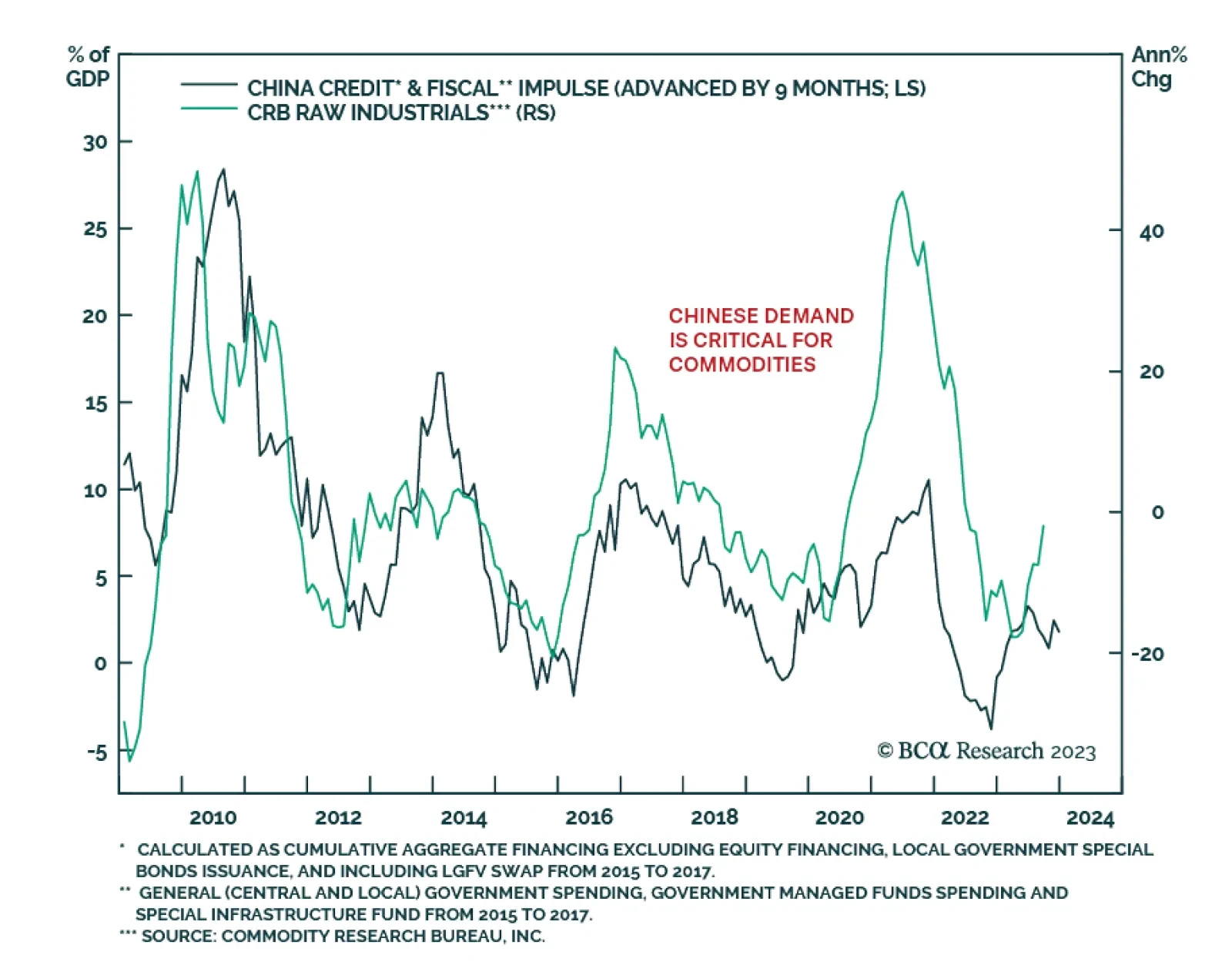

The CRB Raw Industrials Price Index has been relatively stable over most of 2023. To the extent that the index contains non-tradable raw materials such as burlap, hide, rosin, and tallow, it is less influenced by speculative…

