According to BCA Research's Commodity & Energy Strategy service, Qatar will be the winner as it takes advantage of the global energy transition towards renewables and the world fragments under economic and…

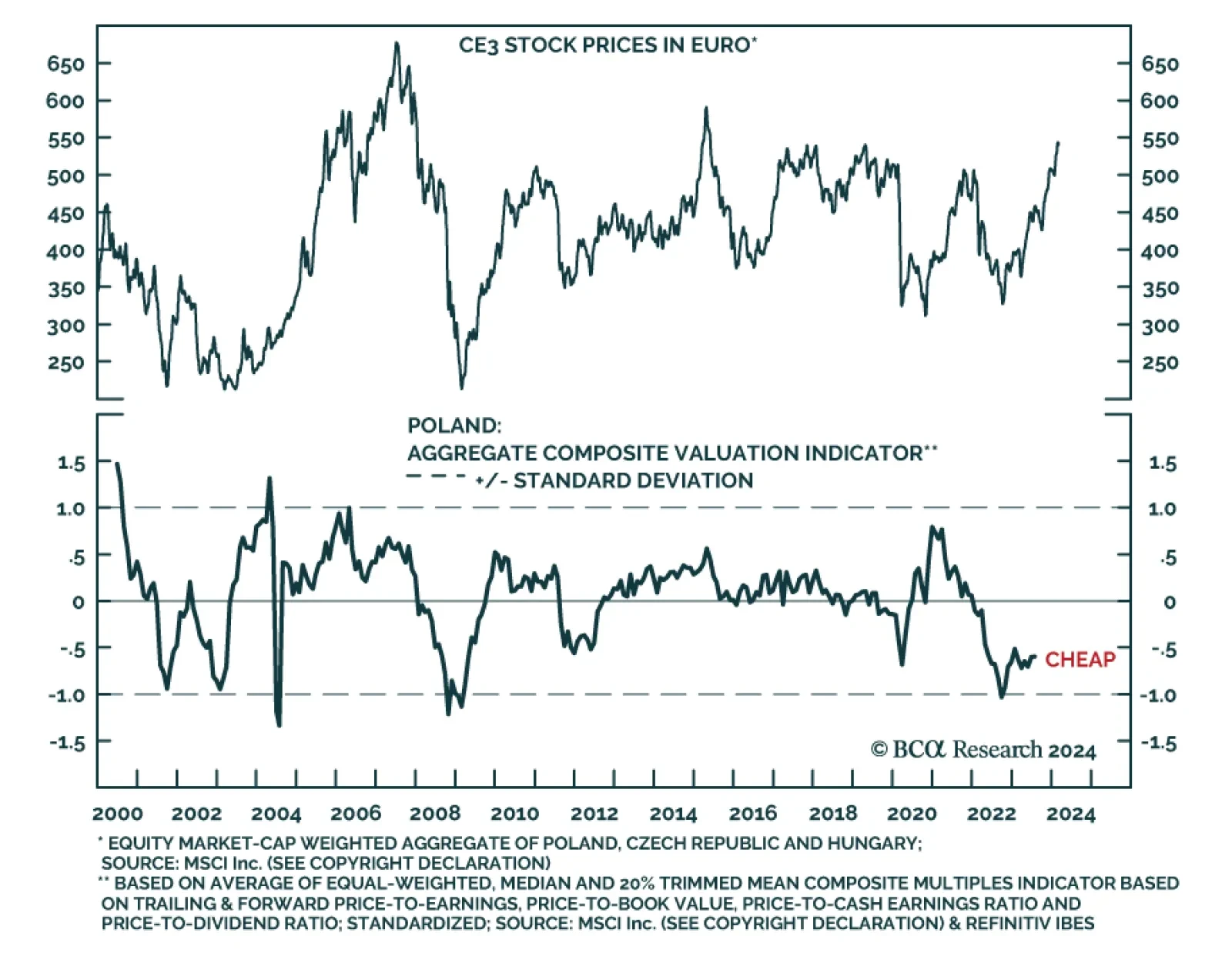

A market-cap weighted index of CE3 economies (Poland, Hungary and Czechia) returned a whopping 64% in common currency terms since its 2022 low. Polish and Hungarian equities led the rally, advancing by a respective 86% and 78% in…

