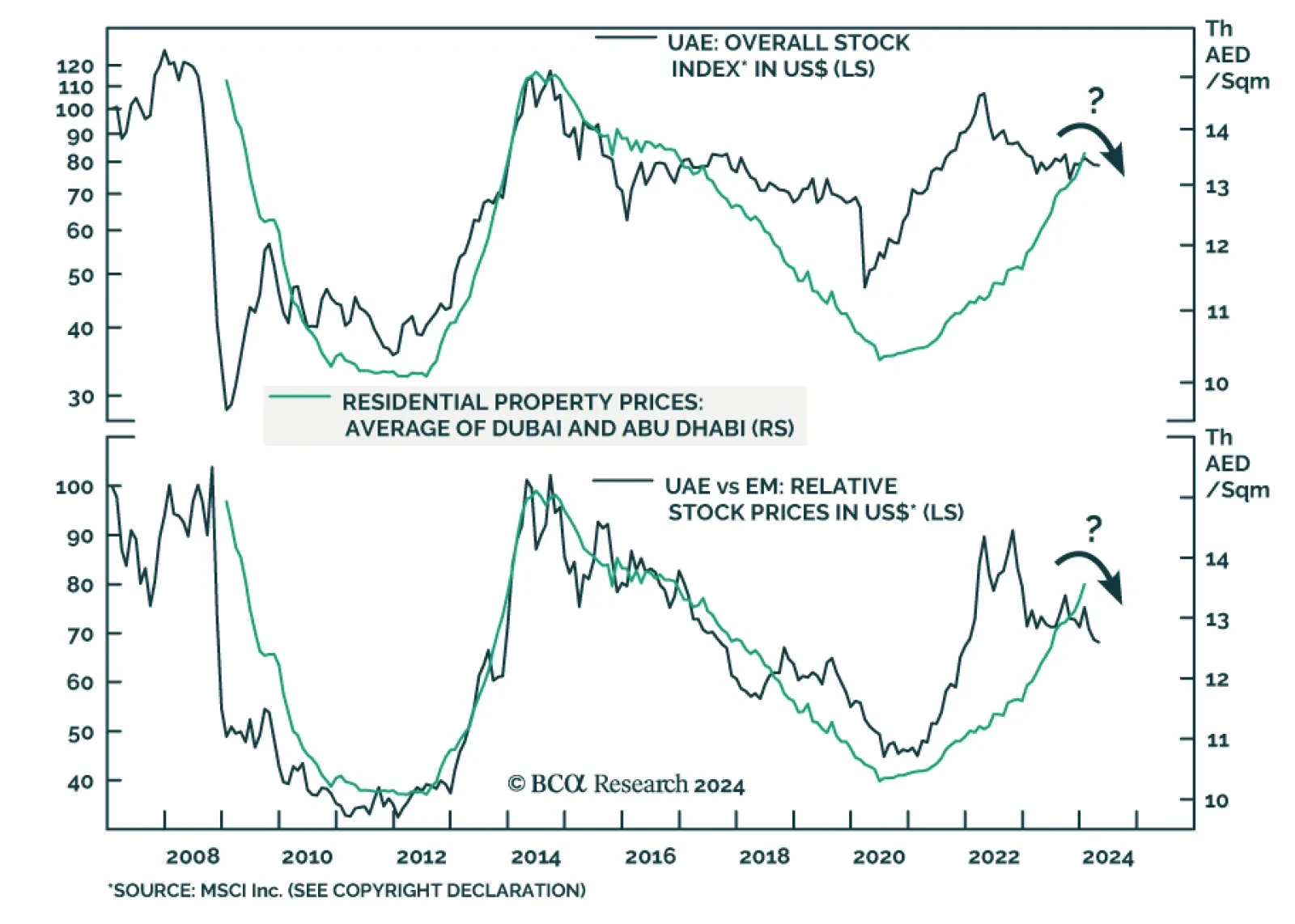

According to BCA Research’s Emerging Markets Strategy service, peaking property prices will remove the sole tailwind behind the Emirati Stock Market. Over the past couple of years, the Emirati stock market has been…

