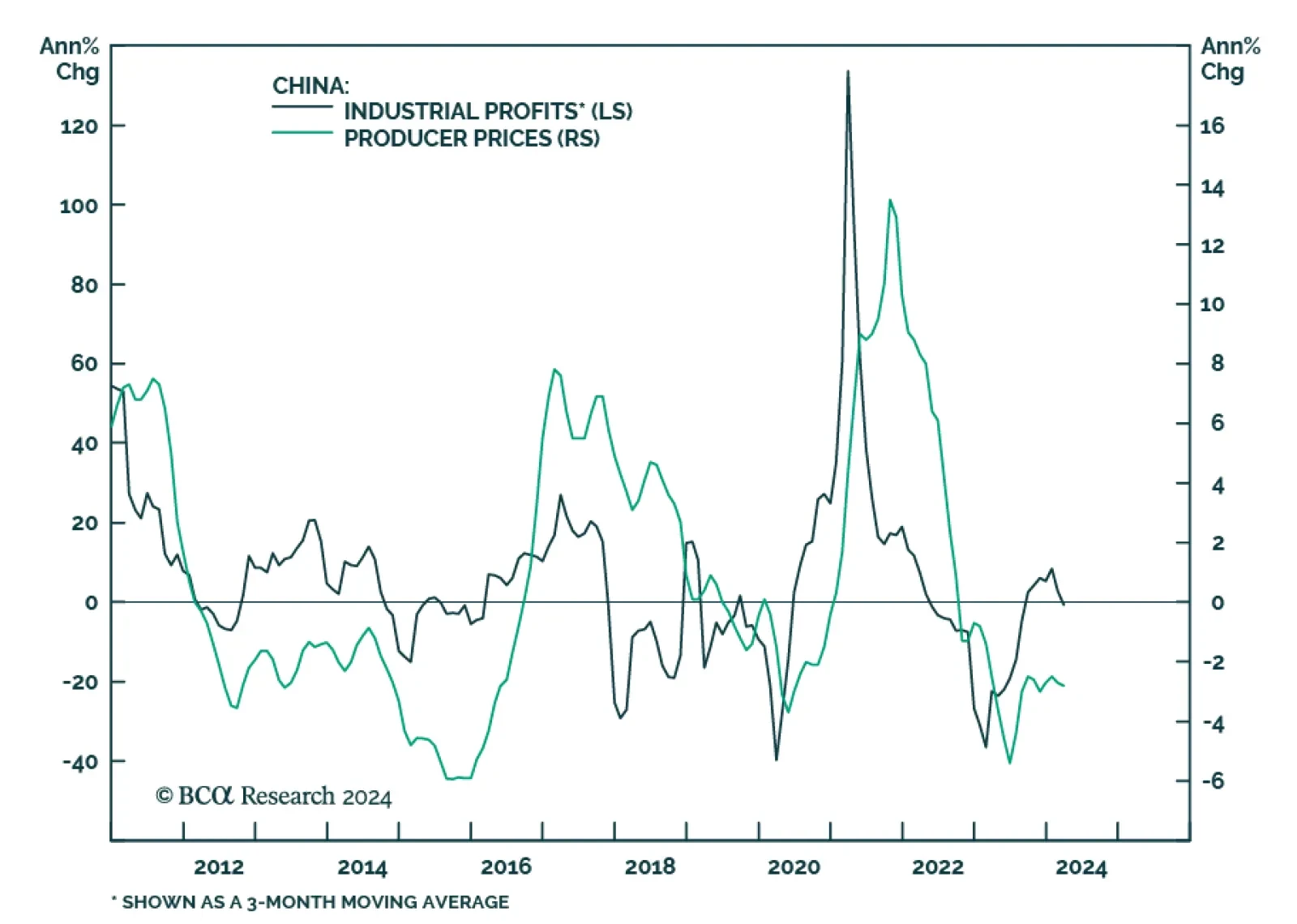

Chinese industrial profit growth slowed in the first three months of the year to 4.3% YTD y/y, from 10.2% y/y in January and February. The March slowdown is meaningful since industrial profits outright contracted by 3.5% relative…

