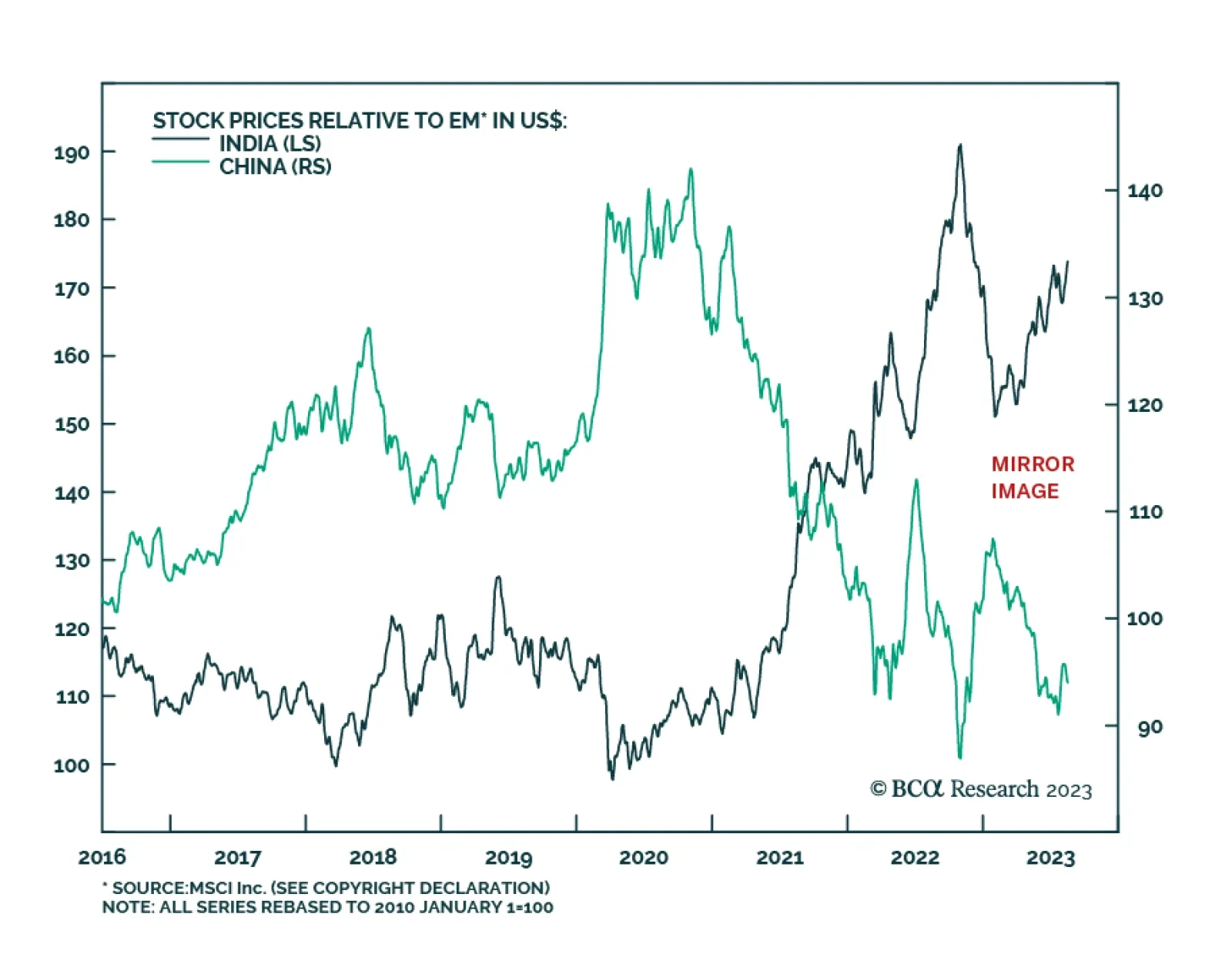

Indian stocks have gone up this year even as the broader EM markets have been falling. How long can Indian markets continue to rise?

