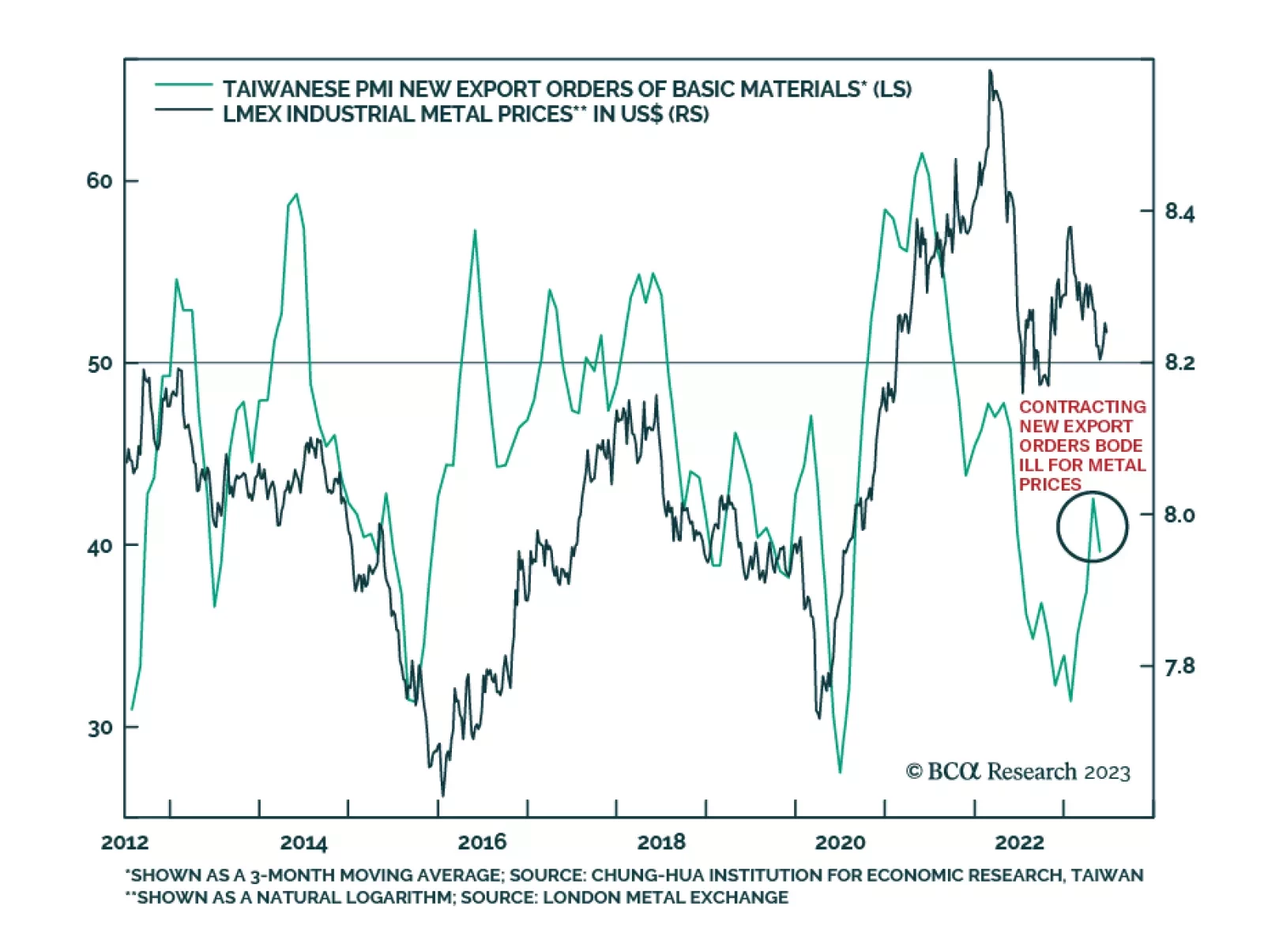

Industrial metals have been rallying in recent weeks. The London Metals Exchange Metals Index (LMEX) – a weighted index that captures the price movement of primary aluminum, zinc, nickel, lead, copper, and tin – has…