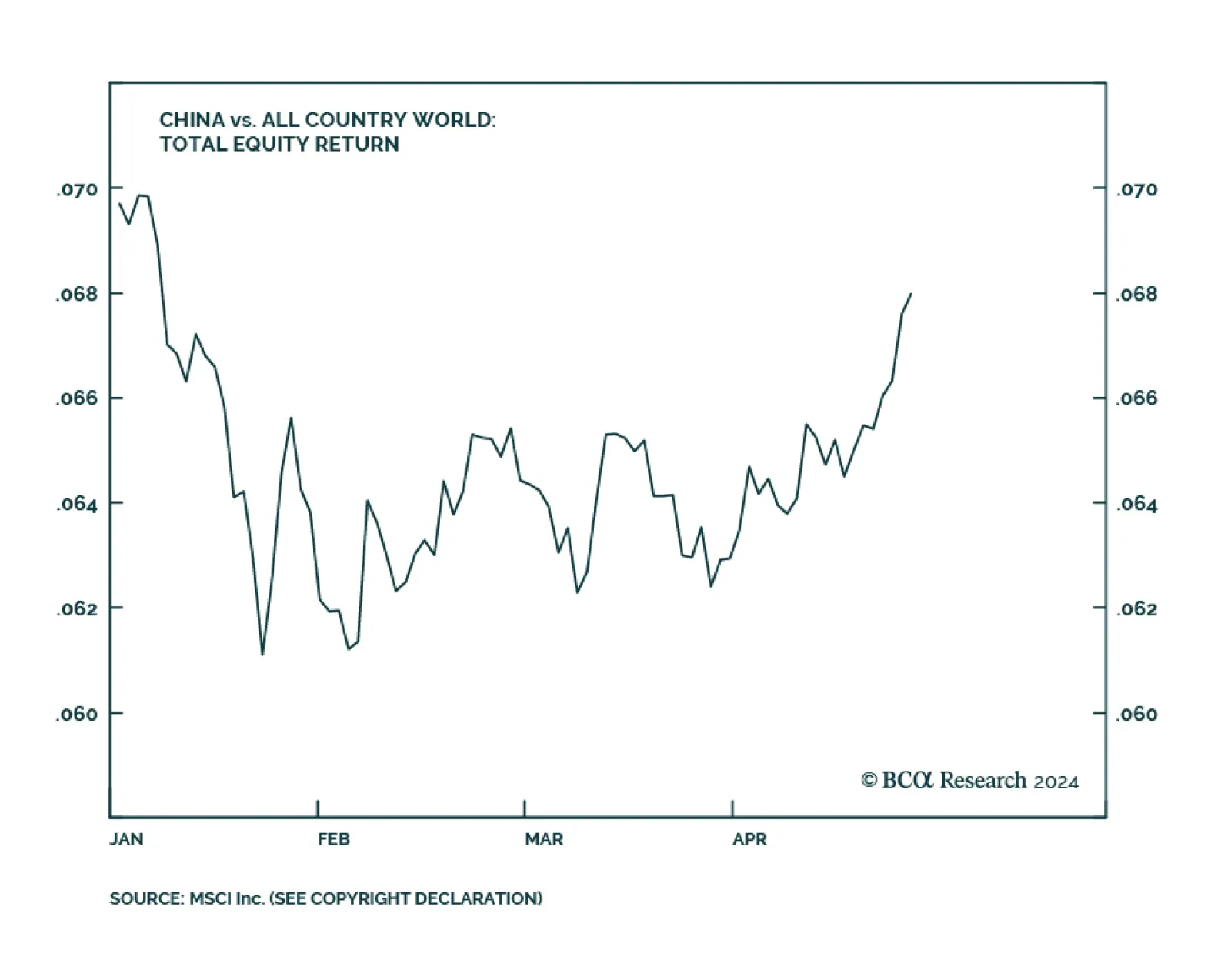

2023 was an awful year for Chinese equities. Though last year, the MSCI China Investable index declined by over 10% even as global equities rallied by over 20%. The pain extended into January of this year, with Chinese stocks…