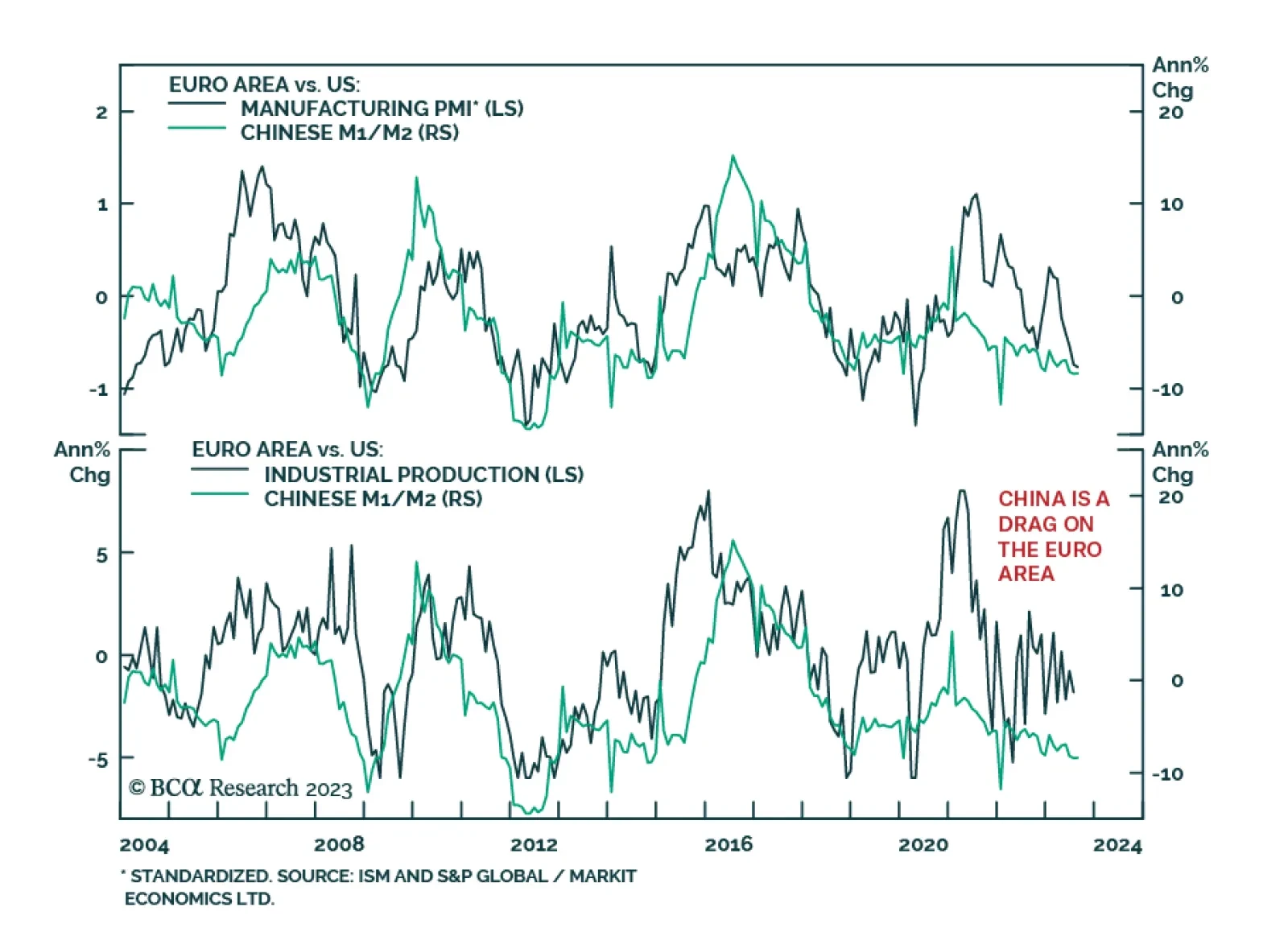

The Euro Area’s industrial production figures for July sent a disappointing signal on Wednesday. The 1.1% m/m decline in output fell below expectations of a smaller 0.9% m/m decrease. On a year-over-year basis, IP…

While Chinese stocks have low valuations and are oversold, their attractiveness is dampened by uncertainties in the magnitude of stimulus and the dismal outlook for corporate profits in the next six to nine months.

