The ongoing profit contraction among Chinese industrial firms underscores that deflationary headwinds dominate the domestic economy. Although the annual pace of decline of industrial profits slowed from 8.3% y/y in June to 6.7% y…

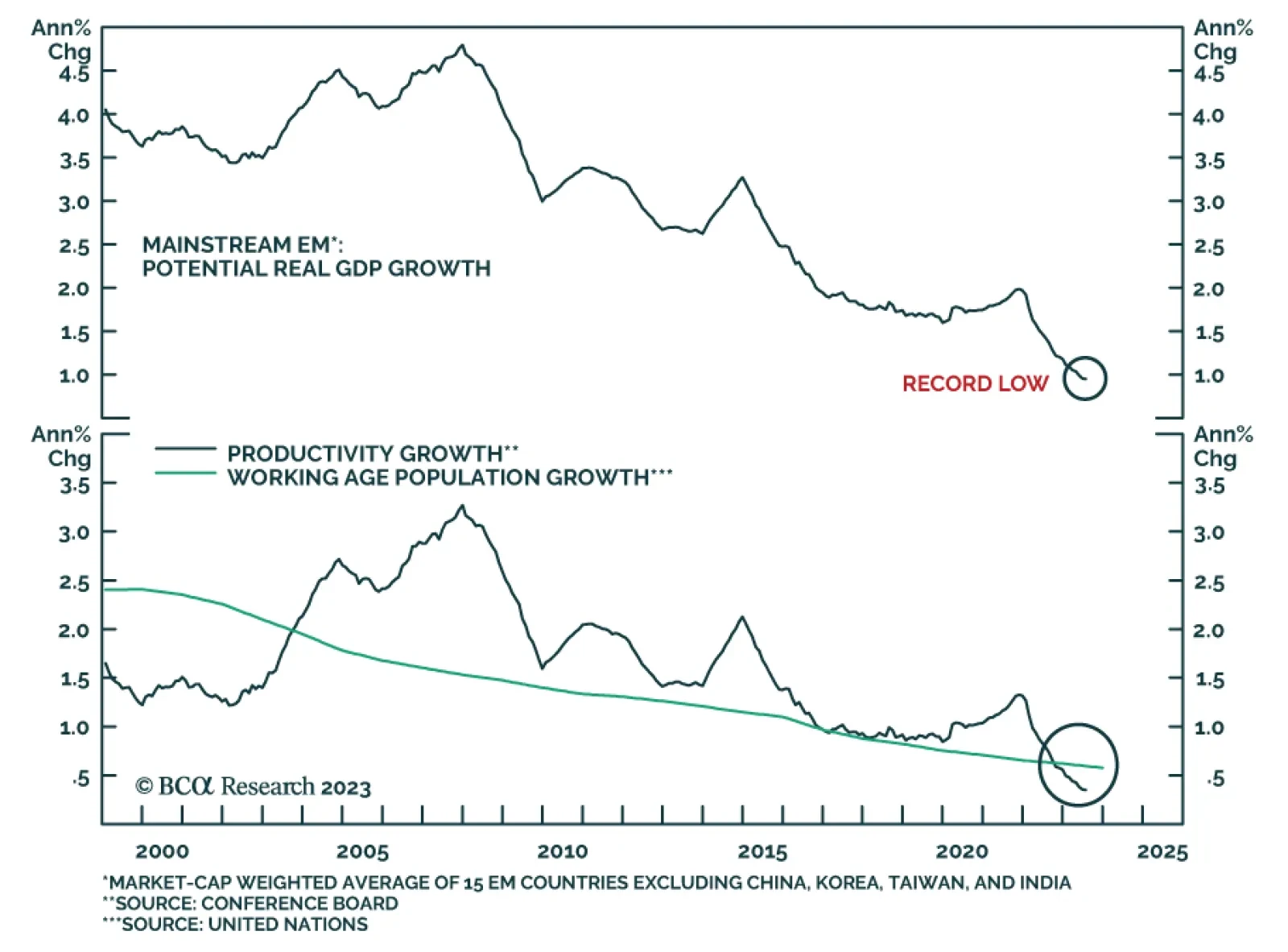

According to BCA Research’s Emerging Markets Strategy service, even though mainstream EM equities are cheap, their cyclical and structural growth prospects are poor. Equities of mainstream EM economies (excluding…

