On Monday, Asia Pacific equity markets closed in the red due to the news that China’s largest real estate developer, Country Garden, is suspending the trading of some of its bonds. This recent episode is a continuation of…

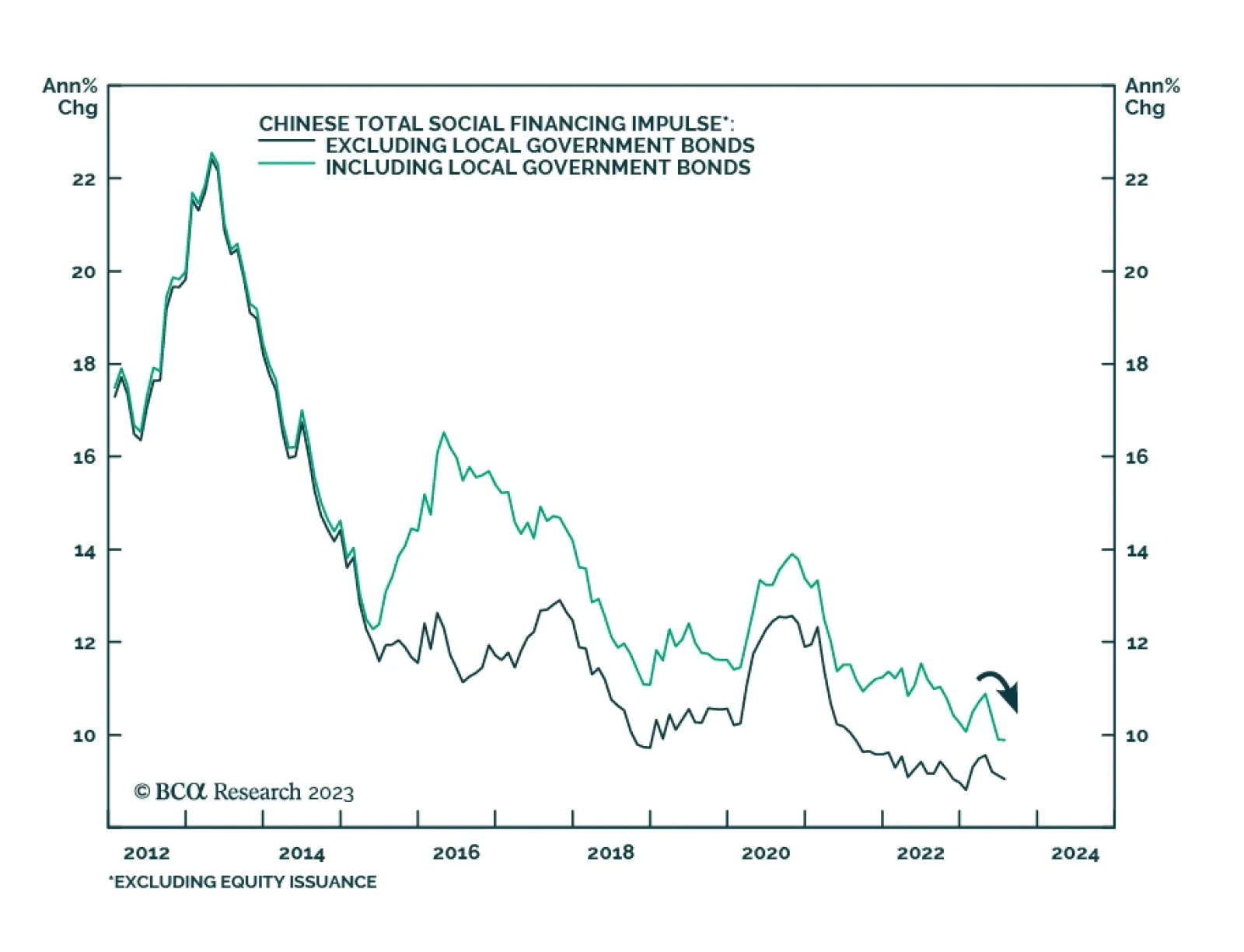

Chinese credit and money data fell significantly below expectations in July. The CNY 0.53 trillion increase in aggregate social financing marks a significant slowdown from CNY 4.22 trillion in June and came in significantly below…

Numerous divergences have opened up between global risk assets and global business cycle variables. These gaps are unsustainable, and odds are that the recoupling will occur to the downside with risk assets selling off.

