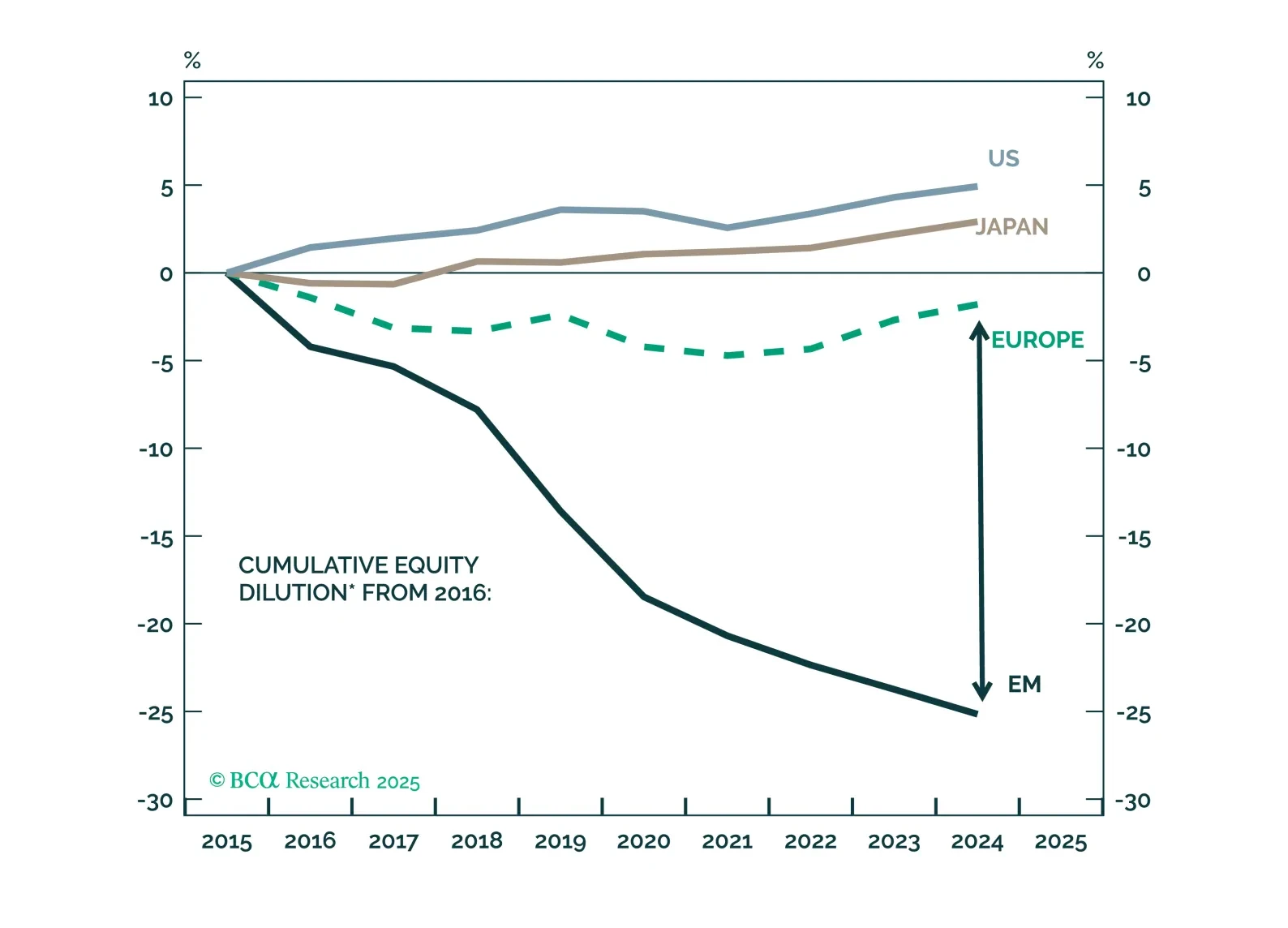

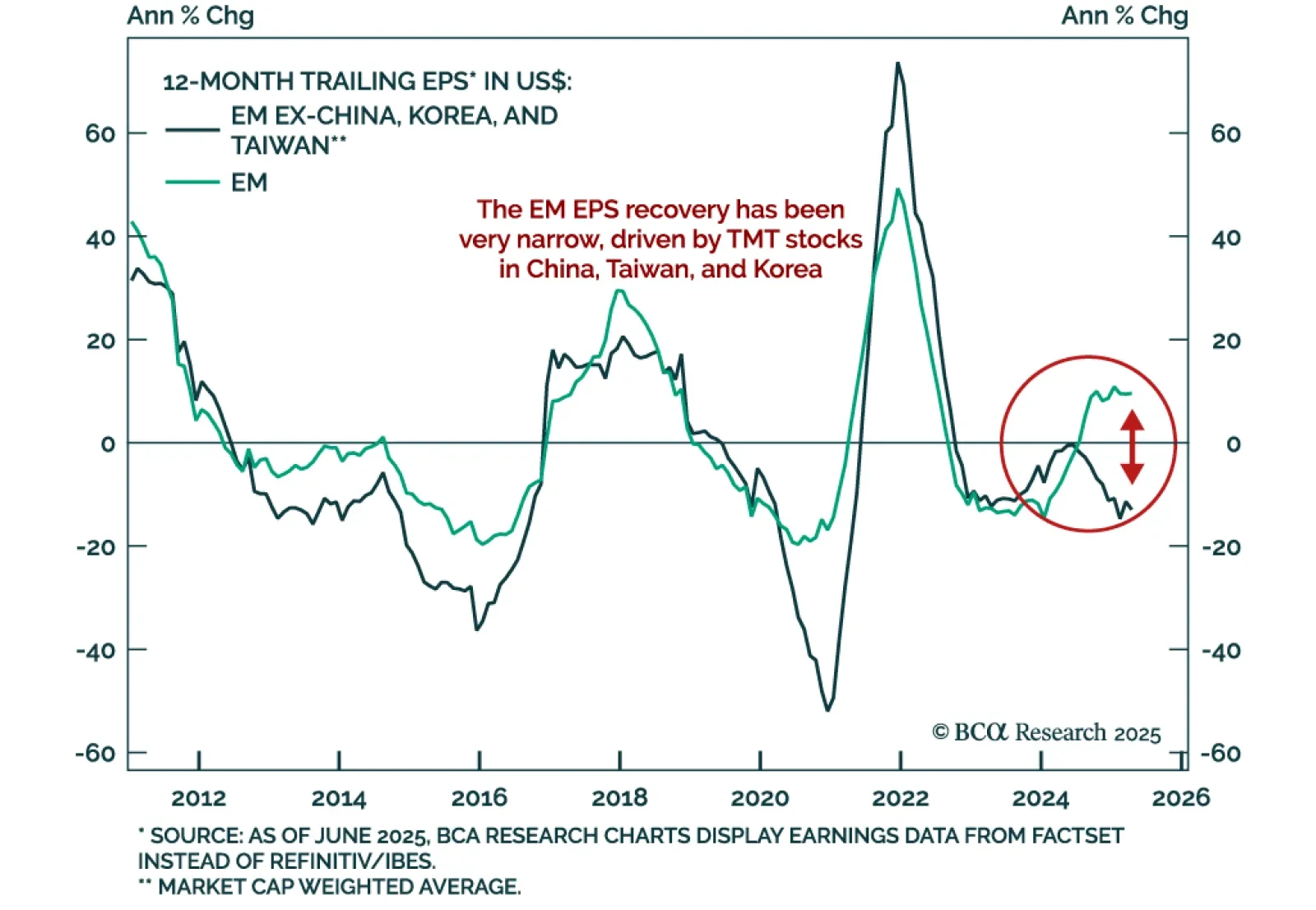

BCA’s EM strategists remain downbeat on EM equities despite a bearish US dollar view, citing profit headwinds and limited valuation support. The ongoing EM earnings recovery has been narrowly concentrated in TMT sectors across China…