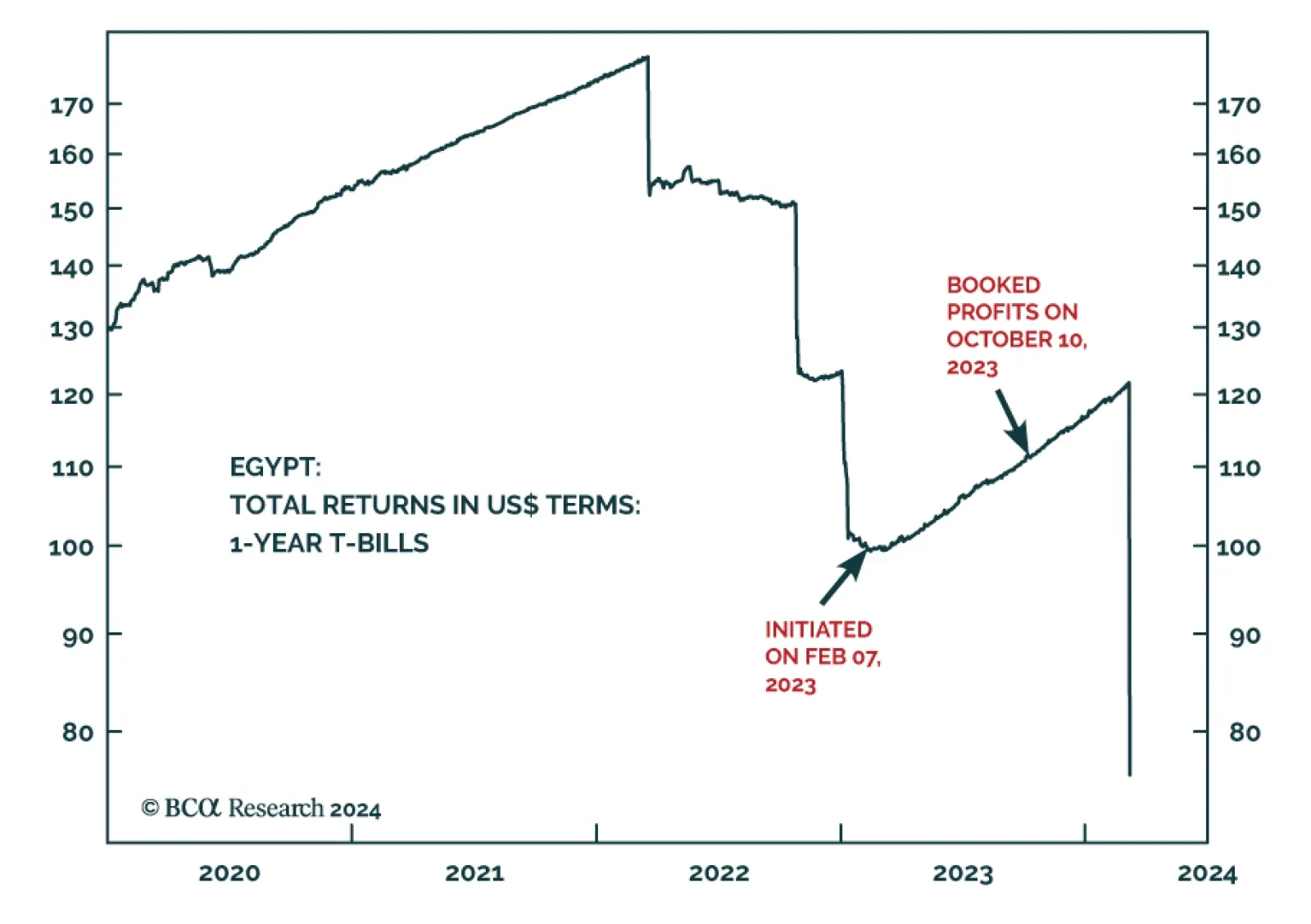

Our Emerging Market Strategy (EMS) colleagues recommended booking an 11.4% gain on their Egyptian T-bill trade initiated earlier in the year. Now that currency-devaluation risk has been removed from the picture for the…