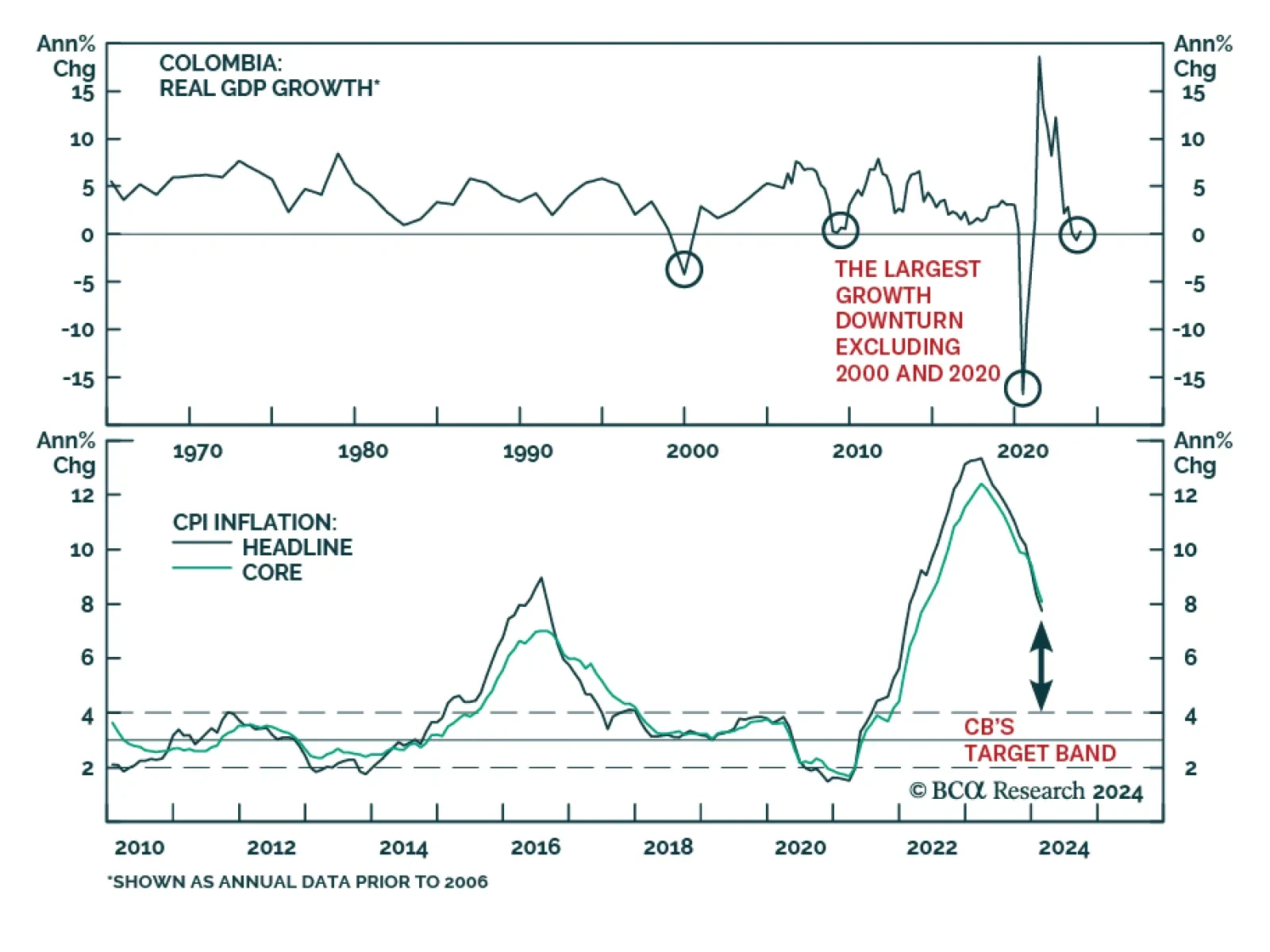

Colombia: Macroeconomic Fundamentals, Public Finances, And Political Uncertainty Warrant Underweight

BCA Research’s Emerging Markets Strategy service argues that Colombia has fallen from grace in terms of its healthy macroeconomic fundamentals, business-friendly government policies, and conservative fiscal stances.…