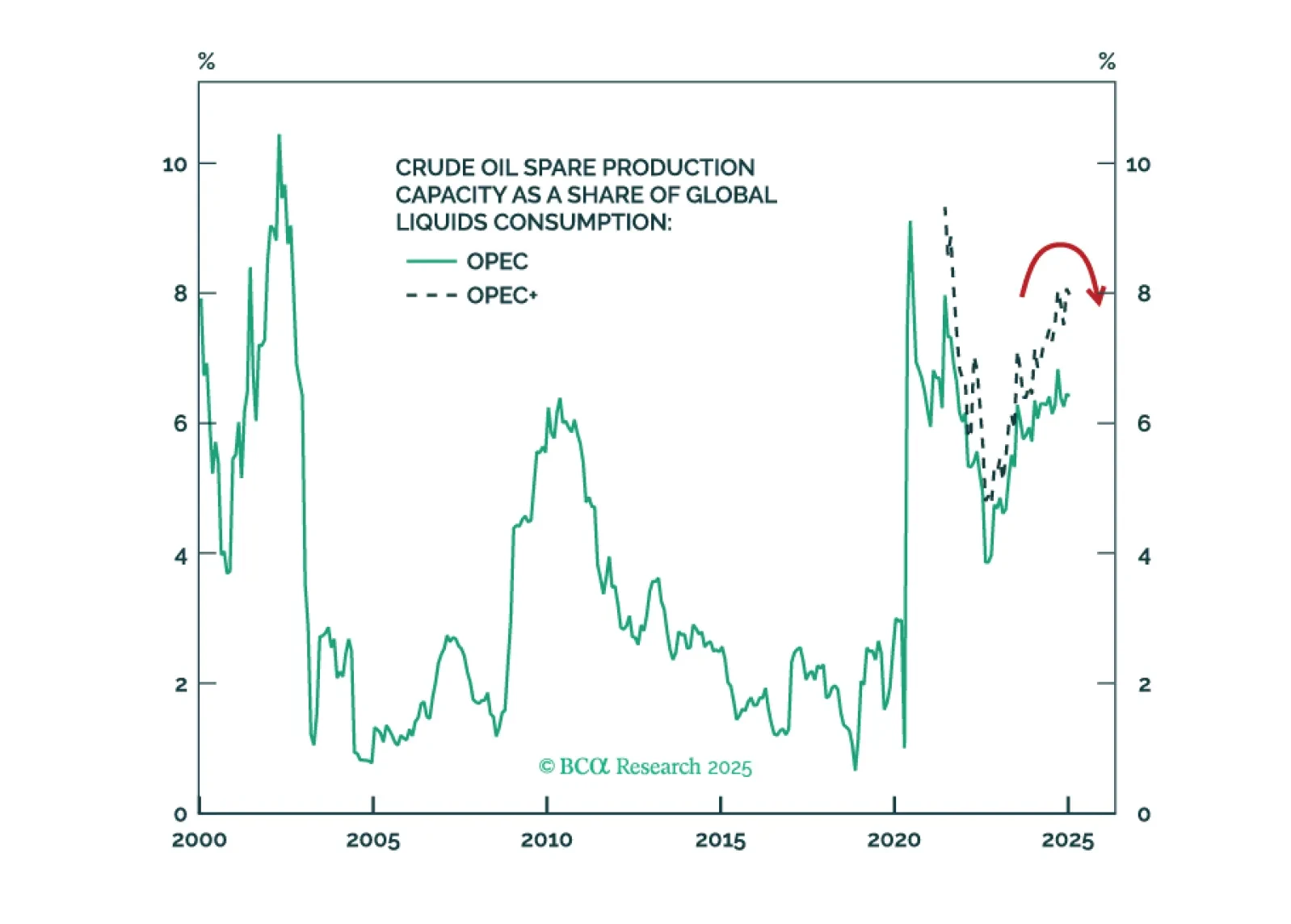

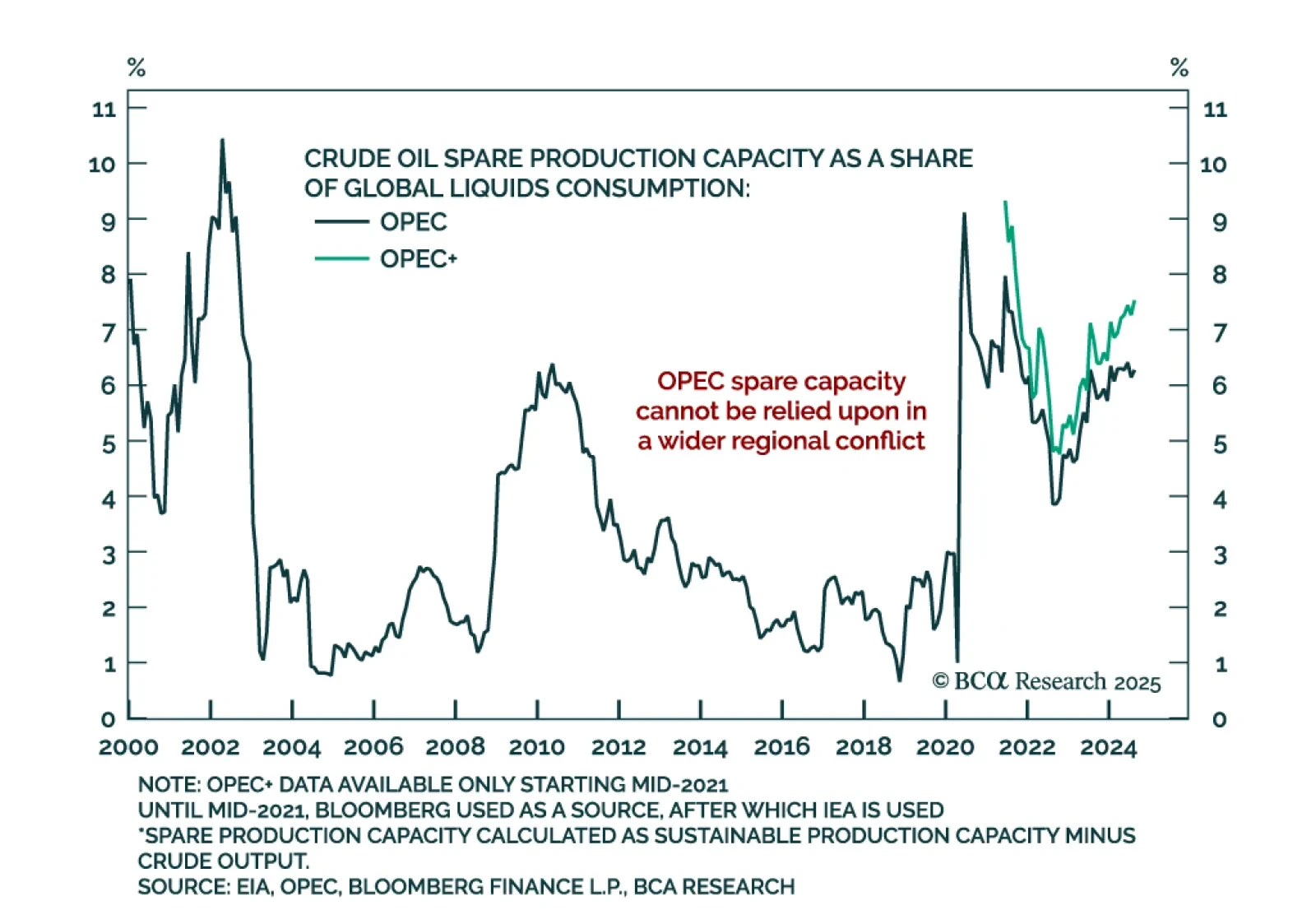

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.

