Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

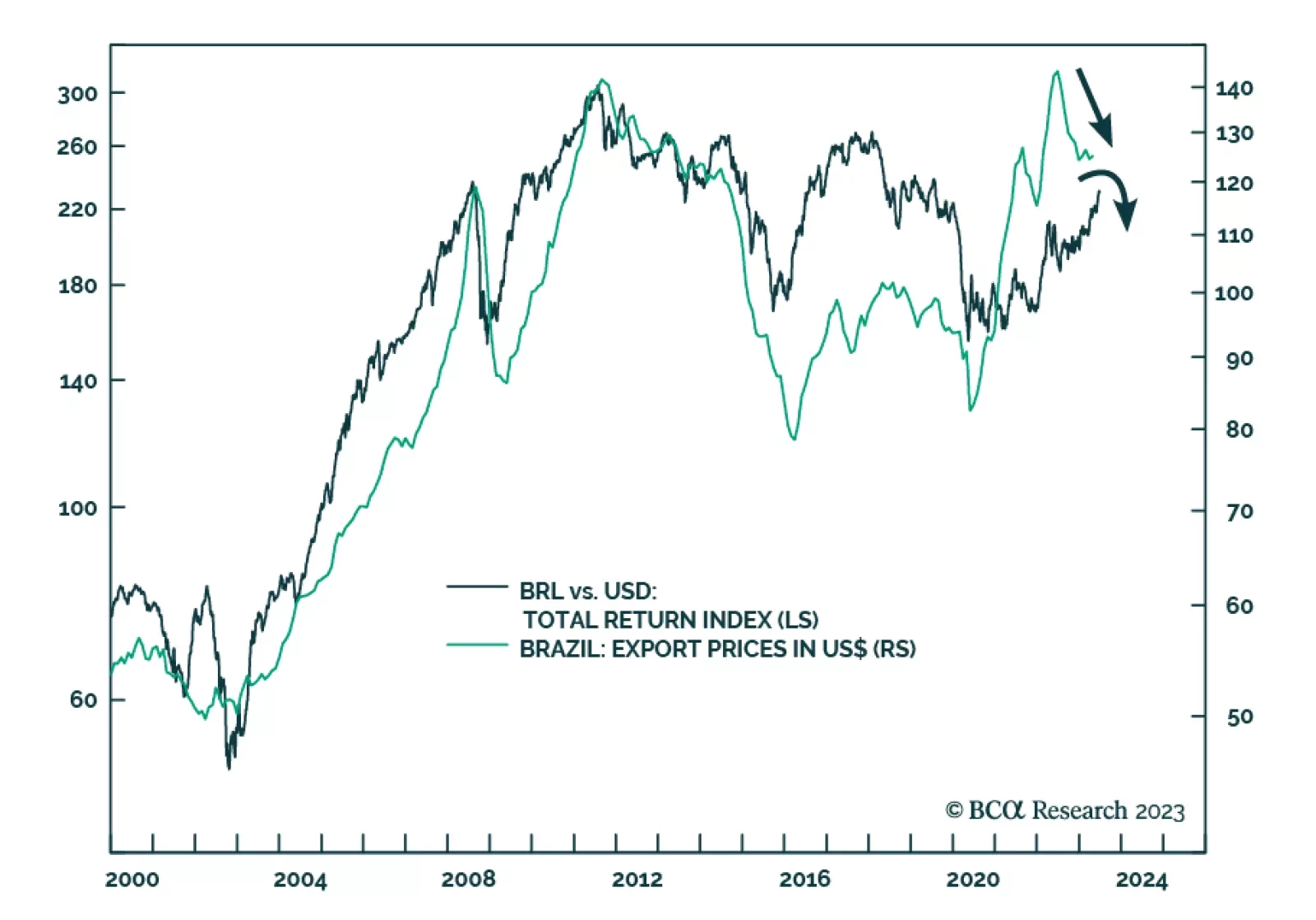

Since the Brazilian Central Bank (BCB) released its latest monetary policy minutes on June 27th, the Brazilian real has depreciated for three days in a row. Will the BRL resume its strengthening trajectory, or is the currency set…

In Section I, we reiterate why a soft economic landing remains improbable in the US. Some reasonable estimates of the level of excess savings point to their depletion in a year’s time, but other estimates indicate a much earlier end…

