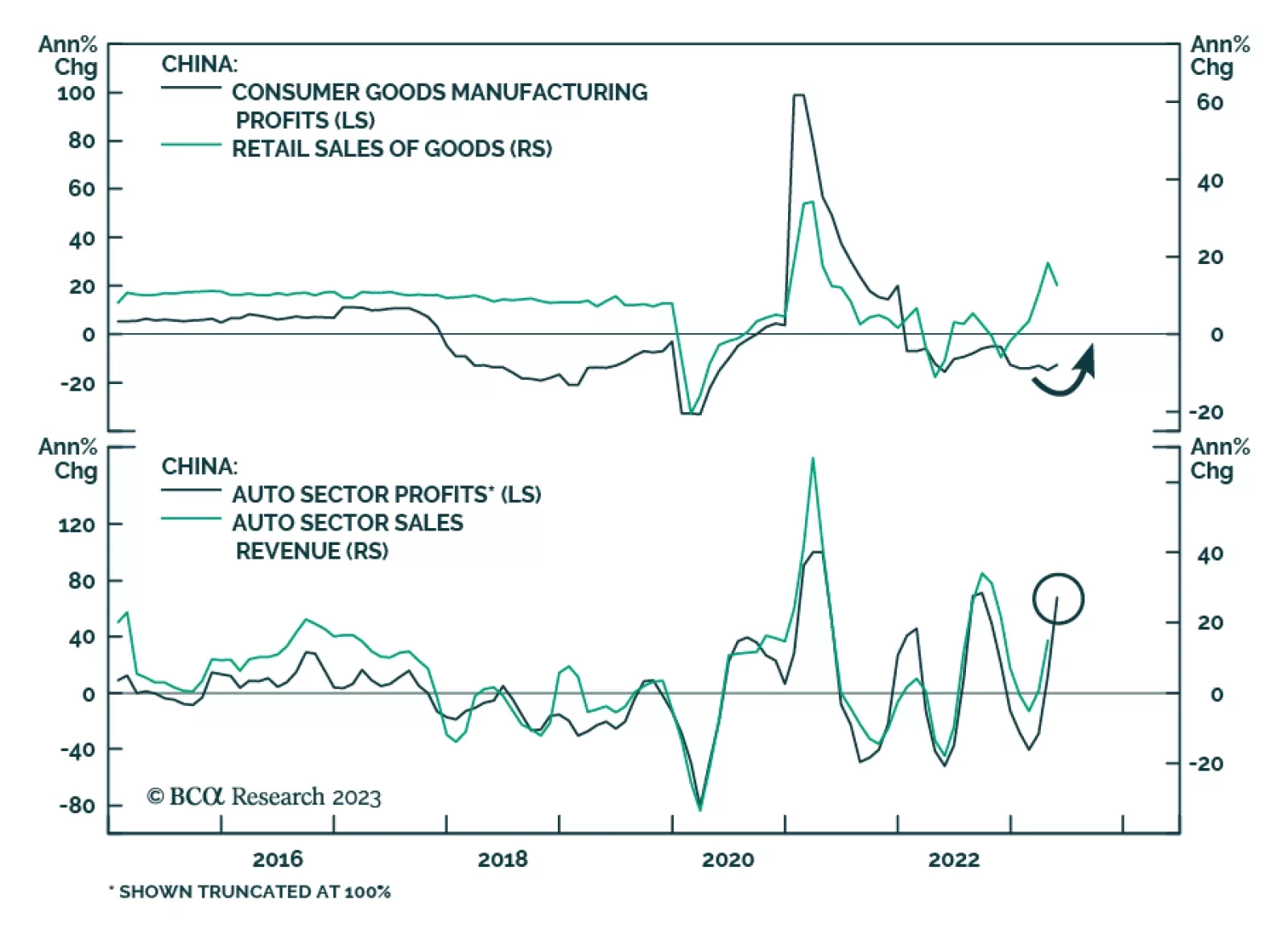

According to BCA Research’s China Investment Strategy service, although the recovery in overall Chinese industrial profits will be subdued, there will be a silver lining among China’s consumer goods producers, autos…