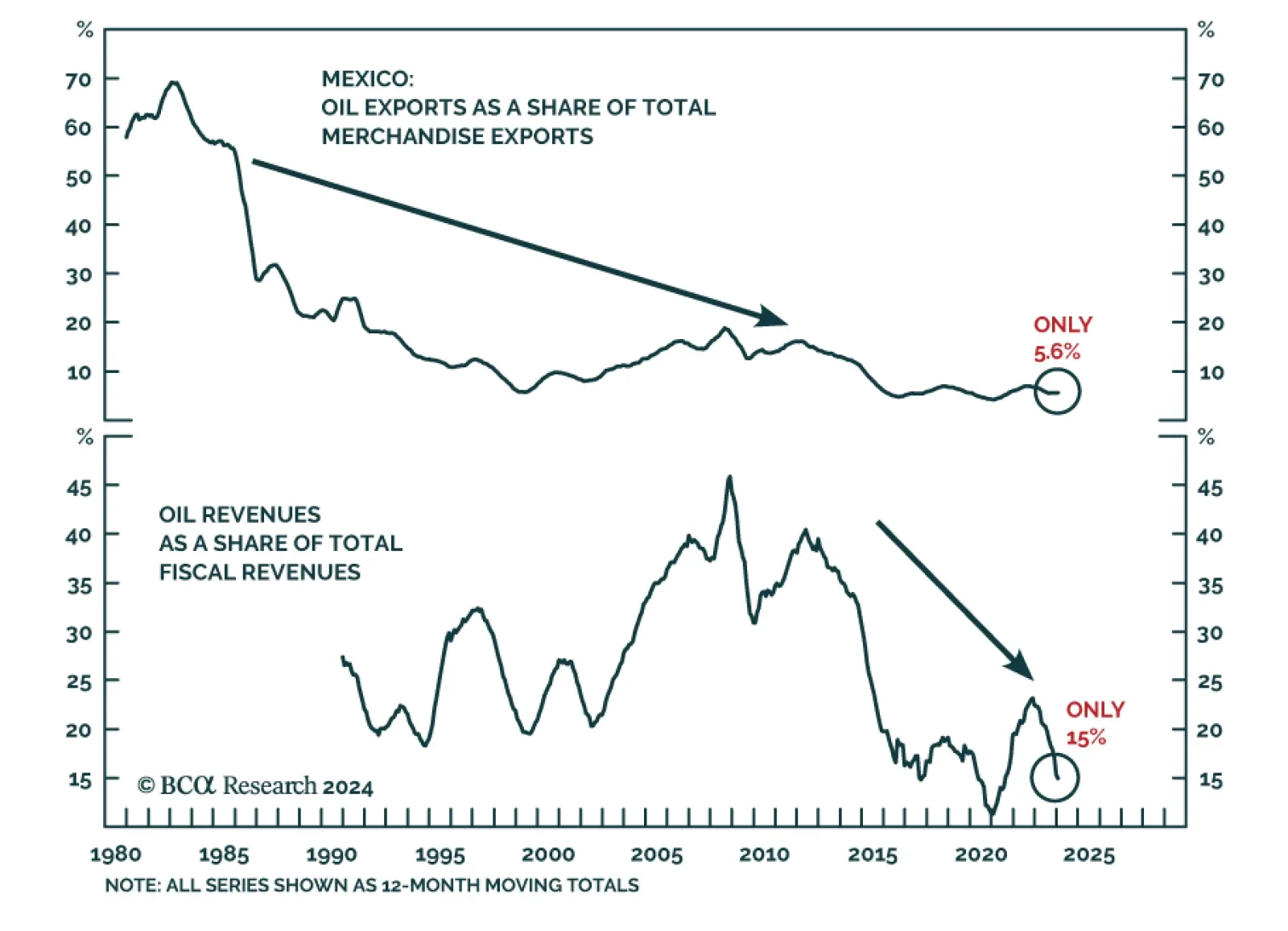

In the past couple of years, Mexico has been among the favorite markets for investors within the EM space. As our Emerging Markets Strategy team argued in a recent report, the cyclical and structural outlook for Mexican risk…