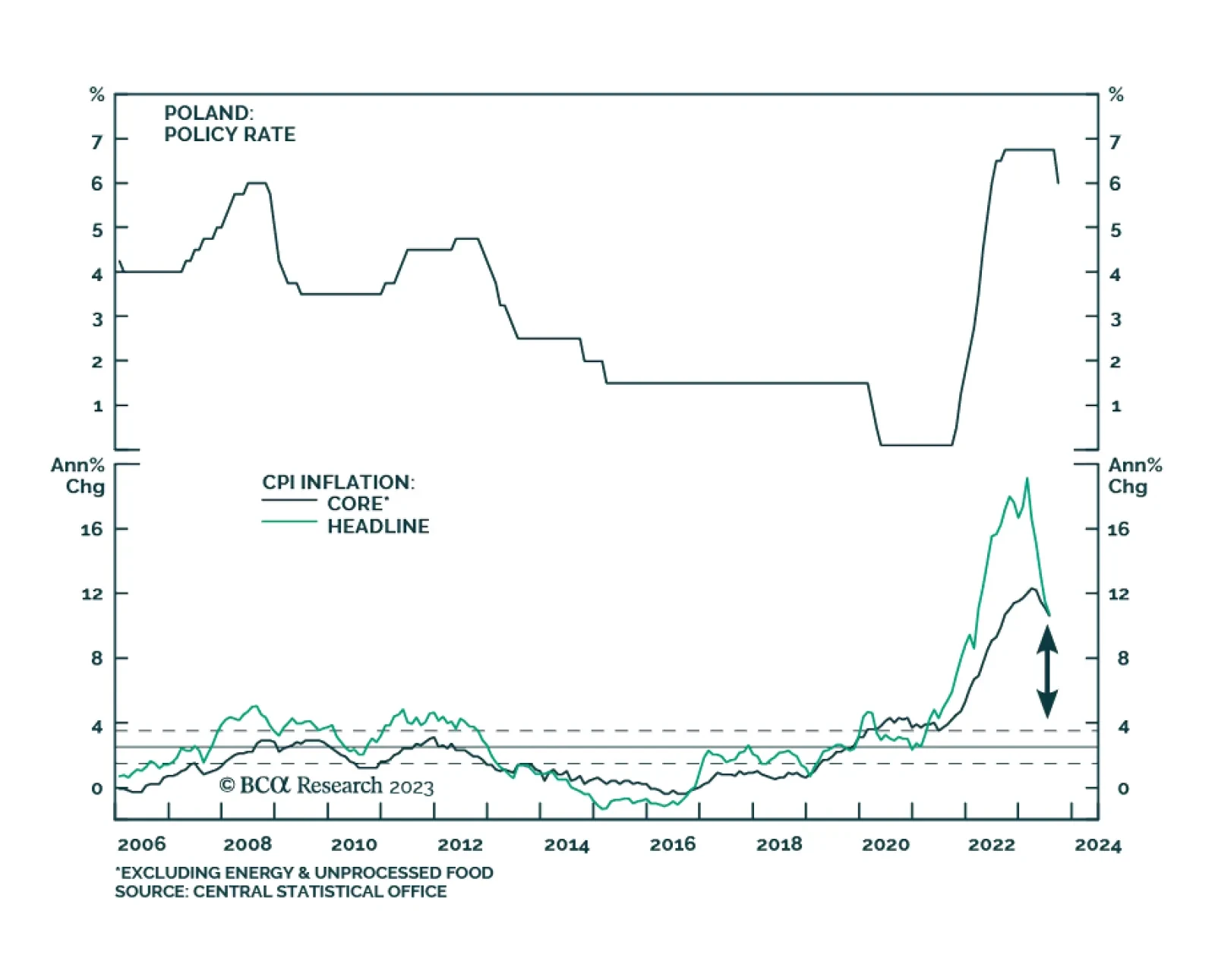

Real wages are set to rise in CE3 economies with implications for their asset markets and currencies. Of the three, Polish assets and the zloty are the most vulnerable.