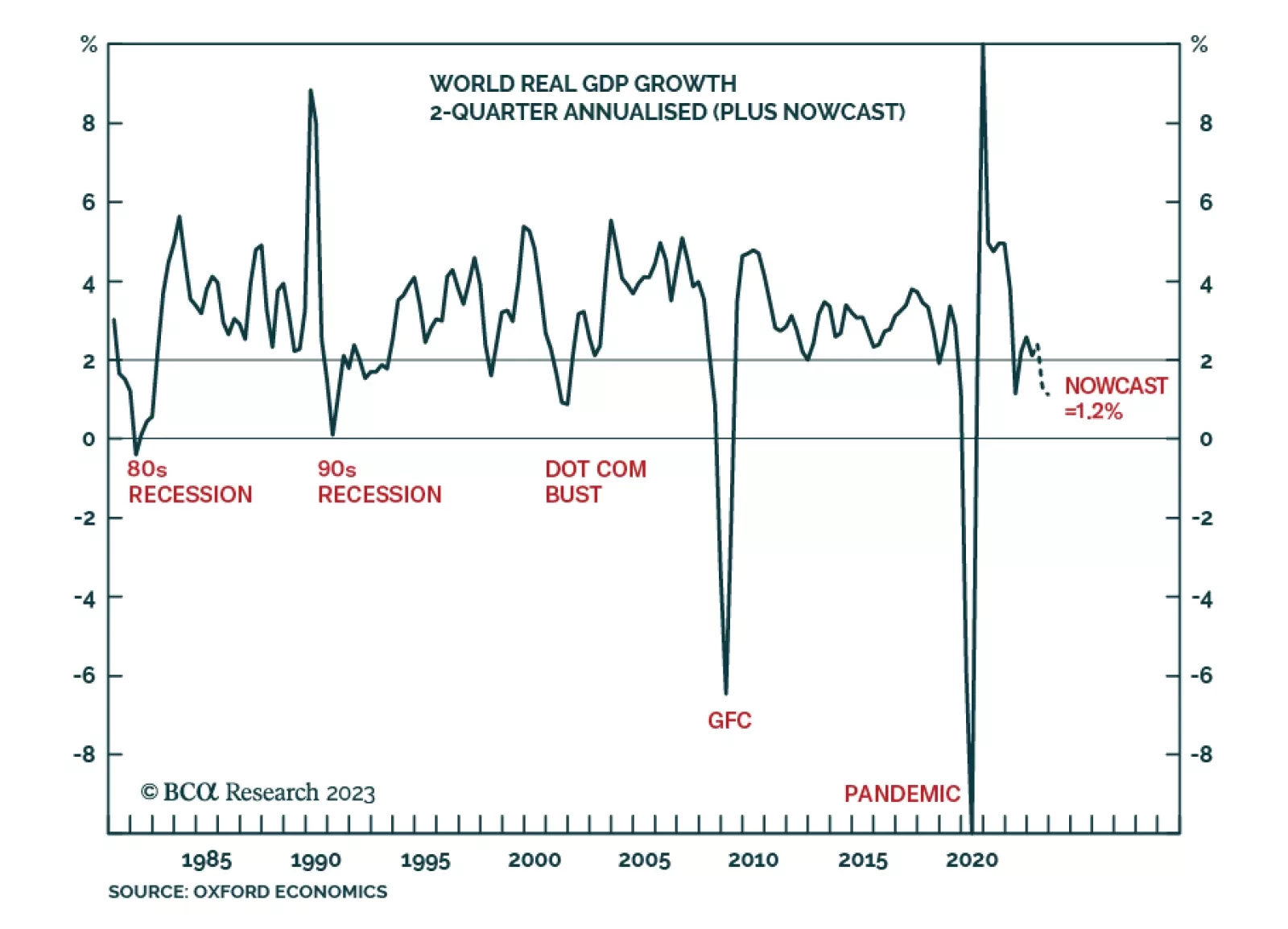

According to our Counterpoint strategy service, latest nowcasts indicate that world growth has likely slowed to sub-2 percent, thereby passing the threshold of a typical world recession as experienced in the early 1970s, early…

