History suggests that a “soft landing” is highly unlikely after such an aggressive Fed tightening cycle. The rally could continue for a little longer but, on the 12-month horizon, market risks are very skewed to the downside.

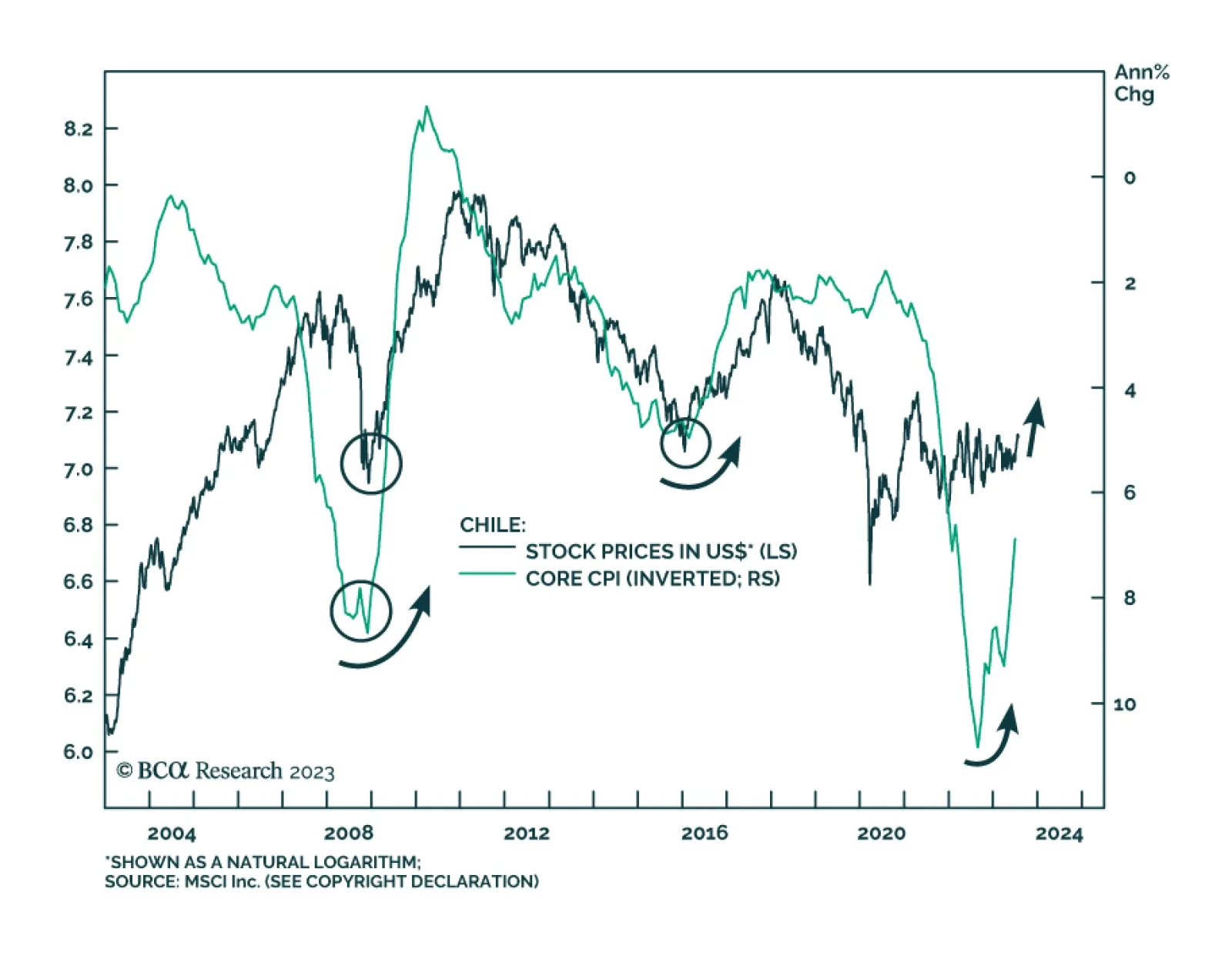

Last Friday, the Central Bank of Chile became the first major Latin American monetary authority to cut rates, thereby beginning the EM monetary easing cycle. In its latest meeting, board members decided to reduce the policy…

In Section I, we audit the market’s “soft landing” narrative in response to a meaningful challenge to our cautious stance from recent financial market developments. We acknowledge that US economic growth was stronger in the first…