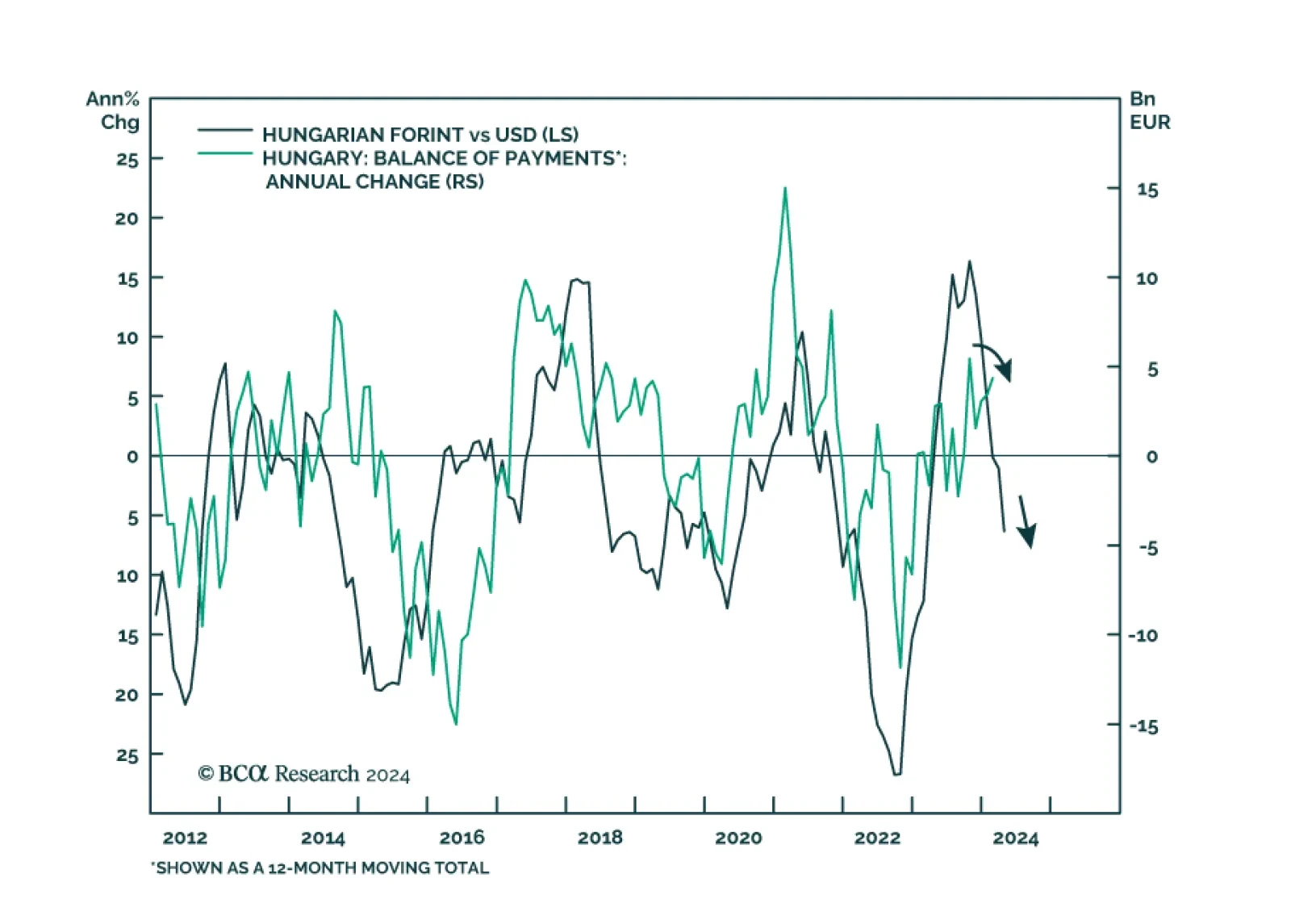

BCA Research’s Emerging Markets Strategy service concludes that among the CE3 currencies, the zloty and the koruna will be the relative winners, while the forint will likely be the worst performer of the three. That said,…