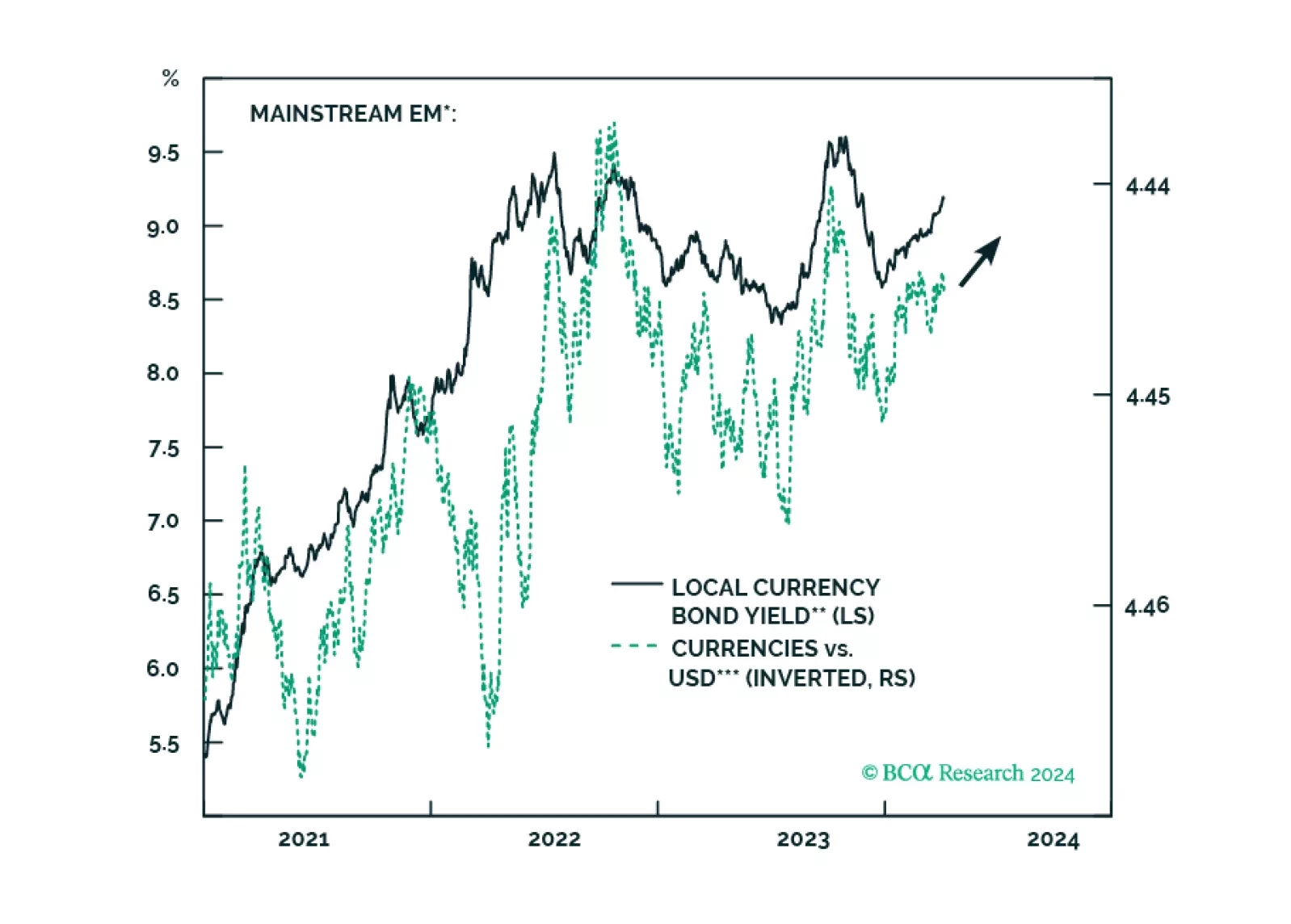

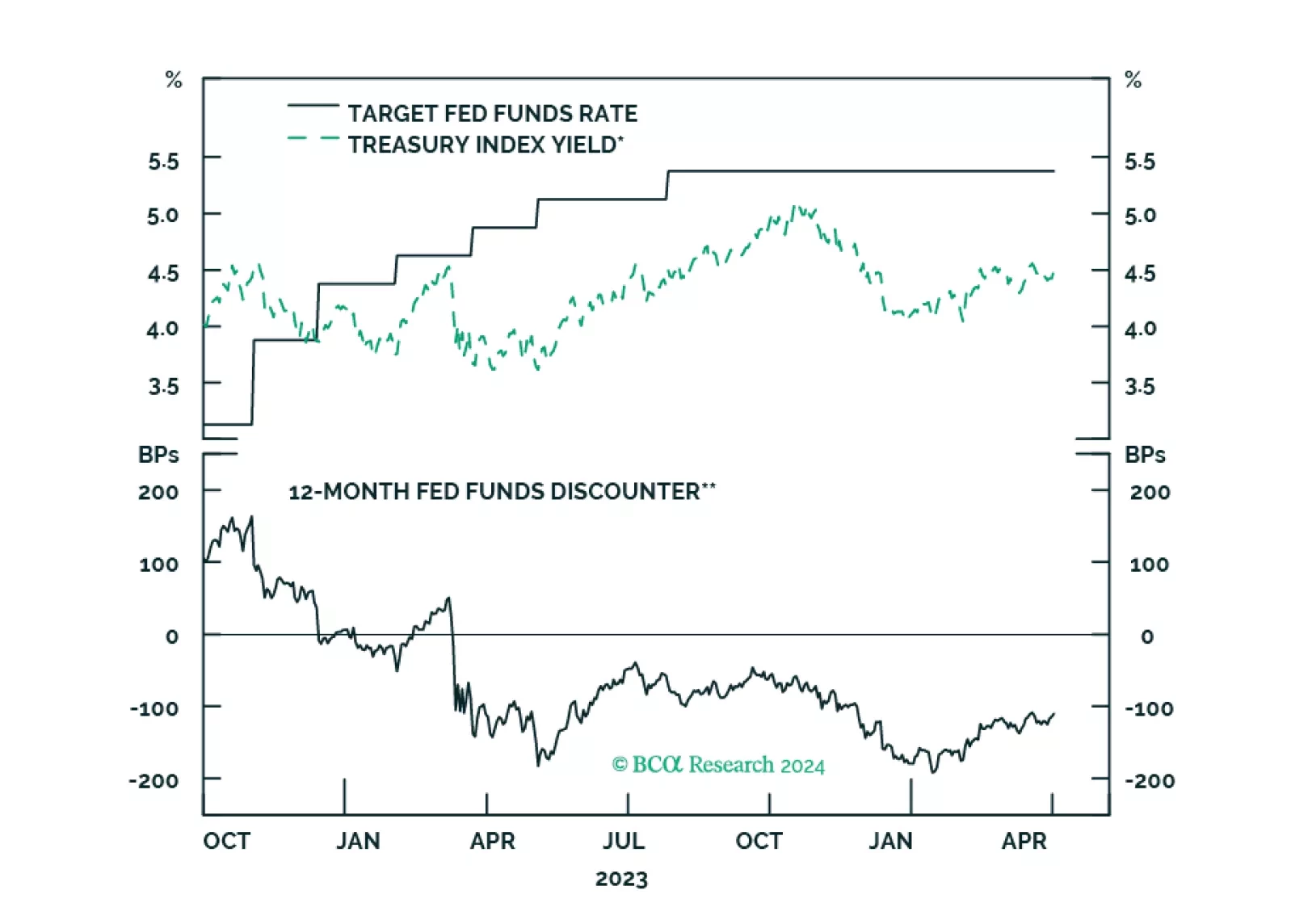

Climbing US bond yields, alongside higher oil prices, might spoil the party for global risk assets. There are budding cracks in EM domestic bonds, and even though we like this asset class in the long run, investors exposed to it…