The Israel-Iran conflict is escalating, raising the odds of a major oil supply shock and reinforcing the case for cash, US equity overweight, and tactical energy exposure. Our Chart Of The Week comes from Matt Gertken, Chief…

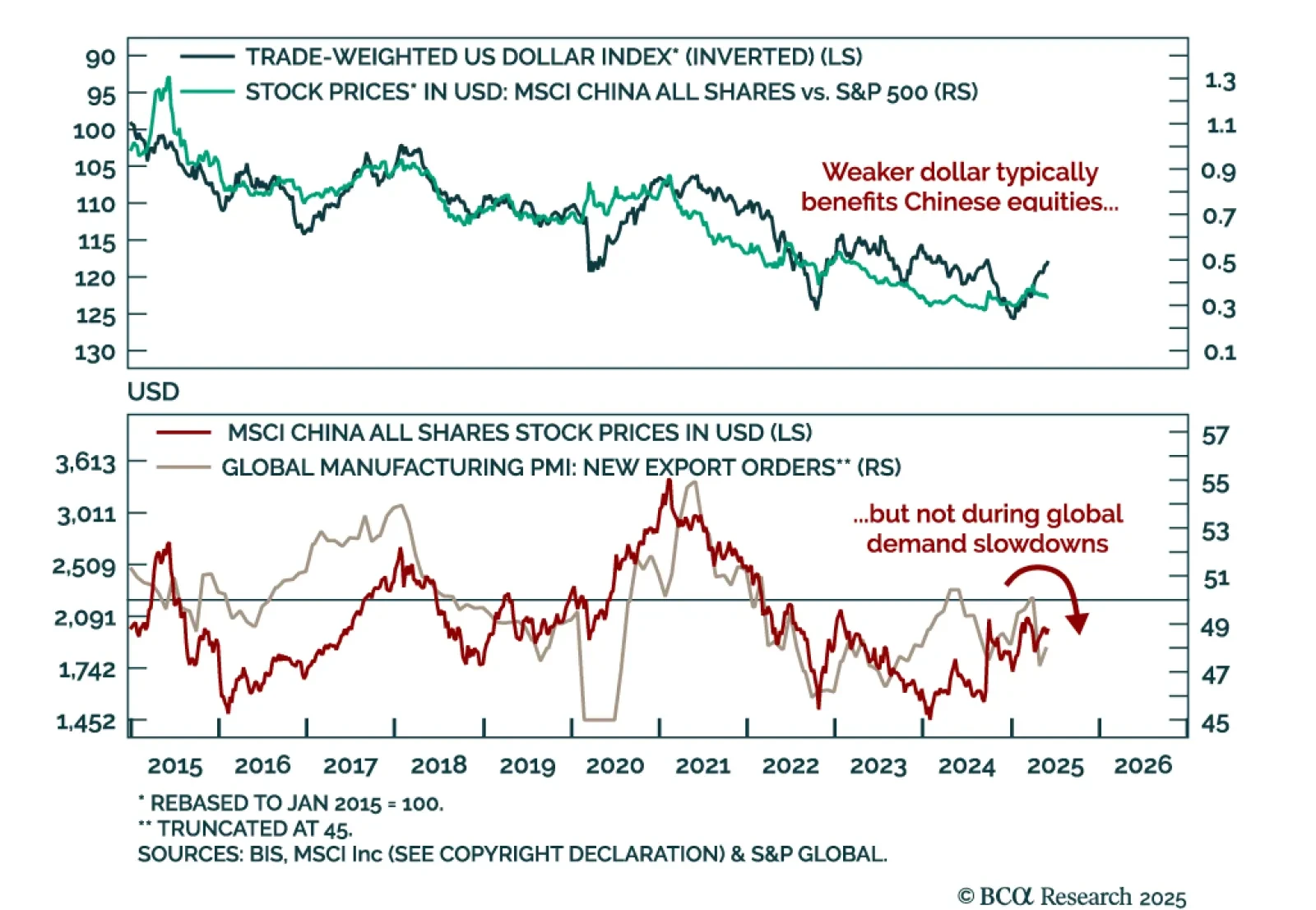