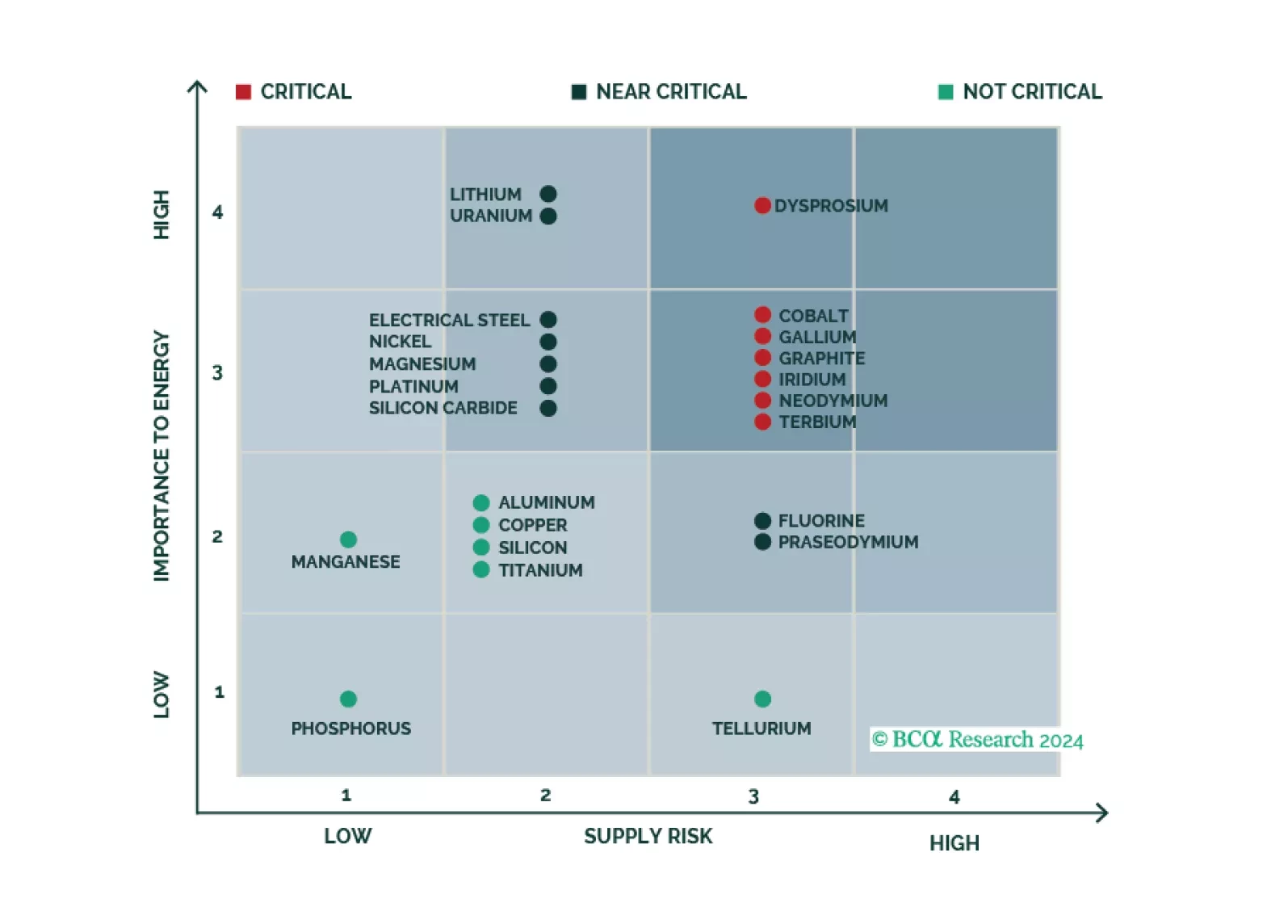

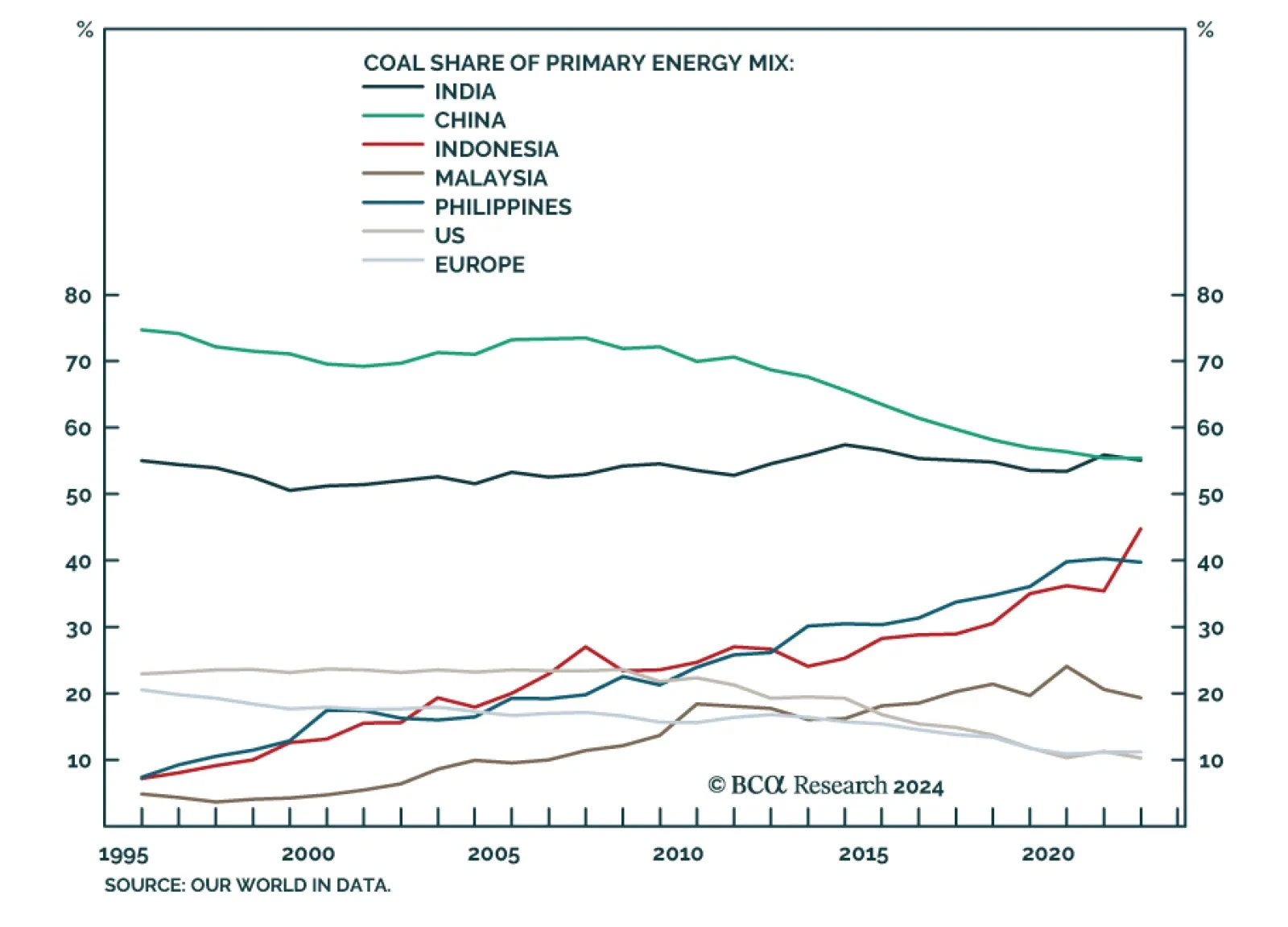

Qatar’s strategy to raise LNG output 84% by 2030 is a bold bet DM demand for energy security – and EM demand for affordable electricity to support economic and population growth – will remain a higher priority than eliminating fossil…

