The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

The broader rally that started in June is premised on a Goldilocks narrative that will prove to be a fairy tale. Either by stubborn inflation. Or, by higher unemployment that shows that the war on inflation is far from costless. Or,…

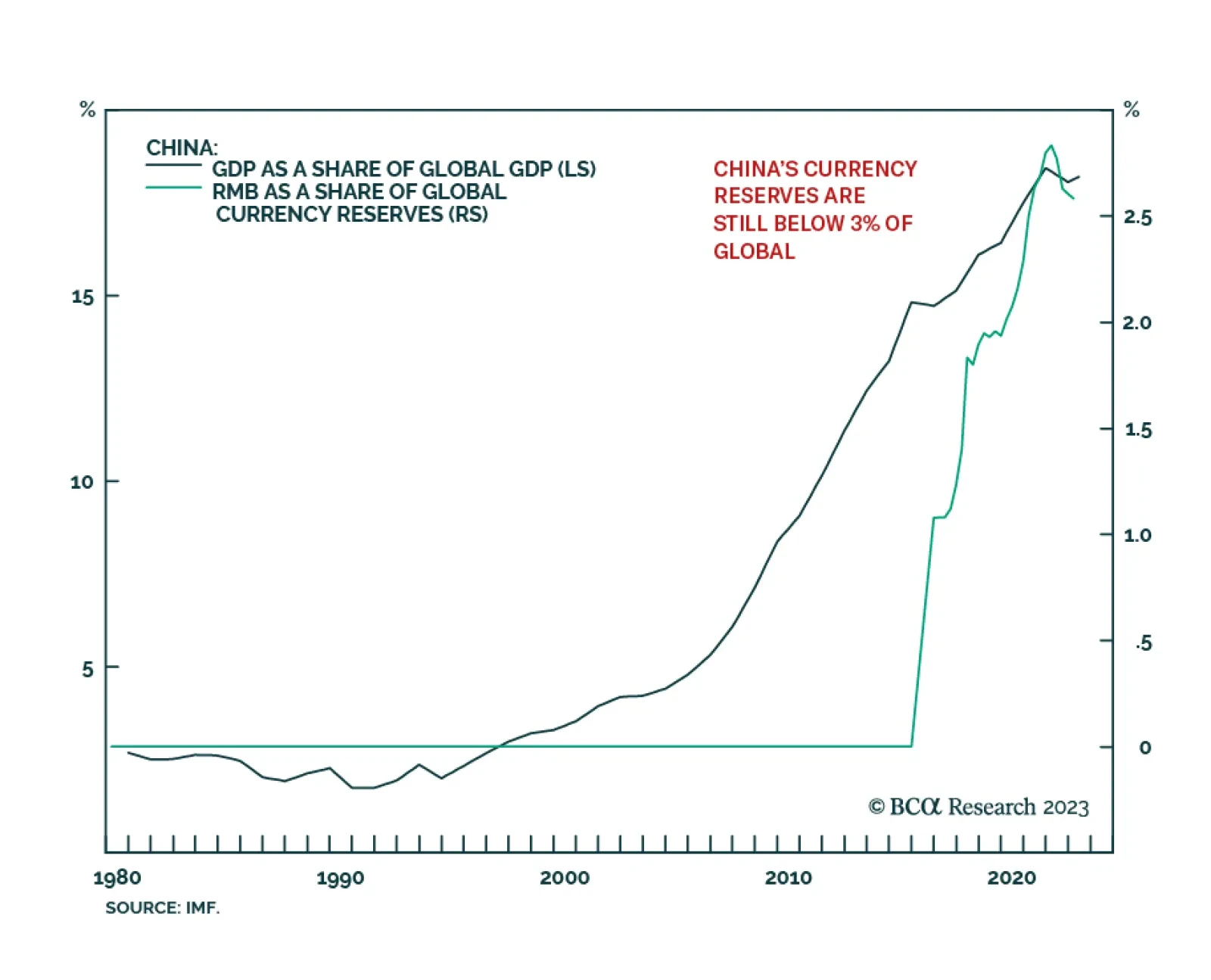

According to BCA Research’s Foreign Exchange Strategy service much of the new BRICS+ countries lack the fundamental basis of making a credible monetary union. A reserve currency needs the military might to control the…

A global recession continues to be likely over the next 12 months. The impact of tighter monetary policy is slowly being felt. Government bonds look increasingly attractive as a safe haven.

The stock market’s pre-eminent growth sector is not US tech, it is French luxuries. No other sector can compare with French luxuries’ massive and sustained pricing power. The risk for French luxuries is not a China slowdown, the risk…

The US and China agreed to hold trade talks more regularly on August 28, even as they fell short of establishing a strategic détente or general reduction of tensions. US Commerce Secretary Gina Raimondo visited Beijing…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.