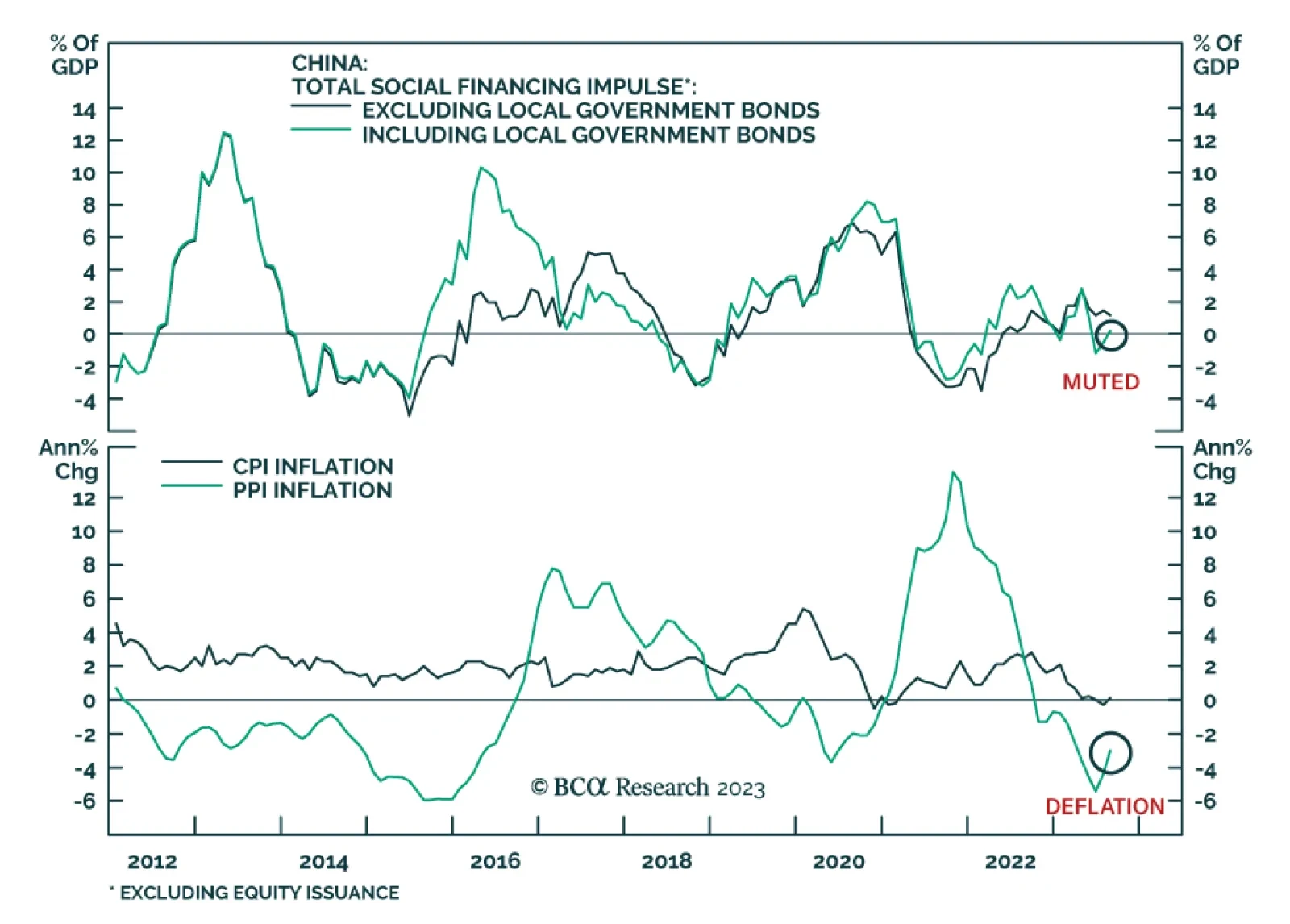

Recent Chinese economic data show some signs of stabilization. China’s credit expansion surprised to the upside in August. Aggregate social financing totaled CNY3.12 trillion – above expectations of CNY2.69…