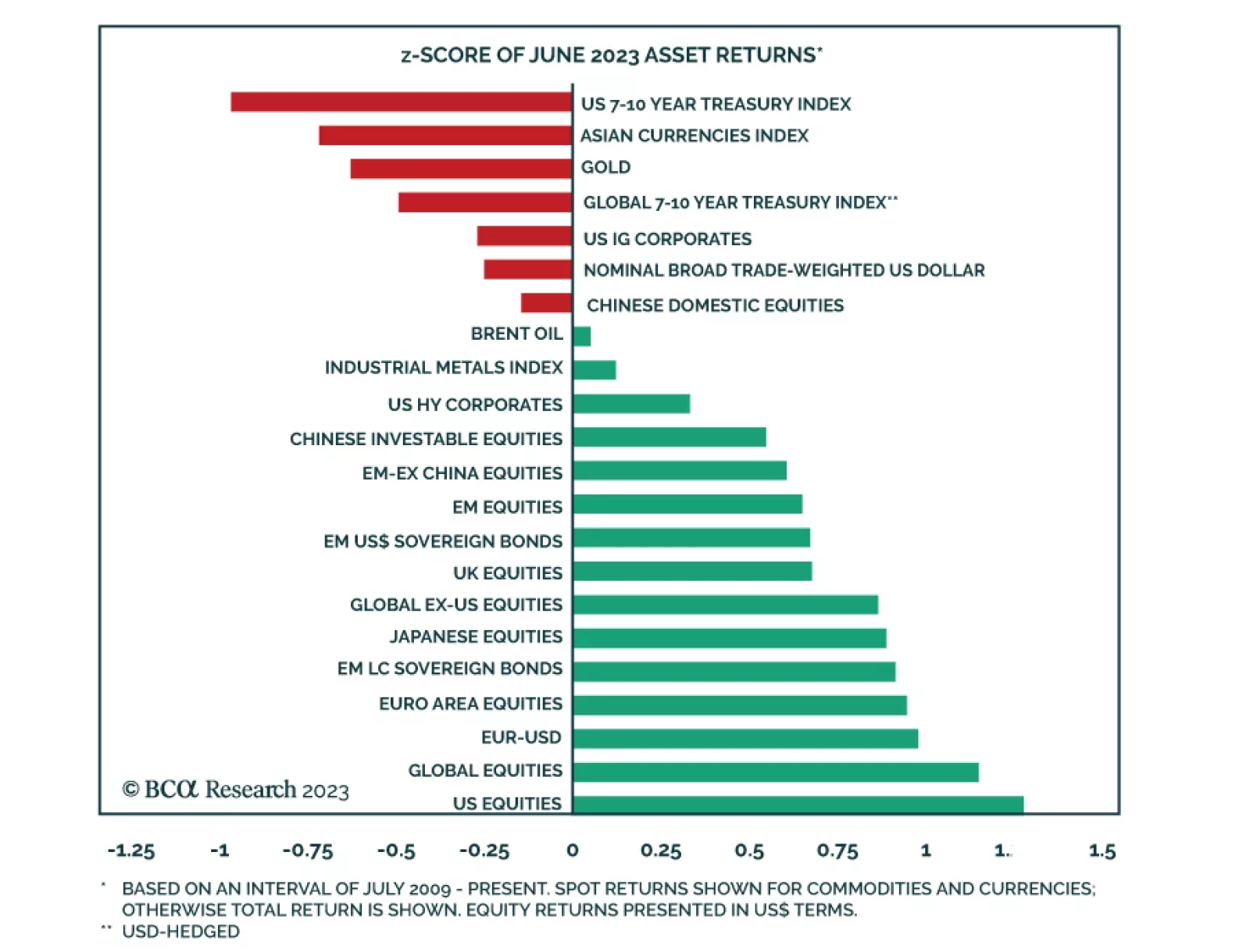

On one hand, China will be exporting deflation to the rest of the world. On the other hand, core inflation is sticky in the US, making the Fed err on the hawkish side. Altogether, these crosscurrents are creating a toxic mix for risk…

Markets continue to be tossed to and fro by central-bank policy, and risks of higher commodity prices. These are due to fiscal stimulus and exogenous weather and war-related risk, which could send food and energy prices higher this…

The world economy is likely already in recession, defined as world growth dipping to sub-2 percent. So far, the world recession has been China-led, but in the coming months it will change to being developed economy-led. Hence, while…