Our Emerging Markets Strategy team expects a further decline in Indian stocks. Foreign equity inflows have been instrumental in the recent rally, but they will likely reverse in the coming months as risk-off sentiments pervade…

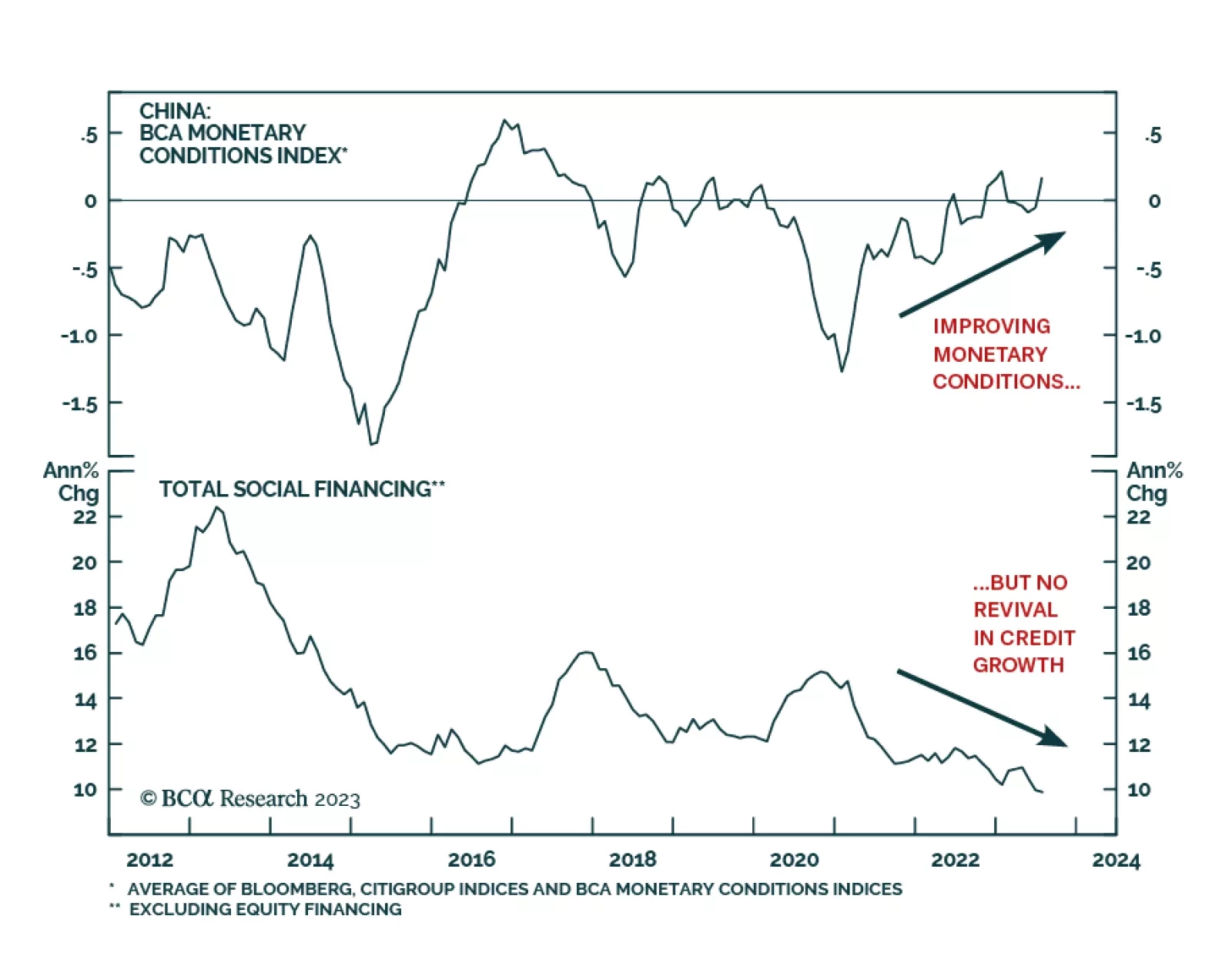