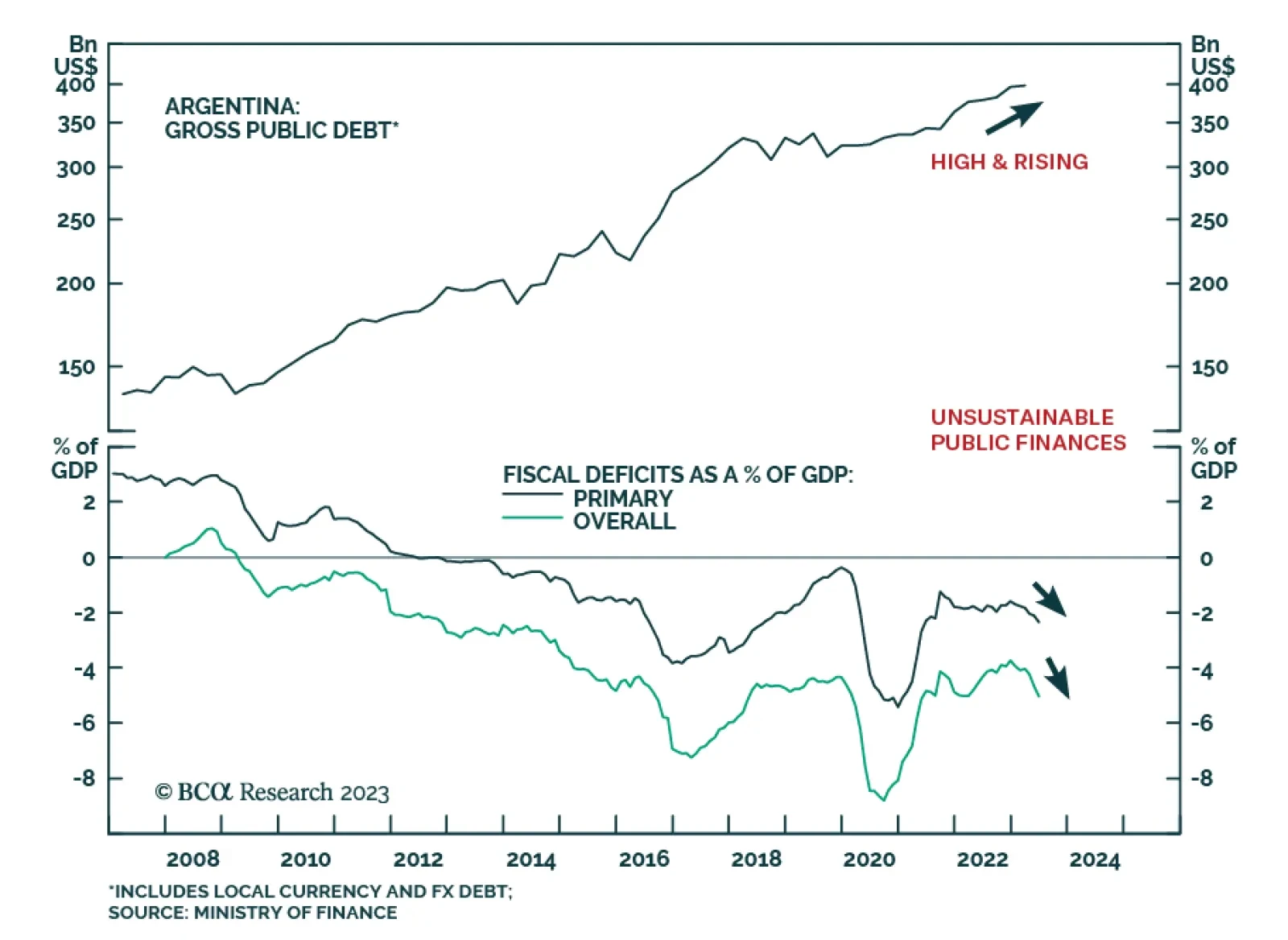

According to BCA Research’s Emerging Markets Strategy service, while it may be tempting to bottom fish, the team advises that investors maintain a cautious stance on Argentinian sovereign credit. Even though the election…