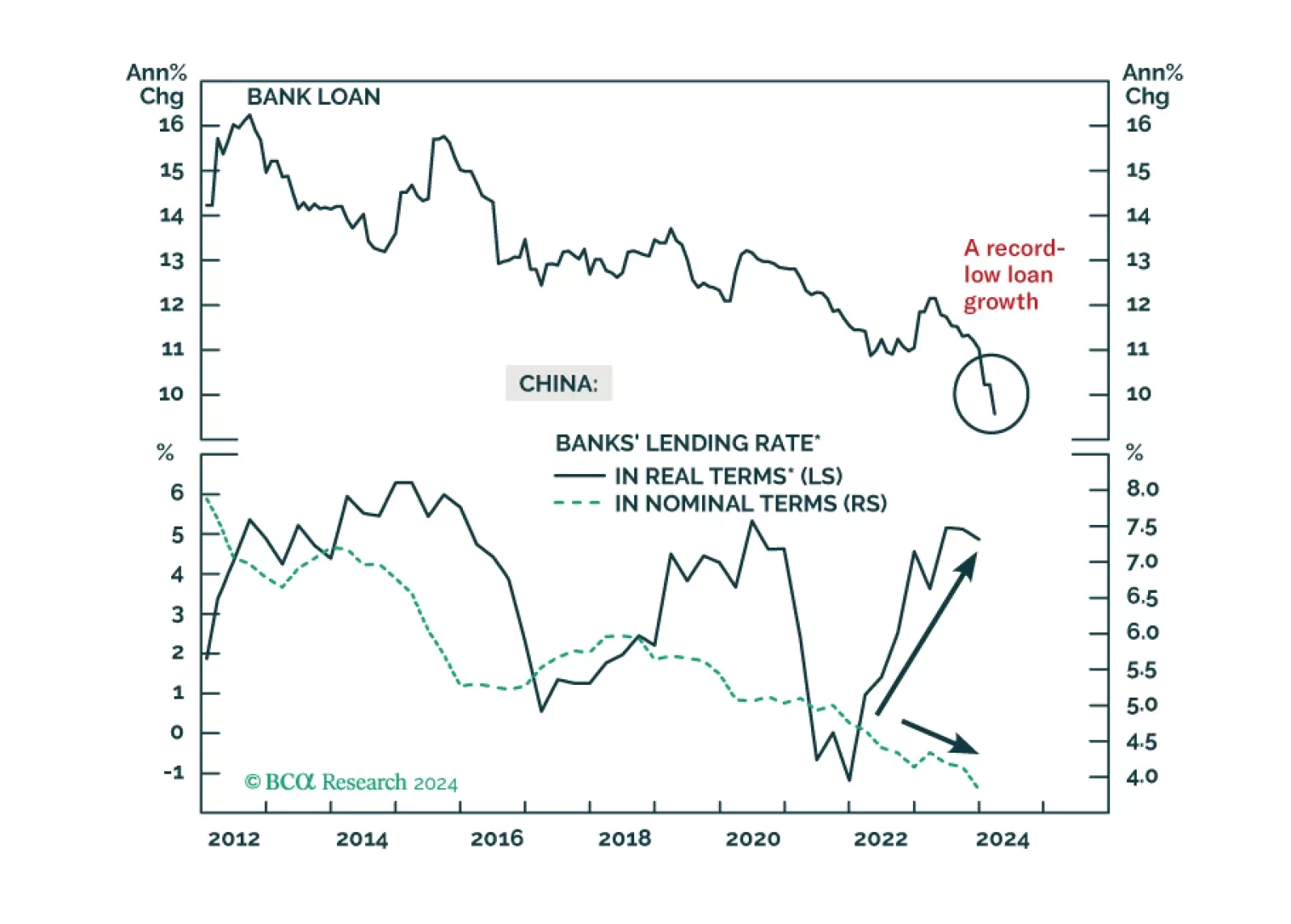

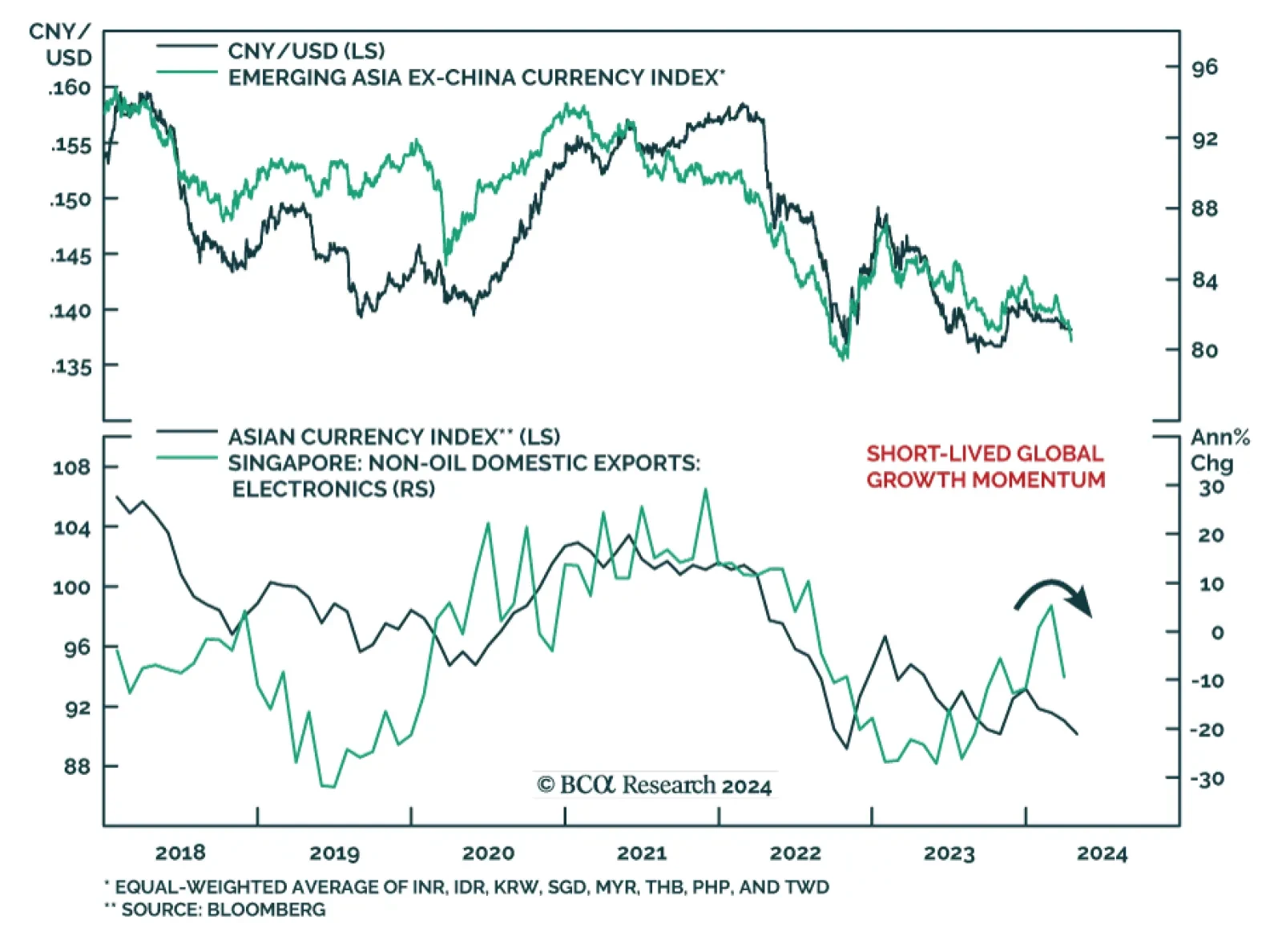

China’s economy is cruising at a very low altitude. The odds are that China’s equity rebound is running out of time. The RMB will continue to depreciate versus the US dollar in the coming months, albeit the pace may be modest.