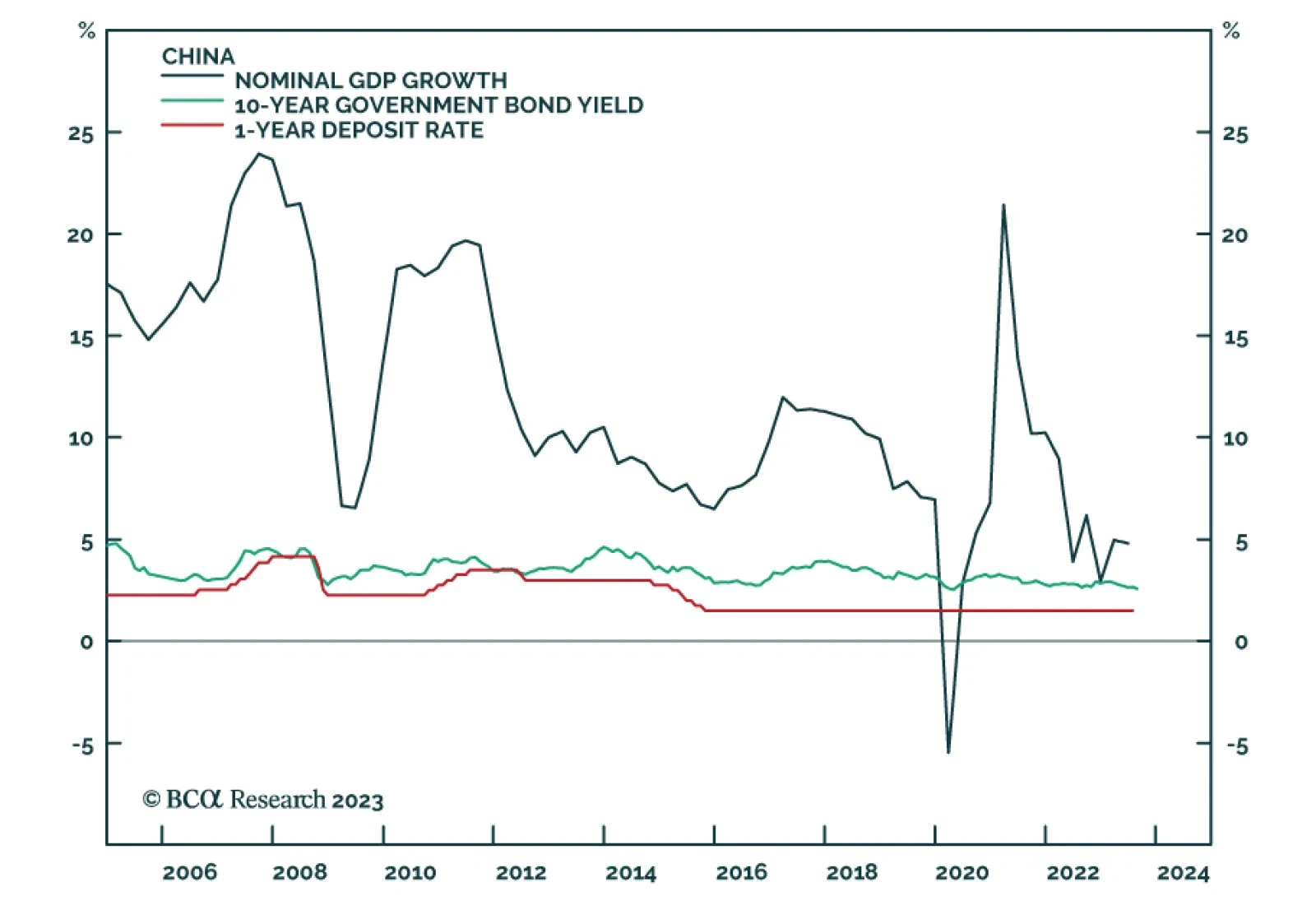

Despite the underwhelming economic recovery, Chinese authorities remain reluctant to open wide stimulus taps as much as they have in past economic downturns. This is corroborated by the PBoC’s marginal interest rate cut…