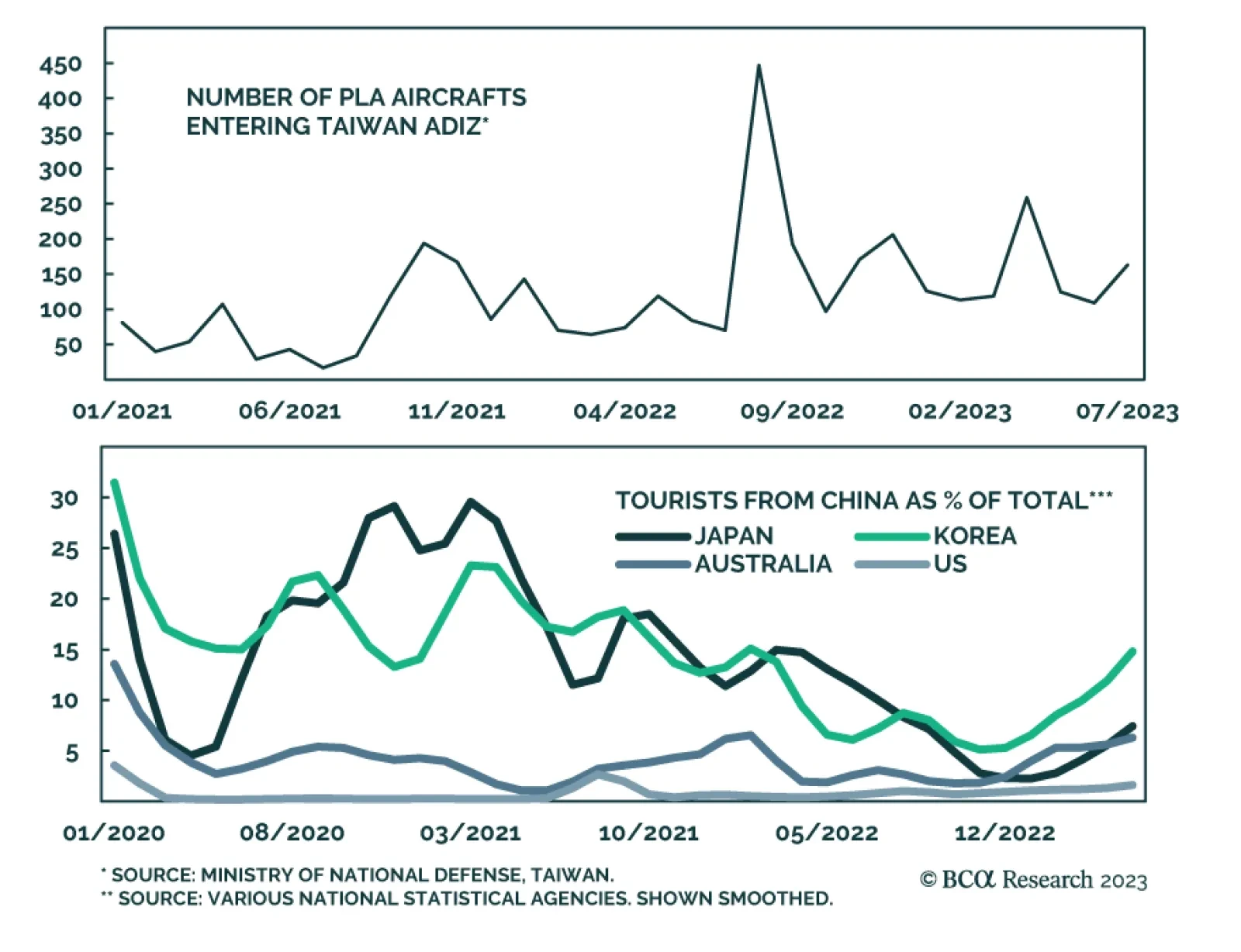

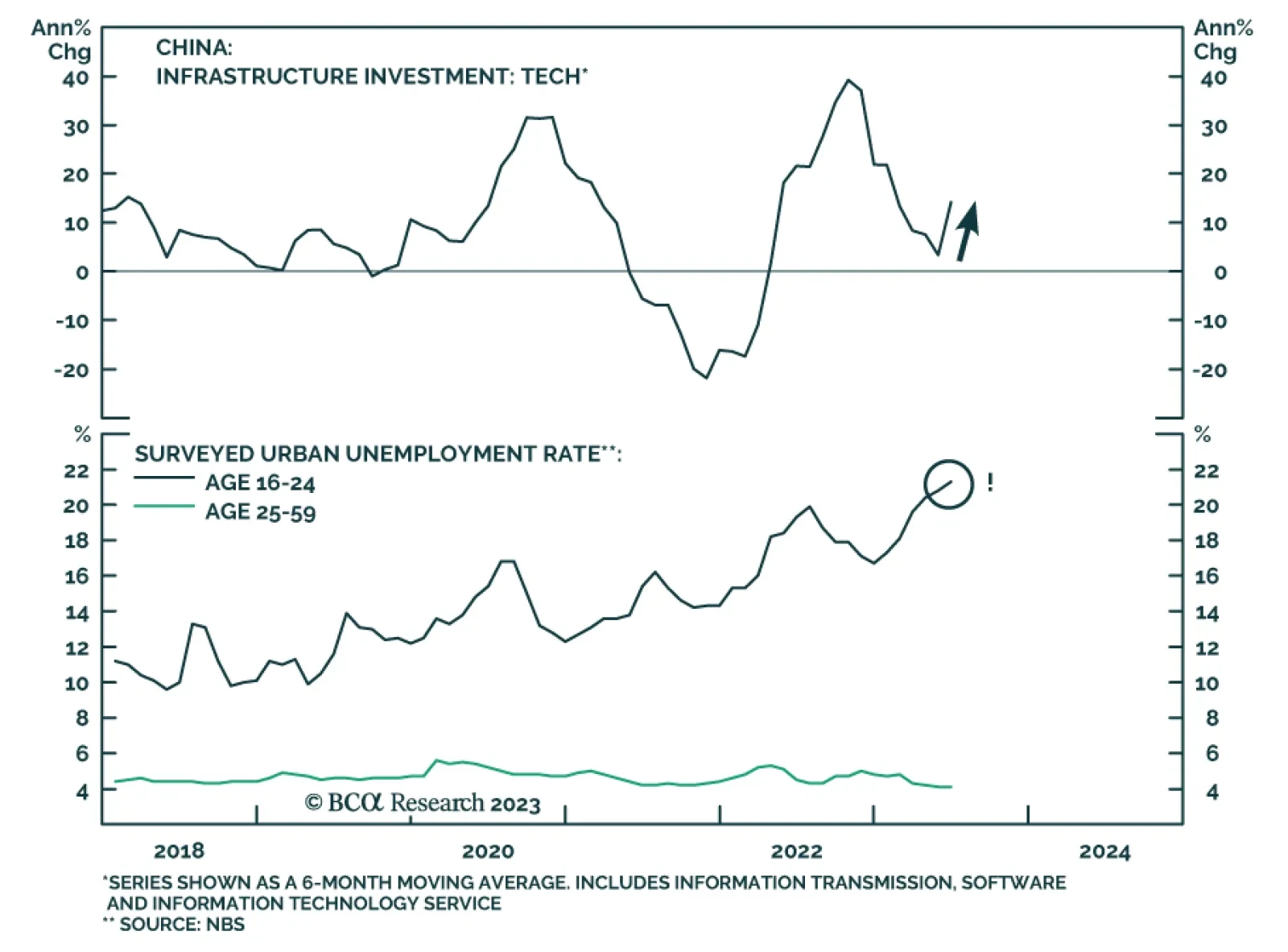

On Wednesday, President Joe Biden announced that a new ban on some US investment into China’s quantum computing, advanced chips and artificial intelligence sectors will come into force next year. This latest escalation is…