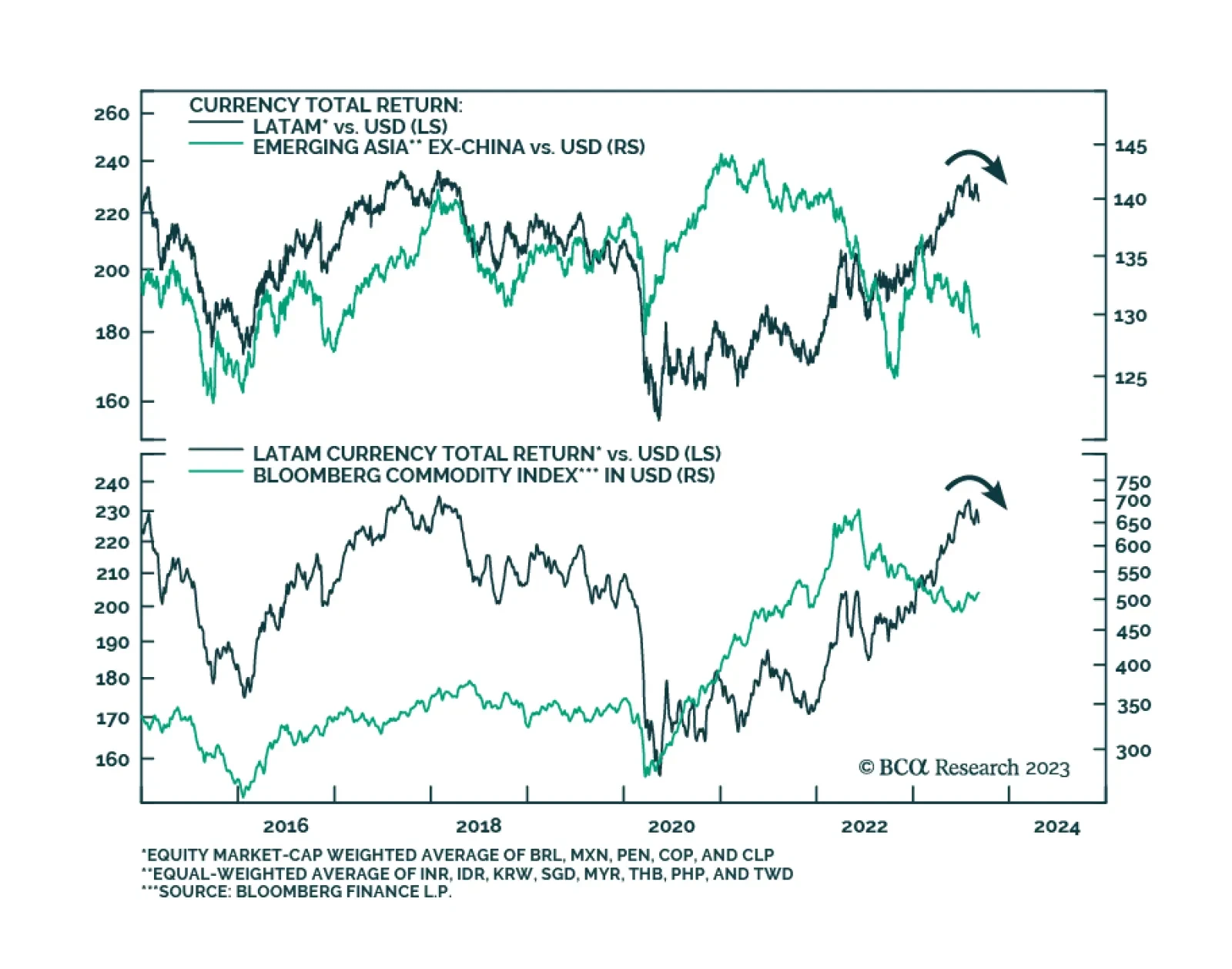

Earlier this year, our Emerging Markets strategists highlighted that the divergence between Latin American and Emerging Asian currencies was unsustainable. While Latam currencies – including the COP, MXN, BRL, PEN, and CLP…

The Polish central bank delivered a larger-than-anticipated 75 basis point rate cut on Wednesday – slashing the policy rate to 6%, versus expectations of 6.5%. The aggressive move marks the first rate cut following a 11-…

Our Portfolio Allocation Summary for September 2023.