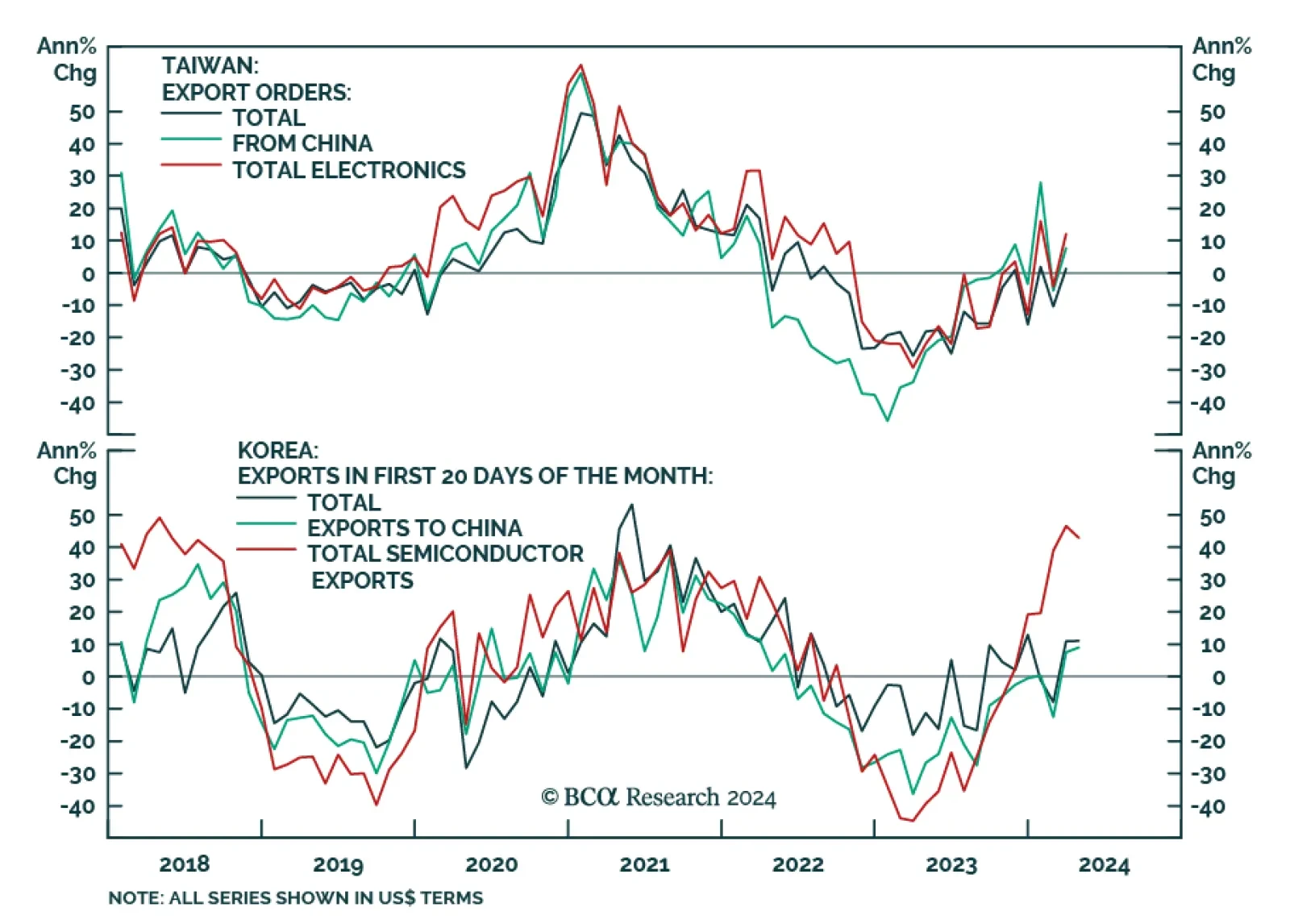

Export dynamics of small open economies are a bellwether for global growth. The latest Taiwanese and Korean export numbers are consistent with a revival in global trade. Taiwanese export orders grew by 1.2% y/y in March…