Among the critical materials needed for the global energy transition, Li is expected to see the largest increase in demand from 2022 to 2050. Li supply is not constrained, but continued investment in mining and refining will be…

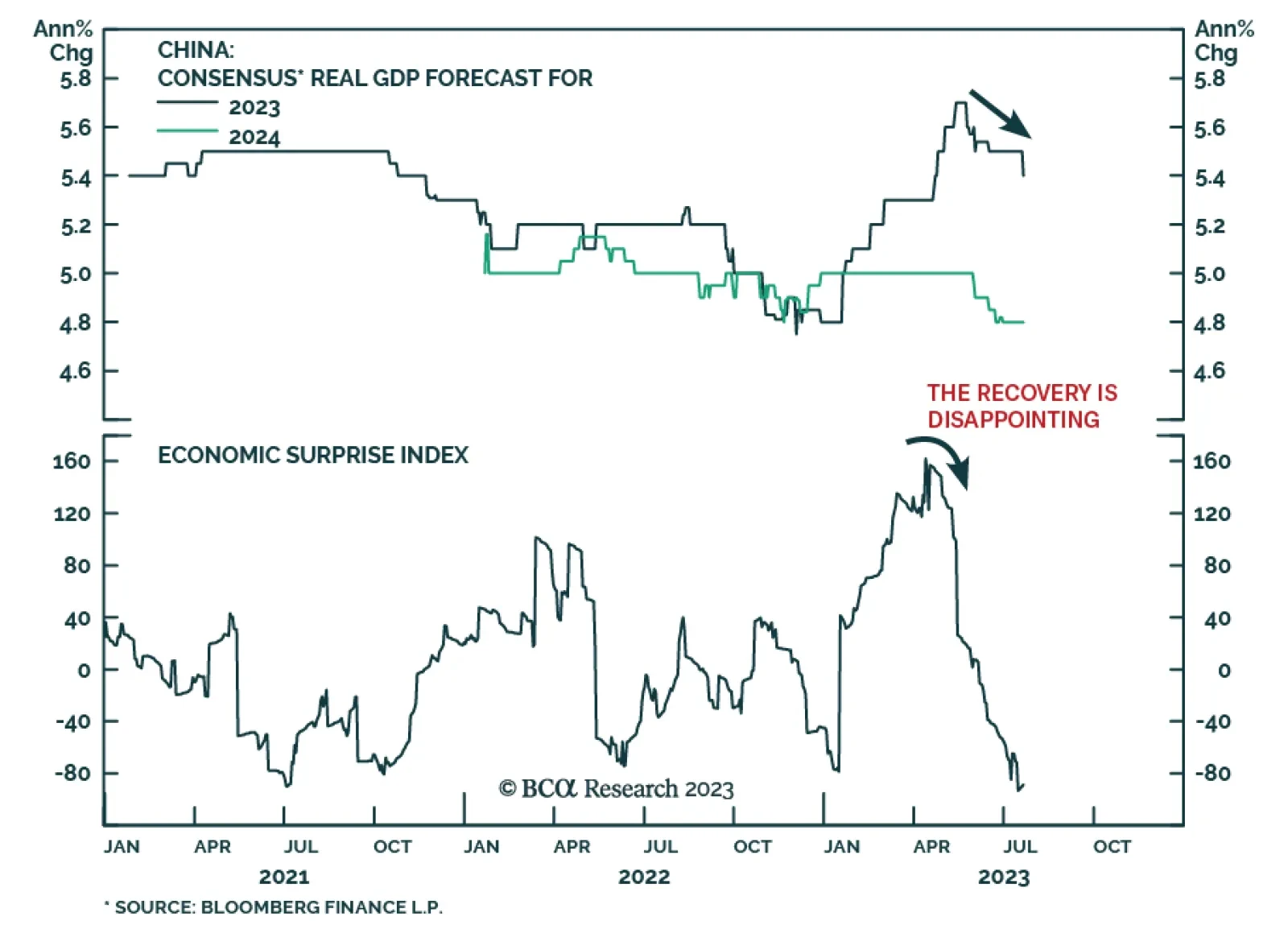

Stay cautious on Chinese stocks. Equity investors should use any rebound in onshore stock prices to downgrade A-shares from overweight to neutral within global and EM equity portfolios. Remain underweight Chinese investable/offshore…

China’s Politburo meeting delivered a disappointing signal about Beijing’s willingness to deliver meaningful stimulus. Although policymakers pledged support for domestic demand, consumer sentiment, and risk prevention…