The performance of financial markets continued to improve in June, with most of the major financial assets we track generating positive abnormal returns. The US equity rally – which had been narrowly concentrated among…

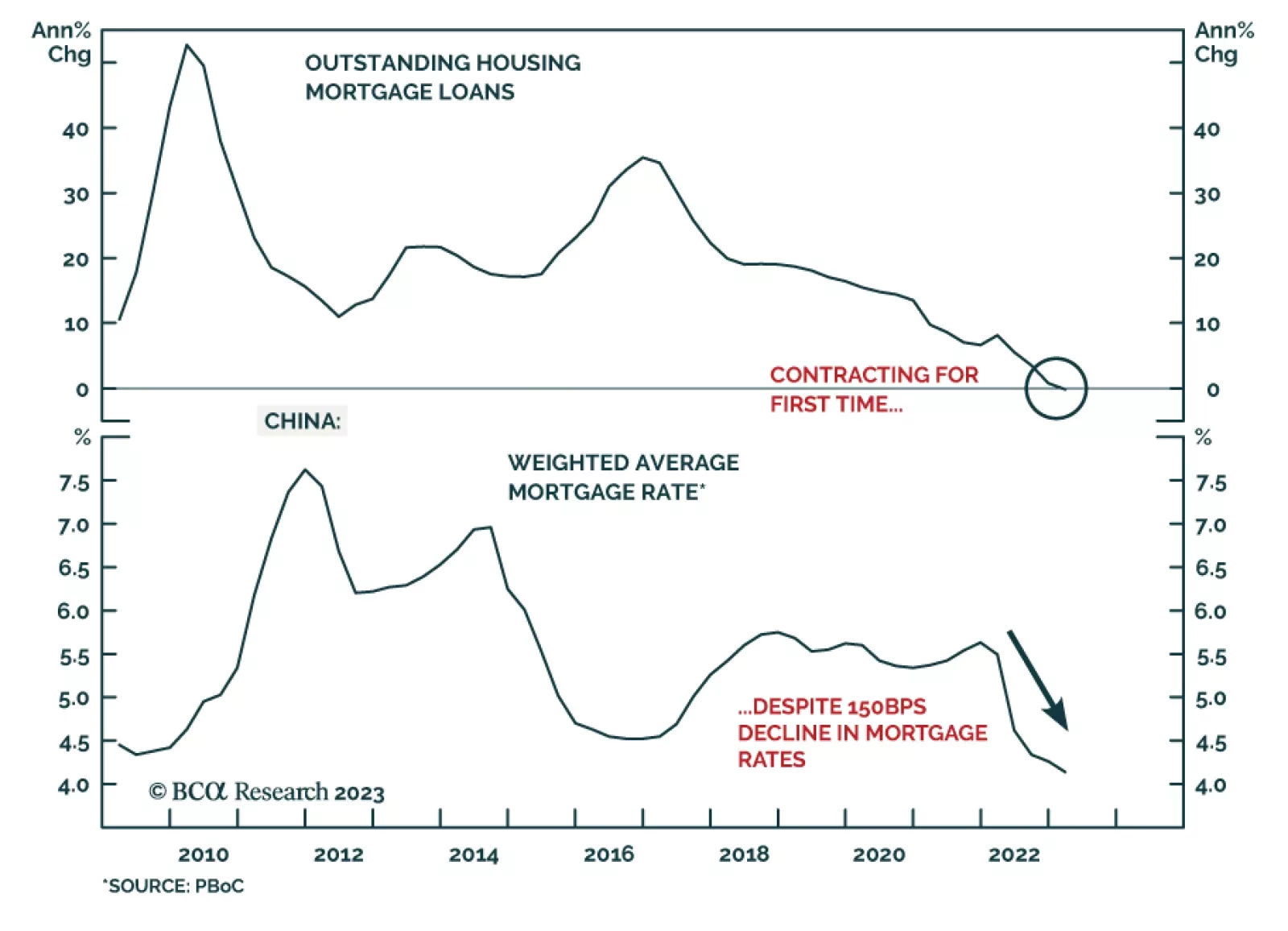

In a recently published report, our China Investment Strategy team revisited the issue of a liquidity trap in China. A liquidity trap is a condition that occurs when lower borrowing costs are unable to boost credit demand and…