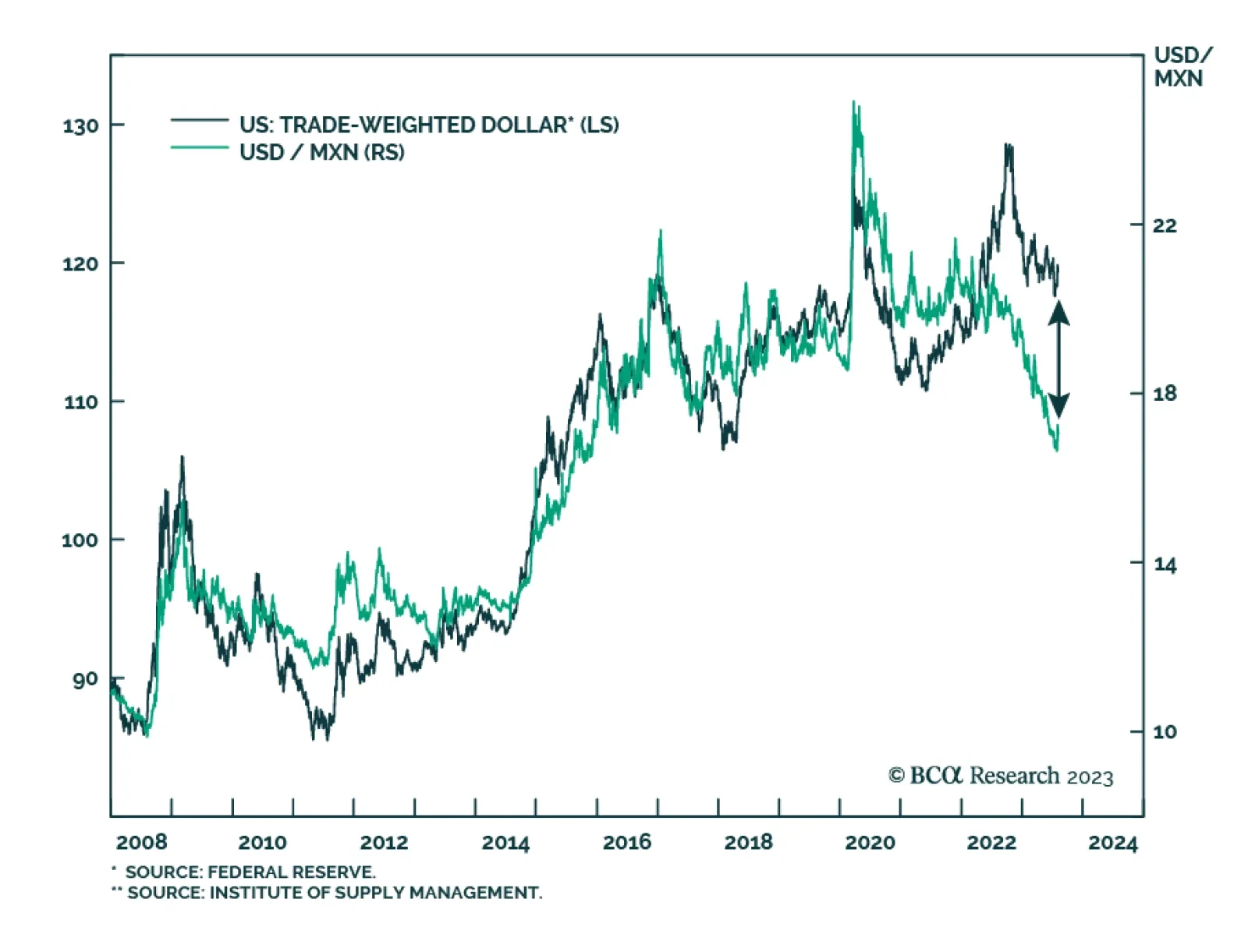

The Mexican peso is the best performing major currency so far this year, gaining 14% vis-à-vis the greenback over this period. Even during the latest bout of dollar strength since mid-July, MXN has weakened by the least…