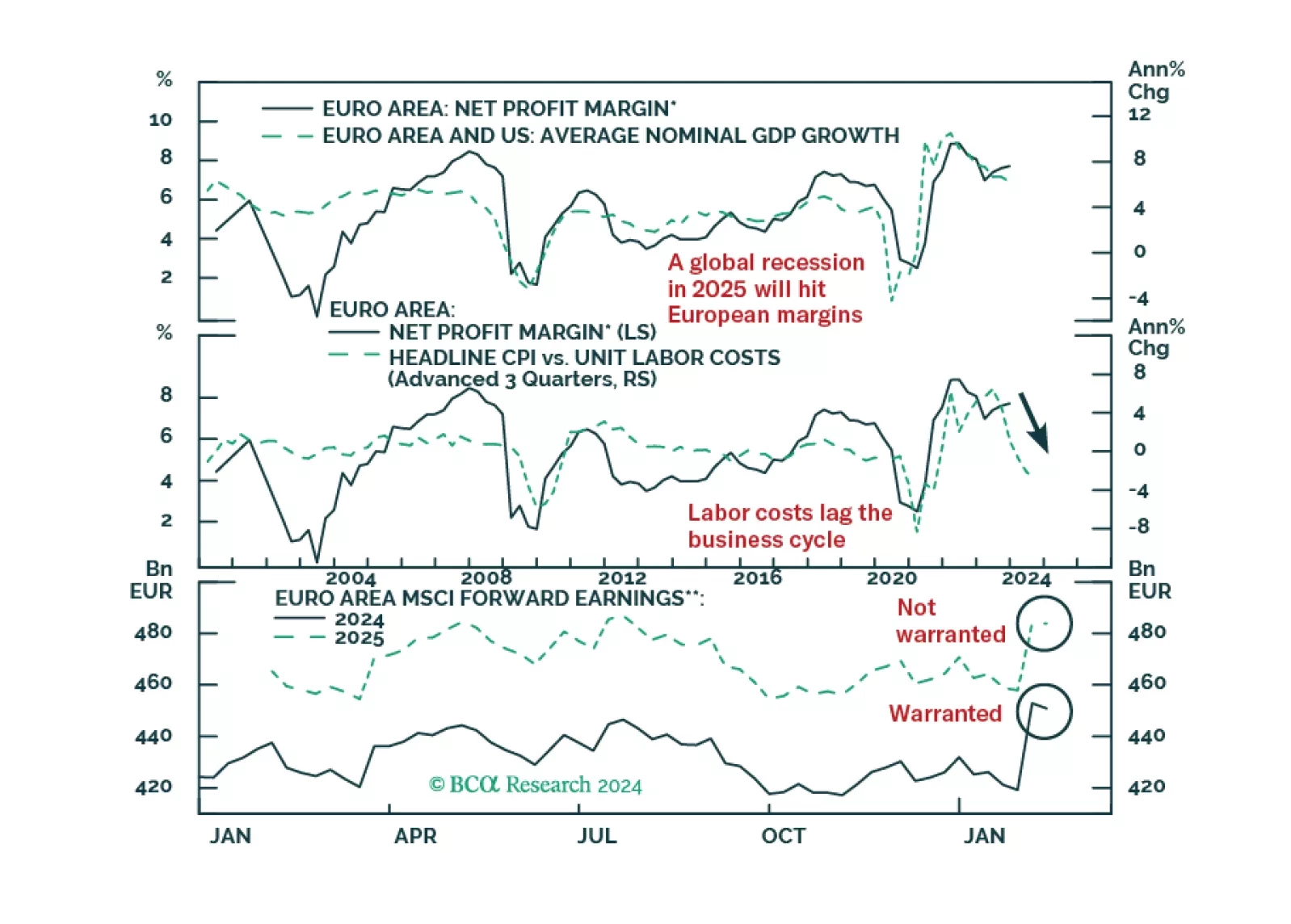

European profits margins are elevated. Will a mild recession be enough to bring them down?

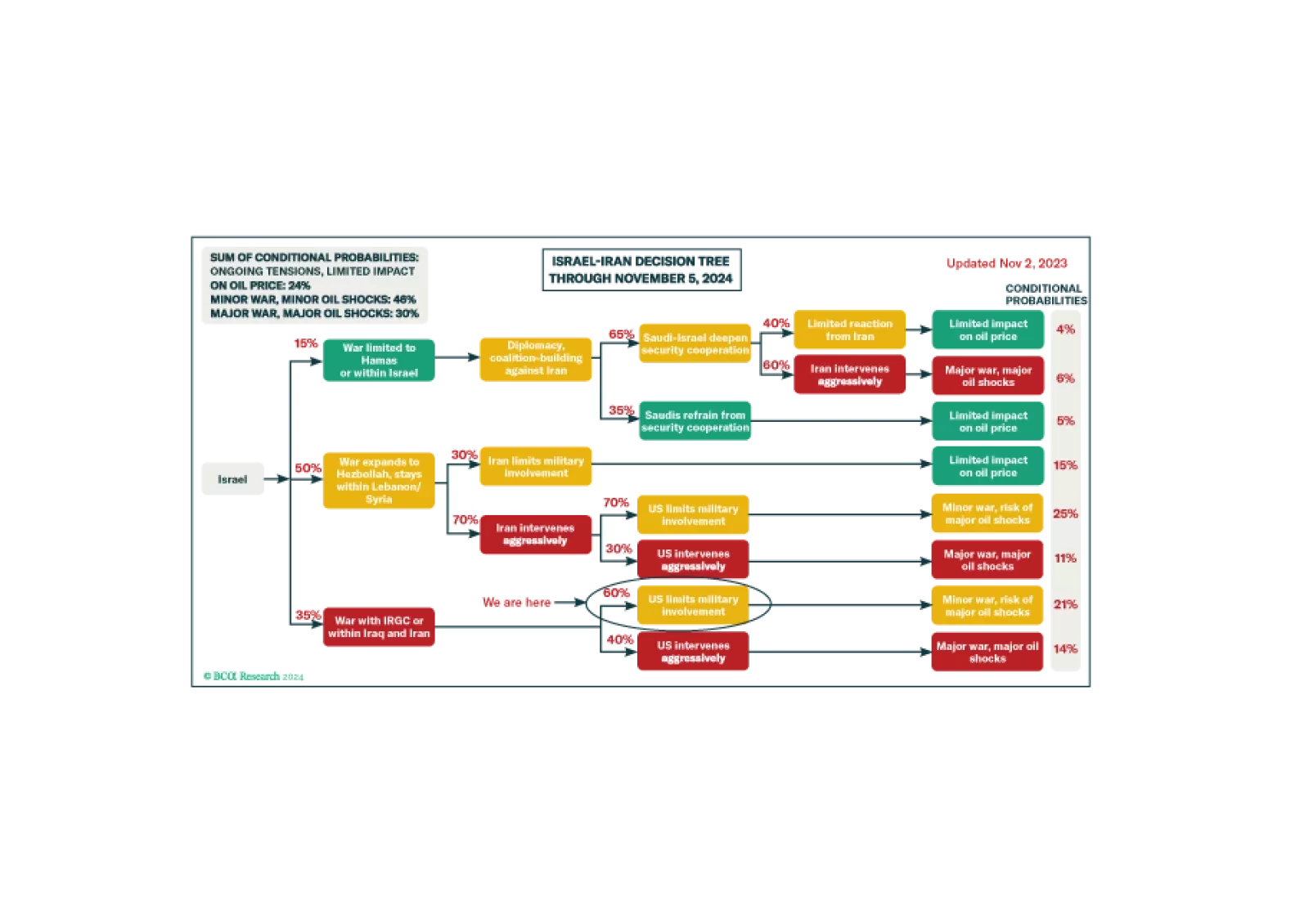

The implication is that Israel chose not to escalate the risk of direct war with Iran. Hence we remain in our base-case “Minor War, Minor Oil Shock” scenario.