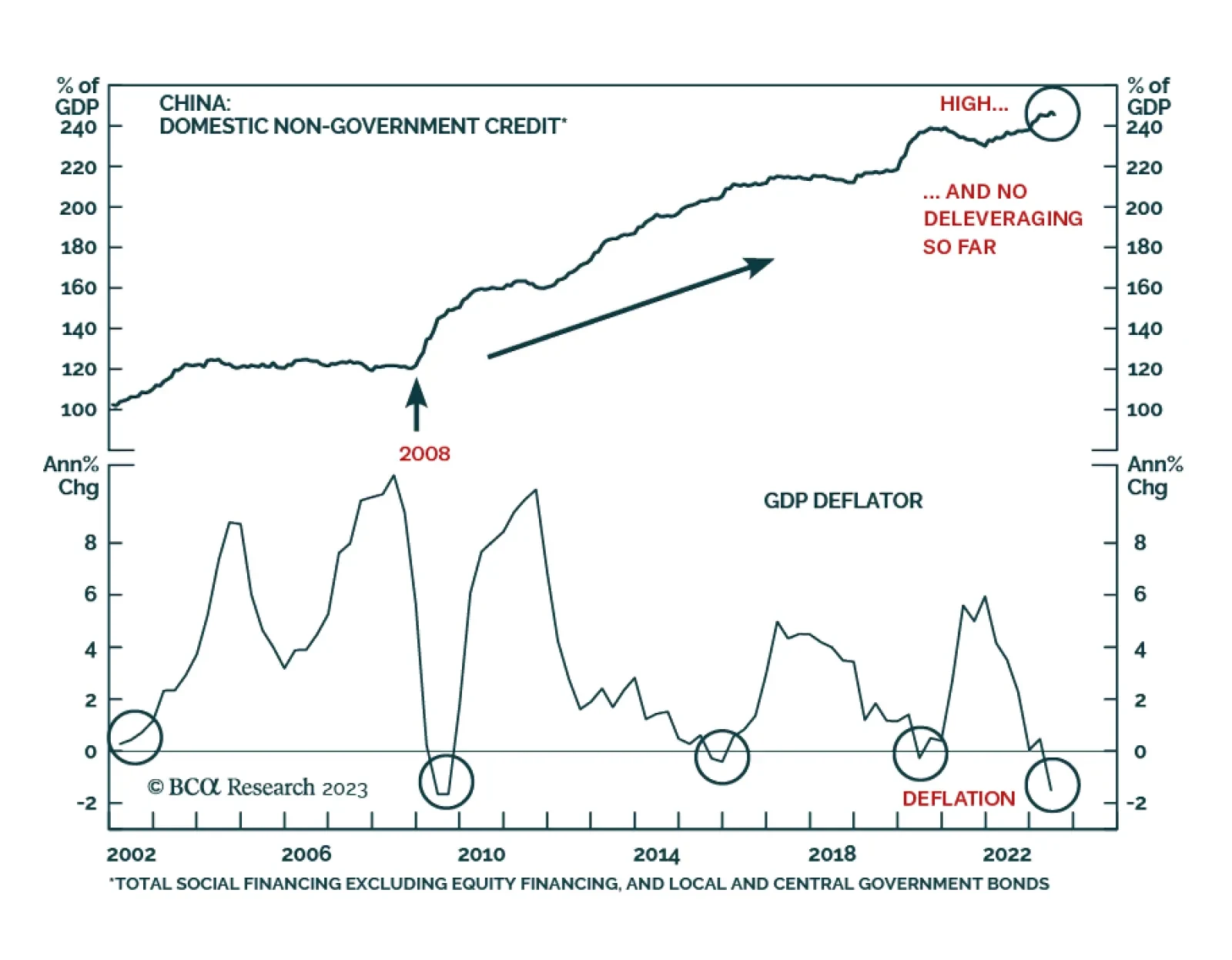

Before doctors prescribe treatments to a patient, they first make a diagnosis. The success of the treatment is contingent upon the accuracy of the diagnosis. The same is true for a country’s economy. Many commentators…

The conventional wisdom is that China’s economy is overly indebted and too reliant on residential construction and exports as drivers of growth. While there is much truth to these claims, they ignore the underlying…