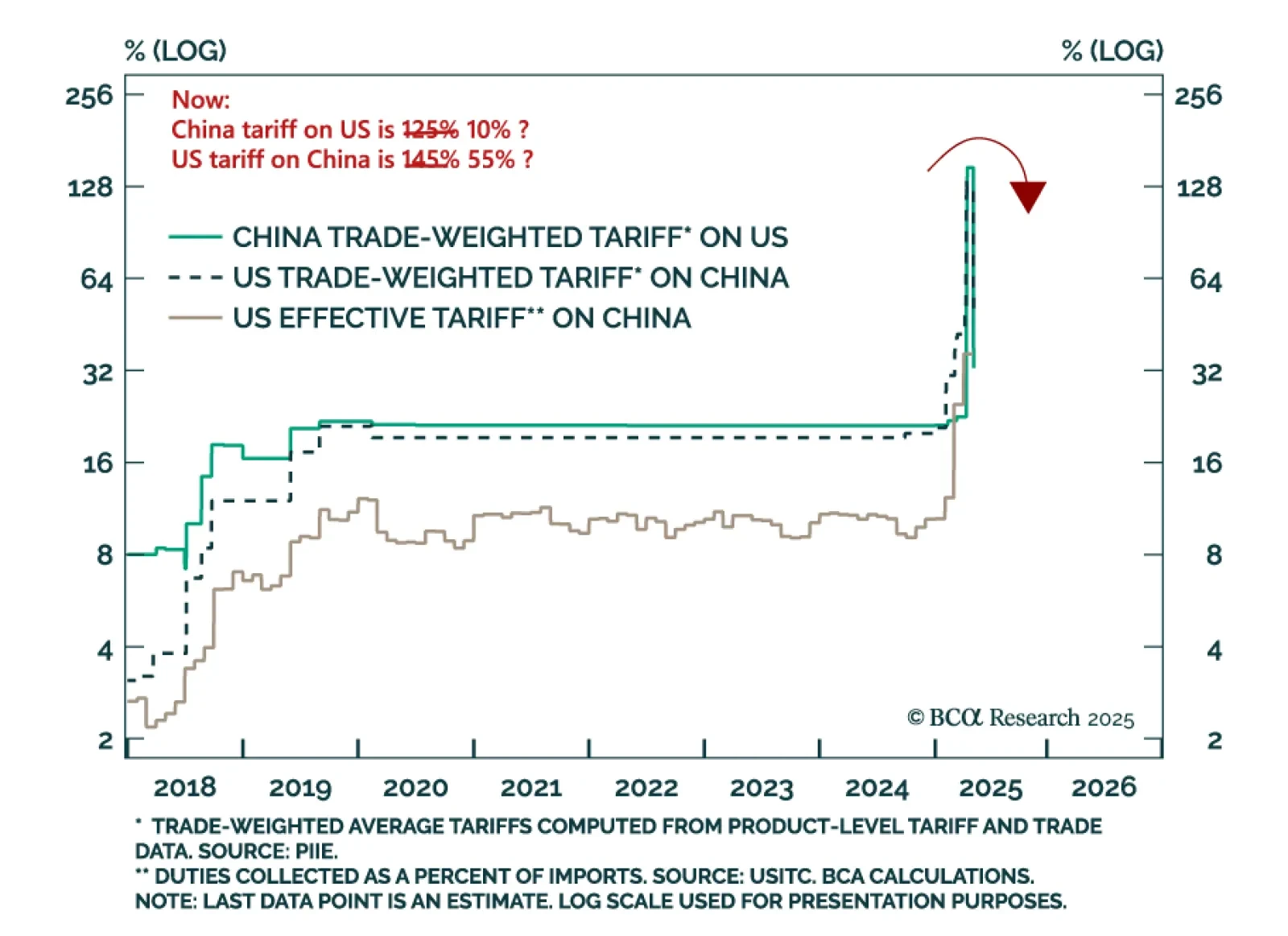

BCA’s China Investment strategists see limited upside for Chinese equities and favor bonds, as trade tensions ease but domestic headwinds persist. This week’s US-China trade talks in London lowered the risk of near-term escalation or…