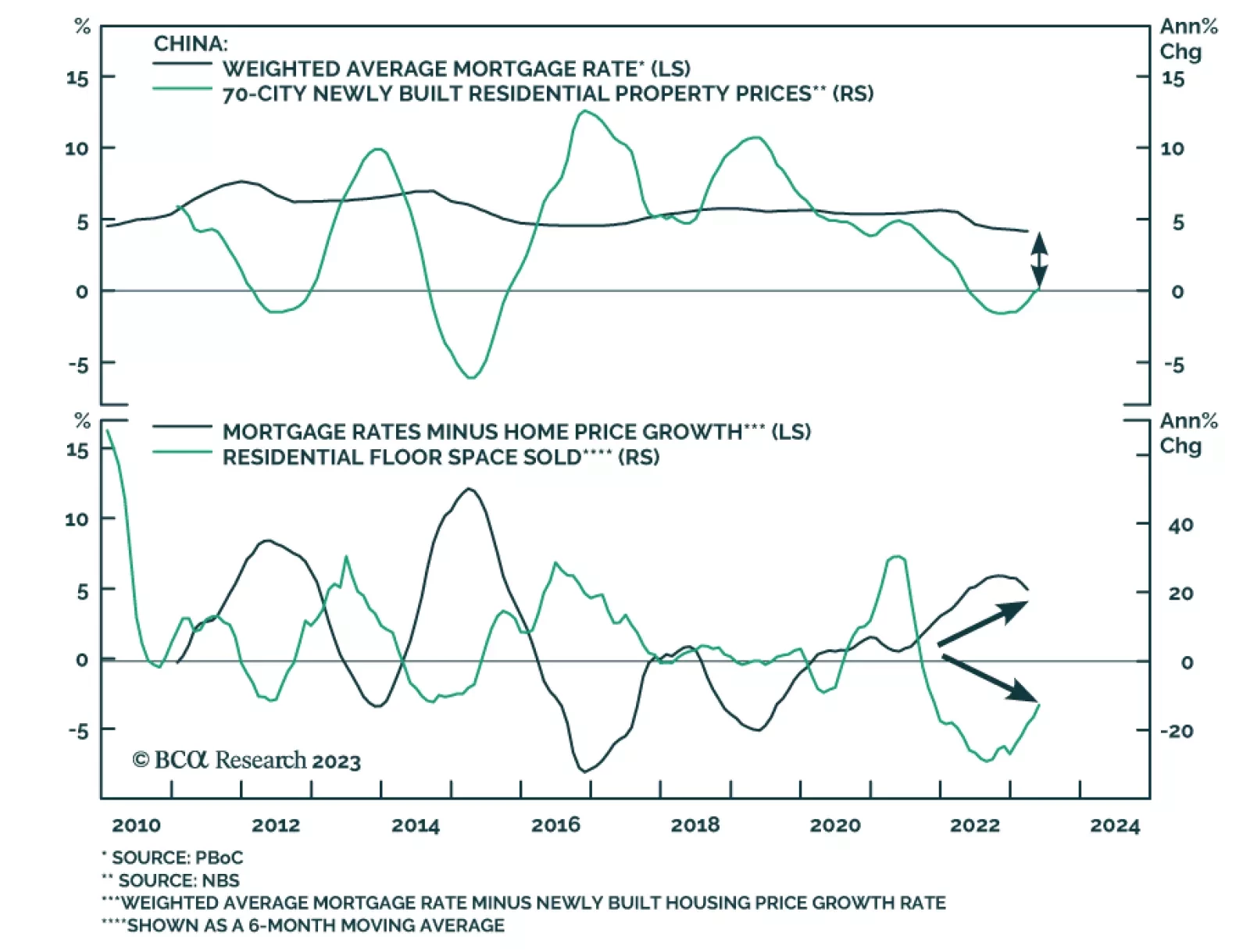

According to BCA Research’s China Investment Strategy service, a sustainable recovery in Chinese property construction is unlikely. The deterioration in China’s property market indicators worsened in May. Home…