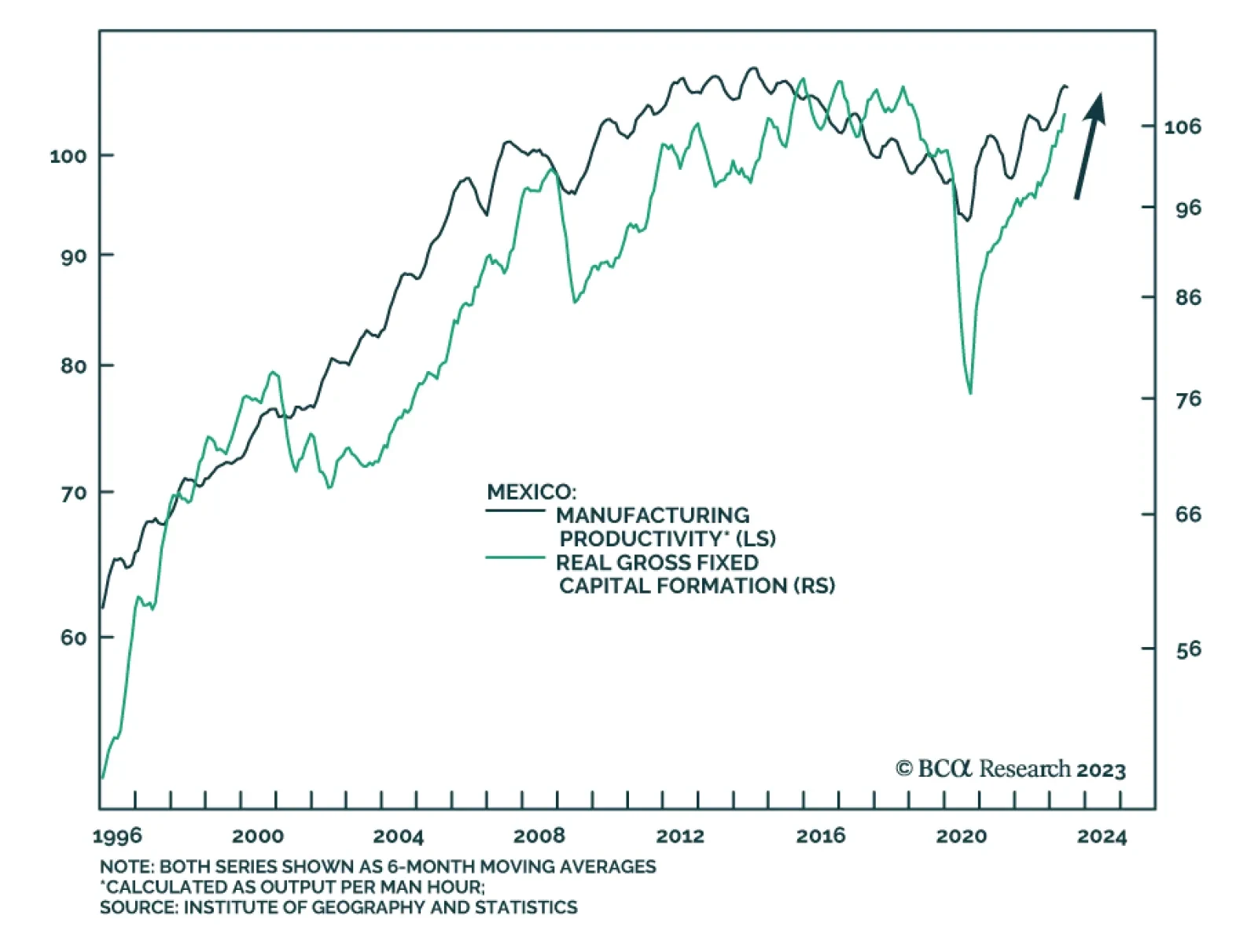

Mexican financial markets have been this year’s stellar outperformers, both in absolute terms and relative to their EM peers. Naturally, the question arises: how sustainable is this rally? According to our Emerging…