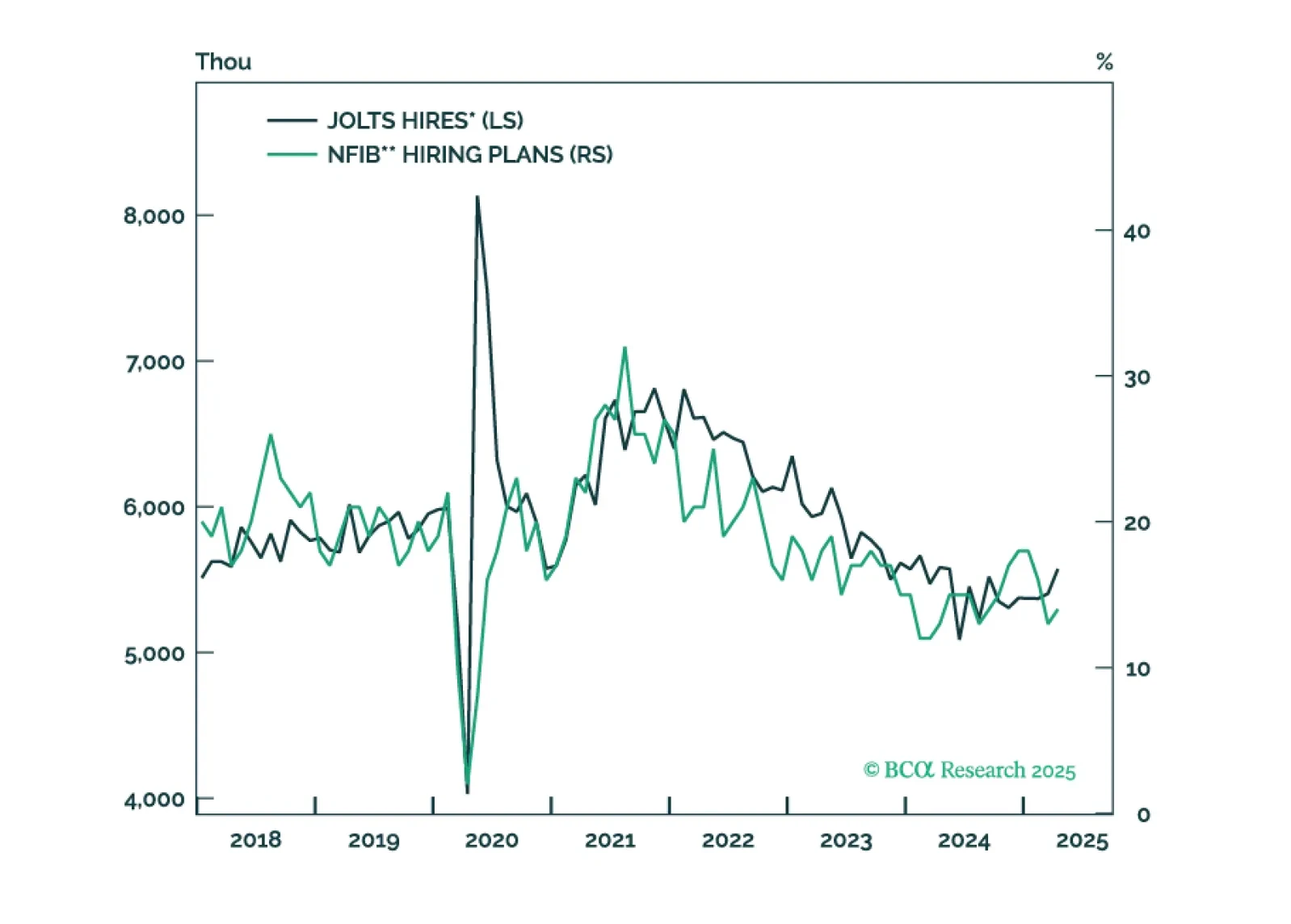

The US-China tariff deal confirms one thing: markets are still priced for perfection, with little upside even if a recession is dodged. The London negotiations yielded a partial agreement: The US will reduce tariffs, and China will…