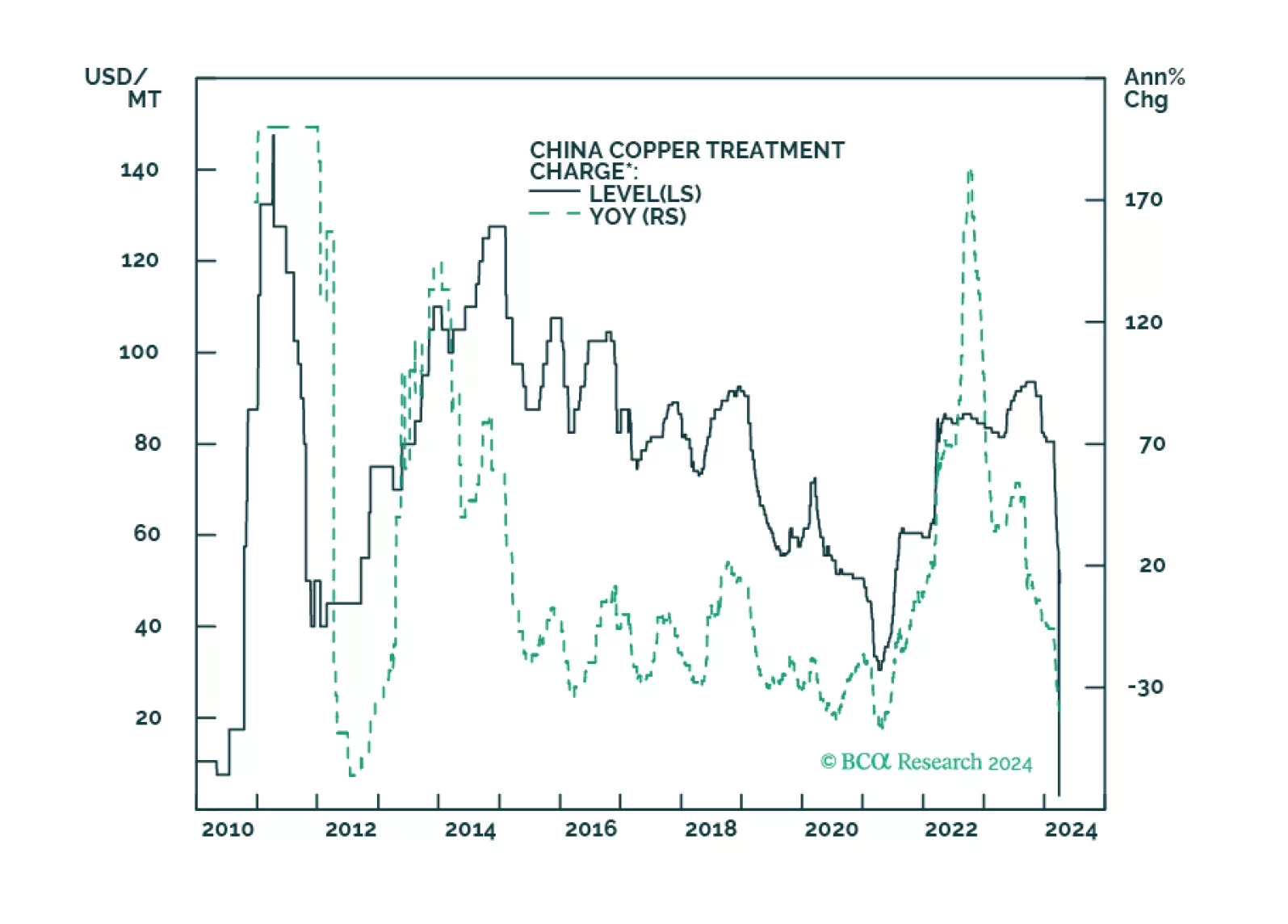

Copper markets are fast approaching a price breakout, as Chinese smelters scramble to find ore to meet increasing refined-copper demand in the wake of a global manufacturing rebound. We are holding fast to our expectation of $4.50/lb…