China’s economy is cruising at a very low altitude where gravity forces are intense. Downbeat consumer and business sentiment will reduce the effectiveness of stimulus. Anything short of “irrigation-style” stimulus will be…

In this report, we present our performance review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for the Q2/2023, and the outlook and scenario analysis for the next six months. The portfolio return…

We see challenges ahead for Global Buyout across geographies as valuations need further resetting. While we are concerned with capital controls and flight risk in Asia-Pacific Venture Capital, the upside potential from AI may be…

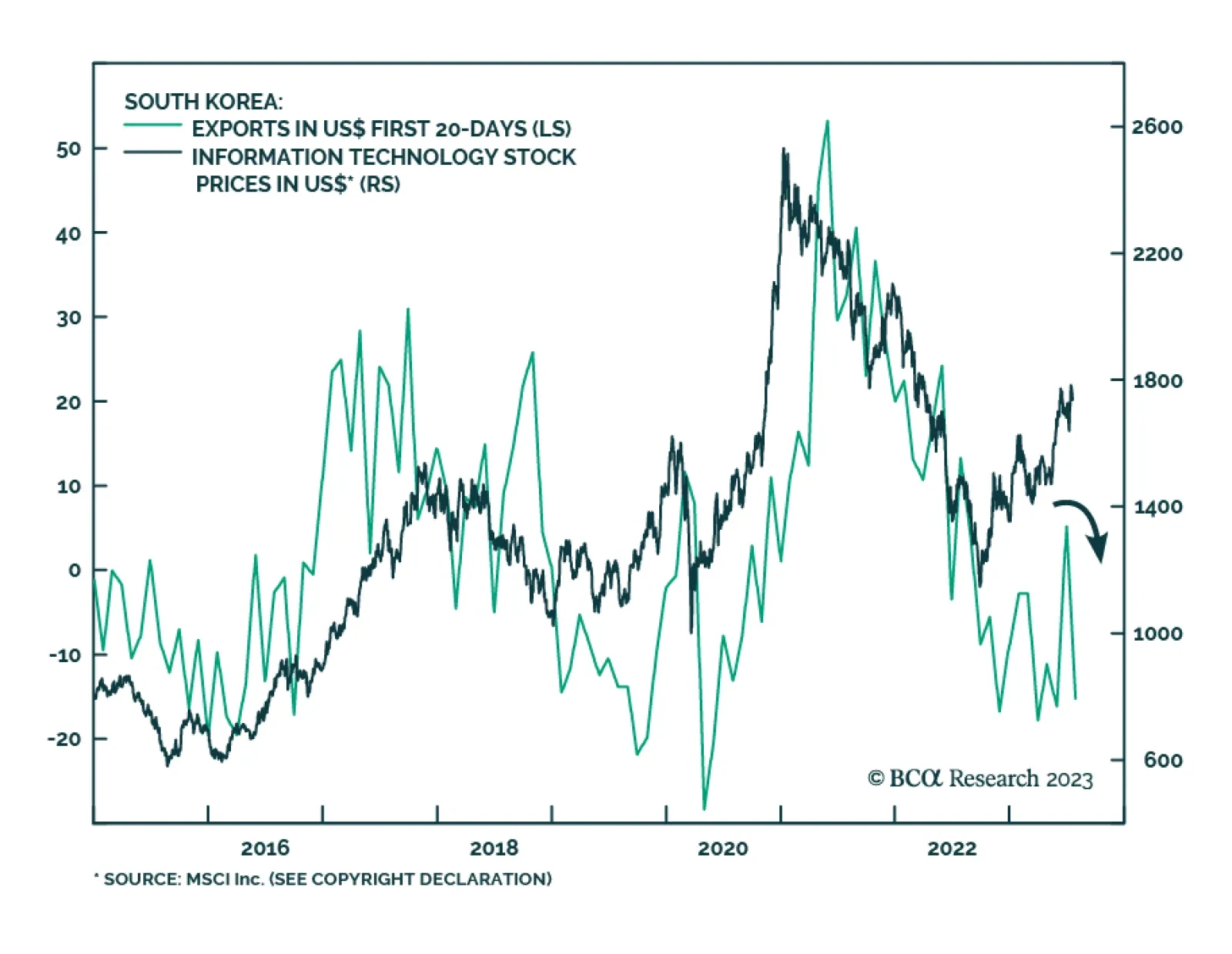

South Korean exports in the first 20 days of July corroborate the signal from Taiwanese export orders that Asian trade conditions remain weak. The former declined by -15.3% y/y, undoing the optimism following a 5.3% y/y increase…