Most diagnoses of China’s liquidity trap miss the point that policies arising from these theories were developed for market-based economies with governments accountable to their electorates, not autocracies pursuing autarky. As the…

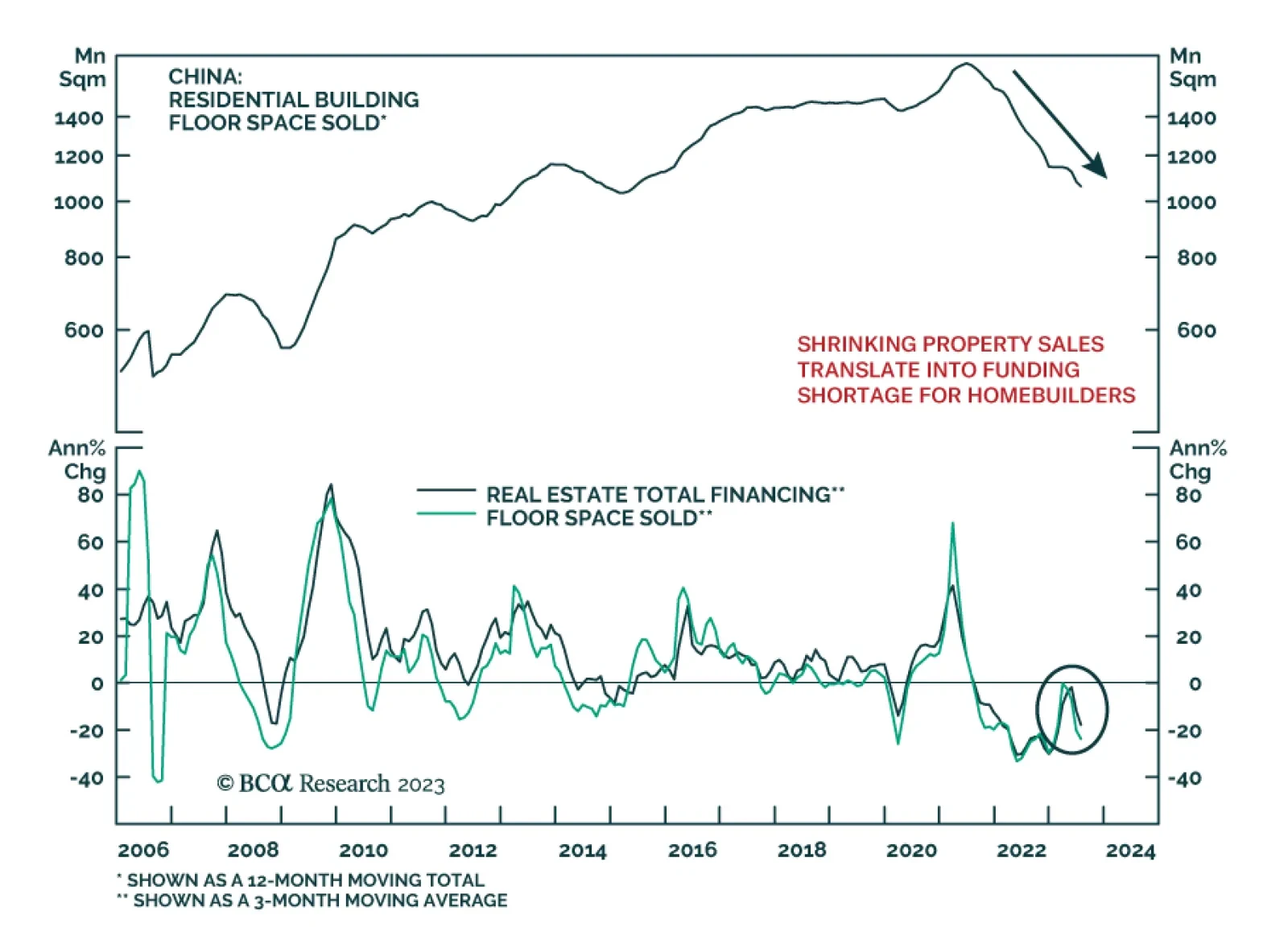

According to BCA Research’s China Investment Strategy service, although property-sector stocks in China’s onshore and offshore markets have been beaten down, they have not yet reached their bottom. The property…