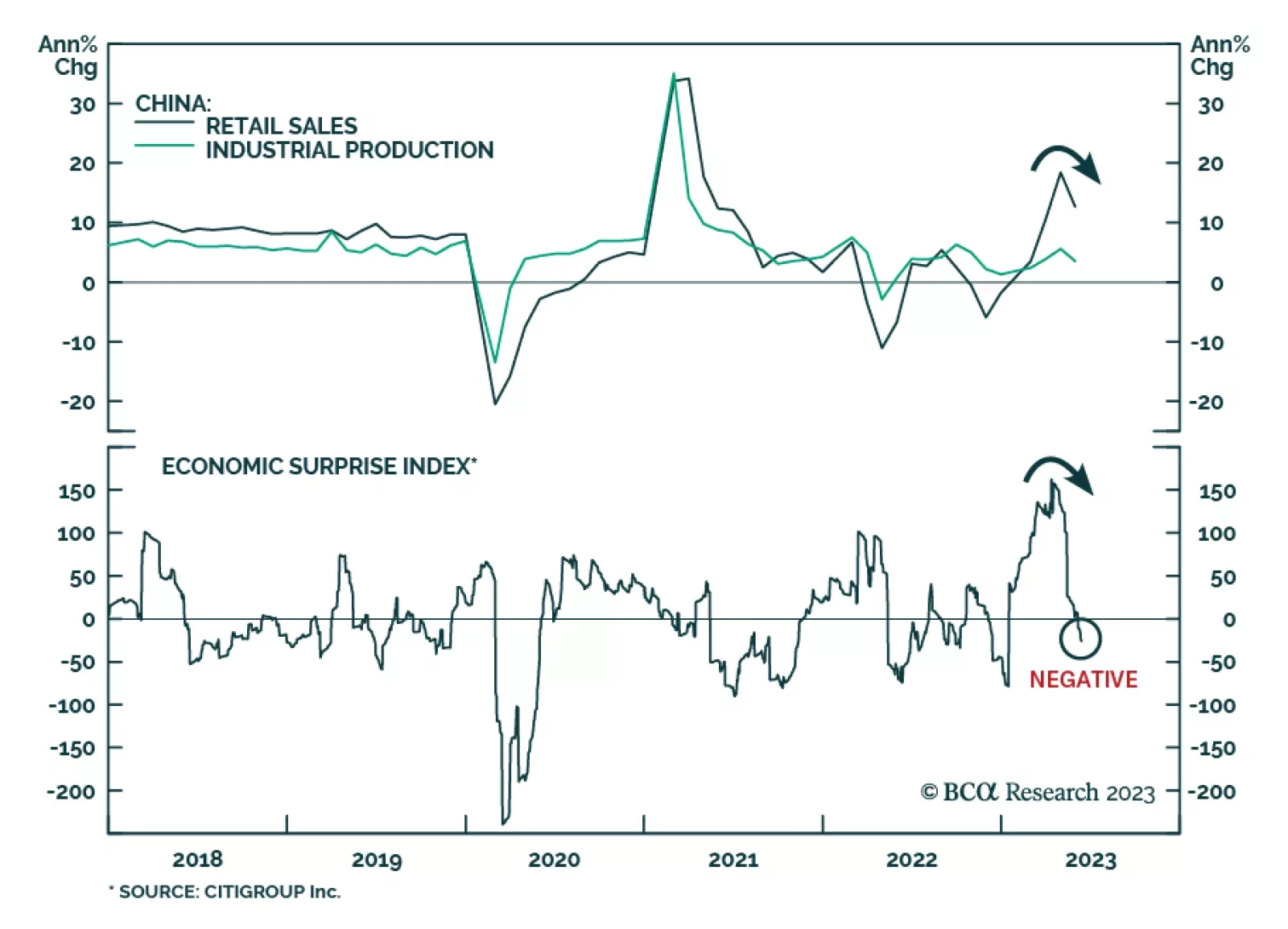

China is facing a risk of deflation. Marginal interest rate cuts and targeted stimulus will be insufficient to boost China’s growth given the current deflationary mindset and the danger is that the economy may be entering a liquidity…