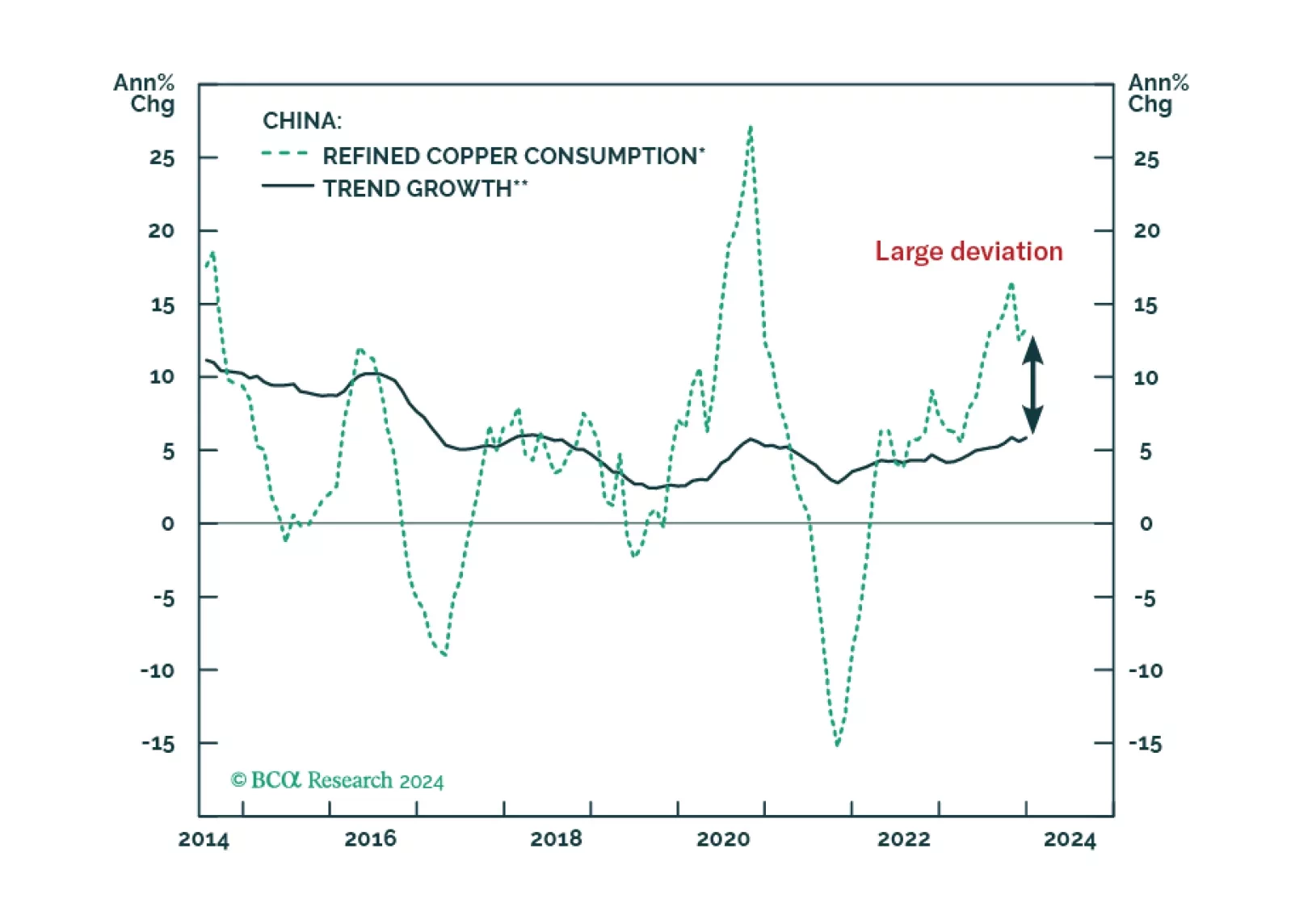

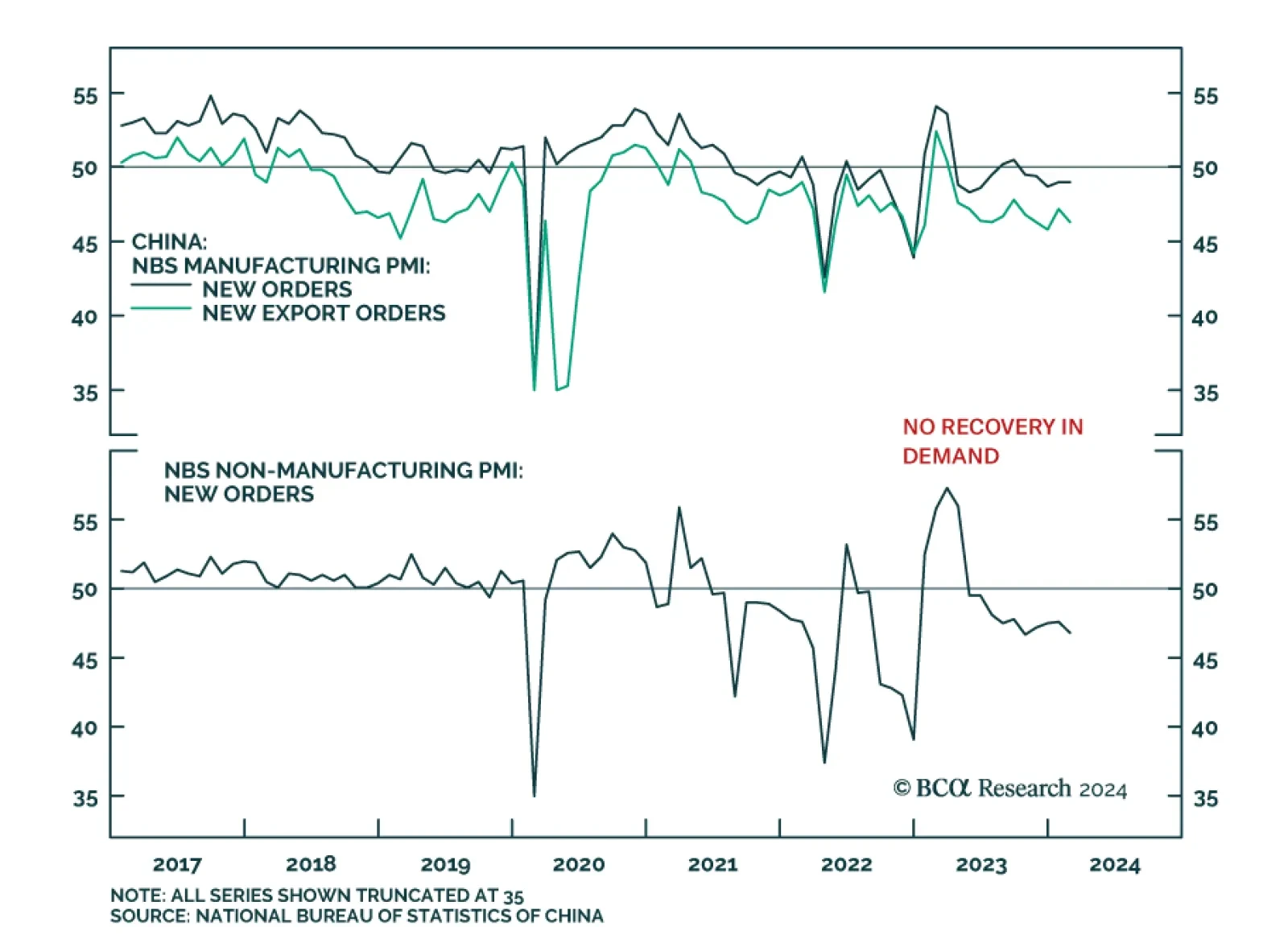

China’s NBS PMI release indicates that the Chinese growth is stabilizing at a low level. The composite PMI came in at 50.9 – unchanged from January. The stabilization was led by the non-manufacturing sector though…

