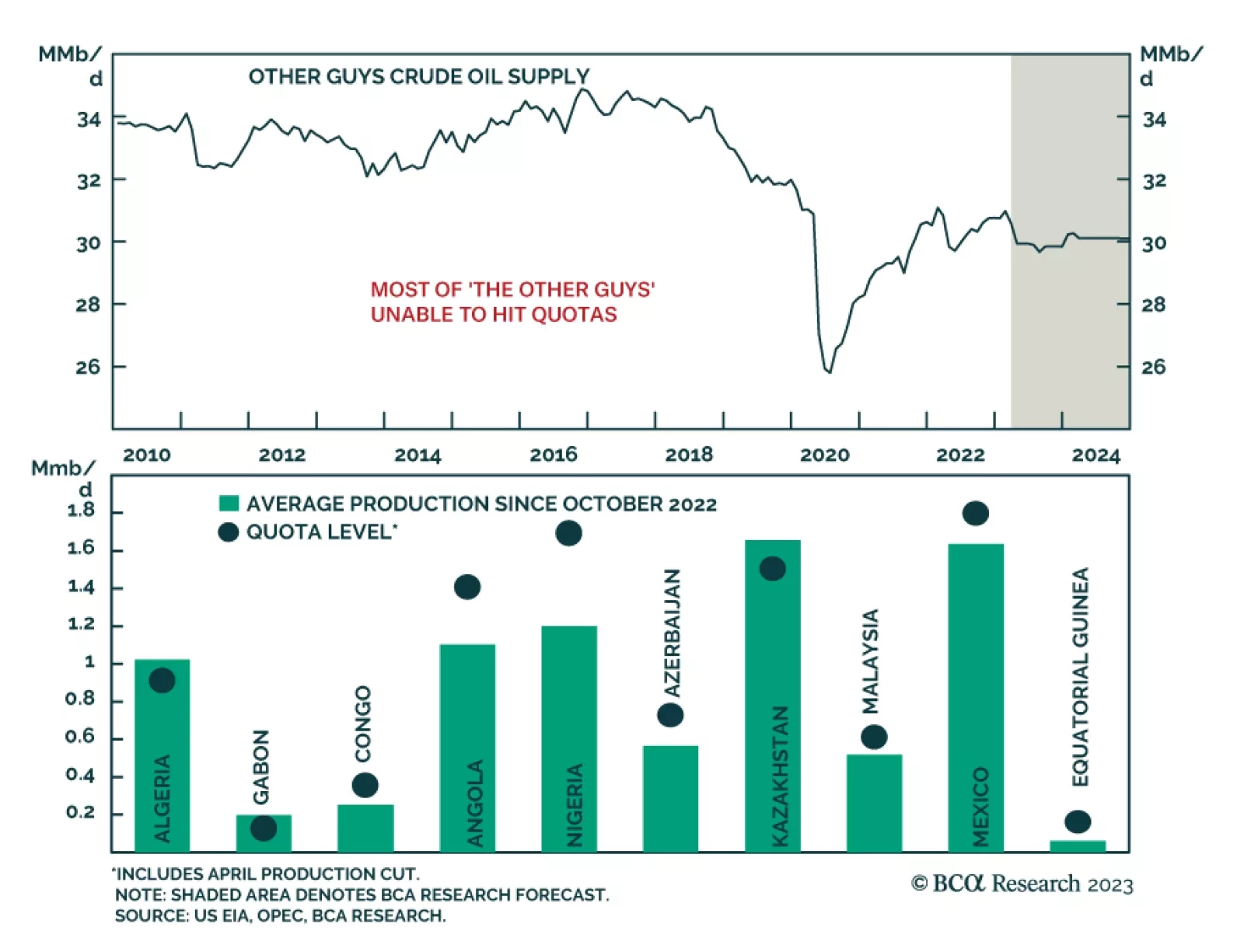

According to BCA Research’s Commodity & Energy Strategy service, oil supply management by OPEC 2.0 and production discipline outside the coalition will be maintained, forcing inventories lower. Russia’s gray…

Global growth will weaken in the coming months, yet monetary authorities worldwide will be reluctant to ease policy. This state of affairs foreshadows a clash between markets and policymakers in the months ahead. China’s recovery is…