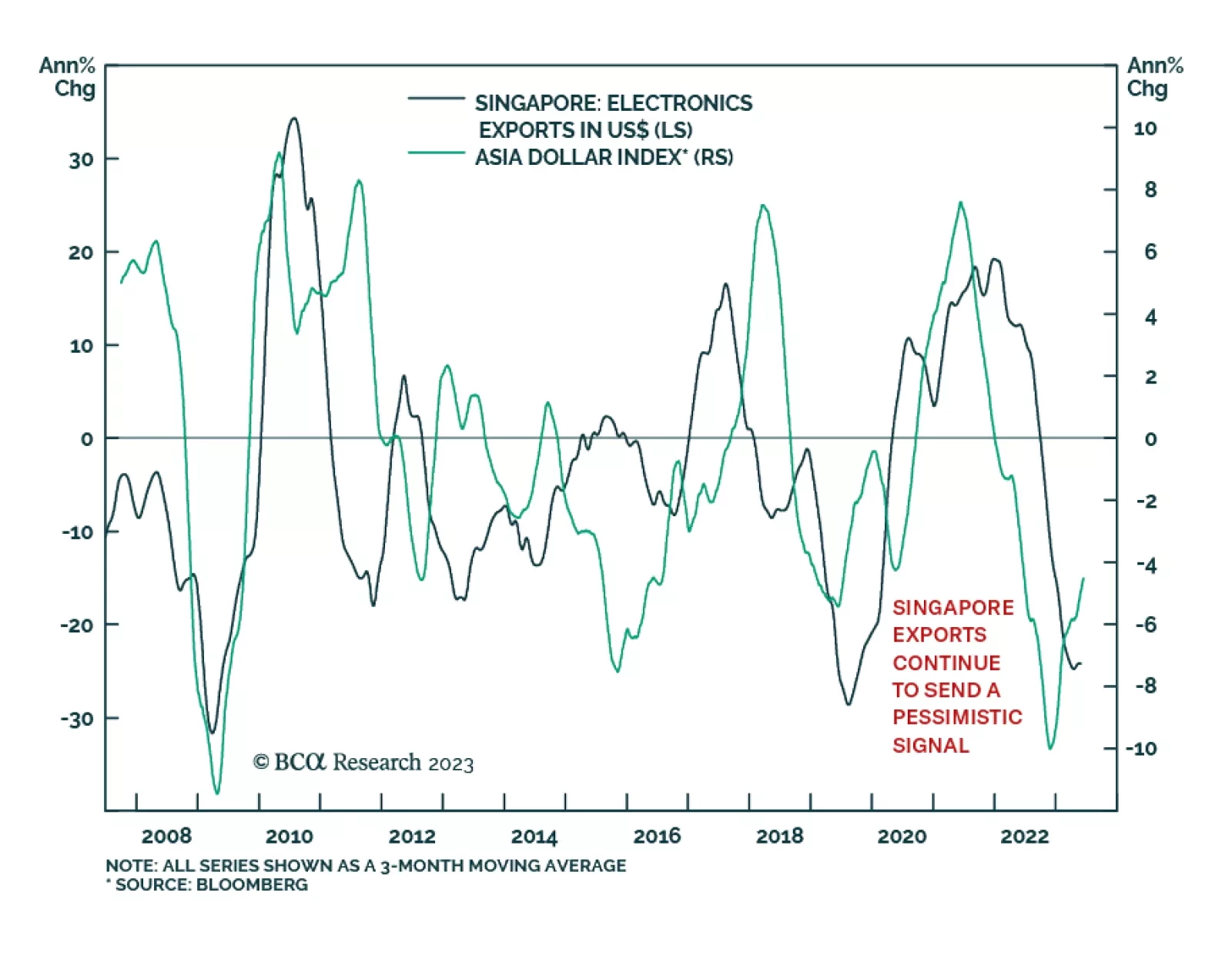

Singapore’s exports have historically acted as a good gauge for the health of the global economy. As a small open economy that is extremely exposed to fluctuations in the Asian and global manufacturing cycles, Singapore…

China’s economic data releases for May fell below consensus estimates. The 7.2% y/y contraction in property investment in the first five months of the year was worse than the expected 6.7% decline. The deceleration in…

The normalization of oil storage markets in the Northern Hemisphere; strong demand, aided by China stimulus this year; and continued production discipline supports our view Brent prices likely have bottomed, and will move higher from…