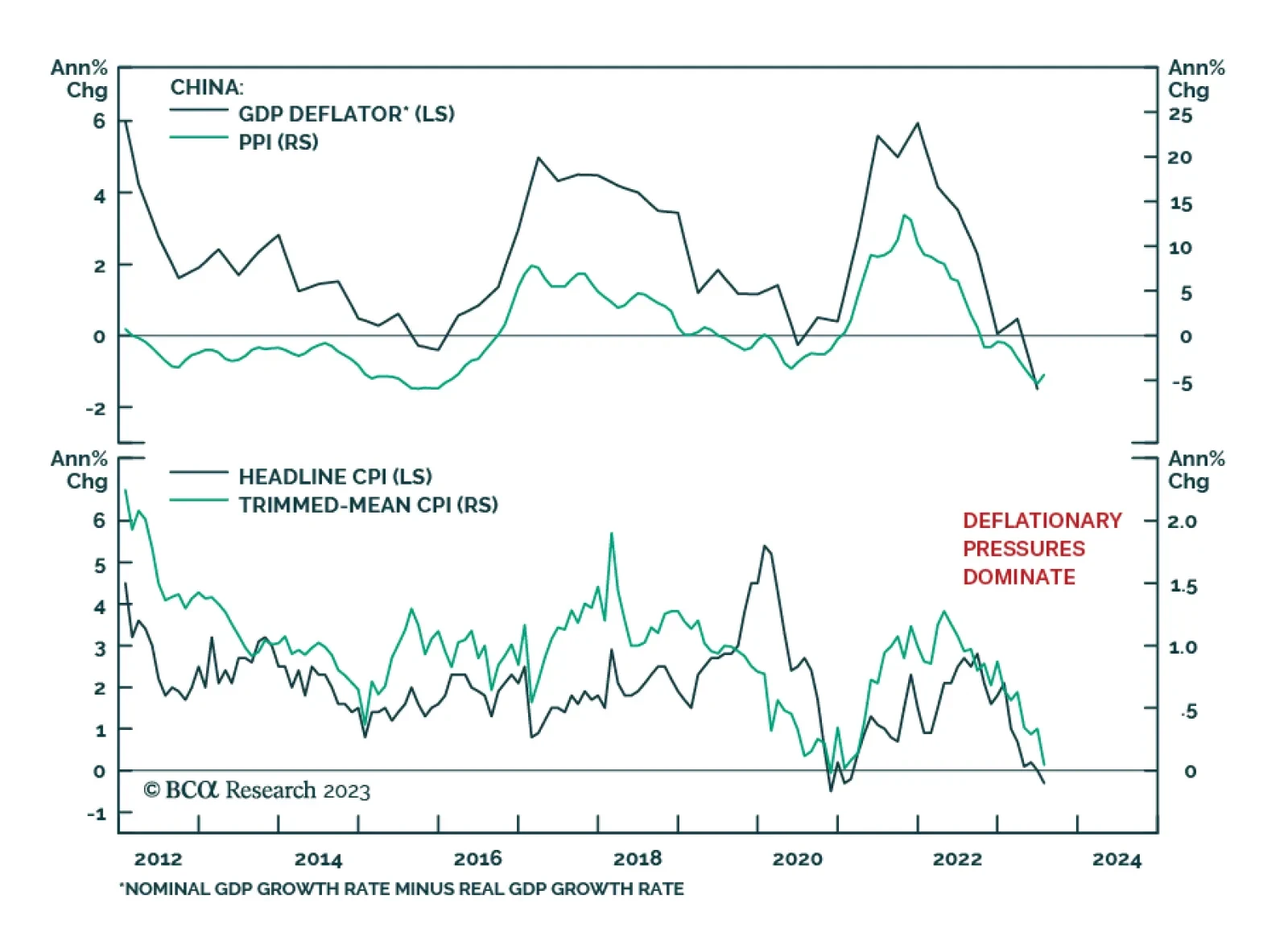

China’s CPI and PPI inflation release for July indicates that deflationary pressures dominate the domestic economy. After remaining unchanged in June, consumer prices fell by 0.3% y/y. Meanwhile, the 4.4% y/y drop in…

China has generated 41 percent of the world’s economic growth through the past ten years, al-most double the 22 percent contribution from the US. Now that the Chinese growth engine is failing, we explain why it is arithmetically…

Although the RMB has cheapened, macro conditions are not yet favorable for the Chinese currency. We expect the RMB to decline by at least another 5% in the next six months. A weak currency and subdued economic growth lead us to…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

