In this report, we explore Brazil’s inflation and monetary policy outlook, the Lula administration’s back-and-forth between pragmatism and populism, and how these factors will affect Brazilian financial markets going forward. All in…

Global oil demand growth is tracking with our estimate of ~ 1.8mm b/d for this year. Supply discipline is being maintained by OPEC 2.0, where the core (KSA and the UAE) and Russia have reduced production by ~ 240k b/d yoy in 1H23.…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

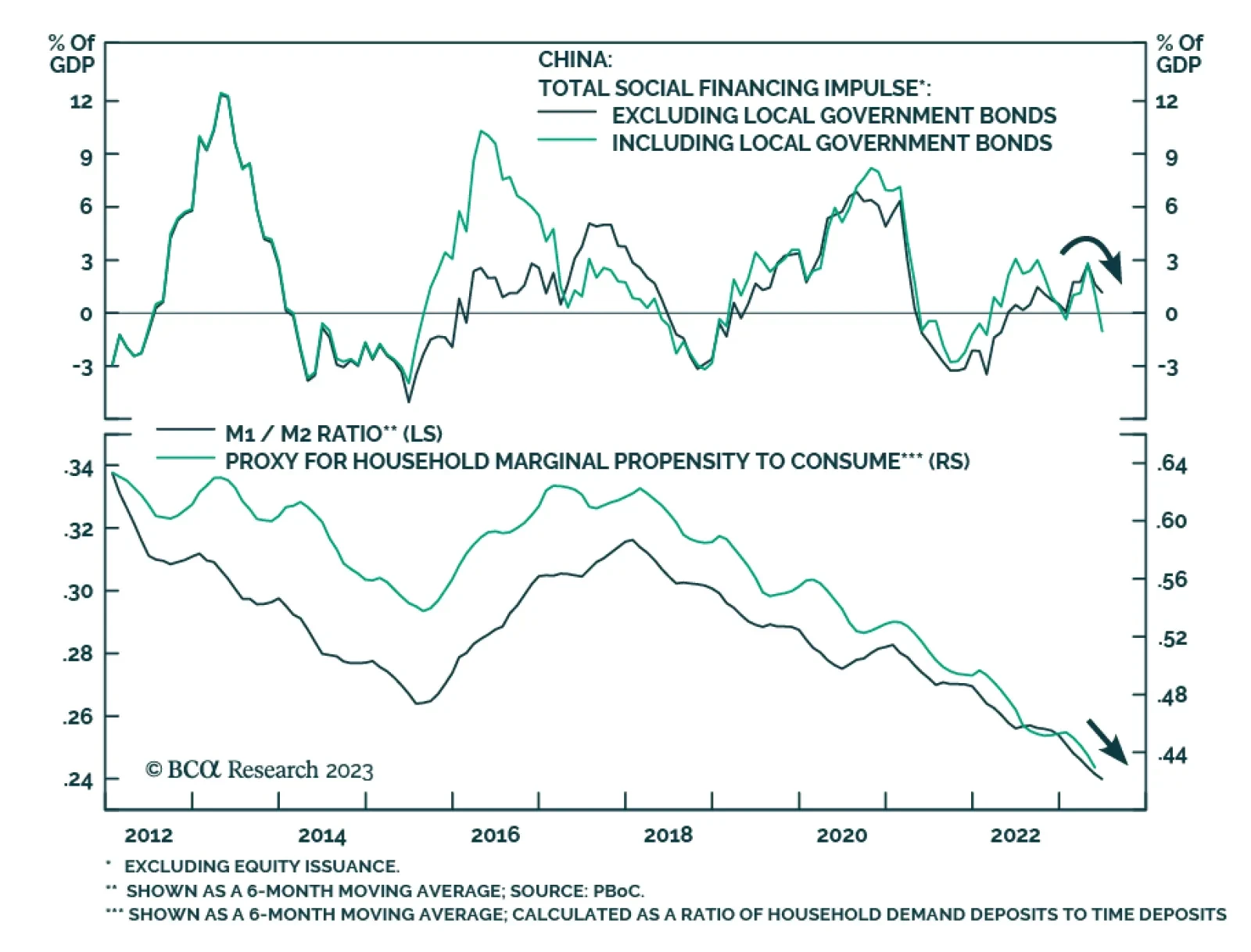

The Politburo meeting in late July will set the course for economic policy for 2H23. We think China will only resort to "irrigation-style" stimulus if something breaks in the economy and/or financial markets. Furthermore, the gradual…