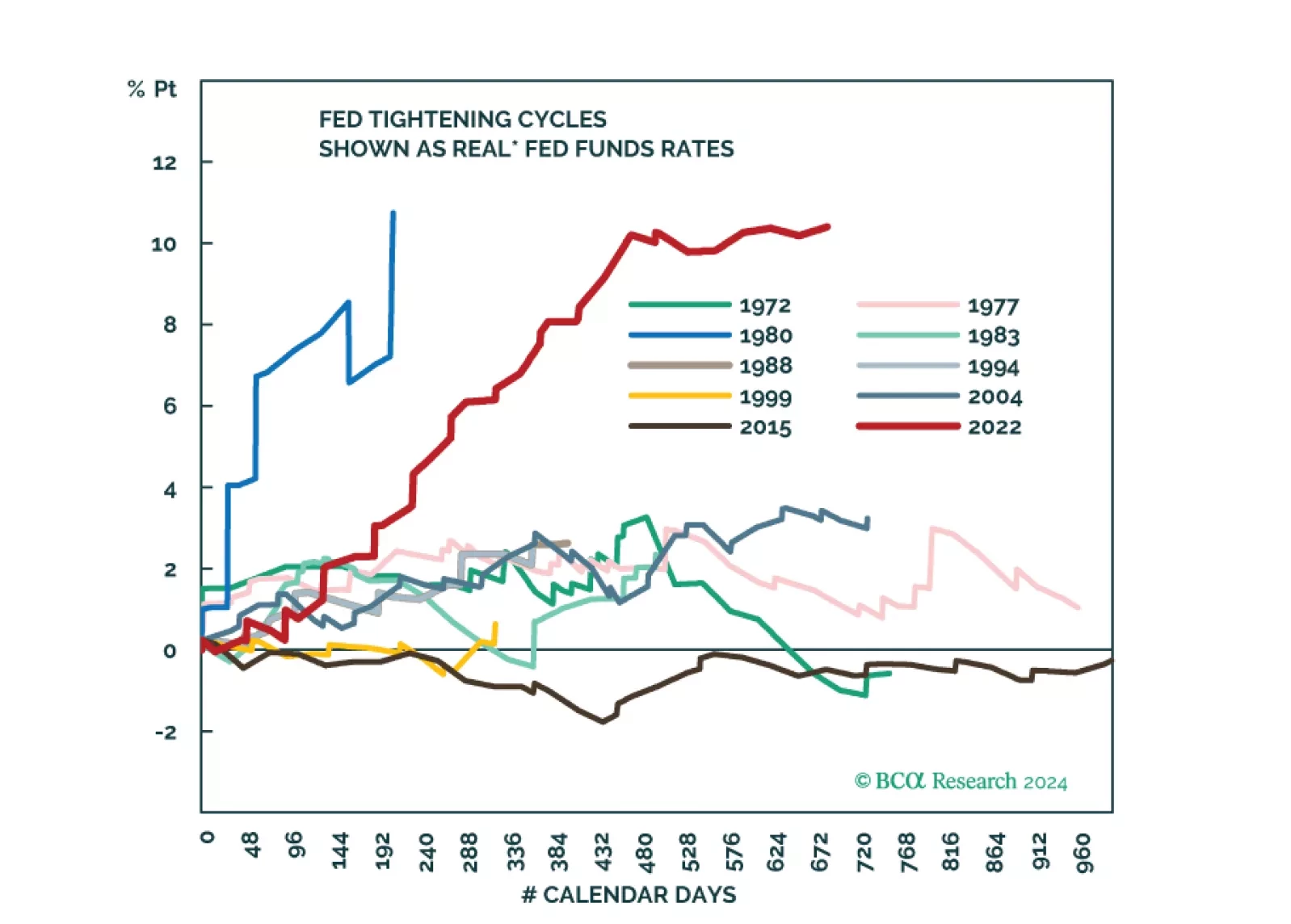

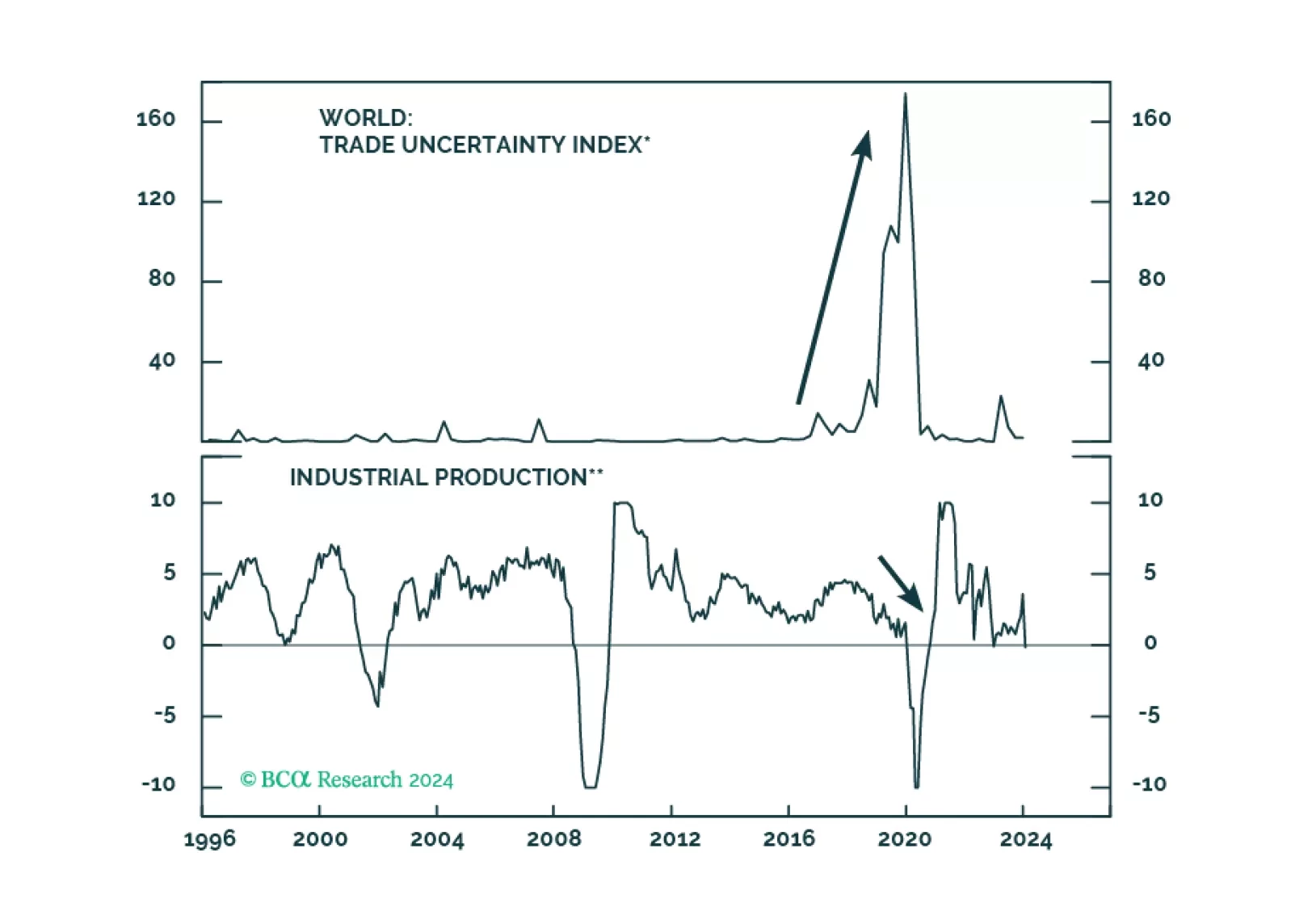

Amid patchy global growth, the US economy remains resilient. However, tight monetary policy will eventually trigger a recession in the US too. The stock market rally has been very narrow. Stay underweight risk assets.