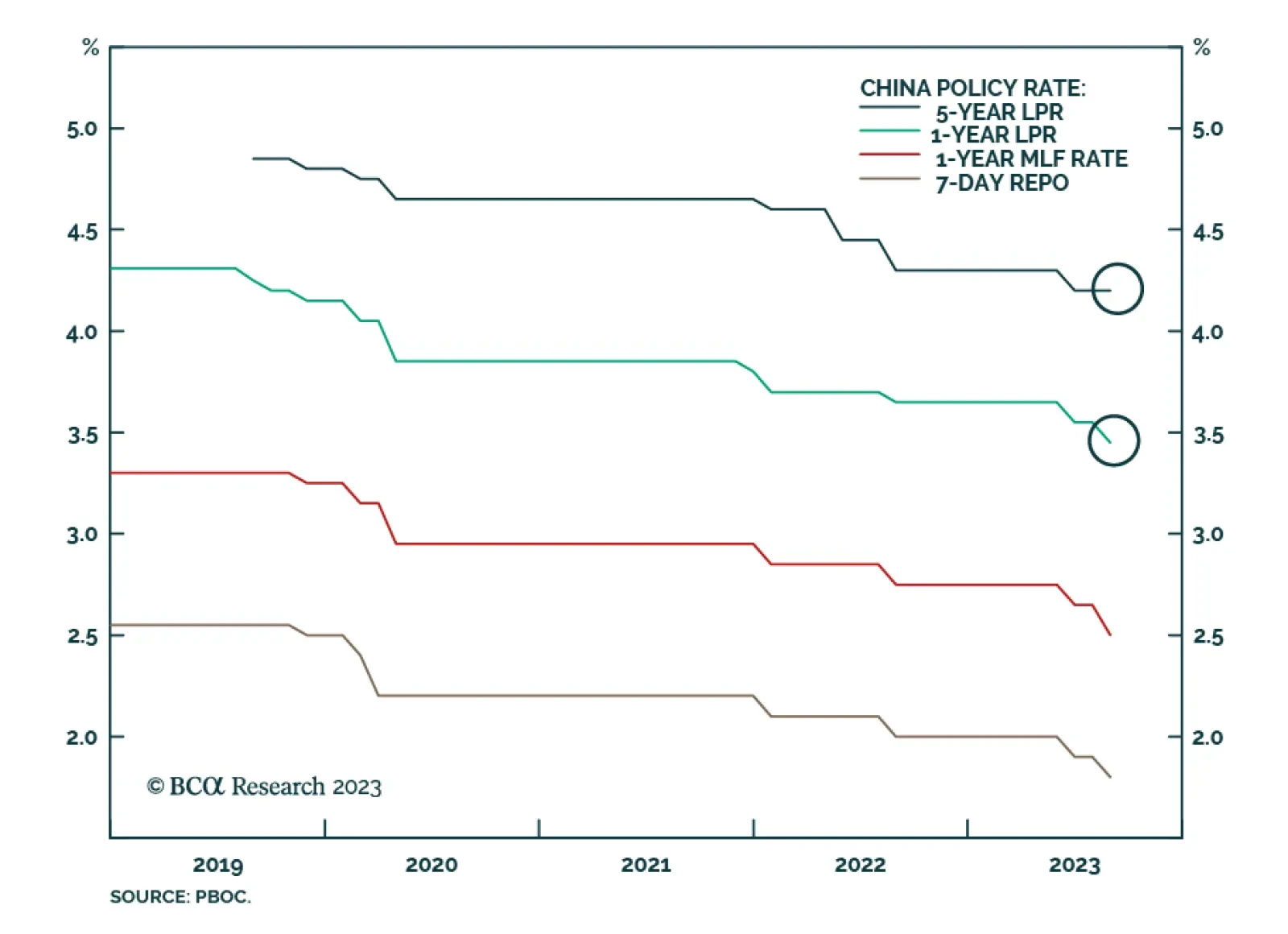

Deflation prevails in China’s economy. Marginal interest rate cuts will be insufficient to boost growth as the economy is experiencing debt deflation and might be entering a liquidity trap. There will likely be more economic…