China’s credit expansion surprised to the upside in June. Aggregate social financing totaled CNY 4.22 trillion – above expectations of CNY 3.10 trillion and exceeding CNY 1.56 trillion in the prior month. Similarly,…

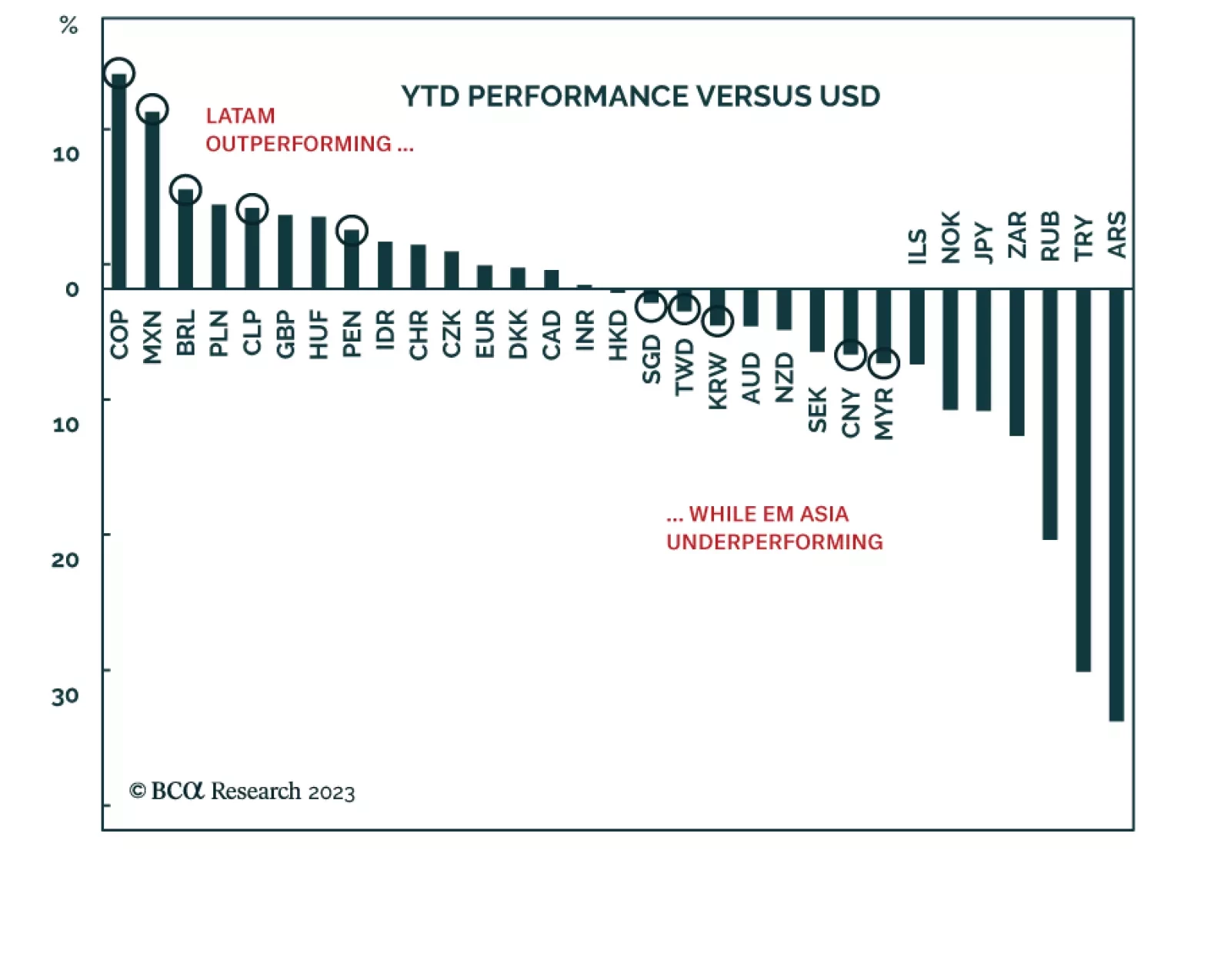

Investors’ positioning in the USD is not homogenous: they are short some currencies but long others versus the greenback. Market commentators often refer to the US dollar. They implicitly mean the US currency is moving…