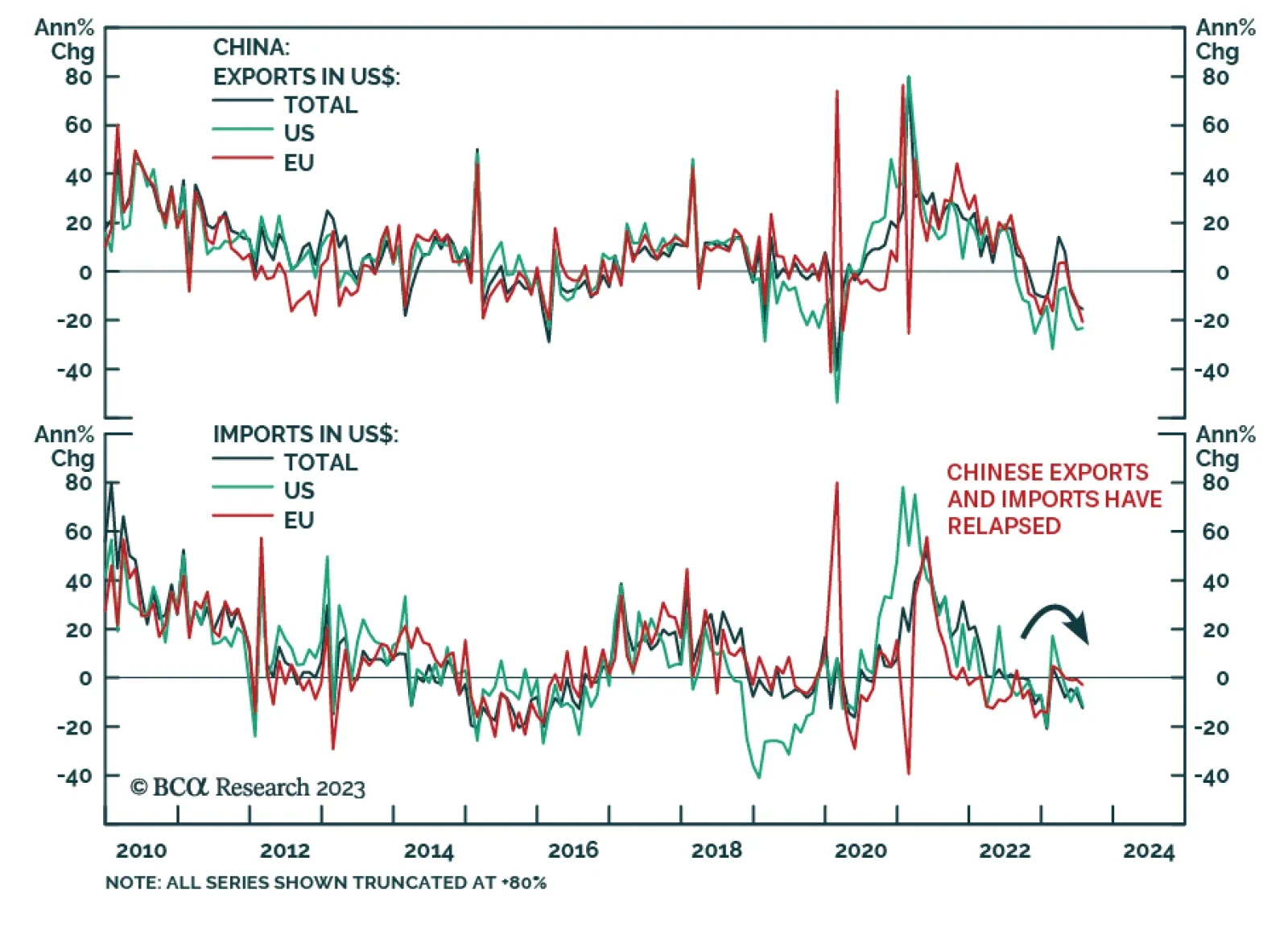

Chinese trade data continued to deliver a pessimistic signal about the global manufacturing cycle. The export contraction deepened to -14.5% y/y in US dollar terms in July – below expectations of a -13.2% y/y decline and…