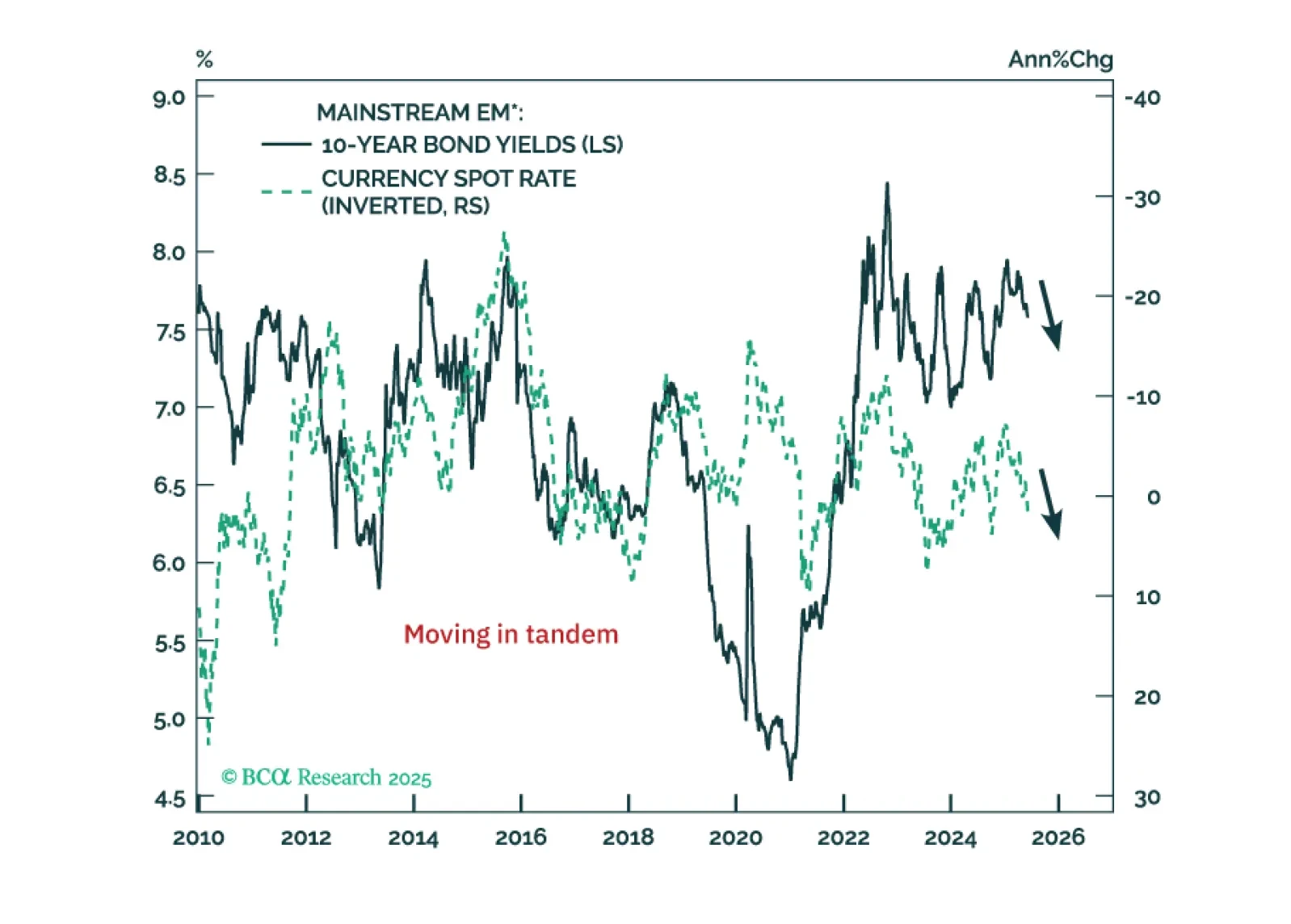

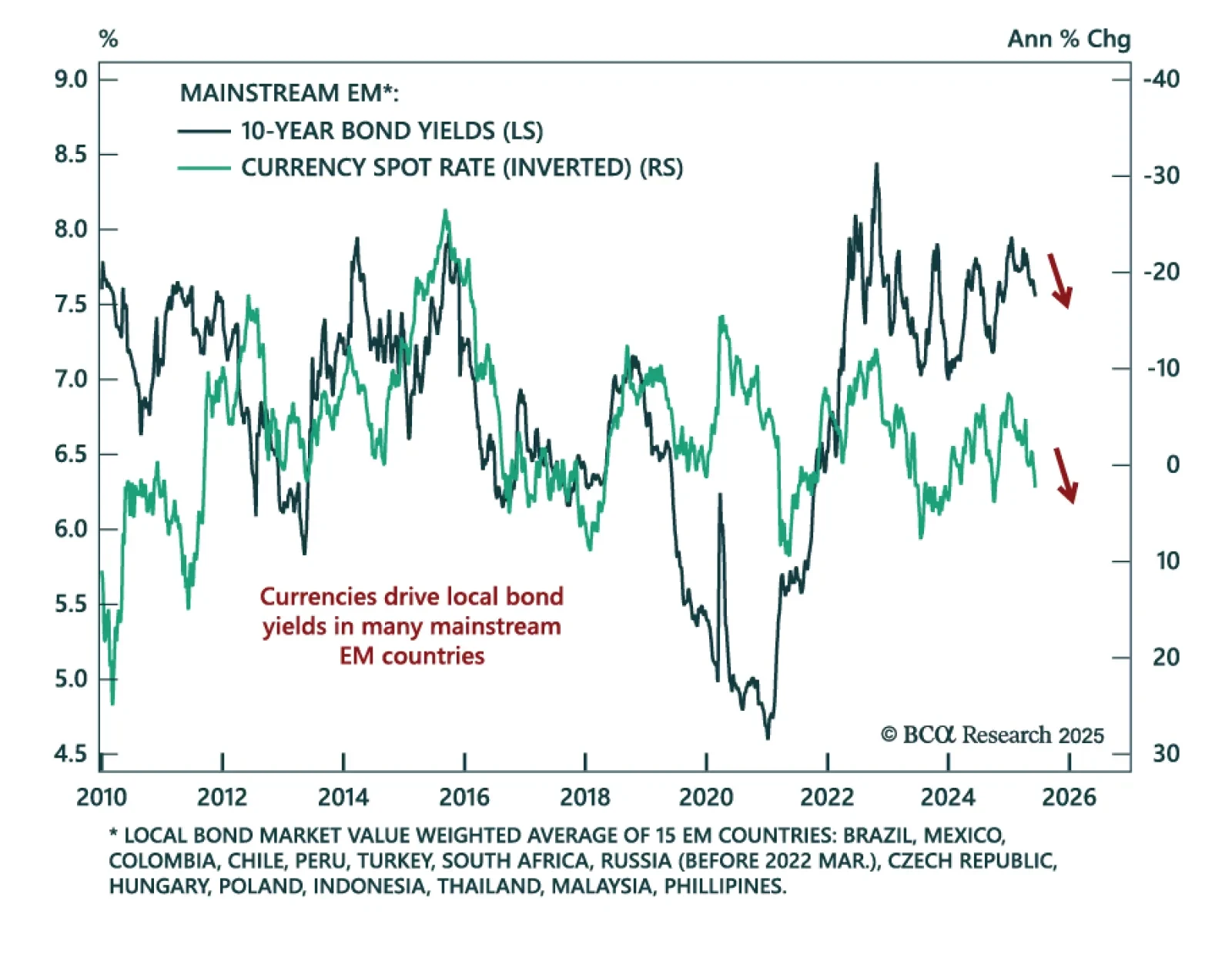

BCA’s EM strategists argue that a global macro shift is underway: A weaker US dollar will drive a retrenchment in US domestic demand and imports. Unlike previous cycles, dollar depreciation will be deflationary for the rest of the…