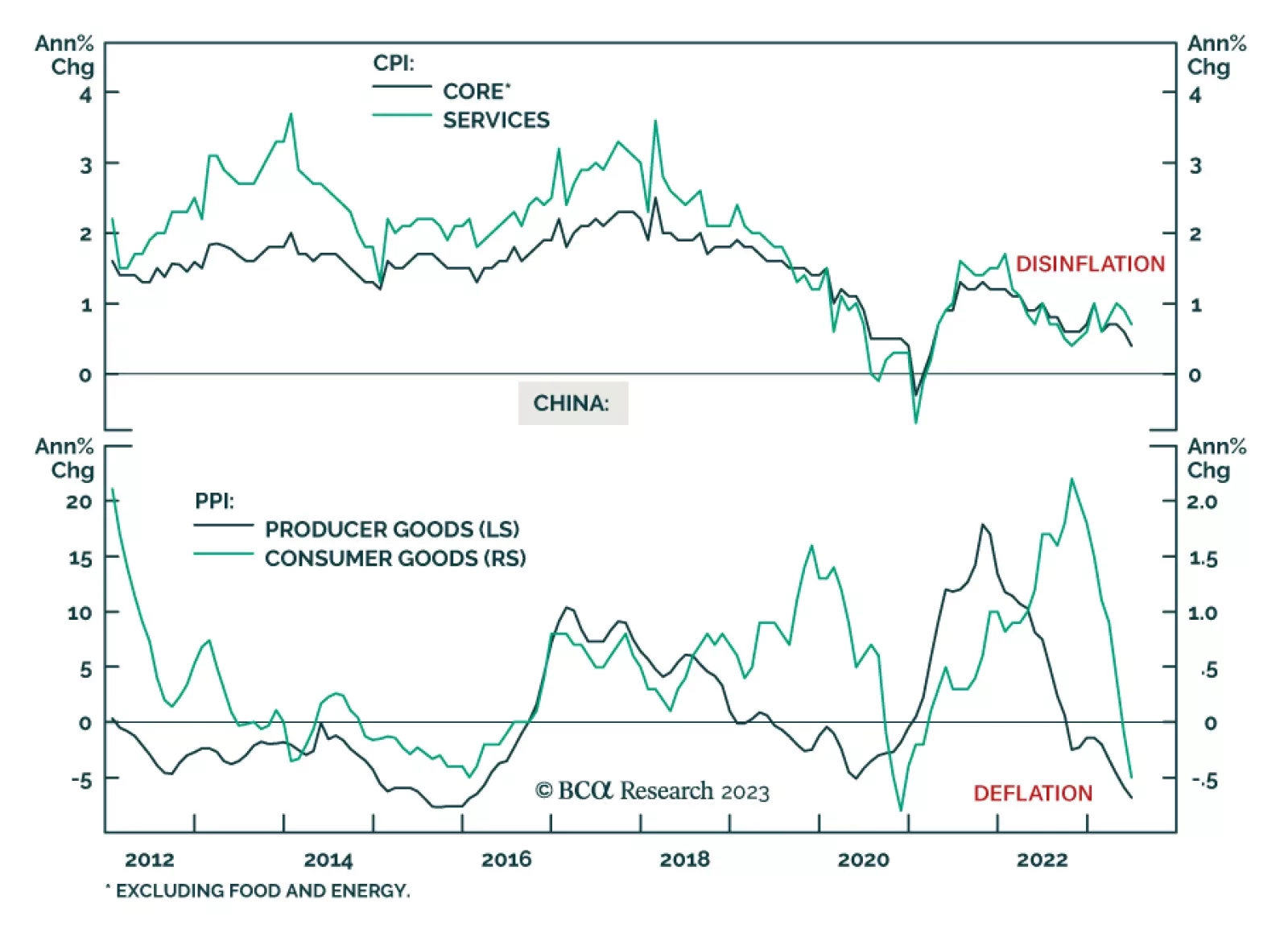

China’s CPI and PPI inflation updates indicate that deflationary pressures continue to dominate the domestic economy in June. Producer prices declined at a faster pace than in the prior month, falling by -5.4% y/y following…

This week we present our Portfolio Allocation Summary for July 2023.

Latin American currencies are among the best performers in the FX space this year. The Colombian peso, Mexican peso, and Brazilian real occupy the top three spots among the major EM and DM currencies, up by 16%, 13%, and 7% vis-…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…