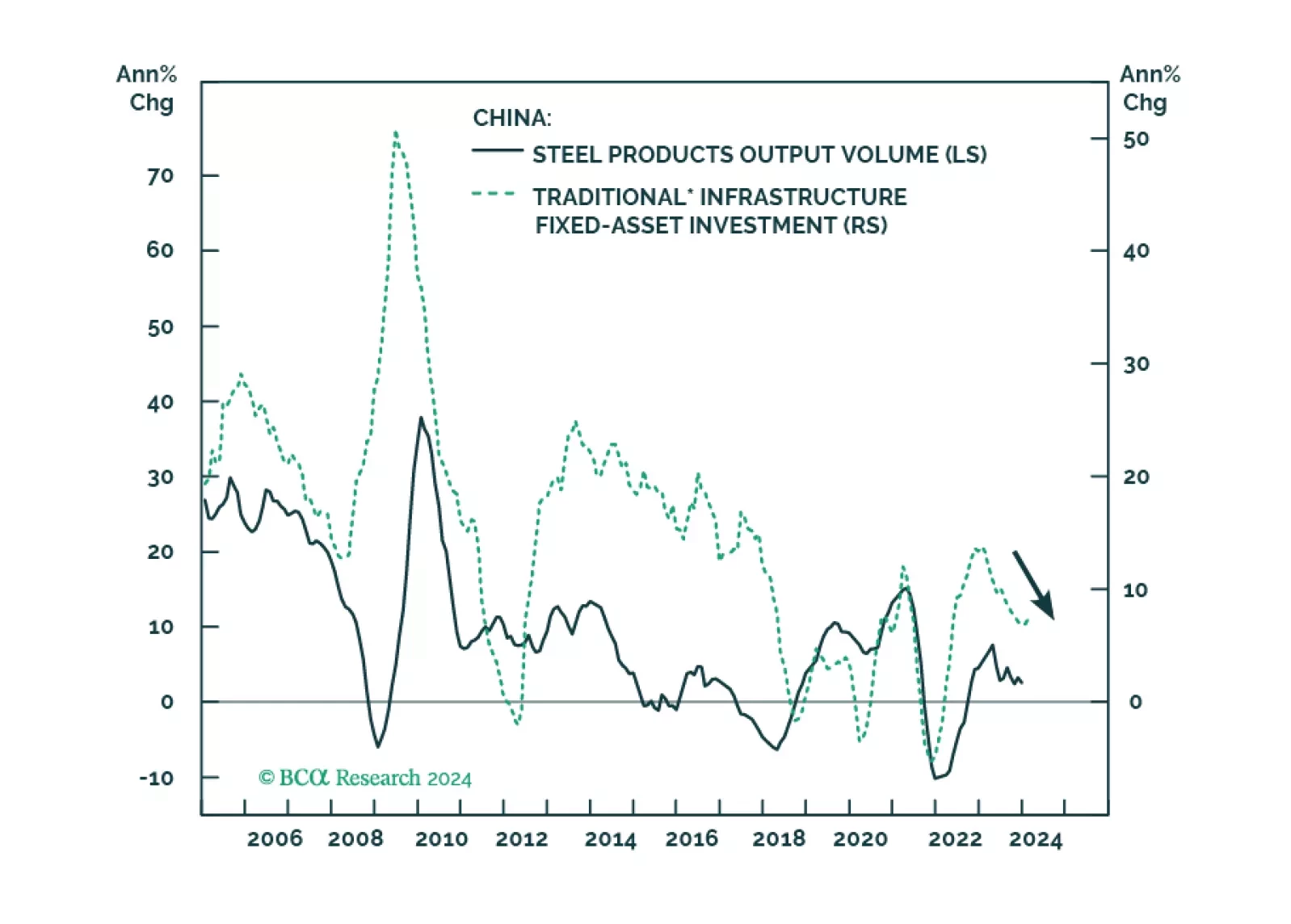

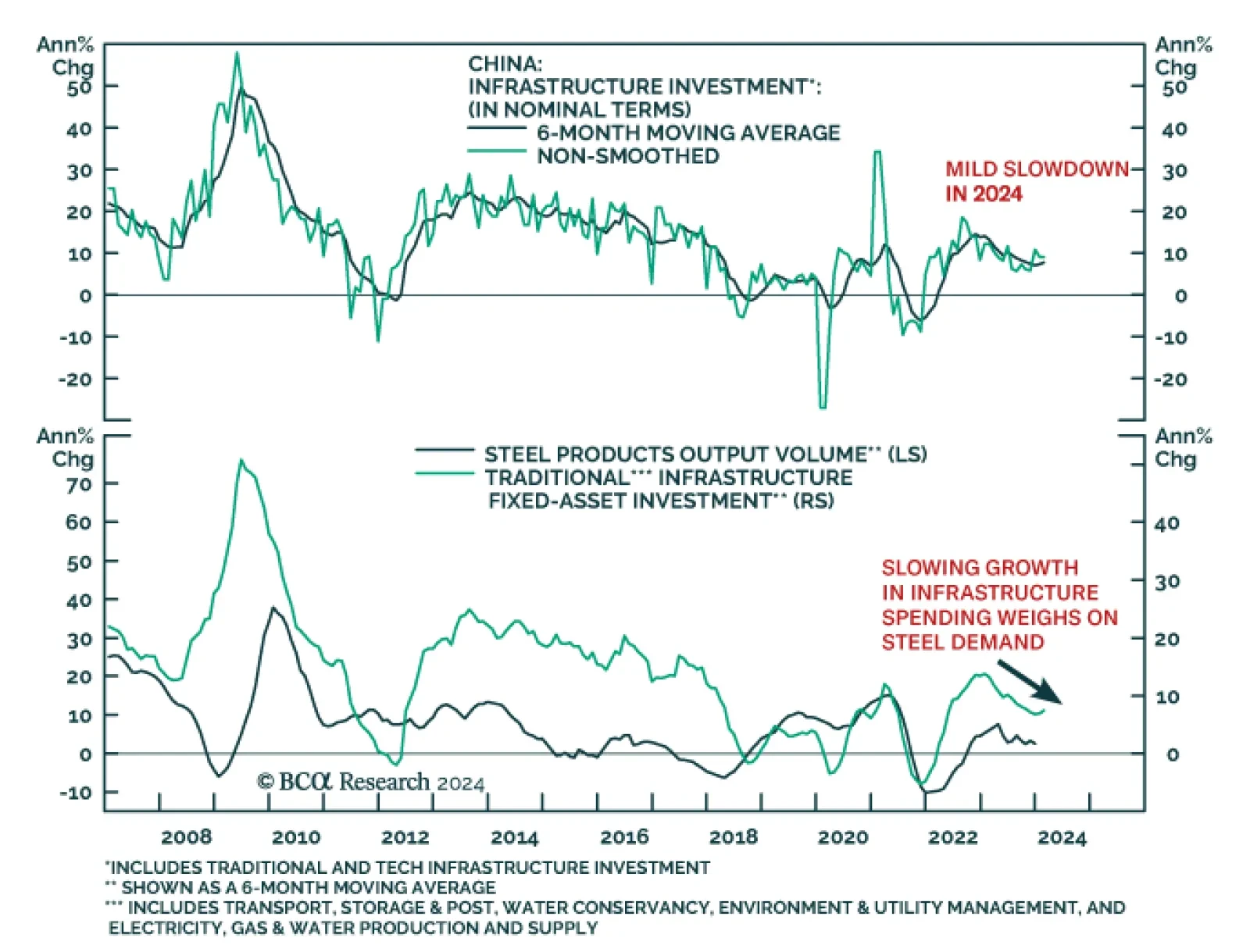

According to BCA Research’s China Investment Strategy service, the growth rate of China’s infrastructure investment will likely slow from a nominal 9% last year to about 6% this year. Funding constraints will limit…