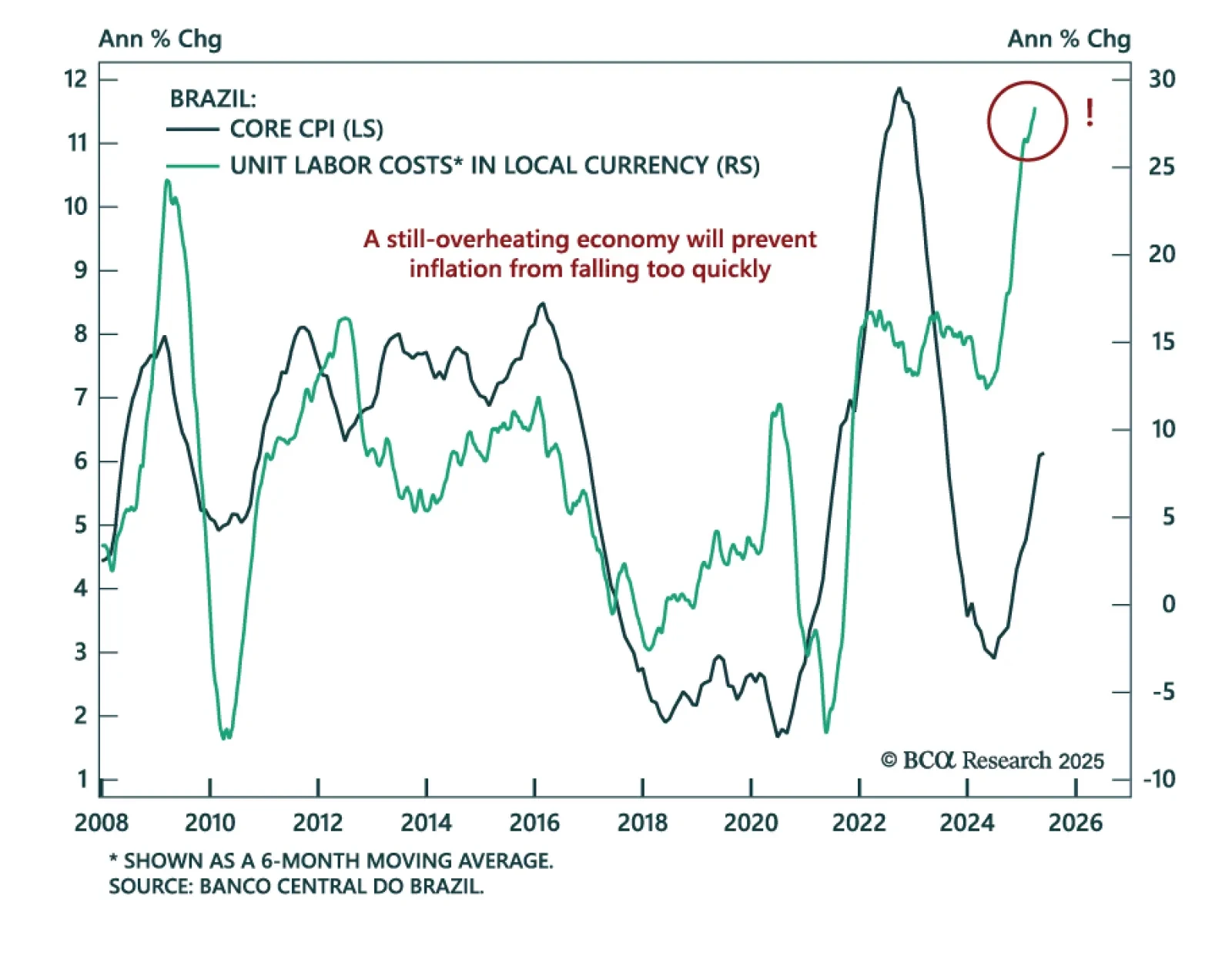

The May Brazilian CPI suggests that price pressures may have reached a peak, but do not expect immediate monetary easing to support fixed income markets. Headline CPI slowed to 5.3% y/y from 5.5% April, but core CPI remained flat at…

Our Portfolio Allocation Summary for June 2025.