The combination of a global manufacturing recession and tight/tightening policy is raising a red flag for global non-TMT stocks. In China, households are entering a liquidity trap, and deflationary pressures are heightening.…

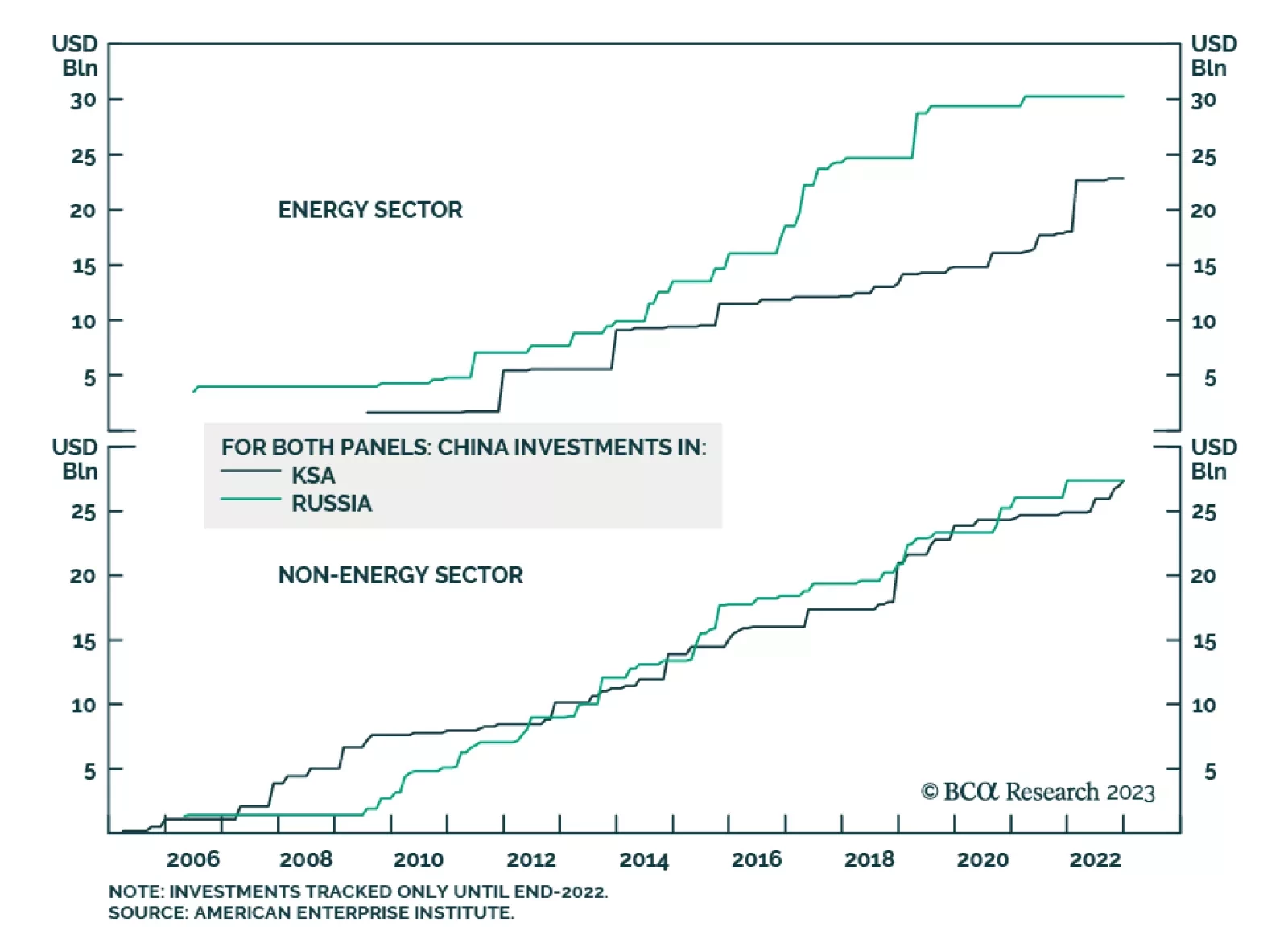

China’s economic and diplomatic interests in the GCC region will expand, as will its military presence. Whether or not this stabilizes the region is yet to be determined, particularly if tensions in the South China Sea and other…