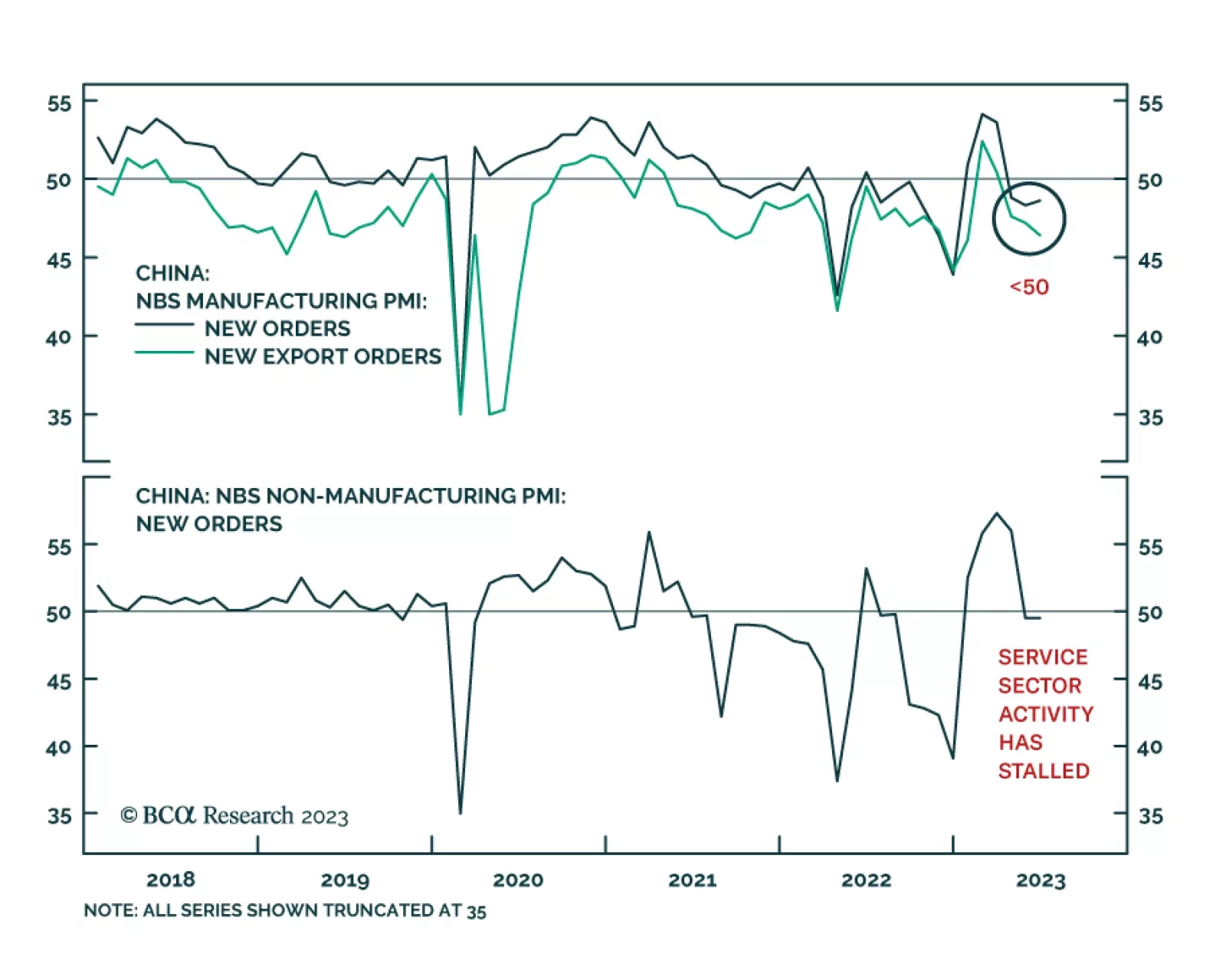

The June NBS PMI data revealed that growth conditions have deteriorated on the margin. The new orders and exports for overall manufacturing as well as for services have not improved and remain below 50. In addition, the import…