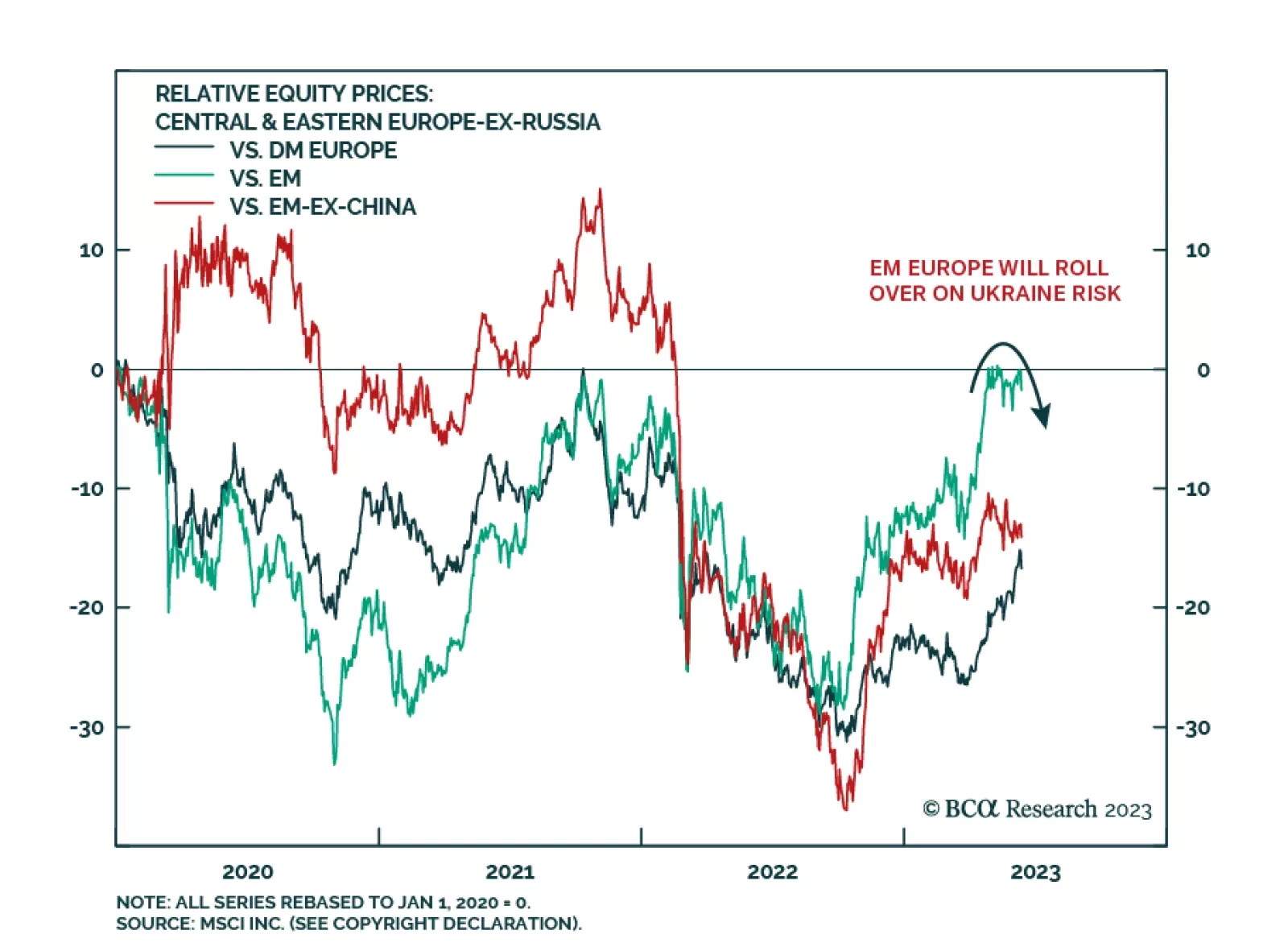

According to BCA Research’s Geopolitical Strategy service, geopolitical risk will rise before the Ukraine war is resolved, punishing eastern European emerging market assets on a relative basis. Ukraine’s…