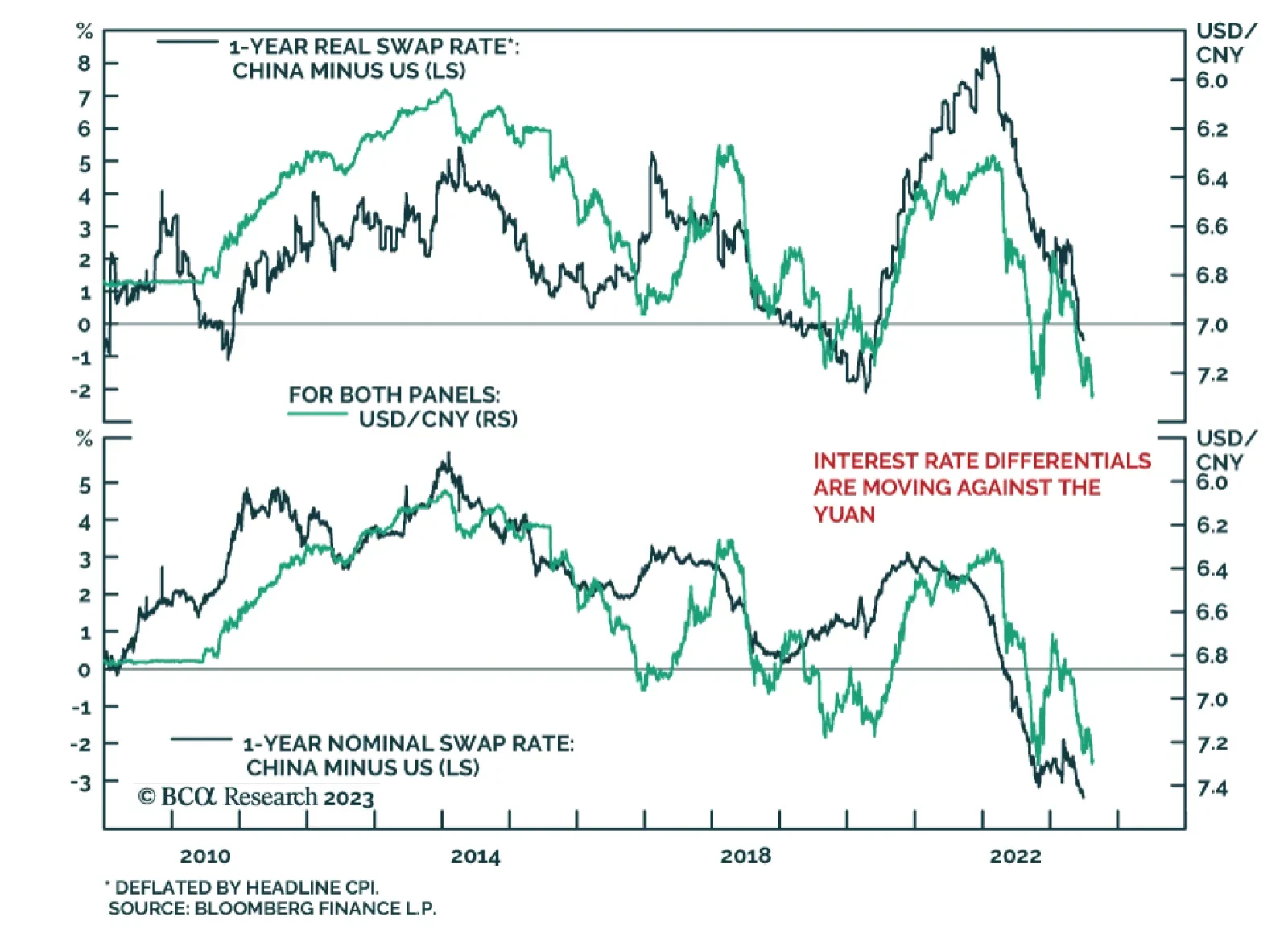

Chinese authorities have recently ratcheted up support for the currency. The PBoC continues to set its daily yuan fixing at a stronger-than-expected rate, with the yuan midpoint (a reference for trading that caps the range…

Chinese banks surprised markets with a more modest-than-anticipated rate cut on Monday. The one-year loan prime rate (LPR) was reduced by 10 basis points to 3.45% – slightly above expectations of a bigger cut to 3.40%.…