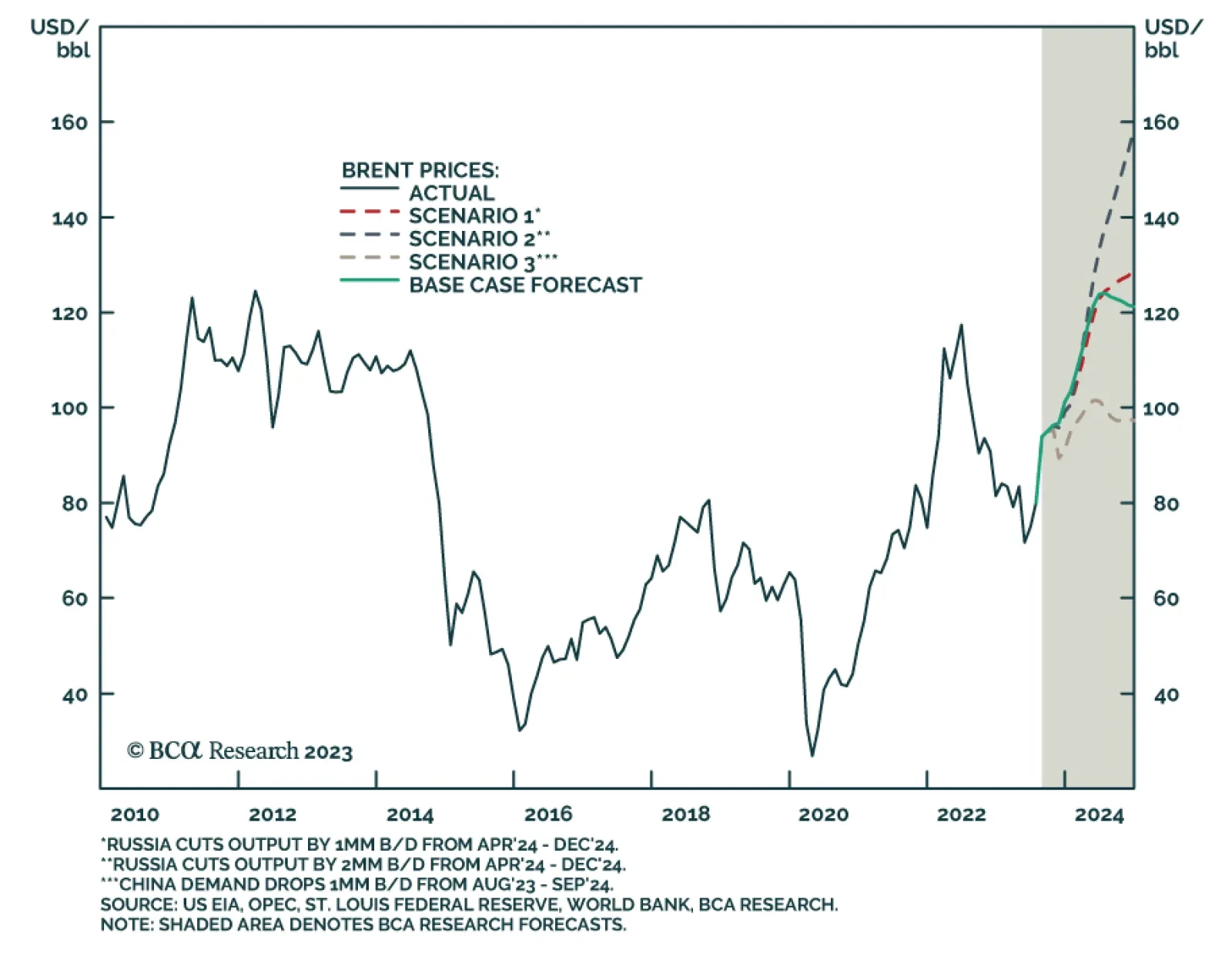

2023 is shaping up as a record-breaking year for global oil demand, according to our colleagues BCA's Commodity & Energy Strategy (CES). By year end, they expect the world will be consuming a record 103.5mm b/d, an…