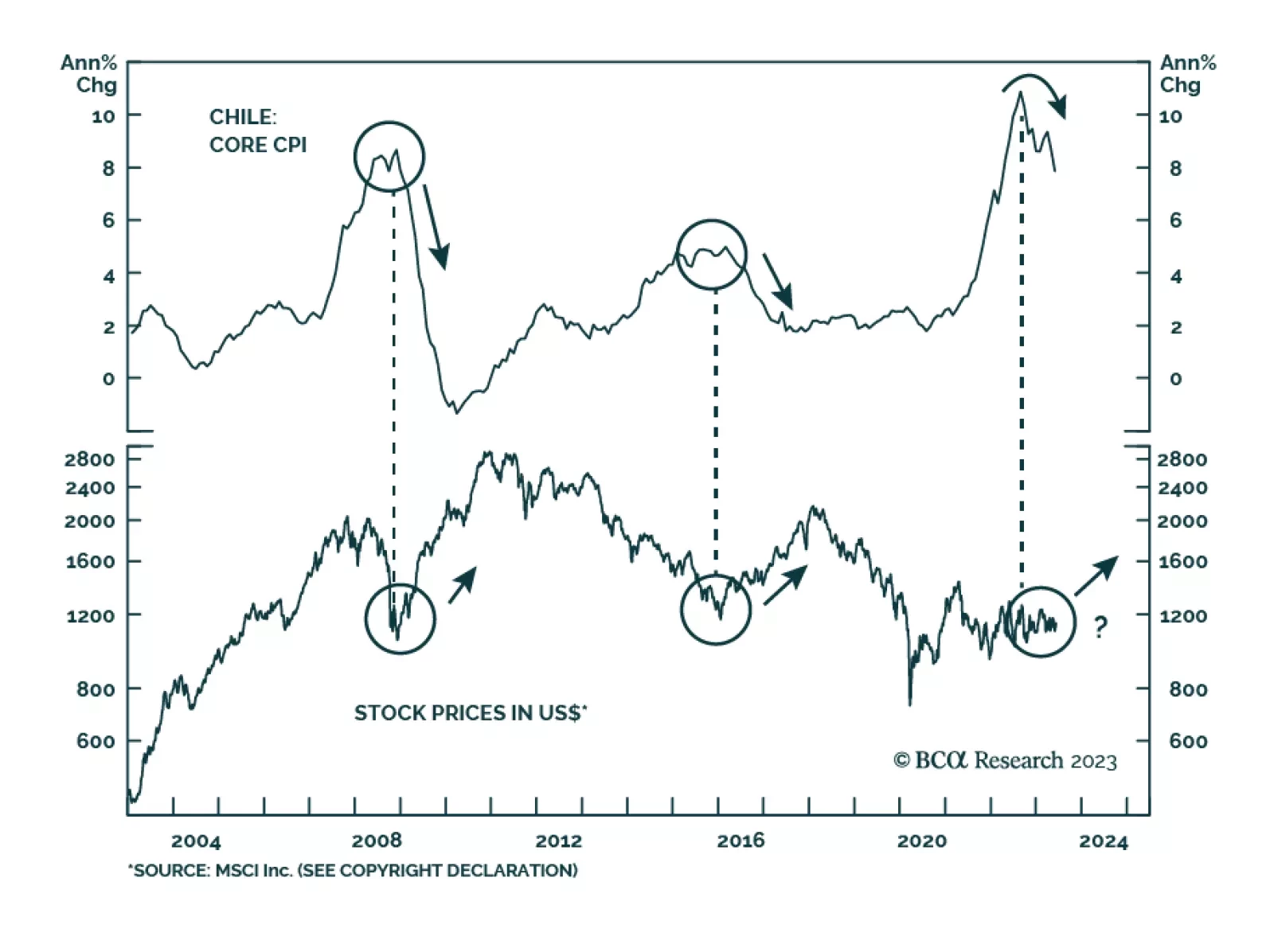

The Chilean economy is entering a recession. After two years of tightening fiscal and monetary policies, real economic growth is beginning to contract and inflation is tumbling. Our Emerging Markets strategists expect the…