EM oil demand remains resilient and will continue to be propelled by global growth this year. Supply management by OPEC 2.0 and production discipline outside the coalition will be maintained, forcing inventories lower. Recent price…

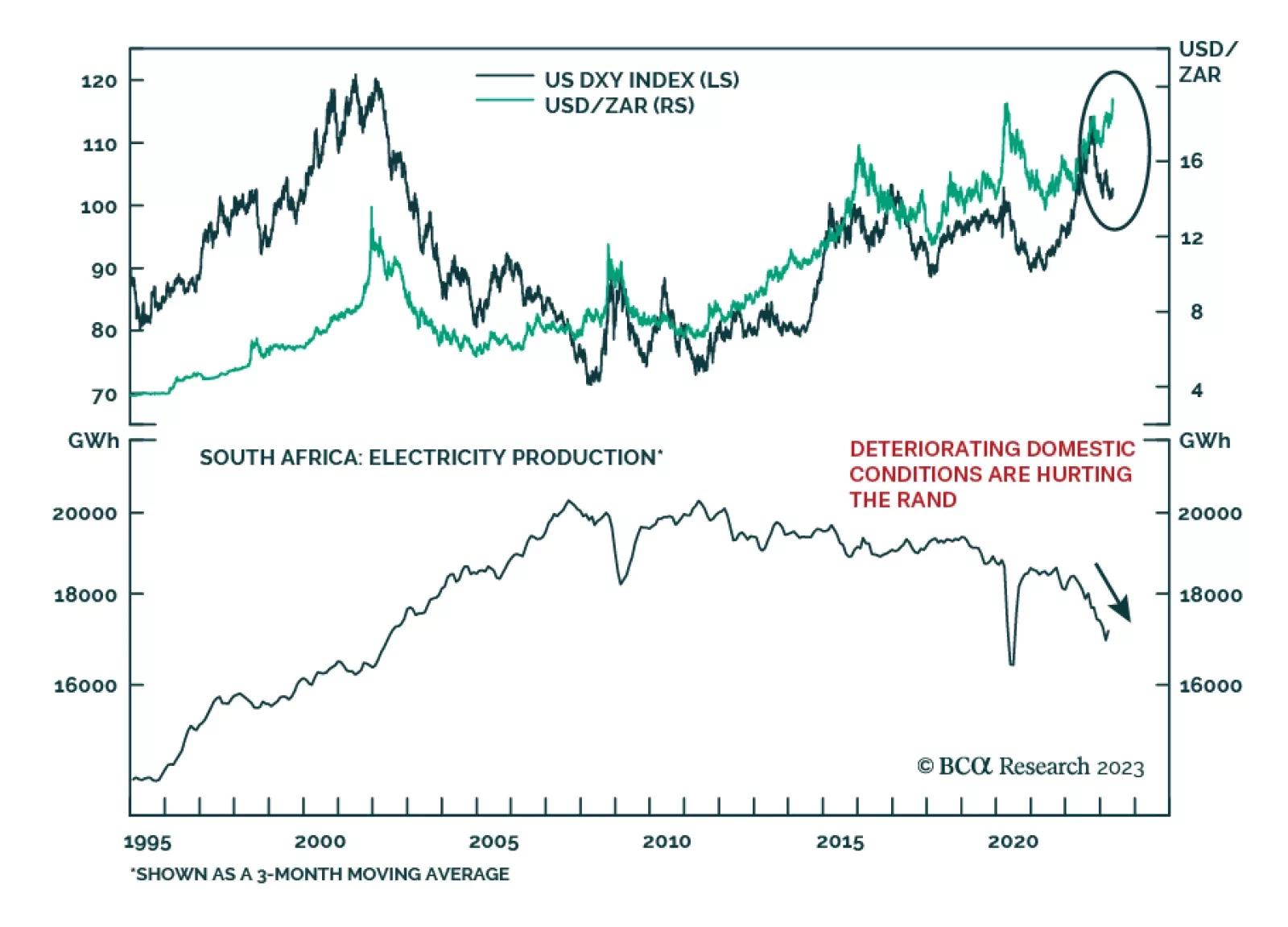

The South African rand is among the worst performing major global currencies since the DXY peaked on September 27 (behind only the Argentine peso, Russian ruble, and Turkish lira). Given that the ZAR is a high-beta currency,…