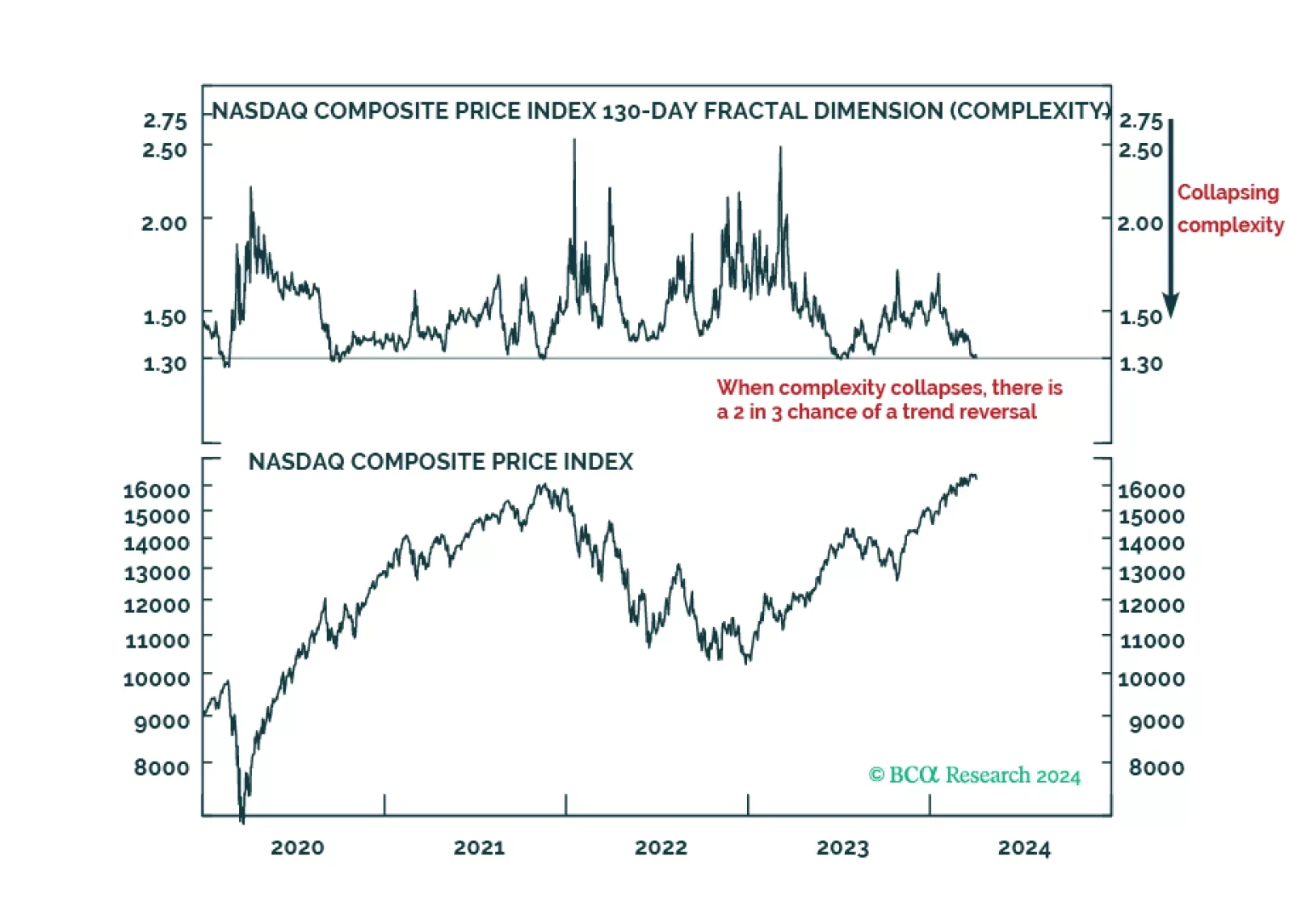

The analysis of complexity is a massive competitive advantage in investing, and from today, clients will be able to monitor the complexities of the world’s 17 major investments on our webpage in real-time.

Our Portfolio Allocation Summary for April 2024.