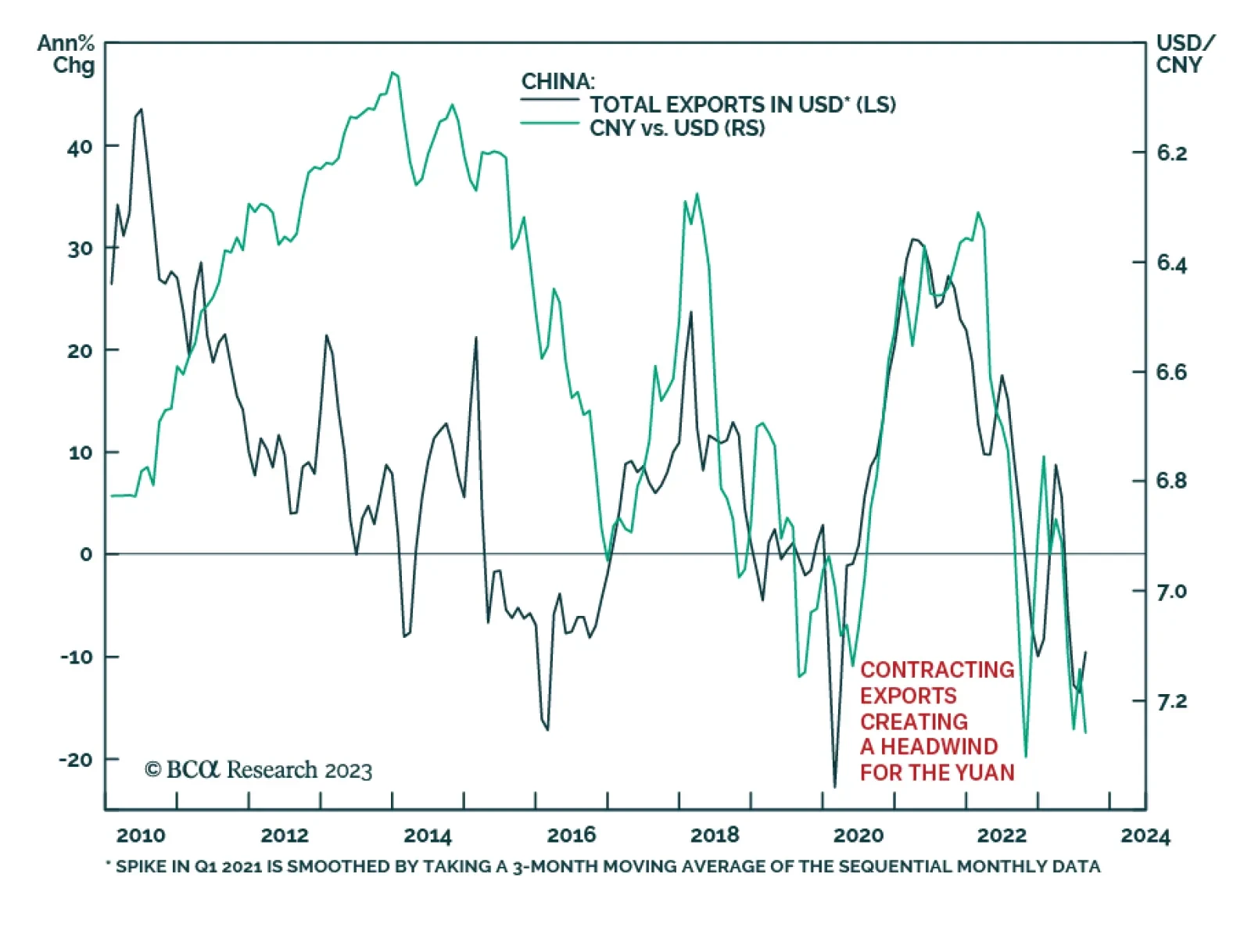

The Chinese yuan fell to its lowest in nearly 16 years vis-à-vis the US dollar on Thursday following the release of Chinese trade data. Although the pace of export contraction slowed from 14.5% to 8.8% y/y in August (and…

If we look at global growth as an aircraft, the plane is experiencing failing engines and will lose more altitude in the coming months. Yet, neither Chinese authorities, nor the Fed or the ECB will be quick to come to the rescue as…