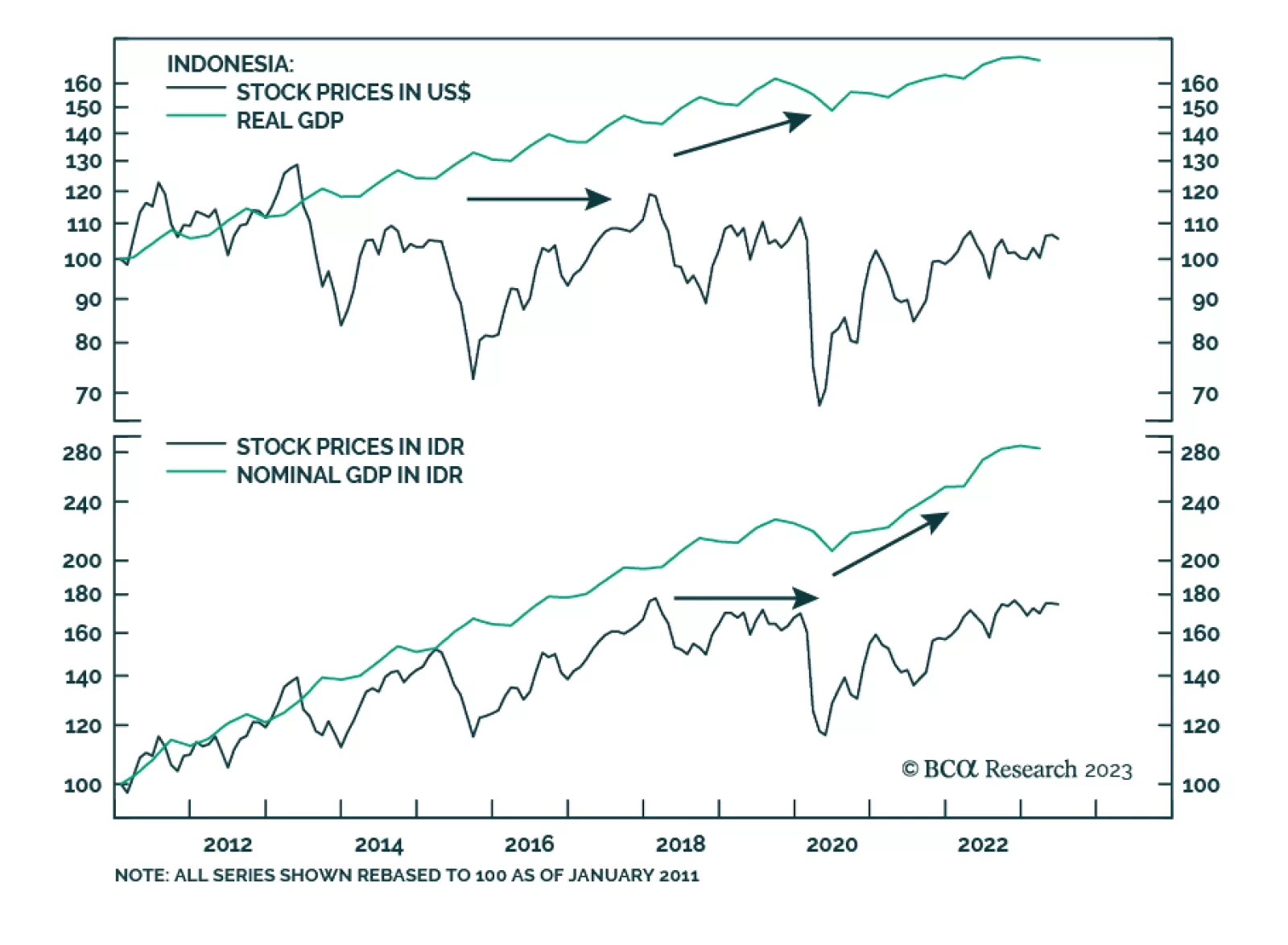

In a recent report, our Emerging Markets Strategy team recommended an underweight stance for Indonesian equities in EM portfolios. The team is also bearish on the rupiah. An unprecedented trade surplus recently gave Indonesia…

The market does not grasp the implied depths of recessions that will be needed to prevent inflation expectations from un-anchoring. Among the major economies, the most vulnerable to a deep recession is the UK. We explain why, and…