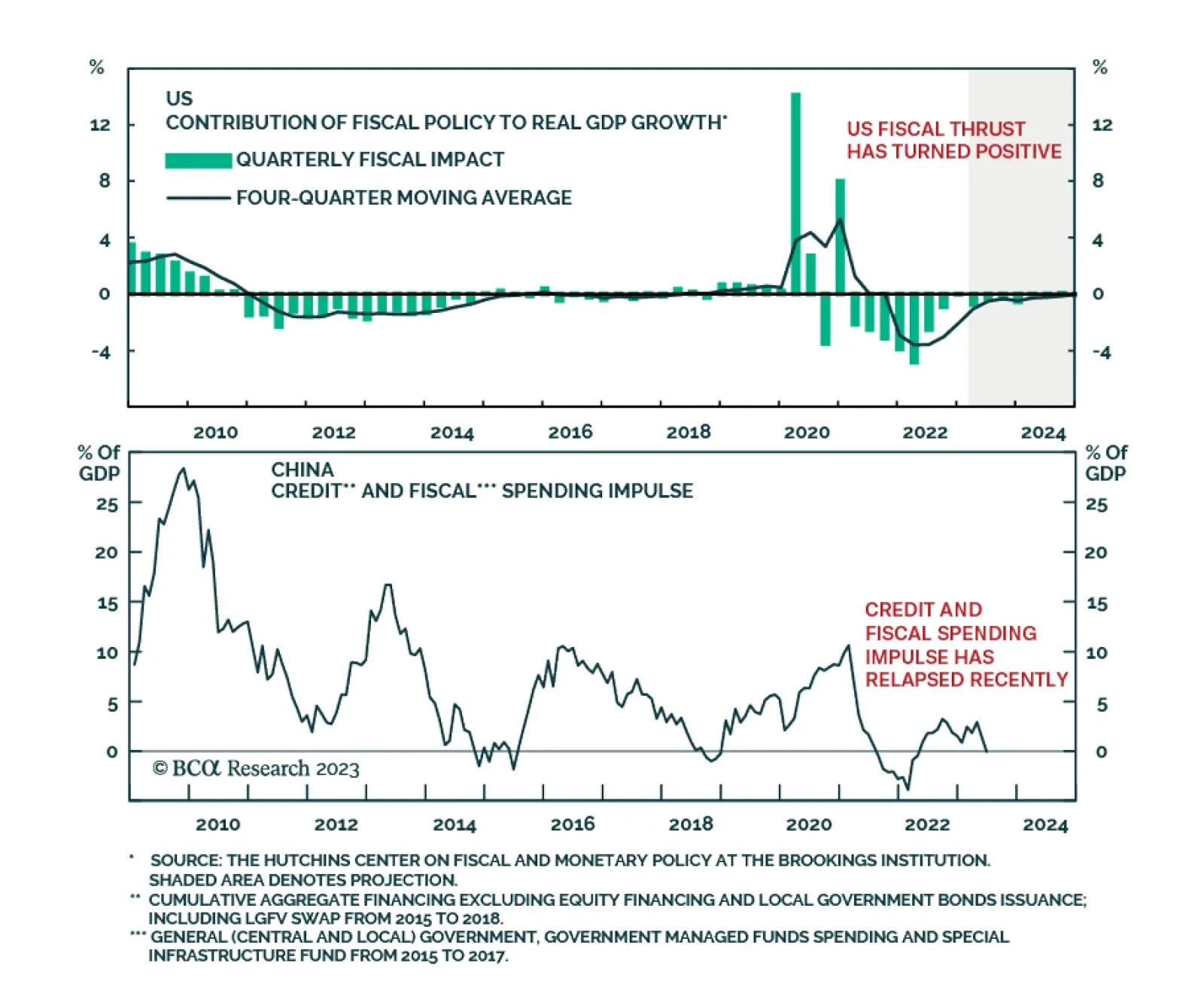

The fiscal impulse philosophies of the two largest economies of the world are set to pull in opposite directions in 2023. After the massive fiscal stimulus of 2020, the US had been cutting back on its deficit. But US fiscal…