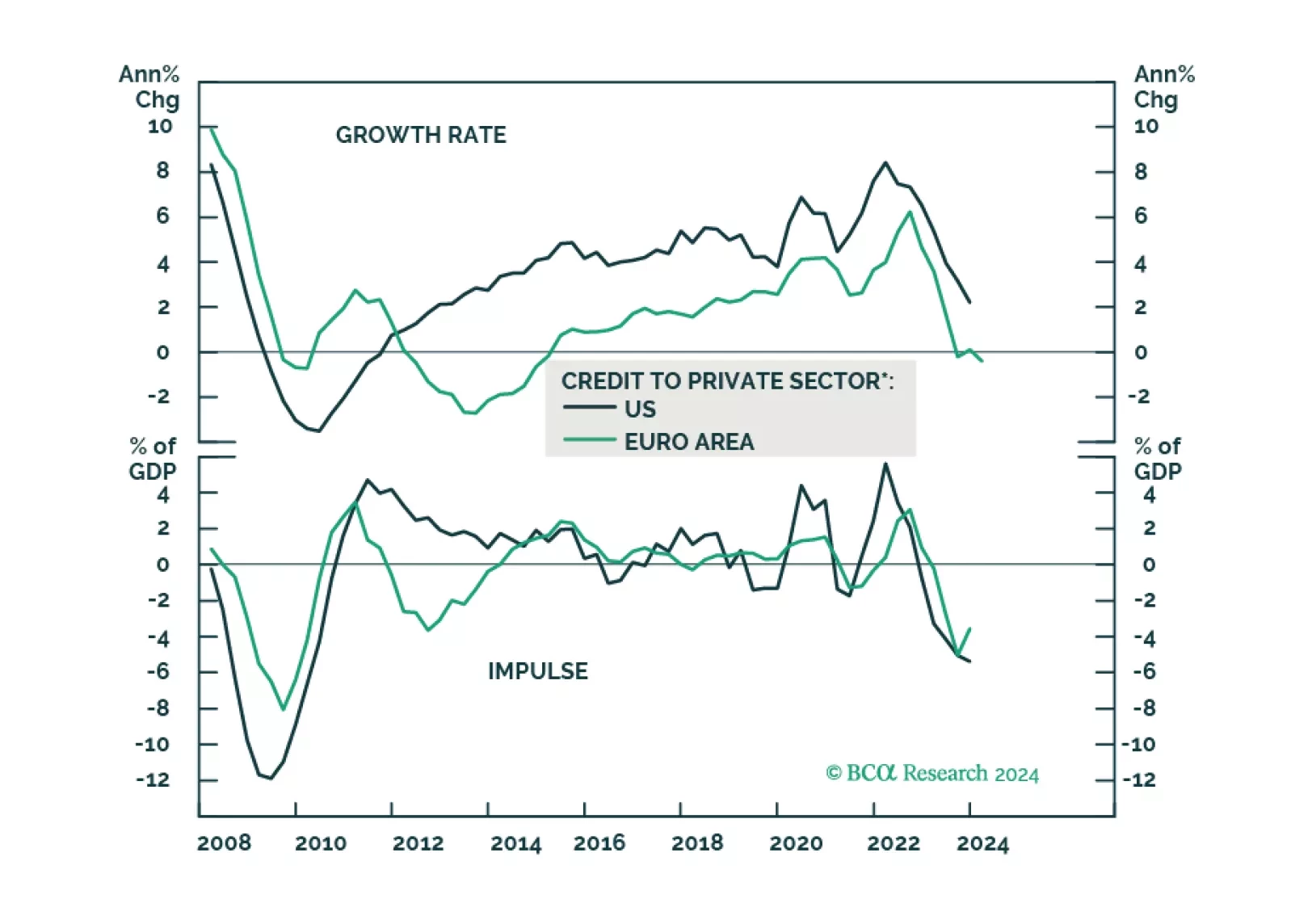

The global economy is wobbling precariously between slowing growth and reaccelerating inflation. This is unlikely to end