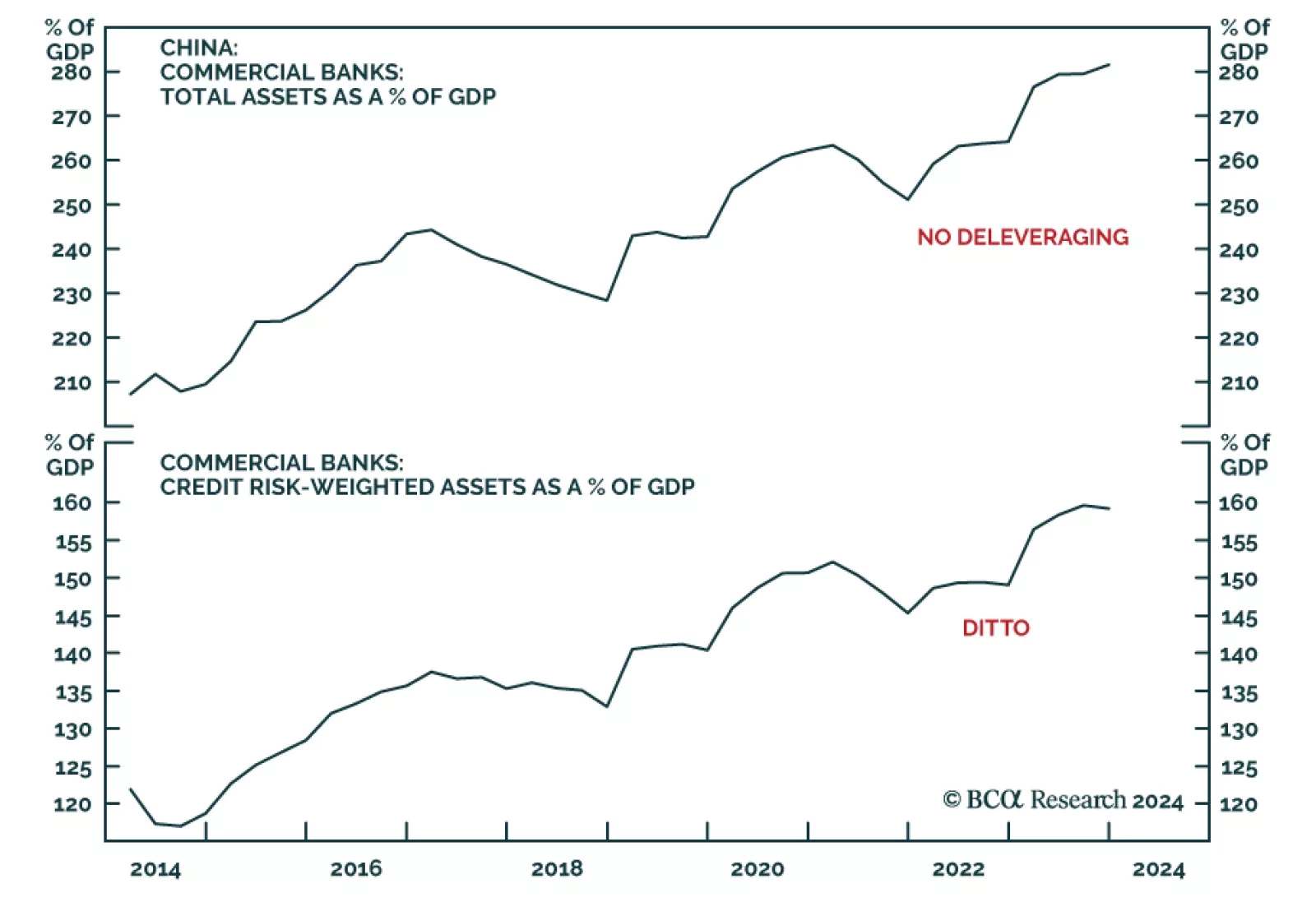

According to BCA Research’s China Investment Strategy service, the odds of a “Minsky Moment” are low for the Chinese banking sector. Chinese banks, however, will continue facing cyclical and structural headwinds…