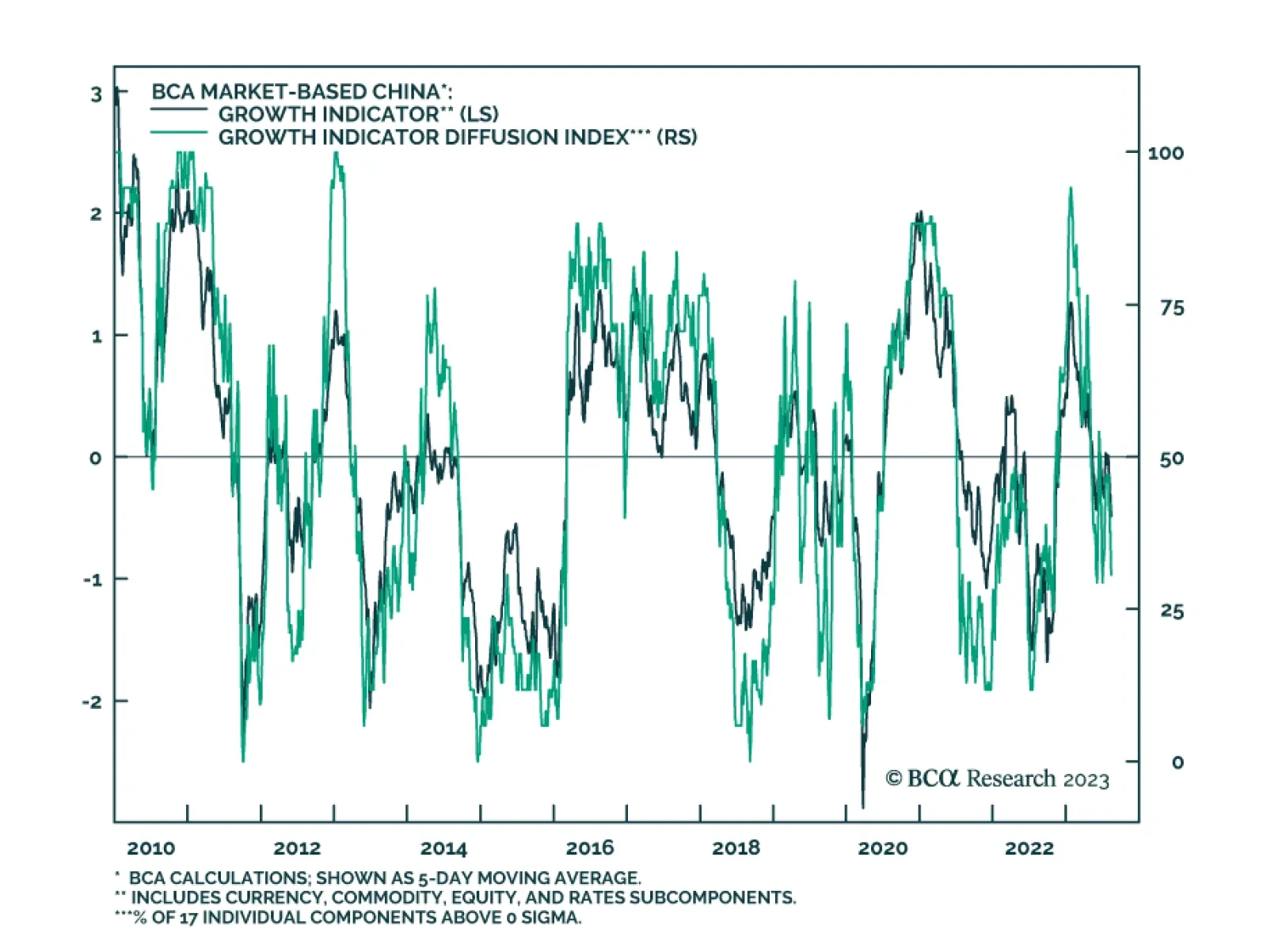

The above chart illustrates the BCA Market-Based China Growth Indicator, which is made up of 17 series grouped into four asset class subcomponents: currencies, commodities, equities, and rates/fixed-income. The purpose of the…