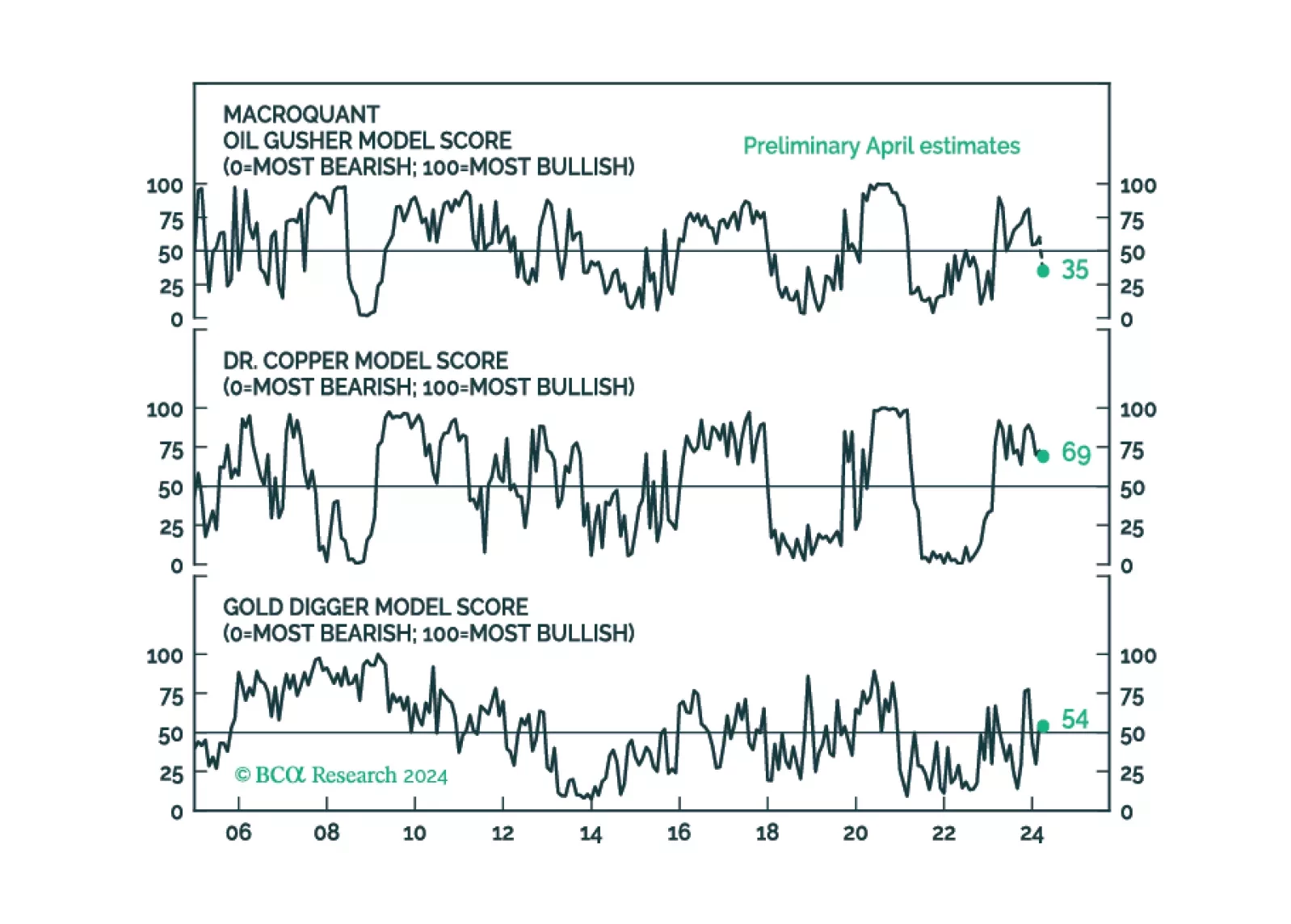

This year’s rise in commodity prices represents a blow-off rally rather than the start of a durable bull market. The global economy is heading for a recession. Stocks, commodities, and other risk assets are vulnerable.

The Asian currency index posted the largest negative post-GFC abnormal returns (z-score) among the major financial markets we tracked in March. Indeed, Asian currencies have been on a general downtrend since early 2023, and more…