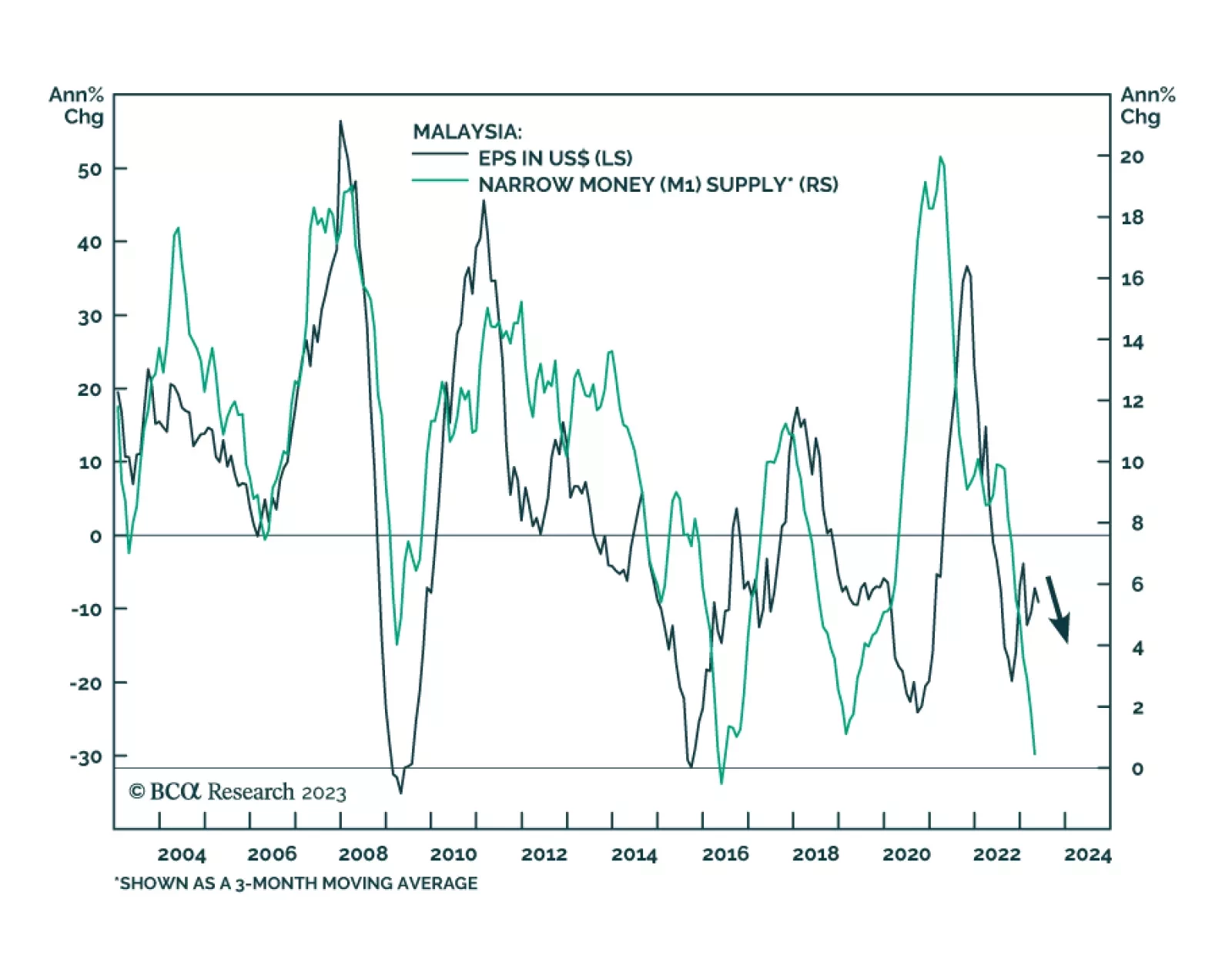

In a recent report, our Emerging Markets Strategy team posited that the bear market in Malaysian stocks will be prolonged. Disinflationary forces have taken hold of the Malaysian economy: money supply has plunged, bond yields…

The attempted coup in Russia produced subdued short-covering rallies in oil, gas, and grains markets, as markets over time have observed that coups, rarely result in loss of production and exports. Markets await Putin’s next move.…