well. Stay cautious, and hedge against both recession and inflation.

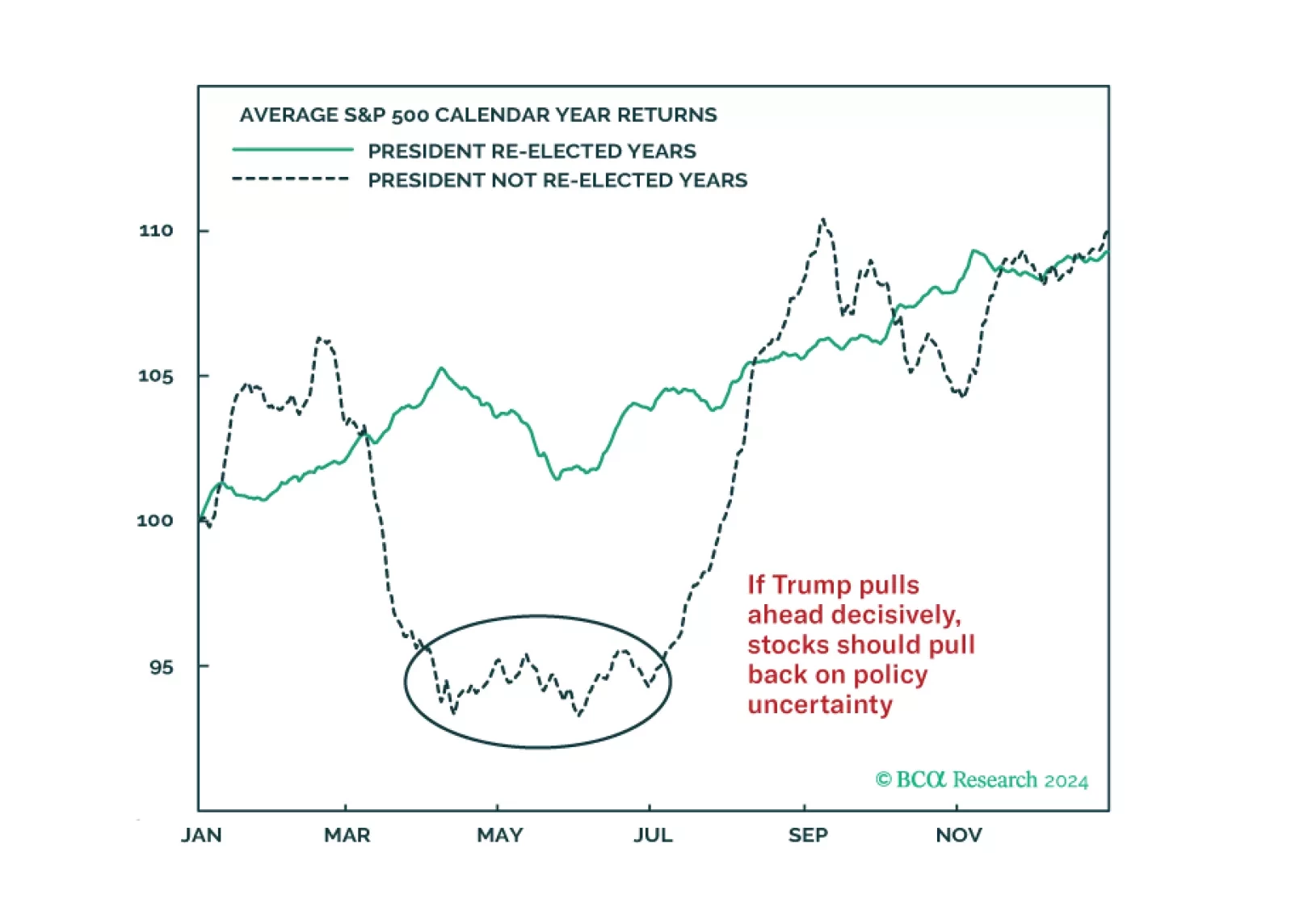

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…